NEBRASKA DEPARTMENT OF MOTOR VEHICLES

Nebraska Electronic Lender Guide

This guidance document is advisory in nature but is binding on an agency until

amended by such agency. A guidance document does not include internal procedural

documents affecting only the internal operations of the agency and does not impose

additional requirements or penalties on regulated p

arties or include confidential

information or rules and regulations made in accordance with the Administrative

Procedure Act. If you believe this guidance document imposes additional requirements

or penalties on regulated parties, you may request a review of the document.

Driver and Vehicle Records Division

Version 5.1

January 29, 2024

Table of Contents

Introduction

I. Introduction to the Nebraska Electronic Lien and Title System (ELT) .................................. 1

II. Program Goal ........................................................................................................................ 1

III. How it Works ......................................................................................................................... 1

Transition Into ELT

I. Existing Paper Titles – Noting of a Lien ................................................................................ 2

II. Existing Paper Titles – Release of a Lien ............................................................................. 2

Non-Participating Lender Process

I. Certificate of Title Issuance with a Lien Notation .................................................................. 3

II. Lien Release ......................................................................................................................... 3

III. Request for Printed Certificate of Title .................................................................................. 3

How to Become a Participating Lender or Provider

I. What is a Participating Lender? ............................................................................................ 4

II. What is a Provider? ............................................................................................................... 4

III. Becoming a Participating Lender .......................................................................................... 4

IV. Becoming a Provider ............................................................................................................. 4

V. Changing Providers ............................................................................................................... 4

VI. Current Providers .................................................................................................................. 5

Contact Information

I. Department of Motor Vehicles Business Contacts ............................................................... 6

II. Office of the CIO FTP Administrator ..................................................................................... 6

Transaction Descriptions ............................................................................................... 7

Field Information ............................................................................................................. 8

File Types

I. Inbound Files ………………………………………………………………………………………9

Inbound File Naming Standards……………………………………………………………...9

FH Transaction – Inbound File Header………………………………………………………9

LO Transaction – Lender Lien Release………………………………………………...……9

LG Transaction – Lender Request for Paper Title………………………………………….10

LC Transaction – Lender Request for Conversion………………………………………....11

LE Transaction – Lender Notify DMV of Error………………………………………………11

II. Outbound Files ...................................................................................................................... 12

Outbound File Naming Standards .................................................................................... 12

FH Transaction – Outbound File Header ......................................................................... 12

LA Transaction – D

MV Notify Lender of Lien Notation .................................................... 13

LK Transaction – DMV Notify Lender of Correction ......................................................... 14

EO Transaction – DMV Notify Lender of Lien Release Error .......................................... 15

PO Transaction – DMV Notify Lender of Lien Release Processed ................................. 16

EG Transaction – DMV Notify Lender of Request for Paper Title Error .......................... 16

PG Transaction – DMV Notify Lender of Request for Paper Title Processed ................. 17

EC Transaction – DMV Notify Lender of Conversion Error ............................................. 17

PC Transaction – DMV Notify Lender of Conversion Processed .................................... 18

PE Transaction – DMV Response to Lender Error .......................................................... 19

Error Codes

LO – Lender Lien Release ............................................................................................................ 20

LG – Lender Request for Paper Title ............................................................................................ 21

LC – Lender Request for Conversion ........................................................................................... 22

File Transfer Schedules .................................................................................................. 23

Data Transfers

I. Required File Transfer Protocol ............................................................................................ 24

II. Standards and Conventions .................................................................................................. 24

Communication and System Testing ....................................................................................... 25

Nebraska Electronic Lien and Title Participating Lender Application ................ Appendix

Nebraska Electronic Lien and Title Provider Application ................................... Appendix

1

Version 5.2 February 23, 2024

Introduction

I. Introduction to the Nebraska Electronic Lien and Title System

The purpose of this guide is to provide lenders with the necessary information to

participate in Nebraska’s Electronic Lien and Title System (ELT).

This guide, a mix of business and technical topics, is available for download from

the DMV’s website and may be updated from time to time as necessary.

II. Program Goal

This program is the responsibility of the Nebraska Department of Motor Vehicles

(DMV).

The goal of ELT is to provide for the electronic transmission of lien transaction data

between lenders and the DMV. The electronic transmission of data is a benefit to

the participating lenders, the vehicle/motorboat owners, the local county treasurer

office, and the DMV.

III. How it Works

Lender participation in this program is, at present, optional. However, all Nebraska

certificates of title containing lien information are stored electronically. No printed

copy is produced for mailing to the lender unless specifically requested.

Certificate of title and lien applications are filed at title issuing offices [local county

treasurer office or the DMV, Division of Motor Carrier Services (MCS) for any

common, contract or private carrier of property by motor vehicles in interstate

commerce]. Upon the notation of a lien, the certificate of title record is stored

electronically on the DMV Vehicle Title and Registration (VTR) database and a

participating lender is electronically notified of the title issuance/lien notation.

At the time of lien satisfaction, a participating lender electronically notifies the DMV

of the lien release and the DMV prints and mails the certificate of title to the owner

(or other entity as directed by the lender).

Providers, on behalf of participating lenders, exchange data files with the DMV

daily. These files contain lien notations, lien releases, error/correction information,

requests for paper titles, and conversion requests.

2

Version 5.2 February 23, 2024

Transition Into ELT

I. Existing Paper Titles – Noting of a Lien

Each paper certificate of title presented for the notation of a lien is retained by the

title issuing office and upon lien notation the certificate of title becomes electronic.

II. Existing Paper Titles – Release of a Lien

The lien is required to be released on the face of the certificate of title, presented

to a title issuing office for release on VTR and the certificate of title is returned to

the owner (or other entity as directed).

3

Version 5.2 February 23, 2024

Non-Participating Lender Process

I. Certificate of Title Issuance with a Lien Notation

Applications for certificates of title and/or lien notation are submitted to a county

treasurer office. The exception to this rule is the applications submitted by any

common, contract or private carrier of property by motor vehicles in interstate

commerce whose vehicles are registered with MCS (applications are filed with

MCS).

Upon issuance of the certificate of title with the lien noted, the certificate of title is

stored electronically on VTR. No printed copy is produced for mailing to the lender.

Title issuance and lien notation can be verified through a check of the DMV records

through the Title Inquiry function available at: www.dmv.nebraska.gov/services.

II. Lien Release

A Non-Participating Lender Lien Release application, completed by the lender,

must be submitted to a title issuing office. Upon acceptance of the Application, the

lien is released on VTR and the certificate of title is printed.

III. Request for Printed Certificate of Title

An electronic certificate of title may be printed, at the request of a lender, if the

owner is relocating to another state or for other purposes as approved by the DMV.

A Non-Participating Lender Request for Paper Title, completed by the lender, must

be submitted to the DMV. Upon acceptance of the Application the DMV will print

and mail the certificate of title as directed by the lender.

4

Version 5.2 February 23, 2024

How to Become a Participating Lender or Provider

I. What is a Participating Lender?

A participating lender is one who has registered with the DMV as a participating

lender, has been assigned a Participating Lender ID by the DMV and has

established a service relationship with a DMV approved provider.

II. What is a Provider?

A provider is an entity who has entered into a written agreement with the DMV to

provide electronic lien and title services for participating lenders.

III. Becoming a Participating Lender

Complete the Nebraska Electronic Lien and Title Participating Lender Application

and submit to the DMV. Requests for additional information or assignment of the

Participating Lender ID (PLID) will be returned within 5 business days.

A participating lender may also become a provider or must engage an existing

provider for the interface with DMV.

IV. Becoming a Provider

Complete the Nebraska Electronic Lien and Title Provider Application and submit

to the DMV. Requests for additional information or a Nebraska Electronic Lien and

Title Provider Agreement, requiring a company signature, will be returned within

10 business days. Upon execution of the Agreement successful completion of

communication and system testing is required prior to implementation.

V. Changing Providers

Complete the Nebraska Electronic Lien and Title Participating Lender Application

and submit to the DMV.

You have the option to have all existing electronic title records sent to the new

provider at the time of application. If records are sent to the new provider, they will

be identified as either LA or LK transactions. The records will be sent as LA

transactions if not sent to previous provider and LK transactions if previously sent.

If you do not select to have the existing electronic records sent to the new provider

at time of application, you will need to utilize the conversion process to request

later.

5

Version 5.2 February 23, 2024

VI. Current Providers

The following entities have been approved as providers for ELT services in

Nebraska.

DDI Technology

1 Wellness Blvd Ste 201

P.O. Box 1337

Irmo, SC 2963

Phone: 803-808-0117

Fax: 803-808-3780

E-mail:

info@dditechnology.com

PDP Group, Inc.

10909 McCormick Rd

Hunt Valley, MD 21031

Phone: 410-584-1500

Fax: 410-584-2052

Email:

contact@pdpgroupinc.com

Dealertrack Collateral

Management Services (CMS)

9750 Goethe Road

Sacramento, CA 95827

Phone: 888.VIN.6500

Fax: 916.638.5301

Email:

CMS.Sales@dealertrack.com

Secure Title Administration

2975 Breckinridge Blvd.

Duluth, GA 30096

Phone: 866.742.1466

Fax: 678.694.9882

Email:

als.info@assurant.com

HCH Transportation Advisors,

Inc.

PO Box 540555

North Salt Lake, UT 84054

Phone: 801.683.3560

Fax: 801.683.3589

Email:

NE@hchta.com

Dealer Support Services, Inc.

Box 169

22 W 56

th

St Ste 107

Kearney, NE 68847

Phone: 800.848.8751

Email:

support@dssal.com

6

Version 5.2 February 23, 2024

Contact Information

I. Department of Motor Vehicles Business Contacts

Shannon Davis, Administrative Programs Officer I

Driver and Vehicle Records Division

Nebraska Department of Motor Vehicles

P.O. Box 94789

Lincoln, NE 68509-4789

Phone: 402-471-3867

Fax: 402-471-8694

E-mail: shannon.davis@nebraska.gov

Cindy Incontro, Administrative Programs Officer I

Driver and Vehicle Records Division

Nebraska Department of Motor Vehicles

P.O. Box 94789

Lincoln, NE 68509-4789

Phone: 402-471-3904

Fax: 402-471-8694

E-mail: cynthia.incontro@nebraska.gov

II. Technical Support

E-mail: elt.dmvsupport@nebraska.gov

7

Version 5.2 February 23, 2024

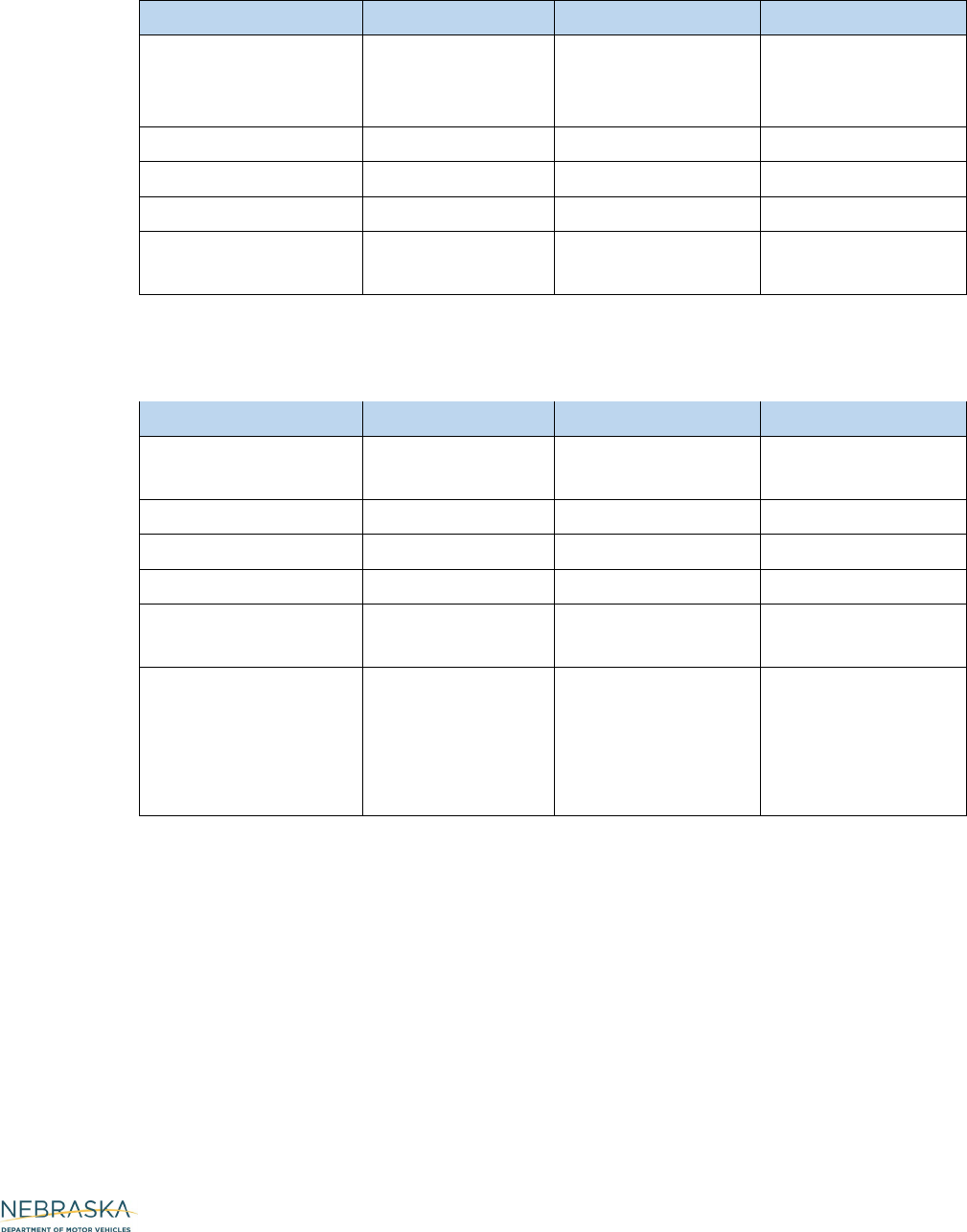

Transaction Descriptions

A. Inbound

Transaction Code

Transaction Code Description

FH

File Header

LO

Lender Lien Release

LG

Lender Request for Paper Title

LC

Lender Request for Conversion

LE

Lender Notify DMV of Error

B. Outbound

Transaction Code

Transaction Code Description

FH

File Header

LA

DMV Notify Lender of Lien Notation

LK

DMV Notify Lender of Correction

EO

DMV Notify Lender of Lien Release Error

PO

DMV Notify Lender of Lien Release

Processed

EG

DMV Notify Lender of Request for Paper

Title Error

PG

DMV Notify Lender of Request for Paper

Title Processed

EC

DMV Notify Lender of Conversion Error

PC

DMV Notify Lender of Conversion

Processed

PE

DMV Response to Lender Error

8

Version 5.2 February 23, 2024

Field Information

The following pages contain content related to Inbound and Outbound Files and Error

Codes. This page provides additional field information detail for the files:

• Text files will be padded with spaces instead of 0’s in both the File Header and

Transaction Code Files.

• Fields marked with * are optional or not applicable to all transactions, may be left

blank.

• Mail To Name is an open field – example John Smith or Smith Enterprises, Inc.

• The Residential Address is the address printed on the title.

• Name Formats:

o I – (Individual) - LAST,FIRST,MIDDLE,SUFFIX (example:

SMITH,JOHN,J,JR)

o B – (Business) - May contain alpha, numeric and/or special characters

(example: SMITH ENTERPRISES INC)

o T – (Trust/Estate) - May contain alpha, numeric and/or special characters

(example: THE HAMILTON FAMILY TRUST)

• Brand Codes:

o Limit of eight brands per title record, the first brand is provided.

o Title brands include Rebuilt, Damaged, Flood, Junked, Manufacturer

Buyback, Non-Highway Use, Repaired, Reconstructed, Replica, Taxi,

Previous Taxi, Previously Salvage, Total Loss, Salvage, Non-

Transferable and Other (free form field up to 20 characters).

o All brands from previous states’ titles are carried forward. Only Salvage,

Previously Salvage, Non-Transferable, Taxi, Previous Taxi, Limousine,

Flood, Reconstructed, Replica and Manufacturer Buyback are brands

assigned natively in Nebraska.

o If more than one brand appears on a title record a “Y” will appear. More

information on the additional brands present may be found through a

check of the DMV records via Title Inquiry function available at:

http://www.dmv.nebraska.gov/services.

• Odometer Codes:

o A = Actual

o N = Not Actual

o E = Exceeds Mechanical Limits

o X = Exempt

9

Version 5.2 February 23, 2024

Inbound Files

Inbound File Naming Standards

All Incoming ELT Files will be named based on the following naming standards:

FH Transaction – Inbound File Header (all fields are required unless * present)

Field Name

Field Length

Start Position

End Position

Transaction Code

(always FH)

2

1

2

Provider Code

4

3

6

File Date

(yyyymmdd)

8

7

14

File Time

(hhmmss)

6

15

20

Total Transactions

6

21

26

Total LO

6

27

32

Total LG

6

33

38

Total LE

6

39

44

Total LC

6

45

50

LO Transaction – Lender Lien Release (all fields are required unless * present)

Field Name

Field Length

Start Position

End Position

Transaction Code

(always LO)

2

1

2

Lender Code

8

3

10

VIN/HIN

30

11

40

Title Number

11

41

51

Lien Notation

Number

19

52

70

10

Version 5.2 February 23, 2024

Lien Release Date

(yyyymmdd)

8

71

78

Mail to Customer

Name

80

79

158

Mail to Address 1

35

159

193

Mail to Address 2 *

35

194

228

Mail to City

18

229

246

Mail to State

2

247

248

Mail to Zip

10

249

258

LG Transaction – Lender Request for Paper Title (all fields are required unless *

present)

Field Name

Field Length

Start Position

End Position

Transaction Code

(always LG)

2

1

2

Lender Code

8

3

10

VIN/HIN

30

11

40

Title Number

11

41

51

Lien Notation

Number

19

52

70

Mail to Customer

Name

80

71

150

Mail to Address 1

35

151

185

Mail to Address 2 *

35

186

220

Mail to City

18

221

238

Mail to State

2

239

240

Mail to Zip

10

241

250

11

Version 5.2 February 23, 2024

LC Transaction – Lender Request for Conversion (all fields are required unless * present)

Field Name

Field Length

Start Position

End Position

Transaction

Code (always

LC)

2

1

2

Lender Code

8

3

10

VIN/HIN

30

11

40

Title Number *

11

41

51

Lien Notation

Number *

19

52

70

LE Transaction – Lender Notify DMV of Error (all fields are required unless * present)

Field Name

Field Length

Start Position

End Position

Transaction Code

(always LE)

2

1

2

Lender Code

8

3

10

VIN/HIN

30

11

40

Title Number

11

41

51

Lien Notation

Number

19

52

70

Error Code

(N = Lender Error)

(V = VIN Error)

( ‘ ‘ = Unknown

Error)

1

71

71

12

Version 5.2 February 23, 2024

Outbound Files

Outbound File Naming Standards

All Outgoing ELT Files will be named based on the following naming standards:

FH Transaction - Outbound File Header

Field Name

Field Length

Start Position

End Position

Transaction Code

(always FH)

2

1

2

Provider Code

4

3

6

File Date

(yyyymmdd)

8

7

14

File Time

(hhmmss)

6

15

20

Total Transactions

6

21

26

Total LA

6

27

32

Total LK

6

33

38

Total EO

6

39

44

Total PO

6

45

50

Total EG

6

51

56

Total PG

6

57

62

Total PC

6

63

68

Total EC

6

69

74

Total PE

6

75

80

13

Version 5.2 February 23, 2024

LA Transaction - DMV Notify Lender of Lien Notation

Field Name

Field Length

Start Position

End Position

Transaction Code

(always LA)

2

1

2

Lender Code

8

3

10

VIN/HIN

30

11

40

Vehicle Make Code

4

41

44

Vehicle Year

4

45

48

Title Brand

20

49

68

More than 1 brand?

(Y/N)

1

69

69

Title Number

11

70

80

Title Issue Date

(yyyymmdd)

8

81

88

Lien Notation Date

(yyyymmdd)

8

89

96

Lien Notation

Number

19

97

115

Primary Lienholder?

(Y/N)

1

116

116

More than 1

Lienholder? (Y/N)

1

117

117

Primary Owner Name

Format

1

118

118

Primary Owner Name

80

119

198

Residential Address 1

35

199

233

Residential Address 2

*

35

234

268

Residential City

18

269

286

Residential State

2

287

288

Residential Zip Code

10

289

298

Secondary Owner

Name Format *

1

299

299

Secondary Owner

Name *

80

300

379

More than 2

Owners? (Y/N)

1

380

380

14

Version 5.2 February 23, 2024

Odometer Reading*

7

381

387

Odometer Code*

1

388

388

LK Transaction - DMV Notify Lender of Correction

Field Name

Field Length

Start Position

End Position

Transaction Code

(always LK)

2

1

2

Lender Code

8

3

10

VIN/HIN

30

11

40

Vehicle Make Code

4

41

44

Vehicle Year

4

45

48

Title Brand

20

49

68

More than 1 brand?

(Y/N)

1

69

69

Title Number

11

70

80

Title Issue Date

(yyyymmdd)

8

81

88

Lien Notation Date

(yyyymmdd)

8

89

96

Lien Notation

Number

19

97

115

Primary Lienholder?

(Y/N)

1

116

116

More than 1

Lienholder? (Y/N)

1

117

117

Primary Owner Name

Format

1

118

118

Primary Owner Name

80

119

198

Residential Address 1

35

199

233

Residential Address 2

*

35

234

268

Residential City

18

269

286

Residential State

2

287

288

Residential Zip Code

10

289

298

Secondary Owner

Name Format *

1

299

299

15

Version 5.2 February 23, 2024

Secondary Owner

Name *

80

300

379

More than 2

Owners? (Y/N)

1

380

380

Odometer Reading*

7

381

387

Odometer Code*

1

388

388

EO Transaction - DMV Notify Lender of Lien Release Error

Field Name

Field Length

Start Position

End Position

Transaction Code

(always EO)

2

1

2

Lender Code

8

3

10

VIN/HIN

30

11

40

Title Number

11

41

51

Lien Notation

Number

19

52

70

Lien Release Date

(yyyymmdd)

8

71

78

Mail to Customer

Name

80

79

158

Mail to Address 1

35

159

193

Mail to Address 2 *

35

194

228

Mail to City

18

229

246

Mail to State

2

247

248

Mail to Zip

10

249

258

Error Code

6

259

264

16

Version 5.2 February 23, 2024

PO Transaction - DMV Notify Lender of Lien Release Processed

Field Name

Field Length

Start Position

End Position

Transaction Code

(always PO)

2

1

2

Lender Code

8

3

10

VIN/HIN

30

11

40

Title Number

11

41

51

Lien Notation

Number

19

52

70

File Processed Date

(yyyymmdd)

8

71

78

Additional Liens

1

79

79

EG Transaction – DMV Notify Lender of Request for Paper Title Error

Field Name

Field Length

Start Position

End Position

Transaction Code

(always EG)

2

1

2

Lender Code

8

3

10

VIN/HIN

30

11

40

Title Number

11

41

51

Lien Notation

Number

19

52

70

Mail to Customer

Name

80

71

150

Mail to Address 1

35

151

185

Mail to Address 2 *

35

186

220

Mail to City

18

221

238

Mail to State

2

239

240

Mail to Zip

10

241

250

Error Code

6

251

256

17

Version 5.2 February 23, 2024

PG Transaction – DMV Notify Lender of Request for Paper Title Processed

Field Name

Field Length

Start Position

End Position

Transaction Code

(always PG)

2

1

2

Lender Code

8

3

10

VIN/HIN

30

11

40

Title Number

11

41

51

Lien Notation

Number

19

52

70

File Processed Date

(yyyymmdd)

8

71

78

EC Transaction – DMV Notify Lender of Conversion Error

Field Name

Field Length

Start Position

End Position

Transaction

Code (always

EC)

2

1

2

Lender Code

8

3

10

VIN/HIN

30

11

40

Title Number *

11

41

51

Lien Notation

Number *

19

52

70

Error Code

6

71

76

18

Version 5.2 February 23, 2024

PC Transaction – DMV Notify Lender of Conversion Processed

Field Name

Field Length

Start Position

End Position

Transaction Code

(always PC)

2

1

2

Lender Code

8

3

10

VIN/HIN

30

11

40

Vehicle Make Code

4

41

44

Vehicle Year

4

45

48

Title Brand

20

49

68

More than 1 brand?

(Y/N)

1

69

69

Title Number

11

70

80

Title Issue Date

(yyyymmdd)

8

81

88

Lien Notation Date

(yyyymmdd)

8

89

96

Lien Notation

Number

19

97

115

Primary Lienholder?

(Y/N)

1

116

116

More than 1

Lienholder? (Y/N)

1

117

117

Primary Owner

Name Format

1

118

118

Primary Owner

Name

80

119

198

Residential Address

1

35

199

233

Residential Address

2 *

35

234

268

Residential City

18

269

286

Residential State

2

287

288

Residential Zip

Code

10

289

298

19

Version 5.2 February 23, 2024

PE Transaction – DMV Response to Lender Error

Field Name

Field Length

Start Position

End Position

Transaction Code

(always PE)

2

1

2

Lender Code

8

3

10

VIN/HIN

30

11

40

Title Number

11

41

51

Lien Notation

Number

1

52

70

Help Desk Email

35

71

105

Error Comment

250

106

355

Secondary Owner

Name Format*

1

299

299

Secondary Owner

Name*

80

300

379

More than 2

Owners? (Y/N)

1

380

380

Odometer

Reading*

7

381

387

Odometer Code*

1

388

388

20

Version 5.2 February 23, 2024

Error Codes

LO - Lender Lien Release

Error Code

Error Code Description

ADDERR

MAIL TO ADDRESS 1 MISSING; ADDRESS DOES NOT VALIDATE

VIA USPS; OR STREET, CITY, STATE, OR ZIP MISSING

DUPNUM

ADMINISTRATIVE ISSUE CONCERNING THIS VEHICLE

PREVENTS RELEASING LIEN - DUPLICATE NOTATION NUMBERS

LENERR

DMV LIEN NOTATION NUMBER MISSING

LNDERR

LENDER CODE MISSING

LNRNFD

LIEN RECORD WITH PROVIDED LIEN NOTATION NUMBER NOT

FOUND

LRDERR

LIEN RELEASE DATE MISSING OR INVALID

LRDGRT

LIEN RELEASE DATE IS GREATER THAN FILE DATE

LRDLSS

LIEN RELEASE DATE IS EARLIER THAN LIEN NOTATION DATE

LRDNVL

LIEN RELEASE DATE IS NOT A VALID DATE

NAMERR

MAIL TO CUSTOMER NAME MISSING

PRVINV

PROVIDER DOES NOT MATCH PROVIDER ON LIEN

PRVSAT

THE SPECIFIED LIEN NOTATION NUMBER ON THIS VEHICLE

HAS BEEN PREVIOUSLY RELEASED

SYSERR

DMV SYSTEM ERROR WHILE PROCESSING REQUEST

TTLERR

DMV TITLE NUMBER MISSING

TTLNFD

TITLE NUMBER NOT FOUND

TTLNVL

TITLE STATUS IS NO LONGER ACTIVE

TTLPRT

PAPER TITLE PREVIOUSLY PRINTED

TTLVIN

TITLE NUMBER AND VIN MISMATCH

VINERR

VEHICLE IDENTIFICATION NUMBER MISSING

21

Version 5.2 February 23, 2024

LG - Lender Request for Paper Title

Error Code

Error Code Description

ADDERR

MAIL TO ADDRESS 1 MISSING; ADDRESS DOES NOT VALIDATE

VIA USPS; OR STREET, CITY, STATE, OR ZIP MISSING

DUPNUM

ADMINISTRATIVE ISSUE CONCERNING THIS VEHICLE

PREVENTS RELEASING LIEN - DUPLICATE NOTATION NUMBERS

LENERR

DMV LIEN NOTATION NUMBER MISSING

LNDERR

LENDER CODE MISSING

LNDNPM

REQUESTING LENDER IS NOT THE PRIMARY LIENHOLDER

LNDNFD

REQUESTING LENDER DOES NOT MATCH LENDER WITH THIS

NOTATION NUMBER

LNRNFD

LIEN RECORD WITH PROVIDED LIEN NOTATION NUMBER NOT

FOUND

NAMERR

MAIL TO CUSTOMER NAME MISSING

PRVINV

PROVIDER DOES NOT MATCH PROVIDER ON LIEN

PRVSAT

THE SPECIFIED LIEN NOTATION NUMBER ON THIS VEHICLE

HAS PREVIOUSLY BEEN RELEASED

SYSERR

DMV SYSTEM ERROR WHILE PROCESSING REQUEST

TTLERR

DMV TITLE NUMBER MISSING

TTLNVL

TITLE STATUS IS NO LONGER ACTIVE

TTLPRT

PAPER TITLE PREVIOUSLY PRINTED

TTLVIN

TITLE NUMBER AND VIN MISMATCH

VINERR

VEHICLE IDENTIFICATION NUMBER MISSING

22

Version 5.2 February 23, 2024

LC - Lender Request for Conversion

Error Code

Error Code Description

DUPNUM

ADMINISTRATIVE ISSUE CONCERNING THIS VEHICLE

PREVENTS RELEASING LIEN - DUPLICATE NOTATION

NUMBERS

LNDERR

LENDER CODE MISSING

LNDINV

LENDER CODE INVALID

LNRNFD

LIEN RECORD WITH PROVIDED LIEN NOTATION NUMBER NOT

FOUND

MULTLN

MULTIPLE LIENS PRESENT, NO LIEN NOTATION NUMBER

SPECIFIED

MULTRC

MULTIPLE RECORDS FOUND FOR VIN SPECIFIED, NO TITLE

NUMBER SPECIFIED

NOLIEN

NO OPEN LIENS PRESENT

PRVINV

PROVIDER DOES NOT MATCH PROVIDER ON LIEN

PRVSAT

THE SPECIFIED LIEN NOTATION NUMBER ON THIS VEHICLE

HAS PREVIOUSLY BEEN RELEASED

SYSERR

DMV SYSTEM ERROR WHILE PROCESSING REQUEST

TTLELT

TITLE IS ALREADY ELT

TTLNVL

TITLE STATUS IS NO LONGER ACTIVE

TTLSTS

SECONDARY LIENS CAN NOT BE CONVERTED WHEN TITLE

STATUS IS NOT ELECTRONIC

TTLVIN

TITLE NUMBER AND VIN MISMATCH

VHCNFD

VEHICLE IDENTIFICATION NUMBER NOT FOUND

VINERR

VEHICLE IDENTIFICATION NUMBER MISSING

23

Version 5.2 February 23, 2024

File Transfer Schedules

DMV and providers are required to retrieve files seven days a week, 365 days per year

(no holiday or weekend hiatus).

Providers retrieve outbound files from DMV and delete after successful retrieval between

the hours of 3:00 and 9:00 a.m. CDT.

Providers must have inbound files available for DMV processing by 10:00 p.m. CDT each

evening. DMV continually monitors for, retrieves, and stores all incoming files. Files

received are processing each evening between the hours of 10:00 p.m. and midnight

CDT.

Providers must notify the DMV and Technical Support contacts (see page 6) immediately

upon discovery of the failure to retrieve outbound files or submit inbound files. This

notification shall occur within 24 hours of the failure.

24

Version 5.2 February 23, 2024

Data Transfers

I. Required File Transfer Protocol

The Office of the CIO requires all data transfers be encrypted. Methods for

encrypted transfer provided for are SFTP, FTP TLS/SSL and CONNECT:Direct

SECURE +.

• SFTP – Secure File Transfer Protocol

Different protocol than FTP; uses Secure Shell (SSH) communications

technology to secure the control and data connection.

• FTP TLS/SSL (Also known as FTPS)

File Transfer Protocol with the added option of Secure Sockets Layer (SSL) or

Transport Layer Security (TLS – successor to SSL). TLS/SSL is used to

secure the control and data connection.

• CONNECT:Direct (C:D)

CONNECT:Direct (C:D) is a data transfer software product allowing data

centers within and across networks to send and receive large amounts of data.

CONNECT:Direct SECURE + is a comprehensive, cryptographic security

solution, which is approved by the National Institute of Standards and

Technology (NIST).

II. Standards and Conventions

Inbound files (identified on pages 8-9) will be named in the following manner:

FTP.VPID#.INBD.PYYMMDD where PID# is the provider identification number

assigned by the DMV and YYMMDD is the calendar date the file is created (e.g.

an inbound file for September 1, 2010 for vendor 1234 would be named

FTP.V1234.INBD.P100901).

Outbound files (identified on pages 10-12) will be named in the following manner:

FTP.VPID#.OUTBD.PYYMMDD where PID# is the provider identification number

assigned by the DMV and YYMMDD is the calendar date the file is created (e.g.

an outbound file for September 1, 2010 for vendor 1234 would be named

FTP.V1234.OUTBD.P100901).

The same file transfer protocol the provider uses for an inbound file will be used

for an outbound file.

25

Version 5.2 February 23, 2024

Communication and System Testing

Upon execution of the Nebraska Electronic Lien and Title Provider Agreement successful

completion of communication and system testing is required prior to implementation.

The provider shall coordinate testing efforts with DMV Technical Support (see page 6 for

contact information).

Two text files will be forwarded to the provider to use for testing. The first will be used by

the provider as an Inbound File, which will be retrieved by the Office of the OCIO and

verified with the sent text file. The Inbound file will contain a header record and up to ten

transactions consisting of a combination of LE, LG, LO and LC transactions.

The second will be a replica of the file the DMV uses as an Outbound File for the provider

to use in verifying the content of the actual test file retrieved. The Outbound file will

contain a header record and up to ten transactions consisting of a combination of EC,

EG, EO, LA, LK and LX transactions.

Upon successful completion of the testing the Office of the CIO contact person will report

to the DMV. DMV will then add the provider to the list of Current Providers and will

communicate with the provider to determine an implementation date.

Nebraska Electronic Lien and Title

Participating Lender Application

This application form is to be used by financial institutions and other lenders to enroll or modify an existing

account in Nebraska’s Electronic Lien and Title (ELT) Program.

A

Action Requested – To be Completed by Financial Institution/Lender (check one)

Initial Enrollment in ELT Program

Change of Provider

PLID:

Request New Provider Receive All Lien Transactions Associated with Lender

Removal from ELT Program

PLID:

Change of Financial Institution/Lender Address

PLID:

Change of Financial Institution/Lender Name

PLID:

B

Lender Information –

To be Completed by Financial Institution/Lender

Lender Name

FEIN

Mailing Address

City

State

Zip Code

Printed Name of Authorized Requester

Telephone Number

Date

Email Address of Authorized Requester

Provider (select from list below)

Authorized Requester’s Signature

C

Provider Authorization – To be Completed by Provider

Printed Name of Provider Employee Authorizing ELT Account

Title of Provider Employee

Telephone Number

Email Address of Authorizing Provider Employee

Requested Date of Change

Provider Employee Signature

Authorized ELT Providers:

.

DDI Technology

P.O. Box 1337

1 Wellness Blvd, Ste 201

Irmo, SC 29063

PDP Group, Inc.

10909 McCormick Rd

Hunt Valley, MD 21031

Dealertrack

9750 Goethe Rd

Sacramento, CA 95827

-

Lenders must complete Sections A and B, then forward this form to the selected provider.

-

The provider named in section B must submit this completed application to the Nebraska DMV.

-

Lenders must establish a service relationship with one of Nebraska DMV’s approved providers for transmission of all vehicle a

nd

title data or apply to become an authorized provider.

By s

igning above Participating Lenders agree to the following conditions and requirements:

-

The lender must provide the Participating Lender ID (PLID) assigned by Nebraska DMV to all loan recipients and dealers utiliz

ing

selected lender services. The lender mu

st require all dealers utilizing selected lender services record the PLID on the Nebraska

Application for Certificate of Title with the accompanying lienholder information.

-

The lender must work directly with their chosen provider’s Help Desk to resolve all

ELT discrepancies and data transmission

issues.

-

The lender shall protect the confidentiality of the information and data to which lender has access. At no time shall the le

nder

furnish to any person, association or organization any vehicle or title data

received from Nebraska DMV without Nebraska DMV’s

prior written consent.

-

The lender has no proprietary rights to the information received from Nebraska DMV.

-

The lender understands Nebraska DMV and its employees shall not be liable to the lender for any dam

age, costs, lost production

or any other loss of any kind for failure of Nebraska DMV’s equipment hardware or software or the for the loss of consequenti

al

damages as the result of any other type of failure.

-

Either party, upon giving 30 days written notice

to the other party, may terminate authorization. In the event of termination,

Nebraska DMV is released from any and all obligations to the lender.

Rev 03/2022

Secure Title Administration HCH Transportation Advisors, Inc. Dealer Support Services, Inc.

2975 Breckinridge Blvd

PO Box 540555 Box 169

Duluth, GA 30096

North Salt Lake, UT 84054 22 W 56

th

St Ste 107

Kearney, NE 68847

Yes

No

Nebraska Electronic Lien and Title

Provider Application

This application form is to be used by entities to apply to become an approved provider

for Nebraska’s Electronic Lien and Title (ELT) Program.

A

Company Name – Formal name to be used on Contract

Company Name

Mailing Address

City

State

Zip Code

B

Contact Information

1

Name of Individual to Sign Agreement w/DMV

Title

Telephone Number

Email Address

2

Name of Individual to Process Agreement

Title

Telephone Number

Email Address

3

Name of Business Contact (i.e. Help Desk Support)

Title

Telephone Number

Email Address

4

Name of Technical Support Contact

Title

Telephone Number

Email Address

C

File Transfer Protocol

Secure File Transfer Protocol to be used:

- Upon receipt of this Application, the DMV will draft an Agreement and forward it to the

individual identified on line 2 above.

- Upon completion of the Agreement process, the DMV will assign a Provider ID, publish

the applicant’s name in the Nebraska Electronic Lender Guide as an approved

provider, and will communicate with the individual identified on line 4 above to share

the necessary File Transfer Protocol information and to schedule a test file process.

- Upon completion of the Agreement process, the applicant may publish their role as a

DMV approved provider and may assist lenders in the submission of Nebraska

Electronic Lien and Title Participating Lender Applications.