pg. 1

“

Adoption of Technology for better Customer

Experience and Growth of Business in Urban Co-

operative Banks

”

A Summer Internship Report

SUBMITTED TO

International Management Institute,

Bhubaneswar

IN PARTIAL FULFILMENT FOR THE AWARD OF POST

GRADUATE DIPLOMA

IN MANAGEMENT

By

PRIYA SINGH

2019

pg. 2

AKOWLEGMENTS

Amidst the pandemic that we are going through, many companies have cancelled their internship as

we all know is a massive part of the learning curve of a B-school program and one’s career path to

becoming a successful manager.

The Reserve Bank of India (RBI) has made this internship possible for me by on-boarding me during

these unprecedented times. It’s my privilege of a lifetime to work as a management Intern for Reserve

Bank of India (RBI), in fact, an opportunity to learn Bankers to Banks and Government in depth. Being

a part of Department of Supervision, RBI Bhubaneswar and working on the topic title ‘Adoption of

Technology for better Customer Experience and Growth of Business in Urban Co-operative Banks’

helped me to learn the nuances of the banking sector in general and Urban Co-operative Banks in

particular with special focus on technology integration thereat.

I would like to thank Smt. Sonali Das for being a mentor to me and providing me the opportunity to

practice my theoretical knowledge in pragmatic purview.

I feel privileged to have Shri. Aloka Ranjan Ranarahu as my industry mentor who provided me with

the phased opportunities during my internship tenure to demonstrate my aptitude in this. I appreciate

sir’s unwavering support by providing me with all the necessary data and making it possible to complete

the project from home. He made it easier by floating the survey in different co-operative banks on my

behalf and guided me in the entire project, I am deeply indebted to him, who was always a call or text

away and ready to guide me at any time of my project, without his support and guidance, this would

have not been possible for me.

Thanks to Shri. Sushant Kispotta for making it possible to reach out to the Urban Co-operative Banks

and ensuring all the necessary feedbacks.

I am thankful to RBI’s Human Resource team for a seamless virtual onboarding, thank you to Shri.

Ashish Kumar Verma was in constant touch and there for any help from beginning to ending of this

Internship.

At last, I extend the gratitude to my faculty mentor Shri. Devesh Baid from IMI Bhubaneswar for being

a source of guidance.

I hope I have done justice to the project framework. As a result of this experience, I am more exhilarated

than ever to pursue a career in the Banking Industry.

Priya Singh

International Management Institute Bhubaneswar

pg. 3

Student’s Undertaking

I, Priya Singh, bearing Institute Roll No 19PGDM-BHU049, declare that the summer project

titled ‘Adoption of Technology for better Customer Experience and Growth of Business in

Urban Co-operative Banks’ is my original work and completed under the supervision of Smt.

Sonali Das (General Manager) of Reserve Bank of India, Bhubaneswar, Prof. Devesh Baid

of International Management Institute, Bhubaneswar. Further, I also declare that the report

being submitted herewith is free of any textual plagiarism.

Priya Singh

Place: International Management

Institute, Bhubaneswar

Date:

pg. 4

Successful Internship completion Certificate.

pg. 5

Certificate From Faculty Guide

Recommended that the Summer Internship Report titled ‘Adoption of Technology for better Customer

Experience and Growth of Business in Urban Co-operative Banks’ prepared by Ms. Priya Singh under

my supervision and guidance be accepted as fulfilling this part of requirements for the award of Post

Graduate Diploma in Management. To the best of my knowledge, the contents of this report did not

form a basis for award of any previous degree/diploma to anybody else.

Date:

Signature:

Name of the guide:

pg. 6

Contents

List of Table: ................................................................................................................................................ 8

List of Figures: ............................................................................................................................................. 9

EXECUTIVE SUMMARY: .......................................................................................................................... 10

CHAPTER 1 INTRODUCTION................................................................................................................... 11

1.1 Introduction to Financial System ..................................................................................................... 11

1.2 Significance and Definition ............................................................................................................. 11

1.3 The Concept of the Financial System ............................................................................................. 11

1.4 Inter-relationship in the Financial System ....................................................................................... 11

1.5 Indigenous Banking in India ........................................................................................................... 12

1.6 Rural Financial System .................................................................................................................. 13

1.7 Position of UCBs in banking eco system ........................................................................................ 13

OBJECTIVES OF THE STUDY .................................................................................................................. 14

METHODOLOGY ...................................................................................................................................... 15

BACKGROUND ......................................................................................................................................... 16

4.1 Overview of Banking Sector ........................................................................................................... 16

4.2 Structure of Indian Banking ............................................................................................................ 16

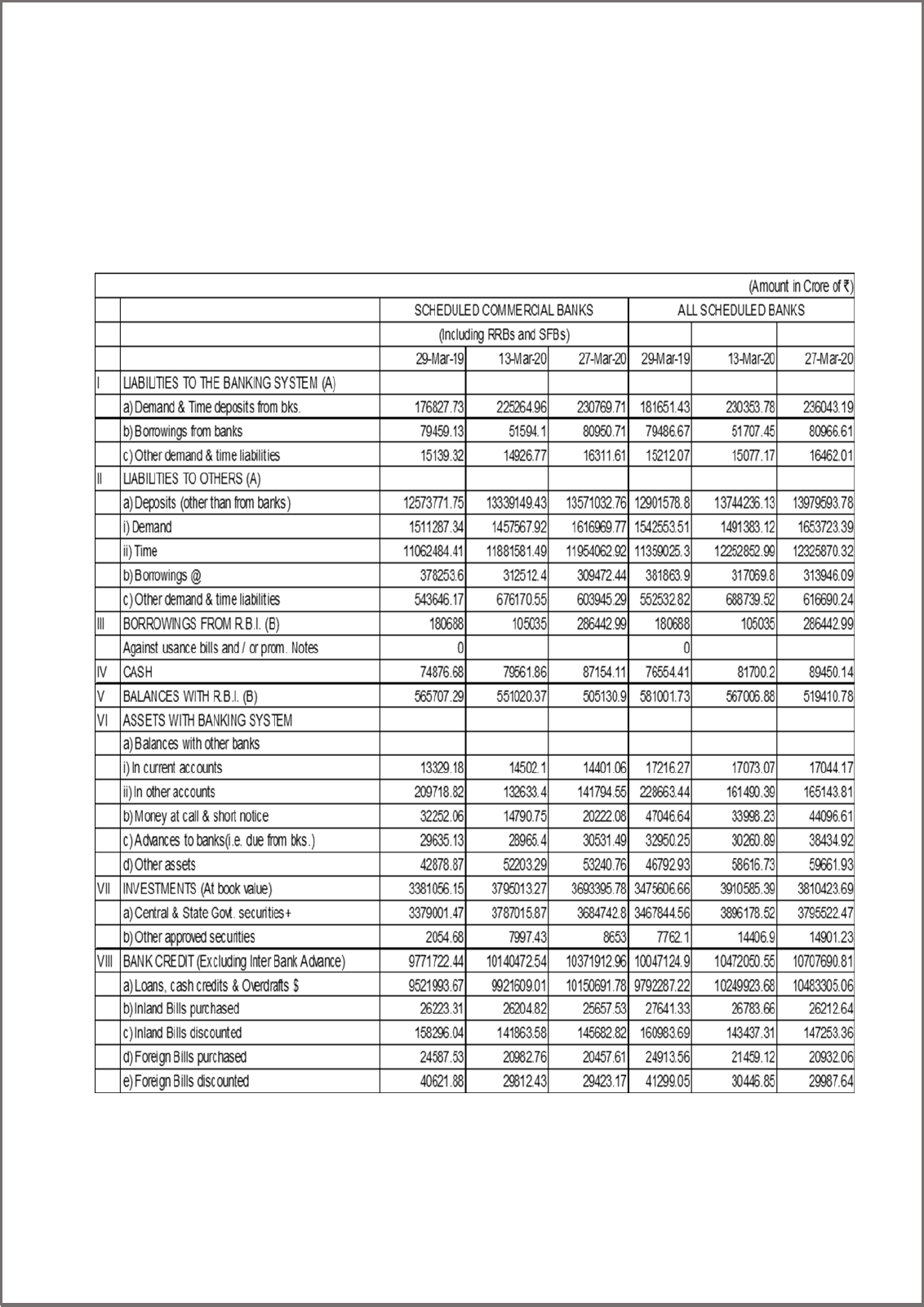

4.3 Some statistics of Scheduled Commercial Banks ................................................................................. 17

COOPERATIVE BANKS ............................................................................................................................ 18

5.1 Co-operative Banks: A Cross-Country Comparison ........................................................................ 19

5.2 Place of UCBs in Indian Banking System ....................................................................................... 20

URBAN CO-OPERATIVE BANKS (UCBs) IN INDIA................................................................................... 21

6.1 Role of Urban Co-operative banks in developments ....................................................................... 21

6.2 RBI’s Role in Empowering UCBs.................................................................................................... 21

6.3 Trends in Urban Co-operative Banking Sector: ............................................................................... 22

CHAPTER 7 .............................................................................................................................................. 29

URBAN CO-OPERATIVE BANKS (UCBs) IN ODISHA .............................................................................. 29

CHAPTER 8 .............................................................................................................................................. 35

EVOLUTION OF BANKING TECHNOLOGIES ........................................................................................... 35

8.1 Role of Technology in development of UCBs: ................................................................................. 35

8.2 Extent of technology integration in Urban Co-operative Banks: ....................................................... 36

8.3 Technologies used by some major Co-operative banks .................................................................. 36

8.4 Technology and UCBs in Odisha. ................................................................................................... 36

CHAPTER 9 FINDINGS ............................................................................................................................. 37

9.1. Questionnaire based Survey: The extent of technological integration in UCBs of Odisha: ............... 37

9.2 The technologies the UCBs wish to adopt in future ......................................................................... 40

9.3 Challenges before UCBs ................................................................................................................ 40

9.4 Problems associated with new technologies ................................................................................... 41

9.6. A comparative analysis through CAMEL Analysis Model ..................................................................... 45

CHAPTER 10 SUGGESTION .................................................................................................................... 47

CHAPTER 11 CONCLUSION .................................................................................................................... 48

CHAPTER 12 LIMITATIONS OF THE STUDY ........................................................................................... 50

pg. 7

CHAPTER 13 ............................................................................................................................................ 50

SCOPE OF FUTURE IMPROVEMENTS.................................................................................................... 50

APPENDICES: .......................................................................................................................................... 51

REFERENCE: ........................................................................................................................................... 51

pg. 8

List of Table:

Table 6.3. 1.Tier-wise Distribution of Urban Co-operative Banks. (as on March 2019) (In crores) ...... 23

Table 6.3. 2.The market share of deposits in India ........................................................................... 23

Table 6.3. 3. State and Union Territories(UT) wise distribution of UCBs ............................................ 24

Table 6.3. 4. Region wise volume of banking business per branch for UCBs .................................... 27

Table 7. 1.Overview of UBCs in Odisha (as on March 2019) .................................................................. 28

Table 7. 2.Details of Urban Co-operative bank based in Odisha (as on March 2020) ........................ 28

Table 7. 3. Details of based on Financial parameters of UCBs in Odisha .......................................... 29

Table 8.1. 1.Important Committes on Bnaking Technology in India by RBI........................................ 38

Table 9.1. 1. showing the summary of the Responses ...................................................................... 42

Table 9.5. 1.Table The comparative financial parameters of these banks ......................................... 46

Table 9.5. 2.Comparison of Lokmangal UCB and Kendrapara UCB ................................................. 47

Table 9.5. 3.Comparison of Cuttack UCB and Pandharpur UCB ...................................................... 48

pg. 9

List of Figures:

Figure 4.3. 1. Scheduled Banks’ Statement of Position in India (as on March 27, 2020) .................... 16

Figure 5. 1. The structure of co-operatives by asset size .................................................................. 18

Figure 5.1. 1. Market share of financial co-operatives....................................................................... 18

Figure 6.3.1. Balance sheet of Urban Co-operative Banks. (as on March 2019) ................................ 21

Figure 6.3. 2. Number of UCBs ........................................................................................................ 22

Figure 6.3. 3. Consolidation and Asset Size of UCBs ....................................................................... 22

Figure 6.3.4. State and UT wise total number of UCB as on March 2019 .......................................... 25

Figure 6.3. 5. Region wise distribution of UCBs at the end of March 2019 ........................................ 25

Figure 6.3.6. State wise number of UCBs in Eastern Region ............................................................ 26

Figure 6.3. 7. Region wise volume of banking business per branch for UCBs ................................... 27

Figure 7. 1.Asset size of all UCBs in Odisha .................................................................................... 30

Figure 7. 2.Deposits of all UCBs in Odisha ....................................................................................... 31

Figure 7. 3.Loans/Advances of all UCBs in Odisha ........................................................................... 31

Figure 7. 4.Net NPA and Gross NPA of UCBs in Odisha ................................................................. 32

Figure 7. 5.Profit of all UCBs in Odisha ............................................................................................ 32

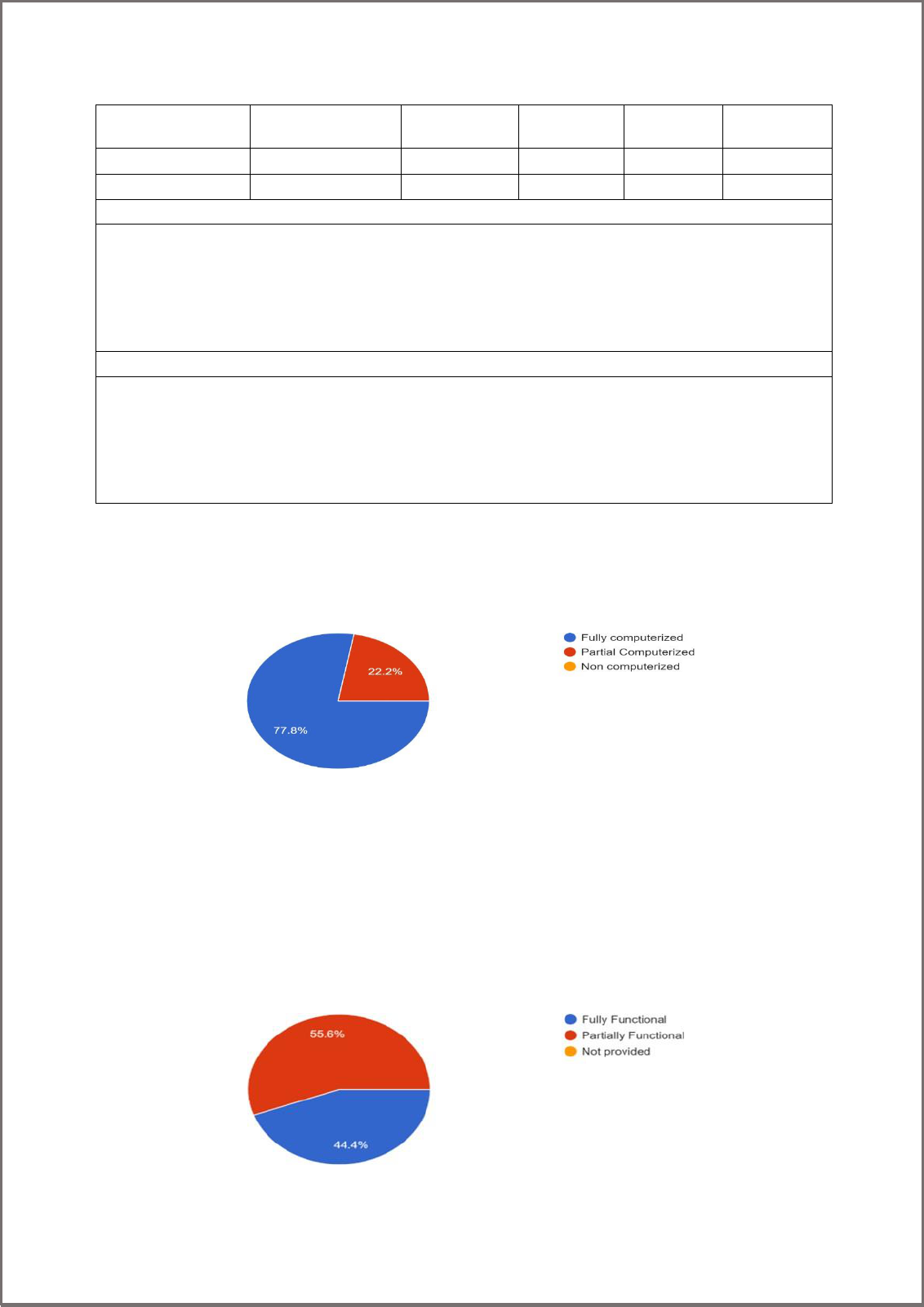

Figure 9.1. 1.The extent of Bank computerization of all UCBs of Odisha........................................... 43

Figure 9.1. 2.The extent of stabilization of Core Banking Solution in all UCBs of Odisha ................... 43

Figure 9.1. 3.Status of Website in all UCBs of Odisha ...................................................................... 44

Figure 9.1. 4.Percentage of banks providing NEFT/RTGS Facilities ................................................. 44

Figure 9.1. 5.Satisfaction level of bankers regarding technology-based services .............................. 45

Figure 9.5. 1.Asset Size: Pandharpur vs Cuttack and Kendrapara vs Lokmangal UCB ..................... 48

Figure 9.5. 2.Deposits: Pandharpur vs Cuttack and Kendrapara vs Lokmangal UCB ....................... 48

Figure 9.5. 3.Loans/ Advances:Pandharpur vs Cuttack and Kendrapara vs Lokmangal UCB ............ 49

Figure 9.5. 4.NNPA: Pandharpur vs Cuttack and Kendrapara vs Lokmangal UCB ......................... 49

Figure 9.5. 5.Profit: : Pandharpur vs Cuttack and Kendrapara vs Lokmangal UCB .......................... 49

pg. 10

EXECUTIVE SUMMARY:

There iare iseveral ifactors iattributed ito iIndia’s ihigh igrowth iin ithe i recent iperiod i- iimproved iproductivity, igrowing

ientrepreneurial ispirit, iand ihigher isavings ito iname ithe ifew iimportant iones. iBut ione ifactor iusually iunder-

acknowledged i– ithat iis ifinancial iintermediation, iimprovement iin ithe iquantum iand iquality iof ifinancial iintermediation

iranks ialong i with iother ifactors, ia ikey igrowth idriver. iAnd i one iof ithe ikey ifactors ithat idrove ithe iimprovement iin ithe

iquantum iand iquality iof ifinancial iintermediation iis ithe i widespread iand iefficient iuse iof iInformation iTechnology i(IT).

iEver isince ithe i18th icentury, ithe ibanking isector ihas ibeen ievolving, iand iit iis iknown ias ione iof ithe ioldest ibusinesses

iin ithe iworld. iIt ihas iprogressed iand i grown iwith ievery ipassing iyear. i Although, iit iwas ithe iindustry ithat itook ithe ilead ito

itransform iitself i with ithe ihelp iof itechnology, iBanks iwhich iwere igenerally iregarded ias ia iplace i with ilong iqueues iand

ian iunmanageable iamount iof ipaperwork ihas icaught iup ifast ithanks ito itechnological iadvancements iand iquick

iadoption iof ithe isame iin ithe ibanking isector.

The ipresent istudy ifocuses i on ithe i analysis iof ithe iinnovation iin ibanking itechnologies iand itechnology iadoption iin ithe

iUrban iCo-Operative iBanking iSector i with ispecial ireference ito iOdisha iState. iThe imajor iobjective iof ithe istudy iis i to

ifind iout ithe iextent iof iintegration iand iimpact i of ibanking itechnology iinnovations iin iUCBs iand isuggest ihow ithe iUCBs

ican ileverage itechnology ifor isustainable igrowth iand idevelopment. iThe istudy iis ibased iprimarily ion i secondary idata

iapart ifrom ia iquestionnaire-based isurvey.

The itotal ideposits iof ithe iIndian i banking i sector iare i₹1, i28, i87,262 icrores, iand iadvances iare i₹97, i09,829 icrores. iIf

iwe italk iabout ithe iUrban ico-operative ibanks iin iIndia, ithe ideposits iare i₹4, i84,315.85 icrores i(which iis i3.75% iof itotal

ideposits iIndian ibanking isector) iand iAdvances iis i₹3, i 03,017.76 icrores i(3.12% iof itotal iadvances iof ithe ibanking

isector). i The iUCBs iin iOdisha ihad ia itotal ideposits iand iadvances iof

₹1235.2 icrores i(0.25% iof itotal iUCBs ideposits) iand i₹ i742.1 icrores( i0.24% iof itotal iUCBs iadvances) irespectively i as

ion iMarch i2019. iThe ibanking isystem iin iour icounty ihas ibeen ileveraging itechnology ito iimprove inot ionly ithe icustomer

iservices ibut ialso iplayed ia ivital irole iin iachieving ithe iset itargets iof ifinancial iinclusion ito i a igreat iextent.

The iobjective iof ithe istudy iis ito iknow ithe iextent iof ithe iUCBs ihave iadopted itechnologies iwith ithe iprospective iof

iOdisha iand ito isuggest ithe i way iforward iafter istudying ithe iimpediments iof itechnologies.

The iaspects iof ithe istudy iincluded ian iintroduction, iobjective iof ithe istudy, iresearch imethodology, idata iinterpretation,

iand ianalysis, ifindings, i suggestions, iand irecommendations.

The istudy isuggests ithat ithe iUrban i Cooperative i Banks ineed ito iredesign iand ire-structure itheir istrategies ifor ithe

ibusiness iby iadopting iinnovative ibanking itechnologies ifor ibetter icustomer iexperience, igrowth iof ithe ibusiness, iand

iremaining irelevant iin ithe isuper idynamic ibanking isector. iMoreover, itheir icompetitors iare iin ia i constant ichurning

iprocess i of ionboarding itechnologies iin itune i with ithe i market idemand iand icustomers’ iexpectations i to idevelop

icustomized iproducts ito isuit ithe irequirements iof ithe iever- idemanding iclients ito igrow ithe ibusiness iand ialso istriving

itowards i“Customer iDelight”.

pg. 11

CHAPTER 1

INTRODUCTION

1.1 Introduction to Financial System

The ieconomic i scene iin ithe ipost-independence iperiod ihas i seen i a isea ichange; ithe iresult ibeing ithat ithe

ieconomy ihas imade ienormous iprogress iin idiverse ifields. iThere ihas ibeen ia iquantitative iexpansion ias iwell

ias idiversification iof ieconomic iactivities. iThe i experiences iof ithe i1980s ihave iled ito ithe iconclusion ithat ito

iobtain iall ithe ibenefits iof igreater ireliance ion ivoluntary iand imarket-based idecision-making, iIndia ineeds

iefficient ifinancial i systems. iThe ifinancial isystem iis ipossibly ithe imost iimportant iinstitutional iand ifunctional

ivehicle ifor ieconomic itransformation. iFinance iis ia ibridge i between ithe ipresent iand ithe ifuture iand iwhether

iit ibe ithe imobilization iof isavings ior itheir iefficient, ieffective, iand iequitable iallocation ifor iinvestment, iit iis ithe

isuccess i with i which ithe ifinancial i system i performs iits ifunctions ithat i sets i the ipace ifor ithe iachievement iof

ibroader inational iobjectives.

1.2 Significance and Definition

The iterm ifinancial isystem iis i a iset iof iinter-related iactivities/services iworking itogether ito iachieve isome

ipredetermined ipurpose ior i goal. iIt iincludes idifferent imarkets, iinstitutions, iinstruments, i services, iand

imechanisms ithat iinfluence ithe igeneration iof isavings, iinvestment icapital iformation, iand igrowth. iVan

iHorne idefined ithe ifinancial isystem ias ithe ipurpose iof ifinancial imarkets ito iallocate isavings iefficiently iin ian

ieconomy ito iultimate iusers ieither ifor iinvestment iin ireal iassets ior ifor iconsumption. iChristy i has iopined ithat

ithe iobjective iof ithe ifinancial isystem i is ito i"supply ifunds ito ivarious isectors iand i activities iof i the ieconomy iin

iways ithat ipromote ithe ifullest ipossible iutilization iof iresources i without ithe idestabilizing iconsequence iof

iprice ilevel ichanges ior iunnecessary iinterference iwith iindividual idesires." iAccording ito iRobinson, ithe

iprimary ifunction iof ithe isystem iis i"to iprovide ia ilink ibetween isavings iand iinvestment ifor ithe icreation iof inew

iwealth iand ito ipermit iportfolio iadjustment iin ithe icomposition iof ithe iexisting iwealth." iFrom ithe iabove

idefinitions, iit imay ibe i said ithat ithe iprimary ifunction iof ithe ifinancial i system iis ithe imobilization iof i savings,

itheir idistribution ifor iindustrial iinvestment iand i stimulating icapital iformation ito iaccelerate ithe iprocess iof

ieconomic igrowth.

1.3 The Concept of the Financial System

The iprocess iof isavings, ifinance, iand iinvestment iinvolves ifinancial iinstitutions, imarkets, iinstruments, i and

iservices. iAbove iall, isupervision icontrol iand iregulation iare iequally isignificant. iThus, ifinancial

imanagement iis ian iintegral ipart iof ithe ifinancial isystem. iBased ion ithe iempirical ievidence, iGoldsmith isaid

ithat i"... ia icase ifor ithe ihypothesis ithat ithe i separation iof ithe ifunctions iof i savings i and iinvestment iwhich iis

imade ipossible iby ithe iintroduction iof ifinancial iinstruments ias iwell ias ienlargement iof ithe irange iof ifinancial

iassets iwhich ifollows ifrom ithe icreation iof ifinancial iinstitutions, i increase ithe iefficiency iof i investments iand

iraise ithe iratio iof icapital iformation ito inational iproduction iand ifinancial iactivities iand ithrough ithese itwo

ichannels iincrease ithe irate iof igrowth……" iThe iinter-relationship ibetween ivaried i segments iof ithe

ieconomy iare iillustrated ibelow: i-

1.4 Inter-relationship in the Financial System

A ifinancial isystem iprovides i services ithat iare iessential i in ia imodern ieconomy. iThe iuse iof ia i stable, i widely

iaccepted imedium iof iexchange ireduces ithe icosts iof itransactions. iIt ifacilitates itrade iand, itherefore,

ispecialization iin iproduction. iFinancial iassets iwith iattractive i yield, iliquidity iand irisk icharacteristics

iencourage isaving iin ifinancial iform. i By ievaluating ialternative iinvestments iand imonitoring ithe iactivities iof

iborrowers, ifinancial iintermediaries iincrease ithe iefficiency iof iresource iuse. iAccess ito ia

pg. 12

variety iof ifinancial iinstruments ienables ian i economic iagent ito ipool, iprice iand iexchange irisks iin ithe

imarkets. iTrade, ithe iefficient iuse iof iresources, isaving iand irisk itaking iare ithe icornerstones iof ia igrowing

ieconomy. iIn ifact, ithe icountry i could imake ithis ifeasible iwith ithe iactive isupport iof ithe ifinancial isystem. iThe

ifinancial i system ihas ibeen iidentified ias ithe imost icatalysing iagent ifor igrowth iof ithe ieconomy, imaking iit

ione iof ithe ikey iinputs i of idevelopment. iThe iIndian ifinancial isystem iis ibroadly iclassified iinto itwo ibroad

igroups:

(i) Organised sector

(ii) Unorganised sector.

The ifinancial isystem iis ialso idivided iinto iusers iof ifinancial i services iand iproviders. iFinancial iinstitutions

isell itheir iservices ito ihouseholds, ibusinesses iand igovernment. iThey iare ithe iusers iof i the ifinancial

iservices. iThe iboundaries ibetween ithese isectors iare inot i always iclear icut. iIn ithe icase iof iproviders iof

ifinancial iservices, ialthough ifinancial isystems idiffer ifrom icountry ito icountry, ithere iare imany isimilarities.

(i) iOrganised iIndian iFinancial iSystem

The iorganised ifinancial i system icomprises iof ian iimpressive inetwork iof i banks, iother ifinancial i and

iinvestment iinstitutions iand ia irange iof ifinancial iinstruments, iwhich itogether ifunction iin ifairly ideveloped

icapital iand imoney imarkets. iShort-term ifunds iare imainly iprovided iby ithe icommercial iand icooperative

ibanking i structure. iNine-tenth iof i such ibanking ibusiness iis imanaged iby i18 ileading ibanks i(as ion iMarch

i2019) i which iare iin ithe i public isector. iIn iaddition ito icommercial ibanks, ithere iis ithe inetwork iof icooperative

ibanks iand iland idevelopment ibanks iat istate, idistrict iand i block ilevels. iWith iaround itwo- ithird i share iin ithe

itotal iassets iin ithe i financial i system, ibanks i play ian iimportant irole. iOf ilate, iIndian ibanks ihave ialso

idiversified iinto iareas isuch ias imerchant ibanking, imutual ifunds, ileasing iand ifactoring. iThe iorganised

ifinancial isystem icomprises ithe ifollowing i sub-systems:

1. Banking system

2. Cooperative system

3. Development Banking system:

(i) Public sector

(ii) Private sector

4 .Money markets and

5. Financial companies/institutions.

Over ithe iyears, ithe istructure iof ifinancial iinstitutions iin iIndia ihas i developed i and ibecome ibroad ibased.

iThe isystem ihas ideveloped iin ithree iareas i- istate, icooperative iand iprivate. iRural iand iurban iareas iare iwell

iserved iby ithe icooperative isector ias iwell ias iby i corporate ibodies iwith inational istatus. iThere iare imany

inon-banking ifinancial iinstitutions ichannelizing icredit iinto ieconomy inamely idevelopment ifinance

iinstitutions, i investment icompanies ietc.

ii) iUnorganised iFinancial iSystem

On ithe iother ihand, ithe iunorganised ifinancial isystem i comprises iof irelatively iless icontrolled

imoneylenders, iindigenous ibankers, ilending ipawn ibrokers, i landlords, itraders ietc. iThis ipart iof ithe

ifinancial isystem iis inot idirectly iamenable ito icontrol iby ithe iReserve iBank iof iIndia i(RBI). iThere iare ia ihost

iof ifinancial icompanies, iinvestment icompanies, ichit ifunds ietc., iwhich iare ialso inot iregulated iby ithe iRBI ior

ithe igovernment iin ia isystematic imanner. iHowever, ithey iare ialso igoverned iby irules iand iregulations iand

iare, itherefore iwithin ithe iorbit iof ithe imonetary iauthorities.

1.5 Indigenous Banking in India

At independence, India had an indigenous banking system with a centuries-old tradition. This system

had developed the hundi, a financial instrument still in use that is similar to the commercial bill of

pg. 13

Western Europe. Hundi were used to finance local trade as well as trade between port towns and inland centres

of production. They were often discounted by banks, especially if they were endorsed by indigenous bankers.

Indigenous bankers combined banking with other activities, much as the goldsmiths, merchants, and shippers

of eighteenth and nineteenth century Europe had done. They usually belonged to certain castes or communities,

such as the Multanis, Marwaris and Chettiars, and they differed in the extent to which they relied on their own

resources, rather than deposits and other funds for their lending. Some brokers specialized in introducing

indigenous bankers to commercial banks, while others brought together traders and indigenous bankers.

1.6 Rural Financial System

Rural financial system has been evolved over a period of time from the year 1904, when the first Primary

Agricultural Credit Society was organized, by accepting and implementing important recommendations of expert

committees appointed by the Government of India/RBI from time to time. During the pre-reform period, more

particularly, after the advent of the scientific and technological revolution in the sphere of agriculture, the

Government of India and the RBI have evolved several new concepts, innovations and novel approaches, which,

the Rural Financial Institutions (RFls) have responded very favourably by implementing them.

1.7 Position of UCBs in banking eco system

Credit is an essential requirement of any society. With economic development, banking institutions also evolved to

fulfil the demand for credit. The origin of urban co-operative credit movement in India can be traced to the close of

the 19th century. The origin of urban co-operative credit movement in India dates back to 5 February 1889 when

under the guidance of Late Shri Vithal Laxman Kavthekar, a mutual aid society was formed by same middle-class

Maharashtrian families in Baroda state. The name of the bank was “Anyonya Sahakari Mandali”. When the Co-

operative Credit Society Act 1904 conferred legal status on credit societies, the first Urban Co-operative Credit

Society was registered in October 1904. This happened in Conjeevaram in Madras province (now known as

Chennai). Since then the UCBs in India have passed through many phases. Co-operatives occupy an important

position in the Indian financial system and were the first formal institution to be conceived and developed to purvey

credit to rural India. Thus far, co-operatives have been key instrument of financial inclusion in reaching out to the

last mile in rural areas. The Urban counterparts of rural cooperatives, the Urban Co-operative Banks (UCBs) too

have traditionally been an important channel of financial inclusion for the middle- and low- income sections in the

semi-urban and urban areas. These banks are formed to serve the common man for encouraging self-help and

thrift in the semi urban and urban areas. The UCBs are regulated and supervised by State Registrars of Co-

operative Societies, Central Registrar of Co-operative Societies in case of Multi-state co-operative banks and by

Reserve Bank. The Registrars of Co- operative Societies of the States exercise powers under the respective Co-

operative Societies Act of the States in regard to incorporation, registration, management, amalgamation,

reconstruction or liquidation. In case of the urban co-operative banks having multi-state presence, the Central

Registrar of Co-operative Societies, New Delhi, exercises such powers. The banking related functions, such as

issue of license to start new banks / branches, matters relating to statutory reserves, interest rates, investments,

income recognition and asset classification, prudential exposure norms etc. are regulated and supervised by the

Reserve Bank of India under the provisions of the Banking Regulation Act, 1949.

pg. 14

CHAPTER 2

OBJECTIVES OF THE STUDY

The study is conducted with the objectives of understanding the level of technology integration and adoption in

UCBs along with impediments. An attempt has been made to achieve the following key objectives of this study.

The conclusion and suggestion part of the report gives an overview of the extent of fulfilment of these objectives:

I. To what extent UCBs has adopted the banking technologies

II. To understand the prospective of Odisha.

III. To identify the impediments to technology adoption

IV. To suggest the way forward.

pg. 15

CHAPTER 3

METHODOLOGY

The adopted procedure for the conduct of research assumes significance as it has a direct bearing on the

reliability, accuracy, and adequacy of the obtained results. The methodology is the science of studying how the

study is carried out scientifically, it also talks about the logic behind the method is used in the context of the study.

The methodology adopted for studying the project was surveying the Urban Co-operative Banks in Odisha.

Research design used in this study

In this study, the descriptive research design is used to ensure the maximization of reliability and minimization of

bias of data collected.

Data collected method

The process of data collection begins after a research problem has been defined and research design has been

chalked out. There are two types of data secondary and primary data. For the fieldwork a survey is done to

understand the extent of integration of banking technology in UCBs of Odisha.

PRIMARY DATA:

It is first-hand data, which is collected by the researcher itself. Primary data is collected by various approaches to

get precise, accurate, realistic, and relevant data. The main tool is gathering primary data was Questionnaire

Survey. It was achieved by a direct approach and observation from the officials of the banks.

SECONDARY DATA:

It is the data that is already collected by someone else. The researcher has to analyse the data and interprets the

results. It has always been important for the completion of any report. It provides reliable, suitable, adequate, and

specific knowledge. The secondary data is collected by using banks' annual reports and authorized websites of

banks.

Method of Data Analysis

For analysing the collected data and measuring various phenomena efficiently and effectively to draw sound

suggestions and conclusions, certain statistical techniques were used. The data collected were tabulated, edited,

and classified for analysis.

ANALYTICAL TOOL:

CAMEL Analysis Model

The data collected were tabulated, edited, and classified for analysis. The analytical tool used in this study is

CAMELS Analysis to compare the performance of Indian banks. To analyze the data MS- EXCEL tool is used.

Further the Analysis is divided into two steps:

1.Questionnaire method : to know the extent of technology integration in Odisha.

2. CAMEL Analysis: to know the Overall performance of the bank and the correlation between performance and

technological adoption of the bank.

pg. 16

CHAPTER 4

BACKGROUND

4.1 Overview of Banking Sector

A ibank iis ia i financial iinstitution iand ia ifinancial iintermediary ithat iaccepts ideposits i and ichannels

ithose ideposits iinto ilending iactivities, ieither i directly ior ithrough icapital imarkets. iA ibank iconnects

icustomers ithat ihave icapital ideficits ito icustomers iwith icapital isurpluses. iDue ito itheir icritical istatus

iwithin ithe ifinancial i system iand ithe ieconomy igenerally, i banks i are ihighly iregulated iin imost

icountries. iThey iare igenerally i subject ito iminimum icapital irequirements i which iare ibased ion ian

iinternational iset iof icapital istandards, iknown ias ithe iBasel iAccords.

Banking iin iIndia ioriginated iin ithe ilast idecades iof ithe i18th icentury. iThe ifirst ibanks iwere iThe

iGeneral iBank iof i India, iwhich istarted iin i1786, iand iBank iof iHindustan, iwhich istarted iin i1790; iboth

iare inow idefunct. iThe ioldest ibank iin iexistence iin iIndia iis ithe iState iBank iof iIndia, iwhich ioriginated

iin ithe iBank iof iCalcutta iin iJune i1806, iwhich ialmost iimmediately ibecame ithe iBank iof i Bengal. iThis

iwas ione iof ithe ithree ipresidency ibanks, ithe iother itwo ibeing ithe iBank iof iBombay iand ithe iBank iof

iMadras, iall ithree iof i which i were iestablished iunder icharters ifrom ithe iBritish iEast iIndia iCompany.

iFor imany iyears ithe iPresidency ibanks iacted ias iquasi-central ibanks, ias idid itheir isuccessors. iThe

ithree ibanks imerged iin i1921 ito iform ithe iImperial iBank iof iIndia, iwhich, i upon iIndia's

iindependence, ibecame ithe iState iBank iof iIndia iin i 1955.

4.2 Structure of Indian Banking

As iper iSection i5(b) iof ithe iBanking iRegulation iAct i1949: i“Banking” imeans ithe iaccepting, ifor

ilending ior iinvestment, iof ideposits iof imoney ifrom ithe ipublic, irepayable ion idemand ior iotherwise,

iand i withdrawal iby icheque, idraft, i order ior iotherwise.” iAll ibanks i which iare iincluded iin ithe iSecond

iSchedule ito ithe iReserve iBank iof iIndia iAct, i1934 i are ischeduled ibanks. iThese ibanks icomprise

iScheduled iCommercial iBanks iand iScheduled iCooperative iBanks. iScheduled iCommercial

iBanks iin iIndia iare icategorized iinto ifour idifferent igroups iaccording ito itheir iownership iand/or

inature iof i the ioperation. iThese ibank igroups iare:

Public Sector Banks

Private Sector Banks,

Foreign Banks

Small finance bank

Payment ibanks iare ithe inew iintroduction i to ithe icategory. iBesides ithe iNationalized ibanks

i(majority iequity iholding iis iwith ithe iGovernment), ithe icommercial i banks icomprise iforeign iand

iIndian iprivate ibanks. iNationalized ibanks iand iRegional iRural iBanks iare iconstituted iunder

irespective ienactments iof ithe i Parliament, ithe iprivate isector ibanks iare ibanking icompanies ias

idefined iin ithe iBanking iRegulation iAct. iThese ibanks, i along i with iregional irural ibanks, iconstitute

ithe ipublic i sector i(state-owned) ibanking isystem iin iIndia. iThe iPublic iSector iBanks iin iIndia iare ithe

ibackbone iof ithe iIndian ifinancial isystem. iThe icooperative icredit iinstitutions iare ibroadly i classified

iinto iurban icredit icooperatives iand irural icredit icooperatives. iScheduled iCo-operative iBanks

iconsist iof iScheduled iState iCo-operative iBanks iand i Scheduled iUrban iCo-operative iBanks.

iRegional iRural iBanks i(RRB’s) iare istate-sponsored, iregionally i based, i and irural ioriented

icommercial ibanks. iThe iGovernment iof iIndia ipromulgated ithe iRegional iRural iBanks iOrdinance

ion i26th iSeptember i1975, i which i was ilater ireplaced iby ithe iRegional iRural iBank iAct i1976. iThe

ipreamble ito ithe iAct istates ithe i objective ito idevelop i the irural ieconomy iby iproviding icredit iand

ifacilities i for ithe idevelopment iof iagriculture, itrade, icommerce, iindustry iand iother iproductive

iactivities iin

pg. 17

the rural areas, particularly to small and marginal farmers, agricultural laborers, artisans, and small

entrepreneurs.

1. 4.3 Some statistics of Scheduled Commercial Banks

Figure 4.3. 1. Scheduled Banks’ Statement of Position in India (as on March 27, 2020)

pg. 18

CHAPTER 5

COOPERATIVE BANKS

People who come together in conjunction to serve their common interests frequently form a co-operative

society under the Co-operative Societies Act. When a co-operative society occupies itself in the banking

business then these co-operative societies are called a cooperative Bank. Society has to acquire a license

from the Reserve Bank of India (RBI) before starting the banking business. Any cooperative bank as a society

is to function under the overall administration of the registrar, cooperative societies of the state. As regards the

banking business, society must go along with the guidelines set and issued by the Reserve Bank of India (RBI).

In keeping with their ‘grassroots’ integration into the life and essence of the widest sections of society, co-

operative banks in India are invested with developmental goals among which financial inclusion has assumed

crucial importance. These institutions play a critical role in last-mile credit delivery and in extending financial

services across the length and breadth of the country through their geographic and demographic outreach.

At the end of March 2019, credit cooperative banks comprised 1,544 urban co-operative banks (UCBs) and 96,248

rural co-operative banks (end-March 20181), with the latter accounting for 64.7 percent of the total assets of co-

operatives. UCBs and among the rural co-operatives, the State Co-operative Banks (SCBs), and the District

Central Co-operative Banks (DCCBs) are registered either under the Co-operative Societies Act of the state

concerned or under the Multi-State Co-operative Societies Act, 2002. Banking laws were made significant to co-

operative societies since March, 1966. Currently, there is a duality of control over SCBs/DCCBs/UCBs between

the Registrar of Cooperative Societies (RCS) or the Central Registrar of Cooperative Societies (CRCS) and the

Reserve Bank. While the mandates of the RCS/CRCS encompass incorporation, registration, management,

recovery, audit, the supersession of Board of Directors, and liquidation, the Reserve Bank is invested with

regulatory functions. The Reserve Bank is also entrusted with the responsibility of supervision of UCBs, entailing

prescription of prudential norms for capital adequacy, income recognition, asset classification and provisioning,

liquidity requirements, and single/group exposure norms. Also, it helps in the capacity building of employees and

assists in the implementation of IT infrastructure in UCBs.

Primary Agricultural Credit Societies (PACS) and long-term co-operatives are outside the purview of the Banking

Regulation Act, 1949. The NABARD has been given power under Section 35 (6) of the Banking Regulation Act to

conduct inspections of SCBs and DCCBs. The NABARD also conducts voluntary inspections of State Co-

operative Agriculture and Rural Development Banks (SCARDBs).

The growth of these co-operative institutions has not been commensurate with that of other constituents of the

banking sector in India. At the end of March 2019, the combined assets of urban and rural co- operatives were10.6

percent of the total assets of scheduled commercial banks (SCBs), down from

19.4 percent in 2004-05. Several operational and governance-based impediments have operated as drags on

their performance, stunting their growth.

pg. 19

Figure 5. 1. The structure of co-operatives by asset size

5.1 Co-operative Banks: A Cross-Country Comparison

The financial co-operative (FC) institutions, which trace back their origins to the 19th century,

were established across jurisdictions to extend loans at affordable prices to the unbanked

population. Amongst the FCs, the services of credit unions are exclusive for their members,

who share a common profession, entrepreneurship interests, or in some cases, just their

location. In contrast, co-operative banks offer services to non-members as well (Birchall, 2013).

While there are co-operatives based on a simple business model of deposit-taking and lending,

others, such as those in Europe, form federations by pooling their resources resembling large

banking groups and provide a large array of services (for example, Rabobank Group in

Netherlands, Credit Agricole Group in France and Op- Pohjola Group in Finland).

Figure 5.1. 1. Market share of financial co-operatives

Market share of financial co-operatives all over world

60

50

40

30

20

10

France Germany kenya India

US

Country

Ireland

China

Brazil Australia

Assets Loans Deposits

Percentage

pg. 20

5.2 Place of UCBs in Indian Banking System

Inspired by the success of experiments which was related to the Co-operative credit movement in Germany and

the co-operative movement in Britain formed the origin of UCBs. Mutual help, open membership, and

democratic decision making are the principle of Co-operative Societies. “Anyonya Sahakari Mandali” was the

first known mutual aid society in India. Initially, UCBs came to meet the consumption-oriented credit needs of

the members but at present, it mobilizes the savings of middle and low-income urban groups to their members

from whom many belong to the weaker section.

The primary co-operative bank in the urban and semi-urban areas are termed as Urban Co-operative banks

(UCBs). Till 1996 these banks were allowed to lend their money for the only purpose of non- agriculture, small

borrowers, and businesses. Today the scope of their operation has widened considerably.

There is a duality of control in the Urban Co-operative banks as the banking-related functions (viz. area of

operation, licensing, interest rates, IRAC, etc.) were to be governed by RBI and management, registration, audit,

and liquidation, etc were to be governed by the state acts of the state government.

Over the years, primary (urban) cooperative banks have registered a significant growth in number, size, and

volume of business handled. As of March 2019, there are 1544 UCBs of which 54 are banks that are scheduled.

About 79 percent of these are located in five states i.e. Tamil Nadu, Andhra Pradesh, Karnataka, Gujarat, and

Maharashtra. Recently the problems faced by a few large UCBs have highlighted some of the difficulties these

banks face and policy endeavours are geared to consolidating and strengthening this sector and improving

governance.

pg. 21

CHAPTER 6

URBAN CO-OPERATIVE BANKS (UCBs) IN INDIA

There are over 1,544 UCBs in the country. Yet they form a tiny part of the banking system

accounting for less than 3% of the total banking assets and deposits and less than 3.5% of total

advances. They also follow the 80-20 rule. The top 20% of UCBs accounts for almost 80% of

its deposits. In spite of being present in 25 states, much (almost 80%) of the action happens in

the five states of Gujarat, Maharashtra, Andhra Pradesh, Karnataka, and Tamil Nadu with the

largest share going to Maharashtra. Till March 2019, Maharashtra stood first among all UCBs,

there 56.18 percent of all UCB branches, around 59 % of total extension counters of UCBs and

more than 70% of all its automated teller machines (ATMs) are in Maharashtra. As a result, more

than 60% of the total banking business of the UCBs sector was concentrated in Maharashtra

but their numbers have been decreasing in recent years. During 2000-2010, 132 banks had

their licenses cancelled and 62 merged with other banks. In this scenario, it is perhaps

understandable why this sector does not exactly steal the limelight in banking policy.

6.1 Role of Urban Co-operative banks in developments

As far as financial inclusion is concerned, ignoring the value of this sector would be a serious

mistake. By their nature, UCBs in India can play a critical role in this area. They have traditionally

played an important role in mobilizing resources from lower and middle-income groups and in

providing direct finance to small entrepreneurs and traders. The UCBs, with their deep-rooted

connections with specific communities, can easily inspire the trust of small savers and

borrowers. By being local in nature and intricately interwoven with the local community, the

UCBs have a clear advantage over commercial banks. It is easier for the UCBs to break the

psychological barrier that proves prohibitive in the last mile of financial inclusion i.e. to create a

trust for the bank among its target community and bring customers within its fold. Today, when

large commercial banks are working hard to set up branches and employing technology to reach

out to these far untouched regions of the country, it is time for the UCBs to step into the game

that is naturally theirs.

6.2 RBI’s Role in Empowering UCBs

In order to empower the cooperative banks in their commercial/managerial functioning, RBI in

its Memorandum of Understanding (MoUs) with the State Governments has committed to

facilitate the development of human resources and skills and to provide assistance in

information technology (IT) initiatives undertaken by the UCBs. The UCBs here have to take a

lead and play a more pro-active role in order to utilize the services and assistance provided by

the Reserve Bank to make themselves more competitive by bringing efficiency in their

functioning. This has to be achieved through cultivating Capital Adequacy and Non-Performing

Assets (NPA) Provisioning Standards; better Corporate Governance; introducing Professional

Management and following best practices in banking operations.

The Reserve Bank committed itself to strengthen the sector and to protect the depositors’

interests. The Reserve Bank’s Vision Document for UCBs brought out in March 2005 with the

objective of maintaining the viability and competitiveness of the cooperative sector. RBI felt the

need to have more effective interaction with the State Government to address some of the

systemic issues hindering the growth and functioning of the cooperative banks. In view of this,

RBI has signed Memorandum of Understanding (MoU) with 26 States so far, which provides

the basis for the constitution of Task Force for Urban Cooperative Banks (TAFCUB), the forum

for the consultative decision-making process. The various TAFCUB meetings across the States

have generated the desired effects and have helped in the strengthening of the UCB sector.

pg. 22

The Central Government vide Notification dated 29

th

June 2020 while exercising the power conferred by

sub-section (2) of section 1 of the Banking Regulation(Amendments) Ordinance, 2020 (12 0f 2020) has

notified that the provisions of section 4 of the said Ordinance shall come into force for Primary Co-

operative banks (UCBs). The said amendments might help RBI to bring the much needed reform in UCB

sector, which otherwise was not possible due to limitation to the existing statutory powers vested upon

RBI.

6.3 Trends in Urban Co-operative Banking Sector:

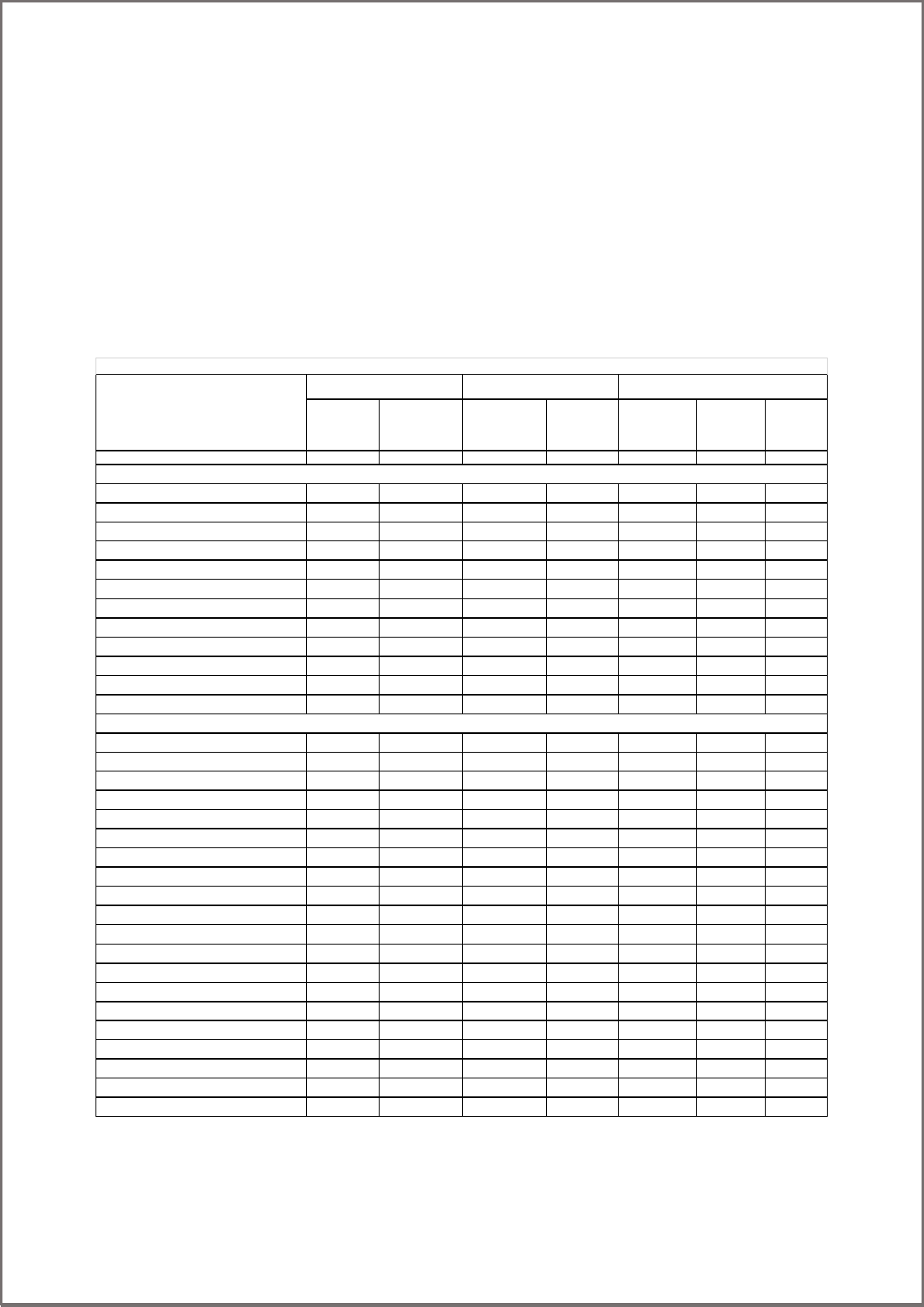

Figure 6.3.1. Balance sheet of Urban Co-operative Banks. (as on March 2019)

(Amt in ` Crores)

Items

Scheduled UCBs

Non-Scheduled UCBs

All UCBs

2018

2019

2018

2019

2018

2019

Growth

(%) in

2019 over

No. of UCBs

54

54

1497

1490

1551

1544

Liabilities

1) Capital

4,118.32

4,348.16

8,851.80

9,234.77

12,970.12

13,582.93

4.72

(1.56)

(1.53)

(2.97)

(2.94)

(2.30)

(2.27)

2) Reserves and Surplus

16,662.54

18,447.27

18,625.88

19,341.68

35,288.41

37,788.96

7.09

(6.29)

(6.47)

(6.24)

(6.15)

(6.27)

(6.31)

3) Deposits

2,12,041.12

2,25,687.51

2,44,465.72

2,58,628.34

4,56,506.84

4,84,315.85

6.09

(80.09)

(79.21)

(81.90)

(82.29)

(81.05)

(80.83)

4) Borrowings

4,628.15

4,907.73

367.19

333.31

4,995.34

5,241.04

4.92

(1.75)

(1.72)

(0.12)

(0.11)

(0.89)

(0.87)

5) Other Liabilities and Provisions

27,307.59

31,538.04

26,183.21

26,746.90

53,490.80

58,284.94

8.96

(10.31)

(11.07)

(8.77)

(8.51)

(9.50)

(9.73)

Total Liabilities

2,64,757.71

2,84,928.72

2,98,493.79

3,14,285.00

5,63,251.51

5,99,213.72

6.38

(100.00)

(100.00)

(100.00)

(100.00)

(100.00)

(100.00)

Assets

1) Cash in Hand

1481.58

1341.74

3,982.39

4,046.17

5,463.97

5,387.92

-1.39

(0.56)

(0.47)

(1.33)

(1.29)

(0.97)

(0.90)

2) Balances with RBI

10,359.76

11,079.83

2,143.54

2,698.84

12,503.31

13,778.67

10.20

(3.91)

(3.89)

(0.72)

(0.86)

(2.22)

(2.30)

3) Balances with Banks

16,155.16

17,065.43

46,813.23

43,779.76

62,968.39

60,845.19

-3.37

(6.10)

(5.99)

(15.68)

(13.93)

(11.18)

(10.15)

4) Money at Call and Short Notice

3,080.81

4,290.84

1,380.70

1,580.15

4,461.51

5,871.00

31.59

(1.16)

(1.51)

(0.46)

(0.50)

(0.79)

(0.98)

5) Investments

68,927.94

72,305.33

80,906.05

84,637.84

1,49,833.98

1,56,943.17

4.74

(26.03)

(25.38)

(27.10)

(26.93)

(26.60)

(26.19)

A) SLR Investments

61,068.33

61,394.03

74,795.09

78,055.89

1,35,863.42

1,39,449.92

2.64

(23.07)

(21.55)

(25.06)

(24.84)

(24.12)

(23.27)

B) Non-SLR Investments

7,859.60

10,911.30

6,110.96

6,581.95

13,970.56

17,493.26

25.22

(2.97)

(3.83)

(2.05)

(2.09)

(2.48)

(2.92)

6) Loans and Advances

1,36,822.38

1,46,571.55

1,43,637.21

1,56,446.21

2,80,459.59

3,03,017.76

8.04

(51.68)

(51.44)

(48.12)

(49.78)

(49.79)

(50.57)

7) Other Assets

27,930.09

32,273.99

19,630.67

21,096.03

47,560.76

53,370.02

12.21

(10.55)

(11.33)

(6.58)

(6.71)

(8.44)

(8.91)

Total Assets

2,64,757.71

2,84,928.72

2,98,493.79

3,14,285.00

5,63,251.51

5,99,213.72

6.38

(100.00)

(100.00)

(100.00)

(100.00)

(100.00)

(100.00)

Despite their large number, only 3.6 percent of the total asset of SCBs are accounted for by UCBs. With

limited avenues to raise capital, most of them are single branch entities.

pg. 23

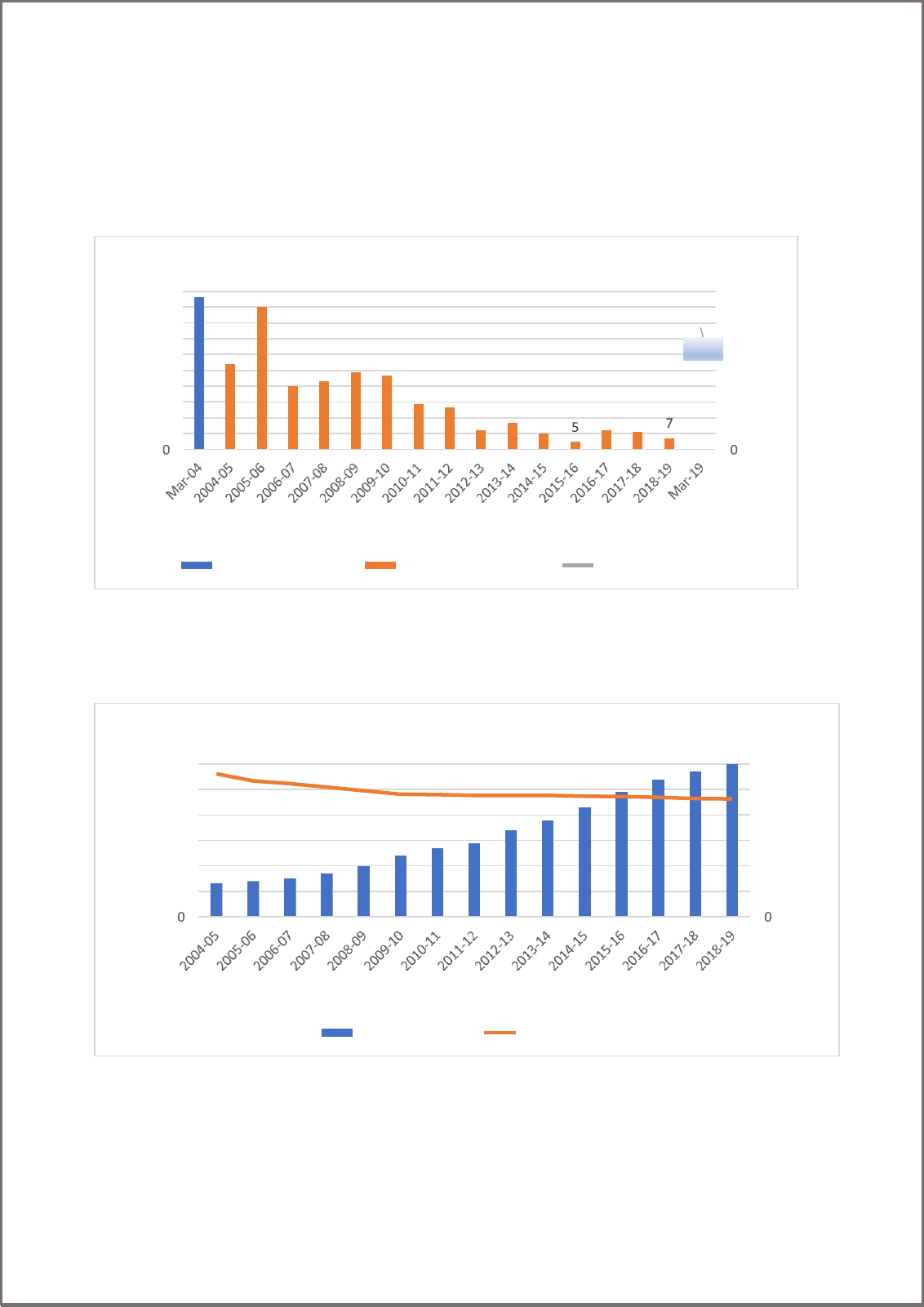

Enabled by a liberal licensing policy, the period 1991-2004 saw phenomenal growth in UCBs’ number

and asset size. Subsequently, this expansion turned unsustainable and some of them became weak

and unviable over time.

Figure 6.3. 2. Number of UCBs

Notwithstanding the fall in the number of UCBs, however, their combined asset continuously increased

Figure 6.3. 3. Consolidation and Asset Size of UCBs

UCBs in march 2019

Fall in Numberof UCBs

UCBs in march 2004

Years

100

90

80

70

60

50

40

30

20

10

12

11

10

17

12

27

29

47

43

40

49

54

90

1926

2000

1800

1600

1400

1200

1000

800

600

400

200

Number of UCBs

1544

Years

Assets in Rs.crore Number of UCBs

2000

1500

1000

500

600000

500000

400000

300000

200000

100000

UCBs: Consolidation and Asset Size

Amount in crores

No.of UCBs

Fall in No.of UCBs

Number of UCBs

pg. 24

UCBs are classified for regulatory purposes into Tier-I and Tier-II (deposit below and more than ₹ 100

crores respectively) categories, based on their depositor bases. Tier II UCBs have larger depositor

bases and wider geographical presence than their Tier I counterparts. During 2018-19, the number of

Tier II UCBs increased sharply

Table 6.3. 1.Tier-wise Distribution of Urban Co-operative Banks. (as on March 2019) (In crores)

Tier

Type

Number of

Banks

Deposits

Advances

Total Assets

Number

%total

Amount

%total

Amount

%total

Amount

%total

Tier I

UCBs

917

59.4

43,588

9.0

25,076

8.3

54,591

9.1

Tier II

UCBs

627

40.6

4,40,728

91.0

2,77,942

91.7

5,44,622

90.1

All

UCBs

1544

100.0

4,84,316

100.0

3,03,018

100.0

599,214

100.0

The SCBs share in the total bank deposits has been 93.56 and 93.36 percent in the year 2018 and

2019 as compared to UCBs 2.73 and 2.82 percent in the corresponding period, displaying a downward

trend.

Table 6.3. 2.The market share of deposits in India

Deposits Share (%)

Year

2018

2019

Schedule Commercial Banks

93.56

95.36

UCBs

2.73

2.82

Other Banks

3.72

3.82

Total

100.0

100.0

Uneven geographical dispersal of UCBs had resulted in 80 percent of the total presence and 75 percent

of total deposits concentrated in five states such as Tamil Nadu, Gujarat, Maharashtra, undivided

Andhra Pradesh, and Karnataka as on March 2019. The predominant concentration of Urban

Cooperative Banks in these 5 states is mainly on account of the emergence of strong cooperative

leadership.

pg. 25

Table 6.3. 3. State and Union Territories(UT) wise distribution of UCBs.

S. No.

State

No. of UCBs

No. of UCBs (% in Total)

Years

2016

2017

2018

2019

2016

2017

2018

2019

1

Maharashtra

508

502

498

496

32.27

32.14

32.11

32.12

2

Karnataka

265

264

264

263

16.84

16.9

17.02

17.03

3

Gujarat

224

220

220

219

14.23

14.08

14.18

14.18

4

Tamil Nadu

129

129

129

129

8.2

8.26

8.32

8.35

5

Uttar Pradesh

67

66

63

62

4.26

4.23

4.06

4.02

6

Kerala

60

60

60

60

3.81

3.84

3.87

3.89

7

Telangana

52

52

51

51

3.3

3.33

3.29

3.3

8

Madhya

Pradesh

51

51

49

49

3.24

3.27

3.16

3.17

9

Andhra

Pradesh

48

48

47

47

3.05

3.07

3.03

3.04

10

West Bengal

43

43

43

43

2.73

2.75

2.77

2.78

11

Rajasthan

37

37

37

35

2.35

2.37

2.39

2.27

12

Delhi

15

15

15

15

0.95

0.96

0.97

0.97

13

Chhattisgarh

12

12

12

12

0.76

0.77

0.77

0.78

14

Odisha

9

9

9

9

0.57

0.58

0.58

0.58

15

Assam

8

8

8

8

0.51

0.51

0.52

0.52

16

Jharkhand

2

2

2

2

0.44

0.45

0.45

0.45

17

Odisha

9

9

9

9

0.38

0.38

0.39

0.39

18

Assam

8

8

8

8

0.32

0.32

0.32

0.32

19

Uttarakhand

5

5

5

5

0.32

0.32

0.32

0.32

20

Jammu and

Kashmir

4

4

4

4

0.25

0.26

0.26

0.26

21

Punjab

4

4

4

4

0.25

0.26

0.26

0.26

22

Bihar

3

3

3

3

0.19

0.19

0.19

0.19

23

Manipur

3

3

3

3

0.19

0.19

0.19

0.19

24

Meghalaya

3

3

3

3

0.19

0.19

0.19

0.19

25

Jharkhand

2

2

2

2

0.13

0.13

0.13

0.13

26

Puducherry

1

1

1

1

0.06

0.06

0.06

0.06

27

Sikkim

1

1

1

1

0.06

0.06

0.06

0.06

28

Tripura

1

1

1

1

0.06

0.06

0.06

0.06

29

Mizoram

1

1

1

1

0.06

0.06

0.06

0.06

Total

All India

1574

1562

1551

1544

100

100

100

100

Maharashtra and Karnataka continued to top the list of UCBs in India since 2016. The Odisha occupies

the 14

th

place with a share of 0.58% as on March 2019. However, the overall growth of UCBs are

constantly in a decline stage in India well as in Odisha due to merger and liquidation of UCBs. The total

UCBs has been declined to 1544 as on March 2019 from 1574 as on March 2016. The states and UTs

like Arunachal Pradesh, Nagaland, Dadar Andaman and Nicobar, Dadra and Nagar Haveli, Daman and

Diu, and Lakshadweep have no presences of UCB.

pg. 26

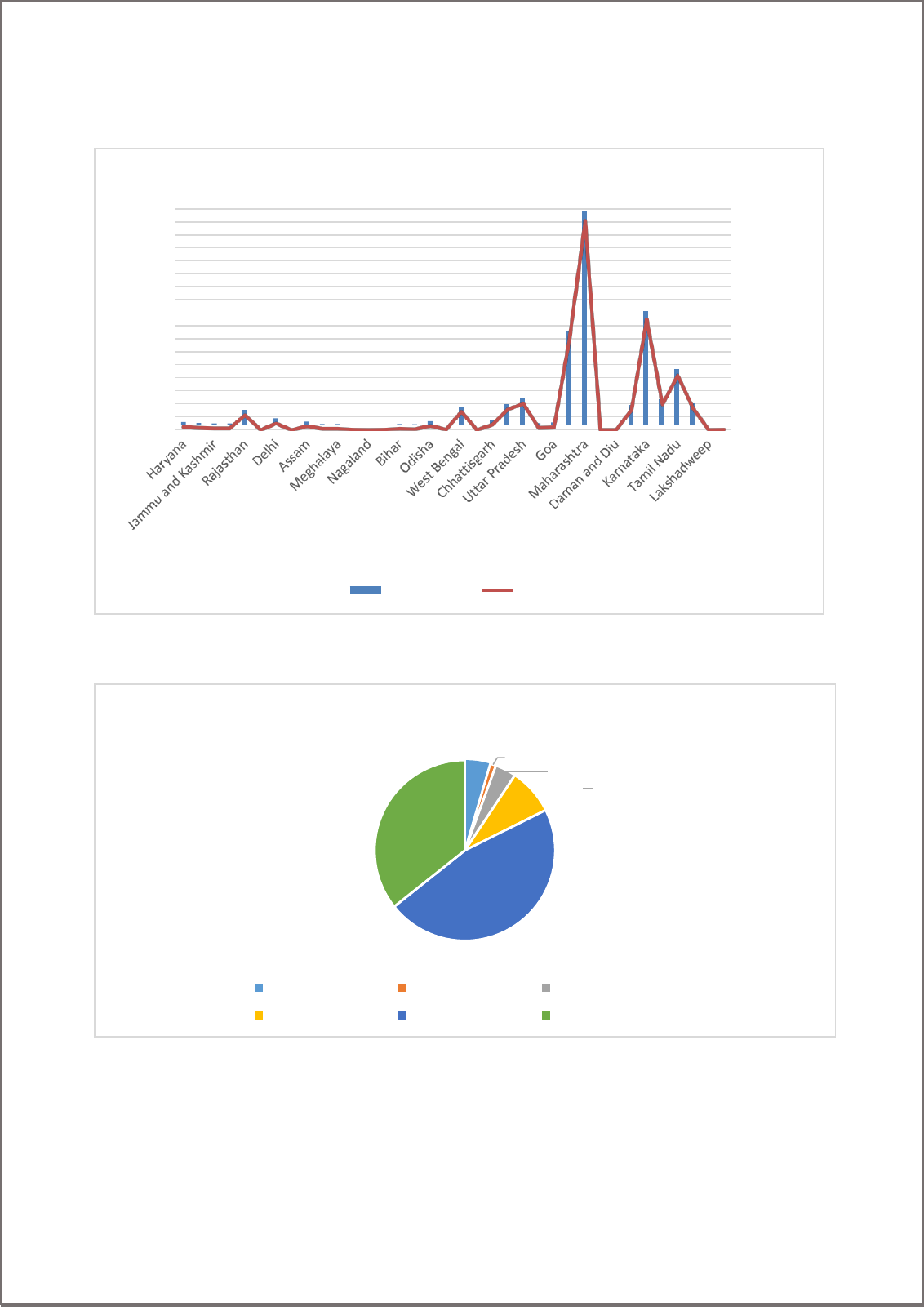

Figure 6.3.4. State and UT wise total number of UCB as on March 2019:

Figure 6.3. 5. Region wise distribution of UCBs at the end of March 2019:

The western region has the highest number of UCB’s (721 out of 1544) followed by the southern region

(551 out of 1544).

Southern Region

Western Region

North Eastern Region Eastern Region

Northern Region

Central Region

46.70%

PERCENTAGE

4.53%

1.04%

3.76%

8.29%

35.68%

State and UTs

No. of UCBs* % of total

34.00

32.00

30.00

28.00

26.00

24.00

22.00

20.00

18.00

16.00

14.00

12.00

10.00

8.00

6.00

4.00

2.00

0.00

500

470

440

410

380

350

320

290

260

230

200

170

140

110

80

50

20

-10

state wise total number of UCBs

No. of UCBs

% of total

pg. 27

Figure 6.3.6. State wise number of UCBs in Eastern Region:

In the Eastern region West Bengal state has the largest number of UCBs (43 out of 58) followed by

Odisha (9) and Bihar(3).

The banking business of UCBs captured spatially concentrated in the Western region followed by the

Eastern region. As depicted in Table No.6.3.4, the volume of banking business per branch was

significantly higher in the western and southern regions of India.

Percentage

0.00%

5.20%

3.50%

15.50%

1.70%

74.10%

Bihar Jharkhand Odisha Sikkim West Bengal Andaman and Nicobar

pg. 28

Table 6.3. 4. Region wise volume of banking business per branch for UCBs

Regions

Volume of banking business

per branch (in millions)

Years

2019

2018

2017

Northern Region Total

427

423

408

North Eastern Region Total

49

48

53

Eastern Region Total

138

171

168

Central Region Total

496

500

514

Western Region Total

7577

7265

6898

Southern Region Total

2428

2239

2180

All India

11115

10646

10221

Figure 6.3. 7. Region wise volume of banking business per branch for UCBs

All India

2019

2018

YEARS

Southern Region Total

2017

Northern Region Total

North Eastern Region Total

Eastern Region Total

Central Region Total

Western Region Total

10000

8000

6000

4000

2000

Region wise volume of banking business per branch for UCBs

12000

Volume of banking business per

branch(in millions)

pg. 29

CHAPTER 7

URBAN CO-OPERATIVE BANKS (UCBs) IN ODISHA

Odisha with nine UCBs has occupied the fourteenth place in terms of number of UCBs in India. The

history of the UCBs in Odisha dates back to 1904 when the Co-operative Credit Societies Act was

enacted in the country. Initially, a considerable impact of this movement was witnessed in Ganjam

district. Within a short span, three UCBs were established in the Ganjam District. To be specific the

Paralakhemundi Co-operative Urban Bank, the first urban bank in Odisha, was established in the year

1914 followed by the Utkal Urban Co-operative Bank in 1934. Afterward, a few more banks were opened

in different corners of the state. In Odisha, there was 18 UCBs in between 1950-1951. Most of the banks

amongst these have achieved significant progress in their work.

Table 7. 1.Overview of UBCs in Odisha (as on March 2019)

No. of UCBs

9

No. of Branches

32

No. of Extension Counters

4

Deposits (in Crores)

1235.2

Advances (in Crores)

742.1

Total Districts

30

No. of Districts with a presence of UCB

11

No. of ATMs

0

Table 7. 2.Details of Urban Co-operative bank based in Odisha (as on March 2020)

Sr. No

Name of the bank

Year of

Registration

and Banking

License

Location

No. of Branches

1.

Balasore Co-operative

Urban bank Ltd

1945 & 2009

Balasore

Unit Bank

2.

Berhampur Co-operative

Urban bank Ltd

1945 & 1984

Berhampur

1(Evening branch)

3.

Urban Co-operative bank

Ltd., Cuttack

1981 & 1981

Cuttack

Branch-16.

Extension Counter-

2

4.

Jeypore Co-operative bank

Ltd

1943 & 2002

Jeypore

Unit Bank

5.

Kendrapara Urban Co-

operative bank Ltd

1986 & 1987

Kendrapara

6

6.

Puri Urban Co-operative

bank Ltd

1945 & 2009

Puri

2

7.

The Co-operative Urban

bank Ltd., Parlakhemundi

1915 & 2010

Parlakhemundi

Unit bank

8.

Urban Co-operative bank

Ltd., Rourkela

1988 & 1989

Rourkela

5

pg. 30

9.

Utkal Co-operative bank

Ltd

1934 & 2017

Bhubaneswar

Branch-2,

Extension counter-

2

Table 7. 3. Details of based on Financial parameters of UCBs in Odisha

Financial Parameters(Audited Figures)(in lakhs)

Name of the

Bank

Years

Asset

Size

Deposits

Loans/

Advances

NNPA&

GNPA(%)

Profit

Balasore

UCBL

2019

8070.5

6732.48

2350.71

3.13/18.24

20.57

2018

7571.57

6308.01

2252.95

7.49/21.00

23.47

2017

7196.89

6034.89

2143.36

11.85/23.45

18.53

2016

6237.85

5187.3

2109.07

16.33/26.88

16.42

2015

5627.13

4651.08

1884

15.34/26.88

28.45

Berhampur

UCBL

2019

6582.99

4844.62

3529.72

31.22/41.96

23.92

2018

6353.66

4778.52

3506.01

29.86/39.49

21.5

2017

6265.63

4823.02

3249.53

28.57/37.42

20.45

2016

6133.26

4790.87

3025.13

25.36/34.31

23.1

2015

5786.06

4573.88

2315.6

30.73/40.20

-8.14

Cuttack UCBL

2019

76301

44598.6

26117.1

2.82/16.38

77.1

2018

78144.2

44557.9

24572.3

3.26/18.95

289.41

2017

79665.8

45413.9

21946

2.17/21.46

-581.94

2016

77247

45175.7

21768.9

3.67/23.07

-94.71

2015

73036.7

44049.2

19603.2

4.45/26.31

-561.39

Jeypore UCB

2019

852.63

564.35

239.04

15.42/40.63

3.53

2018

1072.1

600.32

217.05

11.09/39.38

3.26

2017

1119.92

651.07

261.79

18.80/48.92

1.94

2016

1036.22

637.37

286.45

20.88/43.76

2.08

2015

895.54

608.05

309.25

31.89/47.54

-33.78

Kendrapara

UCB

2019

18919.21

15894.25

10446.03

10.22/18.22

34.54

2018

18295.95

14950.34

9765.59

11.66/19.62

40.49

2017

17699.05

14724.72

8932.62

12.09/20.76

29.24

2016

17682.85

14919.14

9604.08

13.39/20.84

8.87

2015

16568.56

14238.78

9424.4

13.70/13.73

152.89

Puri UCB

2019

12043

9208

4786

-0.20/11.99

43.31

2018

11329

8706

4598

0.00/12.64

99.37

2017

11700

9127

4262

4.36/17.43

67.87

2016

10884

8154

4023

5.97/19.84

17.06

2015

10223

7660

3738

8.50/22.46

32.14

Parlakhemundi

UCB

2019

1555.24

1357.4

736.79

19.09/22.06

2.39

2018

1432.89

1247.51

656.64

16.77/21.88

2.3

2017

1281.51

1119.62

532.54

26.94/33.80

2.27

2016

1121.4

985.3

472.04

28.59/34.28

1.16

2015

1210.55

1062.52

555.21

31.01/36.04

1.69

Rourkela UCB

2019

20316.17

13318.59

9949.46

3.07/14.73

173.18

2018

18961.28

12493.4

8364.16

4.65/18.07

163.22

2017

19173.68

12367

7581.11

7.62/23.17

95.78

2016

16944.78

10962.81

6907.35

11.62/27.85

17.25

2015

16169.62

10521.17

7269.98

18.13/30.08

35.19

pg. 31

Utkal UCB

2019

32255.37

27310.5

16208.25

19.09/22.06

357.28

2018

27569.26

14698.94

14698.94

-0.70/3.52

348.65

2017

23262.54

18801.28

13487.29

26.94/33.80

249.09

2016

19638.35

14536.79

11231.21

0.29/4.21

298.55

2015

16953.15

12768.75

9913.6

1.24/5.11

132.16

Different banks function at different levels considering the parameters like asset size, deposit, advances,

NPA and Profit. The reasons could be the geographical presence, management, embracing change over

the period of time etc.

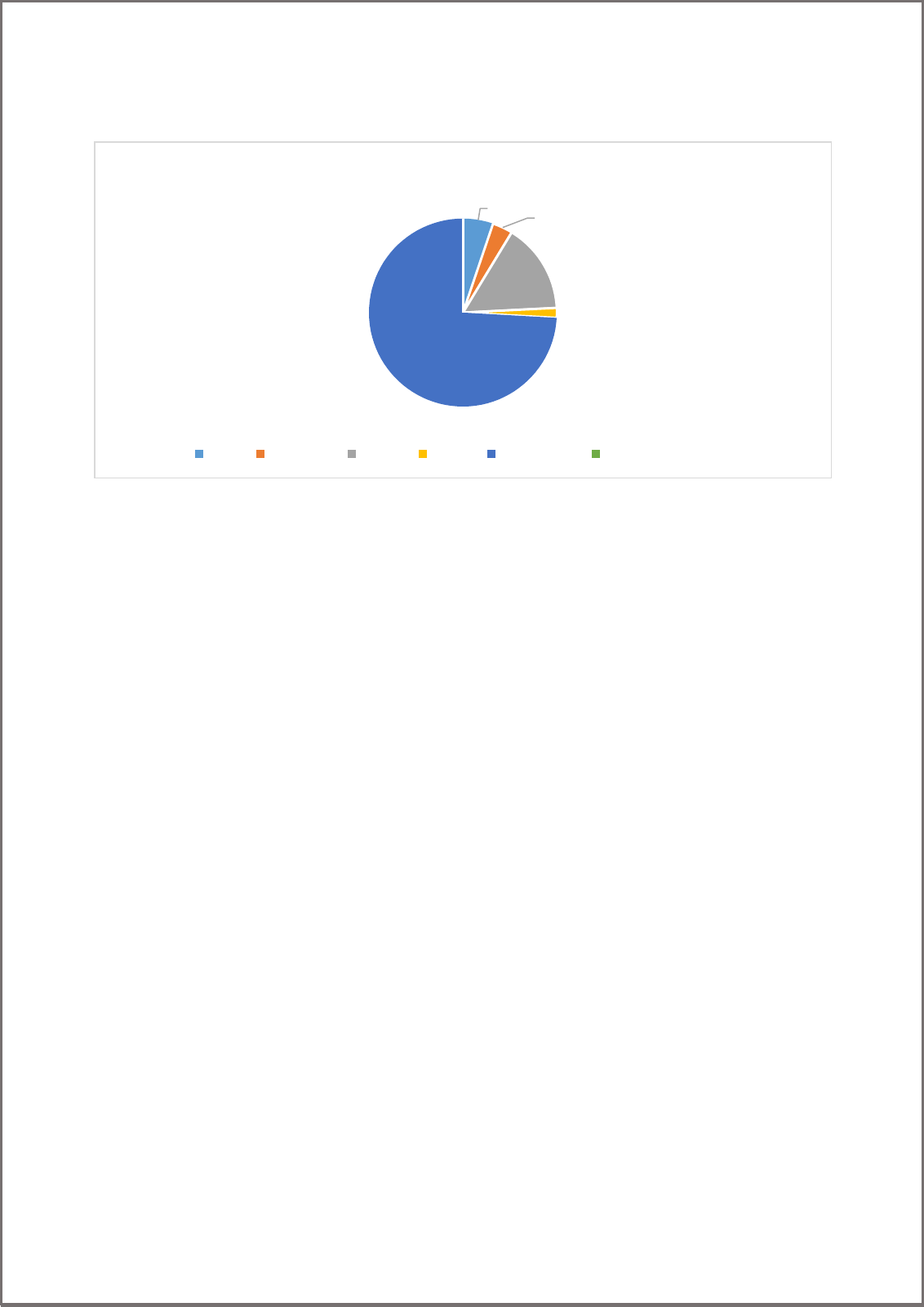

Figure 7. 1.Asset size of all UCBs in Odisha

The Cuttack Co-operative has the highest asset size followed by Utkal co-operative bank, and the lowest

is Jeypore Co-operative Bank. In last five years almost all the banks have increased their Asset Size.

The Co-operative Urban bank Ltd.,

Parlakhemundi

Urban Co-operative bank Ltd.,

Rourkela

Utkal Co-operative bank Ltd

2019

2018

2017

YEARS

2016

2015

20000

10000

Kendrapara Urban Co-operative bank

Ltd

Puri Urban Co-operative bank Ltd

40000

30000

Urban Co-operative bank Ltd.,

Cuttack

Jeypore Co-operative bank Ltd

60000

50000

Berhampur Co-operative Urban bank

Ltd

80000

70000

Balasore Co-operative Urban bank Ltd

90000

Asset size for last 5 years

Assets Size

pg. 32

Figure 7. 2.Deposits of all UCBs in Odisha

The Cuttack Co-operative bank has the highest deposits whereas Jeypore UCB has the lowest since

2015.it is seen that since last 5 years, there is a decline in the deposits of almost all the UCBs. Especially

Jeypore UCB and Parlamekhundi UCB.

Figure 7. 3.Loans/Advances of all UCBs in Odisha

Deposits for last 5 years

50000

Balasore Co-operative Urban bank Ltd

45000

40000

35000

30000

Berhampur Co-operative Urban bank

Ltd

Urban Co-operative bank Ltd.,

Cuttack

Jeypore Co-operative bank Ltd

25000

20000

15000

Kendrapara Urban Co-operative bank

Ltd

Puri Urban Co-operative bank Ltd

10000

5000

The Co-operative Urban bank Ltd.,

Parlakhemundi

Urban Co-operative bank Ltd.,

2015 2016

2017

YEARS

2018

2019

Rourkela

Utkal Co-operative bank Ltd

The Co-operative Urban bank Ltd.,

Parlakhemundi

Urban Co-operative bank Ltd.,

Rourkela

Utkal Co-operative bank Ltd

2019

2018

2017

YEARS

2016

2015

5000

Kendrapara Urban Co-operative bank

Ltd

Puri Urban Co-operative bank Ltd

10000

15000

Berhampur Co-operative Urban bank

Ltd

Urban Co-operative bank Ltd., Cuttack

Jeypore Co-operative bank Ltd

25000

20000

Balasore Co-operative Urban bank Ltd

30000

Loans/advances for the last 5 years

LOANS/ADVANCES

DEPOSITS

pg. 33

Since 2015 Cuttack co-operative Bank has the highest advances and loans followed Utkal Co-operative

Bank and Kendrapara Bank and lowest is Jeypore Co-operative Bank followed by Parlakhemundi.

Figure 7. 4.Net NPA and Gross NPA of UCBs in Odisha.

Cuttack Cooperative bank has the highest GNPA which ₹4279.19 lakhs at 16.38 % of the total advance

Figure 7. 5. Profit of all UCBs in Odisha

Banks

GNPA(Amt.)

NNPA(Amt.)

GNPA(%)

NNPA(%)

45.00%

40.00%

35.00%

30.00%

25.00%

20.00%

15.00%

10.00%

5.00%

0.00%

-5.00%

4500

4000

3500

3000

2500

2000

1500

1000

500

NNPA AND GNPA

YEARS

Urban Co-operative bank Ltd.,

Rourkela

Utkal Co-operative bank Ltd

-600

-800

The Co-operative Urban bank Ltd.,

Parlakhemundi

-400

Kendrapara Urban Co-operative bank

Ltd

Puri Urban Co-operative bank Ltd

-200

2019

2018

2017

2016

2015

Berhampur Co-operative Urban bank

Ltd

Urban Co-operative bank Ltd.,

Cuttack

Jeypore Co-operative bank Ltd

400

200

Balasore Co-operative Urban bank Ltd

600

PROFIT FOR LAST 5 YEARS

PROFIT

Amount

Percent

pg. 34

The Utkal Co-operative Bank has the highest audited profit followed by Rourkela in 2019. The Cuttack

and Jeypore Co-operative Banks are reeling under accumulated loss of ₹1131.57 lakh and ₹22.83 lakhs

respectively, as on March 2019.

Considering the branch networks, asset size, deposit and advances Cuttack, Utkal, Rourkela, and

Kendrapara UCBs are the major players followed by Puri and Balasore in the UCB sector of Odisha.

pg. 35

CHAPTER 8

EVOLUTION OF BANKING TECHNOLOGIES

Technological innovation in general and information technology (IT) applications in particular, have had

a major effect in banking and finance. Outstanding IT-based innovations are considered and grouped

into four distinct periods based on Indian Scenarios are:

Early adoption (1960-1980),

Specific application (1980-1990),

Emergence (1990-2000) and

Diffusion (2000-till date).

8.1 Role of Technology in development of UCBs:

Technological innovation has not only enabled a broader reach for consumer banking and financial

services but has enhanced its capacity for continued and inclusive growth. Banks and financial

institutions rely on gathering, processing, analyzing information in order to improve its service and meet

the expectations of customers. Banks have been quick to realize and adopt technology in a big way.

The visible benefits of IT in day-to-day banking in India are quite well known. The ‘Anywhere Banking’

through Core Banking Systems, ‘Anytime Banking’ through new, 24/7/365 delivery channels such as

Automated Teller Machines (ATMs), and Net and Mobile Banking, etc. are also increasingly becoming

an integral part of the services provided by the UCBs. In addition, IT has enabled the efficient, accurate,

and timely management of the increased transaction volume that comes with a larger customer base.

Another important aspect with regard to technology implementation for internal purposes in UCBs is the

Management Information System (MIS). The MIS reports so generated help the top management as

effective risk management and a strategic decision-making tool.

The use of IT reduces the costs of financial transactions, improves the allocation of financial resources,

and increases the competitiveness and efficiency of financial institutions. Most importantly, it enables