11.4.2

Phoenix Life Limited

Principles and Practices of

Financial Management

January 2024

PLL PPFM Page 1 January 2024

Phoenix Life Limited

Principles and Practices of Financial Management

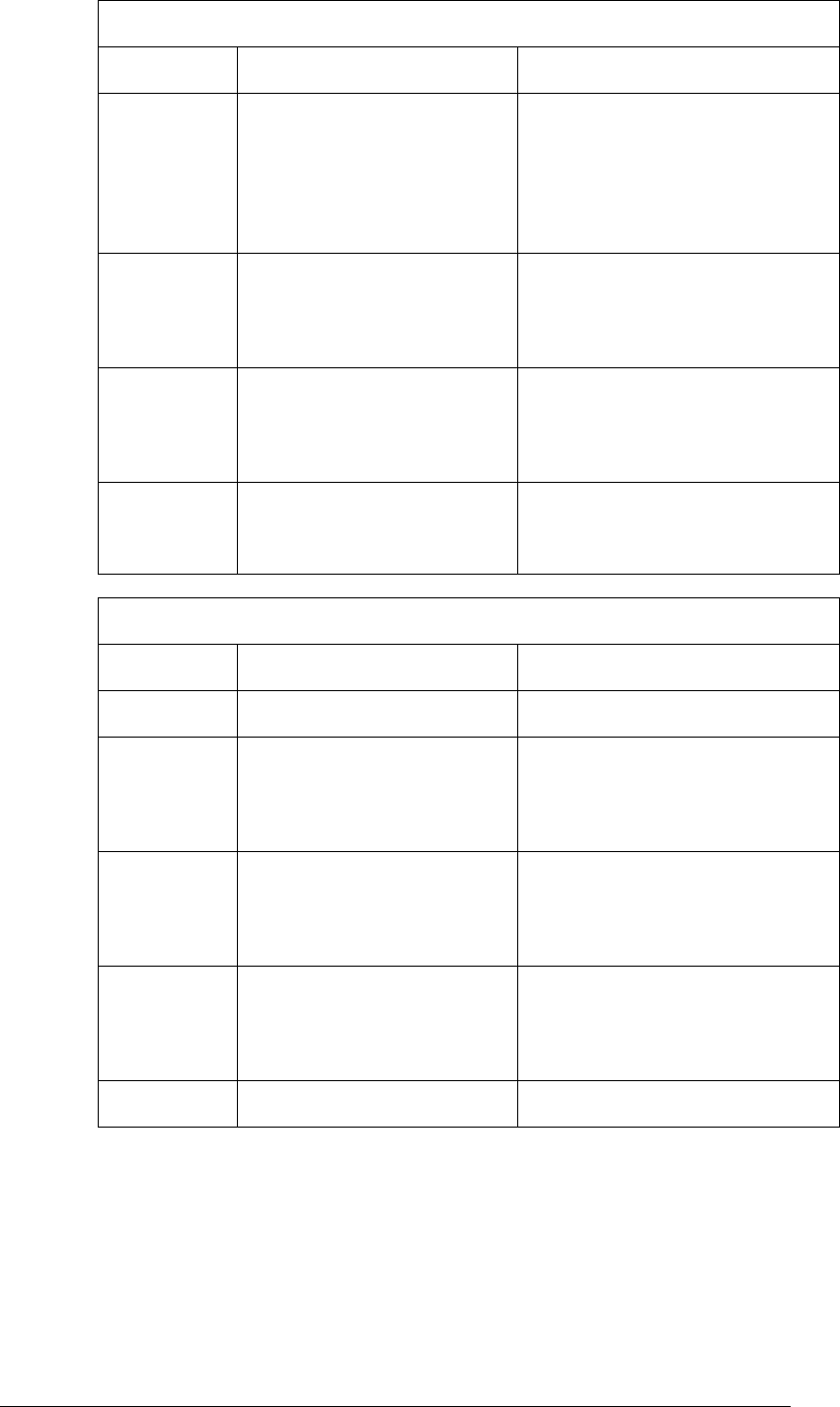

Contents

Page

Introduction and Background

1. Introduction 3

2. Background to Principles and Practices of 6

Financial Management

3. Company Background 8

4. Key Concepts of With-Profits Business 15

Principles and Practices of Financial Management

5. Guiding Principles and Practices 22

6. Principles and Practices – 90% With-Profits Fund 30

7. Principles and Practices – 100% With-Profits Fund 68

8. Principles and Practices – Alba With-Profits Fund 99

9. Principles and Practices – Britannic With-Profits Fund 130

10. Principles and Practices – Britannic Industrial Branch Fund 170

11. Principles and Practices – Phoenix With-Profits Fund 197

12. Principles and Practices – Scottish Mutual With-Profits Fund 230

13. Principles and Practices – SPI With-Profits Fund 262

14. Principles and Practices – SAL With-Profits Fund 294

15. Principles and Practices – Pearl With-Profits Fund 333

16. Principles and Practices – SERP Fund 367

17. Principles and Practices – London Life With-Profits Fund 382

18. Principles and Practices – National Provident Life With-Profits Fund 410

With-Profits Governance Arrangements

19. With-Profits Governance Arrangements 435

Appendices

1. Glossary 437

2. Historic Information 445

PLL PPFM Page 2 January 2024

3. History of Principles and Practices of 450

Financial Management for Phoenix Life Limited

PLL PPFM Page 3 January 2024

1. Introduction

This document sets out the Principles and Practices of Financial Management applied in

managing the with-profits business of Phoenix Life Limited as at 1 January 2024. Although

Phoenix Life Limited contains policies originally issued by Standard Life Assurance Limited,

this document is aimed at holders of policies that were not originally issued by Standard Life

Assurance Limited and there are separate documents for the Standard Life policies.

Phoenix Life Limited’s assets are divided between a large long-term business fund and a

much smaller Shareholder Fund. The long-term business fund is internally segregated into

18 funds:

• the 90% With-Profits Fund;

• the 100% With-Profits Fund;

• the Alba With-Profits Fund;

• the Britannic With-Profits Fund;

• the Britannic Industrial Branch Fund;

• the Phoenix With-Profits Fund;

• the Scottish Mutual With-Profits Fund;

• the SPI With-Profits Fund;

• the SAL With-Profits Fund;

• the Pearl With-Profits Fund;

• the SERP With-Profits Fund;

• the London Life With-Profits Fund;

• the National Provident Life With-Profits Fund;

• the Heritage With-Profits Fund;

• the UK Smoothed Managed With-Profits Fund;

• the German With-Profits Fund;

• the German Smoothed Managed With-Profits Fund; and

• the Non-Profit Fund.

With-profits business is contained in each of the first 17 funds listed above. The Board is

responsible for managing the with-profits business in most of these funds, including setting

bonuses. The With-Profits Committee is responsible for setting investment and bonus policy

for the SPI With-Profits Fund and National Provident Life With-Profits Fund only.

This Principles and Practices of Financial Management also applies to the participating Irish

business which transferred under the 2022 Scheme to Phoenix Life Assurance Europe dac

(PLAE) and was reinsured back to Phoenix Life Limited (see appendix 2 for more detail).

Unless specifically stated otherwise, where we talk about ‘policies’ in this document we mean

both policies that participate directly in the Phoenix Life Limited funds and policies that

participate in the funds via reinsurance.

Separate documents are maintained for the Principles and Practices of Financial

Management for the with-profits funds that were previously part of Standard Life Assurance

Limited. These are the:

• the Heritage With-Profits Fund;

• the UK Smoothed Managed With-Profits Fund;

• the German With-Profits Fund; and

• the German Smoothed Managed With-Profits Fund.

This also applies to participating European business which transferred to Standard Life

International dac (SLIntl) and was reinsured back to Standard Life Assurance Limited.

The rest of this document is applicable only for the funds listed in sections 6 to 18 and the

term with-profits funds means the with-profits funds of Phoenix Life Limited excluding those

that were previously part of Standard Life Assurance Limited.

PLL PPFM Page 4 January 2024

The Principles and Practices of Financial Management:

• is used in the governance of the with-profits business within the with-profits funds of

Phoenix Life Limited by the Board and the With-Profits Committee, with particular regard to

the use of discretion in managing the with-profits funds; and

• provides information on the possible risks and rewards associated with a with-profits policy

within a particular with-profits fund.

The Principles and Practices of Financial Management is prepared in accordance with

Section 20.3 of the Conduct of Business Sourcebook which forms part of the Handbook

issued by the Financial Conduct Authority (FCA).

These Principles and Practices have been drawn up in accordance with the law and

regulation as Phoenix Life Limited understands it as at 1 January 2024. Should this

understanding prove to have been incorrect, for example as a result of a court or regulatory

ruling with retrospective effect, the Principles and Practices will be amended to comply and

will be applied as if they had always been so amended.

Section 2 gives more details about the background to Principles and Practices and how and

when they can be changed. Appendix 3 gives details of changes to this document since

1 January 2007.

Section 3 provides some background information on Phoenix Life Limited and its with-profits

funds. Appendix 2 gives details of the historic schemes of transfer.

Section 4 introduces the key concepts of with-profits business and types of with-profits

business. This information is key to understanding the management of the with-profits funds.

Section 5 documents the guiding principles and practices adopted in managing the with-

profits business of Phoenix Life Limited. These guiding principles apply to all the with-profits

funds and in the event of conflict with other principles take priority.

Sections 6 to 18 document the principles and practices adopted in each of the with-profits

funds. Nothing in any of these sections should be inferred as applying to any other fund

unless explicitly stated.

Section 19 documents the with-profits governance arrangements.

A glossary of terms and a summary of abbreviations used in the document are given in

Appendix 1. Words that are defined in the glossary appear in italics in the main text.

Sections 1 to 4 and 19 of this document and the Appendices are background or explanatory

material and therefore neither principles nor practices for the purpose of the FCA rules.

None of the contents of this document forms part of, or varies, the terms or conditions of any

policy under which Phoenix Life Limited is the insurer. In the event of any inconsistency

between the contents of this document and any policy, the terms and conditions of the policy

prevail (except where overridden by a court order).

This document is intended to assist knowledgeable observers to understand the way in which

the with-profits business of the Phoenix Life Limited with-profits funds is conducted and the

material risks and rewards involved in effecting or maintaining a with-profits policy in a fund.

It is not a comprehensive explanation either of the management of the with-profits business of

a fund or of the other funds within Phoenix Life Limited or of every matter which may affect

the business. In addition, no part of the document should be read as a recommendation to

policyholders or potential policyholders or their advisers in relation to the effecting or

maintaining of a with-profits policy. Accordingly, any person considering whether to effect or

maintain a with-profits policy within a fund should seek independent financial advice.

When referring to with-profits policies, with-profits business accepted by Phoenix Life Limited

under reassurance agreements is included for the purposes of determining the amount

PLL PPFM Page 5 January 2024

payable to the reassuring company. However, the benefits payable to the with-profits

policyholders of the reassuring company are the responsibility of that company, and not

Phoenix Life Limited.

Statements in this document in relation to the risks and rewards involved in effecting and

maintaining a with-profits policy in a fund are by their nature forward-looking statements that

are subject to a variety of uncertainties. Readers of this document should read such forward-

looking statements in that context.

The contents of this document may change as the circumstances of Phoenix Life Limited and

the business environment change. The document may also change to reflect changes made

by Phoenix Life Limited to the management of its with-profits business. Phoenix Life Limited

intends to give notice of some changes as explained in section 2 of this document, other

changes will be made without notice.

Readers of this document should be aware that reading only selected sections or paragraphs

in isolation may result in a misleading impression of the way in which the with-profits business

of the funds is conducted and the material risks and rewards involved in effecting and

maintaining a with-profits policy with the funds. The principles set out in this document and

their associated practices should in particular be read together.

Phoenix Life Limited is authorised by the Prudential Regulation Authority (PRA) and regulated

by the FCA and PRA.

PLL PPFM Page 6 January 2024

2. Background to Principles and Practices of Financial Management

2.1 Principles and Practices

2.1.1 The principles:

• are enduring statements of the overarching standards adopted by Phoenix Life

Limited in managing the with-profits funds; and

• describe the business model used by Phoenix Life Limited in meeting its duties

to with-profits policyholders in the funds and in responding to longer-term

changes in the business and economic environment.

The principles are divided into guiding principles which apply to all the with-profits

funds (and are described in section 5) and other principles, which apply to a

particular with-profits fund (and are described in sections 6 to 18).

2.1.2 The practices set out how the principles are implemented:

• describe Phoenix Life Limited’s approach to managing the funds and to

responding to changes in the business and economic environment in the

shorter-term; and

• contain sufficient detail to enable a knowledgeable observer to understand the

material risks and rewards from effecting or maintaining a with-profits policy in

the funds.

There are practices associated with each principle and these are set out below

each principle.

2.2 Demonstrating Compliance with Principles and Practices

2.2.1 The Board produces an annual report addressed to with-profits policyholders

within six months of the financial year end. This report covers Phoenix Life

Limited’s compliance with its Principles and Practices of Financial Management

and significant matters where discretion has been exercised, in particular where

such matters relate to the competing or conflicting interests of policyholders and

shareholders. Policyholders will normally be advised of the report as part of their

next annual statement. The report is made available to policyholders on our

website.

2.2.2 An annual report for the Board is produced by the With-Profits Actuaries on key

aspects of the discretion exercised in respect of each fund (including the

application of its Principles and Practices of Financial Management).

2.3 Amendments to the Principles

2.3.1 The principles are not expected to change often. However Phoenix Life Limited

may amend any of the principles at any time. Any change will follow formal

consultation with and take into account the opinions of the Chief Actuary, the With-

Profits Actuary and the With-Profits Committee. Any changes to the principles will

be approved by the Board.

2.3.2 Policyholders will normally be provided with three months written notice in

advance of any changes to the principles. The written notice will set out any

proposed changes to the principles.

PLL PPFM Page 7 January 2024

2.3.3 The circumstances and reasons normally leading to such amendments to the

principles are likely to include:

• changes in regulations;

• to improve the management of the with-profits funds;

• maintaining equity between classes or groups of policyholders; and

• significant changes in the financial condition of Phoenix Life Limited.

2.4 Amendments to the Practices

2.4.1 The practices are expected to change as Phoenix Life Limited’s circumstances

and the business environment change. Any change will follow formal consultation

with and take into account the opinions of the Chief Actuary, the With-Profits

Actuary and the With-Profits Committee. Any material changes to the practices

will be approved by the Board.

2.4.2 The FCA will be provided with details of any material changes.

2.4.3 Policyholders will not be provided with any advance notification of changes to the

practices, although they will be informed within a reasonable period after any

material changes have been made. This notification will normally be with the next

annual statement.

2.5 Summary of Amendments Made to Phoenix Life Limited’s Principles and

Practices of Financial Management

2.5.1 The Principles and Practices of Financial Management will normally be displayed

on the www.phoenixlife.co.uk internet site and the version displayed on the

internet site will normally be updated shortly after any changes have been

implemented.

2.5.2 Appendix 3 gives details of amendments previously made to the Principles and

Practices of Financial Management since 1 January 2007.

2.6 With-Profits Governance Arrangements

2.6.1 The with-profits governance arrangements are described in section 19.

PLL PPFM Page 8 January 2024

3. Company Background

3.1 Company History and Group Structure

3.1.1 Phoenix Life Limited as it is currently constituted is the result of a series of

previous business transfers. The most recent business transfer was in 2023 and

the provisions of the court scheme used to effect that transfer (the 2023 Scheme)

replaced those of previous schemes to which Phoenix Life Assurance Limited,

Phoenix Life Limited and Standard Life Assurance Limited were party.

However, both the 2022 Scheme between Phoenix Life Limited and Phoenix Life

Assurance Europe dac and the 2019 Scheme between Standard Life Assurance

Limited and Standard Life International dac remain in operation.

The 2023 Scheme became effective on its transfer date, 27 October 2023. Full

details of the past court schemes and other events are set out in Appendix 2.

3.1.2 The 2023 Scheme amended the closure provisions for each of the with-profits

funds listed in Appendix 2 A2.23. Closure can occur when the with-profits policy

liabilities fall below £10m (subject to annual indexation using RPI from the transfer

date) in the case of the 90% With-Profits Fund and the 100% With-Profits Fund or

below £50m (subject to annual indexation using RPI from the transfer date) in all

other cases. Upon the closure date policies may be

• transferred to the Non-Profit Fund and with-profits policies will be converted to

non-profit with a schedule of future guaranteed bonus additions, or

• transferred to the Non-Profit Fund and with-profit policies converted to unit-

linked policies investing in unit linked funds,

• transferred to another with-profits fund, or

• a combination of these.

Closure will only occur if the Board concludes, having taken advice from the

relevant With-Profits Actuaries and the With-Profits Committee, that closing the

With-Profits Fund is fair and in the best interests of policyholders of the relevant

With-Profits Fund.

Where a ‘may terminate’ point has been passed for any with-profits fund but the

decision is taken not to close the fund, the Board will state this fact along with any

relevant explanation in its annual report to with-profits policyholders.

On the closure of a with-profits fund with reinsured Irish business from PLAE, the

reinsurance will terminate and PLAE will use the termination amount it receives to

set up benefits in the PLAE Non-Profit Fund.

3.1.3 In accordance with the 2023 Scheme Phoenix Life Limited continues to have the

right to re-allocate any non-profit policy in any of the with-profits funds of Phoenix

Life Limited to the Non-Profit Fund provided that:

• such re-allocation is not contrary to the terms of the policy, and has been

approved by the With-Profits Committee; and

• in the opinion of the Board, having obtained appropriate actuarial advice,

assets:

• with a market value which is fair and equitable (in the context of the risks

being re-allocated to the Non-Profit Fund in respect of the policy); or

• with a market value which is consistent with an amount (where such an

amount can be calculated) that Phoenix Life Limited would have charged

in consideration of the assumption of the risk in respect of a new policy

which it issued on the same terms as the policy to be re-allocated from the

relevant with-profits fund to the Non-Profit Fund (subject to appropriate

adjustment to reflect differences in expenses or commission incurred),

PLL PPFM Page 9 January 2024

are being transferred or re-allocated from the relevant with-profits fund to the

Non-Profit Fund.

In respect of the SPI With-Profits Fund, separate provisions apply in relation to the

provision of non-profit annuities (including non-profit deferred annuities). For

these, the assets transferred from the SPI With-Profits Fund to the Non-Profit

Fund shall be based on the annuity rates being used by Phoenix Life Limited or

any other authorised insurer in the Phoenix Group or, if unavailable, on rates

consistent with those generally available in the market. If the With-Profits Actuary

considers that the amount that would be transferred exceeds that which is

reasonable based on the rates generally available in the market, then they may

recommend that the annuity benefit be provided from the SPI With-Profits Fund

and the With-Profits Committee shall have the right to require that the annuity

benefit be provided from the SPI With-Profits Fund or not.

3.1.4 The 2023 Scheme also includes provisions relating to the workings of the funds,

the allocation of tax, the shareholders share of surplus, and investment and bonus

policy. These have been incorporated into this document.

In particular, in relation to the investment policy, the provisions continue to allow

further hypothecation of the assets in the with-profits funds where this would not

be inappropriate having regards to the interests of relevant policyholders. For

example this may involve the matching of non asset share liabilities more

accurately, the hypothecation of different equity (and property) backing ratios to

further classes or groups of policies or through the hypothecation of fixed interest

assets by term remaining within asset shares to reduce the volatility of

policyholder returns near maturity.

3.1.5 The Buffer Reserve as described in sections 9 and 10 and appendix 2 continues

under the 2023 Scheme.

3.1.6 As a consequence of the 2023 Scheme the Principles and Practices of Financial

Management was updated. Changes were made to incorporate any changes in

the 2023 Scheme.

3.2 Capital Policy

3.2.1 The 2023 Scheme provides for Phoenix Life Limited to maintain a specific capital

policy.

3.2.2 The capital policy seeks to ensure that the company would be able to withstand a

number of internally specified stress scenarios.

3.2.3 The capital policy also seeks to ensure that each with-profits fund has sufficient

assets to meet its liabilities. Section 3.3 describes to the capital support available

to with-profits funds.

3.2.4 Under the requirements of the 2023 Scheme Phoenix Life Limited must

• hold sufficient assets to satisfy the Scheme Capital Quantity and Scheme

Capital Quality tests, and

• conduct its business so that there is no significant foreseeable risk that a

Capital Event arises and requires actions to be taken in its With-Profits Funds

(that would not be in accordance with the 2023 Scheme).

3.2.5 The Scheme Capital Quantity Test states that Phoenix Life Limited must hold

sufficient assets in excess of liabilities to:

• meet its Solvency Capital Requirement (SCR) in internally specified scenarios

consistent with the Board’s risk appetite, and

• in those stress scenarios, provide any support needed by With-Profits Funds

in accordance with section 3.3.

PLL PPFM Page 10 January 2024

3.2.6 The risk appetite for the purpose of the Scheme Capital Quantity Test is specified

as a ‘less than 1-in-10 chance of failing to meet its SCR in one year’ but this can

be changed from time to time as described in 3.2.12.

3.2.7 The Scheme Capital Quality Test states that Phoenix Life Limited shall hold assets

in the Non-Profit Fund and the Shareholder Fund such that in stress scenarios

considered appropriate by the Board, Phoenix Life Limited can:

• maintain compliance of the Matching Adjustment Fund with the relevant

Solvency II regulations, and

• meet anticipated liquidity demands that would arise in those stress scenarios

including provision of support to with-profits funds as contemplated in section

3.3 below in the form of assets that would be appropriate for the with-profits

funds to hold.

3.2.8 If, in the reasonable opinion of the Board (having regard to the advice of the Chief

Actuary), a capital event arises, Phoenix Life Limited shall identify and take actions

that, in the reasonable opinion of the Board (having regard to the advice of the

Chief Actuary) are necessary for Phoenix Life Limited to cease to experience a

capital event. For the London Life With-Profits Fund there are historic scheme

requirements to be met before interventions can be made. For the SPI With-

Profits Fund and National Provident Life With-Profits Fund the Board does not

have powers to take such actions as this is a matter for the With-Profits

Committee.

3.2.9 Phoenix Life Limited shall not take any actions that would result in the business of

each with-profits fund not being conducted in accordance with the Scheme

Principles of Financial Management of the 2023 Scheme, unless the Board

considers that the actions otherwise permitted would be insufficient for the capital

event to cease.

3.2.10 Where this is the case, Phoenix Life Limited may take additional actions that would

result in the business of a with-profits fund not being conducted in accordance with

the 2023 Scheme provided that

• in the reasonable opinion of the Board (having regard to the advice of the

Chief Actuary and the relevant With-Profits Actuaries), such actions treat

policyholders fairly and are only taken to the extent that they are necessary

after taking into account the actual and/or expected impact of the actions

permitted under 3.2.9 and

• such actions shall be limited to changing the asset mix for with-profits policies

allocated or reinsured to that with-profits fund, as necessary for Phoenix Life

Limited to cease to experience a capital event.

3.2.11 Phoenix Life Limited shall notify the regulators as soon as reasonably practicable

after it has determined that a capital event has occurred or is reasonably likely to

occur.

3.2.12 The 2023 Scheme provides that the Board may change the Scheme Capital

Quantity Test and/or the Scheme Capital Quality Test in order to reflect a change

to the risk appetite or stress scenarios which the Board has set for Phoenix Life

Limited as a whole.

To the extent that a change in risk appetite would have the effect of reducing the

amount of assets required to be held by Phoenix Life Limited under the Scheme

Capital Quantity Test, Phoenix Life Limited shall be required to obtain a certificate

from an independent actuary to the effect that, in their opinion, the proposed

changes to the Scheme Capital Quantity Test are unlikely to have a material

adverse effect on the interests of the holders of policies of Phoenix Life Limited

overall.

PLL PPFM Page 11 January 2024

3.2.13 A Capital Event arises if Phoenix Life Limited is unduly exposed to a risk of being

unable to meet its SCR, or its capital needs (as determined in accordance with

regulatory requirements to be adequate, both as to amount and quality, to ensure

that there is no significant risk that its liabilities cannot be met as they fall due).

3.3 Capital Support

In the unlikely event that the with-profits asset value of any of the with-profits funds

falls below (or is likely to fall below) the threshold amount for that fund, support will

be provided to that fund by way of a loan or other contribution arrangement from

the Non-Profit Fund or the Shareholder Fund to the extent that the Board

determines there are assets in those funds available to make such a loan.

The loan would be repayable with the approval of the Board if the with-profits

asset amount is more than the threshold amount.

Whether or not interest would be payable by the fund on any loan received, and

the interest rate payable if applicable, will vary depending on the with-profits fund

receiving the loan.

The terms for any such loan (including the rate of return and the manner of

repayment) will be determined as the Board thinks fit, provided that the relevant

With-Profits Actuary has certified to the with-profits committee that the terms of

such arrangements are, in the opinion of the relevant With-Profits Actuary, no less

favourable than arm’s length commercial terms and will not detrimentally affect the

reasonable expectation of the holders of with-profits policies in the relevant with-

profits fund.

In the event that any of the with-profits funds cannot meet its regulatory capital

requirements from its own resources, the With-Profits Committee can recommend,

or in the case of the SPI With-Profits Fund request, that the Board holds additional

capital in the Non-Profit Fund or the Shareholder Fund to meet any shortfall. To

the extent that the Board does not or cannot make sufficient assets available, then

it will be necessary to take other actions within the relevant with-profits fund to

ensure that it can meet its regulatory capital requirements from its own capital

resources.

This document does not cover the capital support agreements in respect of the

former Standard Life Assurance Limited business.

3.4 Main inter fund agreements – risk transfer arrangements

3.4.1 This document does not cover any of the internal arrangements in respect of the

former Standard Life Assurance Limited business.

3.4.2 The Britannic With-Profits Fund transfers the unit-linked liability and associated

expense risk under most unitised life and pensions business to the Non-Profit

Fund.

3.4.3 The Phoenix With-Profits Fund transfers the unit liability for non-profit unit-linked

policies and certain expense risks to the Non-Profit Fund.

3.4.4 The Non-Profit Fund transfers certain mortality risks associated with Progressive

Protection Plan, Fair Share Whole Life and Linkplan to the Phoenix With-Profits

Fund.

3.4.5 The Non-Profit Fund transfers the With-Profits Performance Fund and With-Profits

Pension Fund element of former Alba Life former Crusader policies invested in

these notional funds to the Alba With-Profits Fund.

PLL PPFM Page 12 January 2024

3.4.6 The Non-Profit Fund transfers the Pension With-Profits Fund element of former

Swiss Life personal pension plan and free standing AVC policies to the 90% With-

Profits Fund.

3.4.7 The Non-Profit Fund transfers the unitised with-profits and smoothed return

business investment and guarantee risks of former Scottish Mutual Assurance

Limited business to the Scottish Mutual With-Profits Fund.

3.4.8 The Non-Profit Fund transfers the unitised with-profits investment and guarantee

risks and unit-linked guaranteed annuity option risk in respect of former Scottish

Provident Limited business to the SPI With-Profits Fund.

3.4.9 With-profits liabilities of unitised with-profits pensions and capital account policies

originally issued by NPI are fully reinsured on original terms from the Phoenix Life

Limited Non-Profit Fund to the Pearl With-Profits Fund.

3.4.10 The SPI With-Profits Fund transfers some of the expense risks under traditional

with-profits business to the Non-Profit Fund.

3.4.11 The 90% With-Profits Fund transfers the expense risks under the ex Swiss with-

profits business to the Non-Profit Fund other than in the event of major regulatory

change.

3.4.12 The SAL With-Profits Fund transfers the risks of the unitised with-profits bonds

written between October 1997 and December 1998, and the unitised with-profits

pensions (excluding the final salary unitised with-profits group pension policies)

into the Phoenix With-Profits Fund.

3.4.13 The SAL With-Profits Fund transfers the risks of some of the with-profits life

endowments written after September 1988 (‘Endowment Assurance’, ‘Economy

Mortgage Plan’, ‘Economy Plan’ and ‘Moneymaker’) to the 100% With-Profits

Fund.

3.4.14 The SAL With-Profits Fund transfers the risks of the property linked liabilities to the

Non-Profit fund.

3.4.15 The Pearl With-Profits Fund transfers the unit liability for non-profit unit-linked

policies and certain expense risks to the Non-Profit Fund.

3.4.16 The National Provident Life With-Profits Fund transfers the liability for certain

unitised with-profits investment known as Portfolio Bond to the Pearl With-Profits

Fund.

3.4.17 The London Life With-Profits Fund reinsures the basic and bonus annuity

payments for the Secure Pension Plus with-profits annuity to the Pearl With-Profits

Fund.

3.4.18 Annuity payments for pre 1 January 2000 pension annuities are reinsured from the

National Provident Life With-Profits Fund to the Pearl With-Profits Fund.

3.4.19 Unitised with-profits element of Portfolio and Investment Bonds originally issued by

NPI are reinsured from the Phoenix Life Limited Non-Profit fund to the Pearl With-

Profits Fund.

3.4.20 The unit-linked liabilities for policies in the National Provident Life With-Profits

Fund are reassured to the Non-Profit Fund.

PLL PPFM Page 13 January 2024

3.5 Main intra group agreements

3.5.1 This document does not cover any of the intra group arrangements in respect of

the former Standard Life Assurance Limited business.

3.5.2 Phoenix Life Limited has agreements with Phoenix Group Management Services

(PGMS) to provide management services to the with-profits funds.

3.5.3 Phoenix Life Assurance Europe dac reinsures its with-profits business into

Phoenix Life Limited.

3.6 Other significant arrangements

3.6.1 There are agreements between PGMS and Diligenta Limited, under which PGMS

sub-contracts to Diligenta some of the services it provides for policies in the with-

profits funds.

3.6.2 Where PGMS provide services to Phoenix Life Limited but have in turn outsourced

provision of those services to other providers, PGMS still retains responsibility for

providing all services, even in the event of a failure of these other providers.

Should PGMS be unable to meet any of its obligations to provide services then

Phoenix Life Limited would request that Phoenix Group, as owners of PGMS step

in to restore the position. Should Phoenix Group not do this, then Phoenix Life

Limited would attribute any losses to the shareholder fund or Non-Profit Fund, and

the with-profits funds would only be affected if the shareholder fund or Non-Profit

Fund had insufficient excess assets to bear the losses.

3.6.3 Phoenix Life Limited uses its investment managers to provide investment

management services for the with-profits funds, either directly or via collective

investment structures. Different investment managers may be used for the

different types of investments. The fees payable by Phoenix Life Limited under

this agreement vary for each with-profits fund depending on asset mix. The

investment management arrangements can typically be terminated with three

years notice or six months if the underperformance termination clause is invoked.

3.6.4 There is an agreement with HSBC under which HSBC provides accounting and

other administrative services in relation to the investments.

3.7 Management services agreements

3.7.1 This document does not cover any of the management services agreements in

respect of the former Standard Life Assurance Limited business.

3.7.2 The agreements provide specified policy and corporate administration services

associated with business as usual activity in return for specified charges, based on

unit charges and policy volumes. The unit charges are subject to annual

increases linked to movements in an external index, such as the Retail Prices

Index (RPI) or National Average Earnings Index (NAE).

3.7.3 There are additional activities that the service provider will provide on request to

Phoenix Life Limited. These are charged on different bases, usually related to the

actual costs incurred by the service provider.

3.7.4 Costs associated with day to day administrative problems are borne by the service

provider. Compensation costs for pensions review and mortgage endowment

reviews remain with Phoenix Life Limited, whilst the costs for undertaking these

reviews are met by either Phoenix Life Limited or the service provider, depending

on the cause and the terms of each agreement.

PLL PPFM Page 14 January 2024

3.7.5 Most agreements are for a set period with the option to review and continue at the

end of the period. The extent to which unit charges can or will change on any

review are specified in each agreement. The exception to this is the contract

between Phoenix Life Limited and PGMS. In respect of the former Phoenix

Assurance Limited, Bradford, Phoenix Life & Pensions, Scottish Mutual, Scottish

Provident business and Phoenix & London Assurance Limited business, it is a

perpetual agreement and in respect of the former Swiss Life and Pearl business it

is also a perpetual agreement but under which the charges may be amended in

the event of major regulatory change. It is also a perpetual agreement in respect

of most of the former Britannic Assurance unitised with-profits life and pension

business.

3.7.6 Termination rights are provided based only on certain specific events (such as

material or persistent breach, persistent failure to meet service standards,

insolvency).

3.7.7 Service levels and performance under the management services agreements are

regularly reviewed.

PLL PPFM Page 15 January 2024

4 Key Concepts of With-Profits Business

4.1 Workings of a With-Profits Fund

Each with-profits fund in Phoenix Life Limited is operated as a stand-alone fund.

This means that on the whole, the policyholders of one fund are not affected by

the state or operation of another fund. This is described in more detail in section

5.

The premiums paid in respect of each policy go into the fund, which is then used

to pay out the policy benefits as defined in the policy conditions. The costs of

managing the fund and tax are paid out of the fund, together with an amount each

year to the shareholders, where applicable. The fund is invested in a variety of

different types of investments and the return earned on these investments

increases or decreases the value of the fund.

In order to help the Board (or the With-Profits Committee in the case of the SPI

With-Profits Fund) to determine the level of bonuses to pay and the fair distribution

of any surplus arising, asset shares are generally calculated. More details are

given in section 4.3.

The fund is subject to a number of inherent risks that arise from a range of factors,

including product design (for example the provision of guarantees to

policyholders), selling and marketing practices, interest rate and market

fluctuations and demographic changes. Phoenix Life Limited makes provisions

which it considers to be appropriate for the risks which it identifies in relation to the

business within each fund. There can be no assurance that all risks which might

emerge have been identified nor that the provisions for identified risks will prove to

be adequate. In addition, the risks to which the fund is exposed inevitably change

over time.

4.2 Types of With-Profits Business

There are two main types of with-profits business – traditional and unitised.

Details of some of the common features of these are given below. Not all with-

profits funds contain all the different types of contract and there are also additional

types of with-profits business such as smoothed return and deposit administration

business. Within Phoenix Life Limited there are many different types of policies,

some of which may operate differently or may have particular or special features,

not all of which are referred to below.

4.2.1 Traditional With-Profits Business

Policies are eligible to participate in the distribution of surplus in the fund by the

addition of annual and final bonuses.

Policies can be written as life or pension policies.

Life policies include endowment assurances and whole life policies.

Pension policies include retirement annuity policies where the benefit is in the form

of an annuity payable from the selected retirement age and endowment type

policies where the benefit is in the form of a cash sum at the selected retirement

age. Endowment type policies may have an option to convert the cash sum into

annuity benefits on fixed terms. For pension business on earlier death premiums

are refunded either with or without interest, an early termination value may be paid

or there may be no benefit paid, depending on the terms and conditions of the

policy.

PLL PPFM Page 16 January 2024

For life policies, the benefit payable at maturity (for endowment assurances) or on

death (or, if applicable, terminal illness or critical illness) includes:

• a guaranteed amount, the sum assured;

• annual bonuses, which may be added to each year as part of the annual bonus

declaration and which increase the guaranteed benefit; and

• final bonus, which may be added on death (or, if applicable, terminal illness or

critical illness) or maturity claims.

Some endowment assurances have an additional sum assured that is payable on

death before maturity but this is not eligible for bonuses. Some endowment

assurances have a guaranteed minimum death benefit which is a minimum

amount of benefit payable on death (but not on maturity). This guaranteed

minimum death benefit is not eligible for bonuses.

For pension policies, the benefit at selected retirement age includes:

• a guaranteed amount, the basic annuity or a sum that will be used to purchase

an annuity at retirement;

• annual bonuses, which may be added to each year as part of the annual bonus

declaration and which increase the guaranteed benefit; and

• final bonus, which may be added on retirement (either increasing the annuity

payable or increasing the cash sum available to purchase an annuity

depending on the type of policy).

A proportion can be taken as a lump sum and the rest of the benefit being a

reduced annuity or being used to purchase an annuity.

The death benefit for pension policies does not participate in bonuses unless the

benefit is based on the early termination value.

At retirement, when the annuity comes into payment, the policy becomes non-

profit and may be transferred to the Non-Profit Fund subject to the conditions in

paragraph 3.1.3 or may remain in the relevant with-profits fund. Reinsured Irish

business would be transferred to the PLAE Non-Profit Fund or remain in the

relevant PLAE with-profits fund.

For both life and pension policies, to receive the benefit, regular premiums must

be maintained except for some whole of life assurances where premiums are

designed to cease at a specified age, and some policies paid by a single premium.

Otherwise if premiums cease and certain criteria (that are explained in the terms

and conditions of each policy) have been met:

• a surrender value may be paid or a transfer value may be paid to another

pension provider; or

• the policy will be made paid up and the benefits due at maturity, retirement or

earlier death will be reduced. Depending on the policy terms, future bonuses

may or may not be added.

If the criteria are not met, then the policy will lapse with no value.

Traditional with-profits business is sometimes referred to as conventional with-

profits business.

4.2.2 Life Regular Premium Unitised With-Profits Business

A proportion of each premium less charges buys with-profits units and, where

annual bonus is declared, either:

• the price of the with-profits units increases at the daily equivalent of the current

annual bonus rate (but subject to any rounding in the unit prices); or

• the bonuses purchase additional units.

PLL PPFM Page 17 January 2024

The benefit payable at maturity or on death (or, if applicable, terminal illness or

critical illness) includes:

• the value of the with-profits units;

• bonus units, if applicable; and

• any final bonus, which may be added.

Some types of policy might have a guaranteed minimum death benefit which is a

minimum amount of benefit payable on death (or, if applicable, terminal illness or

critical illness), but not on maturity. The cost of providing the guaranteed minimum

death benefit is generally met by cancelling units each month based on the sum at

risk.

If premiums cease and certain criteria (that are explained in the terms and

conditions of each policy) have been met:

• a surrender value may be paid; or

• the policy will be made paid up and the guaranteed minimum death benefit will

no longer apply.

The surrender value may include an element of final bonus. On surrender, the

value of each with-profits unit and bonus unit may be reduced by the application of

a market value reduction. If the criteria are not met then the policy will lapse with

no value.

For certain policies, with-profits units can be switched to buy units in a unit-linked

fund. If this is done, then the value of with-profits units will usually be calculated in

the same way as for a surrender value.

4.2.3 Life Single Premium Unitised With-Profits Business

These are similar to the above, except that only one premium is payable at the

start of the policy. Policies are whole of life assurance single premium bonds

where the benefit is payable on death. Some policies also provide for the benefit

to be payable upon surrender at a specified guarantee date or dates. The type of

policy and the date at which it was taken out determines the guarantee dates

applicable for that policy.

The benefit payable on surrender at a guarantee date is the same as at maturity

above. Some policies provide for an uplifted benefit to be paid on death.

The surrender value (withdrawal value) for claims, at other than a guarantee date,

may include an element of final bonus. The value of each with-profits unit and

bonus unit may be reduced by the application of a market value reduction. Any

market value reduction is calculated by reference to the underlying fair value and

in some cases allowing for smoothing.

4.2.4 Pension Unitised With-Profits Business

Under these policies the benefit is payable at the selected retirement age or earlier

death. For some policies a range of dates around the selected retirement age

applies. Otherwise they are similar to life unitised with-profits business.

Premiums may be single or regular contributions from an employee or employer,

payments for policies contracted out of the state second pension or transfers from

other pension providers. The business may be split into sections, such as for

contributions, for payments as a result of contracting out or for transfers in.

At retirement, the benefit is available to purchase an annuity. A proportion of the

benefit can usually be taken in a cash form at retirement.

PLL PPFM Page 18 January 2024

4.3 Asset Share Methodology

The purpose of asset share calculations is to assess the contribution a policy, or

group of policies, has made to its with-profits fund since the policy, or policies,

started. The asset share calculation is therefore intended to represent the effect of

the historical cashflows on the fund as a result of the policy, or group of policies.

Asset shares are not normally calculated for each individual policy. Rather the

asset shares are calculated for a limited number of specimen policies, or groups of

specimen policies, and these are then taken to be representative of the business

generally.

Asset shares are calculated by accumulating premiums paid at the rates of

investment return earned on the assets, after allowing for charges, such as

expenses, mortality and morbidity costs, cost of guarantees, cost of capital,

distributions to shareholders and tax as appropriate.

The exact components of asset share calculations and practices relating to asset

shares vary by the type of business. For each of the with-profits funds in Phoenix

Life Limited, details of how asset shares will be calculated in the future are given in

its principle 4 and the associated practices.

Asset shares are used to guide policy payouts and bonus declarations because

they provide a good indication of the appropriate level of total payouts in respect of

a policy or groups of policies.

Asset shares can decrease as well as increase and, at any time, may be greater

or less than the contractual guaranteed benefits due under the policy.

PLL PPFM Page 19 January 2024

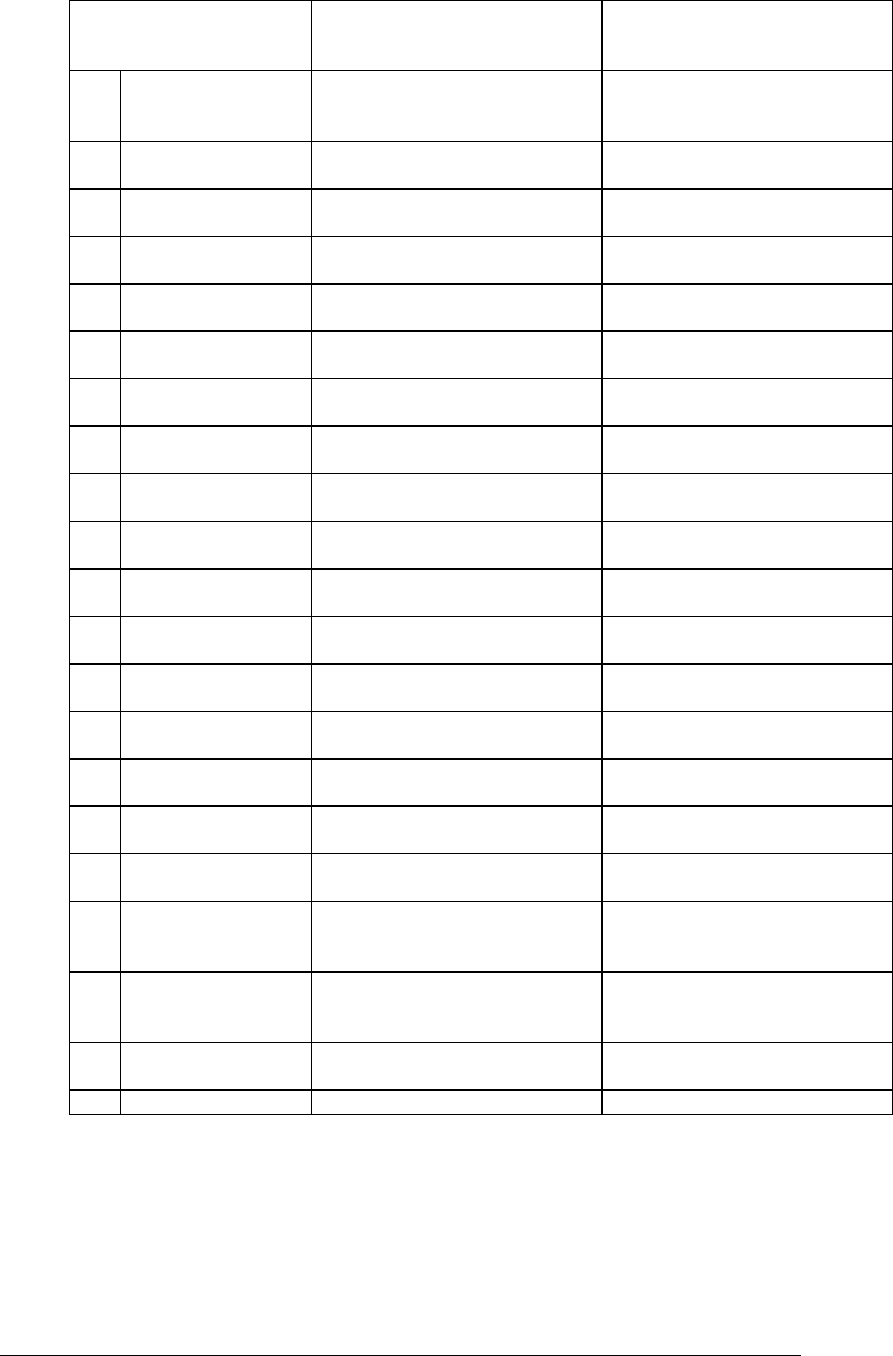

The following table describes the possible elements credited or charged to asset

shares.

Element

Description of Allowance

(a)

Premiums

Premiums paid under the policy

(b)

Investment return

Investment return on assets backing asset shares

(before investment expenses)

(c)

Investment

expenses

Investment expenses incurred in maintaining

investments

(d)

Initial expenses

Administrative expenses incurred in setting up

policies, including commissions

(e)

Renewal expenses

Administrative expenses incurred in maintaining

policies and paying claims

(f)

Other expenses

Project and other one-off expenses incurred

(g)

Tax on investment

return

Tax charge on investment return

(h)

Tax relief on

expenses

Tax relief on expenses

(i)

Mortality & morbidity

costs

Costs of providing mortality and morbidity benefits

(j)

Early terminations

Effect of surrender and lapse experience

(k)

Paid-up policies

Effect of policies becoming paid up experience

(l)

Partial and regular

withdrawals

Effect of partial and regular withdrawals during

policy lifetime

(m)

Surrenders at

protected dates

Effect of surrender at guarantee date experience

(n)

Annuity payments

Annuity payments made under the policy

(o)

Charges for the cost

of guarantees

Charges for the costs of providing guarantees to

both with-profits and non-profit policies in the fund

(p)

Charges for the cost

of capital

Charges for the cost of providing capital to support

guarantees and new business strain

(q)

Distributions to

shareholders

The shareholder share of the distributed surplus

(r)

Tax on distributions

to shareholders

The tax associated with the shareholder share of

the distributed surplus

(s)

Profit and losses

from other business

Effect of experience of other business profits and

losses including from non-profit business in the fund

(t)

Estate distribution or

charge

Future distributions from or charges to the estate

(u)

Exceptional items

Enhancements or charges for exceptional items

Mortality and morbidity costs reflect that the amounts payable on death or serious

illness are generally more than the underlying asset share, but this may not always

be the case and, for some products, where the underlying asset share exceeds

the amount payable, the cost becomes negative and adds to the asset share.

Asset shares may take into account profit and losses from the experience of early

terminations, such as surrenders and lapses and policies becoming paid up. For

example profits occur where the early termination value is less than the underlying

asset share and conversely for losses.

PLL PPFM Page 20 January 2024

The precise approach to calculating asset shares differs between funds, and

between products within funds depending upon, amongst other things, the

historical practices.

4.4 Initial Asset Shares

4.4.1 The initial asset shares used when the funds were transferred into Phoenix Life

Limited were in most cases the closing asset shares in the transferring company.

Details of how those asset shares were calculated are not included here. Not all

the above items may necessarily have applied at all times for all types of policy in

the past. Different practices, often more approximate, may have been used in the

past and the practice is generally to continue to use the results of these practices

when determining the effect of those years on the asset shares of specimen

policies.

4.4.2 The calculation of the asset shares for certain policies as at 1 January 2006 where

they did not exist previously was specified in the 2005 Scheme.

4.4.3 Asset shares were calculated for all Swiss Life IB Fund endowment policyholders

transferring to the 90% With-Profits Fund as at 31 December 2005 on the basis of

Swiss Life’s then current Principles and Practices of Financial Management.

Appropriate bonus rates were then determined based on an enhancement of these

asset shares by 100%. A bonus reserve valuation was then carried out using the

bonus rates determined as above, and the resulting values were the starting point

for the development of asset shares within the 90% With-Profits Fund from

31 December 2005.

4.4.4 Asset shares for Swiss Life OB Fund Pensions With Profit Fund units were

calculated as at 31 December 2005 using the Principles and Practices of Financial

Management of Swiss Life. The resulting values were the starting point for the

development of asset shares within the 100% With-Profits Fund from

31 December 2005.

4.4.5 Asset shares for other Swiss Life OB Fund with-profits policies were calculated as

at 31 December 2005 using the Principles and Practices of Financial Management

of Swiss Life. The resulting asset shares were then scaled up to be equal to the

available assets in the Swiss Life OB Fund after allowing for other liabilities,

including liabilities for other policy types in accordance with the 2005 Scheme.

The resulting values were the starting point for the development of asset shares

within the 90% With-Profits Fund from 31 December 2005.

4.4.6 For former Swiss Life policies in the 100% With-Profits Fund, the individual policy

asset share at the date of transfer into Phoenix Life Limited was calculated using a

prospective (forward looking) valuation to apportion the assets of the Swiss Life

With Profit Fund between the in force policies in an appropriate manner. For

former Bradford policies, the individual policy asset share at the date of transfer

into Phoenix Life Limited was the original individual policy asset share increased

by 88.5% to apportion the assets attributable to with-profits policies between the in

force policies in an appropriate manner. In each case, from 31 December 2005

onwards these asset shares will be accumulated as described in this document

allowing for premiums, expenses, investment returns and other items from that

date forwards.

4.4.7 The calculation of the asset shares for Century policies as at 1 January 2007 was

specified in the 2006 Scheme.

Initial asset shares for Century with-profits policies were calculated using a bonus

reserve valuation as at 31 December 2006 adjusted so that at that date the value

of the transferring assets equalled the bonus reserve valuation liabilities of the

PLL PPFM Page 21 January 2024

transferring business. The bonus reserve valuation was calculated using the

future bonus relationships indicated by Century’s Court Order in 2001 (see

paragraph 9.1.2). The bonus reserve valuation included a liability in respect of

expected future shareholder transfers.

The transferring assets included the agreed value of the non-profit business which

existed, prior to the 2006 Scheme, in the Century With Profit Fund and the transfer

of assets worth £2.549m to the Britannic With-Profits Fund.

The adjustment took place after assets were set aside to either improve values for

surrendering policies or to smooth any anticipated discontinuities in policy payouts

which would arise if then current annual and final bonus scales were maintained.

The amounts of assets set aside were determined by the Century Board before

the Effective Date of the 2006 Scheme after taking advice from the Century With

Profits Committee and the Century With Profits Actuary.

4.4.8 The calculation of the asset shares for the former Scottish Mutual Assurance

Limited policies and former Scottish Provident Limited policies were specified at

the time of demutualisation on 1 January 1992 and 1 August 2001 respectively.

PLL PPFM Page 22 January 2024

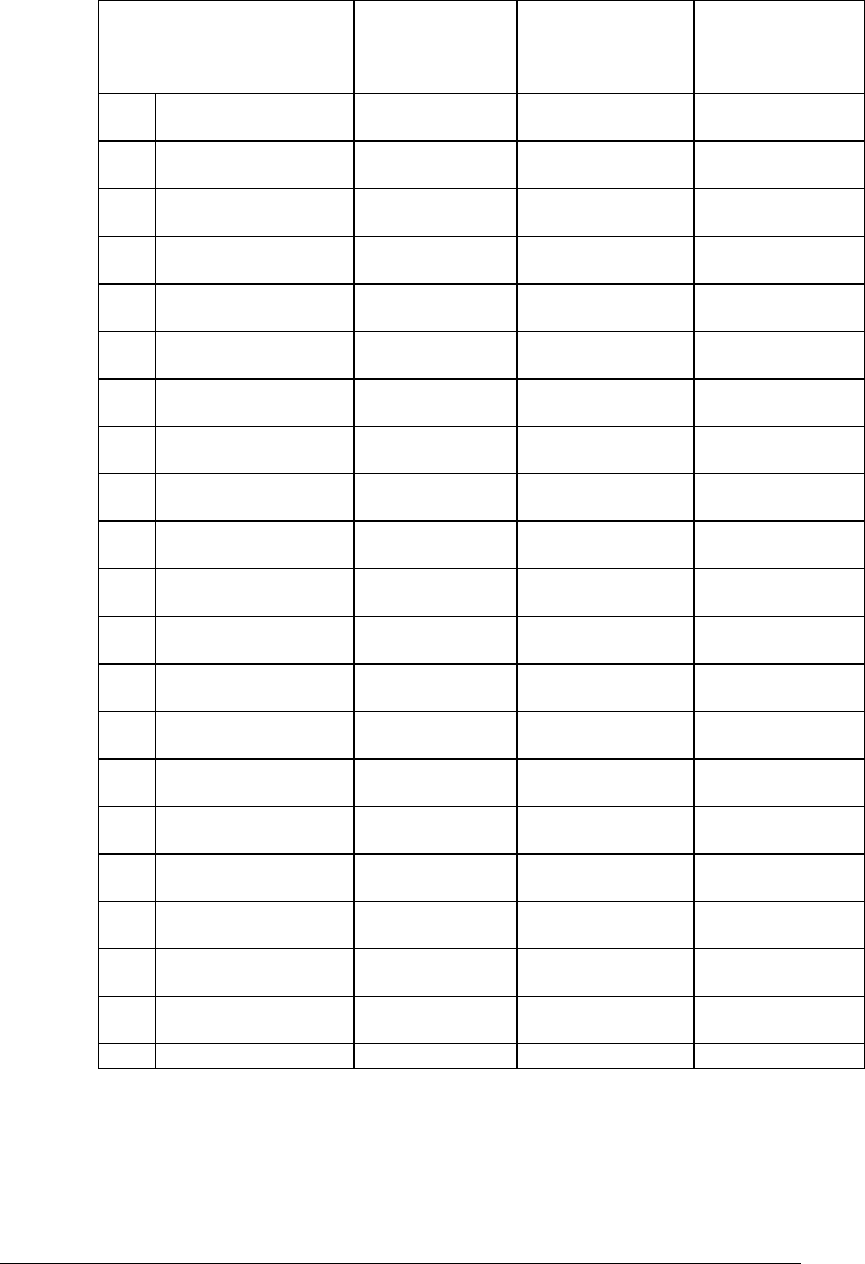

5 Principles and Practices – Guiding Principles

In managing Phoenix Life Limited and its with-profits funds, a number of guiding principles are

applied. These guiding principles are considered when applying the other principles and

practices set out in this document. Should a situation arise in which there is a conflict

between one or more principles or practices, the fund is managed in order that the guiding

principles are applied. The guiding principles are part of the principles of financial

management used in managing each fund. The guiding principles and their associated

practices are shown below.

Principle

5.1

Legal Requirements

Phoenix Life Limited and its with-profits funds are managed in accordance with

Phoenix Life Limited’s then current understanding of all legal and regulatory

requirements.

This includes a commitment to observe all contractual terms set out in policy

documents, all guaranteed commitments and other obligations including:

• sound and prudent financial management of the with-profits funds;

• treating customers fairly;

• meeting solvency requirements; and

• the terms of the 2023 Scheme.

Practices

5.1.1 Periodic valuations of the assets and liabilities of Phoenix Life Limited and each

fund are carried out to establish the solvency level and the level of excess assets

within a fund, if any. These valuations are currently carried out quarterly and

changes from one period to the next are analysed. In between periodic valuations

solvency is monitored on an approximate basis allowing for market movements

and other known changes.

5.1.2 As described in section 3.2, the Board aims to maintain an internal margin over

and above the minimum solvency standard required by the regulations.

5.1.3 If the internal margin is breached then no action will be taken to reduce the capital

of Phoenix Life Limited, such as the payment of dividends, until the breach has

been rectified. Immediate action to restore the internal margin will be considered.

Immediate action means that changes may be made to, but are not restricted to,

investment strategy, bonus declarations and surrender values.

5.1.4 The capital requirements and the capital available are regularly assessed and

monitored to ensure that adequate levels of capital are maintained.

5.1.5 Key insurance risks and operational risks are regularly monitored.

5.1.6 Treating customers fairly from a financial perspective is achieved through the

monitoring of compliance with the Principles and Practices of Financial

Management.

5.1.7 The long-term business fund is operated in accordance with the 2023 Scheme,

(see Appendix 2). These govern practices relating to the following:

• maintenance of separate assets for each fund;

• allocation of surplus between policyholders and shareholders;

• allocation of tax between funds; and

• the Buffer Reserve as it affects the Britannic With-Profits Fund and the

Britannic Industrial Branch Fund.

PLL PPFM Page 23 January 2024

Principle

5.2

Basic Fund Concepts

Subject only to Principle 5.1, the interests of with-profits policyholders extend to,

but are also limited to, the assets of the fund to which the policy belongs (other

than in respect of the shareholders’ entitlement to a share of the cost of bonuses

as indicated in the Principles for each fund and the Buffer Reserve for the

Britannic With-Profits Fund and Britannic Industrial Branch Fund).

Each of the with-profits funds is operated as a stand-alone fund and investment

and bonus policy set accordingly. Separate revenue accounts and balance sheets

are maintained for each fund within the long-term business fund.

Assets may be loaned by, or made available by a contribution arrangement with,

the Non-Profit Fund and Shareholder Fund to eliminate any deficit in the with-

profits funds. For the purposes of managing the funds the assets of the with-

profits funds will be treated as being permanently increased from shareholder

resources to the extent that there is no realistic prospect of the deficit being

reversed. However, this does not preclude the repayment of such loans should

the actual experience be such that surplus emerges and repayment becomes due

under the terms of the loans.

In the highly unlikely event that the assets of any of the with-profits funds of

Phoenix Life Limited, the surplus assets in the Non-Profit Fund and the surplus

assets in the Shareholder Fund are insufficient to enable that with-profits fund to

meet its guaranteed benefits, then assets from the other with-profits funds would

be used, but only to the extent that such assets were not required to meet the

guaranteed benefits in the other with-profits funds.

Items of income and outgo (revenue items) within Phoenix Life Limited are

allocated to funds in a manner which is considered fair. The allocation

methodology is regularly reviewed by the Board or in the case of the SPI With-

Profits Fund the With-Profits Committee, and may change.

Premiums are directly associated with a specific policy and are allocated to the

fund which contains that policy.

Separate asset pools are maintained in respect of each fund and the investment

income and gains arising are allocated to originating asset pools. Policy benefits

and claim payments are directly associated with a specific policy and are allocated

to the fund which contains that policy.

The overall aim when apportioning expenses to different funds is to reflect the

actual costs incurred in respect of each fund, always maintaining consistency with

the 2023 Scheme and with any commitments made to the regulator.

Expenses allocated to the long-term business fund which are not directly

attributable to a fund, are allocated across the funds in the following way:

• Where significant value added projects are undertaken or the benefits are not

clearly attributable to a particular fund, the Board or in the case of the SPI

With-Profits Fund the With-Profits Committee, determines a fair and

reasonable apportionment, for example in proportion to the fees paid to the

outsourced service providers or in proportion to the benefits which may accrue

from the expenditure or in proportion to another key driver of the cost.

• Other costs directly incurred by Phoenix Life Limited, but which are not directly

incurred by a fund, are allocated in a fair and reasonable way based on the

drivers of those costs.

PLL PPFM Page 24 January 2024

Should PGMS be unable to meet any of its obligations to provide services then

Phoenix Life Limited would request that Phoenix Group, as owners of PGMS step

in to restore the position. Should Phoenix Group not do this, then Phoenix Life

Limited would attribute any losses to the Shareholder Fund or Non-Profit Fund,

and the with-profits funds would only be affected if the Shareholder Fund or Non-

Profit Fund had insufficient excess assets to bear the losses.

Should the agreement with PGMS be terminated then, in circumstances where the

interests of with-profits policyholders in a with-profits fund (or funds) had not been

the cause of such termination, Phoenix Life Limited would aim to manage its

business in such a way that expenses would be allocated to that (or those) with-

profits fund(s) as if the agreement with PGMS had continued in full force, and that

(or those) with-profits fund(s) would only be affected if the Shareholder Fund or

Non-Profit Fund had insufficient excess assets to support this aim.

Subject to Principle 5.1, the tax allocated to each of the with-profits funds is

assessed as the amount of tax which the with-profits fund would have incurred

had it been the whole of the long-term business fund of Phoenix Life Limited.

Practices

5.2.1 The Buffer Reserve is available to support the Britannic Industrial Branch Fund

and the Britannic With-Profits Fund. Its mechanics are covered in sections 9.12

and 10.12.

5.2.2 Shareholder’s entitlements and other potential benefits are covered in the

principles and associated practices for each fund.

5.2.3 Each with-profits fund is operated as a stand-alone fund. In formulating

investment and bonus policy for a particular with-profits fund, no account is taken

of the availability of potential support from outside the fund, except to the extent

that the 2023 Scheme requires such consideration to be taken or support existed

and was being utilised at 27 October 2023, or is drawn down in the future, or

where the Board decides is otherwise appropriate.

5.2.4 The assets, liabilities and capital requirements of each fund are reviewed no less

frequently than four times a year, using realistic assumptions and generally

accepted methodologies. If the assets and liabilities are materially different action

is taken. This action may include, but is not restricted to, changes to investment

strategy, bonus declarations, asset shares and surrender values. In this context,

materiality is determined by the Board or in the case of the SPI With-Profits Fund

the With-Profits Committee.

5.2.5 In the event that the with-profits asset value of any of the with-profits funds falls

below (or is likely to fall below) the threshold amount for that fund support will be

provided to that fund by way of a loan or other contribution arrangement from the

Non-Profit Fund or the Shareholder Fund to the extent that the Board determines

there are assets in those funds available to make such a loan.

The loan would be repayable with the approval of the Board if the with-profits

asset value is more than the threshold amount.

In considering whether to approve any such transfer or repayment to the Board

shall have regard to matters including, but not limited to:

• the presumption that any support will be repaid to the extent that the with-

profits asset value is greater than the threshold amount,

• the Scheme Capital Policy,

• the financial needs of the relevant with-profits fund,

• the company’s duty to treat its customers fairly, and

• advice from the With-Profits Actuary.

PLL PPFM Page 25 January 2024

Whether or not interest would be payable by the fund on any loan received, and

the interest rate payable if applicable will vary depending on the with-profits fund

receiving the loan.

5.2.6 In the event that any of the with-profits funds cannot meet its regulatory capital

requirements from its own capital resources, the With-Profits Committee can

recommend, or in the case of the SPI With-Profits Fund request, that the Board

holds additional capital in the Non-Profit Fund or the Shareholder Fund to meet

any shortfall. To the extent that the Board does not or cannot make sufficient

assets available, then it will be necessary to take other actions within the relevant

with-profits fund to ensure that it can meet its regulatory capital requirements from

its own capital resources.

5.2.7 The assets of one with-profits fund may be used to support another with-profits

fund in Phoenix Life Limited if the fund which is to provide the support has

sufficient assets to cover its contractual obligations and, both the following unlikely

situations prevail:

• there are no surplus assets available in the Non-Profit Fund and Shareholder

Fund; and

• the regulatory regime has been ineffective. The regulatory regime is aimed at

ensuring that life assurance companies do not become insolvent on a

Companies Act basis and there are prudential margins and intervention points

incorporated into the PRA’s rules that are aimed at preventing this.

Similarly the assets of one with-profits fund may be required to be used to support

another fund in Phoenix Life Limited if Phoenix Life Limited has become insolvent

on a Companies Act basis.

5.2.8 Should a fund trigger the fund closure provisions incorporated into the 2023

Scheme, then the fund will be closed in accordance with those provisions. See

paragraphs 3.1.2. On closure of the 90% With-Profits Fund, Alba With-Profits

Fund, Phoenix With-Profits Fund or the SPI With-Profits Fund, the reinsured Irish

business from PLAE will be recaptured and transferred to the PLAE Non-Profit

Fund.

5.2.9 Future non-profit annuities arising from policies in the with-profits funds may

remain in the with-profits fund or, alternatively may be set up in the Non-Profit

Fund using the open market option under such policies or the powers incorporated

in the 2023 Scheme to re-allocate non-profit policies. Where the latter is the case

the With-Profits Committee will periodically review the terms to ensure that they

are consistent with the fair treatment of the with-profits policyholders. See

paragraph 3.1.3.

5.2.10 Other than for the non-profit annuities per paragraph 5.2.9, the powers to re-

allocate non-profit policies in the with-profits funds will not be regularly used. If a

re-allocation is made, it is expected that it would be on commercial terms with the

Non-Profit Fund receiving an adequate return for the risks it was taking on. If the

total value of such a re-allocation exceeds a minimum size (currently £500m), then

an independent actuary will normally be appointed to consider the proposed terms,

unless the With-Profits Committee decided that the terms were clearly fair and

equitable and that no such review was therefore needed.

5.2.11 The allocation of revenue items and the underlying methodology is reviewed at

least once a year by the With-Profits Committee.

PLL PPFM Page 26 January 2024

5.2.12 The allocation methods and any changes are approved by the Board or in the

case of the SPI With-Profits Fund the With-Profits Committee. Changes would

typically be due to:

• changes in regulations; and

• maintaining equity between the with-profits funds and the shareholders.

5.2.13 Most revenue account items are directly received or incurred in respect of one

fund and so are directly allocated to that fund.

5.2.14 Expenses allocated to the long-term business fund that are directly incurred by or

associated with a particular fund are allocated to that fund. This includes

commission, the charges made under the Management Services Agreements by

PGMS and the fees payable to the investment managers in connection with the

management of the investments of the fund, or any fees payable to third parties for

services.

5.2.15 The Board may approve limiting expenses charged to asset shares where this is

felt to be fairer. Any such expenses not charged to asset shares will fall to the

estate.

5.2.16 Other charges and benefits relating to business risks as described in the principles

and associated practices for each fund are allocated to the relevant fund to which

that risk relates as determined by the Board (or the With-Profits Committee for the

SPI With-Profits Fund).

5.2.17 The Board (or the With-Profits Committee for the SPI With-Profits Fund) may also

change the method of apportioning expenses between funds if it was possible to

do so without ceasing to treat customers fairly and to do so assisted in meeting

one of Phoenix Group’s other corporate objectives. However such changes would

only be made if they were consistent with the 2023 Scheme and with any

commitments made to our regulator.

5.2.18 Fines levied by the regulators or costs incurred on the instruction of the regulator

will be charged to the Shareholder Fund or a particular fund within the long-term

business fund in accordance with guidance from our regulator and the terms of the

2023 Scheme.

5.2.19 In particular, actual regulatory penalties (fines) and compensation payments

relating to events which occurred after 31 July 2009 are paid directly from the

Shareholder Fund and so will impact neither asset shares nor the excess assets in

the with-profits funds.

5.2.20 The principles and associated practices for each fund give more information on

expenses and charges that are specific to that fund.

5.2.21 Tax will be attributed to each with-profits fund, so far as is practicable, on the basis

that the 100% With-Profits Fund, the Scottish Mutual With-Profits Fund, the SPI

With-Profits Fund, SERP Fund, London Life With-Profits Fund and National

Provident Life With-Profits Fund are separate mutual life assurance companies

and each of the other with-profits funds is a separate proprietary life assurance

company.

5.2.22 The tax allocated to one or more of the with-profits funds may be reduced if the

Board believes this to be necessary to treat customers fairly in accordance with

regulator’s rules.

5.2.23 If any tax benefits are allocated to a with-profits fund in accordance with paragraph

5.2.20, the With-Profits Committee will recommend to the Board whether these

benefits should accrue to the estate or should be credited to the asset shares of

policies within that fund or to the asset share of a group of policies within that fund.

PLL PPFM Page 27 January 2024

5.2.24 Phoenix Life Limited has issued subordinated loan notes (debt). The with-profits

funds are managed so that the discretionary benefits under with-profits policies are

calculated and paid disregarding, to the extent necessary to treat customers fairly,

any liability Phoenix Life Limited may have to make payments under these

subordinated loan notes.

PLL PPFM Page 28 January 2024

Principle

5.3

Fair Treatment

Phoenix Life Limited aims to treat its with-profits policyholders fairly. The

approach used may involve the pooling of risks and rewards across and within

policy classes and sometimes across generations of policyholders. We do not

pool risks across the different with-profits funds in Phoenix Life Limited. Different

risks may be pooled at different levels.

The overall aim when determining the bonus rates to apply to different with-profits

policies is to broadly reflect the actual profits, losses and costs incurred over the

lifetime of the policies, but allowing for any pooling and smoothing.

Costs may be recovered from policies directly, for example by the cancellation of

units of unitised policies, or indirectly via bonuses and early termination values.

Practices

5.3.1 With-profits business in each with-profits fund is split into various types of business

and classes when determining benefits and bonuses. The primary aim is to

ensure fair treatment of policyholders at this broad level.

5.3.2 Risks and rewards are pooled at different levels. Some are pooled at fund level,

others are pooled at type of business, class and bonus series levels.

5.3.3 Within this pooling, experience is aggregated. This aggregation includes:

• Combining large and small policies, with the only differentiation between the

policy benefits being set at the policy outset via the sum assured, annuity or

product charges, thus having the same bonus rates applied regardless of policy

size.

• Mortality, morbidity and surrender experience are based on investigations

which cover various groups and types of policies.

• Asset share models and assumptions contain approximations, but are not

intended to prejudice the overall fair treatment of policyholders.

5.3.4 The broad level of fair treatment means some cross subsidy between different

groups of policyholders, but this is an inherent feature of the with-profits business

and is not considered prejudicial to the overall fair treatment of policyholders.

5.3.5 Where costs are specific to a class of policy then, allowing for approximations,

such costs will be taken into account in assessing the bonuses added to that

policy class and in assessing the early termination value payable.

5.3.6 Where costs are not specific to a single policy class, they will be apportioned

across the policy classes to which they are relevant in a reasonable manner.

5.3.7 Implicit charges for mortality, sickness and other benefits will generally reflect

Phoenix Life Limited’s own or insurance industry actual claims experience.

Explicit charges for such benefits will be determined in line with policy conditions

and, where this requires periodic reviews in the light of experience, such reviews

will be carried out and charges adjusted accordingly.