Liu, Chen-Hao; Huang, Kuang-Chiu

Conference Paper

The Hard Decision of Mobile Operators: A Dumb Pipe

or a Value-Added Service Provider

14th Asia-Pacific Regional Conference of the International Telecommunications Society (ITS):

"Mapping ICT into Transformation for the Next Information Society", Kyoto, Japan, 24th-27th

June, 2017

Provided in Cooperation with:

International Telecommunications Society (ITS)

Suggested Citation: Liu, Chen-Hao; Huang, Kuang-Chiu (2017) : The Hard Decision of Mobile

Operators: A Dumb Pipe or a Value-Added Service Provider, 14th Asia-Pacific Regional Conference of

the International Telecommunications Society (ITS): "Mapping ICT into Transformation for the Next

Information Society", Kyoto, Japan, 24th-27th June, 2017, International Telecommunications Society

(ITS), Calgary

This Version is available at:

https://hdl.handle.net/10419/168492

Standard-Nutzungsbedingungen:

Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen

Zwecken und zum Privatgebrauch gespeichert und kopiert werden.

Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle

Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich

machen, vertreiben oder anderweitig nutzen.

Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen

(insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten,

gelten abweichend von diesen Nutzungsbedingungen die in der dort

genannten Lizenz gewährten Nutzungsrechte.

Terms of use:

Documents in EconStor may be saved and copied for your personal

and scholarly purposes.

You are not to copy documents for public or commercial purposes, to

exhibit the documents publicly, to make them publicly available on the

internet, or to distribute or otherwise use the documents in public.

If the documents have been made available under an Open Content

Licence (especially Creative Commons Licences), you may exercise

further usage rights as specified in the indicated licence.

The Hard Decision of Mobile Operators:

A Dumb Pipe or a Value-Added Service Provider

Kuang-Chiu Huang

1

, Chen-Hao Liu

2

Institute of Telecommunications Management, National Cheng Kung University, No.1,

University Road, Tainan City 701, Taiwan

Abstract

With progress of communication technologies, it enables rapid development of all

kinds of services over the Internet, and we call these services with a name as over the

top (OTT). The penetration rate of 4G has increased rapidly and also increased mobile

operator’s revenue. With the increase of digital convergence demand and other video

platforms appear, it can be predicted the level of complex and competition will rise in

whole market. The business expansion from scale of economies and the popularity of

flat rates all have provided some convenience for people to surf and enjoy OTT services

with no worry. However, the mobile Internet service providers (ISPs) have increase the

number of market penetration rate quickly and have to deal with huge mobile traffic

generated from OTT services. Video streaming accounts for 58 percentages in all

mobile data traffic from a recent survey and it indicates that OTT videos streaming

services convert mobile operators to be dumb pipes. If mobile operators have to

maintain quality of service, they need to invest more money to upgrade their

communication infrastructure.

Although voice of IP (VoIP) services provided by Facebook, line and Skype do not

consume huge amount of mobile bandwidth, it decreases mobile operator’s’ voice

revenues and average revenue per user (APRU) significantly. Moreover, the revenue of

SMS from mobile operators decline dramatically, too. Therefore, the paper addresses

whether mobile operators are capable facing the impact of OTT videos and VOIP, to

cope with emerging challenges from OTT services.

In Taiwan, all mobile operators have developed their OTT platforms, and some

mobile operators bundle their OTT services and mobile Internet service together to

1

of Transportation and Communication Management and Institute of Telecommunications Management,

National Cheng Kung University, Tainan City, 70101 Taiwan.

2

Corresponding author. E-mail address: k0939152880@hotmail.com.tw (C.-H. Liu), Master Student,

Institute of Telecommunications Management, National Cheng Kung University, Tainan City, 70101

Taiwan.

make more attractive for reducing churn rates and increase ARPU. In addition,

cooperation with content providers and mobile operators are necessities and large scale

of merger and acquisition (M&A) between AT&T and Time Warner to enrich their OTT

capacities also emerged.

This paper discusses different options of mobile operators to cope with OTT

challenges. 1. Mobile operators choose to be dumb pipes and upgrade their

infrastructures aggressively, and adopt strategic alliance with OTT service providers. 2.

Mobile operators aggregate contents to develop OTT platforms by themselves to

compete with other OTT services providers.

In addition, the paper also how do asymmetric regulations between BISPs and

OTT service operators affect the competition between mobile operators and OTT

service providers. One is network neutrality and the other is data protection of personal

privacy. Network neutrality has been discussed and debated for many years with

different kinds of interpretation, but restrictions of selling personal data for mobile

operators can produce more notable effect. OTT service provides can sell customer data

to make profits whether mobile operators can sell customer data with precise location

data.

In order to study the competition between mobile operators and OTT service

providers clearly, we propose, basing on mobile operator’s perspective, six options from

pure wholesale dumb pipe to fully bundle service provider.

1. Wholesale only. It means mobile operators won’t contact consumers directly,

and provides their spectrum and infrastructure to mobile virtual network

operators(MVNO).

2. Retail only. It means mobile operators focus on their mobile business (e.g.

voice business and mobile data business) and don’t get involving in developing their

OTT services.

3. Wholesale and retail together. But mobile operators do provide OTT services.

4. Wholesale, retail and strategic alliance with OTT service providers. Mobile

operator do develop their own OTT services but take strategic alliance with other OTT

service providers and bundle those services together.

5. Wholesale, retail, and develop their owned OTT platforms. Mobile operators

can produce contents by themselves or purchase copyright from channel operators and

other content providers.

6. The last option is to combine all of above five options.

This study adopts cost-benefit analysis to compare total cost and benefit and assess

profitability of each option, because cost-benefit analysis can provide quantitative

number to aid for analyzing each option and obtaining a clear picture for input and

output.

The research outcome not only can depict the competition between mobile

operators and OTT service providers clearly but also offers a valuable reference for

NRAs, mobile operators and OTT service providers about how to regulate and how to

compete with difference scenarios and options.

Keywords: OTT, mobile operators, competition, asymmetric regulations, business

strategy, options.

1. Introduction

With progress of information and communication technologies (ICT), it enables

rapid development transition of all kinds of services from analog to digital over the

Internet, and these services have a set name as over the top (OTT). The penetration

rate of the fourth generation (4G) has increased quickly and also enhanced mobile

operator revenues. With the development of digital convergence from streaming music

and video, on-line games, social network, and sharing economic model from AirBNB

and Uber, the impacts of OTT has been unleashed and the trend would change the old

business model and force broad Internet service providers (BISPs) make some hard

decisions. The business expansion from scale of economies and the popularity of flat

rates all have provided some convenience for people to surf and enjoy OTT services

with no worry of unaffordable bill of mobile data charges. However, the mobile Internet

service providers (MISPs) have increased market penetration rates quickly and need to

deal with huge mobile traffic generated from OTT services. Video streaming accounts

for 58 percentages in all mobile data traffic from a recent survey and it indicates that

OTT videos streaming services convert mobile operators to be dumb pipes. If mobile

operators have to maintain quality of service, they need to invest more money to

upgrade their communication infrastructure.

Although voice of IP (VoIP) services provided by Facebook, Line and Skype do

not consume huge amount of mobile bandwidth, they have decreased mobile operator’s’

voice revenues and average revenue per user (APRU) significantly. Moreover, the

revenue of SMS from mobile operators decline dramatically, too. Therefore, the paper

addresses whether mobile operators are capable to confront the impacts of OTT videos

and VOIP, to cope with emerging challenges from OTT services. In Taiwan, all mobile

operators have developed their OTT platforms, and some mobile operators bundle their

OTT services and mobile Internet service together to make more attractive for reducing

churn rates and increase ARPU. In addition, cooperation with content providers and

mobile operators are necessities and large scale of merger and acquisition (M&A)

between AT&T and Time Warner to enrich their OTT capacities also emerged.

This paper discusses different options of mobile operators to deal with OTT

challenges. 1. Mobile operators choose to be dumb pipes and upgrade their

infrastructures aggressively, and adopt strategic alliance with OTT service providers. 2.

Mobile operators aggregate contents to develop OTT platforms by themselves to

compete with other OTT services providers. In addition, the paper also how do

asymmetric regulations between BISPs and OTT service operators affect the

competition between mobile operators and OTT service providers. One is network

neutrality and the other is data protection of personal privacy. Network neutrality has

been discussed and debated for many years with different kinds of interpretation, but

restrictions of selling personal data for mobile operators can produce more notable

effect. OTT service provides can sell customer data to make profits whether mobile

operators can sell customer data with precise location data.

2. Literature Review

The first part of literature review discusses user behavior change, it causes mobile

operators have to confront the challenge from OTT services. The second part is

domestic and foreign mobile operators’ strategies, we can analysis their strategies and

think how to help mobile operators in this study. Besides, definition and implement

scenarios of cost benefit analysis and sensitivity analysis are introduced in the last part

referring to related precedent cases.

2.1 User Behavior Change

According to the institute for information industry report, user’s behavior of

watching video has been changing. Most of users have used smart phones to watched

OTT videos. With progress of high speed 4G technology, video’s demand and

dependence of users is getting higher. The institute for information industry issues

questionnaires for using smart phones and 4G Internet users. There are more than 70%

of the users have used mobile devices to watch online streaming videos, and compared

with 2014, the proportion increased from 69.9% to 75.7%. We can see the ratio

increased significantly.

2.2 Domestic and foreign mobile operators’ strategies

Blocking OTT

When mobile operators confront the challenge from OTT operators, the first

strategy is operators can adopt a short term strategy wherein they can decide to deny

users the access to the OTT services. However, it is a short term strategy and has a high

dependency on net neutrality policies in a given country; moreover it is detrimental to

the business as it will limit the revenue-generation possibilities for the operator through

increased data usage. It should be noted that the strategy only work if all the operators

adopts same strategy simultaneously. Example:

A. In South Korea, after being pressurized by CSPs KT and SK Telecom, the

national regulator sanctioned the blocking of Kakao Talk Service. Telecom companies

in many countries have either blocked Skype or slowed down the speed of Skype traffic

however users can get access to the blocked content using VPNs. Finally, KT and SK

Telecom charges Kakao to let users use this service but this strategy had aroused protest

from Korea people, they think it has already violated the internet neutrality.

B. In UAE, Etisalat (mobile operator) has blocked the Skype and other VoIP

services for using their network and decreasing their revenue, blocking OTT strategy

has been possible only because of UAE is a highly regulated market and Etisalat has the

support of telecom regulator.

Bundling with OTT

Bundling of services is another strategy which can be followed. Many operators

are resorting to this strategy wherein they are bundling offers in such a way that the lure

of financial saving by using OTT services becomes less enticing. For example in case of

SMS services, they are trying to extract a base revenue from users in the form of a fixed

free for the SMS package and then charging data based on actual usage. Thus by

bundling data or voice package with SMS plan, at an affordable price operators can

maximize their revenues and at the same time reduce the threat of OTT services.

However, this would only help the operator retain some level of customer loyalty for a

short time period. Content bundling is another innovative way of operator to bundle the

data intensive OTTs like Video apps (Netflix) with their normal voice subscription plans

to encourage the customer for using these apps thus driving the increased data usage or

decreased churn rate. Example:

A. After a failed attempt to block Skype, European mobile operator TeliaSonera

offers Skype with select data plans. Many Indian telcos such as Tata Docomo, RCom,

Airtel among others have plans specifically for whatsapp, Facebook, saavn services.

B. Taiwan mobile operator T-star offers a new tariff which bundle with OTT

operator i-QIY. It can be subscribed with lower price. T-star offers this strategy planning

to decrease churn rate and increase new subscribers.

Partnering with OTT

Partnering with the opponent can be a good strategy when it is difficult to beat

them at their game. Many Mobile operators are already adopting this strategy wherein

they are partnering with the OTT players and benefit from their traffic. The strategy has

enabled the operators to keep the traffic and gain a share of the revenues. Mobile

operators also cooperate in their consumer information, money and technology.

However, the operator has limited or almost no control on the direction as well as

quality of the services offered through these partnership deals. This may adversely

affect their relationship with their customers. Examples:

A. DiGi telecommunications, a Malaysian mobile service provider, has partnered

with WhatsApp provider as a result of which the DiGi customers can get unlimited

access to WhatsApp service for a fixed fee. Same strategy has also been adopted by 3

Hong Kong, a mobile network operator and broadband service provider in Hong Kong

and by reliance Communications in India.

B. Aircel partnered with Nimbuzz and promoted their partnership, in the state of

Jammu and Kashmir wherein the Aircel via SMS informed and encouraged its

subscribes to download Nimbuzz application whereby 40 MB of data usage would be

transferred for free to those subscribers who would download and activate the

application within a time span of 24 hours.

Developing their Own Services

Another long term strategy which can be adopted by mobile operators would be to

introduce its own OTT service. This will enable them to have full control over the

service and interact with more consumers. However, the investment required for such an

approach is quite high and the approach is risky for mobile operators as they do not

have the necessary skills to launch such services. Example:

A. T-Mobile USA has launched Bobsled, Telefonica Digital has introduced Tu

Me service both of which offer free voice and texts. Orange have also launched their

own branded OTT communication services namely Libon. Similarly, Comcast has

started providing web access to its films and TV shows in order to compete with

Netflix.

B. AT&T mergers with Time Warner, this acquisition makes both of them more

influential. AT&T wants to make use of Time Warner’s content to expand their OTT

video platform, like CNN and HBO.

2.3 Cost-Benefit Analysis

Cost-benefit analysis is a technique that provides a systematic and consistent

procedure for evaluating the best approach for the adoption and practice in terms of

benefits in labour, time and cost savings. CBA is also defined as a systematic process

for evaluating and comparing costs and benefits from different decision, policies and

projects. Processes of cost benefit analysis are standardized by Weimer and Vining in

2015. First, define more specific impact categories in terms of goal and decide which

costs and benefits should be counted. Items of cost and revenue are delineated in details

in this step. Next, quantify or monetize these items. Treatment of non-monetized cost

and benefits, for example devoted opportunity cost or users’ willingness to pay, is to

describe reasons of non-monetized, impacts and limitation. As to treatment of

uncertainty and risk, sensitivity analysis and Monte Carlo analysis are applied to

observe relationship of manipulated parameters and results (Campbell & Brown, 2003).

The last step is applying economic benefit assessment index such as Net Profit Value

(NPV), Internal Rate of Return (IRR), Benefit-Cost Ratio to calculate present value and

select the best option.

In 1970, the concept and quantification theory of CBA was introduced in Taiwan.

With maturity of concepts and techniques, CBA was implemented in the decision

making process of several fields including agriculture industry, environment protecting

and transportation and etc. And since democratization, economy liberalization and

economic growth in Taiwan in 1990s, the government began to emphasize on how to

utilize limited resources on account of maximization (Kuo, 2007). CBA is now valued

in both public departments and private enterprises for evaluation of strategy decision

and assessment of finance allocation.

Nowadays CBA is widely used to appraise investment plans. There are two cases

applying in media industry. New Zealand government commissioned independent

spectrum strategy consultant institute ‘Free to Air ’ in 2005 to proceed in DTT

development research implementing cost benefit analysis (Lin, 2008). ‘High quality

television development plan’, which was executed by Bureau of Audiovisual and Music

Industry Development (MOC), estimated budget distribution and expected benefit

including domestic broadcasting benefit and oversea sale benefit to discuss whether

proposed plan generate economic profit.

Net Present Value

Net Present Value (NPV) is a measure applied in capital budget to evaluate a

project's potential return on investment. Time value of money is considered in NPV

using discount rate to estimate cash inflow and outflow for each period. The function is

as follows:

∑

R

t

−C

t

(1+i)

n

−C

0

n

t=0

′Rt ′ means revenue generated before year ‘t’, ′Ct ′represents investment in year ‘t’,

‘i’ is discount rate, C0 is initial capital invested in the project.

The study adopts NPC as economic revenue evaluation index. Generally, the

decision maker chooses the strategy with positive NPV. In this study, we select the best

strategy with highest NPV value. As to evaluation of uncertain factors, the study adopt

sensitivity analysis to figure out which variable parameters lead to more significant

influence on cost and benefit items.

3. Research Method

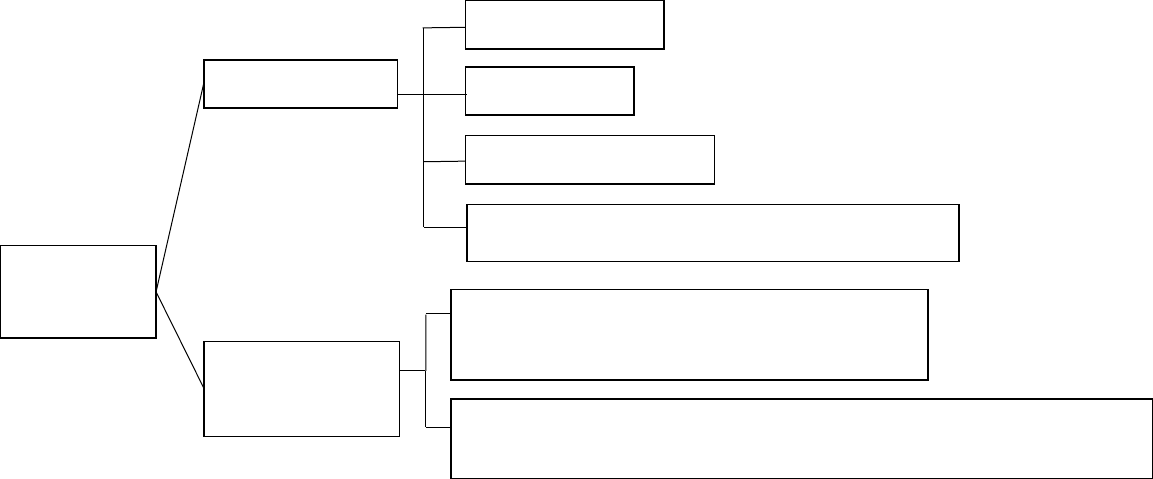

Strategy Analysis of Mobile Operators

In order to study the competition between mobile operators and OTT service

providers clearly, we propose, basing on mobile operator’s perspective, six options from

pure wholesale dumb pipe to fully bundle service provider.

1. Wholesale only. It means mobile operators won’t contact consumers directly, and

provides their spectrum and infrastructure to mobile virtual network operators

(MVNO).

2. Retail only. It means mobile operators focus on their mobile business (e.g. voice

business and mobile data business) and don’t get involving in developing their

OTT services.

3. Wholesale and retail together. But mobile operators do provide OTT services.

4. Wholesale, retail and strategic alliance with OTT service providers. Mobile

operator do develop their own OTT services but take strategic alliance with other

OTT service providers and bundle those services together.

5. Wholesale, retail, and develop their owned OTT platforms. Mobile operators can

produce contents by themselves or purchase copyright from channel operators and

other content providers.

6. The last option is to combine all of above five options.

Wholesale + Retail +Develop their OTT video

service

Mobile

operator

Dumb Pipe

Value-Added

Service Provider

Wholesale only

Retail only

Wholesale + Retail

Wholesale + Retail + Bundle with OTT service

Wholesale + Retail + Bundle with OTT service + Develop their own

OTT video service

Figure1. The figure of strategy

This study adopts cost-benefit analysis to compare total cost and benefit and assess

profitability of each option, because cost-benefit analysis can provide quantitative

number to aid for analyzing each option and obtaining a clear picture for input and

output.

The research outcome not only can depict the competition between mobile

operators and OTT service providers clearly but also offers a valuable reference for

NRAs, mobile operators and OTT service providers about how to regulate and how to

compete with difference scenarios and options.

Table1. The item of cost benefit analysis

Table2. Variable parameter table

Item

Strategy1

Strategy2

Strategy3

Strategy4

Strategy5

Strategy6

Wholesale Benefit

Retail Benefit

Bundle OTT Service Benefit

OTT Video Platform’s

Advertisement Benefit

Subscription Benefit

Bundle OTT Service Cost

Develop OTT Platform Cost

Content Coding Cost

Rent Cost for Cloud and Bandwidth

OTT Platform Content Cost

Content Purchase Cost

Spectrum Cost

Spectrum Bidding Cost

Spectrum Using Cost

Parameter

Parameter Abbreviation

Original Churn Rate

OCR

New Churn Rate

NCR

Total Customers

TC

Number of Viewing per Month

N_VM

Number of Own OTT Platform Subscribers

NS_OTT

Price Difference in Bundling OTT service

PD_BOS

Number of Choosing Bundling OTT Service Tariff

N_CBOST

Number of Buying Movie of Each Set

NOMES

X

, x≥0

4. Model Analysis

Before going to analyzing the results, we separate strategies in two parts by

strategy characteristic. Strategy 1, 2 and 3 cover a large range of business, including

voice and data revenue. With bundling OTT service and developing their OTT video

platforms is only a part of the overall business. Compared to the wholesale and retail

business, it covers a small range of business and the user it impacts is less. Therefore,

we compare strategy1, 2 and 3 together, and strategy 4, 5 and 6 together.

Strategy 1: Wholesale only

In calculating the net present value of the wholesale only, n is the forecast for the

next 10 years, R_t has Wholesale Benefit, C_t has Spectrum Using Cost, C_0 is the

Spectrum Bidding Cost in the beginning and i is discounting rate 3.83%.

Strategy 2: Retail only

In calculating the net present value of the retail only, n is the forecast for the next

10 years, R_t has retail benefit, C_t has Spectrum Using Cost, C_0 is the Spectrum

Bidding Cost in the beginning and i is discounting rate 3.83%.

Strategy 3: Wholesale + Retail

In calculating the net present value of the wholesale and retail, we assume that

each business account for 50%. n is the forecast for the next 10 years, R_t has 50%

retail benefit and 50% wholesale benefit, C_t has spectrum using cost, C_0 is the

spectrum bidding cost in the beginning and i is discounting rate 3.83%.

Table3. The result of estimation in strategy 1, 2 and 3

Year

Strategy1

Strategy2

Strategy3

2017

4,724,845.517

9,860,912.843

7,292,879.178

2018

4,351,877.497

9,298,489.576

6,825,183.537

2019

3,993,324.691

8,757,470.005

6,375,397.348

2020

3,665,164.01

8,253,573.249

5,959,368.630

2021

3,349,108.263

7,768,263.844

5,558,686.054

2022

3,044,710.934

7,300,856.153

5,172,783.544

2023

2,751,541.997

6,850,689.833

4,801,115.905

2024

2,469,187.207

6,417,128.897

4,443,158.052

2025

2,197,247.719

5,999,560.817

4,098,404.268

2026

1,935,339.323

5,597,395.663

3,766,367.493

NPV

32,482,347.16

69,534,340.88

54,293,344.01

Figure2. The result of estimation in strategy 1, 2 and 3

Strategy 4: Wholesale + Retail + Bundle with OTT service

In calculating the net present value of wholesale, retail and bundle with OTT service,

we have to add the cost and benefit of bundle OTT service. n is the forecast for the next

10 years, R

t

has wholesale benefit, retail benefit and bundle OTT service benefit, C

t

has spectrum using cost and bundle OTT service cost, C

0

is the spectrum bidding cost

in the beginning and i is discounting rate 3.83%. The equation is below:

Bundle OTT Profit(year)=(OCR-NCR)×TC×AP_T

Operation Fee(year) = (PD_BOS×N_CBOST) ×12(month)

Strategy 5: Wholesale + Retail + Develop their OTT video service

In calculating the net present value of wholesale, retail and develop their OTT video

service, we have to add the cost and benefit of develop OTT video service. n is the

forecast for the next 10 years, R

t

has wholesale benefit ,retail benefit, OTT video

platform’s advertisement benefit and subscription benefit, C

t

has spectrum using cost,

content coding cost, rent cost for cloud and bandwidth and content purchase cost, C

0

is

the spectrum bidding cost and content purchase cost in the beginning. i is discounting

rate 3.83%.

Strategy 6: Wholesale + Retail + Bundle with OTT service + Develop their

own OTT video service

In calculating the net present value of wholesale, retail, bundle with OTT service and

develop their OTT video service, we have to add the cost and benefit of bundle with

OTT service and develop OTT video service. n is the forecast for the next 10 years, R

t

has all the benefit items, C

t

has all the cost items, C

0

is the spectrum bidding cost and

content purchase cost in the beginning. i is discounting rate 3.83%.

Strategy1

Strategy2

Strategy3

Table4. The result of estimation in strategy 4, 5 and 6

Year

Strategy4

Strategy5

Strategy6

2017

7,293,534.136

7,257,852.258

7,258,507.216

2018

6,825,694.486

6,777,519.125

6,778,030.075

2019

6,375,774.024

6,327,234.589

6,327,611.265

2020

5,959,675.826

5,909,468.985

5,909,776.181

2021

5,558,874.850

5,506,773.090

5,506,961.886

2022

5,172,862.257

5,118,832.904

5,118,911.617

2023

4,801,142.056

4,745,180.608

4,745,206.759

2024

4,443,135.413

4,385,304.801

4,385,282.162

2025

4,098,382.464

4,038,701.907

4,038,679.268

2026

3,766,257.768

3,704,883.885

3,704,774.160

NPV

54,295,333.28

53,771,752.15

53,773,740.59

Figure3. The result of estimation in strategy 4, 5 and 6

Strategy4

Strategy6

Strategy5

5. Conclusion and suggestion

The main purpose of this research is to find the best strategy and provide useful

suggestions for mobile operators. The result of this research is described in section 5.1,

and research suggestions in section 5.2. Then the limitations of the research are

mentioned in last section.

5.1 Summary of the Results

This study aims to analyze the Taiwan telecom operators adopted strategies when

facing the challenges of the OTT industry. The Analyzing outcome indicates telecom

operators should maintain their dumb pipe service as the cash cow and develop as many

as OTT value added services as they could. To build their owned OTT video platform is

one of the options. With the different strategies, there are also different revenue

generation avenues. (e.g., advertisement, subscription fees and the benefit of bundle

OTT video). At the same time, it should summarize the cost items needed to invest in

different strategies and also builds a cost-benefit model. After estimating the each

strategies of a cost-benefit analysis, it can provide the appropriate strategy for the

telecoms operators. The results of estimating are as followed:

Strategy 1: Mobile operators choose to continue be a dumb pipe and wholesale

only will have the least benefit. The advantage is that do not have to contact with

customers directly and responsible for the customers services, and the challenge form

OTT service providers will be confronted by MVNOs. Mobile operators adopt this

strategy have less risk. However, there has no chance to create new revenue except the

revenue from rental infrastructure and spectrum.

Strategy 2: Mobile operators choose to continue be a dumb pipe and retail only

will have the most benefit. They have to provide service to consumers directly, but they

can provide innovative services for customers. However, they have to take the risk when

providing innovative service. Moreover, they can’t solve the challenges from OTT

operators effectively.

Strategy 3: Mobile operators choose to continue be a dumb pipe and adopt retail

and wholesale will be the third best in all strategies. The advantage is they can not only

benefit from rental spectrum to the MVNOs, but also operate their own mobile business.

Compared with strategy two, this strategy can release data usage and spectrum pressure

from OTT operators. If mobile operators’ mobile business has been impact seriously,

they can adjust the rental spectrum costs as a balance. This strategy will be more

flexible.

Strategy 4: When mobile operators choose to provide bundling OTT service, it will

be the second best in all strategies. It can bring positive profit, but it will start reduce

after strategy begin eight years. The reason is that the reduction in customer churn rate

has limited effect as time goes on. When the churn rate is no longer significant, the cost

of the Bundle OTT service will surpass the benefits. This study will show that Bundling

OTT service has been effective in previous years, but when the reduction of customer

churn rate is no longer significant, it will lead to lost in in business.

Strategy 5: When mobile operators choose to develop their OTT video service, it

will be the fifth best in all strategies. Most of Taiwan's mobile operators operate their

OTT video platform is showing a loss. OTT video platform decisive key lies in the

platform content. There has too many competitors, and most users tend to subscribe to

the platform which has popular content. Content in Taiwan mobile operators’ OTT

platform can’t compete with the OTT operators like LiTV, Netflix and i-QIY. Therefore,

if mobile operators can’t invest more money in purchase content, they won’t have

ability to compete with extensive OTT operators.

Strategy 6: When mobile operators choose to provide bundling OTT service and

develop their OTT video service, it will be the fourth best in all strategies. We can know

that the profit in strategy 4 can’t balance the deficit in strategy 5. Therefore, it also

presents a lower efficiency than the business of wholesale and retail.

5.2 Suggestions of the research

There are three suggestions for mobile operators in our research. The first one is

mobile operators have to pay attention how to deal with churn rate. It’s very important

whether the degree of decline in churn rate can balance the cost in bundling OTT

service or not. The subscribers of bundling with OTT service will not only be the

customers who choose to stay for this strategy, but also the customers who choose to

stay in the beginning. Therefore, mobile operators have to pay attention when the

strategy goes on.

The second suggestion is mobile operators have to provide not only the OTT video

platform, but also the platforms integrate other value-added services like shopping,

music, mobile payment and games. When mobile operators develop their OTT platform,

they have to confront many foreign OTT video service providers, for example, Netflix,

i-QIY and Dailymotion. The content costs of these foreign OTT service providers are

lower than Taiwan mobile operators. To compete with these OTT service providers, the

main goal is to provide consumers attractive and famous video content. However, the

content copyright costs and investment risks have to evaluate seriously.

The third suggestion is mobile operators have to generate extra income resources.

When mobile operators confront the challenge from OTT service providers, the extra

income resources could be make good use of user’s personal information. Based on user

privacy regulations in Taiwan, mobile operators can’t sell and use the user information

legally. However, the US Senate rejected the privacy rules established by the Federal

Communications Commission (FCC) by 50 to 48 on March 24, 2017. They intended to

allow mobile operators to sell user’s personal information without having to get their

consent. Although the rules are still need to verify by the relevant agencies, it can

indicate that mobile operators pay attention for these income resources. Consumers can

choose the mobile operators they preferred easily when mobile operators adopted the

two methods of protecting privacy or not. We considered the best strategy for mobile

operators is price discrimination with providing several of choose (e.g., mobile

operators will provide higher cost when users choose not to provide their information,

and vice versa). On the contrary, the level of extra cost depend on the market

equilibrium of supply and demand (i.e., consumers can accept the range and

management level of privacy strategy of mobile operators).

5.3 Limitations of the research

The cost-benefit analysis relies on accurate information. In this study, the initial

parameter values are limited by the latest data and commercial confidential. Therefore,

there are several assumptions of parameters are made by ourselves without historical

data or can’t obtain. The research limitations of this study were listed as followed:

1. We can’t obtain the key data in the strategies which select wholesale. Therefore, it

can only calculate in traffic and voice. If the relevant information is available in the

future, we can estimate the result more accurately.

2. Churn rate can’t obtain because Taiwan’s mobile operators choose to bundle with

OTT service recently. The decline in churn rate will affect the calculation results.

Moreover, the subscribers of bundling with OTT service don’t have the exact number

and growth rate. It will be able to obtain accurate information to calculate after the

strategy operating for longer.

3. In the calculation of the mobile operator’s OTT video platform subscribers, we use

Chunghwa Telecom’s OTT video platform subscribers growth rate to estimate. Due to

OTT video industry changes rapidly, there are too many competitors. Therefore, it is

difficult to predict whether mobile operators will reinforce for the lack of their OTT

platform or not. It will also affect the growth rate of subscribers in the future.

Reference

AT&T. (2015). AT&T completes acquisition of DIRECTV. Retrieved from http://

about .att.com/story/att_completes_acquisition_of_directv.html

Forbes. (2015). AT&T Closes DirecTV Acquisition: Reviewing The Concessions

And Benefits. Retrieved from http://www.forbes.com

/sites/greatspeculations

/2015/07/27/att-closes-directv-acquisition-reviewing-the-concessions-and-

benefits/#2ccdda07e896

Alpert, L. I., & Knutson, R. (2015) Verizon strikes deal with vice media for new

video service. The wall street journal. Retrieved from

http://www.wsj.com/

articles/verizon-strikes-deal-with-vice-media-for-new-video-service-1436

888320

Baburajan, K. (2014). OTT impact reflects in Idea Cellular, Airtel fourth fiscal

quarter 2014 revenues. Retrieved from http://www.telecomlead.com/news

/ott-impact-reflects-in-idea-cellular-airtel-fourth-fiscal-quarter-2014-reven

ues-83272-50461

Campbell, H. F., & Brown, R. P. (2003). Financial and economic appraisal using

spreadsheets. Benefit-cost analysis. Retrieved from https://books. Google.

com.tw/books?hl=zh-TW&lr=&id=b3_8Tapt2MYC&oi=fnd&pg=PR6&d

q=Benefit-cost+analysis:+financial+and+economic+appraisal+using+spre

adsheets&ots=C8Zc4Mf-d2&sig=Zdo2Ky4VE1ne0L7PbKeTmkES64s&r

edir_esc=y#v=onepage&q=Benefit-cost%20analysis%3A%20financial%2

0and%20economic%20appraisal%20using%20spreadsheets&f=false

Cisco. (2015a). Cisco Visual Networking Index: Forecast and Methodology,

2014-2019 White Paper. Retrieved from http://goo.gl/KpGYNz

Cisco. (2015b). Cisco Visual Networking Index: Global Mobile Data Traffic

Forecast Update 2014–2019 White Paper.

Cisco. (2016). Cisco Visual Networking Index: Global Mobile Data Traffic

Forecast Update, 2015–2020 White Paper. Retrieved from

http://www.cisco.com/c/en/us/solutions/collateral/service-provider/visual-

networking-index-vni/mobile-white-paper-c11-520862.html

Erman, J., Gerber, A., Ramadrishnan, K. K., Sen, S., & Spatscheck, O. (2011).

Over the top video: the gorilla in cellular networks. In Proceedings of the

2011 ACM SIGCOMM conference on Internet measurement conference,

11(3), 127-136.

Federal Communications Commission. (2015). Annual assessment of the status

of competition in the market for the delivery of video programming.

Retrieved from https://www.fcc.gov/document/fcc-adopts-16

th

\-video–

competition – report

Fried, I., (2016) What is Verizon’s Go90 and why should I care?. Retrieved from

http://www.recode.net/2016/7/27/12303084/what-is-verizon-go90-faq

Gravey, A., Guillemin, F., & Moteau, S. (2013). Last mile caching of video

content by an ISP. In ETS 2013: 2nd European Teletraffic Seminar, 14(3),

1-10.

Kimbler, K., & Taylor, M. (2012). Value added mobile broadband services

Innovation driven transformation of the ‘smart pipe’. Institute of Electrical

and Electronics Engineers, 30-34.

Liu, Y. L. (2014). The Business models of the OTT video services in Taiwan.

Retrieved from http://itsrio2014.com/public/download/Yu-li%20Liu%20

The

%20Business%20Model%20of%20the%20OTT%20Video%20Services.p

df

OOYALA. (2016). Global video index. Retrieved from http://go.ooyala.

com/wf-video-index-q2-2016.html

Rao, A., Legout, A., Lim, Y. S., Towsley, D., Barakat, C., & Dabbous, W.

(2011). Network characteristics of video streaming traffic. In Proceedings

of the Seventh COnference on emerging Networking EXperiments and

Technologies, 16(4), 1-12.

Shah, S. S. A. (2012). Media Processing in Video Conferences for Cooperating

Over the Top and Operator Based Networks. Retrieved from

https://aaltodoc.aalto.fi/bitstream/handle/123456789/5224/master_shah_sy

ed_safi_ali_2012.pdf?sequence=1&isAllowed=y

Silverstreet. (2013). The OTT opportunity for operators. Retrieved from

http://www.gsma.com/membership/wp-content/uploads/2013/10/White-pa

per-Aug2013.pdf

Schuman, R. & Gabrielczyk, M. (2013). Wholesale mobile broadband: what

could go wrong, and how it could be fixed. Retrieved from http://www.

analysysmason.com/About-Us/News/Insight/Wholesale-mobile-broadban

d-Mar2013/

Sujata, J., Sohag, S., Tanu, D., Chintan, D., Shubham, P., & Sumit, G. (2015).

Impact of Over the Top (OTT) Services on Telecom Service

Providers. Indian Journal of Science and Technology, 8(4), 145-160.

Zink, M., Suh, K., Gu, Y., & Kurose, J. (2009). Characteristics of YouTube

network traffic at a campus network–measurements, models, and

implications. Computer networks, 53(4), 501-514.

Zenith. (2015). Mobile to drive 19.8% increase in online video consumption in

2016 Retrieved from

http://www.zenithmedia.com/mobile-drive-19-8-increase–online

-video-consumption-2016/

Zenith. (2016). Zenith forecasts 75% of internet use will be mobile in 2017.

Retrieved from http://www.zenithmedia.com/zenith-forecasts-75-internet-

use-will-mobile-2017/