Historical Monetary Policy Analysis

and the Taylor Rule

Athanasios Orphanides

∗

Board of Governors of the Federal Reserve System

June 2003

Abstract

This study examines the usefulness of the Taylor-rule framework as an organizing device

for describing the policy debate and evolution of monetary policy in the United States.

Monetary policy during the 1920s and since the 1951 Treasury-Federal Reserve Accord

can be broadly interpreted in terms of this framework with rather surprising consistency.

In broad terms, during these periods policy has been generally formulated in a forward-

looking manner with price stability and economic stability serving as implicit or explicit

guides. As early as the 1920s, measures of real economic activity relative to “normal” or

“potential” supply appear to have influenced policy analysis and deliberations. Confidence

in such measures as guides for activist monetary policy proved counterproductive at times,

resulting in excessive activism, such as during the Great Inflation and at the brink of the

Great Depression. Policy during the past two decades is broadly consistent with natural-

growth targeting variants of the Taylor rule that exhibit less activism.

JEL Classification System: E3, E5, B2

Correspondence: Federal Reserve Board, Washington, D.C. 20551, Tel.: (202) 452-2654, e-mail:

Athanasios.Orphanides@frb.gov.

∗

Prepared for the Carnegie-Rochester Conference on Public Policy on the 10th anniversary of the

Taylor rule, Pittsburgh, PA, November 22-23, 2002. I would like to thank Oldrich Dedek, Gregory

Hess, William Keech, David Lindsey, Bennett McCallum, Allan Meltzer, William Poole, Richard

Porter, Simon van Norden, Anna Schwartz, Jan Qvigstad, as well as participants at the conference

and at presentations at Harvard University, George Mason University, the Norges Bank Workshop

on Monetary Policy Rules in Inflation Targeting Regimes, and the 2003 meeting of the American

Economic Association for helpful discussions and comments. The opinions expressed are those of

the author and do not necessarily reflect views of the Board of Governors of the Federal Reserve

System.

1 Introduction

In the decade since John B. Taylor’s celebrated essay on “Discretion versus policy rules in

practice” was presented at the 39th Carnegie-Rochester Conference on Public Policy in the

Fall of 1992, his analysis has had considerable influence on the way monetary economists

and practitioners think about the policy debate. Taylor showed that actual monetary policy

in the United States could be usefully described in terms of a simple rule that appeared

promising on the basis of policy evaluation experiments. Most importantly, he described

the monetary policy process in terms of the short-term nominal interest rate that was close

to the actual decision making process, and described policy directly in terms of the two

major operational objectives of monetary policy, inflation and economic growth.

My aim in this study is to investigate the usefulness of the Taylor-rule framework as an

organizing device for describing the policy debate and evolution of monetary policy in the

United States. Key to this undertaking is the examination of interest rate policy decisions

linked directly to the Federal Reserve’s underlying policy objectives, as these may have

been understood over time. In the spirit of Friedman and Schwartz (1963), I rely heavily

on narrative descriptions of events and ideas, supplemented, as possible, with information

available to policy practitioners when policy was made. A major difference is my reliance

on the language of interest-rate-based policies, instead of the stock of money, and some of

the resulting analysis can be seen as a re-interpretation of earlier findings using the latter

language. The ultimate goal of this effort is to use the historical experience to draw lessons

about past policy successes and policy errors.

The theme that emerges from this examination is that Federal Reserve policies over

many periods, virtually since the founding of the institution, can be broadly interpreted in

terms of the Taylor-rule framework with surprising consistency. The Taylor rule serves as a

particularly good description of policy, however, both when subsequent economic outcomes

were exemplary as well as less than ideal. A recurrent source of errors has been misper-

ceptions of the state of the economy, the result of incorrect assessments of the economy’s

productive potential. This concept has appeared in policy discussions with different names

and in various contexts from the first years of operation of the System. It has often led

to false predictions of inflation or disinflation, prompting tightening or easing actions that

1

were only recognized as counterproductive long after the fact. This historical analysis sug-

gests that the Taylor rule appears to serve as a useful organizing device for interpreting

past policy decisions and mistakes, but adoption of the Taylor-rule framework for policy

analysis is not insurance that past policy mistakes would not have occured.

2 Two Interpretations of the Taylor Rule

In his original exposition of a rule-based framework for monetary policy analysis, Taylor

offered two interpretations of rules-based policy. The first concentrated on an example

presented with a precise algebraic formula. The second emphasized the broad characteristics

of policy rules, recognizing that, as with virtually any rule, implementation details should

be left to policymakers. Although the precise algebraic formula caught most of the attention

originally, my analysis suggests that the broader interpretation is of at least as much interest,

especially for historical analysis. In this section, I review the two interpretations, and relate

the framework to an alternative simple rule motivated by money growth targeting.

2.1 A Narrow Interpretation: The Classic Taylor Rule

The specific example that captivated so much attention was presented by Taylor as a “hy-

pothetical but representative policy rule” (1993, p. 214). In effect, this example was a

particular parameterization of a policy rule that had already been studied in detail by par-

ticipants of the Brookings project on policy regime evaluation reported in Bryant, Hooper

and Mann (1993), and also examined in another contribution to the Fall 1992 Carnegie-

Rochester conference by Henderson and McKibbin (1993).

1

The Brookings study examined

rules setting deviations of the short-term nominal interest, i, from a baseline path, i

∗

,in

proportion to deviations of a target variables z, from its target, z

∗

.

i − i

∗

= θ(z − z

∗

)(1)

Among the alternative target variables examined, the collective findings in the Brookings

study pointed to two as more likely to result in better economic performance. One of

1

The Brookings conference, which took place in March 1990, and to which both Taylor, and Henderson and

McKibbin contributed, appears to have had an influence on the contributions by Taylor and by Henderson

and McKibbin to the 1992 Carnegie-Rochester conference. Taylor’s contribution on nominal GNP targeting

at an earlier Carnegie-Rochester conference (Taylor 1985), offered an earlier related analysis of some of the

issues that also appeared in the later work.

2

these suggested targeting the sum of the price level p, and real output q—that is nominal

income, p + q (“nominal income targeting regime”). The other suggested targeting the sum

of inflation, π =∆p, and real output (“real-output-plus-inflation targeting regime”):

2

i − i

∗

= θ((π + q) − (π

∗

+ q

∗

)) (2)

Variations of this formulation, with differential responses to inflation and output:

i − i

∗

= θ

π

(π − π

∗

)+θ

q

(q − q

∗

)(3)

were also considered in some of the contributions to the Brookings study. In his parameteri-

zation, Taylor adopted the “real-output-plus-inflation” variant and set the baseline nominal

interest rate to equal the sum of the equilibrium or natural rate of interest, r

∗

, and inflation,

π. He employed an output gap measure obtained from a smooth trend, y = q − q

∗

,and

used the year-over-year rate of change of the output deflator to measure inflation. Setting

the inflation target and equilibrium real interest equal to two and the response parameter,

θ to one half, he arrived at what we now know as the classic Taylor rule:

i =2+π +

1

2

(π − 2) +

1

2

(q − q

∗

)(4)

Taylor noted that this parameterization appeared to fit Federal Reserve behavior well over

the previous several years and observed: “If the policy rule comes so close to describing

actual Federal Reserve behavior in recent years and if FOMC members believe that such

performance was good and should be replicated in the future even under a different set of

circumstances, then a policy rule could provide some guidance to future decisions.” (p. 208.)

2.2 Some Limitations

Some of the suggested attractive qualities of this rule, however, were promptly questioned.

As McCallum (1993) noted, Taylor’s formulation was not “operational.” It required in-

formation that the policymaker did not necessarily have at his disposal.

3

Crucially, this

formula requires policymakers to take a stand on and formulate policy on the basis of implicit

2

Unless otherwise noted, I use capital letters to denote levels and small letters (except for interest rates)

to denote respective logarithms. Throughout, I use log differences to approximate rates of change, scaled to

annual rates, in percent. Interest rates are in percent, annual rates.

3

McCallum was originally concerned with the timing of information on inflation and the output gap.

Orphanides (2001, 2003) later demonstrated that the informational problem was broader and quantitatively

severe in practice, especially regarding the measurement of the “output gap.”

3

assumptions regarding concepts such as the natural rate of interest and potential output

(or the related natural rate of unemployment or “NAIRU”), which are known to be notori-

ously unreliable as policy indicators.

4

Not all academic observers and policy practitioners

believe such concepts are either necessary or helpful for formulating policy. Policymakers,

in particular, might prefer to avoid the dogmatic reliance on natural-rate-gap-based policy

rules, such as Taylor’s classic formulation.

5

At the very least, these difficulties serve as an important reason for viewing this par-

ticular rule as a strategy that could only be implemented with a substantial element of

discretion. This point was emphasized by Chairman Greenspan in 1997:

As Taylor himself has pointed out, these types of formulations are at best “guide-

posts” to help central banks, not inflexible rules that eliminate discretion. One

reason is that their formulation depends on the values of certain key variables–

most crucially the equilibrium real federal funds rate and the production po-

tential of the economy. In practice these have been obtained by observation of

past macroeconomic behavior–either through informal inspection of the data, or

more formally as embedded in models. In that sense, like all rules, as I noted

earlier, they embody a forecast that the future will be like the past. Unfortu-

nately, however, history is not an infallible guide to the future, and the levels of

these two variables are currently under active debate.

In addition, the classic Taylor rule lacks an explicit role for forecasts and related judgments

about prospective economic developments. As noted by Meyer (2002):

Although the Taylor rule has been a useful benchmark for policymakers, my

experience during the last 5-1/2 years on the FOMC has been that considerations

that are not explicit in the Taylor rule have played an important role in policy

deliberations. In particular, forecasts clearly have played a powerful role in

shaping the response of monetary policy in a way not reflected in the simple

Taylor rule.

Indeed, forecasts of the economic outlook have always served an important role in monetary

policy decisions at the Federal Reserve, with rather similar justifications being provided for

4

Quantifications of this unreliability are presented in several recent studies, including Staiger, Stock and

Watson (1997), and Laubach (2001), for the natural rate of unemployment; Christiano and Fitzgerald (2001),

Orphanides and van Norden (2002), and van Norden (2002) for potential output; Laubach and Williams

(2001), for the natural rate of interest and Orphanides and Williams (2002), for the natural rates of interest

and unemployment.

5

The classic exposition of the dangers of such natural-rate-gap-based policies appears in Friedman’s 1967

AEA presidential address, (Friedman, 1968).

4

this practice over the decades. Consider, for instance, the following remarks by Chairman

Greenspan from 1999 and the remarks by Chairman Martin in 1965, both offered during

periods when monetary policy was in a tightening phase and inflation appeared to be the

predominant threat.

For monetary policy to foster maximum sustainable economic growth, it is use-

ful to preempt forces of imbalance before they threaten economic stability. But

this may not always be possible—the future at times can be too opaque to pen-

etrate. When we can be preemptive, we should be, because modest preemptive

actions can obviate more drastic actions at a later date that would destabilize

the economy. (Greenspan, 1999)

To me, the effective time to act against inflationary pressures is when they are

in the development stage—before they have become full-blown and the damage

has been done. Precautionary measures are more likely to be effective than

remedial action: the old proverb that an ounce of prevention is worth a pound

of cure applies to monetary policy as well as to anything else. (Martin, 1965)

More generally, preemption appeared to be a guiding principle of the Federal Reserve as

early as the founding of the System. As the Board explained in its First Annual Report

for 1914, which was published in January 1915: “[A reserve bank’s] duty is not to await

emergencies but by anticipation, to do what it can to prevent them.”

Given that Federal Reserve officials have always described the formulation of monetary

policy as a forward-looking process, policy rules failing to incorporate such information into

historical analyses of policy decisions could easily prove inadequate. A popular approach is

to modify Taylor’s classic formulation by replacing current and recent outcomes in rules of

the form (3) with forecasts of these variables.

6

Alternatively, as suggested by Taylor (1993),

policymakers could consult the forecast path of the federal funds rate obtained by projecting

rule (3) using forecasts of inflation and economic activity. Attempting to incorporate an

explicit role for forecasts in a monetary policy rule, however, must be seen in the context

of a broader interpretation of policy rules than the one embedded in Taylor’s classic rule

example. I turn to such a broad interpretation next.

6

Examples of such variants in policy evaluations and descriptive exercises include Batini and Haldane

(1999), Batini and Nelson (2000), Clarida, Gali and Gertler (1999, 2000), Levin, Wieland and Williams

(1999, 2003), Nessen (1999) and Orphanides (2001, 2002, 2003).

5

2.3 A Broad Interpretation

The broad interpretation of Taylor’s rule-based framework for monetary policy provides

a degree of flexibility that addresses some of the perceived limitations of the classic rule.

In describing this broad interpretation Taylor stressed that “a policy rule need not be a

mechanical formula,” (1993, p. 198). Rather, adopting a position closer to earlier in-

terpretations of policy rules such as in Samuelson (1951, 1967) and Tobin (1983), Taylor

emphasized the broader definition of a rule as a systematic policy program geared towards

the attainment of the fundamental policy objectives. In general terms, Taylor described the

fundamental features of the policy he was proposing by quoting a useful summary descrip-

tion from the 1990 Economic Report of the President, (which, as a member of the Council

that year, he had co-authored):

The Federal Reserve generally increases interest rates when inflationary pres-

sures appear to be rising and lowers interest rates when inflationary pressures

are abating and recession appears to be more of a threat. (Council of Economic

Advisers, 1990, p. 85).

As with the classic, narrow interpretation, the objectives of monetary policy are to dampen

business cycle fluctuations and maintain price stability. But unlike the narrow interpreta-

tion, policymakers are given more leeway in taking actions to achieve the desired effect. This

permits the use of sound judgment outside the scope of any fixed formula in formulating

policy and without restricting policymakers necessarily to a specific analytical framework.

Of course, this broad interpretation has the disadvantage of reduced precision—indeed

as a policy rule it must be seen as one whose implementation requires discretion. On the

other hand, this broad interpretation of Taylor’s rule-based policy presents some substantial

advantages as a descriptive device. It maintains a role for pre-emption and the use of

forecasts in setting policy, and it accommodates the exhibited policymakers’ preference

for adopting explicitly forward-looking policy guides. Equally important, Taylor’s broad

interpretation does not require policymakers to accept natural-rate-gap-based policy as their

guiding principle. By being more encompassing, the broad interpretation of the Taylor rule

arguably better captures the actual policy process over time.

This broad interpretation of Taylor’s framework, as opposed to the classic Taylor rule,

also relates more closely to the inflation targeting approach to policy, discussed in Bernanke

6

and Mishkin (1997), and Bernanke, Laubach, Mishkin and Posen (1998). Indeed, as

Bernanke and Mishkin stress, inflation targeting is a framework of “constrained discretion.”

The broader interpretation of Taylor’s policy framework places its emphasis on the

identification of the System’s operational objectives regarding price stability and economic

growth and asks that policymakers apply their collective judgment to adjust interest rates

so as to balance the perceived risks with regard to the outlook for the two objectives. In

this sense, the crucial element for interpreting historical monetary policy with the Taylor

rule rests on two elements: First, the extent to which the System has relied on short-term

interest rates as its primary policy instrument, which is widely accepted as a fairly accurate

description. Second, the evolution of the System’s operational objectives vis-a-vis price

stability and economic growth, as interpreted by policymakers over time for the conduct of

policy. As I illustrate next, policymaking in the System has broadly exhibited a remarkable

consistency in this regard as well. The System’s consistency with regard to these two key

elements of the Taylor-rule framework through time provides the strongest rationale for the

usefulness of the framework for interpreting historical monetary policy decisions.

2.4 Policy Objectives and Strategy Over Time

An appropriate starting point for examining the evolution of policy objectives and their

interpretation is to examine the current statutory objectives of the System, as reflected in

the November 16, 1977 amendment of Section 2A of the Federal Reserve Act. These are:

“maximum employment, stable prices, and moderate long-term interest rates.” A recent

operational interpretation can be found in the Committee’s January 19, 2000 statement

which introduced the practice of announcing: “the FOMC’s consensus about the balance

of risks to the attainment of its long-run goals of price stability and sustainable economic

growth.” Related interpretations of the dual objective of price stability and maximum

growth can be traced back to the legislative mandate of the Employment Act of 1946. As

an illustration, consider the following statement from a 1957 Congressional Hearing:

The objective of the System is always the same—to promote monetary and credit

conditions that will foster sustained economic growth together with stability in

the value of the dollar. (United States Congress, 1957, p. 1252.)

7

However, even before the 1946 Act, the Federal Reserve appeared to be interpreting its

“implicit” objectives in rather similar terms. The following statement from the Annual

Report for 1945 suggests a modern interpretation of both the goals of policy, as well as the

broad guiding principles for Taylor’s conduct of policy:

It is the Board’s belief that the implicit predominant purpose of Federal Reserve

policy is to contribute, insofar as the limitations of monetary and credit policy

permit, to an economic environment favorable to the highest possible degree of

sustained production and employment. Traditionally, this over-all policy has

been followed by easing credit conditions when deflationary factors prevailed

and, conversely, by restricting measures when inflationary forces threatened.

Indeed, as Chairman McCabe noted in 1949: “... for the entire period since 1935, Federal

Reserve credit policies have been altogether in conformity with the objectives stated in

the Employment Act of 1946. Review of a longer period would show that throughout

the System’s existence Federal Reserve objectives have been in harmony with these broad

purposes.” (Joint Committee on the Economic Report, 1949, p. 25-26.)

2.5 Monetary Growth Targeting in the Taylor Framework

The broad interpretation of the Taylor rule is also of interest because it permits investi-

gations of alternative specific policy rules that are consistent with the attainment of the

policy objectives of price stability and maximum sustainable growth.

One such example may be viewed as a reformulation of Friedman’s monetary growth

rule in terms of the family of policy rules investigated in the Brookings study. Recall that

one of the key advantages of Friedman’s money growth rule is that is stays clear of the

pitfalls known to plague the natural-rate-gap-based policy approach. In terms of rule (1),

a strategy that meets this criterion but maintains the spirit of the “nominal income” and

“real-output-plus-inflation” targeting regimes considered in the Brookings project, is to set

the growth (instead of the level) of nominal income, ∆(p+q)=π +∆q, as the target variable

z, and rely on the lagged value of the interest rate instrument as the baseline for policy

adjustments. The resulting rule becomes:

∆i = θ((π +∆q) − (π

∗

+∆q

∗

)) (5)

To see the relationship to money growth targeting recall that, given a monetary aggregate,

8

m, and its velocity, v, the equation of exchange implies:

∆m +∆v = π +∆q (6)

Allowing for adjustments in the change of equilibrium velocity and potential output growth,

a non-activist money growth rule with the objective of achieving an inflation target π

∗

sets:

7

∆m = π

∗

+∆q

∗

− ∆v

∗

(7)

or, after substituting the equation of exchange, stated in terms of velocity:

∆v − ∆v

∗

=(π − π

∗

)+(∆q − ∆q

∗

)(8)

To reformulate this strategy in terms of an interest rate rule, consider the simplest formu-

lation of money demand as a (log-) linear relationship between velocity deviations from its

equilibrium and the rate of interest. In difference form this is:

8

∆v − ∆v

∗

= a∆i + e (9)

where a>0ande summarizes short-run dynamics and money-demand fluctuations. Sub-

stituting (9) into (8) but without the term e—that is avoiding the short-run velocity fluctu-

ations which are the suggested principal drawback of money growth strategies that interest-

rate based strategies are designed to avoid—yields:

∆i = θ((π − π

∗

)+(∆q − ∆q

∗

)) (10)

where θ>0. As can be readily seen, this has exactly the same form as rule (5). More

generally, money growth rules that incorporate additional responses to inflation, real output

7

For example, Friedman’s famous 4% rule for the growth of M2 during the late 1960s and early 1970s,

corresponded to a zero inflation target with the assumptions that M2 velocity exhibited no trend and

potential output growth equaled 4% (the prevailing estimate at the time), or with the assumption of a

somewhat smaller estimate of potential output growth and a corresponding small downward trend in velocity.

8

This reformulation presupposes that interest rates are positive and not near the zero bound. If additional

monetary easing is required when the rate is at zero, it can be easily achieved by increasing the rate of money

growth further, but this easing is obviously not reflected in additional reductions in the interest rate policy

instrument. This break in the link between interest rates and easy money sometimes leads to the flawed

conclusion that no additional easing is possible at the zero bound. (Examples would be the experience during

the Great Depression and, more recently, in Japan. See Orphanides, 2003d, for details.) As Taylor stressed

at a 1995 Bank of Japan conference, the deflation experienced at the time in Japan “made an interest rate

rule unreliable, calling for greater emphasis on money supply rules.” (Taylor 1997, p. 36). Orphanides

and Wieland (2000) elaborate on this transition from Taylor-rule-based to money-based policies under these

circumstances. Using data from the Great Depression and recent Japanese experience, they also illustrate

how the simple velocity-interest rate relationship reflected in (9) breaks down at the zero bound.

9

growth or nominal output growth, such as rules in the spirit of Brunner, Cooper, Fischer,

McCallum and Meltzer, which can be written as:

9

∆m = π

∗

+∆q

∗

− ∆v

∗

− b

π

(π − π

∗

) − b

∆q

(∆q − ∆q

∗

) (11)

for b

π

,b

∆q

≥ 0 can be similarly reformulated as

∆i = θ

π

(π − π

∗

)+θ

∆q

(∆q − ∆q

∗

) (12)

for positive values of θ

π

and θ

∆q

. To differentiate these specific rules from Taylor’s classic

formulation, I will refer to them as natural-growth targeting rules to highlight that these

rules rely on estimates of the economy’s natural growth rate for guidance, responding to

perceived imbalances between the growth of aggregate demand and aggregate supply, and

not an output gap.

10

In words, these natural-growth targeting rules call for the Federal Reserve to raise

interest rates “when inflationary pressures appear to be rising” and lower rates “when

inflationary pressures are abating and recession appears to be more of a threat,” matching

quite closely Taylor’s verbal description of the broad guidelines for an interest-rate-based

rule described earlier. Indeed, Taylor himself stressed the broad relation of money growth

targeting rules and his interest-rate-based policy framework (1993, p. 209 and 1999, p. 322)

and also suggested “a policy rule where the growth rate of GDP rather than its level appears”

(1993, p. 208) as one of the examples of specific rules that Federal Reserve staff could

present to the FOMC as part of the policy decision process.

11

The reliance of information

regarding growth rates, as opposed to natural-rate gaps, is also not inconsistent with verbal

descriptions of policy considerations.

12

As with Taylor’s classic alternative, natural-growth

9

Brunner and Meltzer (1993), Cooper and Fischer (1972, 1974), Fischer and Cooper (1973), Meltzer

(1987), McCallum (1988, 1990, 2000).

10

Rules (10) and (12) also relate to price level targeting and to nominal income targeting rules, stated in

difference form. Letting n = π +∆q denote the growth of nominal income and n

∗

= π

∗

+∆q

∗

denote the

natural growth of nominal income, given the desired rate of inflation, the simplest form, (10), can be written

more simply as: ∆i = θ(n− n

∗

). Orphanides and Williams (2002) offer detailed econometric policy evaluation

comparisons of rules of the form (3) and (12) and an extensive bibliography of earlier studies examining

the relative merits of the level/difference elements of the two alternatives. See, in particular, Goodfriend

(1991), Levin et al (1999), Rotemberg and Woodford (1999), Sack and Wieland (2000), Williams (1999)

and Woodford (1999) for the role of interest smoothing and Leitemo and Lonning (2001), McCallum (2001),

Orphanides et al (2000), Woodford (2002), and Walsh (2003) for the role of output growth.

11

McCallum (2000) and Razzak (2003) also investigated the relation between money-growth and interest-

rate-based policy rules. A grandparent of such comparisons is the classic study by Poole (1970).

12

A recent example to this effect appeared in remarks by Chairman Greenspan articulating his concerns

10

targeting rules could be implemented based on either current data and recent realizations

of inflation and output growth, or based on the outlook of inflation and growth in the near

future.

3 Monetary Policy Since the Treasury-Federal Reserve Ac-

cord Through the Lens of a Taylor Rule

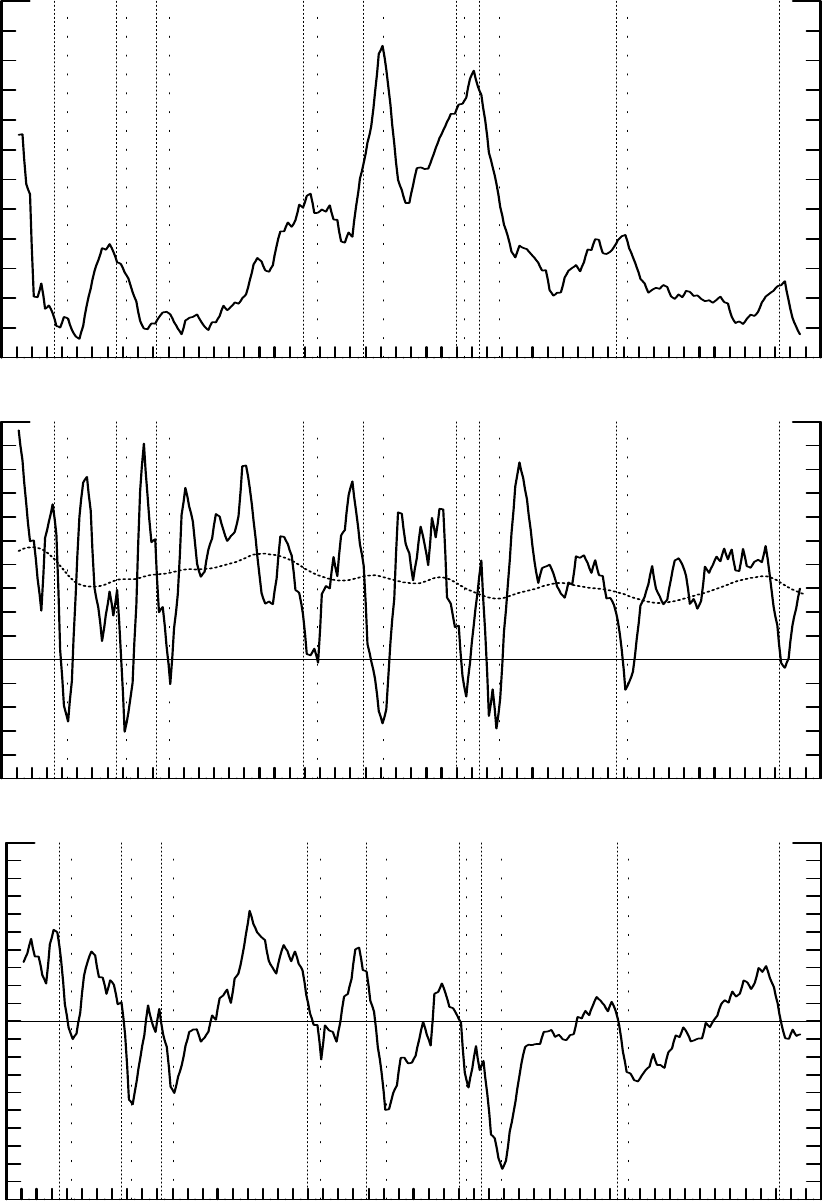

Figure 1 provides a summary overview of macroeconomic developments in the United States

since 1951—the year that marked the re-birth of the System following the subordination

of Federal Reserve policy to Treasury financing operations during World War II.

13

The top

panel shows the familiar path of inflation, measured as the rate of change of the output

(GDP) deflator over four quarters. The middle panel plots real output growth over four

quarters (solid line) as well as an estimate of the natural rate of growth of the economy over

time—the growth of potential output (dotted line). The bottom panel plots an estimate of

the output gap. All data in the figure are the most recently available estimates, as produced

by the Commerce Department for the GDP data and by the Congressional Budget Office

for potential output. As is well known, all of these series, but particularly the estimates

of potential output, are subject to revisions, redefinitions, rebenchmarks, remodeling and

so forth—an issue whose significance will become evident shortly. In this, and subsequent

figures, the vertical dotted lines represent business cycle peaks and troughs as dated by the

National Bureau of Economic Research (NBER). (The narrow spacing reflects peaks and

the wide spacing troughs, respectively. As of this writing, the date of the trough of the

recession that started in 2001 has not been announced.)

Historical policy evaluation is seen as an attempt to explain the interactions of policy

decision with subsequent economic outcomes, and to assess whether policy action or inaction

was appropriate in terms of its direction, timing and perhaps magnitude. The most precise

method for such evaluations requires the use of a model. Such evaluations, however, are

limited by and the results are conditioned upon the confidence with which we can hold

that the model serves as an adequate representation of reality for that purpose. Given our

about the economic outlook in January 2000, during a tightening policy phase: “It is this imbalance between

growth of supply and growth of demand that contains the potential seeds of rising inflationary and financial

pressures that could undermine the current expansion.”

13

Hetzel and Leach (2001) provide a fascinating narrative account of the events leading to the March 4,

1951 Accord.

11

severely limited knowledge of the workings of the economy, we can therefore never hope

to be able to evaluate specific actions with much accuracy, even in hindsight. We may,

however, succeed in pinpointing particular periods when better outcomes would appear to

have been likely, at least with the benefit of hindsight, had better policies been pursued.

For example, retrospectively, it is sometimes straightforward to identify periods when the

economy was overheated and inflation was deviating from price stability. Based on just

rudimentary knowledge of the monetary transmission mechanism and its lags, those are

periods before which tighter monetary policy would have been seen as more successful than

its actual path. Consider, for instance, the years surrounding 1955, 1965, 1978—to select

just an example from each of the first three decades shown. In each case, according to

the figure, output exceeded its potential, output growth exceeded the growth of potential

supply, and inflation worsened. In each case, if an outside observer to the System could have

rerun that particular episode in history (with the benefit of hindsight), tighter monetary

policy would have likely been suggested.

In general, for a suggested monetary policy framework to be seen as an improvement

over the arrangements that in fact were put in place over history, it must be the case that

the framework would have suggested a better policy, at least over some of these clearly

identifiable periods, and no worse policy at most other times. Accurate identification of

any suggested improvement, however, requires that policy rule prescriptions from a rule

under consideration be based on information available to policymakers when decisions are

made, as opposed to information that has become available ex post. This distinction is

of particular significance for natural-rate-gap-based policy rules as natural rate concepts

are particularly prone to revision on the basis of the subsequent evolution of the economy,

which is obviously unknown when policy decisions are made.

In this section, I conduct counterfactual analyses of the Taylor rule over the past half

century examining the performance of such strategies with the criteria outlined above. To

illustrate the dangers of historical evaluation that is not based on real-time information,

I build on the approach I suggested in earlier work (2000, 2001, 2003c) and distinguish

between real-time and retrospective renditions of history, as seen through the lens of Tay-

lor rules. To that end, I perform parallel exercises using the two alternative information

environments.

12

3.1 The Classic Taylor Rule Over the Pa st Twenty Years.

Some key issues regarding the distinction between real-time and retrospective analysis can

be usefully highlighted by reconstructing the classic rendition of the Taylor rule, as it was

originally published. Figure 2 plots alternative versions of the classic Taylor rule against

the federal funds rate since mid-1982. The solid line in the figure shows the evolution of the

federal funds rate during this period. The dark dashed line (the “1992” rule) reconstructs

the Taylor rule as was originally published, replicating all of Taylor’s original assumptions.

The two vertical lines mark the beginning and end of the sample over which the rule was

originally examined, from 1987:1 to 1992:4.

14

Comparison of the 1992 version of the rule and actual policy confirms Taylor’s finding

that this simple rule matched the actual behavior of policy in the 1987:1 to 1992:4 remark-

ably well. However, as can be seen in the figure, this match did not extend to earlier years,

even using Taylor’s original data and assumptions. To extend the rule forward, I also con-

structed a “2002” rendition of the rule. For this exercise, I rely on the latest published data,

asshowninFigure1.

15

The resulting rule prescriptions using rule (3), that is maintaining

the implicit assumptions r

∗

= π

∗

= 2, is shown with the thin-wide-dash line in the figure.

The classic version of the Taylor rule based on the latest data does not appear particularly

impressive as a description of policy over the past twenty years. Of course, neither the 1992

nor the 2002 renditions reflect actual policy settings that policymakers following rule (3)

could have arrived at in real time. Rather, as output data and estimates of potential output

undergo continuous revisions, to recover those realistic settings requires a reconstruction of

the real-time rendition of the rule. For this, extending forward the data presented in Or-

phanides (2001, 2003) I created a dataset with first announced measures of output data

and real-time estimates of potential output, as would be available to the FOMC at the

time of the FOMC meetings by the middle month of any quarter. Federal Reserve staff

estimates for quarters after 1997:4 are not yet available to the public and could not be used

14

Data for the 1992:4 quarter were not available at the time of the 1992 conference given Taylor’s use

of within-quarter data for forming prescriptions for his rule but became available before publication of the

original study. For this replication, I rely on data as available in 1993:1, which also match closely the figures

in Taylor (1993), the published version of the paper.

15

Thus, for the “2002” rendition shown, the output gap is defined using the CBO estimates of potential

output. The CBO series has also been employed over the past few years by the Federal Reserve Bank of St

Louis for illustrations of the Taylor rule published in the monthly publication Monetary Trends.

13

for this study, however. To complete this dataset, I relied on the real-time CBO estimates

for the past five years instead.

16

(These estimates are published twice a year, usually in

February and August). Finally, to avoid the use of within-quarter forecasts in creating the

real-time rendition of the rule, I adopted the operational version of the classic Taylor rule

in this real-time reconstruction. That is, in each quarter t, the output gap and inflation

data inputs to the rule are for those for quarter t − 1. (Data for quarter t − 1arethemost

recent available actual data during quarter t.) The result is shown with the dotted line.

The contours of the real-time rule do not capture the contours of policy quite as well as the

“1992” rendition. The real-time rendition tracks policy well only in a few of the years of

Taylor’s sample.

An obvious difficulty is that the real-time rule as well as the “2002” rendition yield

prescriptions that appear too low, on average, even for the period originally examined by

Taylor. An important problem, which generates this average discrepancy, is that alternative

historical renditions of the underlying series for inflation and, particularly, for the output

gap, may have different averages for any given period. Variations in these averages, in turn,

suggest that alternative assumptions regarding the equilibrium real interest rate would be

required to reconcile the stance of a rule with either actual policy, or policy desired to

achieve a specific operational objective for inflation on average. Unfortunately, since the

appropriate averages cannot be known at the time policy is made, real-time renditions of the

classic Taylor rule may provide policy prescriptions that are systematically too tight or too

easy for extended periods of time. Needless to say, this is not a problem if our main interest is

simply to find a rule that appears to “fit” policy ex post. We can always choose assumptions

to ensure the correct averages—though the interpretation of the resulting “fitted” rule is

not clear in such an exercise. However, this is a problem of great significance if the aim is

to identify a specific rule meant to be useful for real-time policy analysis.

3.2 Moving Backwards in Time

Figure 3 provides a real-time comparison with the retrospective view of the economy pre-

sented in Figure 1 from 1951 to the present. The data are shifted by one quarter, so that

16

Obviously, without knowing whether and how closely these real-time estimates reflect the parallel real-

time estimates at the Federal Reserve, rule prescriptions based on these estimates should not be interpreted

as necessarily bearing a resemblance to actual rule prescriptions that could have presumably been produced

at the Federal Reserve in real time.

14

observations plotted in quarter t reflect values for quarter t − 1. This is done to capture the

one-quarter lag with which initial estimates of actual output data have generally become

available during this period. The real-time data in the figure are also limited to the period

after 1960, reflecting the beginning of the systematic construction of potential GNP/GDP

in the United States and the availability of quarterly real output data. Thus, for the

1950s, the estimates shown for the real-time output gap series are based on Okun’s (1962)

quarterly estimates—the published version of the estimates originally presented in Heller,

Gordon and Tobin (1961).

17

From 1961:1 to 1979:4, the data on potential output reflect

the Council of Economic Advisers estimates, which, as detailed in Orphanides (2000, 2003,

2003c), represented the “official” estimates during this period and were widely used, includ-

ing by the staff at the Federal Reserve. (Board staff first presented output gap estimates

based on these data to the FOMC at the June 1961 FOMC meeting.) As highlighted in

Figure 3, real-time perceptions of the state of the economy over this period at times differed

markedly from current perceptions. Revisions in the inflation and real output growth data

have at times been significant, even exceeding one percentage point. Most problematic,

retrospectively, appear to have been estimates of the output gap and their revisions. Part

of these revisions can be attributed to revisions in the measurement of actual output.

18

In general, however, the most problematic element associated with real-time estimates of

the output gap is that it is based on end-of-sample estimates of an output trend (potential

output), which are unavoidably highly imprecise. Statistical techniques and models em-

ployed for estimating potential output have evolved during this period, reflecting, among

other elements, the evolution of best accepted estimation practice.

19

This complicates the

17

To be sure, estimates of potential GNP were generated in earlier years, dating as far back as the time

when estimates of actual GNP first appeared. But prior to the 1960s, their construction was not as systematic

and relied on annual data. Quarterly data on real output, were introduced in December 1958 (United States

Department of Commerce, 1958). The earliest estimates of potential GNP published by the Federal Reserve

Board, as far as I have been able to determine, are those presented in the May 1944 Bulletin (Goldenweiser

and Hagen, 1944). In light of the later discussion, it is of interest to note that these estimates presumed

that an unemployment rate of 3.3 percent corresponded to the non-inflationary full employment potential

for the economy.

18

As shown in the middle panel, revisions in the measurement of real output growth were unusually large

and one sided around 1975. For that year, as much as five percentage points of the revision in the output

gap could be attributed to the revisions in the real-time estimates of output growth (Orphanides, 2000).

19

Of course, over history, best accepted practices and most fashionable theories proclaiming to identify the

“optimal” approach of the day need not correspond to and may vary greatly from what one might consider

best practices at later times. With the benefit of hindsight, and based on later methodological perspectives,

one can always identify flaws, false starts, and recurrent periods of regress.

15

interpretation of the total revision presented in the figure.

20

An important commonality,

however, is that throughout this period estimates of potential output were meant to cor-

respond to a concept of non-inflationary (or non-increasing-inflation) level of employment

and production. For example, in constructing the earliest of the real-time estimates shown

in the figure (in 1961:1) Okun emphasized: “The full employment goal must be understood

as striving for maximum production without inflation pressure” (Okun, 1962, p. 82). Thus,

these estimates reflect real-time perceptions of the non-inflationary productive potential of

the economy, and the evolution of these perceptions over time. Real-time perceptions and

retrospective “reality,” needless to say, proved to be far apart for long stretches over this

sample.

The effect of the historical revisions in inflation and the output gap on policy prescrip-

tions from the classic Taylor rule are shown in Figure 4. The figure plots two renditions

(real-time and retrospective) of the operational version of the rule (with data lagged by a

quarter, as shown in Figure 3) with the original assumptions π

∗

= r

∗

=2.

Consider again the years 1955, 1965 and 1978. On these three occasions, based on the

current rendition of the data, policy prescribed by the rule would have been tighter than

actual decisions. However, as a comparison with the real-time rendition of the rule makes

clear, the stance of policy adopted by the FOMC during these three years was either about

as tight (in 1955 and 1978) or tighter than would have been suggested by the rule (in

1965). The primary difference is that for all three years current estimates indicate that the

economy was overheated, while at the time this overheating was not as clear.

In 1955, real-time information indicated the economy may have been on the verge of

achieving and perhaps exceeding full capacity, based on perceptions at the time. The policy

record points to an awareness of the difficulties of assessing the limits of expansion and the

Committee’s intent to act pre-emptively in the face of threats of an overheated economy.

21

But policymakers at the time did not recognize the extent of the inflationary danger reflected

20

Orphanides and van Norden (2002) present decompositions of sources of errors in estimation of output

gap estimates based on various fixed statistical techniques from the mid-1960s to the late-1990s. Their

results suggest that the statistical properties of the revisions shown here are not out of line with those of

revisions corresponding to many statistical techniques, even if a common technique had been used over time.

Needless to say, ignorance as to which method is “the best” is one of the fundamental issues regarding

estimation of any natural rate concept, including the level of potential output.

21

These positive elements of policy during the 1950s are not always appreciated, a point emphasized

recently by Romer and Romer (2002) who argue that policy during that period was more modern that is

frequently presumed.

16

in current data. In a sense, they appeared to have the wrong sign on the gap—although the

level of utilization of resources was not nearly as important an indicator as it became later,

following the perceived methodological advancements for policy control during the 1960s.

22

Consider the following descriptions of the economic situation and need for action from the

Minutes for the August 2, 1955, FOMC meeting:

23

I do not know whether we have reached the limits of our productive capacity

in terms of men, materials and equipment. On these matters we have opinions

rather than conclusive evidence. (Sproul statement, p. 21.)

We can all agree that the economic situation is ebullient and presses on the com-

fortable capacity of the economy. It can thus be concluded that the apparent

present trends in the economy simply extend themselves to over-reach comfort-

able capacity and that, accordingly, an inflation is inevitable in the absence of

additional immediate, and substantial monetary restraint. (Bryan statement,

p. 23.)

Inflation is a thief in the night and if we don’t act promptly and decisively

we will always be behind. All of us know that it sometimes takes a long time

for seeds to germinate, but when they flower, they do so with explosive force.

(Martin, p 13)

The Committee decided to tighten policy, but given the easy money policy that was earlier

in place, a bout of inflation, evident in the top panel of Figure 3, could not be averted.

In 1965, the economy was believed to be approaching full capacity for the first time since

the close monitoring of output gap measures had begun four years earlier. By contrast, as

seen in Figure 3, according to the current CBO estimates the economy was already severely

overheated. But again, the extent of the danger was not recognized in time, despite (or

perhaps because of) a forward-looking “modern” framework.

24

Although, retrospectively,

22

The statement regarding the sign of the gap presupposes that the 1961 estimate of potential output for

1955 used in the figure is similar to prevailing perceptions in 1955. This appears consistent with narrative

evidence from the period.

23

One of the critical pieces of new information at this meeting was a revision to the NIPA for the previous

3 years which both significantly dampened the depth of the 1953-54 recession and raised estimates of growth

during the subsequent expansion. This prompted the concern that the economy was fast approaching its

limits, which had not been recognized prior to the NIPA revisions.

24

A significant difficulty was that by the end of 1965, Federal Reserve staff, in line with best accepted

practices of the day, started relying more heavily on a Phillips curve framework for forecasting inflation,

which translated misestimates of economic activity gaps into biased forecasts of inflation. The difficulty is

that the analysis failed to take into account that, in real time, gap-based forecasts of inflation are largely

uninformative and often misleading (Orphanides and van Norden, 2003). As would be expected, the bias

in output gap estimates during the 1960s and 1970s, resulted in inflation forecasts that were too optimistic

(Orphanides, 2002, 2003). Private forecasts were no more accurate (Romer and Romer, 2000).

17

it is very clear that a tightening was long overdue, the Committee was split on whether

action was needed. Examine the following from the go-around of comments and views on

economic conditions and monetary policy from the Minutes for the November 23, 1965,

FOMC meeting:

[T]he gap between between actual and potential levels of activity will probably

narrow further; and this should mean continued pressure on industrial capacity

and the labor market. (Hayes statement, p. 33)

Mr Mitchell did not see a threat to stability in the present and prospective rates

of resource utilization (p. 59)

The present situation was dangerous and worrisome because the economy was

balanced at a high level of employment and output, but it was a very satisfactory

level and one that he hoped could be maintained. (Maisel remarks, p. 67)

Although the upcreep in prices had slowed and capacity limitations still did not

appear to block further gains on output, many forecasts now emerging suggested

a growth rate that could move the economy very close to full employment levels

as 1966 unfolded. (Bopp remarks, p. 71)

Once again, assessments of the gap had the wrong sign. Once again, members of the

Committee who were examining the policy problem in terms of gaps were misled. Policy

was tightened after this meeting but the tightening had come too late.

25

For 1978 the record suggests that the perceptions of Federal Reserve policymakers were

even further removed from reality than in the two previous episodes. Once again, the

economy was substantially overheated, and yet policy actions appeared to be based on the

erroneous belief that a (negative) output gap was still lingering from the 1975 recession. The

record suggests that the Committee recognized that the growth of the economy exceeded

the growth of potential supply (as is confirmed with both the retrospective and real-time

data in the middle panel of Figure 3). However, even in 1979 the Committee believed that

a gap persisted. This is most clearly reflected in the February 20, 1979, Humphrey-Hawkins

Report to Congress: “The narrowing of the gap between actual and potential output implies

that a tighter hold on the nation’s aggregate demand for goods and services is necessary if

25

This tightening was the controversial increase in the discount rate on December 6, 1965, adopted at the

urging of Chairman Martin. It should be noted that the Chairman himself was not favoring the gap-based

policy analysis that was increasingly becoming more accepted at the time. The record suggests that on this

occasion he would have favored tightening policy earlier, based on the observation that the rate of growth

of the economy was unsustainably high, as is confirmed by both the real-time and retrospective readings in

the middle panel of Figure 3.

18

inflationary forces are to be contained.” Though the potential inflationary threat of pushing

the economy beyond its limits were clearly understood, policymakers had the wrong sign

on the gap during that time.

26

The overview provided by Figure 4 suggests that the real-time prescriptions of the

classic Taylor rule, with the implicit inflation target of 2 percent, appear to successfully

capture the broad contours of actual policy over many years. The success appears closest

during the period from the mid 1960s to the late 1970s—the Great Inflation. Since policy

appears so similar to the classic rule over this period, a straightforward conclusion is that

the experience of the Great Inflation would not have been prevented if this rule had been

followed exactly. Importantly, the rather close match of the real-time prescriptions from the

rule with actual policy during the Great Inflation is not evident in a comparison of policy

with prescriptions based on current data, which serves to illustrate the potential pitfalls

of historical policy analysis based on information which was not available when policy was

made.

27

By contrast, the biggest and most systematic departures appear in the years prior

to the Great Inflation and during the Volcker disinflation period.

Another way to examine the source of this difference is by comparing the real-time and

ex post renditions of the output gap with the implicit output gap that would be necessary

if the Taylor rule prescription were exactly matched over history by the actual federal funds

rate. The top panel of Figure 5 presents such a comparison for the period since 1961. For

the gap implied by the rule, the figure presents a 9-quarter moving average that smooths

out high-frequency variations. As can be seen, the gap implied by the rule was extremely

low during most of the 1970s, much like the actual real-time gap estimates. By contrast,

policy during most of the 1980s and from 1994 to 1999 would have been consistent with the

real-time Taylor rule only if the actual output gap were far greater than it actually was.

Two elements are important to understand the timing, magnitude and direction of the

apparent errors in the real-time output gap estimates. First, the evolution of beliefs regard-

ing estimates of the rate of unemployment that were consistent with full employment—what

26

It is of interest to note that this significant error occured after estimates of potential output had been

drastically scaled down. See Orphanides (2003c) for further details on the timing and size of those revisions.

27

Indeed, the counterfactual simulations presented in Orphanides (2003c) indicate that application of the

classic Taylor rule could not have averted the Great Inflation if policy were based on information actually

available when decisions were made but better outcomes would have resulted if the rule could have been

applied with information available ex post.

19

later became known as the natural rate or unemployment, NIRU or NAIRU and so forth.

As is well known, estimates held with some confidence from the late 1940s to the early

1970s—around 4 percent—later proved to have been exceedingly optimistic. Economists,

however, generally failed to recognize this change sufficiently quickly.

28

Okun’s law may be

used to illustrate the quantitative significance of misperceptions regarding the natural rate

of unemployment for output gap errors. With an Okun’s law coefficient of 2 (at the low

end of the range of current parameterizations) a misperception of 2 percentage points on

theunemploymentgaptranslatestoa4percentagepointerrorinthemeasurementofthe

output gap. With Okun’s original 3.3 coefficient, (which is more typical for the 1960s and

early 1970s,) the error exceeds 6 percentage points.

The other key element for the huge misestimates of the output gap during the 1970s and

even later was the productivity slowdown which had started in the late 1960s, worsened in

the mid 1970s and persisted well into the 1990s, and still lacks a compelling explanation.

Errors in estimates of output gaps due to such hard-to-explain changes in the growth rate

of potential output can be particularly problematic as it is impossible to assess with any

confidence the likely persistence of what may appear to be a once-in-a-lifetime event. To

illustrate just how persistent such errors tend to be, the bottom panel of Figure 5 contrasts

the historical output gap series from three years: 1973, 1982 and 1994. Although by 1982

about 15 years had passed from the suspected start of the slowdown, output gap estimates

for the late 1960s and early 1970s still did not reflect nearly as much of the extent of the

revision that was to be added to these estimates from that time until 1994. Indeed, the

historical path of potential output was generally revised in one direction—downwards—for

a period that lasted about twenty years. From the mid-1990s on, the reverse pattern started

to appear in the data, although the recent revisions in the upward direction (as reflected in

the CBO estimates) appeared to be faster than the revisions to the productivity slowdown

a generation earlier. An optimistic interpretation of this behavior is that, conceivably,

the recognition of the errors of the past may have led practitioners to dampen real-time

estimates of output gaps towards zero, which in turn would reduce the magnitude of the

28

Chairman Burns described this failure shortly after he left the Federal Reserve: “a broad consensus

developed that an unemployment rate of about 4 percent corresponded to a practical condition of full

employment ... now widely believed to be about 5 1/2 or 6 percent. ... But governmental policymakers ...

were slow to recognize the changing meaning of unemployment statistics ... The Federal Reserve did not

escape this lag of recognition.” (Burns, 1979, p. 17).

20

errors associated with changes in the trend.

29

If history is a guide, on the other hand, it

might take another decade or more before we can begin to evaluate the accuracy of estimates

for the late 1990s.

The magnitude of the error apparent in historical estimates of the output gap from 1982,

confirms that had the gap-based policies which appear to describe the Great Inflation period

been continued during the early 1980s, the Great Inflation problem could have persisted.

Indeed, the counterfactual simulations presented in Orphanides (2003c) using these data

and an estimated model of the U.S. economy, confirm that had policy followed the classic

Taylor rule, not only inflation would have followed a path very similar to that experienced

during the Great Inflation, it would have remained at those high levels during the 1980s as

well.

3.3 Forecast-Based Variants of the Classic Rule

The top panel of Figure 6 presents an illustration of two forecast-based variants of the classic

rule. As already pointed out, given the emphasis that Federal Reserve policymakers have

attached on forecasts over the past decades, it would be reasonable to expect that such

rules could provide better descriptions of historical policy. The figure presents two such

alternatives. The first replaces inflation with its forecast in the rule, but retains the most

recent outcome for the gap. The second also replaces the output gap outcome with its

forecast. (These rules are similar to the estimated Taylor-style rules in Clarida, Gali and

Gertler (1999, 2000), and Orphanides (2001, 2002, 2003).)

For the illustration in the figure, I relied on forecasts of inflation over a four-quarter

period starting from the quarter of latest available actual data. Given the one-quarter-lag

in output data releases this implies, for each quarter t, a “year-ahead” forecast over the

horizon t − 1tot + 3. Similarly, for the rule that employs a forecast of the output gap I rely

on the forecast for quarter t + 3, a “year-ahead” from the latest actual output data for t − 1.

Forecasts at this horizon have been prepared by the Federal Reserve staff systematically as

part of the Greenbook since 1969. (A few missing quarters in the early part of the sample

reflect occasions when only shorter-horizon forecasts were produced by the staff. Shorter-

29

In the limit, a robust approach is to “estimate” that the gap equals zero in every period, as a first

approximation. This is equivalent to the robust approach of ignoring the output gap for policy analysis, as

a first approximation. (Orphanides 2003b.)

21

horizon forecasts are available since 1966.) Starting from the quarterly dataset of these

forecasts in Orphanides (2003), I extended the sample with the latest available Greenbook

forecasts, to the end of 1997. The implied prescriptions from this rule, based on these

forecasts, are shown in the figure for the 1969 to 1997 period. The end of this period is

marked in the figure with the vertical solid line. As a hypothetical illustration of what

such a policy rule might have suggested over the past five years, from 1998:1 to the current

quarter (2002:4), I extended the figure by using, instead of the Greenbook forecasts, the

forecasts available from the Survey of Professional Forecasters (SPF), (and for the output

gap, the real-time CBO estimates of potential output).

30,31

Broadly, the contours of these forecast-based variants of the classic rule appear similar

to the outcome-based variant presented in Figure 4. Less noticeable differences are also of

interest, however. The contours of policy during the 1970s, in particular the timing of policy

reversals, appears to be better captured with the forecast-based, rather than the outcome-

based rule. The forecast based rules also do a somewhat better job of capturing the policy

turning point of 1994. Evidently, an element of the preemptive strike against inflation that

year is captured in these forecast-based variants, but not in the outcome-based version.

3.4 The Natural Growth Targeting Variation

Next, I provide a comparison of the classic rule with its money-growth-motivated variation,

natural growth targeting. As an illustration of a forecast-based application of this alterna-

tive, I computed the settings implied by rule (10), maintaining, for direct comparability,

Taylor’s assumptions of an inflation target, π

∗

= 2 and, also a responsiveness coefficient,

θ =

1

2

.

∆i =

1

2

(π − 2) +

1

2

(∆q − ∆q

∗

) (13)

For this illustration, I relied on forecasts of inflation and real growth relative to the growth

of potential supply over a four-quarter period starting from the quarter of latest available

30

The SPF survey, a continuation of the quarterly NBER-ASA survey, is currently maintained by the Fed-

eral Reserve Bank of Philadelphia. Zarnowitz and Braun (1993), and Croushore (1993) provide informative

descriptions.

31

Parallel to the remark in footnote 16 regarding prescriptions based on CBO estimates, without knowing

whether and how closely the SPF forecasts match the parallel Federal Reserve staff forecasts, rule prescrip-

tions based on the CBO estimates and SPF forecasts should not be interpreted as necessarily bearing a

resemblance to rule prescriptions that could have presumably been produced at the Federal Reserve in real

time.

22

actual data. The source and timing of the data and forecasts is exactly as described for the

forecast-based variants of the classic rule.

The bottom panel of Figure 6 presents this natural growth variant together with the

classic version of the rule (reproduced from Figure 4). As can be seen from the figure,

this variation of the Taylor framework appears more successful in capturing the actual

setting of the federal funds rate over the past twenty years than the classic rendition. But

on average, and consistently over many years, this policy would have suggested somewhat

tighter policy settings than actual decisions. Evidently, this policy rule, consistent with a

monetary targeting growth rule in the spirit of Friedman, would have consistently prescribed

that faster progress towards disinflation should have been made during the 1970s and 1980s,

as long as inflation deviated from its 2 percent target. But since the early 1990s, when

inflation has hovered around this target, this policy rule appears to describe actual policy

remarkably well and significantly better than the classic Taylor rule.

3.5 Estimated Policy Rules

Real-time data and forecasts may be used to estimate the implied policy rules reflected in

the policy choices over the past several decades. For estimation, I consider a simple policy

rule form that nests various variants of the Taylor rule, including the ones just discussed,

as special cases:

i

t

= θ

0

+ θ

i

i

t−1

+ θ

π

π

a

t+3

+ θ

∆y

∆

a

y

t+3

+ θ

y

y

t−1

(14)

Here, π

a

t+3

= p

t+3

− p

t−1

is the “year-ahead” inflation forecast starting at t − 1, as described

earlier, y

t−1

= q

t−1

− q

∗

t−1

is the output gap in period t − 1, and ∆

a

y

t+3

= y

t+3

− y

t−1

=

∆

a

q

t+3

− ∆

a

q

∗

t+3

is the “year-ahead” growth forecast relative to potential. Variables dated

t and later reflect real-time forecasts formed during quarter t.

To nest the various alternatives, this specification is somewhat more general than the

one estimated by Clarida, Gali and Gertler (1999, 2000), Orphanides (2001, 2003), and

others, in that it includes a growth rate term with a horizon matching that of the horizon

of the inflation forecast. Similar policy rules that also allow for such growth terms have

been shown to offer simple characterizations of recent historical monetary policy in earlier

studies (Orphanides and Wieland 1998, McCallum and Nelson 1999, Levin et al. 1999,

2002). These studies, however, relied on ex post revised data for estimation. Here I rely on

23

real-time renditions.

In equation (14), the special case θ

i

= θ

∆y

= 0 corresponds to the inflation forecast

version of the classic rule, and the case θ

i

=0andθ

∆y

= −θ

y

> 0 corresponds to the classic

rule that targets the forecasts of both inflation and the output gap. The case θ

i

=1,θ

y

=0

and θ

∆y

> 0 corresponds to the natural growth variant.

Table 1 presents estimates of equation (14) for three different samples and two alternative

sets of forecasts. The top panel presents estimates based on Greenbook forecasts, available

through the end of 1997. The bottom panel shows corresponding estimates using the SPF

survey which extends to the end of 2002. In both cases, the beginning of the sample is

1969. I report estimates for the full sample of available data as well two subsamples, one

with data prior to the 1979:3 and another beginning in 1982:3.

The estimated equations indicate that this generalized version of the specific rules ex-

amined before broadly describes the time path of policy decisions with a rather surprising

degree of consistency. Elements of both the classic variant of the rule and the natural

growth variant appear in the estimates. The restrictions implied by both the classic and

natural growth special cases are rejected by the data. There is a substantial element of

inertia, but θ

i

is smaller that one. And the responses to both the output gap and to output

growth are positive.

During both subsamples, policy appeared to respond strongly to inflation forecasts.

32

This contrasts sharply with findings (based on ex post data analysis) suggesting that Federal

Reserve policymakers responded to inflation insufficiently strongly for economic stability

during the Great Inflation. (Clarida, Gali and Gertler (1999, 2000).) Rather the estimation

over the two subsamples identifies another important but subtle difference: it suggests

that policy responded relatively more heavily to the level of the output gap rather than

the growth rate of output during the Great Inflation and has responded much less to the

output gap relative to inflation since then. As argued in Orphanides (2003, 2003b), although

subtle, a change of this nature likely contributed importantly to the apparent improvement

in macroeconomic stability over the past two decades, relative to the earlier period.

33

32

These estimated rules satisfy the stability criteria detailed in Woodford (2002).

33

See also McCallum (2001), Gaspar and Smets (2002), Mishkin (2002), and Orphanides and Williams

(2003), for related arguments indicating how excessive emphasis on output gaps can prove counterproductive

for economic stability.

24

In summary, based on these estimates, somewhat different variants of the Taylor rule

appear to capture historical behavior during and after the Great Inflation, but the differences

are subtler than they appear on the basis of retrospective analysis. In particular, the policies

pursued during the Great Inflation do not appear to be obviously flawed or to be out of line

with broad characterizations of good policy practice based on the Taylor-rule framework.

4 The Genesis of Activist Stabilization Policy at the Federal

Reserve

Thus far we have seen that starting with the Accord, Federal Reserve policy can be broadly

characterized with the Taylor-rule framework with considerable consistency. In this section,

I delve further back in an attempt to identify when this approach begins to offer a useful

characterization of the monetary policy debate, and to track the resulting policies and

economic outcomes from the viewpoint of this framework. The evidence leads us to the

1920s, a period which marked, in effect, the birth of modern central banking in the United

States. Remarkably, the 1920s span both what Friedman and Schwartz termed “the high

tide of the reserve system,” as well as the origins of the System’s greatest failure—the Great

Depression.

My aim in this section is to briefly review some basic aspects of the state of knowledge in

empirical macroeconomics during the 1920s and relate the salient characteristics of policy

to the Taylor-rule framework. A number of issues, of course, are left untouched. For

completeness, I refer the reader to the comprehensive treatments of the period provided by

Friedman and Schwartz (1963) and Meltzer (2003).

An underlying premise in my description is that the objectives of the Federal Reserve

System during that period were interpreted, from a modern perspective, as a mandate for

general economic stability and welfare, which in turn implied that, to the extent possible,

the Federal Reserve would want to pursue countercyclical monetary policy, or, which is the

same in modern parlance, reduce fluctuations in the “output gap.”

34

Indeed, as noted by

34

To be sure, these objectives should be seen in the context of the gold standard, which, at times, con-

strained policy options directed towards the domestic economy. However, because the United States enjoyed

a relatively large quantity of gold reserves, it was believed that the Federal Reserve had some flexibility for

pursuing objectives beyond the maintenance of the standard. For example, as Burgess explained in Novem-

ber 1929, whereas “bank of issue policy in other countries, both at other times and even more recently

has been largely determined by the position of the gold standard,” because of its reserve cushion, “[Federal

Reserve] policy can be determined not by what it has to do, but by what is best for it to do for the well-being

25

Burgess (1936) (an influential economist at the Federal Reserve Bank of New York during

this period), although section 14 of the original Federal Reserve Act stated that rates of

discount “shall be fixed with a view of accommodating commerce and business,” this could

not have been and was not interpreted literally. Rather, he explained: “The only reasonable

interpretation of the phrase is that policy is to be directed towards the general economic

welfare of the country.” (Burgess, 1936, p. 296.) On the other hand, price stability, per

se, was not considered a primary objective. However, it was implicitly understood that if

policy were successful in stabilizing business, prices would generally also remain stable. In

addition, the gold standard provided a nominal anchor.

Though the Federal Reserve started its operations in 1914, it was not until 1920-21 that

the System finally had the opportunity to start formulating the nation’s monetary policy

in earnest. Earlier, and in particular during the turbulence immediately following the end

of World War I, policy appeared subordinated to supporting Treasury financing operations.

As early as 1921 the basic principles that underlay monetary policy during the decade begun

to appear and by 1922/23 all pieces fell in place and the modern era had begun.

The timing of a number of developments contributed to the genesis of modern pol-

icy. First, the abrupt rise and fall in prices and economic activity experienced in 1919-1920