Userid: CPM Schema:

instrx

Leadpct: 100% Pt. size: 9.5

Draft Ok to Print

AH XSL/XML

Fileid: … ions/i1041/2023/a/xml/cycle03/source (Init. & Date) _______

Page 1 of 53 10:51 - 9-Jan-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

2023

Instructions for Form 1041

and Schedules A, B, G, J,

and K-1

U.S. Income Tax Return for Estates and Trusts

Department of the Treasury

Internal Revenue Service

Section references are to the Internal Revenue Code unless

otherwise noted.

Contents Page

What's New ............................... 1

Reminders ................................ 1

Photographs of Missing Children ................ 2

The Taxpayer Advocate Service (TAS) ............ 2

How To Get Forms and Publications .............. 3

General Instructions ......................... 3

Purpose of Form ............................ 3

Income Taxation of Trusts and Decedents'

Estates ............................... 3

Abusive Trust Arrangements ................... 3

Definitions ................................ 4

Who Must File ............................. 5

Electronic Filing ............................ 8

When To File .............................. 8

Period Covered ............................ 8

Where To File .............................. 9

Who Must Sign ............................. 9

Accounting Methods ......................... 9

Accounting Periods ......................... 10

Rounding Off to Whole Dollars ................. 10

Estimated Tax ............................ 10

Interest and Penalties ....................... 10

Other Forms That May Be Required ............. 11

Additional Information ....................... 13

Assembly and Attachments ................... 13

Special Reporting Instructions ................. 13

Specific Instructions ........................ 18

Name of Estate or Trust ...................... 18

Name and Title of Fiduciary ................... 18

Address ................................. 18

A. Type of Entity ........................... 18

B. Number of Schedules K-1 Attached ........... 19

C. Employer Identification Number .............. 19

D. Date Entity Created ....................... 19

E. Nonexempt Charitable and Split-Interest Trusts ... 19

F. Initial Return, Amended Return, etc. ........... 20

G. Section 645 Election ...................... 20

Income ................................. 21

Deductions .............................. 22

Limitations on Deductions .................... 23

Tax and Payments ......................... 27

Contents Page

Schedule A—Charitable Deduction ............. 28

Schedule B—Income Distribution Deduction ....... 29

Schedule G—Tax Computation and Payments ..... 31

Net Investment Income Tax (NIIT) .............. 36

Other Information .......................... 37

Schedule J (Form 1041)—Accumulation

Distribution for Certain Complex Trusts ........ 39

Schedule K-1 (Form 1041)—Beneficiary's Share of

Income, Deductions, Credits, etc. ............ 41

Index ................................... 53

Future Developments

For the latest information about developments related to

Form 1041 and Schedules A, B, G, J, K-1 and its instructions,

such as legislation enacted after they were published, go to

IRS.gov/Form1041.

What's New

Due date of return. Calendar year estates and trusts must

file Form 1041 by April 15, 2024. If you live in Maine or

Massachusetts, you have until April 17, 2024, because of the

Patriots' Day and Emancipation Day holidays.

Capital gains and qualified dividends. For tax year 2023,

the 20% maximum capital gains rate applies to estates and

trusts with income above $14,650. The 0% and 15% rates

apply to certain threshold amounts. The 0% rate applies to

amounts up to $3,000. The 15% rate applies to amounts over

$3,000 and up to $14,650.

Bankruptcy estate filing threshold. For tax year 2023, the

requirement to file a return for a bankruptcy estate applies

only if gross income is at least $13,850.

Qualified disability trust. For tax year 2023, a qualified

disability trust can claim an exemption of up to $4,700. This

amount is not subject to phaseout.

Qualified sick and family leave credits. Generally, the

credits for qualified sick and family leave wages have expired.

However, qualified sick and family leave wages paid in 2023

for leave taken before April 1, 2021, and for leave taken after

March 31, 2021, and before October 1, 2021, may be eligible

to claim the credits in 2023.

Reminders

•

Review a copy of the will or trust instrument, including any

amendments or codicils, before preparing an estate's or

trust's return.

•

We encourage you to use Form 1041-V, Payment Voucher

for Estates and Trusts, to accompany your payment of a

Jan 9, 2024 Cat. No. 11372D

Page 2 of 53 Fileid: … ions/i1041/2023/a/xml/cycle03/source 10:51 - 9-Jan-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

balance of tax due on Form 1041, particularly if your payment

is made by check or money order.

Form 8978 Worksheet. A Form 8978

Worksheet—Schedule G, Part I, Line 8 has been added to

the instructions to calculate the amount due when there is a

negative amount from Form 8978, line 14, that was not used

to reduce Schedule G, line 3, to zero, and you have chapter 1

taxes and/or tax and interest from Form 8621.

Advanced manufacturing production credit. Section

13502 of the Inflation Reduction Act of 2022 (IRA 2022)

created the advanced manufacturing production credit for

certain components produced and sold after 2022. See Form

7207, Advanced Manufacturing Production Credit, and its

instructions and section 45X.

Net operating loss (NOL) carryback. Generally, an NOL

arising in a tax year beginning in 2021 or later may not be

carried back and instead must be carried forward indefinitely.

However, farming losses arising in tax years beginning in

2021 or later may be carried back 2 years and carried

forward indefinitely.

For special rules for NOLs arising in 2018, 2019 or 2020,

see Pub. 536, Net Operating Losses (NOLs) for Individuals,

Estates, and Trusts, for more information.

Section 965. Section 965(a) inclusion amounts are not

applicable for tax year 2021 and later years. However,

section 965 may still apply to certain estates and trusts

(including the S portion of electing small business trusts

(ESBTs)) where a section 965(h) or section 965(i) election

has been made.

Section 1061 reporting. Section 1061 recharacterizes

certain long-term capital gains of applicable partnership

interests held by an estate or trust as short-term capital

gains. See

Section 1061 Reporting Guidance FAQs.

Excess deductions on termination. Under Final

Regulations - TD9918, each excess deduction on termination

of an estate or trust retains its separate character as an

amount allowed in arriving at

adjusted gross income (AGI), a

non-miscellaneous itemized deduction, or a miscellaneous

itemized deduction.

See Box 11, Code A Excess Deductions on

Termination—Section 67(e) Expenses and Box 11, Code B

Excess Deductions on Termination—Non-Miscellaneous

Itemized Deductions, later, for more information.

Qualified Opportunity Investment. With the exception of

grantor trusts, if you held a qualified investment in a qualified

opportunity fund (QOF) at any time during the year, you must

file your return with Form 8997, Initial and Annual Statement

of Qualified Opportunity Fund (QOF) Investments, attached

to your return. For more information, see Form 8997 and its

instructions.

Extension of time to file. The extension of time to file an

estate (other than a bankruptcy estate) or trust return is 5

1

/2

months.

Item A. Type of entity. On page 1 of Form 1041, item A,

taxpayers should select more than one box, when

appropriate, to reflect the type of entity.

Item F. Net operating loss (NOL) carryback. If an

amended return is filed for an NOL carryback, check the Net

operating loss carryback box in item F. See Amended Return,

later, for complete information.

Item G. Section 645 election.

If the estate has made a

section 645 election, the executor must check item G and

provide the taxpayer identification number (TIN) of the

electing trust with the highest total asset value in the box

provided.

The executor must also attach a statement to Form 1041

providing the following information for each electing trust

(including the electing trust provided in item G): (a) the name

of the electing trust, (b) the TIN of the electing trust, and (c)

the name and address of the trustee of the electing trust.

Form 1041 e-filing. When e-filing Form 1041, use either

Form 8453-FE, U.S. Estate or Trust Declaration for an IRS

e-file Return, or Form 8879-F, IRS e-file Signature

Authorization for Form 1041.

Note. Form 8879-F can only be associated with a single

Form 1041. Form 8879-F can no longer be used with multiple

Forms 1041.

For more information about e-filing returns through MeF,

see Pub. 4164, Modernized e-File (MeF) Guide for Software

Developers and Transmitters.

Photographs of Missing Children

The Internal Revenue Service is a proud partner with the

National Center for Missing & Exploited Children® (NCMEC).

Photographs of missing children selected by the Center may

appear in instructions on pages that would otherwise be

blank. You can help bring these children home by looking at

the photographs and calling 1-800-THE-LOST

(1-800-843-5678) if you recognize a child.

The Taxpayer Advocate Service (TAS)

The TAS Is Here To Help You

What Is TAS?

TAS is an independent organization within the IRS that

helps taxpayers and protects taxpayer rights. TAS strives to

ensure that every taxpayer is treated fairly and that you know

and understand your rights under the Taxpayer Bill of Rights.

How Can You Learn About Your Taxpayer Rights?

The Taxpayer Bill of Rights describes 10 basic rights that all

taxpayers have when dealing with the IRS. Go to

TaxpayerAdvocate.IRS.gov to help you understand what

these rights mean to you and how they apply. These are your

rights. Know them. Use them.

What Can TAS Do for You?

TAS can help you resolve problems that you can't resolve

with the IRS. And their service is free. If you qualify for their

assistance, you will be assigned to one advocate who will

work with you throughout the process and will do everything

possible to resolve your issue. TAS can help you if:

•

Your problem is causing financial difficulty for you, your

family, or your business;

•

You face (or your business is facing) an immediate threat

of adverse action; or

•

You’ve tried repeatedly to contact the IRS but no one has

responded, or the IRS hasn’t responded by the date

promised.

2

Instructions for Form 1041 (2023)

Page 3 of 53 Fileid: … ions/i1041/2023/a/xml/cycle03/source 10:51 - 9-Jan-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

How Can You Reach TAS?

TAS has offices in every state, the District of Columbia, and

Puerto Rico. To find your advocate’s number:

•

Go to TaxpayerAdvocate.IRS.gov/Contact-Us;

•

Download Pub. 1546, The Taxpayer Advocate Service Is

Your Voice at the IRS, available at IRS.gov/pub/irs-pdf/

p1546.pdf;

•

Call the IRS toll free at 800-TAX-FORM (800-829-3676) to

order a copy of Pub. 1546;

•

Check your local directory; or

•

Call TAS toll free at 877-777-4778.

How Else Does TAS Help Taxpayers?

TAS works to resolve large-scale problems that affect many

taxpayers. If you know of one of these broad issues, report it

to TAS at IRS.gov/SAMS. Be sure to not include any personal

taxpayer information.

How To Get Forms and Publications

Internet. You can access the IRS website 24 hours a

day, 7 days a week, at IRS.gov to:

•

Download forms, including talking tax forms, instructions,

and publications;

•

Order IRS products;

•

Use the online Internal Revenue Code, regulations, and

other official guidance;

•

Research your tax questions;

•

Search publications by topic or keyword;

•

Apply for an employer identification number (EIN); and

•

Sign up to receive local and national tax news by email.

Tax forms and publications. The estate or trust can

download or print all of the forms and publications it may

need on

IRS.gov/FormsPubs. Otherwise, the estate or trust

can go to IRS.gov/OrderForms to place an order and have

forms mailed to it. The IRS will process your order for forms

and publications as soon as possible.

General Instructions

Purpose of Form

The fiduciary of a domestic decedent's estate, trust, or

bankruptcy estate uses Form 1041 to report:

•

The income, deductions, gains, losses, etc., of the estate

or trust;

•

The income that is either accumulated or held for future

distribution or distributed currently to the beneficiaries;

•

Any income tax liability of the estate or trust;

•

Employment taxes on wages paid to household

employees; and

•

Net Investment Income Tax (NIIT). See Schedule G, Part I,

line 5, and the Instructions for Form 8960.

Income Taxation of Trusts and

Decedents' Estates

A trust or a decedent's estate is a separate legal entity for

federal tax purposes. A decedent's estate comes into

existence at the time of death of an individual. A trust may be

created during an individual's life (inter vivos) or at the time of

their death under a will (testamentary).

If the trust instrument

contains certain provisions, then the person creating the trust

(the grantor) is treated as the owner of the trust's assets.

Such a trust is a grantor type trust. See Grantor Type Trusts,

later, under Special Reporting Instructions.

A trust or decedent's estate figures its gross income in

much the same manner as an individual. Most deductions

and credits allowed to individuals are also allowed to estates

and trusts. However, there is one major distinction. A trust or

decedent's estate is allowed an income distribution

deduction

for distributions to beneficiaries. To figure this

deduction, the fiduciary must complete Schedule B. The

income distribution deduction determines the amount of any

distributions taxed to the beneficiaries.

For this reason, a trust or decedent's estate is sometimes

referred to as a “pass-through entity.” The beneficiary, and not

the trust or decedent's estate, pays income tax on their

distributive share of income. Schedule K-1 (Form 1041) is

used to notify the beneficiaries of the amounts to be included

on their income tax returns.

Before preparing Form 1041, the fiduciary must figure the

accounting income of the estate or trust under the will or trust

instrument and applicable local law to determine the amount,

if any, of income that is required to be distributed, because

the income distribution deduction is based, in part, on that

amount.

Abusive Trust Arrangements

Certain trust arrangements claim to reduce or eliminate

federal taxes in ways that are not permitted under the law.

Abusive trust arrangements are typically promoted by the

promise of tax benefits with no meaningful change in the

taxpayer's control over or benefit from the taxpayer's income

or assets. The promised benefits may include reduction or

elimination of income subject to tax; deductions for personal

expenses paid by the trust; depreciation deductions of an

owner's personal residence and furnishings; a stepped-up

basis for property transferred to the trust; the reduction or

elimination of self-employment taxes; and the reduction or

elimination of gift and estate taxes. These promised benefits

are inconsistent with the tax rules applicable to trust

arrangements.

Abusive trust arrangements often use trusts to hide the

true ownership of assets and income or to disguise the

substance of transactions. These arrangements frequently

involve more than one trust, each holding different assets of

the taxpayer (for example, the taxpayer's business, business

equipment, home, automobile, etc.). Some trusts may hold

interests in other trusts, purport to involve charities, or are

foreign trusts. Funds may flow from one trust to another trust

by way of rental agreements, fees for services, purchase

agreements, and distributions.

Some of the abusive trust arrangements that have been

identified include unincorporated business trusts (or

organizations), equipment or service trusts, family residence

trusts, charitable trusts, and final trusts. In each of these

trusts, the original owner of the assets nominally subject to

the trust effectively retains the authority to cause financial

benefits of the trust to be directly or indirectly returned or

made available to the owner. For example, the trustee may be

the promoter, a relative, or a friend of the owner who simply

carries out the directions of the owner whether or not

permitted by the terms of the trust.

When trusts are used for legitimate business, family, or

estate planning purposes, either the trust, the beneficiary, or

Instructions for Form 1041 (2023)

3

Page 4 of 53 Fileid: … ions/i1041/2023/a/xml/cycle03/source 10:51 - 9-Jan-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

the transferor of assets to the trust will pay the tax on income

generated by the trust property. Trusts can't be used to

transform a taxpayer's personal, living, or educational

expenses into deductible items, and can't seek to avoid tax

liability by ignoring either the true ownership of income and

assets or the true substance of transactions. Therefore, the

tax results promised by the promoters of abusive trust

arrangements are not allowable under the law, and the

participants in and promoters of these arrangements may be

subject to civil or criminal penalties in appropriate cases.

For more details, including the legal principles that control

the proper tax treatment of these abusive trust arrangements,

see Notice 97-24, 1997-1 C.B. 409.

For additional information about abusive tax

arrangements, go to IRS.gov and type “Abusive Trusts” in the

search box.

Definitions

Adjusted gross income (AGI). Compute the AGI of an

estate or a non-grantor trust by subtracting the following from

total income on line 9 of page 1.

1. The administration costs of the estate or trust (the total

of lines 12, 14, and 15a to the extent they are costs incurred

in the administration of the estate or trust) that wouldn't have

been incurred if the property were not held by the estate or

trust.

2. The income distribution deduction (line 18).

3. The amount of the exemption (line 21).

4. The net operating loss deduction (NOLD) claimed on

line 15b.

Electing small business trust (ESBT). Compute the

AGI of the S portion of an ESBT in the same manner as an

individual taxpayer, except that administration costs allocable

to the S portion (to the extent they are costs incurred in the

administration of the trust that wouldn't have been incurred if

the property were not held by the estate or trust) shall be

deducted in arriving at AGI.

Beneficiary. A beneficiary includes an heir, a legatee, or a

devisee.

Decedent's estate. The decedent's estate is an entity that

is formed at the time of an individual's death and is generally

charged with gathering the decedent's assets, paying the

decedent's debts and expenses, and distributing the

remaining assets. Generally, the estate consists of all the

property, real or personal, tangible or intangible, wherever

situated, that the decedent owned an interest in at death.

Distributable net income (DNI). The income distribution

deduction allowable to estates and trusts for amounts paid,

credited, or required to be distributed to beneficiaries is

limited to DNI. This amount, which is figured on Schedule B,

line 7, is also used to determine how much of an amount

paid, credited, or required to be distributed to a beneficiary

will be includible in their gross income.

Income in respect of a decedent (IRD). When completing

Form 1041, you must take into account any items that are

IRD.

In general, IRD is income that a decedent was entitled to

receive but that was not properly includible in the decedent's

final income tax return under the decedent's method of

accounting.

IRD includes:

•

All accrued income of a decedent who reported their

income on the cash method of accounting,

•

Income accrued solely because of the decedent's death in

the case of a decedent who reported their income on the

accrual method of accounting, and

•

Income to which the decedent had a contingent claim at

the time of their death.

Some examples of IRD for a decedent who kept their

books on the cash method are:

•

Deferred salary payments that are payable to the

decedent's estate,

•

Uncollected interest on U.S. savings bonds,

•

Proceeds from the completed sale of farm produce, and

•

The portion of a lump-sum distribution to the beneficiary of

a decedent's individual retirement arrangement (IRA) that

equals the balance in the IRA at the time of the owner's

death. This includes unrealized appreciation and income

accrued to that date, less the aggregate amount of the

owner's nondeductible contributions to the IRA. Such

amounts are included in the beneficiary's gross income in the

tax year that the distribution is received.

The IRD has the same character it would have had if the

decedent had lived and received such amount.

Deductions and credits in respect of a decedent. The

following deductions and credits, when paid by the

decedent's estate, are allowed on Form 1041 even though

they were not allowable on the decedent's final income tax

return.

•

Business expenses deductible under section 162.

•

Interest deductible under section 163.

•

Taxes deductible under section 164.

•

Percentage depletion allowed under section 611.

•

Foreign tax credit.

For more information on IRD, see section 691 and Pub.

559, Survivors, Executors, and Administrators.

Income required to be distributed currently. Income

required to be distributed currently is income that is required

under the terms of the governing instrument and applicable

local law to be distributed in the year it is received. The

fiduciary

must be under a duty to distribute the income

currently, even if the actual distribution is not made until after

the close of the trust's tax year. See Regulations section

1.651(a)-2.

Fiduciary. A fiduciary is a trustee of a trust, or an executor,

executrix, administrator, administratrix, personal

representative, or person in possession of property of a

decedent's estate.

Note. Any reference in these instructions to “you” means the

fiduciary of the estate or trust.

Trust. A trust is an arrangement created either by a will or by

an inter vivos declaration by which trustees take title to

property for the purpose of protecting or conserving it for the

beneficiaries under the ordinary rules applied in chancery or

probate courts.

Revocable living trust. A revocable living trust is an

arrangement created by a written agreement or declaration

during the life of an individual and can be changed or ended

at any time during the individual's life. A revocable living trust

is generally created to manage and distribute property. Many

people use this type of trust instead of (or in addition to) a

will.

4

Instructions for Form 1041 (2023)

Page 5 of 53 Fileid: … ions/i1041/2023/a/xml/cycle03/source 10:51 - 9-Jan-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Because this type of trust is revocable, it is treated as a

grantor type trust for tax purposes. See

Grantor Type Trusts

under Special Reporting Instructions, later, for special filing

instructions that apply to grantor trusts.

Be sure to read Optional Filing Methods for Certain

Grantor Type Trusts, later. Generally, most people

that have revocable living trusts will be able to use

Optional Method 1. This method is the easiest and least

burdensome way to meet your obligations.

Who Must File

Decedent's Estate

The fiduciary (or one of the joint fiduciaries) must file Form

1041 for a domestic estate that has:

1. Gross income for the tax year of $600 or more;

2. A beneficiary who is a nonresident alien; or

3. If you held a qualified investment in a qualified

opportunity fund (QOF) at any time during the year, you must

file your return with Form 8997 attached. See the Form 8997

instructions.

An estate is a domestic estate if it isn't a foreign estate. A

foreign estate is one the income of which is from sources

outside the United States that isn't effectively connected with

the conduct of a U.S. trade or business and isn't includible in

gross income. If you are the fiduciary of a foreign estate, file

Form 1040-NR, U.S. Nonresident Alien Income Tax Return,

instead of Form 1041.

Trust

The fiduciary (or one of the joint fiduciaries) must file Form

1041 for a domestic trust taxable under section 641 that has:

1. Any taxable income for the tax year;

2. Gross income of $600 or more (regardless of taxable

income);

3. A beneficiary who is a nonresident alien; or

4. If you held a qualified investment in a QOF at any time

during the year, you must file your return with Form 8997

attached. See the Form 8997 instructions.

Two or more trusts are treated as one trust if the trusts

have substantially the same grantor(s) and substantially the

same primary beneficiary(ies) and a principal purpose of

such trusts is avoidance of tax. This provision applies only to

that portion of the trust that is attributable to contributions to

corpus made after March 1, 1984.

A trust is a domestic trust if:

•

A U.S. court is able to exercise primary supervision over

the administration of the trust (court test), and

•

One or more U.S. persons have the authority to control all

substantial decisions of the trust (control test).

See Regulations section 301.7701-7 for more information

on the court and control tests.

Also treated as a domestic trust is a trust (other than a

trust treated as wholly owned by the grantor) that:

•

Was in existence on August 20, 1996,

•

Was treated as a domestic trust on August 19, 1996, and

•

Elected to continue to be treated as a domestic trust.

A trust that isn't a domestic trust is treated as a foreign

trust. If you are the trustee of a foreign trust, file Form

1040-NR instead of Form 1041. Also, a foreign trust with a

TIP

U.S. owner must generally file Form 3520-A, Annual

Information Return of Foreign Trust With a U.S. Owner.

If a domestic trust becomes a foreign trust, it is treated

under section 684 as having transferred all of its assets to a

foreign trust, except to the extent a grantor or another person

is treated as the owner of the trust when the trust becomes a

foreign trust.

Grantor Type Trusts

If all or any portion of a trust is a grantor type trust, then that

trust or portion of a trust must follow the special reporting

requirements discussed later under Special Reporting

Instructions. See Grantor Type Trust under Specific

Instructions, later, for more details on what makes a trust a

grantor type trust.

Note. A trust may be part grantor trust and part “other” type

of trust, for example, simple or complex, or ESBT.

Qualified subchapter S trusts (QSSTs). QSSTs must

follow the special reporting requirements for these trusts,

discussed later under Special Reporting Instructions.

Special Rule for Certain Revocable Trusts

Section 645 provides that if both the executor (if any) of an

estate (the related estate) and the trustee of a qualified

revocable trust (QRT) elect the treatment in section 645, the

trust must be treated and taxed as part of the related estate

during the election period. This election may be made by a

QRT even if no executor is appointed for the related estate.

In general, Form 8855, Election To Treat a Qualified

Revocable Trust as Part of an Estate, must be filed by the due

date for Form 1041 for the first tax year of the related estate.

This applies even if the combined related estate and electing

trust don't have sufficient income to be required to file Form

1041. However, if the estate is granted an extension of time

to file Form 1041 for its first tax year, the due date for Form

8855 is the extended due date.

Once made, the election is irrevocable.

Qualified revocable trusts (QRTs). In general, a QRT is

any trust (or part of a trust) that, on the day the decedent

died, was treated as owned by the decedent because the

decedent held the power to revoke the trust as described in

section 676. An electing trust is a QRT for which a section

645 election has been made.

Election period. The election period is the period of time

during which an electing trust is treated as part of its related

estate.

The election period begins on the date of the decedent's

death and terminates on the earlier of:

•

The day on which the electing trust and related estate, if

any, distribute all of their assets; or

•

The day before the applicable date.

To determine the applicable date, first determine whether a

Form 706, United States Estate (and Generation-Skipping

Transfer) Tax Return, is required to be filed as a result of the

decedent's death. If no Form 706 is required to be filed, the

applicable date is 2 years after the date of the decedent's

death. If Form 706 is required, the applicable date is the later

of 2 years after the date of the decedent's death or 6 months

after the final determination of liability for estate tax. For

additional information, see Regulations section 1.645-1(f).

Instructions for Form 1041 (2023)

5

Page 6 of 53 Fileid: … ions/i1041/2023/a/xml/cycle03/source 10:51 - 9-Jan-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Taxpayer identification number (TIN). All QRTs must

obtain a new TIN following the death of the decedent whether

or not a section 645 election is made. (Use Form W-9,

Request for Taxpayer Identification Number and Certification,

to notify payers of the new TIN.)

An electing trust that continues after the termination of the

election period doesn't need to obtain a new TIN following

the termination unless:

•

An executor was appointed and agreed to the election

after the electing trust made a valid section 645 election, and

the electing trust filed a return as an estate under the trust's

TIN; or

•

No executor was appointed and the QRT was the filing

trust (as explained later).

A related estate that continues after the termination of the

election period doesn't need to obtain a new TIN.

For more information about TINs, including trusts with

multiple owners, see Regulations sections 1.645-1 and

301.6109-1(a).

General procedures for completing Form 1041 during

the election period.

If there is an executor. The following rules apply to filing

Form 1041 while the election is in effect.

•

The executor of the related estate is responsible for filing

Form 1041 for the estate and all electing trusts. The return is

filed under the name and TIN of the related estate. Be sure to

check the “Decedent's estate” box at the top of Form 1041

and item G if the estate has made a section 645 election. The

executor continues to file Form 1041 during the election

period even if the estate distributes all of its assets before the

end of the election period.

•

The Form 1041 includes all items of income, deduction,

and credit for the estate and all electing trusts.

•

For item G, the executor must provide the TIN of the

electing trust with the highest total asset value.

•

The executor must attach a statement to Form 1041

providing the following information for each electing trust

(including the electing trust provided in item G): (a) the name

of the electing trust, (b) the TIN of the electing trust, and (c)

the name and address of the trustee of the electing trust.

•

The related estate and the electing trust are treated as

separate shares for purposes of computing DNI and applying

distribution provisions. Also, each of those shares can

contain two or more separate shares. For more information,

see Separate share rule, later, and Regulations section

1.645-1(e)(2)(iii).

•

The executor is responsible for ensuring that the estate's

share of the combined tax obligation is paid.

For additional information, including treatment of transfers

between shares and charitable contribution deductions, see

Regulations section 1.645-1(e).

If there isn't an executor. If no executor has been

appointed for the related estate, the trustee of the electing

trust files Form 1041 as if it were an estate. File using the TIN

that the QRT obtained after the death of the decedent. The

trustee can choose a fiscal year as the trust's tax year during

the election period. Be sure to check the “Decedent's estate”

box at the top of Form 1041 and item G if the filing trust has

made a section 645 election. For item G, the filing trustee

must provide the TIN of the electing trust with the highest

total asset value. The electing trust is entitled to a single $600

personal exemption on returns filed for the election period.

If there is more than one electing trust, the trusts must

appoint one trustee as the filing trustee. Form 1041 is filed

under the name and TIN of the filing trustee's trust. A

statement providing the same information about the electing

trusts (except the filing trust) that is listed under If there is an

executor above must be attached to these Forms 1041. All

electing trusts must choose the same tax year.

If there is more than one electing trust, the filing trustee is

responsible for ensuring that the filing trust's share of the

combined tax liability is paid.

For additional information on filing requirements when

there is no executor, including application of the separate

share rule, see Regulations section 1.645-1(e). For

information on the requirements when an executor is

appointed after an election is made and the executor doesn't

agree to the election, see later.

Responsibilities of the trustee when there is an

executor (or there isn't an executor and the trustee isn't

the filing trustee). When there is an executor (or there isn't

an executor and the trustee isn't the filing trustee), the trustee

of an electing trust is responsible for the following during the

election period.

•

To timely provide the executor with all the trust information

necessary to allow the executor to file a complete, accurate,

and timely Form 1041.

•

To ensure that the electing trust's share of the combined

tax liability is paid.

The trustee does not file a Form 1041 during the election

period (except for a final return if the trust terminates during

the election period, as explained later).

Procedure for completing Form 1041 for the year in

which the election terminates.

If there is an executor. If there is an executor, the Form

1041 filed under the name and TIN of the related estate for

the tax year in which the election terminates includes (a) the

items of income, deduction, and credit for the related estate

for its entire tax year; and (b) the income, deductions, and

credits for the electing trust for the period that ends with the

last day of the election period. If the estate won't continue

after the close of the tax year, indicate that this Form 1041 is

a final return.

At the end of the last day of the election period, the

combined entity is deemed to distribute the share comprising

the electing trust to a new trust. All items of income, including

net capital gains, that are attributable to the share comprising

the electing trust are included in the calculation of DNI of the

electing trust and treated as distributed. The distribution rules

of sections 661 and 662 apply to this deemed distribution.

The combined entity is entitled to an income distribution

deduction for this deemed distribution, and the "new" trust

must include its share of the distribution in its income. See

Regulations sections 1.645-1(e)(2)(iii) and 1.645-1(h) for

more information.

If the electing trust continues in existence after the

termination of the election period, the trustee must file Form

1041 under the name and TIN of the trust, using the calendar

year as its accounting period, if it is otherwise required to file.

If there isn't an executor. If there isn't an executor, the

following rules apply to filing Form 1041 for the tax year in

which the election period ends.

•

The tax year of the electing trust closes on the last day of

the election period, and the Form 1041 filed for that tax year

includes all items of income, deduction, and credit for the

electing trust for the period beginning with the first day of the

tax year and ending with the last day of the election period.

•

The deemed distribution rules discussed above apply.

6

Instructions for Form 1041 (2023)

Page 7 of 53 Fileid: … ions/i1041/2023/a/xml/cycle03/source 10:51 - 9-Jan-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

•

Check the box to indicate that this Form 1041 is a final

return.

•

If the filing trust continues after the termination of the

election period, the trustee must obtain a new TIN. If the trust

meets the filing requirements, the trustee must file a Form

1041 under the new TIN for the period beginning with the day

after the close of the election period and, in general, ending

December 31 of that year.

Responsibilities of the trustee when there is an

executor (or there isn't an executor and the trustee isn't

the filing trustee). In addition to the requirements listed

above under this same heading, the trustee is responsible for

the following.

•

If the trust will not continue after the close of the election

period, the trustee must file a Form 1041 under the name and

TIN of the trust. Complete the entity information and items A,

C, D, and F. Indicate in item F that this is a final return. Don't

report any items of income, deduction, or credit.

•

If the trust will continue after the close of the election

period, the trustee must file a Form 1041 for the trust for the

tax year beginning the day after the close of the election

period and, in general, ending December 31 of that year. Use

the TIN obtained after the decedent's death. Follow the

general rules for completing the return.

Special filing instructions.

When the election isn't made by the due date of the

QRT's Form 1041. If the section 645 election hasn't been

made by the time the QRT's first income tax return would be

due for the tax year beginning with the decedent's death, but

the trustee and executor (if any) have decided to make a

section 645 election, then the QRT isn't required to file a

Form 1041 for the short tax year beginning with the

decedent's death and ending on December 31 of that year.

However, if a valid election isn't subsequently made, the QRT

may be subject to penalties and interest for failure to file and

failure to pay.

If the QRT files a Form 1041 for this short period, and a

valid section 645 election is subsequently made, then the

trustee must file an amended Form 1041 for the electing

trust, excluding all items of income, deduction, and credit of

the electing trust. These amounts are then included on the

first Form 1041 filed by the executor for the related estate (or

the filing trustee for the electing trust filing as an estate).

Later appointed executor. If an executor for the related

estate isn't appointed until after the trustee has made a valid

section 645 election, the executor must agree to the trustee's

election and they must file a revised Form 8855 within 90

days of the appointment of the executor. If the executor

doesn't agree to the election, the election terminates as of

the date of appointment of the executor.

If the executor agrees to the election, the trustee must

amend any Form 1041 filed under the name and TIN of the

electing trust for the period beginning with the decedent's

death. The amended returns are still filed under the name

and TIN of the electing trust, and they must include the items

of income, deduction, and credit for the related estate for the

periods covered by the returns. Also, attach a statement to

the amended Forms 1041 identifying the name and TIN of

the related estate, and the name and address of the executor.

Check the “Final return” box on the amended return for the

tax year that ends with the appointment of the executor.

Except for this amended return, all returns filed for the

combined entity after the appointment of the executor must

be filed under the name and TIN of the related estate.

If the election terminates as the result of a later appointed

executor, the executor of the related estate must file Forms

1041 under the name and TIN of the related estate for all tax

years of the related estate beginning with the decedent's

death. The electing trust's election period and tax year

terminate the day before the appointment of the executor.

The trustee isn't required to amend any of the returns filed by

the electing trust for the period prior to the appointment of the

executor. The trust must file a final Form 1041 following the

instructions above for completing Form 1041 in the year in

which the election terminates and there is no executor.

Termination of the trust during the election period. If

an electing trust terminates during the election period, the

trustee of that trust must file a final Form 1041 by completing

the entity information (using the trust's EIN), checking the

Final return box, and signing and dating the form. Don't report

items of income, deduction, and credit. These items are

reported on the related estate's return.

Alaska Native Settlement Trusts

The trustee of an Alaska Native Settlement Trust may elect

the special tax treatment for the trust and its beneficiaries

provided for in section 646. The election must be made by

the due date (including extensions) for filing the trust's tax

return for its first tax year ending after June 7, 2001. Don't

use Form 1041. Use Form 1041-N, U.S. Income Tax Return

for Electing Alaska Native Settlement Trusts, to make the

election. Additionally, Form 1041-N is the trust's income tax

return and satisfies the section 6039H information reporting

requirement for the trust.

Bankruptcy Estate

The bankruptcy trustee or debtor-in-possession must file

Form 1041 for the estate of an individual involved in

bankruptcy proceedings under chapter 7 or 11 of title 11 of

the U.S. Code if the estate has gross income for the tax year

of $13,850 or more. See

Bankruptcy Estates, later, for

details.

Charitable Remainder Trusts (CRTs)

A section 664 CRT doesn’t file Form 1041. Instead, a CRT

files Form 5227, Split-Interest Trust Information Return. If the

CRT has any unrelated business taxable income, it must also

file Form 4720, Return of Certain Excise Taxes Under

Chapters 41 and 42 of the Internal Revenue Code.

Common Trust Funds

Don't file Form 1041 for a common trust fund maintained by a

bank. Instead, the fund may use Form 1065, U.S. Return of

Partnership Income, for its return. For more details, see

section 584 and Regulations section 1.6032-1.

ESBTs

ESBTs file Form 1041. However, see Electing Small Business

Trusts (ESBTs), later, for a discussion of the special reporting

requirements for these trusts.

Pooled Income Funds

Pooled income funds file Form 1041. See Pooled Income

Funds, later, for the special reporting requirements for these

trusts. Additionally, pooled income funds must file Form 5227.

Qualified Funeral Trusts

Trustees of pre-need funeral trusts who elect treatment under

section 685 file Form 1041-QFT, U.S. Income Tax Return for

Instructions for Form 1041 (2023)

7

Page 8 of 53 Fileid: … ions/i1041/2023/a/xml/cycle03/source 10:51 - 9-Jan-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Qualified Funeral Trusts. All other pre-need funeral trusts, see

Grantor Type Trusts, later, for Form 1041 reporting

requirements.

Qualified Settlement Funds

The trustee of a designated or qualified settlement fund

(QSF) must generally file Form 1120-SF, U.S. Income Tax

Return for Settlement Funds, instead of Form 1041.

Special election. If a QSF has only one transferor, the

transferor may elect to treat the QSF as a grantor type trust.

To make the grantor trust election, the transferor must

attach an election statement to a timely filed Form 1041,

including extensions, that the administrator files for the QSF

for the tax year in which the settlement fund is established. If

Form 1041 isn't filed because Optional Method 1 or 2

(described later) was chosen, attach the election statement

to a timely filed income tax return, including extensions, of

the transferor for the tax year in which the settlement fund is

established.

Election statement. The election statement may be

made separately or, if filed with Form 1041, on the

attachment described under Grantor Type Trusts, later. At the

top of the election statement, enter “Section 1.468B-1(k)

Election” and include the transferor's:

•

Name,

•

Address,

•

TIN, and

•

A statement that they will treat the QSF as a grantor type

trust.

Widely Held Fixed Investment Trust (WHFITs)

Trustees and middlemen of WHFITs don't file Form 1041.

Instead, they report all items of gross income and proceeds

on the appropriate Form 1099. For the definition of a WHFIT,

see Regulations section 1.671-5(b)(22). A tax information

statement that includes the information given to the IRS on

Forms 1099, as well as additional information identified in

Regulations section 1.671-5(e), must be given to trust

interest holders. See the General Instructions for Certain

Information Returns for more information.

Electronic Filing

Qualified fiduciaries or transmitters may be able to file Form

1041 and related schedules electronically. To become an

e-file provider, complete the following steps.

1. Create an IRS e-Services account.

2. Submit your e-file provider application online.

3. Pass a suitability check.

The online application process takes 4–6 weeks to

complete.

Note. Existing e-file providers must now use e-Services to

make account updates.

Help is available online at e-services or through the e-Help

Desk at 866-255-0654 (512-416-7750 for international calls),

Monday through Friday, 6:30 a.m.–6:00 p.m. (Central time).

Frequently asked questions and Online Tutorials are available

to answer questions or to guide users through the application

process.

If you file Form 1041 electronically, you may sign the return

electronically by using a personal identification number (PIN).

See Form 8879-F for details.

Form 8879-F can only be associated with a single

Form 1041. Form 8879-F can't be used with multiple

Forms 1041.

Form 1041 may also be e-filed using Form 8453-FE.

For more information about e-filing returns through MeF,

see Pub. 4164.

If Form 1041 is e-filed and there is a balance due, the

fiduciary may authorize an electronic funds withdrawal with

the return.

Private Delivery Services (PDSs)

You can use certain PDSs designated by the IRS to meet the

“timely mailing as timely filing/paying” rule for tax returns and

payments. Go to IRS.gov/PDS for the current list of

designated services.

The PDS can tell you how to get written proof of the

mailing date.

For the IRS mailing address to use if you’re using a PDS,

go to IRS.gov/PDSstreetAddresses.

PDSs can't deliver items to P.O. boxes. You must use

the U.S. Postal Service to mail any item to an IRS

P.O. box address.

When To File

For calendar year estates and trusts, file Form 1041 and

Schedule(s) K-1 by April 15, 2024. If you live in Maine or

Massachusetts, you have until April 17, 2024, because of the

Patriots' Day and Emancipation Day holidays.

For fiscal year estates and trusts, file Form 1041 by the

15th day of the 4th month following the close of the tax year.

For example, an estate that has a tax year that ends on June

30, 2024, must file Form 1041 by October 15, 2024. If the

due date falls on a Saturday, Sunday, or legal holiday, file on

the next business day.

Extension of Time To File

If more time is needed to file the estate or trust return, use

Form 7004, Application for Automatic Extension of Time To

File Certain Business Income Tax, Information, and Other

Returns, to apply for an automatic 5

1

/2-month extension of

time to file.

Period Covered

File the 2023 return for calendar year 2023 and fiscal years

beginning in 2023 and ending in 2024. If the return is for a

fiscal year or a short tax year (less than 12 months), fill in the

tax year space at the top of the form.

The 2023 Form 1041 may also be used for a tax year

beginning in 2024 if:

1. The estate or trust has a tax year of less than 12

months that begins and ends in 2024, and

2. The 2024 Form 1041 isn't available by the time the

estate or trust is required to file its tax return. However, the

estate or trust must show its 2024 tax year on the 2023 Form

1041 and incorporate any tax law changes that are effective

for tax years beginning after 2023.

CAUTION

!

CAUTION

!

8

Instructions for Form 1041 (2023)

Page 9 of 53 Fileid: … ions/i1041/2023/a/xml/cycle03/source 10:51 - 9-Jan-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Who Must Sign

Fiduciary

The fiduciary, or an authorized representative, must sign

Form 1041. If there are joint fiduciaries, only one is required

to sign the return.

A financial institution that submitted estimated tax

payments for trusts for which it is the trustee must enter its

EIN in the space provided for the EIN of the fiduciary. Don't

enter the EIN of the trust. For this purpose, a financial

institution is one that maintains a Treasury Tax and Loan

(TT&L) account. If you are an attorney or other individual

functioning in a fiduciary capacity, leave this space blank.

Don't enter your individual social security number (SSN).

Paid Preparer

Generally, anyone who is paid to prepare a tax return must

have a Preparer Tax Identification Number (PTIN), sign the

return, and fill in the other blanks in the

Paid Preparer Use

Only area of the return.

The person required to sign the return must:

•

Complete the required preparer information including their

PTIN,

•

Sign it in the space provided for the preparer's signature (a

facsimile signature is acceptable), and

•

Give you a copy of the return for your records.

If you, as fiduciary, fill in Form 1041, leave the Paid

Preparer Use Only space blank.

If someone prepares this return and doesn't charge you,

that person should not sign the return.

Paid Preparer Authorization

If the fiduciary wants to allow the IRS to discuss the estate's

or trust's 2023 tax return with the paid preparer who signed it,

check the “Yes” box in the signature area of the return. This

authorization applies only to the individual whose signature

appears in the Paid Preparer Use Only area of the estate's or

trust's return. It doesn't apply to the firm, if any, shown in that

section.

If the “Yes” box is checked, the fiduciary is authorizing the

IRS to call the paid preparer to answer any questions that

may arise during the processing of the estate's or trust's

return. The fiduciary is also authorizing the paid preparer to:

•

Give the IRS any information that is missing from the

estate's or trust's return;

•

Call the IRS for information about the processing of the

estate's or trust's return or the status of its refund or

payment(s); and

•

Respond to certain IRS notices that the fiduciary has

shared with the preparer about math errors, offsets, and

return preparation. The notices won't be sent to the preparer.

The fiduciary isn't authorizing the paid preparer to receive

any refund check, bind the estate or trust to anything

(including any additional tax liability), or otherwise represent

the estate or trust before the IRS.

The authorization will automatically end no later than the

due date (without regard to extensions) for filing the estate's

or trust's 2024 tax return. If the fiduciary wants to expand the

paid preparer's authorization or revoke the authorization

before it ends, see Pub. 947, Practice Before the IRS and

Power of Attorney.

Accounting Methods

Figure taxable income using the method of accounting

regularly used in keeping the estate's or trust's books and

records. Generally, permissible methods include the cash

method, the accrual method, or any other method authorized

by the Internal Revenue Code. In all cases, the method used

must clearly reflect income.

Generally, the estate or trust may change its accounting

method (for income as a whole or for any material item) only

by getting consent on Form 3115, Application for Change in

Accounting Method. For more information, see Pub. 538,

Accounting Periods and Methods.

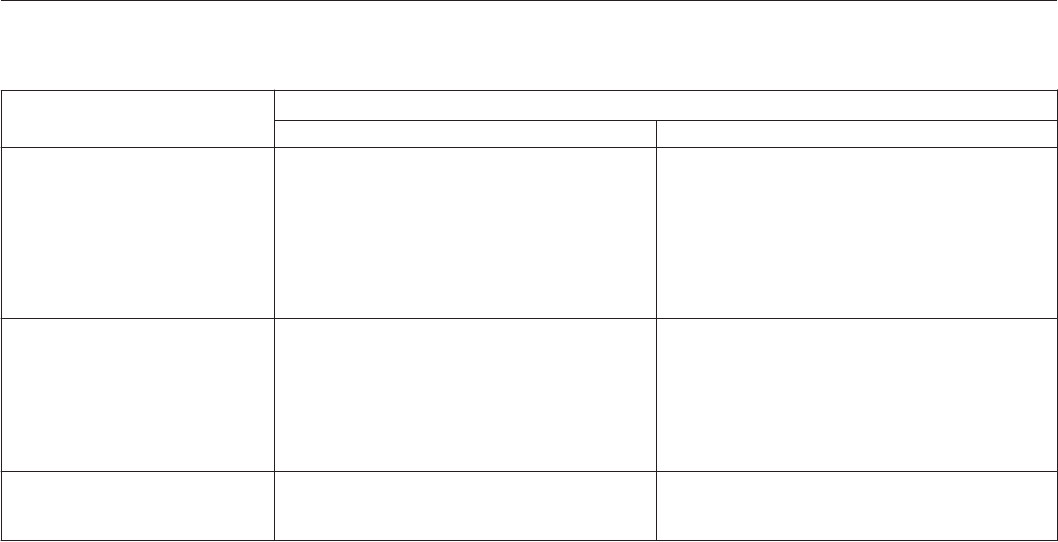

Where To File

For all estates and trusts, including charitable and split-interest trusts (other than CRTs).

THEN use this address if you...

IF you are located in...

Are not enclosing a check or money order: Are enclosing a check or money order:

Connecticut, Delaware, District of

Columbia, Georgia, Illinois, Indiana,

Kentucky, Maine, Maryland,

Massachusetts, Michigan, New

Hampshire, New Jersey, New York, North

Carolina, Ohio, Pennsylvania, Rhode

Island, South Carolina, Tennessee,

Vermont, Virginia, West Virginia,

Wisconsin

Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999-0048

Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999-0148

Alabama, Alaska, Arizona, Arkansas,

California, Colorado, Florida, Hawaii,

Idaho, Iowa, Kansas, Louisiana,

Minnesota, Mississippi, Missouri,

Montana, Nebraska, Nevada, New

Mexico, North Dakota, Oklahoma,

Oregon, South Dakota, Texas, Utah,

Washington, Wyoming

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0048

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0148

A foreign country or U.S. territory Internal Revenue Service

P.O. Box 409101

Ogden, UT 84409

Internal Revenue Service

P.O. Box 409101

Ogden, UT 84409

Instructions for Form 1041 (2023)

9

Page 10 of 53 Fileid: … ions/i1041/2023/a/xml/cycle03/source 10:51 - 9-Jan-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Accounting Periods

For a decedent's estate, the moment of death determines the

end of the decedent's tax year and the beginning of the

estate's tax year. As executor or administrator, you choose

the estate's tax period when you file its first income tax return.

The estate's first tax year may be any period of 12 months or

less that ends on the last day of a month. If you select the last

day of any month other than December, you are adopting a

fiscal tax year.

To change the accounting period of an estate, use Form

1128, Application To Adopt, Change, or Retain a Tax Year.

Generally, a trust must adopt a calendar year. The

following trusts are exempt from this requirement.

•

A trust that is exempt from tax under section 501(a).

•

A charitable trust described in section 4947(a)(1).

•

A trust that is treated as wholly owned by a grantor under

the rules of sections 671 through 679.

Rounding Off to Whole Dollars

You may round off cents to whole dollars on the estate's or

trust's return and schedules. If you do round to whole dollars,

you must round all amounts. To round, drop amounts under

50 cents and increase amounts from 50 to 99 cents to the

next dollar. For example, $1.39 becomes $1 and $2.50

becomes $3.

If you have to add two or more amounts to figure the

amount to enter on a line, include cents when adding the

amounts and round off only the total.

If you are entering amounts that include cents, make sure

to include the decimal point. There is no cents column on the

form.

Estimated Tax

Generally, an estate or trust must pay estimated income tax

for 2024 if it expects to owe, after subtracting any withholding

and credits, at least $1,000 in tax, and it expects the

withholding and credits to be less than the smaller of:

1. 90% of the tax shown on the 2024 tax return (66

2

/3% of

the tax if the estate or trust qualifies as a farmer or

fisherman); or

2. 100% of the tax shown on the 2023 tax return (110%

of that amount if the estate's or trust's AGI on that return is

more than $150,000, and less than

2

/3 of gross income for

2023 and 2024 is from farming or fishing).

However, if a return was not filed for 2023 or that return

didn't cover a full 12 months, item 2 doesn't apply.

For this purpose, include household employment taxes in

the tax shown on the tax return, but only if either of the

following is true.

•

The estate or trust will have federal income tax withheld for

2024 (see the instructions for Schedule G, Part II, line 14).

•

The estate or trust would be required to make estimated

tax payments for 2024 even if it didn't include household

employment taxes when figuring estimated tax.

Exceptions

Estimated tax payments aren't required from:

1. An estate of a domestic decedent or a domestic trust

that had no tax liability for the full 12-month 2023 tax year;

2. A decedent's estate for any tax year ending before the

date that is 2 years after the decedent's death; or

3.

A trust that was treated as owned by the decedent if

the trust will receive the residue of the decedent's estate

under the will (or, if no will is admitted to probate, is the trust

primarily responsible for paying debts, taxes, and expenses

of administration) for any tax year ending before the date that

is 2 years after the decedent's death.

For more information, see Form 1041-ES, Estimated

Income Tax for Estates and Trusts.

Electronic Deposits

A financial institution that has been designated as an

authorized federal tax depository, and acts as a fiduciary for

at least 200 taxable trusts that are required to pay estimated

tax, is required to deposit the estimated tax payments

electronically using the Electronic Federal Tax Payment

System (EFTPS).

A fiduciary that isn't required to make electronic deposits

of estimated tax on behalf of a trust or an estate may

voluntarily participate in EFTPS. To enroll in or get more

information about EFTPS, go to

EFTPS.gov or call

800-555-4477. To contact EFTPS using Telecommunications

Relay Services (TRS) for people who are deaf, hard of

hearing, or have a speech disability, dial 711 and then

provide the TRS assistant the 800-555-4477 number above

or 800-733-4829. Also, see Pub. 966, Electronic Federal Tax

Payment System: A Guide to Getting Started.

Depositing on time. For a deposit using EFTPS to be on

time, the deposit must be submitted by 8:00 p.m. Eastern

time the day before the due date of the deposit.

Section 643(g) Election

Fiduciaries of trusts that pay estimated tax may elect under

section 643(g) to have any portion of their estimated tax

payments allocated to any of the beneficiaries.

The fiduciary of a decedent's estate may make a section

643(g) election only for the final year of the estate.

Make the election by filing Form 1041-T, Allocation of

Estimated Tax Payments to Beneficiaries, by the 65th day

after the close of the estate's or trust's tax year. Then, include

that amount in box 13, code A, of Schedule K-1 (Form 1041)

for any beneficiaries for whom it was elected.

If Form 1041-T was timely filed, the payments are treated

as paid or credited to the beneficiary on the last day of the tax

year and must be included as an other amount paid, credited,

or required to be distributed on Form 1041, Schedule B,

line 10. See the instructions for Schedule B, line 10, later.

Failure to make a timely election will result in the estimated

tax payments not being transferred to the beneficiary(ies)

even if you entered the amount on Schedule K-1.

See the instructions for Schedule G, Part II, line 11, for

more details.

Interest and Penalties

Interest

Interest is charged on taxes not paid by the due date, even if

an extension of time to file is granted.

Interest is also charged on penalties imposed for failure to

file, negligence, fraud, substantial valuation misstatements,

substantial understatements of tax, and reportable

transaction understatements. Interest is charged on the

10

Instructions for Form 1041 (2023)

Page 11 of 53 Fileid: … ions/i1041/2023/a/xml/cycle03/source 10:51 - 9-Jan-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

penalty from the due date of the return (including extensions).

The interest charge is figured at a rate determined under

section 6621.

Late Filing of Return

The law provides a penalty of 5% of the tax due for each

month, or part of a month, for which a return isn't filed up to a

maximum of 25% of the tax due (15% for each month, or part

of a month, up to a maximum of 75% if the failure to file is

fraudulent). If the return is more than 60 days late, the

minimum penalty is the smaller of $485 or the tax due.

The penalty won't be imposed if you can show that the

failure to file on time was due to reasonable cause. If you

receive a notice about penalty and interest after you file this

return, send us an explanation and we will determine if you

meet reasonable-cause criteria.

Don't attach an explanation

when you file Form 1041.

Late Payment of Tax

Generally, the penalty for not paying tax when due is

1

/2 of 1%

of the unpaid amount for each month or part of a month it

remains unpaid. The maximum penalty is 25% of the unpaid

amount. The penalty applies to any unpaid tax on the return.

Any penalty is in addition to interest charges on late

payments.

If you include interest on either of these penalties

with your payment, identify and enter these amounts

in the bottom margin of Form 1041, page 1. Don't

include the interest or penalty amount in the balance of tax

due on line 28.

Failure To Provide Information Timely

You must provide Schedule K-1 (Form 1041), on or before

the day you are required to file Form 1041, to each

beneficiary who receives a distribution of property or an

allocation of an item of the estate.

For each failure to provide Schedule K-1 to a beneficiary

when due and each failure to include on Schedule K-1 all the

information required to be shown (or the inclusion of incorrect

information), a $310 penalty may be imposed with regard to

each Schedule K-1 for which a failure occurs. The maximum

penalty is $3,783,000 for all such failures during a calendar

year. If the requirement to report information is intentionally

disregarded, each $310 penalty is increased to $630 or, if

greater, 10% of the aggregate amount of items required to be

reported, and no maximum penalty applies.

The penalty won't be imposed if the fiduciary can show

that not providing information timely and correctly was due to

reasonable cause and not due to willful neglect.

Underpaid Estimated Tax

If the fiduciary underpaid estimated tax, use Form 2210,

Underpayment of Estimated Tax by Individuals, Estates, and

Trusts, to figure any penalty. Enter the amount of any penalty

on Form 1041, line 27.

Trust Fund Recovery Penalty

This penalty may apply if certain excise, income, social

security, and Medicare taxes that must be collected or

withheld aren't collected or withheld, or these taxes aren't

paid. These taxes are generally reported on Forms 720, 941,

943, 944, or 945. The trust fund recovery penalty may be

imposed on all persons who are determined by the IRS to

TIP

have been responsible for collecting, accounting for, or

paying over these taxes, and who acted willfully in not doing

so. The penalty is equal to the unpaid trust fund tax. See the

Instructions for Form 720; Pub. 15 (Circular E), Employer's

Tax Guide; or Pub. 51 (Circular A), Agricultural Employer's

Tax Guide, for more details, including the definition of

responsible persons.

Other Penalties

Other penalties can be imposed for negligence, substantial

understatement of tax, and fraud. See Pub. 17, Your Federal

Income Tax, for details on these penalties.

Other Forms That May Be Required

Form W-2, Wage and Tax Statement, and Form W-3,

Transmittal of Wage and Tax Statements.

Form 56, Notice Concerning Fiduciary Relationship. You

must notify the IRS of the creation or termination of a

fiduciary relationship. You may use Form 56 to provide this

notice to the IRS.

Form 461, Limitation on Business Losses.

Form 706, United States Estate (and Generation-Skipping

Transfer) Tax Return; or Form 706-NA, United States Estate

(and Generation-Skipping Transfer) Tax Return, Estate of

nonresident not a citizen of the United States.

Form 706-GS(D), Generation-Skipping Transfer Tax

Return for Distributions.

Form 706-GS(D-1), Notification of Distribution From a

Generation-Skipping Trust.

Form 706-GS(T), Generation-Skipping Transfer Tax

Return for Terminations.

Form 709, United States Gift (and Generation-Skipping

Transfer) Tax Return.

Form 720, Quarterly Federal Excise Tax Return. Use Form

720 to report environmental excise taxes, communications

and air transportation taxes, fuel taxes, luxury tax on

passenger vehicles, manufacturers' taxes, ship passenger

tax, and certain other excise taxes.

See Trust Fund Recovery Penalty, earlier.

Form 926, Return by a U.S. Transferor of Property to a

Foreign Corporation. Use this form to report certain

information required under section 6038B.

Form 940, Employer's Annual Federal Unemployment

(FUTA) Tax Return. The estate or trust may be liable for FUTA

tax and may have to file Form 940 if it paid wages of $1,500

or more in any calendar quarter during the calendar year (or

the preceding calendar year) or one or more employees

worked for the estate or trust for some part of a day in any 20

different weeks during the calendar year (or the preceding

calendar year).

Form 941, Employer's QUARTERLY Federal Tax Return.

Employers must file this form quarterly to report income tax

withheld on wages and employer and employee social

security and Medicare taxes. Certain small employers must

file Form 944, Employer's ANNUAL Federal Tax Return,

instead of Form 941. For more information, see the

Instructions for Form 944. Agricultural employers must file

Form 943, Employer's Annual Federal Tax Return for

CAUTION

!

Instructions for Form 1041 (2023)

11

Page 12 of 53 Fileid: … ions/i1041/2023/a/xml/cycle03/source 10:51 - 9-Jan-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Agricultural Employees, instead of Form 941, to report

income tax withheld and employer and employee social

security and Medicare taxes on farmworkers.

See Trust Fund Recovery Penalty, earlier.

Form 945, Annual Return of Withheld Federal Income Tax.

Use this form to report income tax withheld from nonpayroll

payments, including pensions, annuities, IRAs, gambling

winnings, and backup withholding.

See Trust Fund Recovery Penalty, earlier.

Form 965-A, Individual Report of Net 965 Tax Liability.

Form 982, Reduction of Tax Attributes Due to Discharge of

Indebtedness (and Section 1082 Basis Adjustment).

Form 1040, U.S. Individual Income Tax Return.

Form 1040-NR, U.S. Nonresident Alien Income Tax

Return.

Form 1040-SR, U.S. Tax Return for Seniors.

Form 1041-A, U.S. Information Return Trust Accumulation

of Charitable Amounts.

Form 1042, Annual Withholding Tax Return for U.S.

Source Income of Foreign Persons; and Form 1042-S,

Foreign Person's U.S. Source Income Subject to Withholding.

Use these forms to report and transmit withheld tax on

payments or distributions made to nonresident alien

individuals, foreign partnerships, or foreign corporations to

the extent such payments or distributions constitute gross

income from sources within the United States that isn't

effectively connected with a U.S. trade or business. For more

information, see sections 1441 and 1442, and Pub. 515,

Withholding of Tax on Nonresident Aliens and Foreign

Entities.

Forms 1099-A, B, INT, LTC, MISC, NEC, OID, Q, R, S, and

SA. You may have to file these information returns to report

acquisitions or abandonments of secured property; proceeds

from broker and barter exchange transactions; interest

payments; payments of long-term care and accelerated

death benefits; miscellaneous income payments;

nonemployee compensation; original issue discount;

distributions from Coverdell ESAs; distributions from

pensions, annuities, retirement or profit-sharing plans, IRAs

(including SEPs, SIMPLEs, Roth IRAs, Roth Conversions,

and IRA recharacterizations), insurance contracts, etc.;

proceeds from real estate transactions; and distributions from

an HSA, Archer MSA, or Medicare Advantage MSA.

Also, use certain of these returns to report amounts

received as a nominee on behalf of another person, except

amounts reported to beneficiaries on Schedule K-1 (Form

1041).

Form 8275, Disclosure Statement. File Form 8275 to

disclose items or positions, except those contrary to a

regulation, that are not otherwise adequately disclosed on a

tax return. The disclosure is made to avoid parts of the

accuracy-related penalty imposed for disregard of rules or

substantial understatement of tax. Form 8275 is also used for

disclosures relating to preparer penalties for

understatements due to unrealistic positions or disregard of

rules.

CAUTION

!

CAUTION

!

Form 8275-R, Regulation Disclosure Statement, is used to

disclose any item on a tax return for which a position has

been taken that is contrary to Treasury regulations.

Form 8288, U.S. Withholding Tax Return for Certain

Dispositions by Foreign Persons; and Form 8288-A,

Statement of Withholding on Certain Dispositions by Foreign

Persons. Use these forms to report and transmit withheld tax

on the sale of U.S. real property by a foreign person. Also,

use these forms to report and transmit tax withheld from

amounts distributed to a foreign beneficiary from a “U.S. real

property interest account” that a domestic estate or trust is

required to establish under Regulations section 1.1445-5(c)

(1)(iii).

Form 8300, Report of Cash Payments Over $10,000

Received in a Trade or Business. Generally, this form is used

to report the receipt of more than $10,000 in cash or foreign

currency in one transaction (or a series of related

transactions).

Form 8855, Election To Treat a Qualified Revocable Trust

as Part of an Estate. This election allows a QRT to be treated

and taxed (for income tax purposes) as part of its related

estate during the election period.

Form 8865, Return of U.S. Persons With Respect to

Certain Foreign Partnerships. The estate or trust may have to

file Form 8865 if it:

1. Controlled a foreign partnership (that is, owned more

than a 50% direct or indirect interest in a foreign partnership);

2. Owned at least a 10% direct or indirect interest in a

foreign partnership while U.S. persons controlled that

partnership;