Government of the District of Columbia

Office of the Chief Financial Officer

Office of Revenue Analysis

D.C. Tax Facts

2016

Muriel Bowser

Mayor

Phil Mendelson, Chairman

Council of the District of Columbia

Jeffrey DeWitt

Chief Financial Officer

i

TABLE OF CONTENTS

SUBJECT PAGE

MESSAGE FROM THE CFO ......................................................................................................... iii

CORRECTION ................................................................................................................................ v

INTRODUCTION ........................................................................................................................... vi

PART I

-- D.C. GENERAL FUND REVENUE

FY 2015 ......................................................................................................................................... 1

FY 2016 AND FY 2017 ESTIMATES ........................................................................................... 2

PART II

-- DISTRICT TAXES AND NON-TAX REVENUE SOURCES

ALCOHOLIC BEVERAGE TAX ................................................................................................. 4

CIGARETTE TAX ....................................................................................................................... 5

ESTATE TAX ............................................................................................................................. 7

INCOME TAXES

CORPORATION AND UB FRANCHISE TAXES .................................................................. 8

INDIVIDUAL INCOME TAX ................................................................................................. 10

INSURANCE PREMIUMS TAX ................................................................................................. 12

MOTOR VEHICLE TAXES

MOTOR VEHICLE EXCISE TAX .......................................................................................... 13

MOTOR VEHICLE FUEL TAX .............................................................................................. 14

MOTOR VEHICLE REGISTRATION FEES ......................................................................... 15

PROPERTY TAXES

PERSONAL PROPERTY TAX ............................................................................................. 17

REAL PROPERTY TAX........................................................................................................ 19

PUBLIC SPACE RENTAL ......................................................................................................... 22

PUBLIC UTILITY TAX ............................................................................................................... 23

RECORDATION AND TRANSFER TAXES ............................................................................. 25

SALES AND USE TAX .............................................................................................................. 28

TOLL TELECOMMUNICATIONS TAX ..................................................................................... 31

BASEBALL GROSS RECEIPTS TAX ...................................................................................... 33

HEALTHCARE PROVIDER TAX .............................................................................................. 34

ICF-IDD ASSESSMENT ........................................................................................................... 34

MEDICAID HOSPITAL INPATIENT RATE SUPPLEMENT ..................................................... 34

MEDICAID HOSPITAL OUTPATIENT SUPPLEMENT PAYMENT ......................................... 35

NON-TAX REVENUE AND LOTTERY ..................................................................................... 36

SPECIAL PURPOSE NON-TAX REVENUE ............................................................................ 37

PART III

--SELECTED D.C. TAX STATISTICS ........................................................................................ 38

PART IV

-- HISTORY OF MAJOR CHANGES IN D.C.

TAX STRUCTURE, FY 1970 TO FY 2016 ................................................................................. 42

PART V

-- FILING AND PAYMENT DATES FY 2016 ............................................................................. 69

OFFICE LOCATIONS AND TELEPHONE NUMBERS ............................................................... 74

ii

STATISTICAL TABLES

SUBJECT PAGE

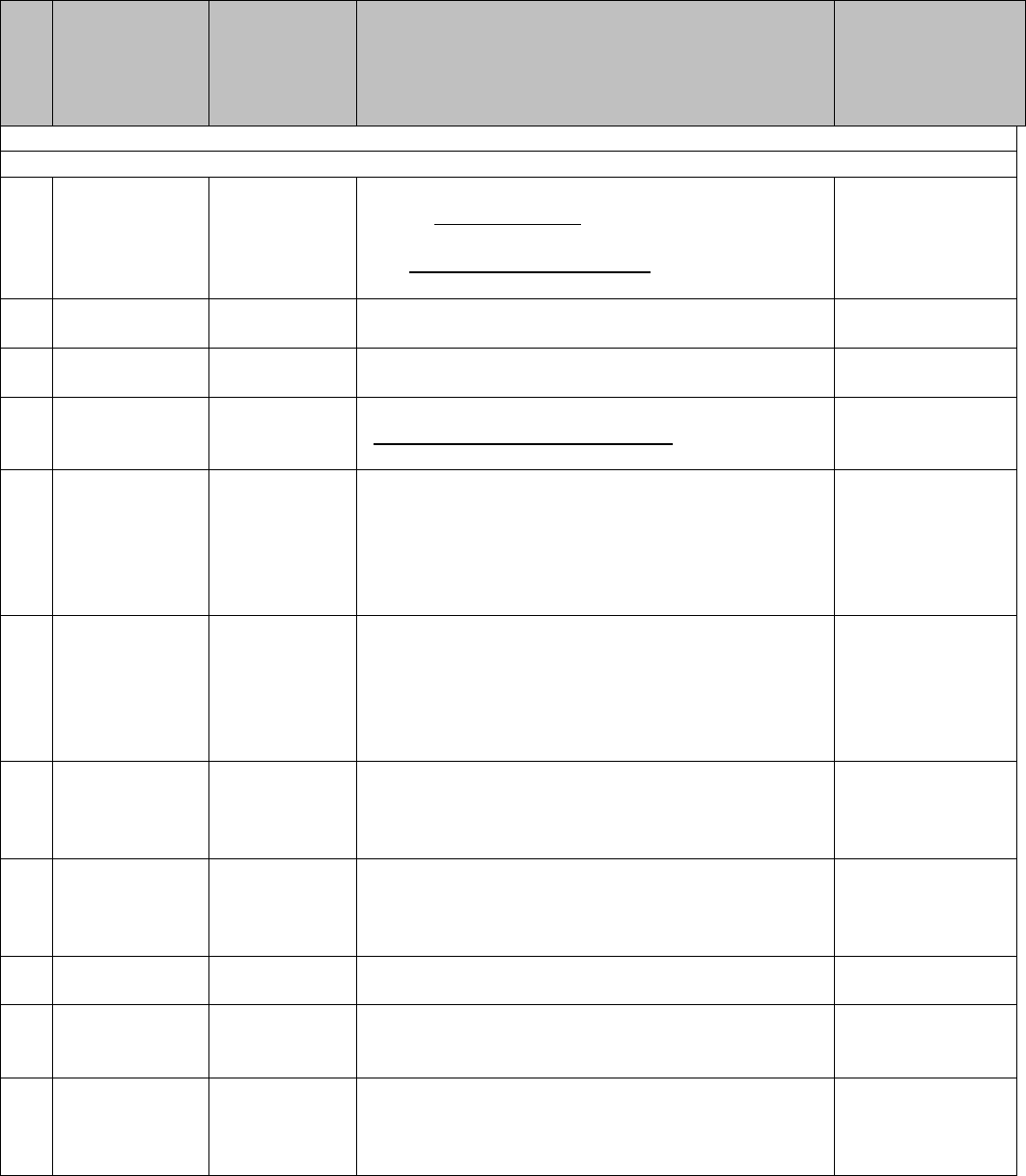

TABLE 1

D.C. GENERAL FUND REVENUE

FY 2015 REVENUE ...................................................................................................................... 1

TABLE 2

D.C. GENERAL FUND REVENUE

FY 2016 AND FY 2017 REVENUE ESTIMATES ......................................................................... 2

TABLE 3

D.C. TAX REVENUE, 1993-2015 ................................................................................................ 39

TABLE 4

2013 D.C. INCOME TAX DISTRIBUTION ................................................................................... 40

TABLE 5

D.C. REAL PROPERTY ASSESSMENTS-TAXABLE, EXEMPT AND TOTALS

TAX YEAR 2015 .......................................................................................................................... 41

iii

MESSAGE FROM THE CFO

The District of Columbia is a single unit of government that provides many of the services

typically provided by and shared between state and local levels of government in the fifty states.

Typical local-level revenue sources used by the District include the real property tax, personal

property tax, deed transfer and recordation taxes, traffic fines, and a variety of other taxes and

fees. D.C. also uses many state-level revenue sources, including the individual income tax, the

general sales and use tax, motor vehicle license fees, business net income taxes and various

excise taxes. The District levies various taxes and a great number of fees in support of General

Fund revenue each year. With over $7 billion in revenue flowing into the General Fund, our

taxpayers are important investors in the nation’s capital city.

The District’s principal local revenue producers are the individual income tax, real property

taxes, sales tax, and gross receipts taxes. The real property tax, which is generally administered

by local jurisdictions, is the largest source of tax receipts for the District government, accounting

for 27.7 percent of total local-source General Fund revenues in fiscal year 2015. Several

property tax relief options are available to eligible property owners. The most widely used is the

Homestead Deduction Program. For owner-occupied residences of five units or less, the

homestead program provides a $71,700 deduction from the assessed value. Other property tax

relief measures include a 10 percent cap on the annual growth of real property tax liability for

homeowners and the Senior Citizen and Disabled Homeowner Tax Relief Program, which

allows certain senior citizens and persons with disabilities to claim a 50 percent reduction in

property taxes.

The individual income tax, which generally is administered by state governments, is the second

largest source of tax revenue for the District, providing 23.6 percent of the total local-source

General Fund revenues for fiscal year 2015. Because the individual income tax is progressive,

the rate of increase for income tax revenues is greater than the rate of increase in income

subject to the tax. Personal income tax credits include: out-of-state tax credit, credit for child

and dependent care expenses, D.C. low income credit, property tax credit, and D.C. earned

income tax credit.

The District’s third largest revenue producer, the sales and use tax, is based on taxable sales in

the District, which include most retail items, construction materials, and utilities used by

business entities. Groceries, prescription and non-prescription drugs, and professional services

such as consulting, engineering, legal, and physician services, are exempt from the sales and

use tax. The sales and use tax is generally administered by state and local governments. This

tax provided 16.6 percent of the District’s fiscal year 2015 local revenue.

iv

Although the District has features of a complete state/local revenue structure, it does not have

the mix of economic activity of a typical state or city revenue base. Manufacturing, which

enhances the tax bases of most major cities and states, is largely lacking in the District.

The federal presence in the District further compounds the disparity between the revenue-

raising capacity of the District and that of many state and local governments. Some of the

revenue implications due to the extraordinary federal presence include: (1) a narrower property

tax base because of the substantial amount of federally owned tax-exempt property in the city;

(2) a reduced income and sales tax base because of the tax-exempt status of the federal

government, which is the city’s largest employer, and (3) a significant amount of tax-exempt

property due to the presence of foreign embassies. Federal actions that limit the District’s tax

revenues include: (1) prohibition of taxing non-resident income earned in the District; and (2)

congressional limitations on the height of buildings in the District, which restrain economic

development.

Details concerning the various taxes used by the District are presented in this publication for the

purpose of taxpayer education and to enhance citizens’ awareness of their tax responsibilities.

The Office of Revenue Analysis welcomes comments on this document and how it could be

made more useful to the public.

Jeffrey S. DeWitt

Chief Financial Officer

Government of the District of Columbia

v

CORRECTIONS

The tax rates edited include the following:

Corporate franchise rate (page 8):

9.2% as of January 2016 instead of 9.0%

Public utility tax (page 23):

Maryland Natural Gas and Electricity tax rate are:

Natural gas: $0.00402 per therm

Electricity: $0.00062 per kwh

Footnote added that reads: “All local telephone utility taxes in Virginia are taxed with 5%

statewide communications sales and use tax.”

Motor vehicle registration fees (page 16):

Footnote added that reads: 1/ “Vehicles are registered for two (2) years at time of titling or at the

time registration is renewed. The fees shown include a $34.00 surcharge for the EMS system”.

This applies to Charles County, MD, Montgomery County, MD, and Prince George’s County,

MD.

vi

INTRODUCTION

Each year the Office of Revenue Analysis in the Office of the Chief Financial Officer receives

numerous requests from citizens, legislators and the general public for statistics relating to

District tax collections, tax burdens and tax rates.

D.C. Tax Facts presents a brief summary of information on the District's tax structure, tax rates,

legal references and other comparative tax data. Tax rates used in this publication are those in

effect as of January 1, 2016. More detailed information on these subjects may be obtained

online from other publications of this office, including: (1) A Comparison of Tax Rates and

Burdens in the Washington Metropolitan Area, (2) Tax Rates and Tax Burdens in the District of

Columbia: A Nationwide Comparison, and 3) the biannual Tax Expenditure Report. These

publications are available on the Internet at www.cfo.dc.gov.

The primary source for the 2016 revenue numbers presented in this report is the District of

Columbia FY 2017 Proposed Budget and Financial Plan.

District of Columbia revenues (including non-tax revenues) totaled $7.91 billion in FY 2015.

Details concerning the various taxes used by the District are presented in this publication for the

purpose of taxpayer education and to enhance citizens’ awareness of their tax responsibilities.

Questions regarding this report should be directed to: Charlotte Otabor, Fiscal Analyst, Office of

the Chief Financial Officer, Office of Revenue Analysis, 1101 4

th

Street, SW, Suite W770,

Washington, DC 20024. Telephone: (202) 727-4054.

Fitzroy Lee, Ph. D.

Deputy Chief Financial Officer and Chief Economist

Office of Revenue Analysis

vii

(this page intentionally left blank)

PART I -- D.C. GENERAL FUND REVENUE, FY 2015,

FY 2016 and FY 2017 (Estimated)

TABLE 1

GENERAL FUND

FISCAL YEAR 2015 REVENUE

(In Thousands of Dollars and Percent Composition)

Tax

FY 2015

Revenue

Percent of General Fund

Own Source Revenue

Real Property 1/

2,194,500

27.73%

Personal Property

57,225

0.72%

Public Space Rental

36,122

0.46%

General Sales 2/

1,315,295

16.62%

Alcoholic Beverages

6,244

0.08%

Cigarette

31,492

0.40%

Motor Vehicle

46,607

0.59%

Motor Fuel Tax 3/

25,256

0.32%

Individual Income

1,868,037

23.60%

Corporate Franchise

308,027

3.89%

U.B. Franchise

139,778

1.77%

Public Utility 4/

145,852

1.84%

Toll Telecommunications 4/

56,205

0.71%

Insurance Premiums 5/

104,507

1.32%

Healthcare Provider Tax 6/

12,854

0.16%

Ballpark fee 4/

34,942

0.44%

ICF-IDD Assessment 7/

5,032

0.06%

Estate

48,274

0.61%

Deed Recordation 8/

257,865

3.26%

Deed Transfer 8/

198,315

2.51%

Economic Interest 9/

24,412

0.31%

Total Taxes 10/

6,916,841

87.40%

Total Non-Tax

416,557

5.26%

Other Sources 11/

55,586

0.70%

Special Purpose (O Type) 12/

524,826

6.63%

Total General Fund 10/

7,913,810

100.00%

1/ Gross of transfer to the TIF Fund.

2/ Gross of legislated transfers to the Washington Convention Center Authority (WCCA) for retirement of debt, and to the Tax

Increment Financing (TIF) Fund, Ballpark Fund, Healthy Schools, ABRA, Healthy DC Fund, and WMATA.

3/ Gross of transfer to the Highway Trust Fund.

4/ Gross of transfer to the Ballpark Fund.

5/ Gross of transfer to the Healthy DC Fund.

6/ Gross of transfer to the Nursing Facility Quality of Care Fund.

7/ ICF-IDD Assessment transfers to Stevie Sellows Quality Improvement Fund.

8/ Gross of transfer to the Housing Production Trust Fund (HPTF)/ Bond repayment/ West End.

9/ Includes Coop Recordation Tax.

10/ Includes transfer of Dedicated Tax Revenue to Enterprise Funds in Fiscal Year 2015.

11/ Legalized gambling transfer (lottery).

12/ Special-Purpose Revenues, which are generated from fees, fines, assessments, or reimbursements that are dedicated to the

agency that collects the revenues, are often called “Other-Type,” or “O-Type” Funds.

Note: Some figures may differ from reported CAFR numbers as specific definitions of funds may vary.

2

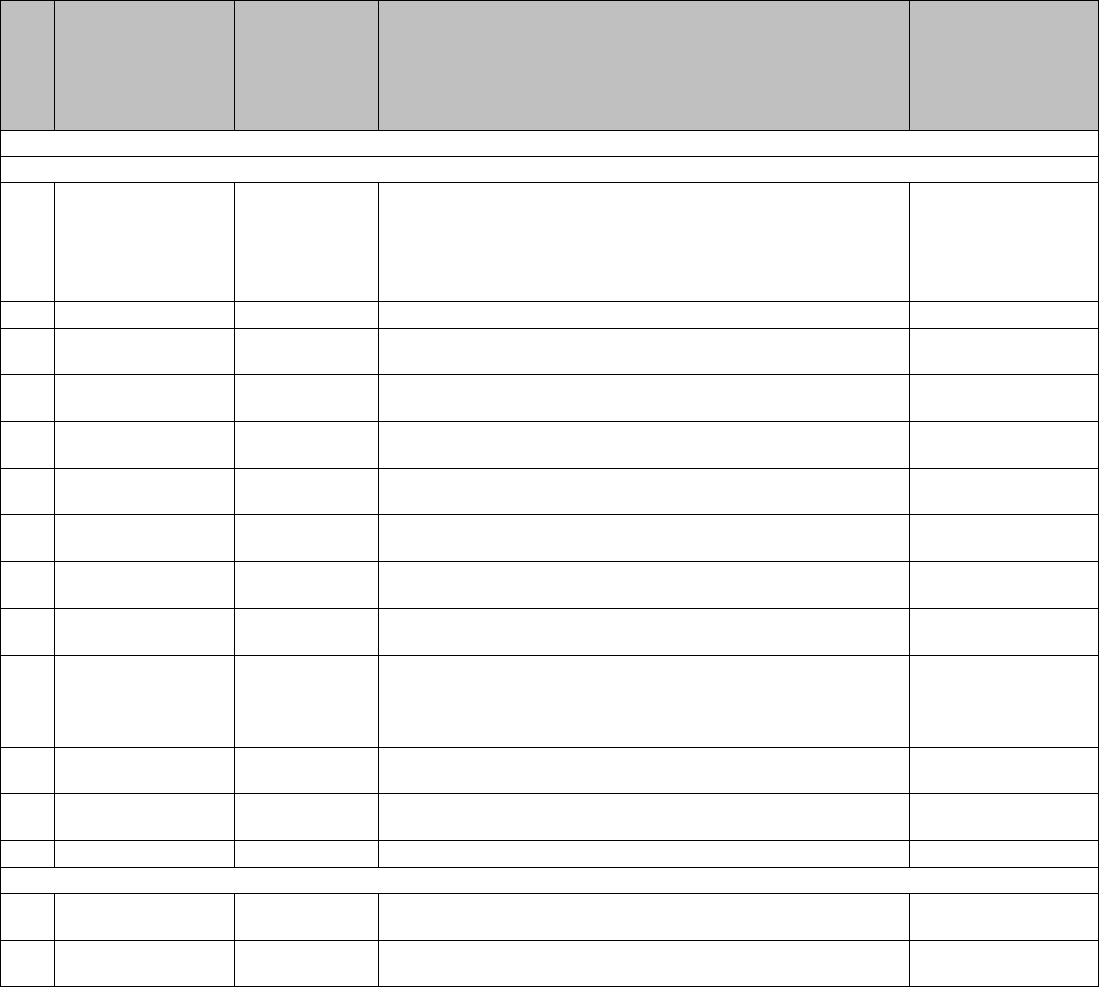

TABLE 2

GENERAL FUND

FY 2016 and FY 2017 REVENUE ESTIMATES

(In Thousands of Dollars)

Tax

FY 2016

Estimates

FY 2017

Estimates

Real Property 1/

2,357,202

2,456,722

Personal Property

58,370

60,529

Public Space Rental

37,242

38,247

General Sales 2/

1,290,847

1,344,385

Alcoholic Beverages

6,369

6,618

Cigarette

30,623

29,398

Motor Vehicle

47,725

49,589

Motor Fuel Tax 3/

25,004

24,754

Individual Income

1,856,982

1,930,426

Corporate Franchise

287,766

284,516

U.B. Franchise

133,159

133,135

Public Utility 4/

146,582

147,315

Toll Telecommunications 4/

58,003

60,033

Insurance Premiums 5/

102,642

97,918

Healthcare Provider Tax 6/

14,591

14,883

Ballpark fee 4/

31,800

32,754

Hospital Inpatient Fee 7/

10,400

-

Hospital Outpatient Fee 8/

6,700

-

ICF-IDD Assessment 9/

5,478

5,519

Estate

34,521

29,519

Deed Recordation 10/

200,687

205,303

Deed Transfer 10/

143,697

146,571

Economic Interest11/

16,789

15,800

Total Taxes 12/

6,903,180

7,113,934

Total Non-Tax

422,082

422,779

Other Sources 13/

55,000

55,500

Special Purpose (O Type) 14/

524,376

537,854

Total General Fund 12/

7,904,637

8,130,067

1/ Gross of transfer to the TIF Fund.

2/ Gross of legislated transfers to the Washington Convention Center Authority (WCCA) for retirement of debt, and to the

Tax Increment Financing (TIF) Fund, Ballpark Fund, Healthy Schools, ABRA, Healthy DC Fund, and WMATA.

3/ Gross of transfer to the Highway Trust Fund.

4/ Gross of transfer to the Ballpark Fund.

5/ Gross of transfer to the Healthy DC Fund.

6/ Gross of transfer to the Nursing Facility Quality of Care Fund.

7/ Hospital Inpatient Fee transfers to Hospital Fund.

8/ Hospital Outpatient Fee transfers to Hospital Provider Fee Fund.

9/ ICF-MR Assessment transfers to Stevie Sellows Quality Improvement Fund.

10/ Gross of transfer to the Housing Production Trust Fund (HPTF)/ Bond repayment/ West End.

11/ Includes Coop Recordation Tax.

12/ Includes transfer of Dedicated Tax Revenue to Enterprise Funds in Fiscal Years 2016 and 2017.

13/ Legalized gambling transfer (lottery).

14/ Special-Purpose Revenues, which are generated from fees, fines, assessments, or reimbursements that are dedicated

to the agency that collects the revenues, are often called “Other-Type,” or “O-Type” Funds.

Note: March 24, 2016 estimates.

3

PART II – DISTRICT OF COLUMBIA TAXES AND NON-TAX REVENUE SOURCES

4

ALCOHOLIC BEVERAGE TAX

GENERAL LIABILITY:

The tax is levied on all alcoholic beverages manufactured by a holder of a manufacturer's

license and on all beverages brought into the District by the holder of a wholesaler's or retailer’s

license.

D.C. Code Citation: Title 25, Chapter 9.

PRESENT RATES: (January 1, 2016)

Beer -- $2.79 per 31 gallon barrel

Light wine (14% alcohol or less) -- 30¢ per gallon

Heavy wine (over 14% alcohol) -- 40¢ per gallon

Champagne and sparkling wine -- 45¢ per gallon

Spirits -- $1.50 per gallon

REVENUE:

Fiscal Year

Revenue

2015

$6,244,227

2016 (Estimate)

$6,369,111

2017 (Estimate)

$6,617,890

COMPARATIVE DATA: (January 1, 2016)

Metropolitan Area

Alcoholic Beverage Tax Facts

ITEM

DC

MD

VA

Beer (per barrel)

$2.79

1/

$2.79

1/

$8.06

Spirits (per gallon)

1.50

1/

1.50

1/

20% of retail price

Wine (per gallon)

14% or less alcohol

.30

1/

.40

1/

1.51

2/ 3/

More than 14% alcohol

.40

1/

.40

1/

1.51

2/ 3/

Sparkling wine (per gallon)

.45

1/

.40

1/

1.51

2/ 3/

1/ In addition, a 10% off- and on- premise sales tax applies in DC and a 9% sales tax applies in MD.

2/ In addition, state sales tax applies. This includes a $.40 per liter wine tax, and the 5.3% state sales tax applied at ABC

stores, except in Northern Virginia and Hampton Roads regions where the state sales tax rate applied is 6%. Wines with

under 4% of alcohol- $0.2565/gallon

3/ Some localities may apply additional tax.

5

CIGARETTE TAX

GENERAL LIABILITY:

The cigarette tax is levied on the sale or possession of all cigarettes in the District. Cigarettes

sold to the military and to Congress are exempt from the tax.

D.C. Code Citation: Title 47, Chapter 24.

PRESENT RATES: (January 1, 2016)

Tax on a pack of twenty or fewer cigarettes is $2.91 per package or 14.6¢ per cigarette, and on

little cigars that weigh no more than 4.5 pounds per thousand. The tax includes a $0.41 per pack

surtax in lieu of a retail sales tax. For more than 20 per pack, the surtax will be incrementally

increased by $0.0205 per each cigarette above 20.

Tax on “other tobacco products,” which are any product containing, made from, or derived from

tobacco, other than cigarettes or a $2.00-plus premium cigar, are taxed at 67% of the wholesale

sales of other tobacco products. The Vapor Product Amendment Act of 2015 expanded the term

“other tobacco product” to include vapor product which results in e-cigarettes being taxed at the

same rate as “other tobacco products”. The term “vapor product” means any non-lighting,

noncombustible product that uses a mechanical heating element, battery, or electronic circuit,

regardless of shape or size that can be used to produce aerosol from nicotine in a solution. This

includes any vapor cartridge or other container of nicotine in a solution or other form that is used

with or in an electronic cigarette, electronic cigar, electronic cigarillo, electronic pipe, or similar

product or device.

The term “other tobacco product” does not include any other product that has been approved by

the United States Food and Drug Administration for sale as a tobacco cessation product, as a

tobacco dependence product, or for other medical purposes and that is being marketed and sold

solely for such an approved purpose.

REVENUE:

Fiscal Year

Revenue

2015

$31,491,836

2016 (Estimate)

$30,622,661

2017 (Estimate)

$29,397,755

6

COMPARATIVE DATA: (January 1, 2016)

Metropolitan Area

Cigarette Tax Facts

State

Tax Per Pack of 20

DC

$2.91 1/

Maryland

$2.00

Virginia 2/

$0.30

Alexandria

$1.15

Arlington County 2/

$0.30

Fairfax City

$0.85

1/ Includes a per pack surtax in lieu of a retail sales tax

calculated every March 31. The current rate is 41¢.

2/ Plus additional local rates. Arlington county tax rate is

$0.375 on each pack containing 25 cigarettes

7

ESTATE TAX

GENERAL LIABILITY:

The estate tax is imposed on the estate of every decedent who died while still a resident of the

District, and on the estate of every nonresident decedent owning property having a taxable situs

in the District at the time of his or her death.

In response to the Federal Economic Growth and Tax Relief Reconciliation Act (EGTRRA) of

2001, the District decoupled from federal estate tax rules. The federal legislation gradually

eliminated the federal estate tax over the next several years, with full repeal taking effect in year

2010. However, the estate tax elimination was only temporary, as the full estate tax returned in

2011. The American Taxpayer Relief Act of 2012 permanently changed the estate tax after a

decade of flux. The federal estate tax rate is 40 percent and the exemption level ($5.45 million in

2016) is indexed for inflation.

By decoupling, the District has chosen to create its estate tax threshold. Hence, some District

estate tax payers may be required to file and pay District estate taxes even when no federal

filing or tax is due. The District’s estate tax rates are linked to federal estate tax credits that

were available prior to the enactment of EGTRRA. The highest rate of 16.0 percent applies to

estates valued at more than $10,000,000 (after allowable federal credits are taken).

The FY15 Budget Support Act instituted a revenue trigger for implementation of tax policy

changes recommended by the District’s Tax Revision Commission beyond FY 2015, one of

which raised the estate tax threshold from $1 million to $2 million. This change is stipulated

upon meeting some revenue triggers that would go into effect before the increase in the estate

tax threshold. This increase in the estate tax threshold became effective in FY 2016 based on

the February 2016 revenue forecast for the period FY 2016-FY 2020.

Virginia repealed its estate tax by the 2006 General Assembly for decedents whose date of

death occurs on or after July 1, 2007. Maryland estate tax rate is similar to the District of

Columbia. The highest Maryland tax rate is 16.0 percent of the amount by which the decedent’s

taxable estate exceeds the Maryland estate tax exemption ($2 million) amount for the year of the

decedent’s death (after allowable federal credits are taken).

There is no inheritance or gift tax in the District of Columbia.

D.C. Code Citation: Title 47, Chapter 37.

REVENUE:

Fiscal Year

Revenue

2015

$48,273,641

2016 (Estimate)

$34,521,000

2017 (Estimate)

$29,518,694

8

INCOME TAXES

CORPORATION AND UNINCORPORATED BUSINESS FRANCHISE TAXES

GENERAL LIABILITY:

The corporation franchise tax is imposed on corporations carrying on a trade, business or

profession in the District or receiving income from District sources. Whoever engages in a trade,

business or profession in the District of Columbia must register. Failure to register may result in

a fine of not more than $500 and a civil penalty of $50 for each and every separate day that

such failure to register continues.

The tax on unincorporated businesses is imposed on businesses with gross income over

$12,000. A 30% salary allowance for owners and a $5,000 exemption are deductible from net

income to arrive at taxable income. No person other than a corporation shall engage in or

conduct a trade, business or profession. A person who fails to obtain a trade or business license

may be fined not more than $300 for each day that such failure continues. The minimum tax is

$250 if DC gross receipts are less than $1 million and $1,000 if DC gross receipts are greater

than $1million.

Generally, persons exempt from filing an unincorporated business franchise tax return include

trade, business, or professional organizations having a gross income not in excess of $12,000

for the taxable year, and trade, business, or professional organizations which by law, customs,

or ethics cannot be incorporated, such as doctors and lawyers. A business is also exempt if

more than 80% of gross income is derived from personal services rendered by the members of

the entity and capital is not a material income-producing factor. Federal conformity is maintained

pursuant to Public Law 105-100.

D.C. Code Citation: Title 47, Chapter 18.

PRESENT RATES: (January 1, 2016)

The franchise tax rate was reduced, beginning January 1, 2016, to 9.2 percent through the

Fiscal Year 2015 Budget Support Act of 2014. Subject to availability of funding, the tax rate

would be further reduced to 9.0%, 8.75%, 8.5%, or 8.25%. Per Subchapter 17, Qualified High

Technology Companies are taxed at a rate of 6.0 percent after 5 years following the date that

the Qualified High Technology Company has taxable income. The tax credit for a Qualified High

Technology Company cannot exceed $15 million in total exemptions.

REVENUE:

Fiscal Year

Corporation

Unincorporated

Business

2015

$308,027,017

$139,778,436

2016 (Estimate)

$287,766,000

$133,159,358

2017 (Estimate)

$284,515,740

$133,135,137

9

INCOME TAXES—Continued

YEAR

DC BUSINESS FRANCHISE TAX

REVENUE ADJUSTED FOR

INFLATION (IN 2012 DOLLARS)

($000,000)

PERCENT OF

TOTAL TAX

COLLECTED

1995

$246.8

6.7%

1996

$229.0

6.3%

1997

$265.6

7.3%

1998

$315.7

7.9%

1999

$303.8

7.6%

2000

$355.0

8.4%

2001

$398.6

9.2%

2002

$275.3

6.5%

2003

$302.9

7.0%

2004

$318.4

6.7%

2005

$374.8

7.4%

2006

$413.8

7.9%

2007

$476.6

8.2%

2008

$443.6

7.8%

2009

$366.2

6.8%

2010

$338.3

6.5%

2011

$366.6

6.8%

2012

$465.9

8.0%

2013

$447.7

7.4%

2014

$404.0

6.6%

2015

$434.0

6.5%

10

INDIVIDUAL INCOME TAX

GENERAL LIABILITY:

The tax is imposed on every resident, defined as any individual who is domiciled in the District at

any time during the tax year, or who maintains an abode in the District for 183 or more days

during the year. On June 11, 1982, D.C. Law 4-118, the District of Columbia Individual, Estates,

and Trusts Federal Conformity Tax Act, which adopted the federal definition of income and

made other modifications to the D.C. income tax, became law. Provisions of this legislation are

effective for tax years beginning after December 31, 1981.

Further conformity to federal provisions was made pursuant to D.C. Law 5-32, the District of

Columbia Income and Franchise Tax Conformity Act of 1983; the Conformity Act of 1984; the

Income and Franchise Tax Conformity and Revision Amendment Act of 1987.

Under current District law (DC Law 13-175) federal changes in income and deductions are

adopted automatically. The latest conformity legislation is Public Law 105-100. It maintains the

District’s limited conformity with the Internal Revenue Code (IRC) of 1986 as amended through

August 20, 1996.

D.C. Code Citation: Title 47, Chapter 18.

PRESENT RATES: (January 1, 2016)

Taxable Income

Tax Rate

First $10,000

4.0%

Over $10,000, but not over $40,000

$400 + 6.0% of excess>$10,000

Over $40,000, but not over $60,000

$2,200 + 6.5% of excess>$40,000

Over $60,000, but not over $350,000

$3,500 + 8.5% of excess>$60,000

Over $350,000, but not over $1,000,000

$28,150 + 8.75% of excess > $350,000

Over $1,000,000

$85,025 + 8.95% of excess > $1,000,000

Standard Deduction/Exemption*

Standard Deduction

Single/Married Filing Separate

Married Filing Jointly

Head of Household

$5,200

$8,350

$6,500

Exemptions

Personal Exemption

$1,775

*Beginning January 1, 2013, the standard deduction and personal exemption amounts are increased annually

by a cost-of-living adjustment.

REVENUE:

Fiscal Year

Revenue

2015

$1,868,037,067

2016 (Estimate)

$1,856,982,173

2017 (Estimate)

$1,930,425,864

11

INDIVIDUAL INCOME TAX-Continued

YEAR

DC INDIVIDUAL INCOME TAX

REVENUE ADJUSTED FOR

INFLATION (IN 2012 DOLLARS)

($000,000)

PERCENT OF TOTAL

TAX COLLECTED

1995

$988.5

26.9%

1996

$1,024.0

28.3%

1997

$1,090.6

29.9%

1998

$1,227.3

30.7%

1999

$1,329.4

33.1%

2000

$1,464.0

34.6%

2001

$1,449.3

33.3%

2002

$1,236.9

29.4%

2003

$1,180.0

27.5%

2004

$1,292.9

27.4%

2005

$1,392.1

27.3%

2006

$1,426.5

27.3%

2007

$1,482.1

25.5%

2008

$1,442.0

25.2%

2009

$1,215.8

22.5%

2010

$1,160.6

22.2%

2011

$1,321.4

24.3%

2012

$1,490.7

25.5%

2013

$1,620.6

26.9%

2014

$1,632.4

26.7%

2015

$1,810.6

27.0%

12

INSURANCE PREMIUMS TAX

GENERAL LIABILITY:

The tax is imposed on the gross insurance premiums received for insuring against risks in the

District, less premiums received for reinsurance assumed, returned premiums and dividends

paid to policyholders. All domestic and foreign insurance companies are liable for the tax, which

is in lieu of all other taxes except real estate taxes and fees provided for by the District's

insurance law.

D.C. Code Citation: Title 31; Title 47, Chapter 26.

REVENUE:

Fiscal Year

Gross Revenue

Net Revenue

2015

$104,507,000

$59,702,000

2016 (Estimate)

$102,642,495

$57,250,236

2017 (Estimate)

$97,918,165

$51,618,061

TRANSFER TO HEALTHY DC and HEALTH CARE EXPANSION FUND:

Fiscal Year

Transfer Amount

2015

$44,805,000

2016 (Estimate)

$45,392,259

2017 (Estimate)

$46,300,104

COMPARATIVE DATA: (January 1, 2016)

Insurance Premiums Tax Facts

Type of Company/Policy

DC

1/

MD

VA

Life insurance companies

1.7%

2.00%

2.25%

Life insurance special benefits

1.7%

2.00%

2.25%

Domestic mutual companies

1.7%

2.00%

1.00%

Industrial sick benefit companies

1.7%

2.00%

1.00%

Worker’s compensation

1.7%

2.00%

2.50%

Other

2.00%

2/

2.00%

3/

2.25%

4/

Legal service insurance companies

---

---

2.25%

1/ Of insurance premium taxes generated by policies with health maintenance organizations

(HMO), 75% of the 2.00% is distributed to the Healthy DC fund for the purpose of providing affordable health

benefits to eligible individuals.

2/ 2.0% on accident and health insurance policy.

3/ 3.0% on unauthorized insurers and surplus line brokers.

4/ Includes surplus line brokers.

13

MOTOR VEHICLE TAXES

MOTOR VEHICLE EXCISE TAX

GENERAL LIABILITY:

The excise tax is imposed on the issuance of every original and subsequent certificate of title on

motor vehicles and trailers. Vehicles brought into the District by new residents, who have been

titled elsewhere, are exempt from the tax.

D.C. Code Citation: Title 50, Chapter 22.

PRESENT RATES: (January 1, 2016)

Based on manufacturer's shipping weight

6% of fair market value-3,499 pounds or less

7% of fair market value-3,500 - 4,999 pounds

8% of fair market value-5,000 pounds or more

0% for hybrid vehicles

REVENUE:

Fiscal Year

Revenue

2015

$46,606,745

2016 (Estimate)

$47,725,307

2017 (Estimate)

$49,589,469

COMPARATIVE DATA: (January 1, 2016)

Metropolitan Area Motor Vehicle

Excise Tax Facts

State

Rate

(based on FMV)

DC 1/

6-8%

Maryland 1/

6%

Virginia 2/

4.10%

1/ Based on fair market value. In Maryland, there is a minimum tax of $38.40.

2/ Based on vehicle’s gross sales price, or $75, whichever is greater. An additional $64 fee applies to hybrid and electric

vehicles, excluding mopeds.

14

MOTOR VEHICLE FUEL TAX

GENERAL LIABILITY:

The tax is imposed on every importer of motor vehicle fuels, including gasoline, diesel fuel,

benzol, benzene, naphtha, kerosene, heating oils, all liquefied petroleum gases and all

combustible gases and liquids suitable for the generation of power for the propulsion of motor

vehicles. Since October 1, 1996, the revenue from the motor vehicle fuel tax has been deposited

into the Highway Trust Fund, rather than the General Fund.

Effective October 1, 2013, the District levies the motor fuel vehicle tax at the wholesale level,

equal to 8 percent of the average wholesale price of a gallon of regular unleaded gasoline. The

average wholesale price will be calculated for adjustment twice a year. As a result, the tax rate

may change each year. The average wholesale price will be determined by the District and

published by February 1 and August 1 of each year. The floor on the wholesale price for the

calculation of the tax is $2.94, or 23.5 cents per gallon. This is the average wholesale price in

effect as of January 2016; it may increase in the future.

D.C. Code Citation: Title 47, Chapter 23.

PRESENT RATES: (January 1, 2016)

23.5¢ per gallon

REVENUE:

Fiscal Year

Revenue

2015

$25,256,173

2016 (Estimate)

$25,003,611

2017 (Estimate)

$24,753,575

COMPARATIVE DATA: (January 1, 2016)

Metropolitan Area Gasoline Tax Facts

State

Rate per Gallon

DC

$0.235

Maryland

$0.326

Virginia*

$0.162

* Virginia also has a 2.1% local wholesale sales tax on fuel sold in the Northern Virginia and Hampton Roads

Planning District Commission areas.

15

MOTOR VEHICLE REGISTRATION FEES

GENERAL LIABILITY:

Fees are imposed on every vehicle operated over the highways of the District of Columbia by a

resident. A resident has the option of registering every two years.

D.C. Code Citation: Title 50, Chapter 15.

PRESENT RATES: (January 1, 2016) - Based on manufacturer's shipping weight

PASSENGER CARS – Class A

Class I (3,499 pounds or less)

$ 72

Class II (3,500 – 4,999 pounds)

$115

Class III (5,000 pounds or greater)

$155

Class IV (clean fuel or electric vehicle [Hybrid])

$ 36

Motorized bicycle

$ 30

Motorcycles

$ 52

Antique vehicles

$ 25

TRUCKS AND BUSES – Class B

Class I (3,499 pounds or less)

$125

Class II (3,500 – 4,999 pounds)

$160

Class III (5,000 – 6,999 pounds)

$220

Class IV (7,000 – 9,999 pounds)

$300

Class V (10,000 pounds or greater) 1/

$575

TRAILERS – Class C

Class I (1,499 pounds or less)

$ 50

Class II (1,500 – 3,499 pounds)

$125

Class III (3,500 – 4,999 pounds)

$250

Class IV (5,000 – 6,999 pounds)

$400

Class V (7,000 – 9,999 pounds)

$500

Class VI (10,000 pounds – or greater) 2/

$500

Driver’s license (1

st

time & renewal) 3/

$ 47

Learner’s permit

$ 20

Driver’s license reinstatement

$ 98

Driver’s instructor license

$ 78

Vehicle titles:

New titles

Duplicate titles

Lien recordation (per lien)

$ 26

$ 26

$ 20

Temporary tags

$ 13

Inspection fee 4/

$ 35

Residential parking permits

$ 35

Reciprocity parking permit for students

$338

1/ Additional $25 per 1,000 pounds over 10,000 pounds.

2/ Additional $50 per 1,000 pounds over 10,000 pounds.

3/ Eight years.

4/ Two years.

Source: DC Department of Motor Vehicles, www.dmv.dc.gov.

16

MOTOR VEHICLE REGISTRATION FEES-Continued

REVENUE:

Fiscal Year

Revenue

2015

$28,001,000

2016 (Estimate)

$26,875,000

2017 (Estimate)

$27,212,000

COMPARATIVE DATA: (January 1, 2016)

METROPOLITAN AREA MOTOR VEHICLE REGISTRATION FEES

PASSENGER VEHICLE WEIGHTS

JURISDICTION

3,499 lbs.

OR LESS

3,500–

3,700 lbs.

3,701–

4,999 lbs.

OVER

5,000 lbs.

District of Columbia

$72.00

$115.00

$115.00

$155.00

Charles County, MD 1/

135.00

135.00

187.00

187.00

Montgomery County, MD 1/

135.00

135.00

187.00

187.00

Prince George’s County, MD 1/

135.00

135.00

187.00

187.00

Alexandria, VA 2/

73.75

73.75

78.75

78.75

Arlington County, VA 2/

73.75

73.75

78.75

78.75

Fairfax, VA 2/

73.75

73.75

78.75

78.75

Fairfax County, VA 2/

73.75

73.75

83.75

83.75

Falls Church, VA 2/

73.75

73.75

78.75

78.75

Loudoun County, VA 2/

65.75

65.75

70.75

70.75

Prince William County, VA 2/

64.75

64.75

69.75

69.75

1/ Vehicles are registered for two (2) years at time of titling or at the time registration is renewed. The fees shown

include a $34.00 surcharge for the EMS system

2/ Autos also subject to personal property tax. Rates shown include a $40.75 state fee on vehicles weighing 4,000

pounds or less and a $45.75 fee on vehicles weighing more than 4,000 pounds.

17

PROPERTY TAXES

PERSONAL PROPERTY TAX

GENERAL LIABILITY:

The tax is levied on all tangible property, except inventories, used in a trade or business. Such

property includes machinery, equipment, furniture and fixtures.

D.C. Code Citation: Title 47, Chapter 15.

PRESENT RATE:

$3.40 per $100 of assessed value; the first $225,000 of taxable value is excluded from tax.

REVENUE:

Fiscal Year

Gross Revenue

2015

$57,225,000

2016 (Estimate)

$58,369,500

2017 (Estimate)

$60,529,172

COMPARATIVE DATA: (January 1, 2016)

Metropolitan Area Personal Property Tax

Facts 1/

Jurisdiction

Rate

District of Columbia

$3.4000

Charles County, MD

$3.0125

2/

Montgomery County, MD

$1.8075

2/

Prince George’s County, MD

$4.2500

2/

Alexandria, VA

$5.0000

3/

4/

Arlington County, VA

$5.0000

3/

Fairfax City, VA

$4.1300

3/

Fairfax County, VA

$4.5700

3/

Falls Church, VA

$4.8400

3/

Loudoun County, VA

$4.2000

3/

Prince William County, VA

$3.7000

3/

1/ Personal property tax year in the Virginia area jurisdictions is on a calendar year basis. The rates submitted by

Virginia jurisdictions for this report are applicable to calendar year 2014. The District of Columbia tax rate is from D.C.

Official Code. In the Maryland area jurisdictions, the 2015 personal property year tax is July 1, 2015 to June 30, 2016.

The rates presented are those in effect for this period. Since 2001, the Virginia personal property tax relief varies by

jurisdiction for qualifying vehicles.

2/ Rate applied to non-town businesses. Maryland property tax rate is not levied against personal property; the 2015

personal property year tax is July 1, 2015 to June 30, 2016.

3/ Rate applied to regular individual personal property, and business tangible personal property.

4/ Personal property rate of $3.55 for vehicles with specially-designed equipment for disabled persons.

Note: The above rates are per $100 of assessed value.

18

PERSONAL PROPERTY TAX-continued

YEAR

DC PERSONAL PROPERTY TAX

REVENUE ADJUSTED FOR INFLATION

(IN 2012 DOLLARS)

($000,000)

PERCENT OF

TOTAL TAX

COLLECTED

1995

$94.1

2.6%

1996

$96.8

2.7%

1997

$87.4

2.4%

1998

$97.5

2.4%

1999

$103.2

2.6%

2000

$95.3

2.3%

2001

$84.7

1.9%

2002

$85.0

2.0%

2003

$85.5

2.0%

2004

$78.8

1.7%

2005

$86.5

1.7%

2006

$75.8

1.5%

2007

$76.0

1.3%

2008

$64.1

1.1%

2009

$74.0

1.4%

2010

$54.4

1.0%

2011

$53.7

1.0%

2012

$55.7

1.0%

2013

$54.2

0.9%

2014

$53.9

0.9%

2015

$55.5

0.8%

19

REAL PROPERTY TAX

GENERAL LIABILITY:

The District of Columbia property tax uses four classifications of real property: Class I--

residential real property; Class II--commercial and industrial property, including hotels and

motels; Class III—vacant property; and Class IV—blighted property. All real properties, other

than expressly exempted properties, are subject to taxation at 100% of estimated market value.

The assessed value for each Class I owner-occupied residence (including condominiums) which

qualifies as a homestead is reduced by a $71,700 homestead deduction. Homestead properties

are also subject to a 10% property tax cap whereby the property tax paid on the property is

limited to at most 110% of the tax paid the previous year. This exemption is indexed annually

(by the CPI) on October 1st of each year. For qualified senior homeowners, as well as

homeowners with a disability, the District allows an additional 50 percent reduction in the

amount of real property taxes that would otherwise be payable. In addition, a property tax

deferral program allows qualified low income homeowners, with total household Adjusted Gross

Income (AGI) of $50,000 or less, to defer a portion of their taxes.

First-time homeowners may be eligible for abatement of real property taxes for a period of five

years under the First Time Homebuyers Lower Income Home Ownership Tax Abatement

program. Another Lower Income, Long-term Homeowners Tax Credit was passed by the DC

Council to ease the effect of rising assessments and taxes on low-income residents who have

lived in their homes seven consecutive years or more. To access this credit, homeowners must

have occupied the property as their principal residence for at least the last seven (7)

consecutive years, be receiving the Homestead Deduction, and must meet specific income

requirements. Owners of certain certified historic buildings may receive property tax relief

through a special assessment if the owners enter an agreement with the city for at least twenty

years. The District also has a property tax relief "circuit-breaker" program for qualified

homeowners and renters (with adjusted gross income of $40,000 or less), which provides a tax

credit for those with low and moderate income, the elderly, blind and disabled.

District law limits the estimated amount of total real property taxes collected from all residential

properties (Class I) by limiting the annual growth in total real property taxes from all residential

properties, by way of a calculated tax rate. If, just before the start of the fiscal year, it is

estimated that actual Class I revenue will exceed the targeted growth amount, the residential tax

rate is to be lowered to achieve only the statutorily specified revenue amount.

Class II properties are subject to a split tax rate structure. The tax rate for the first $3 million in

assessed value for Class II properties is set at $1.65 per $100 of assessed value and the tax

rate for assessed valued greater than $3 million is $1.85 per $100 of assessed value.

Additionally, legislation limits the growth in total Class II revenue to 10 percent annually. If, just

before the start of the fiscal year, it is estimated that actual Class II revenue will exceed the

targeted growth amount, the tax rate for the first $3 million of assessed value is to be lowered to

achieve only the statutorily specified revenue amount for all of Class II properties.

D.C. Code Citation: Title 47, Chapters 7-10, 13, 13A.

The District's Real Property Tax Year is October 1 through September 30.

20

REAL PROPERTY TAX- Continued

REVENUE:

Fiscal Year

Gross Revenue

Net Revenue

2015

$2,194,499,764

$2,154,319,715

2016 (Estimate)

$2,357,202,000

$2,310,808,000

2017 (Estimate)

$2,456,722,000

$2,417,103,000

Tax Increment Financing (TIF) Program and PILOT Transfers:

Fiscal Year

Transfer

Amount

2015

$40,180,050

2016 (Estimate)

$46,394,000

2017 (Estimate)

$39,619,000

COMPARATIVE DATA: (January 1, 2016)

METROPOLITAN AREA REAL PROPERTY TAX FACTS

JURISDICTION

NOMINAL TAX

PER $100

VALUE

LEGAL

ASSESSMENT

(% of estimated

market value)

TAX RATE PER

$100 VALUE 6/

D.C.

Class I (residential) 1/

Class II (commercial) 2/

Class III (vacant)

Class IV (blighted)

$ 0.850

$ 1.850

$ 5.000

$10.00

100%

100%

100%

100%

$ 0.850

$ 1.850

$ 5.000

$10.00

MARYLAND 8/

Charles Co. 3/ 4/

Montgomery Co. 5/

Prince George’s Co. 3/

$ 1.317

$ 1.099

$ 1.112

100%

100%

100%

$ 1.317

$ 1.099

$ 1.112

VIRGINIA 8/

Alexandria 6/ 7/

Arlington Co.

Fairfax City

Fairfax Co.

Falls Church

Loudoun Co.

Prince William Co.

$ 1.073

$ 0.996

$ 1.062

$ 1.090

$ 1.315

$ 1.145

$ 1.122

100%

100%

100%

100%

100%

100%

100%

$ 1.073

$ 0.996

$ 1.062

$ 1.090

$ 1.315

$ 1.145

$ 1.122

1/ The first $71,700 of assessed value is exempt from the tax on owner-occupied housing.

2/ 1st $3(M) rate is $1.65 per $100 of assessed value.

3/ Rates shown include a state rate of 11.2 cents per $100 of assessed value.

4/ Rates are different in tax districts with various levies for fire, rescue and recreation.

5/ Montgomery County property tax rate is a weighted rate.

6/ Nominal tax rate x assessment = tax rate.

7/ On March 15, 2016, the Alexandria City Council voted unanimously that it will consider a 2016 calendar

year real estate tax rate of up to $1.073 per $100 of assessed value. The 2016 real property tax rate of

$1.043 might therefore be temporary.

8/ Virginia and Maryland’s fiscal year cycle is from July 1

st

through June 30

th

, while the District of Columbia’s

fiscal year cycle is from October 1

st

through September 30

th

. The rates for Virginia and Maryland will

therefore be a fiscal year behind to match D.C’s fiscal year.

21

REAL PROPERTY TAX-Continued

YEAR

DC REAL PROPERTY TAX

REVENUE ADJUSTED FOR

INFLATION (IN 2012

DOLLARS)

($000,000)

PERCENT OF TOTAL

TAX COLLECTED

1995

$1,004.8

27.4%

1996

$927.4

25.7%

1997

$894.1

24.5%

1998

$878.8

22.0%

1999

$834.3

20.8%

2000

$830.1

19.6%

2001

$835.6

19.2%

2002

$946.1

22.5%

2003

$1,045.2

24.3%

2004

$1,175.5

24.9%

2005

$1,272.8

25.0%

2006

$1,334.2

25.5%

2007

$1,634.2

28.1%

2008

$1,796.6

31.4%

2009

$1,950.9

36.1%

2010

$1,903.7

36.4%

2011

$1,747.8

32.2%

2012

$1,822.0

31.1%

2013

$1,891.2

31.4%

2014

$1,959.4

32.0%

2015

$2,127.0

31.7%

22

PUBLIC SPACE RENTAL

GENERAL LIABILITY:

The tax is imposed on commercial use of publicly-owned property between the property line and

the street

D.C. Code Citation: Title 10, Chapter 11.

PRESENT RATE: (January 1, 2016)

Various rates for the following: vault, sidewalk (enclosed and unenclosed cafes), surface and

fuel oil tank.

Calculation of Vault Rental Fees

Vault Rental Fee = (assessed value of the land by square foot) x (vault square footage) x

(utilization factor)

Note: The assessed value of the land is determined by the Office of Tax & Revenue; the vault square footage is supplied

by the D.C. Department of Transportation’s Public Space Regulation Administration (PSRA); rent per fuel oil tank is $100;

and the utilization factor is currently 1.2% for vaults with a single level and .30% for additional levels (which is applied

based on information supplied by PSRA).

REVENUE:

Fiscal Year

Gross Revenue

2015

$36,122,000

2016 (Estimate)

$37,241,782

2017 (Estimate)

$38,247,310

23

PUBLIC UTILITY TAX

GENERAL LIABILITY:

The tax is imposed on the gross receipts of telephone, television and radio companies and on

the units delivered to customers of natural gas, electricity and heating oil.

D.C. Code Citation: Title 47, Chapter 25.

PRESENT RATE: (January 1, 2016)

Note: Non-residential rates are 10% (1% for television, radio and telephone) greater than the

residential rates. The 10% surcharge on non-residential customers is dedicated to the Ballpark

Revenue Fund.

REVENUE:

Fiscal Year

Gross Revenues

Net Revenues

2015

$145,852,364

$137,171,085

2016 (Estimate)

$146,581,625

$137,813,534

2017 (Estimate)

$147,314,534

$138,458,761

Transfer to Ballpark Revenue Fund:

Fiscal Year

Transfer Amount

2015

$8,681,279

2016 (Estimate)

$8,768,092

2017 (Estimate)

$8,855,773

COMPARATIVE DATA: (January 1, 2016)

METROPOLITAN AREA UTILITY TAX FACTS

JURISDICTION

UTILITIES SUBJECT TO

TAX

RATE

BASIS

District of Columbia

Television, radio and

telephone

10.0%

11.0%

Gross receipts

Residential

Non-residential

Heating oil

$0.170

$0.187

Per Gallon

Residential

Non-residential

Natural gas

$0.0707

$0.07777

Per Therm

Residential

Non-residential

Electric distribution

$0.0070

$0.0077

Per Kilowatt Hr

Residential

Non-residential.

Maryland

Electric, light and power, gas,

oil pipeline , telegraph and

telephone companies

2.0%

Gross receipts

Natural gas

$0.00402

Per Therm

Electricity

$0.00062

Per Kilowatt Hr

Virginia 3/

Water

2.0%

Gross receipts

Electric 1/

Less than 2,500 kWh

2,500 – 50,000 kWh

Above 50,000 kWh

Gas 1/

Below 500 CCF

$0.00155/kWh

$0.00099/kWh

$0.00075/kWh

$0.0135/CCF

Utility Consumption

1/ Local consumption tax rates and a special regulatory tax rate may also apply.

2/ Telephone companies are subject to the corporate income tax, not the utility gross receipts tax.

3/ All local telephone utility taxes in Virginia are taxed with a 5% statewide communications sales and use tax.

24

PUBLIC UTILITY TAX-continued

YEAR

DC PUBLIC UTILITY TAX REVENUE

ADJUSTED FOR INFLATION

(IN 2012 DOLLARS)

($000,000)

PERCENT OF

TOTAL TAX

COLLECTED

1995

$201.2

5.5%

1996

$215.1

6.0%

1997

$205.4

5.6%

1998

$201.0

5.0%

1999

$179.4

4.5%

2000

$180.5

4.3%

2001

$196.8

4.5%

2002

$183.7

4.4%

2003

$211.8

4.9%

2004

$210.2

4.5%

2005

$208.9

4.1%

2006

$179.4

3.4%

2007

$184.8

3.2%

2008

$164.9

2.9%

2009

$161.7

3.0%

2010

$156.6

3.0%

2011

$152.6

2.8%

2012

$139.8

2.4%

2013

$140.7

2.3%

2014

$141.6

2.3%

2015

$141.4

2.1%

25

RECORDATION AND TRANSFER TAXES

GENERAL LIABILITY:

Recordation Tax

The recordation tax is imposed on the recording of all deeds to real estate in the District. The

basis of the tax is the amount of consideration given for the property, including cash, property

other than cash, mortgages, liens and security interest in non-residential property. Where there

is no consideration or where the consideration is nominal, the tax is imposed on the basis of the

fair market value of the property.

D.C. Code Citation: Title 42, Chapter 11.

PRESENT RATE: (January 1, 2016)

Deed Recordation

1.1% of consideration or fair market value for residential property transfers < $400,000

1.45% of consideration or fair market value on the entire amount for all other deed transfers is ≥

$400,000

REVENUE:

Fiscal Year

Gross Revenue

Net Revenue

2015

$257,865,239

$219,185,453

2016 (Estimate)

$200,687,246

$170,584,159

2017 (Estimate)

$205,303,053

$174,507,595

Transfer Tax

The transfer tax is imposed on each transfer of real property at the time the deed is submitted

for recordation. The tax is based upon the consideration paid for the transfer. Where there is

no consideration or where the amount is nominal, the basis of the transfer tax is the fair market

value of the property conveyed.

D.C. Code Citation: Title 47, Chapter 9.

PRESENT RATE: (January 1, 2016)

Deed Transfer

1.1% of consideration or fair market value for residential property transfers < $400,000

1.45% of consideration or fair market value on the entire amount all other deed transfers is ≥

$400,000

REVENUE:

Fiscal Year

Gross Revenue

Net Revenue

2015

$198,314,992

$168,567,743

2016 (Estimate)

$143,697,105

$122,142,539

2017 (Estimate)

$146,571,047

$124,585,390

Note: All property other than Class 1 taxed at 1.45% of consideration or full market value of transfer.

26

RECORDATION AND TRANSFER TAXES

Fifteen percent of the District’s real estate transfer taxes and 15 percent of deed recordation

taxes are deposited into the Housing Production Trust Fund.

Housing Production Trust Fund Transfers/ Bond repayment/ West End:

Fiscal Year

Recordation

Tax

Transfer

Tax

2015

$38,679,786

$29,747,249

2016 (Estimate)

$30,103,087

$21,554,566

2017 (Estimate)

$30,795,458

$21,985,657

Economic Interest Tax

The economic interest tax is triggered by either one of the following two elements: 1) more than

50% of the controlling interest of the property owner is transferred; and 2) 80% of the assets of

the property owner consist of real property located in DC.

A transfer of shares in a cooperative housing association in connection with the grant, transfer

or assignment of proprietary leasehold or other proprietary interest, in whole or in part, is defined

as a transfer of an economic interest and subject to the tax.

D.C. Code Citation: Title 42, Chapter 11.

PRESENT RATE: (January 1, 2016)

2.9% of consideration or fair market value, except that in the case of a transfer of economic

interest in a cooperative housing association where the consideration is less than $400,000, the

rate of taxation shall be 2.2%

REVENUE:

Fiscal Year

Economic Interest

Transfer

2015

$24,411,923

2016 (Estimate)

$16,789,000

2017 (Estimate)

$15,800,000

27

RECORDATION AND TRANSFER TAXES-continued

YEAR

DC DEED RECORDATION

& TRANSFER TAX REVENUE ADJUSTED

FOR INFLATION (IN 2012 DOLLARS)

($000,000)

PERCENT OF

TOTAL TAX

COLLECTED

1995

$68.4

1.9%

1996

$88.8

2.5%

1997

$83.9

2.3%

1998

$137.4

3.4%

1999

$163.9

4.1%

2000

$142.8

3.4%

2001

$182.2

4.2%

2002

$198.3

4.7%

2003

$302.7

7.0%

2004

$417.8

8.9%

2005

$404.4

7.9%

2006

$381.8

7.3%

2007

$427.7

7.4%

2008

$288.2

5.0%

2009

$191.6

3.5%

2010

$216.8

4.1%

2011

$301.9

5.6%

2012

$284.9

4.9%

2013

$357.0

5.9%

2014

$350.0

5.7%

2015

$442.2

6.6%

28

SALES AND USE TAX

GENERAL LIABILITY:

The District of Columbia has five tax categories that fall under the general sales and use tax.

The retail sales tax rate of 5.75% is imposed on all tangible personal property sold or rented at

retail in the District and on certain selected services. Grocery-type foods, prescription and non-

prescription drugs, and professional services such as consulting, engineering, legal, and

physician services, are among the items exempt from the sales tax. Construction materials and

business purchases of public utility services are among those included. The Tax Revision

Commission Implementation Amendment Act of 2014 (BSA Subtitle (VII) (B)) expanded the

sales tax base to include some services not taxed in the District of Columba. These include

bottled water delivery services and other direct selling establishments, carpet and upholstery

cleaning services, fitness and recreational sports centers, and other personal care services

such as tanning, car washes, bowling centers and billiard parlors. The other rate categories

apply to goods and services as indicated below.

The use tax is imposed at the same rate on property sold or purchased outside the District and

then brought into the District to be used, stored or consumed. Vendors subject to the jurisdiction

of the District are required to collect and pay the use tax. When the vendor is not subject to the

jurisdiction of the District, or when the purchaser brings the property into the District, the

purchaser is required to pay the tax.

D.C. Code Citation: Title 47, Chapters 20 and 22.

PRESENT RATES: (January 1, 2016)

A five-tier rate structure is presently in effect:

5.75% Retail rate for sales of certain tangible personal property and selected services, non-

alcoholic soft drinks, food, or drinks sold in vending machines

6.0% Medical marijuana

10.0% Restaurant meals, liquor sold for consumption on and off the premises, rental vehicles,

prepaid telephone cards, tickets sold for baseball games, merchandise sold at the

baseball stadium, tickets sold for events at the Verizon Center and merchandise sold at

the Verizon Center

14.5% Hotels (transient accommodations)

18.0% Parking of motor vehicles in commercial lots

Note: The following portions of the sales tax go to the Convention Center Fund: 1% from restaurant meals and 4.45%

from transient accommodations. The 18% parking tax in commercial lots tax is dedicated to WMATA. The 6% tax on

medical marijuana is dedicated to the Healthy DC and Health Care Expansion Fund.

There are other transfers from gross sales and use tax including Tax Increment Financing Funds, Ballpark Fund,

Healthy Schools and ABRA.

29

REVENUE:

Fiscal Year

Gross Revenue

Net Revenue

2015

$1,315,294,853

$1,073,401,642

2016 (Estimate)

$1,290,847,232

$1,057,023,225

2017 (Estimate)

$1,344,385,219

$1,106,148,031

Transfers to:

Fiscal Year

Convention Center

Tax Increment Financing (TIF)

2015

$116,448,328

$37,554,203

2016 (Estimate)

$113,971,472

$29,603,000

2017 (Estimate)

$119,100,188

$28,095,000

Fiscal Year

Ballpark Fund

Healthy DC Fund

2015

$14,904,089

$106,000

2016 (Estimate)

$17,900,000

$250,000

2017 (Estimate)

$18,509,000

$427,000

Fiscal Year

WMATA

Healthy Schools

2015

$67,445,591

$4,265,000

2016 (Estimate)

$66,663,535

$4,266,000

2017 (Estimate)

$66,670,000

$4,266,000

Fiscal Year

ABRA

2015

$1,170,000

2016 (Estimate)

$1,170,000

2017 (Estimate)

$1,170,000

30

SALES AND USE TAX—Continued

YEAR

DC SALES & USE TAX REVENUE ADJUSTED

FOR INFLATION (IN 2012 DOLLARS)

($000,000)

PERCENT OF

TOTAL TAX

COLLECTED

1995

$745.8

20.3%

1996

$694.4

19.2%

1997

$698.2

19.1%

1998

$793.6

19.8%

1999

$827.5

20.6%

2000

$870.0

20.5%

2001

$888.3

20.4%

2002

$868.2

20.6%

2003

$876.9

20.4%

2004

$909.5

19.3%

2005

$1,033.3

20.3%

2006

$1,051.0

20.1%

2007

$1,082.9

18.6%

2008

$1,090.2

19.1%

2009

$1,041.9

19.3%

2010

$1,020.8

19.5%

2011

$1,034.3

19.1%

2012

$1,111.0

19.0%

2013

$1,123.8

18.7%

2014

$1,139.4

18.6%

2015

$1,274.8

19.0%

31

TOLL TELECOMMUNICATIONS TAX

GENERAL LIABILITY:

The tax is imposed on telecommunication companies, including wireless telecommunications

providers, for the privilege of providing toll telecommunication service in the District. The service

charge is on any sound, vision or speech communication for which there is a toll charge that

varies in amount with the distance or elapsed transmission time of each individual

communication or the transmission or reception of any sound, vision or speech communication

that entitles a person upon the payment of a periodic charge that is determined as a flat amount

or upon the basis of a total elapsed transmission time, to an unlimited number of

communications to or from all or a substantial portion of persons who have telephone or radio

telephone stations in a specified area outside the local telephone system area in which the

station that provides the service is located.

The items clearly omitted from this tax are anything to do with equipment sales, rental,

maintenance, repair or charges.

D.C. Code Citation: Title 47, Chapter 39.

PRESENT RATE: (January 1, 2016)

10% of gross charges – residential

11% of gross charges – non-residential

Note: Non-residential rates are 1% greater than the residential rates. The incremental revenue from the non-residential

rate is dedicated to the Ballpark Revenue Fund established by [D.C. Code 10-1601.02].

REVENUE:

Fiscal Year

Gross Revenue

Net Revenue

2015

$56,204,730

$53,524,028

2016 (Estimate)

$58,003,281

$55,770,847

2017 (Estimate)

$60,033,396

$57,722,826

Transfer to Ballpark Fund:

Fiscal Year

Transfer Amount

2015

$2,680,702

2016 (Estimate)

$2,232,434

2017 (Estimate)

$2,310,570

Metropolitan Area:

TOLL TELECOMMUNICATIONS TAX RATES

District of Columbia

Maryland

1

Virginia

2

10.0% Residential

11.0% Non-residential

4.0%

4.0%

5%

5%

1

Maryland’s tax is a public service company franchise tax on gross receipts.

2

Virginia’s tax is a communications sales tax, which is listed on consumers’ bills.

32

TOLL TELECOMMUNICATIONS TAX-continued

YEAR

DC TOLL TELECOMMUNICATIONS

TAX REVENUE ADJUSTED FOR

INFLATION (IN 2012 DOLLARS)

($000,000)

PERCENT OF

TOTAL TAX

COLLECTED

1995

$68.4

1.9%

1996

$67.5

1.9%

1997

$76.7

2.1%

1998

$80.8

2.0%

1999

$72.4

1.8%

2000

$65.6

1.5%

2001

$67.6

1.6%

2002

$72.1

1.7%

2003

$67.7

1.6%

2004

$68.2

1.4%

2005

$66.6

1.3%

2006

$65.5

1.3%

2007

$66.6

1.1%

2008

$70.6

1.2%

2009

$71.3

1.3%

2010

$65.7

1.3%

2011

$62.0

1.1%

2012

$58.6

1.0%

2013

$56.1

0.9%

2014

$51.1

0.8%

2015

$54.5

0.8%

33

BASEBALL GROSS RECEIPTS TAX

(Transferred to Ballpark Revenue Fund)

GENERAL LIABILITY:

The Ballpark Omnibus Financing and Revenue Act of 2004 requires that a Ballpark Fee must be

paid by certain businesses on June 15th of every District fiscal year until the bonds issued to

build the ballpark are re-paid. To determine if a business is subject to the Ballpark Fee, that

business must compute its annual District gross receipts for the most recent taxable year ending

before June 15th.

The persons subject to the Ballpark Fee are persons that have income of $5,000,000 or more in

annual District gross receipts and either are subject to filing franchise tax returns (whether

Corporate or Unincorporated) or are employers required to make unemployment insurance

contributions.

An entity granted an exemption from the DC Franchise Tax pursuant to DC Code § 47-1802.01,

is not subject to the Ballpark Fee, unless it has unrelated business taxable income. A tax

exempt entity with unrelated business taxable income must pay the Ballpark Fee if $5,000,000

or more of its annual DC Gross Receipts are attributable to any unrelated business taxable

income for its most recent calendar or fiscal year.

D.C. Code Citation: Title 47, Chapter 27B

PRESENT RATE: (January 1, 2016)

BALLPARK FEE SCHEDULE

DC Gross Receipts

Ballpark Fee

Less than $ 5,000,000

$ 5,000,000 to $ 8,000,000

$ 8,000,001 to $12,000,000

$12,000,001 to $16,000,000

$16,000,001 and greater

$0

$5,500

$10,800

$14,000

$16,500

REVENUE:

Fiscal Year

Revenue

2015

$34,942,000

2016 (Estimate)

$31,800,000

2017 (Estimate)

$32,754,000

34

HEALTHCARE PROVIDER TAX

(Transferred to Nursing Facility Quality of Care Fund)

The Healthcare Provider Tax imposes a 6% tax on the District’s nursing homes (tax is per

annum of net resident revenue) in monthly installments. All of the funds raised are designated

to go to the Nursing Facility Quality of Care Fund.

D.C. Code Citation: Title 47, Chapter 12C

REVENUE:

Fiscal Year

Revenue

2015

$12,854,240

2016 (Estimate)

$14,591,396

2017 (Estimate)

$14,883,224

ICF-IDD ASSESSMENT (Transferred to Stevie Sellows Quality Improvement Fund)

Each intermediate care facility for individuals with intellectual or developmental disabilities (ICF-

IDD) in DC must pay an assessment of 5.5% of gross revenue in quarterly installments. All

assessments shall be transferred to the Stevie Sellows Quality Improvement Fund which is used

to fund quality of care improvements at ICF-IDDs.

D.C. Code Citation: Title 47, Chapter 12D

REVENUE:

Fiscal Year

Revenue

2015

$5,032,000

2016 (Estimate)

$5,477,809

2017 (Estimate)

$5,519,000

MEDICAID HOSPITAL INPATIENT RATE SUPPLEMENT

(Transferred to Hospital Fund)

Hospitals in the District are charged a 0.52% fee based on the hospital’s inpatient net patient

revenue. The fee is in effect for the fiscal year beginning October 1, 2016. It sunsets

September 30, 2016. The revenue collected is deposited in the Hospital Fund.

D.C. Code Citation: Title 44, Chapter 6D

REVENUE:

Fiscal Year

Revenue

2015

-

2016 (Estimate)

$10,400,000

2017 (Estimate)

-

35

MEDICAID HOSPITAL OUTPATIENT SUPPLEMENTAL PAYMENT

(Transferred to Hospital Provider Fee Fund)

Hospitals in the District are charged a 0.16% fee based on the hospital’s outpatient gross

patient revenue. The fee is in effect for the fiscal year beginning October 1, 2016. It sunsets

September 30, 2016. The revenue collected is deposited in the Hospital Provider Fee Fund.

D.C. Code Citation: Title 44, Chapter 6C

REVENUE:

Fiscal Year

Revenue

2015

-

2016 (Estimate)

$6,700,000

2017 (Estimate)

-

36

NON-TAX REVENUE AND LOTTERY

NON-TAX REVENUE

GENERAL LIABILITY:

Local non-tax revenue refers to fines, fees, and other charges that flow into the District of

Columbia’s general fund. These revenues are categorized into four major categories; licenses

and permits, fines and forfeitures, charges for services, and miscellaneous revenues, which

includes interest income, unclaimed property, payment in lieu of taxes, and other revenue

sources.

REVENUE:

Fiscal Year

Revenue

2015

$416,556,860

2016 (Estimate)

$422,082,000

2017 (Estimate)

$422,779,000

LOTTERY

GENERAL LIABILITY:

Every year, the District of Columbia Lottery and Charitable Games Control Board transfers the

net proceeds of receipts from lottery gaming to the General Fund. The proceeds are equal to

gross receipts net of payouts and administrative costs. The transfer is based primarily on ticket

sales and prize payout. Games included as part of the DC Lottery are DC 3, DC 4, DC 5,

Race2Riches, DC Fast Play, Lucky for Life, Powerball, Mega Millions, Hot Lotto, DC Scratchers,

DC Keno, and Tap-N-Play.

REVENUE:

Fiscal Year

Revenue

2015

$55,586,000

2016 (Estimate)

$55,000,000

2017 (Estimate)

$55,500,000

37

SPECIAL PURPOSE NON-TAX REVENUE

GENERAL LIABILITY:

Special purpose non-tax revenues, often times referred to as “Other” or “O-Type” revenues, are

funds generated from fees, fines, assessments or reimbursements that are dedicated to the

District agency that collects the revenues to cover the cost of performing the function. The

“dedication” of the revenue to the collecting agency is what distinguishes this revenue from the

general-purpose non-tax revenues. The legislation that creates the fee, fine or assessment

must stipulate its purpose-designation and must also state whether any unspent funds are to

retain designation at the conclusion of the fiscal year or revert to general-purpose funds.

Unspent revenue in certain funds cannot revert to general purpose funds.

REVENUE:

Fiscal Year

Revenue

2015

$524,825,811

2016 (Estimate)

$524,376,035

2017 (Estimate)

$537,853,866

38

PART III -- SELECTED D.C. TAX STATISTICS

39

TABLE 3

D.C. TAX REVENUE

Budgetary Basis

(In Thousands of Nominal Dollars)

FISCAL

YEAR

TOTAL

COLLECTIONS

INCOME

TAXES /1

PROPERTY

TAXES /2

EXCISE AND

SALES AND

USE TAXES /3

GROSS

RECEIPTS

TAXES /4

OTHER

TAXES

/5

1993

2,557,852

730,519

1,011,663

504,735 a

229,593

a

81,342

1994

2,470,053

800,868

811,009

557,474 a

243,199

b

57,503

1995

2,391,041

804,355

730,343

584,107 a

210,912

c

61,324

1996

2,434,196

843,553

701,635

562,066 a

234,957

a

91,985

1997

2,522,304

936,980

687,599

573,105 a

229,242

a

95,378

1998

2,807,659

1,083,102

695,440

652,598 a

236,637

a

139,882

1999

2,879,765

1,169,751

679,550

675,841 a

207,290

147,333

2000

3,116,477

1,338,564

692,781

731,511

212,011

141,610

2001

3,293,608

1,400,237

707,423

761,474 a

233,740

190,734

2002

3,228,804

1,160,424

803,389

750,059

231,786

283,146

2003

3,384,087

1,167,452

901,888

780,207

261,348

273,192

2004

3,804,572

1,299,009

1,027,976

826,169

271,897

379,521

2005

4,249,024