Agency

Financial Report

2016

Creating prosperity for self-sustaining, repopulating

and economically thriving communities.

United States

Department of

Agriculture

NON- DISCRIMINATION STATEMENT

Non-Discrimination Statement

The U.S. Department of Agriculture (USDA) prohibits discrimination against its customers,

employees, and applicants for employment on the basis of race, color, national origin, age,

disability, sex, gender identity, religion, protected genetic information, reprisals for whistle

blowing or filing grievances, and where applicable, political beliefs, marital status, familial or

parental status, sexual orientation; or whether all or part of an individual’s income is derived

from any public assistance program or any program or activity conducted or funded by the

Department. (Not all prohibited discrimination will apply to all programs and/or employment

activities.)

To File an Employment Complaint

If you wish to file an employment complaint, you must contact your agency’s Equal

Employment Opportunity (EEO) Counselor within 45 days of the date of the alleged

discriminatory act, event, or personnel action. Additional information can be found on the

USDA Office of the Assistant Secretary of Civil Rights web site.

To File a Program Complaint

To file a program discrimination complaint, please complete the USDA Program

Discrimination Complaint Form. You or your authorized representative must sign the

complaint form. You are not required to use the complaint form; you may write a letter instead.

If you write a letter, it must contain all of the information requested in the form and be signed

by you or your authorized representative. Incomplete information will delay the processing of

your complaint. Employment civil rights complaints will not be accepted through the email

address below.

Persons with disabilities who require alternative means for communication of program

information (Braille, large print, audiotape, etc.) should contact USDA’s TARGET Center at

(202) 720-2600 (voice and TDD).

Send your completed complaint form or letter to us by mail, fax, or email:

Mail

U.S. Department of Agriculture

Director, Office of Adjudication

1400 Independence Avenue, SW

Washington, DC 20250-9410

Fax: (202) 690-7442

E-mail: [email protected]ov

USDA FISCAL YEAR 2016 AGENCY FINANCIAL REPORT

About the Report

The purpose of the U.S. Department of Agriculture (USDA) fiscal year (FY) 2016 Agency

Financial Report (AFR) is to inform Congress, the President, and the American people on how

USDA has used Federal resources entrusted to the Department in FY 2016 in order to do the

following: expand economic opportunity through innovation; help rural America to thrive

while promoting agriculture production sustainability that better nourishes the population; and

preserve and conserve the Nation’s natural resources. USDA has demonstrated good

stewardship of financial resources by putting in place well controlled and managed business

lines and financial management systems and processes. USDA has chosen to produce both an

AFR and an Annual Performance Report (APR) for FY 2016. USDA will include its FY 2016

APR with its Congressional Budget Justification and will post this AFR on the following

Department Web Page.

This AFR provides high-level financial and highlighted performance results with assessments

of controls, a summary of challenges, and USDA stewardship information. The AFR enables

the President, Congress, and the public to assess USDA accomplishments and understand its

financial position. USDA’s end-of-fiscal-year financial position includes, but is not limited to,

financial statements, notes to the financial statements, and a report of the independent auditors.

The report satisfies the reporting requirements contained in the following laws and regulations:

• Improper Payments Elimination and Recovery Act of 2010;

• Improper Payments Elimination and Recovery Improvement Act of 2012 (IPERIA);

• Government Performance and Results Modernization Act of 2010;

• Improper Payments Information Act of 2002;

• Reports Consolidation Act of 2000;

• Government Management Reform Act of 1994;

• Chief Financial Officers Act of 1990;

• Federal Managers’ Financial Integrity Act of 1982;

• Federal Financial Management Improvement Act of 1996;

• Office of Management and Budget Circular A-123, Management’s Responsibility for

Internal Controls; and

• Office of Management and Budget Circular A-136, Financial Reporting Requirements.

ABOUT THIS REPORT

The APR is a detailed report on USDA’s progress toward achieving the goals and objectives

described in the Agency’s Strategic Plan and Annual Performance Plan, including progress on

the strategic objectives, performance goals, and Agency Priority Goals. The report will be

delivered to Congress with the annual budget submission.

This report is to be posted on these Web sites: Performance.gov and the USDA Performance

Improvement and Accountability at USDA Web page. Previous reports are posted as well.

USDA FISCAL YEAR 2016 AGENCY FINANCIAL REPORT

Table of Contents

Message from Secretary Vilsack ................................................................................................. i

Section I: Management’s Discussion and Analysis ..................................................................... 1

About USDA ................................................................................................................................ 1

Mission Statement ..................................................................................................................... 1

Strategic Plan and Program Performance ................................................................................. 7

Future Demands, Risks, Uncertainties, Events, Conditions, and Trends ............................... 18

Analysis of Financial Information and Highlights .................................................................... 19

Statement of Assurance ........................................................................................................... 22

Federal Managers’ Financial Integrity Act Report on Management Control ........................ 25

Federal Financial Management Improvement Act Report on Financial

Management Systems ......................................................................................................... 38

Financial Management Systems Strategy ............................................................................... 41

Other Management Information, Initiatives, and Issues ....................................................... 46

Limitations of Financial Statement .......................................................................................... 47

Section II: Financial Information .............................................................................................. 48

Message from Chief Financial Officer ..................................................................................... 48

Independent Auditors Report .................................................................................................. 50

Agency Response to Auditors Report ...................................................................................... 72

Consolidated Balance Sheet .................................................................................................... 75

Notes to the Consolidated Balance Sheet............................................................................... 76

Required Supplementary Stewardship Information .............................................................120

Required Supplementary Information ..................................................................................132

Section III: Other Information ................................................................................................ 138

Unaudited Financial Statements ...........................................................................................138

Unaudited Notes to Financial Statements ............................................................................141

Schedule of Spending .............................................................................................................161

Response to Management Challenges ..................................................................................163

Summary of Financial Statement Audit and Management Assurances ..............................184

Improper Payments ................................................................................................................186

Inspector General Act Amendments of 1988: Management’s Report on

Audit Follow Up .................................................................................................................264

Freeze the Footprint ..............................................................................................................279

Civil Monetary Penalties ........................................................................................................280

Abbreviations—Acronyms ..................................................................................................... 300

MESSAGE FROM THE SECRETARY i

Message from Secretary Vilsack

In fulfillment of our duty to the people, the President, and Congress,

the U.S. Department of Agriculture (USDA) respectfully submits the

Fiscal Year 2016 Agency Financial Report.

For more than 7 years, I have had the honor and privilege of serving

as Secretary of Agriculture. I have traveled to all 50 states and heard

rural Americans—from local businesses, community leaders, farmers, ranchers and other

Americans far and wide, from all walks of life talk about the impact that USDA’s staff,

programs and services have on their lives. I could not be more proud of the work the men and

women of USDA do each and every day.

In fiscal year (FY) 2016, the final full year of this Administration, these men and women

continued to press on in their work and celebrate the many successes of programs they have

helped to implement. While 2016 was not without its challenges, these were outshined by

achievements in every one of USDA’s mission areas on behalf of the American people. We

saw record amounts of credit and support delivered to America’s farmers and ranchers, the

lowest child food insecurity rates on record, and booming local and regional and organic sales,

to name several.

Our efforts not only supported the most productive agricultural sector in the world, but also

helped rural communities become places where businesses, farm and non-farm alike, prosper

and create jobs. Even as commodity prices have weakened and farm incomes have decreased,

the rural economy remains strong. Our work to increase trade, grow the bioeconomy,

strengthen local and regional food systems, and expand conservation have resulted in a more

resilient rural economy.

Like urban areas, rural America is continuing to recover from the Great Recession. Median

income for farm households remains near the historic high of 2014—35 percent higher than

median U.S. household income in 2015. Nationally, the real median household income for

middle class Americans saw a record 5.2 percent increase in 2015. While the nonmetro rates of

unemployment still lag behind the metro areas, nonmetro rates have been recovering at about

the same pace, and we know that both are approaching pre-recessional levels of around

5 percent, providing increasing opportunities for farm families. While the population of rural

areas has been flat or declining lately, we also see that the proportion of adults living in rural

ii USDA FISCAL YEAR 2016 AGENCY FINANCIAL REPORT

areas with some college training now exceeds metro areas. Those bode well for rural America,

and we have seen poverty in nonmetro areas falling in 2015 to its lowest point since 2008.

A major component of USDA’s mission is to provide food assistance to America’s most

vulnerable citizens, including children. A September 2016 report by USDA’s Economic

Research Service shows that since President Obama took office, 7.9 million fewer people are

struggling to provide adequate food for themselves or household members. The report also

shows that in 2015, household food insecurity fell 1.3 percentage points from 2014 and

2.2 points from 2011—the peak of the recession. At the same time, very low food security has

dropped to 5 percent from a peak of 5.7 percent. The report showed the lowest figures on

record for food insecurity among children—a major achievement in our country’s efforts to

ensure every child has a safer, healthier future filled with unlimited opportunity.

In 2016, this Administration continued its strong support for the Supplemental Nutrition

Assistance Program (SNAP). SNAP kept at least 4.7 million people, including nearly

2.1 million children, out of poverty in 2014. During the 2014-2015 school year, over 97 percent

of schools successfully met the nutrition standards of the Healthy, Hunger-Free Kids Act by

serving meals with more whole grains, fruits, vegetables, lean protein, and low-fat dairy, and

less sodium and fat. In the first year of nationwide implementation of the Community

Eligibility Provision (CEP), we have also seen progress in reducing the administrative burden

on schools and improving program integrity while increasing the number of low-income

children certified for school meals. About 60 percent of eligible schools in nearly 3,000 school

districts are participating in CEP, reaching more than 8.5 million students.

Over 22 million students participate in free and reduced-price meals during the school year, but

only a fraction are participating in summer meals. Because hunger does not take a vacation

during the summer months when school meals are unavailable, we have expanded the Summer

EBT for Children demonstration pilots over the last 2 years. Rigorous evaluations of Summer

EBT pilots demonstrate how the program effectively reduces food insecurity and improves

nutrition. In tandem, we have expanded summer food programs—serving nearly 4 million

children in the summer of 2015.

Records were also set last year in terms of agricultural trade. In FY 2015, American

agricultural producers achieved $139.7 billion in exports, the third highest year on record and

up 45 percent from FY 2009. Agricultural exports totaled over $911 billion for the period

FY 2009 through FY 2015, the best 7-year stretch in history. The volume and value of

agricultural exports support more than one million American jobs both on and off the farm each

year, a significant part of the estimated 11.5 million jobs supported by exports all across the

country. Agricultural exports support farm income, which translates into more economic

MESSAGE FROM THE SECRETARY iii

activity in rural areas. Each dollar of agricultural exports is estimated to stimulate another

$1.27 in business activity.

USDA’s efforts knocked down trade barriers to U.S. exports in more than 18 countries,

reopening markets to U.S. agricultural exports. In 2015 alone, USDA resolved foreign access

market issues involving U.S. agricultural exports valued at $3.6 billion. In 2016, Saudi Arabian

and Peruvian markets reopened for U.S. beef; the South Korean market reopened for U.S.

poultry; and the South African market reopened for U.S. poultry, pork, and beef.

U.S. agricultural exports to Panama, Colombia, and South Korea grew by nearly 28 percent,

from $7.6 billion in FY 2012, when the trade agreements with those countries first went into

effect, to $9.7 billion in FY 2015, supporting approximately 73,000 American jobs. Following

years of USDA-led technical exchange, the United States and China signed an agreement in

2015 to expand market access for U.S. apples from just two varieties to all U.S.-grown

varieties. The Chinese apple market could be worth nearly $100 million per year to

U.S. producers. U.S. agricultural exports to all U.S. Free Trade Agreement partners grew from

$15.5 billion in 1994 to $57 billion in 2015, a nearly four-fold increase in 20 years.

Closer to home, USDA has established an in-country presence in Cuba to cultivate key

relationships, gain firsthand knowledge of the country’s agricultural challenges and

opportunities, and begin to explore fruitful information exchanges and research collaboration.

To strengthen our bond, USDA also will allow the 22 industry-funded Research and Promotion

Programs and 18 Marketing Order organizations to conduct authorized research and

information exchange activities in Cuba.

USDA has also made significant strides in expanding our domestic markets for agricultural

goods. The growing consumer interest in buying locally produced products has created major

new market opportunities for American farmers, ranchers, and food-related businesses while

opening the doors of USDA to new stakeholders. USDA resources to strengthen local and

regional food systems extend throughout the supply chain, starting with producers, including

new insurance offerings to help diversified operations better manage risk, right-sized loans for

farms of all sizes, financial support for season-extending tools like high tunnels, and innovative

programs to make food safety verification more affordable.

The value of local food sales has grown from $5 billion in 2008, and some industry sources

estimate that sales could hit $20 billion by 2019. Between 2009 and 2015, USDA invested over

$1 billion in more than 40,000 local and regional food businesses and infrastructure projects.

Today, more than 160,000 farmers and ranchers nationwide are tapping into growing consumer

demand by selling their products locally. USDA support has helped to nearly double the

number of food hubs since 2009; and there are now over 8,500 farmers markets nationwide,

an increase of almost 98 percent since 2006.

iv USDA FISCAL YEAR 2016 AGENCY FINANCIAL REPORT

USDA is also helping producers tap into the market for local and regional foods in schools,

which are now serving healthier breakfasts, lunches, and snacks. In the 2013-14 school year

alone, which is the most recent data available, school districts spent nearly $800 million on

locally and regionally sourced food.

Between 2008 and 2015, the number of farmers markets and direct marketing farmers that

accepted SNAP rose from about 750 to almost 6,500. Over $19 million in SNAP dollars was

spent at farmers markets in 2015, up from less than $3 million in 2008. This is a win-win for

both farmers and SNAP participants, and it shows how our investments are simultaneously

improving the health of low-income shoppers and bolstering the incomes of local farmers.

We have also taken significant steps to grow the emerging bioeconomy, which creates new

uses for agricultural products and is bringing manufacturing jobs back to rural America.

Environmentally, the increased use of biobased products currently displaces about 300 million

gallons of petroleum per year—equivalent to taking 200,000 cars off the road. Since 2009,

Rural Development has supported almost 400 biofuel producers with the production of

advanced biofuels through the Bioenergy for Advanced Biofuel Program. Further, the

Department has helped roughly 15,000 rural small businesses, farmers, and ranchers improve

their bottom lines by installing renewable energy systems and energy efficiency solutions.

This focus on renewable energy has resulted in support for the construction of six advanced

biofuels production facilities, over 4,000 wind and solar renewable electricity generation

facilities, and more than 100 anaerobic digesters to help farm operations capture methane to

produce electricity.

In 2015, we made available $100 million in grants under the Biofuel Infrastructure Partnership

(BIP), estimated to nearly double the number of fueling pumps nationwide that supply

renewable fuels, such as E15 and E85, to American motorists. As of 2016, 21 states are

participating in the BIP, with matching funds from state and private partners, providing

$210 million to build nearly 5,000 pumps at over 1,400 fueling stations to strengthen the rural

economy and increase the demand for agricultural commodities used in the production of

biofuels. We are also proud of our effort to partner with the U.S. Department of Energy (DOE)

and the U.S. Department of the Navy to create advanced drop-in biofuels that will power both

the U.S. Department of Defense and private-sector transportation throughout America—which

to date has led to the procurement of 77.7 million gallons of blended drop in biofuel—and with

the Federal Aviation Administration, DOE, and the commercial aviation sector to sustainably

increase the production and use of alternative jet fuel.

Under this Administration, we have added 70 new categories of qualified biobased products to

our catalog for Federal procurement, which includes over 14,000 products. Currently, more

than 2,700 products have received certification to display the USDA Certified Biobased

MESSAGE FROM THE SECRETARY v

Product label, creating and increasing consumer and commercial awareness about a material’s

biobased (new carbon) content as one measure of its environmental footprint. We awarded

funds through the Forest Service’s Wood Innovations Grants Program and the U.S. Tall Wood

Building Prize Competition to support pioneering demonstration projects, business planning,

and research that can advance new markets for mass timber construction that can support the

health and resilience of our forests and our forested communities alike.

Another way that USDA is strengthening the rural economy is by expanding natural resources

conservation. During this Administration, we have enrolled a record number of private working

lands in conservation programs and implemented strategies to restore our forests and clean our

water supply. This has also created significant economic opportunities in the forms of

recreation and improved resilience to withstand major weather events.

A new model for conservation investment established by the 2014 Farm Bill for the Regional

Conservation Partnership Program (RCPP) has allowed USDA to leverage $800 million to

support 115 high-impact conservation projects across the Nation that will improve the nation’s

water quality, support wildlife habitat, and enhance the environment. In addition to RCPP,

NRCS addresses water quality conservation concerns through other landscape-scale water

quality conservation initiatives, such as the Great Lakes Restoration Initiative (GLRI). From

2009-2015, over $22 million in GLRI funds were used to install conservation practices on

103,000 acres in the Western Lake Erie Basin.

USDA is experiencing record demand from producers interested in participating in the

Conservation Reserve Program (CRP), which improves water quality, prevents soil erosion,

and strengthens wildlife habitat. The recent general and CRP Grassland sign-ups were the most

selective enrollment periods in CRP’s 30-year history with a record high Environmental

Benefits Index cut-off, ensuring that conservation benefits are being maximized. USDA

accepted 101,000 acres in the first-ever CRP Grasslands enrollment, providing participants

with financial assistance for establishing approved grasses, trees and shrubs on pasture and

rangeland that can continue to be grazed. More than 70 percent of these acres are diverse native

grasslands under threat of conversion, and more than 97 percent of the acres have a new,

military veteran, or underserved farmer or rancher as a primary producer.

Using the authorities provided in the 2014 Farm Bill, we have developed “The Building Blocks

for Climate Smart Agriculture and Forestry” strategy to reduce net emissions and enhance

carbon sequestration by over 120 million metric tons of CO2 equivalent (MMTCO2e) per year

by 2025, while also boosting productivity and resilience in the face of a changing climate.

Conservation programs on private working lands have reduced net greenhouse gas emissions

by over 360 million metric tons since 2009, and through this initiative we will give producers

the tools and resources to continue their global leadership in meeting our climate and food

vi USDA FISCAL YEAR 2016 AGENCY FINANCIAL REPORT

security challenges moving forward. Since the announcement of these building blocks, USDA

and its partners have taken actions to reduce Greenhouse Gas (GHG) emissions and increase

carbon sequestration from agriculture, forests, and rural areas.

Finally, any discussion of conservation and adapting to a changing climate would be

incomplete without USDA’s expressing the need to fix fire budget funding. The frequency and

intensity of wildfire is increasing while the cost of controlling the spread of wildfire is rising,

and the way we pay for fire suppression constrains the agency’s capacity to realize additional

gains through efficiencies and partnerships alone. Planned wildland firefighting (suppression)

activities are currently funded entirely within the U.S. Forest Service budget based on a 10-year

rolling average. Today, the agency spends over half of its budget on fire management activities

and has seen a corresponding 39-percent decline in non-fire staffing since 1998. Left

unchecked, two out of every three dollars appropriated to the Forest Service will be spent on

fire programs in the next 10 years. In addition to the rising costs of fire, when appropriated

resources fall short, as they did in 2015 by $700 million dollars, the Forest Service is forced to

transfer funds from non-fire programs to cover the costs of suppression. These mid to late

season transfers stop projects, cause uncertainty and instability in planning, and impact the

agency’s ability to implement projects. Congress must provide a comprehensive solution that

will address both the growth of fire programs as a percent of the agency’s budget and the

compounding problem of fire transfers.

To create a strong resilient farm economy built around trade, the bioeconomy, local and

regional food systems, and conservation, it was clear that we must have basic investments to set

the stage for growth. To accomplish this, we have made historic investments in rural

communities, making them more attractive to non-farm businesses and talented hard-working

individuals looking for opportunities. In FY 2015 alone, we helped 141,000 rural Americans

become homeowners.

USDA also supports innovation to keep U.S. agriculture competitive. Long-term agricultural

productivity growth relies on innovation through research funded by both the public and private

sectors. Innovations in animal/crop genetics, chemicals, equipment, and farm organization all

result in American farmers producing more with less. I am proud that during my service as

Secretary, we have increased investments in peer-reviewed competitive grants through the

Agriculture and Food Research Initiative (AFRI) from $201.5 million in FY 2009 to

$350 million in FY 2016, while still achieving growth in formula funding to our partner

institutions of higher education.

However, over the past 2 years, the combination of a strengthening dollar and relatively high

global production leading to lower prices for commodities has resulted in large drops in 2015

and 2016 net farm income, relative to the 2011 through 2014 period. USDA expects real net

MESSAGE FROM THE SECRETARY vii

farm income this year to be the lowest since 2009. Demand for farm loans has been increasing,

driven in part by the need to cover operating expenses as commodity prices have fallen more

quickly than costs. As a result, the debt-to-asset ratio for U.S. producers has increased over the

past 2 years, but in aggregate is still near historic lows. While the data suggest that net farm

income remains relatively high by historical standards—for example, the 5-year average of net

farm income since 2014 has ranged between $85 billion (for 2012–2016) to $96 billion (for

2010–2014), the highest levels since the mid-1970’s—and that most farms have a strong

balance sheet and delinquency rates remain lower than the 2005 to 2014 average, it is clear that

financial stress is increasing and that some producers are more exposed to financial risk.

The current conditions are leading to increased uncertainty and concern in rural America, but

the current farm safety net that was created during the last Farm Bill is providing support for

producers. In 2015, government farm program payments totaled about $10.8 billion and are

expected to increase to nearly $13.8 billion in 2016. In addition the crop insurance program

offset more than $6 billion in farm losses in 2015 and is expected to cover more than $9 billion

in 2016.

Last year, USDA enrolled 1.76 million farmers in the new Agriculture Risk Coverage (ARC)

and Price Loss Coverage (PLC) programs by conducting an unprecedented education

campaign. ARC and PLC are a part of the farm-safety net, providing assistance only when

there are year-to-year crop revenue or commodity price downturns. ARC and PLC will provide

more than $7 billion to farmers this year, roughly 10 percent of net farm income as projected by

USDA. In addition, more than half of all dairy farms in the U.S.—over 23,000—have enrolled

in the Margin Protection Program for Dairy (MPP-Dairy). This voluntary program provides

financial assistance to participating farmers when the margin—the difference between the price

of milk and feed costs—falls below the coverage level selected by the producer. In 2015, over

$11 million in payments were made to over 4,600 dairy operations for the May/June payment

period. This is the largest payment for any 2-month period since MPP-Dairy was enacted in

2014.

The 2014 Farm Bill indefinitely extended the Farm Service Agency’s livestock disaster

programs and the Tree Assistance Program. Since the passage of the Farm Bill, these programs

have paid producers over $6 billion dollars to recover from natural disasters, including drought

and wildfires.

USDA has continued to strengthen crop insurance to ensure the program works for all farmers

and ranchers. The Risk Management Agency (RMA) has expanded access to crop insurance

options for organic and specialty crop producers through new and innovative programs,

including the Whole-Farm Revenue Protection policy, and coverage options that allow organic

farmers to protect their products at the market value. The number of crops eligible for organic

viii USDA FISCAL YEAR 2016 AGENCY FINANCIAL REPORT

premium pricing went from four in 2011 to 57 for the 2016 crop year. The number of acres

insured by organic producers grew from 576,700 in 2009 to 1.1 million in 2016. The new

Whole-Farm Revenue plan is being offered in all counties in the United States in 2016. In

addition, RMA has worked to ensure that new crop insurance programs from the 2014 Farm

Bill are available for as many crops as possible. The Supplemental Coverage Option (SCO) is

now available for 58 crops, and the Actual Production History Yield Exclusion is available for

50 crops. The Stacked Income Protection Plan for Producers of Upland Cotton (STAX) is

currently available for every county that has a crop insurance policy for cotton. Peanut Revenue

Protection is available in every county with peanut coverage, and Margin Protection Insurance

is available for wheat, corn, rice, and soybeans in select counties. Finally, the new and

beginning farmers and ranchers incentives authorized in the 2014 Farm Bill make crop

insurance more affordable for beginning farmers and ranchers by providing a 10-percent

premium discount, on top of the premium subsidy all producers receive, as well as a waiver of

the catastrophic and additional coverage of administrative fees. Over 13,500 producers have

taken advantage of these incentives and saved around $14.5 million annually in premiums and

administrative fees because of the incentives.

USDA worked with crop insurance companies to educate farmers and ranchers about the new

conservation compliance requirements in the 2014 Farm Bill, and as a result, over 98 percent of

Federal crop insurance participants provided the documentation necessary to comply with those

requirements and maintain their benefits.

Access to credit remains a critical issue for producers, in particular for small and beginning

farmers and ranchers. Since 2009, USDA has provided approximately 276,000 loans totaling

over $39.5 billion to farmers and ranchers. In 2016 alone, FSA has made over 28,000 direct

loans and nearly 10,000 guaranteed loans for a record loan volume of nearly $6.2 billion.

While the Farm Bill has resulted in a strong safety net for producers, the Department has also

utilized other existing authorities to provide assistance to producers when possible. We have

used the Commodity Credit Corporation’s (CCC’s) statutory authority to implement the Cotton

Ginning Cost-Share (CGCS) program, which is providing needed assistance to financially

stressed cotton producers. Through the CGCS program, eligible producers receive a one-time

cost share payment to expand and maintain the domestic marketing of cotton. The program has

provided about $328 million to assist cotton producers. We approved more than $320 million in

section 32 purchases that have the dual benefits of helping producers and providing nutritious

foods to those in need, including a $20 million cheese buy to assist the dairy industry.

The Department’s management team continues to oversee USDA’s assessment of internal

control over its programs, operations, financial systems, and financial reporting. The

Department’s work is consistent with the provisions of the Federal Managers’ Financial

MESSAGE FROM THE SECRETARY ix

Integrity Act (FMFIA) and the Federal Financial Management Improvement Act (FFMIA).

USDA’s continuous monitoring and remediation efforts allow us to provide taxpayers with

reasonable assurance that this report is based on sound, accurate data.

Despite USDA's many successes, continued improvement is needed to remediate the

Department existing material weakness and financial system noncompliance. To accomplish

this goal, management continues to implement corrective action plan activities. Therefore, I

provide a modified statement of assurance that, except for the areas in need of improvement as

described in the Management Assurances section of this report, USDA’s internal control over

operations, financial systems, and financial reporting meets the objectives of FMFIA and

FFMIA. The financial and performance information presented herein is complete and accurate,

and is in accordance with law and Office of Management and Budget guidance.

USDA is often referred to as “the People’s Department,” and this past year the men and women

who are employed here have delivered record service that has impacted every single American

in some way. While my time as Secretary is coming to a close, I am confident that all

Americans, especially those in rural communities, will continue to see results from this

dedicated team for years to come.

Thomas J. Vilsack

Secretary of Agriculture

December 5, 2016

SECTION I MANAGEMENT’S DISCUSSION AND ANALYSIS 1

Section I

Management’s Discussion

and Analysis

About USDA

President Abraham Lincoln founded the U.S. Department of Agriculture (USDA) in 1862 with

the goal of providing effective leadership to the Nation on food, agriculture, natural resources,

and related issues. Since 1862, the dedicated public servants at USDA help millions of

Americans every day. As Americans, you are part of the USDA story that has had a tradition of

excellence in public service for over 150 years.

We would like you to learn more about USDA and the Agencies and Offices that touch every

American, every day. More information about the Department, our history, and our leaders can

be found at www.usda.gov.

Mission Statement

We provide leadership on food, agriculture, natural resources, rural development, nutrition, and

related issues based on sound public policy, the best available science, and efficient

management.

Vision Statement

To expand economic opportunity through innovation, helping rural America to thrive; to

promote agriculture production sustainability that better nourishes Americans while also

helping feed others throughout the world; and to preserve and conserve our Nation’s natural

resources through restored forests, improved watersheds, and healthy private working lands.

2 USDA FISCAL YEAR 2016 AGENCY FINANCIAL REPORT

Core Values

Our success depends on the following:

• Transparency—Making the Department’s management processes more open so that the

public can learn how USDA supports Americans every day.

• Participation—Providing opportunities for USDA constituents to shape and improve

services provided by the Department.

• Collaboration—Working cooperatively at all governmental levels domestically and

internationally on policy matters affecting a broad audience.

• Accountability—Ensuring that the performance of all employees is measured against the

achievement of the Department’s strategic goals.

• Customer Focus—Serving USDA’s constituents by delivering programs that address

their diverse needs.

• Professionalism—Building and maintaining a highly skilled, diverse, and compassionate

workforce.

• Results Oriented—Measuring performance and making management decisions in order

to direct resources to where they are used most effectively.

SECTION I MANAGEMENT’S DISCUSSION AND ANALYSIS 3

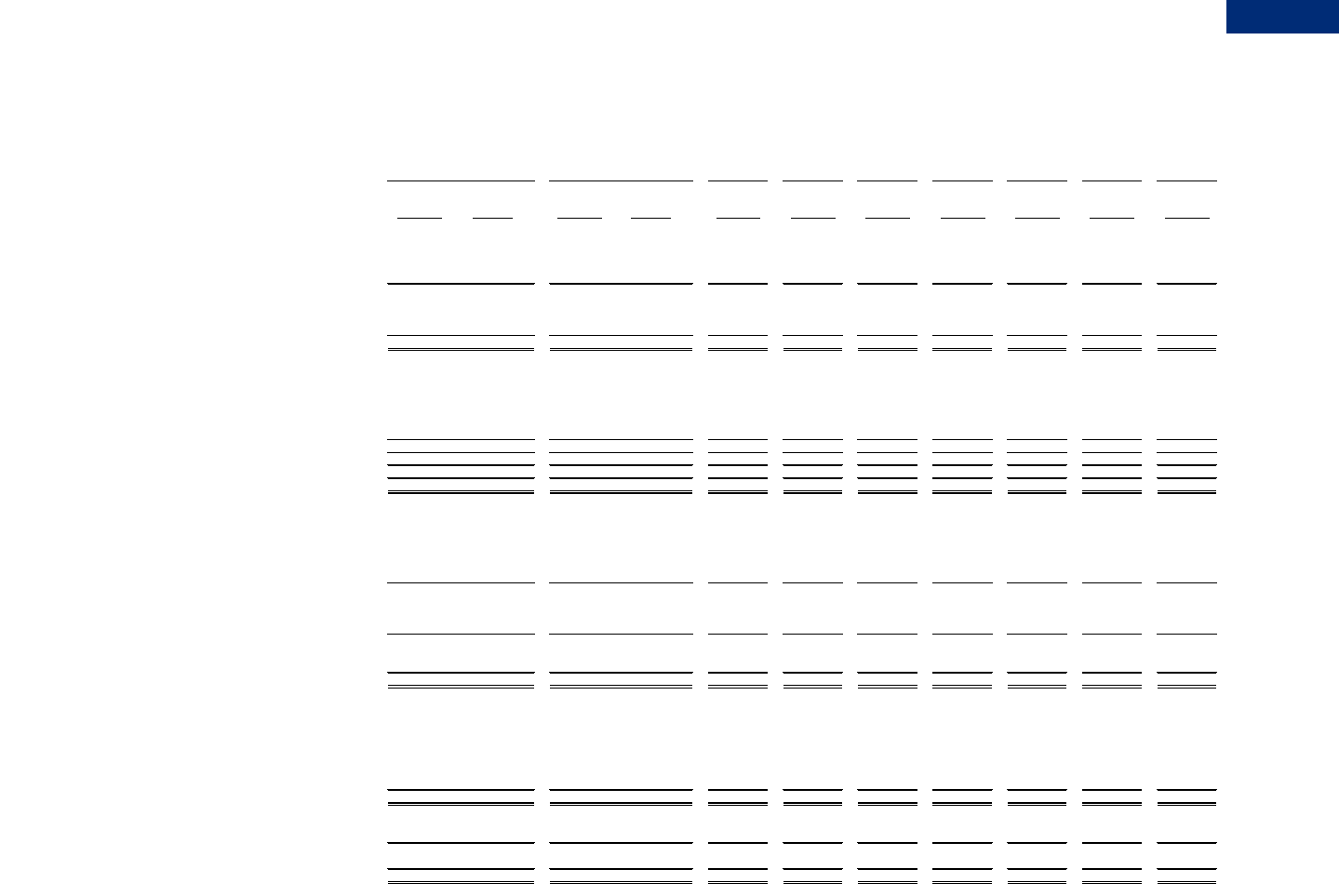

USDA Organization Chart

Level 1:

Secretary

Level 2:

Deputy Secretary

Level 3:

Chief

Economist

Director,

National

Appeals

Division

Office of Small

and

Disadvantaged

Business

Utilization

Director of

Communications

Inspector

General

Office of

Tr

ibal

Relations

Gene

ral

Counsel

Office

of the

Chief

Financial

Officer

Office of

Budget

and

Program

Analysis

Assistant

Secretary for

Congressional

Relation

s

Assistant

Secretary for

Administration

Assistant

Secretary for

Civil Rights

Sub-level 3, under the Assistant Secretary for Administration:

Chief

Information

Officer

Level 4

Under Secretary for

Natural Resources and

Environment

• Forest Service

• Natural Resources

Conservation S

ervice

Under Secretary for

Farm and Foreign

Agricultural Services

• Fa

rm Service Agency

• Foreign Agricultural

Service

• Risk Ma

nagement

Agency

Under Secretary for

Rural Development

• Rural Utilities

Service

• Rural Housing Service

• Rural Busi

ness

Cooperative Service

Under Secretary for

Food, Nutrition, and

Consumer Serv

ices

• Food and Nutrition

Service

• Center for Nutrition

Policy an

d Promotion

Under Secretary for

Food Safety

• Food Safety and

Inspection Servi

ce

Under Secretary for

R

esearch, Education, and

Economics

• Agricul

tural Research

Service

• National Institute of

Foo

d and Agriculture

• Economic Research

Service

• National Agricultural

Statistics Service

Under Secretary for

Marketing and

Regulatory Programs

• Agricult

ural

Marketing Service

• Animal and Plant

Health Ins

pection

Service

• Grain Inspection

Packers and

Stockyards

Administration

4 USDA FISCAL YEAR 2016 AGENCY FINANCIAL REPORT

USDA Mission Areas

The U.S. Department of Agriculture’s (USDA) work is organized by mission areas, which are

collections of agencies that work together to achieve USDA’s strategic goals. A brief

description of USDA’s seven mission areas follows and may be found at: USDA Mission

Areas.

Farm and Foreign Agricultural Services (FFAS)

Farm and Foreign Agricultural Services helps to keep America’s farmers and ranchers in

business as they face the uncertainties of weather and markets. FFAS delivers commodity,

credit, conservation, disaster, and emergency assistance programs that help improve the

stability and strength of the agricultural economy. The agencies under FFAS are as follows:

• Farm Service Agency (FSA)

o Commodity Credit Corporation (CCC)

• Foreign Agricultural Service (FAS)

• Risk Management Agency (RMA)

o Federal Crop Insurance Corporation (FCIC)

Food, Nutrition and Consumer Services (FNCS)

Food, Nutrition and Consumer Services works to harness the Nation’s agricultural abundance

to end hunger and improve health in the United States. It administers Federal domestic nutrition

assistance programs. The Center for Nutrition Policy and Promotion, which links scientific

research to the nutritional needs of consumers through science-based dietary guidance, nutrition

policy coordination, and nutrition education.

• Center for Nutrition Policy and Promotion (CNPP)

• Food and Nutrition Service (FNS)

Food Safety

The Office of Food Safety ensures that the Nation’s commercial supply of meat, poultry, and

egg products is safe, wholesome, and properly labeled and packaged. This mission area also

plays a key role in the President’s Council on Food Safety and has been instrumental in

S ECTION I MANAGEMENT’S DISCUSSION AND ANALYSIS 5

coordinating a national food safety strategic plan among various partner agencies including the

Department of Health and Human Services and the Environmental Protection Agency.

• Food Safety and Inspection Service (FSIS)

Marketing and Regulatory Programs (MRP)

Marketing and Regulatory Programs facilitates domestic and international marketing of

U.S. agricultural products and ensures the health and care of animals and plants. MRP agencies

are active participants in setting national and international standards, and include as follows:

• Agricultural Marketing Service (AMS)

• Animal and Plant Health Inspection Service (APHIS)

• Grain Inspection, Packers, and Stockyards Administration (GIPSA)

Natural Resources and Environment (NRE)

Natural Resources and Environment ensures the health of the land through sustainable

management. Its agencies work to prevent damage to natural resources and the environment,

restore the resource base, and promote good land management.

• Forest Service (FS)

• Natural Resources Conservation Service (NRCS)

Research, Education, and Economics (REE)

Research, Education, and Economics is dedicated to the creation of a safe, sustainable,

competitive U.S. food and fiber system, as well as strong communities, families, and youth

through integrated research, analysis, and education. These agencies include as follows:

• Agricultural Research Service (ARS)

• Economic Research Service (ERS)

• National Agricultural Statistics Service (NASS)

• National Institute of Food and Agriculture (NIFA)

• National Agricultural Library (NAL)

6 USDA FISCAL YEAR 2016 AGENCY FINANCIAL REPORT

Rural Development (RD)

Rural Development is committed to helping improve the economy and quality of life in all of

rural America by providing financial programs to support essential public facilities and services

such as water and sewer systems, housing, health clinics, emergency service facilities, and

electric and telephone service. Rural Development promotes economic development by

providing loans to businesses through banks and community-managed lending pools, while also

assisting communities to participate in community empowerment programs.

• Rural Housing Service

• Rural Utilities Service

• Rural Business Cooperative Service

S ECTION I MANAGEMENT’S DISCUSSION AND ANALYSIS 7

Strategic Plan and Program Performance

USDA Performance, Goals, and Results FY 2016

The U.S. Department of Agriculture’s (USDA) mission is to provide leadership on food,

agriculture, natural resources, rural development, nutrition, and related issues based on sound

public policy, the best available science, and efficient management. Through implementing our

mission, the Department aspires to achieve five strategic goals as reflected in USDA’s

2014–2018 Strategic Plan:

• Assist rural communities to create prosperity so they are self-sustaining, re-populating,

and economically thriving;

• Ensure our national forests and private working lands are conserved, restored, and made

more resilient to climate change, while enhancing our water resources;

• Help America promote agricultural production and biotechnology exports as America

works to increase food security;

• Ensure that all of America’s children have access to safe, nutritious, and balanced meals;

and

• Create a USDA for the 21st century that is high-performing, efficient, and adaptable.

USDA has also established five Agency Priority Goals (APGs) for fiscal years (FY) 2016 and

2017 that identify near-term goals to help USDA progress toward meeting our longer term

strategic goals and objectives. USDA’s APGs are as follows:

• Access and Opportunity for Beginning Farmers and Ranchers;

• Soil Health and Sustainability;

• Increasing assistance for rural, persistent poverty communities;

• Pollinator Habitat Health; and

• Increased food security and diet quality.

More information and reports on the APGs and quarterly progress can be found at

https://www.performance.gov/agency/department-agriculture?view=public#apg.

For purposes of the AFR, a performance summary is provided using the Department’s key

performance indicators as a mechanism to gauge progress in achieving priorities, goals, and

8 USD A F I SC AL Y E AR 2 0 1 6 AGENC Y F INANC I AL R EPORT

strategic objectives. In FY 2016, USDA had 38 key performance indicators, as reflected in the

Department’s FY 2016 Annual Performance Plan

(https://www.obpa.usda.gov/budsum/fy16budsum.pdf).

The following tables and discussion provide a high-level description of key focus areas for the

Department that are being tracked and managed through USDA’s performance management

process, in alignment with the Department’s strategic goals and objectives. The tables provide

key performance indicator historical results, and includes FY2016 preliminary results

indicating anticipation in meeting/not meeting performance targets.

Final performance information and a detailed discussion of results for the Department’s

FY 2016 performance goals, assessment methodologies, metrics, external reviews, and

documentation of performance data will be presented in the FY 2016 USDA Annual

Performance Report. The report is planned to be released with the President’s 2018 budget in

February and will be available on the USDA Performance Improvement and Accountability

website.

The data used by the Department to measure performance is collected using standardized

methodology. This methodology has been vetted by federally employed scientists and

policymakers, and, ultimately, the leadership and Under Secretaries of each respective mission

area. All attest to the completeness, reliability, and quality of the data.

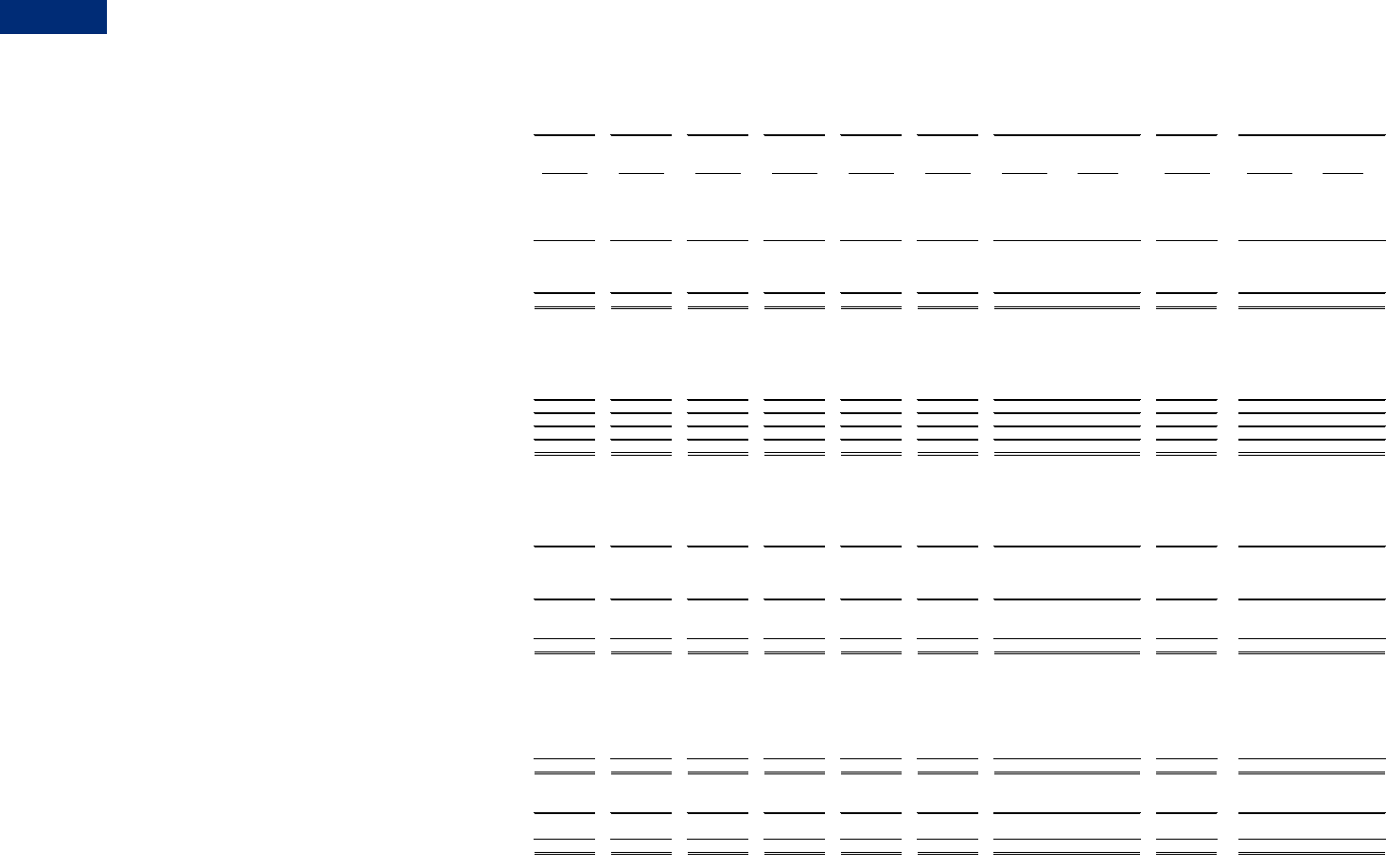

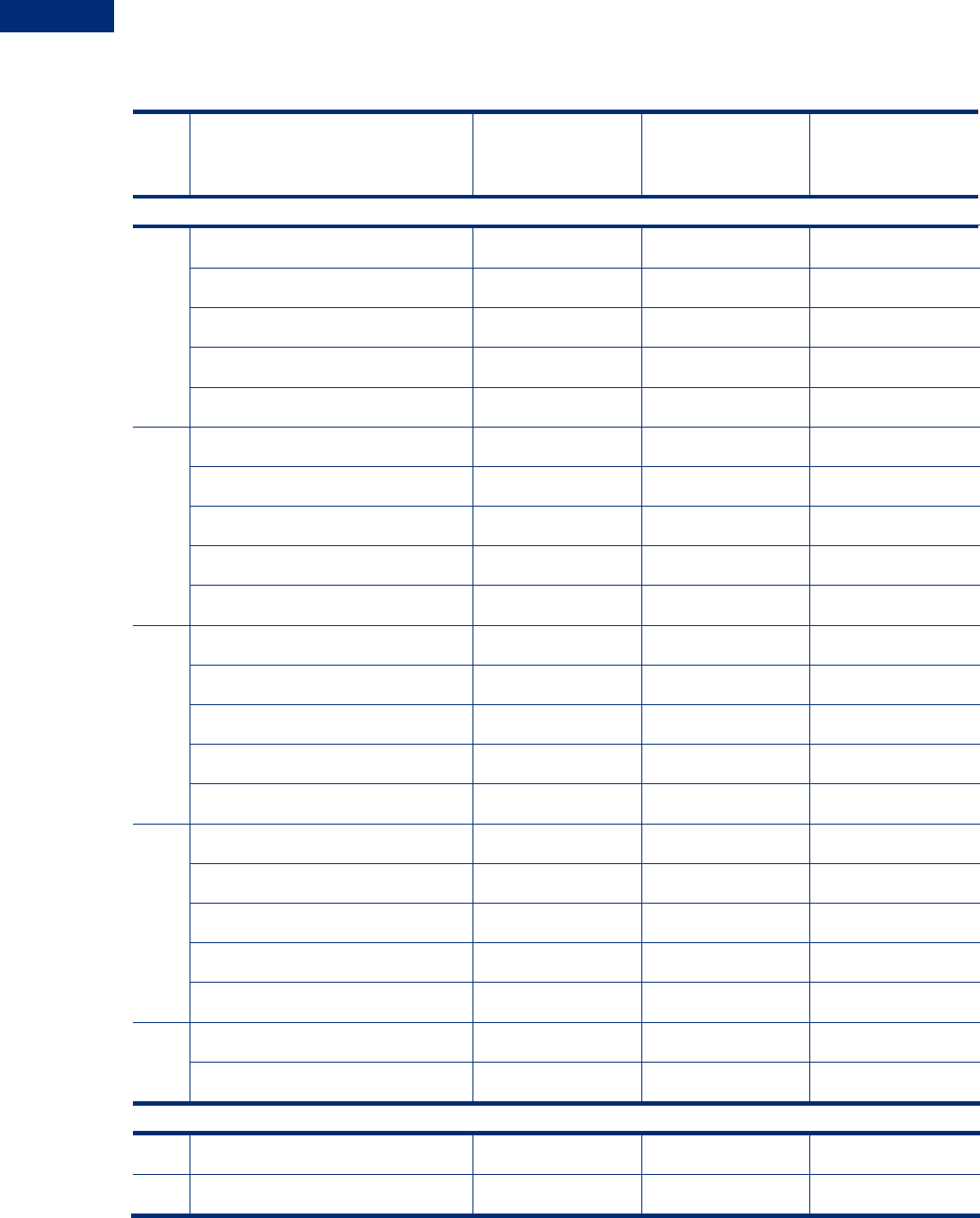

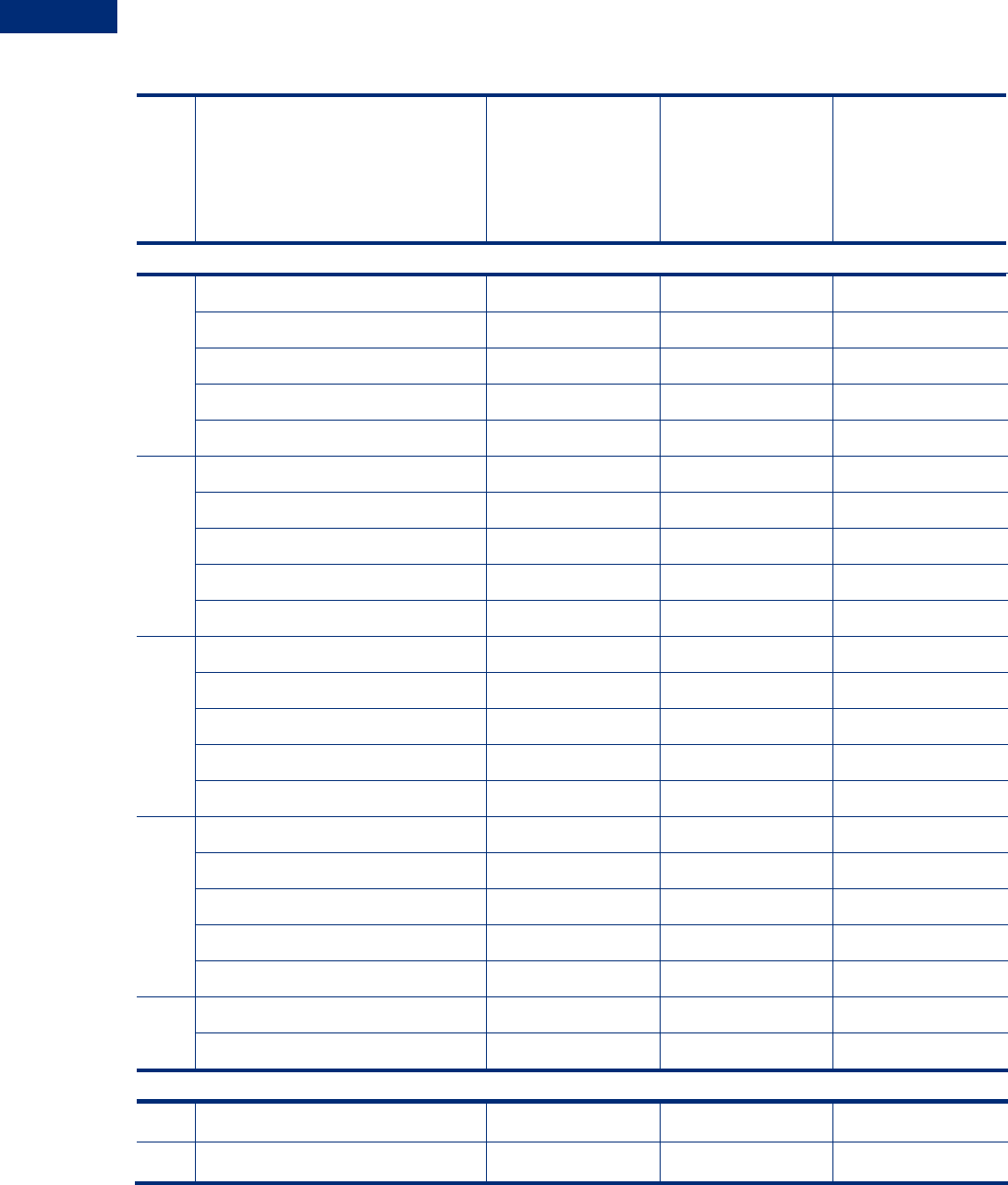

S ECTION I MANAGEMENT’S DISCUSSION AND ANALYSIS 9

GOAL #1: RURAL PROSPERITY

A vibrant American economy depends on a prosperous rural America. Our four primary pillars

of economic opportunity in agriculture are: 1) exports, 2) local food systems, 3) conservation

and outdoor recreation, and 4) enhancing the bio-based economy. USDA is making an impact

on persistent poverty, out-migration, and rural income through increases in the number of

homeownership opportunities provided in rural communities and the percentage of direct and

guaranteed lending to beginning farmers.

Exhibit 1: USDA Strategic Plan Goal #1 – Rural Prosperity Key Performance Indicators

Fiscal Year

2012

Actual

2013

Actual

2014

Actual

2015

Actual

2016

Target

2016

Preliminary

Number of jobs created

or saved through USDA

financing of businesses

52,468 44,419 41,202 52,697 40,877 Met

Homeownership

opportunities provided

153,027 170,055 146,388 141,314 173,150 Unmet

1

Health Facilities:

Percentage of customers

who are provided access

to new and/or improved

essential community

facilities

7.3% 5.4% 6.8% 12.0% 4.5% Met

1

Direct Program obligations exceeded FY 2016 early year expectations. In response to strong

program demand, the agency utilized the Secretary’s 7-percent interchange authority to

increase program funding and provide homeownership opportunities for an additional 430 low-

and very low- income rural borrowers. Guaranteed program obligations fell short of projections

due to multiple market and program factors including: continuing weakness in the refinance

market; lenders’ adjustment to new Truth in Lending Act and Real Estate Settlement

Procedures Act Integrated Disclosure (TRID) rules; the reduction in program-eligible areas

caused by the recent Farm Bill adjustment to the rural definition population limit; and most

importantly, limited inventory in the lower-priced end of the housing market. As a result of the

Guaranteed program shortfall, Rural Development did not provide 129,862 new single family

housing homeownership opportunities, which was the lower bound of its target range, and

therefore, did not meet target expectations. The program is projecting demand to increase in

FY 2017, with the introduction of lower origination fees, a new construction loan product, and

increased outreach to underserved areas.

10 USDA FISCAL YEAR 2016 AGENCY FINANCIAL REPORT

Fiscal Year

2012

Actual

2013

Actual

2014

Actual

2015

Actual

2016

Target

2016

Preliminary

Safety Facilities:

Percentage of customers

who are provided access

to new and/or improved

essential community

facilities

3.7% 3.4% 3.7% 7.2% 2.7% Met

Educational Facilities:

Percentage of customers

who are provided access

to new and/or improved

essential community

facilities

6.4% 9.3% 6.2% 7.9% 4.5% Met

Number of

borrowers/subscribers

receiving new and/or

improved electric

facilities (millions)

8.3 8.7 4.6 5.5 5.1 Met

Number of

borrowers/subscribers

receiving new or

improved

telecommunications

services (millions)

.06 .12 .084 .095 .120 Unmet

2

Number of population

receiving new or

improved service from

agency funded water

facilities (millions)

2.5 1.8 2.2 2.4 2.2 Met

2

In March 2016, The Federal Communications Commission released a Report and Order, Order

and Order on Reconsideration, and Further Notice of Proposed Rulemaking, reforming the

universal service program for rate-of-return carriers. The order made a number of changes to

the mechanisms that provide substantial revenue to rate-of-return carriers. All existing loan

applications had to be held until applicants provided information that took into consideration

the impact of the Order on the feasibility of the loan request. This added about 2 to 3 months

to the loan processing time, thereby having to carry over some loans to complete in FY 2017.

Of the 22 loans processed, 8 applications were not feasible thereby reducing the number of

new subscribers. Loan demand is trending higher, however since as many as 15 applications

were received towards the end of the fiscal year the processing will be completed in FY 2017

and if approved the associated subscribers will be counted in FY 2017.

S ECTION I MANAGEMENT’S DISCUSSION AND ANALYSIS 11

Fiscal Year

2012

Actual

2013

Actual

2014

Actual

2015

Actual

2016

Target

2016

Preliminary

Value of agricultural

exports resulting from

participation in foreign

food and agricultural

trade shows ($ In Billions)

$1.46 $1.48 $1.50 $1.52

3

$1.55 Met

Percentage of Direct and

Guaranteed lending to

Socially Disadvantaged

Farmers (SDA)

13.30% 13.60% 14.20% 15.00% 14.00% Met

Percentage of Direct and

Guaranteed lending to

Beginning Farmers (BF)

68.80% 70% 79.2% 85.6% 76.5% Met

Normalized value of risk

protection provided to

agricultural producers

through the Federal Crop

Insurance Program

($ In Billions)

$62.10 $66.00 $67.90 $68.7 $63.3 Met

Value of trade preserved

annually through USDA

staff intervention leading

to resolution of foreign

market access issues such

as U.S. export

detainment, restrictive

Sanitary/ Phytosanitary or

Technical Barrier to Trade

issues and trade

regulations ($ In Billions)

$3.70 $3.80 $6.40 $3.6 $4.1 Met

3

The 2015 actual result shown on the FY 2015 Agency Financial Report was reported

incorrectly, this report reflects the corrected 2015 actual results.

12 USDA FISCAL YEAR 2016 AGENCY FINANCIAL REPORT

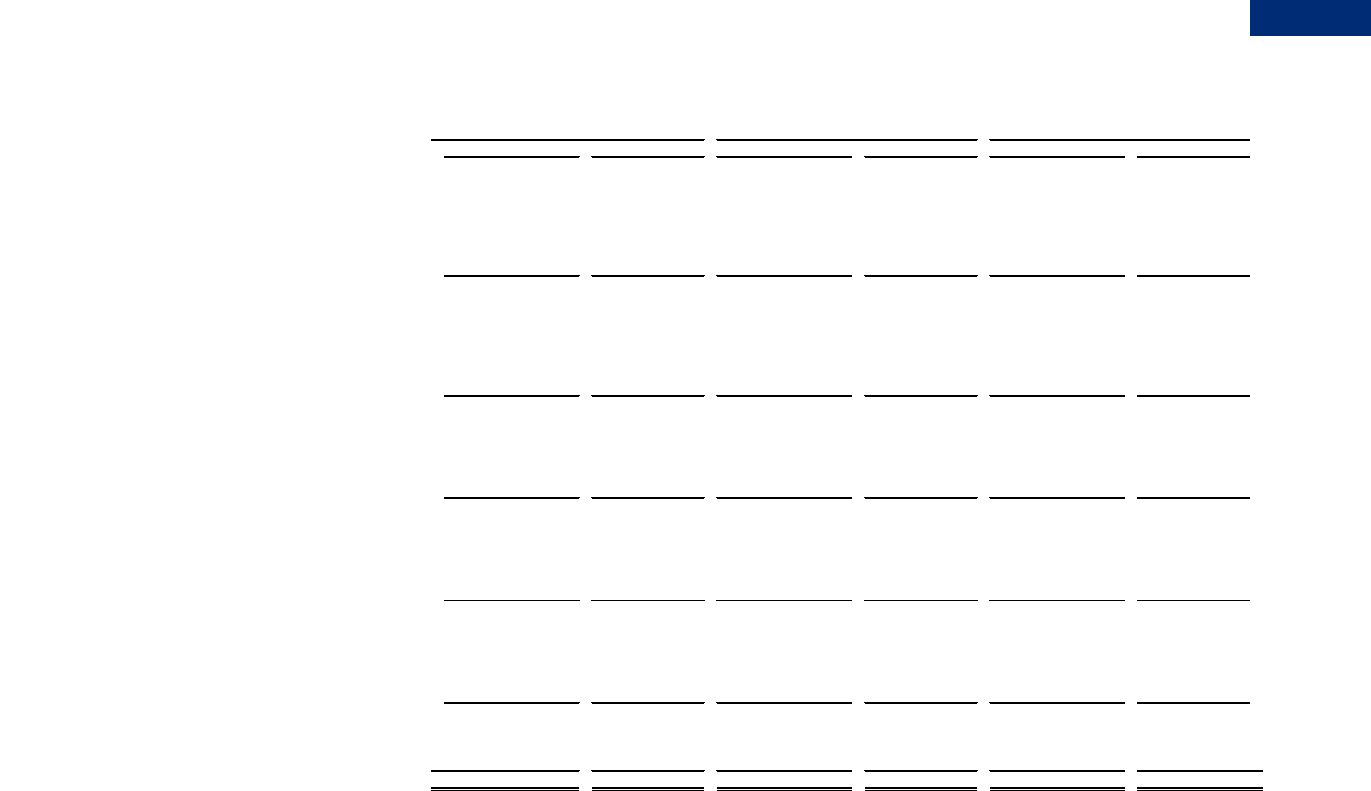

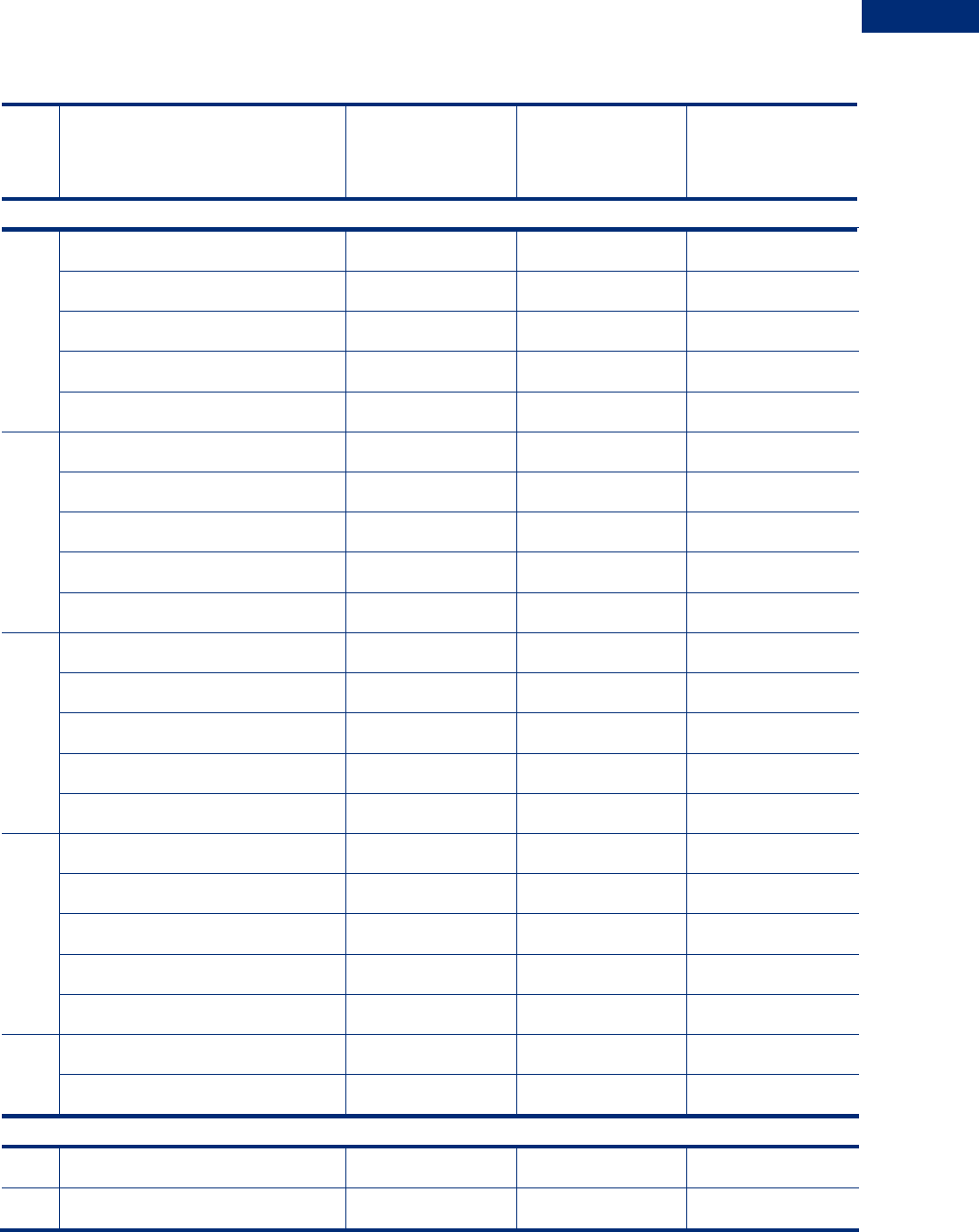

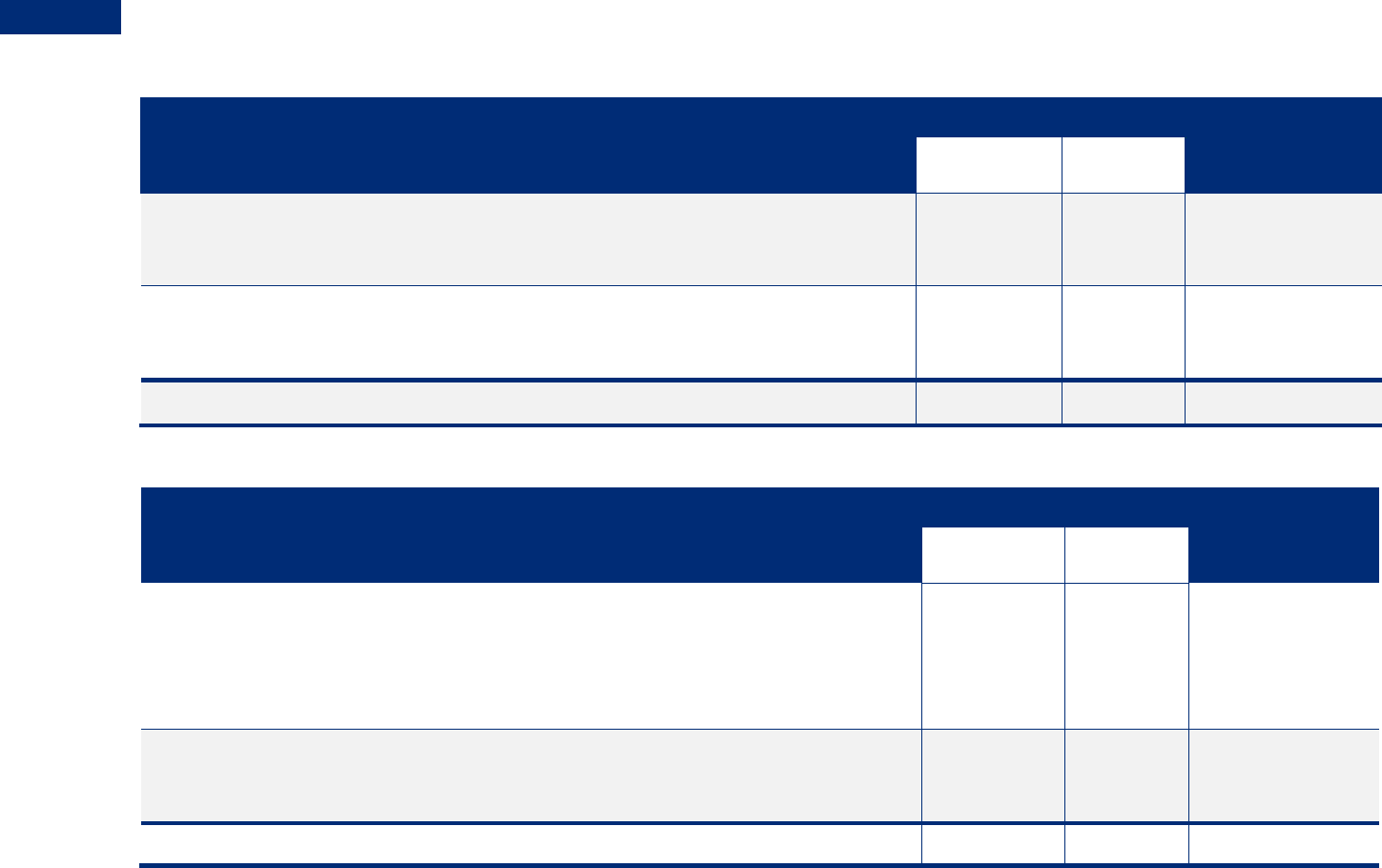

GOAL #2: RESOURCE CONSERVATION, RESTORATION, AND RESILIENCY

A healthy and prosperous America relies on the health of our natural resources, and particularly

our forests and agricultural working lands. Forests and other lands absorb approximately

14 percent of U.S. carbon dioxide emissions. To help improve the health of our natural

resources, USDA has worked to increase the annual acres of public and private forest lands

which are being restored or enhanced and to increase the percentage of national forests and

grasslands in compliance with a climate change adaption and mitigation strategy.

Exhibit 2: USDA Strategic Plan Goal #2 – Resource Conservations, Restoration, and Resiliency

Key Performance Indicators

Fiscal Year

2012

Actual

2013

Actual

2014

Actual

2015

Actual

2016

Target

2016

Preliminary

Conservation Reserve Program

(CRP) restored wetland acreage

(millions of acres)

2.29 2.09 2.00 1.93 1.9 Met

Conservation Technical

Assistance (CTA) land with

conservation applied to

improve water quality (millions

of acres)

N/A N/A 18.2 18.1 17.9 Unmet

4

CTA cropland with conservation

applied to improve soil quality

(millions of acres)

N/A N/A 6.2 6.0 5.9 Met

CTA grazing and forest land

with conservation applied to

protect and improve the

resource base (millions of

acres)

N/A N/A 13.1 13.1 13.0 Unmet

5

4

The minor shortfall was due primarily to the fact that new hiring has only recently caught up

with attrition. New hires take some time to be productive. Only in FY2016 did hiring finally

exceed attrition.

5

The minor shortfall was due primarily to the fact that new hiring has only recently caught up

with attrition. New hires take some time to be productive. Only in FY2016 did hiring finally

exceed attrition.

S ECTION I MANAGEMENT’S DISCUSSION AND ANALYSIS 13

Fiscal Year

2012

Actual

2013

Actual

2014

Actual

2015

Actual

2016

Target

2016

Preliminary

Environmental Quality

Incentives Program (EQIP) land

with conservation applied to

improve water quality (millions

of acres)

N/A N/A 12.3 12.7 12.0 Unmet

6

EQIP cropland with

conservation applied to

improve soil quality (millions of

acres)

N/A N/A 3.1 3.0 3.0 Met

EQIP grazing land and forest

land with conservation applied

to protect and improve the

resource base (millions of

acres)

N/A N/A 14.8 13.9 13.9 Met

EQIP non-Federal land with

conservation applied to

improve fish and wildlife

habitat quality (millions of

acres)

N/A N/A 1.4 1.4 1.1 Met

Annual acres of public and

private forest lands restored or

enhanced (millions of acres)

2.57 2.533 2.91 3.10 2.9 Met

Volume of timber sold (billion

board feet)

2.644 2.610 2.831 2.867 3.2 Met

Percentage of National Forests

and Grasslands in compliance

with a climate change

adaptation and mitigation

strategy

36% 49% 64% 89% 100% Met

Percentage of National Forests

and Grassland watersheds in

properly (class 1 watersheds)

functioning condition

52% 52% 52% 52% 52% Met

6

The minor shortfall was due primarily to various factors that contributed to a delay in

conservation implementation of some very large tracts of land initially planned for application

in FY 2016. These acres are now scheduled for FY 2017 and FY 2018.

14 USDA FISCAL YEAR 2016 AGENCY FINANCIAL REPORT

Fiscal Year

2012

Actual

2013

Actual

2014

Actual

2015

Actual

2016

Target

2016

Preliminary

Acres of Wildland Urban

Interface hazardous fuels

treated to reduce the risk of

catastrophic wildfire (millions of

acres)

1.867 1.737 1.725 1.577 1.800 Met

GOAL #3: INCREASED EXPORTS AND GLOBAL FOOD SECURITY

Working with other Federal partners, USDA is working toward reducing global food insecurity

and increasing agriculture-led economic growth in developing countries. The Department

continues to seek new trade opportunities for American agricultural producers and is also

striving to bring products with new and emerging technologies to the worldwide marketplace.

In addition, USDA is focused on improving efforts to reduce food insecurity across the world

by providing technical assistance to people in food-insecure countries.

Exhibit 3: USDA Strategic Plan Goal #3 – Increased Exports and Global Food Security

Fiscal Year

2012

Actual

2013

Actual

2014

Actual

2015

Actual

2016

Target

2016

Preliminary

Cumulative number of

biotechnology products

deregulated by USDA

based on scientific

determinations that they

do not pose a plant pest

risk to agriculture

93 102 109 117 122 Met

S ECTION I MANAGEMENT’S DISCUSSION AND ANALYSIS 15

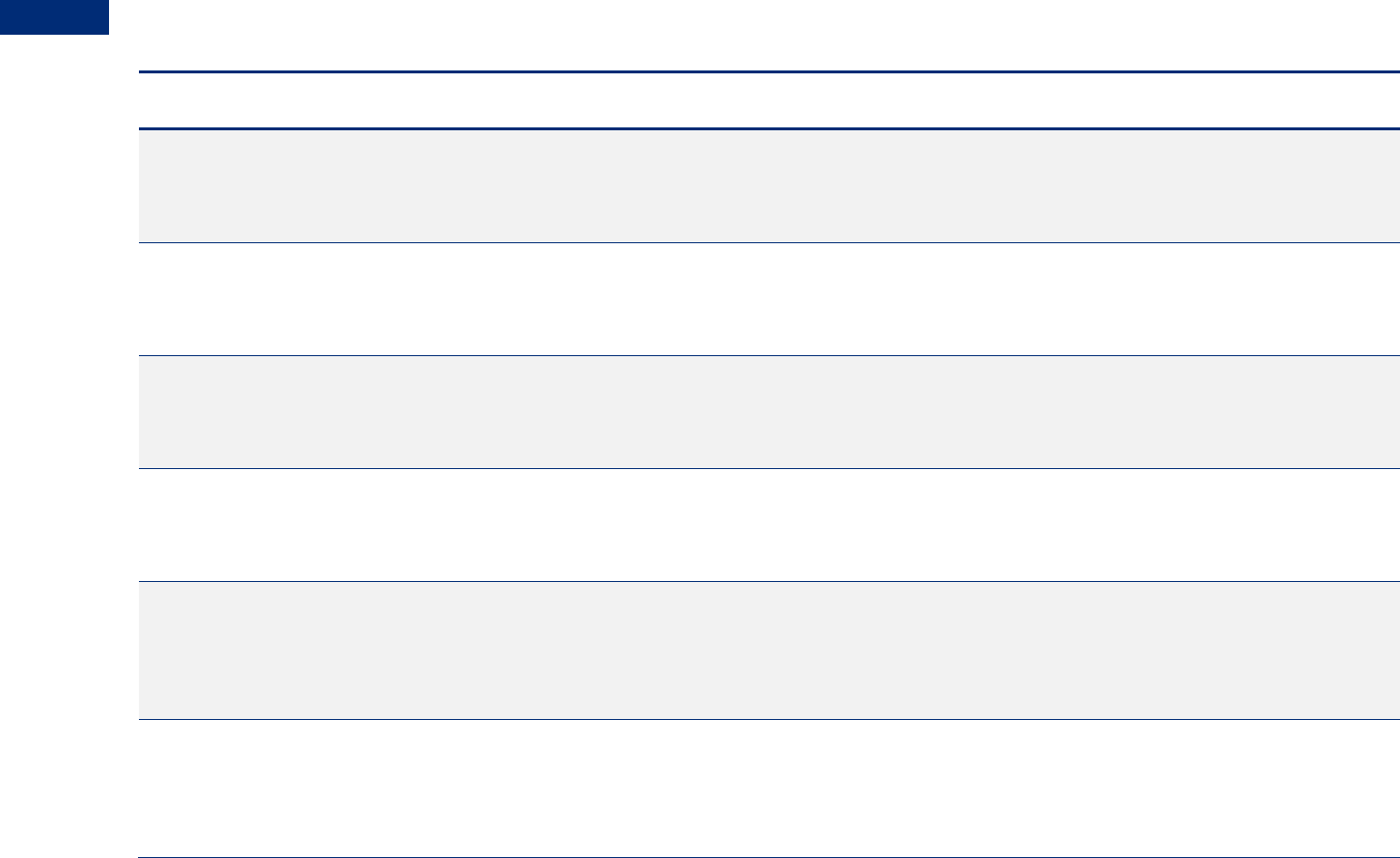

GOAL #4: SAFE AND NUTRITIOUS FOOD

A plentiful supply of safe and nutritious food is essential to the healthy development of every

child in America and to the well-being and productivity of every family. Over the past 4 years,

USDA’s food assistance programs have contributed to a steady decrease in the prevalence of

food insecurity in households with children. Regarding USDA’s Food Safety and Inspection

Service (FSIS)-regulated meat, poultry, and processed egg products, USDA also saw that the

estimated illnesses attributed to the FSIS regulated products decreased by 12 percent from

FY 2009 to FY 2015.

Exhibit 4: USDA Strategic Plan Goal #4 – Safe and Nutritious Food

Fiscal Year

2012

Actual

2013

Actual

2014

Actual

2015

Actual

2016

Target

2016

Preliminary

Prevalence of food

insecurity in households

with children

20% 19.5% 19.2% 16.6% 18.8% Deferred

7

Annual percentage of

eligible people

participating in SNAP

83% 85% 85% N/A 85.0% Deferred

8

SNAP payment accuracy

rate

96.6% 96.8% 96.3% N/A 96.3% Deferred

9

SNAP benefits redeemed

at farmers markets and

direct marketing farmers

annually (millions)

$16.60 $ 17.5 $ 18.8 $19.4 $ 20.00 Deferred

10

Annual percentage of

eligible people

participating in the

National School Lunch

Program

57.6% 55.7% 54.8% 55.4% 56.8% Met

11

7

The actual measure for 2016 will be released in September 2017.

8

FY 2016 data will be available in 2018.

9

FY 2016 data will be available in 2018.

10

FY 2016 data will be available in 2017.

11

Rationale for Met Range: Thresholds for 4.1.2 reflect the margin of error in forecasts of

future participation, estimated at 5 percent for school meals programs. This reflects the

pattern of variance between actual and target performance for both programs during the past

5 years. For FY 2016, this percentage range allows for actual performance that meets the

targets in the range of 54.0-59.6 percent.

16 USDA FISCAL YEAR 2016 AGENCY FINANCIAL REPORT

Fiscal Year

2012

Actual

2013

Actual

2014

Actual

2015

Actual

2016

Target

2016

Preliminary

Annual percentage of

children participating in

the free/reduced price

school lunch program

that participate in

summer feeding

programs

15.5% 16.3% 17.5% 17.1% 17.2% Deferred

12

Increase percentage of

broiler plants passing the

carcass Salmonella

Verification Testing

Standard

90% 90% 92% 96% 95% Unmet

13

Percentage of

establishments with a

functional food defense

plan (annual measure)

77% 83% 84% 85% 90% Unmet

14

Total illnesses from all

FSIS products

479,621 427,171 386,265 382,123 363,547 Unmet

15

12

Initial reports for 2016 will be available in December 2016.

13

While FSIS did not meet the FY2016 target for the percent of broiler establishments passing

the carcass Salmonella verification testing standard, the overall percent of establishments’

passing the standard has risen consistently over the past 5 years, and in Q4, FSIS failed to meet

the target as a result of just 2 establishments not meeting the target.

14

While FSIS did not meet the FY2016 target for voluntary adoption of food defense plans, it

has seen a 34% increase since 2006. FSIS will continue to focus on small and very small

establishments, which represent a majority of those that have not adopted a plan, and will also

focus on assessing to what extent all establishments have good practices in place.

15

FSIS set illness reduction targets for FY2020 with the goal of achieving ambitious Healthy

People 2020 targets. FSIS did not achieve the FY2016 All Illness target; however, FSIS did meet

its E. coli O157:H7 and Lm targets. FSIS did not meet these targets in FY16 because the data

used to determine illnesses attributable to FSIS regulated products—CDC outbreak data from

2011-2013—excluded a very large outbreak in FDA-regulated shell eggs, and included a large

outbreak in FSIS regulated chicken products. As our current methodology includes only 3 years

of data, large outbreaks coming into or falling out of the dataset highly influences the

attribution estimates.

S ECTION I MANAGEMENT’S DISCUSSION AND ANALYSIS 17

GOAL #5: DEPARTMENTAL MODERNIZATION

Through its Blueprint for Stronger Service, USDA is building and implementing a modern

workforce, and exercising good stewardship of the resources entrusted to the Department.

During FY 2016, USDA implemented policies to achieve a more efficient use of funds through

decreases in the amount of leased office and warehouse space controlled by USDA and to build

a more effective workforce through process improvements and increased use of telework.

Exhibit 5: USDA Strategic Plan Goal #5 – Departmental Modernization

Fiscal Year

2012

Actual

2013

Actual

2014

Actual

2015

Actual

2016

Target

2016

Preliminary

Number of employees

participating in core

telework

7,926 9,723 10,455 11,798 12,000 Met

Amount of leased

office and warehouse

space controlled by

USDA (millions of

square feet)

26 25.6 24.9 23.9 23.7 Met

18 USDA FISCAL YEAR 2016 AGENCY FINANCIAL REPORT

Future Demands, Risks, Uncertainties,

Events, Conditions, and Trends

Farmers and ranchers operate in highly competitive markets, both domestically and

internationally. Rapid shifts in consumer demands associated with quality, convenience, taste,

and nutrition dictate that farming, ranching, and marketing infrastructures become more fluid

and responsive. National security is a significant, ongoing priority for the U.S. Department of

Agriculture (USDA). USDA science research, education, and extension will continue to be the

foundation for understanding developments and making advances in solving agricultural and

societal challenges. USDA is working with the U.S. Department of Homeland Security to help

protect agriculture from intentional and accidental acts that might impact America’s food

supply or natural resources.

External factors that challenge USDA’s ability to achieve its

goals include the following:

• Weather-related hardships, including disasters related to the increasing intensity and

duration of extreme weather and climate change, both domestically and internationally;

• The risk of catastrophic fire, depending on weather, drought conditions, and the expanding

number of communities in the wildland-urban interface;

• Non weather-related hardships and other uncontrollable events, both domestically and

internationally;

• Domestic and international macroeconomic factors, including consumer purchasing

power, the strength of the U.S. dollar, and political changes abroad that could impact

domestic and global markets greatly at any time;

• Sharp fluctuations in farm prices, interest rates, and unemployment that could impact the

ability of farmers, other rural residents, communities, and businesses to qualify for credit

and manage debt;

• The impact of future economic conditions and actions by a variety of Federal, State, and

local Governments that could influence the sustainability of rural infrastructure;

• The increased movement of people and goods, which provides the opportunity for crop

and animal pests and diseases to move quickly across domestic and international

boundaries; and

•

Potential exposure to hazardous substances, which may threaten human health as well as

the environment, and the ability of the public and private sectors to collaborate effectively

on food safety, security, and related emergency preparedness efforts.

S ECTION I MANAGEMENT’S DISCUSSION AND ANALYSIS 19

Analysis of Financial Information and

Highlights

Balance Sheet

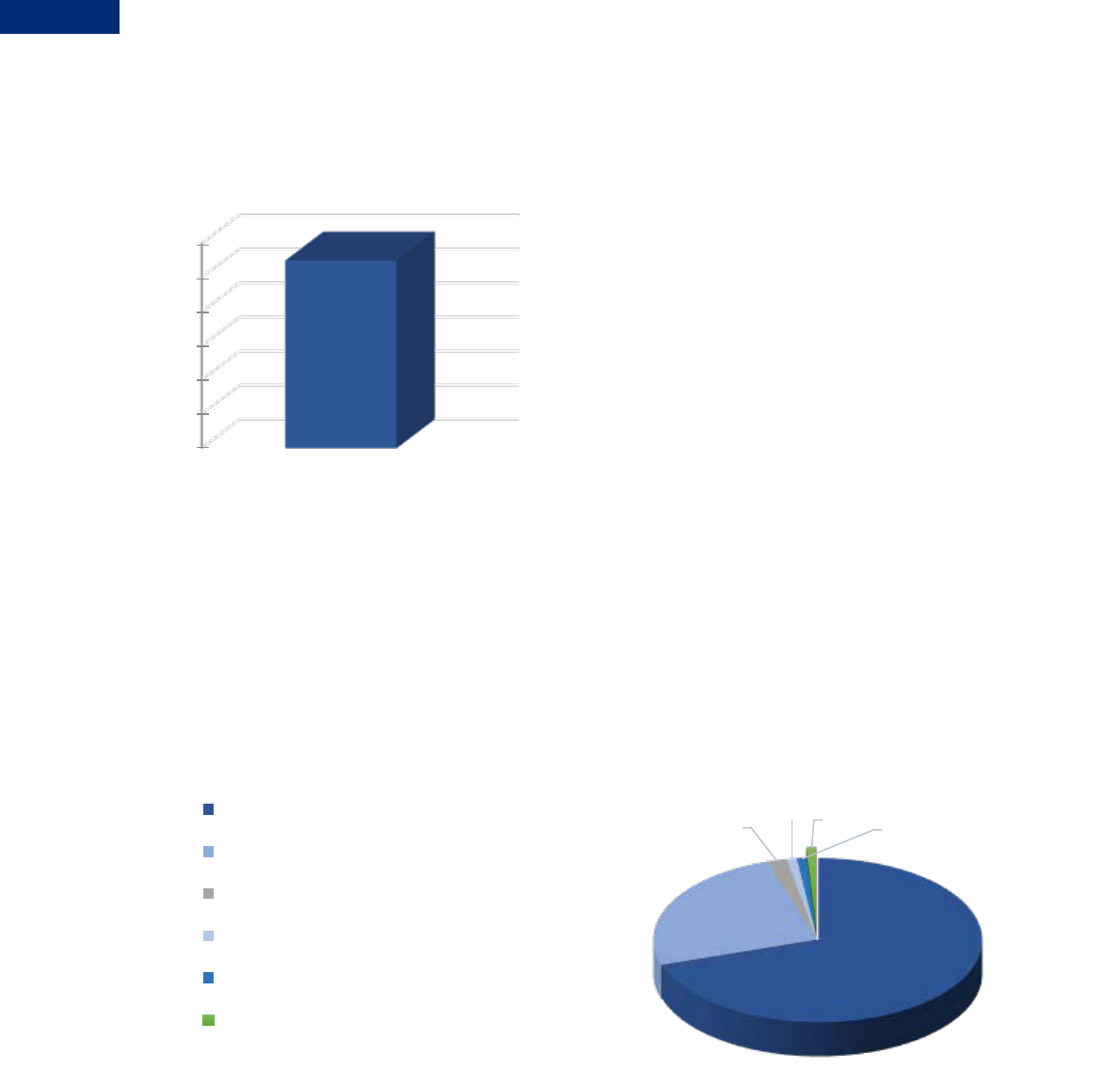

TOTAL ASSETS

Total assets for FY 2016 were $228 billion. The following exhibit presents FY 2016 total

assets.

Exhibit 6: Total Assets ($ In Billions)

55%

43%

1% 1%

Fund Balance with Treasury - $125

Direct Loan and Loan Guarantees,

Net - $99

General Property, Plant and Equipment,

Net - $3

Accounts Receivable, Net - $1

Direct Loan and Loan Guarantees, Net, is one of the largest assets on the USDA Balance Sheet.

RD offers both direct and guaranteed loan products for rural housing and rural business

infrastructure. These products represent 87 percent of the total Department loan programs.

Loan programs administered by FSA represent 10 percent of the total. FSA supports farmers

who are temporarily unable to obtain private, commercial credit. The remaining 3 percent

represents commodity loans and credit programs administered by the CCC. These loans are

used to improve economic stability and provide an adequate supply of agricultural

commodities. CCC credit programs provide international food assistance, expand international

markets, and provide domestic low cost financing to protect farm income and prices.

20 USDA FISCAL YEAR 2016 AGENCY FINANCIAL REPORT

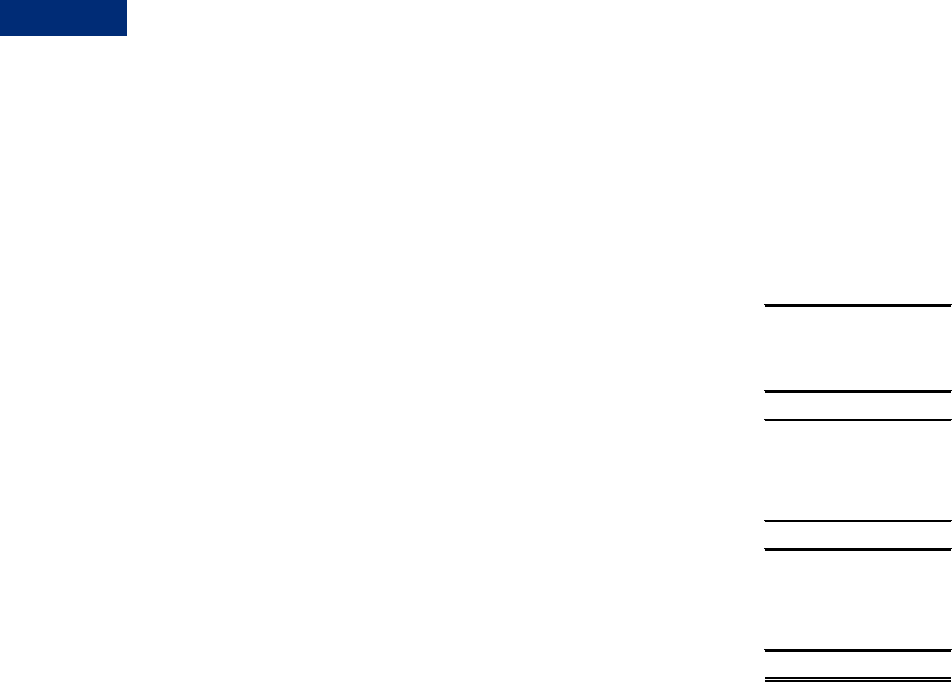

The following exhibit presents significant changes in total assets.

Exhibit 7: Significant Changes in Assets ($ In Billions)

0

2

4

6

8

10

12

Fund Balance with Treasury

$11

The increase in Fund Balance with Treasury was primarily due to a $5 billion increase at FNS

for SNAP and a $5 billion increase at RD for the Guaranteed Single Family Housing program.

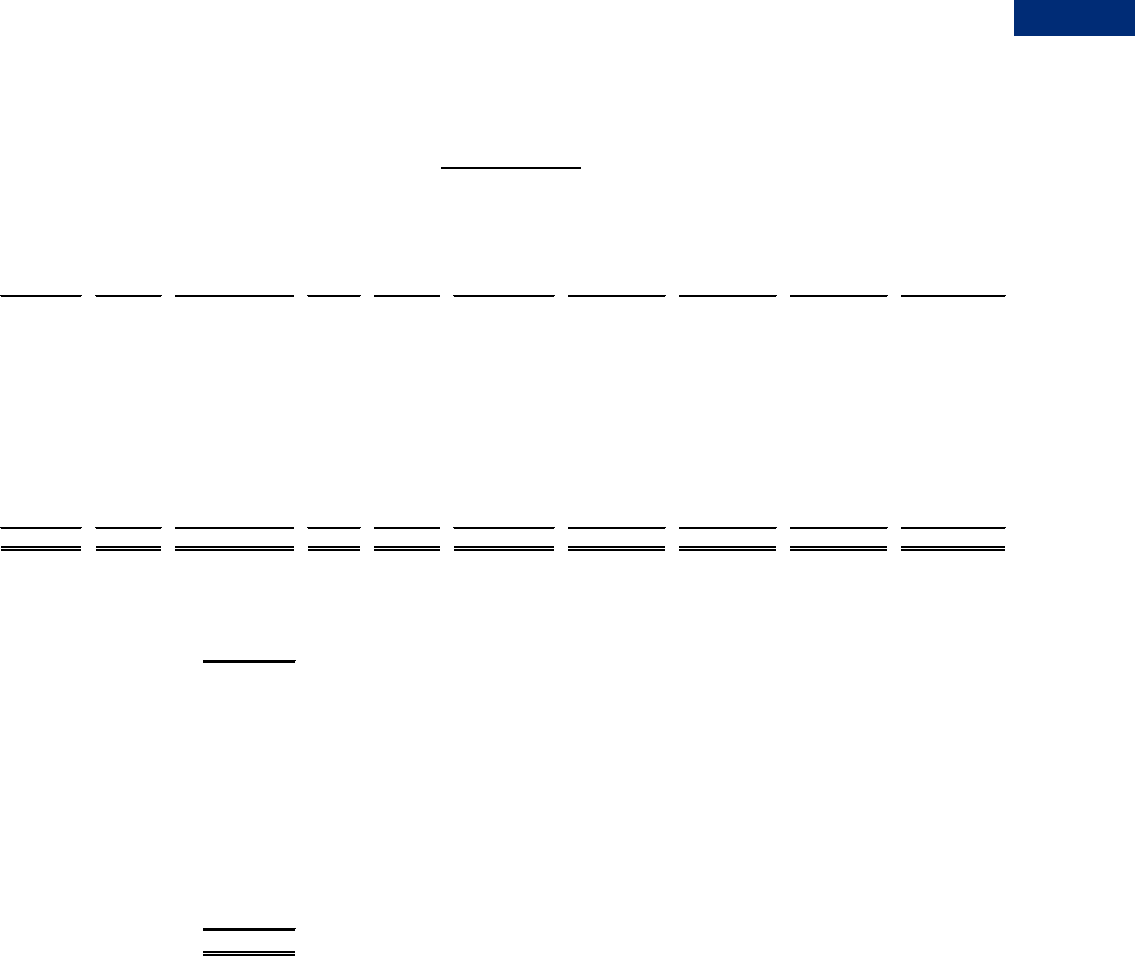

TOTAL LIABILITIES

Total liabilities for FY 2016 were $174 billion. The following exhibit presents FY 2016 total

liabilities.

Exhibit 8: Total Liabilities ($ In Billions)

70%

25%

2%

1%

1%

1%

Debt $122

Other $44

Benefits Due and Payable $4

Accounts Payable $2

Loan Guarantee Liability $1

Federal Employee and $1

Veteran Benefits

Debt is the single largest liability on USDA’s balance sheet. It represents amounts owed

primarily to Treasury by CCC, FSA and RD. For CCC, the debt primarily represents financing

for price support, export credit guarantees, disaster programs and loans related to farm storage

facilities. For FSA, the debt primarily represents financing to support direct and guaranteed

loan programs, with the majority supporting operating, ownership, and emergency loans. For

S ECTION I MANAGEMENT’S DISCUSSION AND ANALYSIS 21

RD, the debt primarily represents financing to support electric and housing loan programs.

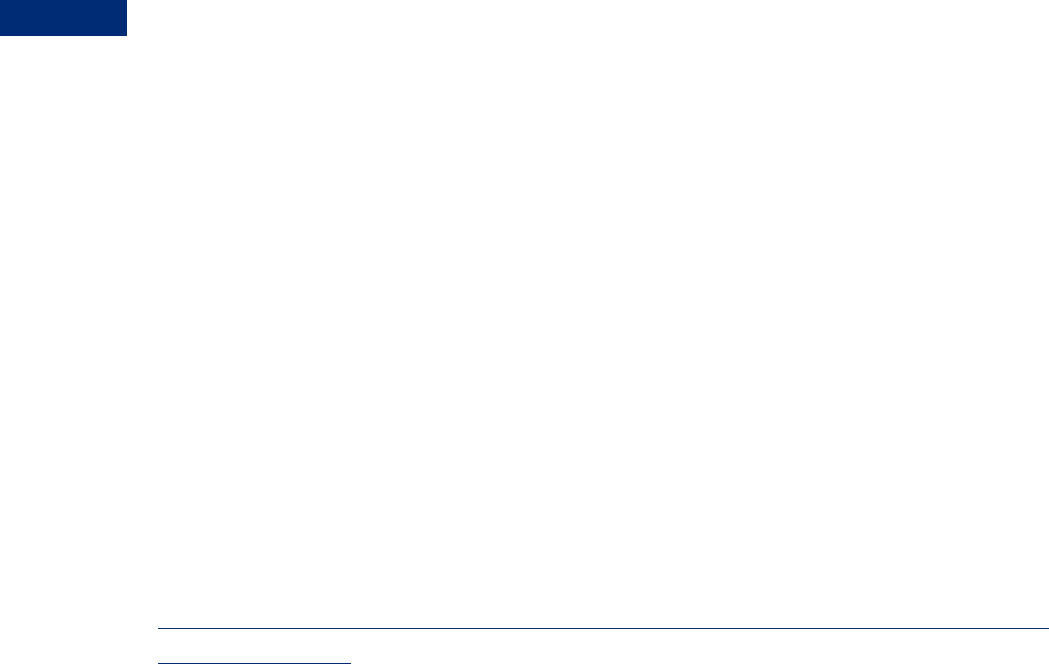

The following exhibit presents significant changes in total liabilities.

Exhibit 9: Significant Changes in Total Liabilities ($ In Billions)

-4

-2

0

2

4

6

8

10

Loan Guarantee

Liability Debt Other Liabilities

-$4

$7

$10

Loan Guarantee Liability decreased primarily due to Guaranteed Rural Housing at RD. Debt

increased $7 billion at CCC primarily due to ARC and PLC. Other Liabilities increased

$6 billion primarily due to Guaranteed Rural Housing at RD and $4 billion at CCC due to

ARC, PLC and the Conservation Reserve Program.

Stewardship Investments (Unaudited)

Stewardship investments are substantial investments made by the Federal Government for the

benefit of the Nation but are not physical assets owned by the Federal Government. When

incurred, they are treated as expenses in determining the net cost of operations. However, these

items merit special treatment so that users of Federal financial reports know the extent of

investments that are made for long-term benefit. Such investments are measured in terms of

expenses incurred for non-Federal physical property, human capital, and research and

development. The following exhibit presents stewardship investments.

Exhibit 10: Stewardship Investments ($ In Millions)

$0

$500

$1,000

$1,500

$2,000

$2,500

Non-Federal Physical

Proper ty Human Capital

Researc h and

Development

$45

$694

$2,257

FY2016

22 USDA FISCAL YEAR 2016 AGENCY FINANCIAL REPORT

Statement of Assurance

The U.S. Department of Agriculture (USDA) is providing modified

assurance that USDA’s systems of internal control comply with the

Federal Managers’ Financial Integrity Act (FMFIA) objectives.

USDA’s systems of internal control meet the objectives of the FMFIA

and the Federal Financial Management Improvement Act (FFMIA),

with the exception of two material weaknesses in internal control, one

financial system non-conformance, and two instances of non-

compliance with laws and regulations. Management is providing

reasonable assurance that the internal controls over operations are

effective. The details of the exceptions are provided in the FMFIA, FFMIA, and Summary of

Financial Statement Audit and Management Assurances sections of this report.

USDA assessed its financial management systems and internal controls over the effectiveness

and efficiency of operations and compliance with applicable laws and regulations as of

September 30, 2016, and financial reporting as of June 30, 2016. The assessment included the

safeguarding of assets and compliance with applicable laws and regulations in accordance with

the requirements of Office of Management and Budget (OMB) Circular No. A-123,

Management’s Responsibility for Enterprise Risk Management and Internal Control.

In fiscal year (FY) 2015, the Forest Service identified an Antideficiency Act (ADA) violation

for FY 1990 through FY 2009 under 31 United States Code (U.S.C.) § 1341(a)(1). The

violation related to the agency’s employment in California of two citizens of Palau. This use of

Federal appropriations violated a general provision of appropriations acts from FY 1990–2009,

which prohibited the use of appropriations to employ non-U.S. citizens. This ADA violation is

in the process of being reported to Congress and the President.

The Farm Service Agency (FSA) identified an ADA violation under 31 U.S.C. § 1517(a).

In September 2013, OMB approved an apportionment request for $1 million from FSA for the

purchase of guaranteed loans in FY 2014. On February 25, 2014, FSA made several loan

purchases, obligating $1,302,823.57, thus exceeding the apportionment for such purchases.

On March 7, 2014, FSA requested another apportionment to cover the deficiency. OMB

approved the request and apportioned funds on March 31, 2014. FSA’s Farm Loan Operations

Office completed corrective actions to ensure future payments are obligated only within

approved apportionment limits. The ADA violation is in the process of being reported to

Congress and the President.

The Office of Advocacy and Outreach (OAO) identified an ADA violation for FY 2011 under

31 U.S.C. § 1517(a). The Food, Conservation, and Energy Act of 2008, Public Law 110-234

(Farm Bill of 2008) permitted OAO to award up to $19 million in FY 2011 for Outreach and

Assistance for Socially Disadvantaged and Veteran Farmers and Ranchers (Section 2501)

S ECTION I MANAGEMENT’S DISCUSSION AND ANALYSIS 23

Grants. OAO exceeded the amount available. The ADA violation is in the process of being

reported to Congress and the President.

In FY 2015, an erroneous transaction was identified associated with the StrikeForce Initiative

funded through transfers from USDA agencies for FY 2010 and 2011. No ADA violation

occurred and all transactions have been corrected.

In FY 2015, The Foreign Agricultural Service (FAS) identified a potential violation of the

ADA that may have occurred in its FY 2009 appropriation. FAS has completed its analyses and

identified the causes of this potential violation. A corrective transaction was processed to clear

the negative cash balances and the U.S. Department of the Treasury (Treasury) and the OMB

approved the transaction on June 30, 2016. Therefore, the FY 2009 appropriation no longer has

a negative cash balance. FAS has requested a final determination on the status of the potential

ADA violation from the Office of the General Counsel.

USDA’s Office of Inspector General determined that improper bank reconciliations were