State of Micro

Enterprise

Financing

Report 2023

State of Micro Enterprise

Financing Report 2023

Author: Praveen Khedale

December 2023

Published by

ACCESS Development Services

22, Hauz Khas Village, New Delhi 110 016

www.accessdev.org

Edition copyright ACCESS Development Services 2023

All rights reserved.

No part of this publication may be reproduced, transmitted, or

stored in a retrieval system, in any form or by any means, electronic,

mechanical, photocopying, recording or otherwise, without the prior

permission of the publisher.

Typeset & Printed by

Elegant Enterprises

198/41-B, Ramesh Market

East of Kailash, New Delhi, India

State of Micro Enterprise Financing Report 2023 | 3

FOREWORD

T

he Indian economy has sustained its growth momentum, with overall economic

activity remaining resilient. The Micro, Small and Medium Enterprise (MSME)

sector has a major role in contributing to the country’s economic growth and socio-

economic development through employment generation and reducing inequalities

and regional imbalances in incomes and economic opportunity. The government

envisages MSMEs to contribute USD 2 trillion to the target of becoming USD 5

trillion economy by 2024.

The MSMEs have comparatively lower capital cost than large industries, provide

low-cost raw material for different sectors, and provide employment in smaller towns

and rural areas. One of the critical indicators to assess the successful development

of MSME sector in an economy is the data on opening of new MSMEs; it depicts

the conducive environment for opening and growth of such units in an economy

as well as show the high morale of entrepreneurs in the macroeconomics of the

economy.

India has approximately 6.3 crore MSMEs out of which 31% share is of

manufacturing, 36% share of trade and 33% share is of other services. Micro sector

accounts for more than 99% of total estimated number of MSMEs and around

97% of total employment in the sector (National Sample Survey (NSS) 73rd round

conducted during 2015-16). Nearly 2 crore MSMEs are registered on the Udyam

Portal of the Ministry of MSME, Government of India, of which 19.15 crore

(96%) are micro enterprises.

MSMEs have great potential to push accelerated growth in this developing economy.

However, lack of managerial, entrepreneurial, and marketing avenues and skills,

access to and integration of advanced technology etc. are major bottlenecks for

micro enterprises for growing and sustaining their businesses. Access to affordable,

adequate and timely credit is often cited as the predominant barrier to their growth.

There is a great relevance of the availability of loan facilities from traditional banking

systems and efciency of MSMEs in India. Complicated procedures, cost of availing

credit, and the overall documentation affect the condence of entrepreneurs to start

up. High collateral requirement is another major factor affecting the capacity of

availing loans at affordable interest rates. It further adds nancial problems for small

businesses.

MSMEs is a fairly diverse ‘group’ with substantial differences in business formality,

sizes and credit needs. A large number of viable and resilient tiny enterprises —

4 | State of Micro Enterprise Financing Report 2023

with turnover of say between INR 50 lakhs - 1 crore — within the microenterprise

segment, have the potential to drive local self-employment and job creation,

including employing people with limited skills and education. These additionally

offer avenues for participation of women in the formal economy and labour force.

This is a segment of microenterprises that need loans of value higher than provided

through the micronance channel, and are not catered to by banks and other formal

nancial institutions through other products due to high risk, lack of past credit

record and other associated challenges.

Over the years, Equifax - one of the leading credit information companies, has

worked with Indian lenders to help maintain high levels of underwriting standards

and helped with assisting consumers in in understanding and managing their credit.

With the objective of providing a distilled view on the state of lending to the ‘tiny’

sub-set within the microenterprises, ACCESS has partnered with Equifax since

2020 to bring out an annual trend report titled Status of Microenterprise Lending.

This Report tracks the performance metrics of portfolio of business loans up to

Rs 25 lakhs as a proxy for reporting on loans to the tiny enterprises, in order to

draw out gaps in lending to this segment, and advocate for necessary attention from

nancial service providers and policy to address this important sub-segment of

microenterprises.

Helping tiny enterprises grow can present tremendous value for India’s development.

With the right investment, tools, and support, tiny and microenterprises offer

the benets of job creation, women economic empowerment, and boosting the

country’s economy. This Report aims to contribute to data based insights on access

to loans to this critical segment.

I thank Aditya B Chatterjee, Managing Director, Equifax India on agreeing to

this continued partnership. I place on record my appreciation for his team led by

Shruti Joshi for providing the required data on various dimensions for the report.

I appreciate Praveen Khedale’s efforts in bringing together the data analysis and

authoring the report.

With the Fourth edition of the Report, ACCESS is happy to present useful trends in

the data covering portfolio growth and quality by loan sizes, geographical trends and

performance by institutional types. The Report will be released at the 20th milestone

edition of the Global Inclusive Finance Summit on December 13, 2023.

Radhika Agashe

Executive Director

ACCESS Development Services

State of Micro Enterprise Financing Report 2023 | 5

PREFACE

E

quifax combines robust data, analytics and advanced technology to provide

actionable insights to businesses, which in turn enable them to make sound

decisions across customer acquisition, extending credit, mitigating fraud or better

managing portfolio risk.

This report was developed in partnership with ACCESS Development Services

to provide insights on the MSME Sector. The main insights highlighted from the

data points, trends and their analysis from the report are focused on MSME are

listed below:

Business Loan

Based on the analysis in the Business Loan segment, it can be seen that loans falling

under ‘Up to `3 Lakhs’ category dominate the numbers while the larger ticket sizes

contribute more signicantly to the portfolio outstanding amount despite their

small numbers. The data shows that the NBFCs lead the segment with a 36%

share in loan sanctions, highlighting the segment as a functional business venture

fueled by competitive market forces. The ‘ `5 to 7 Lakhs’ ticket size has a POS of

9% while ‘ `3 to 5 Lakhs’ ticket size has a value of 12%, revealing an imbalance

to be addressed for a healthier MSME sector. A 90+ DPD of 16% in the ‘Up to

`3 Lakhs’ category indicates that this portion requires investigation driven risk

mitigation. Hence, the data encapsulates the dynamic market shift to micro loans

suggesting the nancial institutions to perform adaptive strategies for capturing

the growing demands while maintaining economic stability in the MSME sector.

Business Loan Agriculture

The Business Loan Agriculture segment analysis afrms that the nancial share

is more evenly distributed across different loan sizes despite the smaller loans

dominating in terms of the number of loans. It is observed that there is a shift

towards larger loans marking a growth in business lending across the segment.

State-wise loan distribution species that Uttar Pradesh and Telangana have high

shares in terms of loan accounts and portfolio outstanding. The distribution also

6 | State of Micro Enterprise Financing Report 2023

indicates a disparity in the distribution of loans in rural, semi-urban, and urban

areas due to varying access and utility of nancial services. In addition to the

geographical analysis, it is noted that PSU banks contribute signicantly to the

segment lending.

Mudra Loan

As per the research on Mudra Loan segment’s data a strong tilt towards smaller

ticket loans can be perceived due to the ‘Up to `3 Lakhs’ category holding a

majority of the accounts and a signicant portion of the Portfolio Outstanding

(POS). This increase in smaller ticket size loans coupled with the year on year shift

towards the ‘ `3 to 5 Lakhs’ and ‘ `7 to 10 Lakhs’ size loans marks the segment’s

effectiveness as well as the growth of businesses in the MSME sector.

Aditya B. Chatterjee

Managing Director

State of Micro Enterprise Financing Report 2023 | 7

TABLE OF CONTENTS

FOREWORD 3

PREFACE 5

1 INTRODUCTION 9

The MSME Sector 9

About the Report 10

2 BUSINESS LOAN 12

INTRODUCTION 12

PORTFOLIO 12

Size-wise Analysis 12

Which Bucket is Full? 13

Size-wise Distribution 15

Institutions Share 16

Rural/Urban Distribution 17

REPAYMENT 20

Overdue by Ticket size 20

Overdue by Location of Borrower 20

Institution wise Overdue 21

Performance of States in 90+ DPD Overdue 22

BUSINESS LOAN SOURCING 23

Demographics-wise Sanction 24

Institution wise Sanction 26

CONCLUSION ON BL 27

3 BUSINESS LOAN AGRICULTURE 28

PORTFOLIO 28

Size wise Analysis 28

Which Bucket is Full? 29

State wise Distribution 30

8 | State of Micro Enterprise Financing Report 2023

Institutions wise Details 32

Rural/Urban Distribution 33

Institutions Share in Different Demographics 34

REPAYMENT 37

Overdue by Ticket size 37

Overdue by Location of Borrower 38

Institution wise Overdue 39

Performance of States in 90+ DPD Overdue 40

SOURCING 41

Demographics-wise Sanction 43

Demographic Trend 43

Performance of Financial Institutions in different Population Groups 44

CONCLUSION ON BL AGRICULTURE 46

4 MUDRA LOAN 47

INTRODUCTION 47

PORTFOLIO 47

Size-wise Analysis 47

Trend on Various Loan Buckets 49

State-wise Distribution 50

Institutions wise Distribution 51

Rural/Urban Distribution 52

REPAYMENT 53

Overdue by ticket size 53

Overdue by Location of Borrower 55

Performance of States in 90+ DPD Overdue 56

MUDRA LOAN SOURCING 57

Demographics wise Sanction 59

States Share in Sanction 60

CONCLUSION ON MUDRA 61

5 CONCLUSION 63

State of Micro Enterprise Financing Report 2023 | 9

1. INTRODUCTION

The MSME Sector

T

he Micro, Small and Medium Enterprise (MSME) sector plays a pivotal role in

the Indian economy, marking its signicance through substantial contributions

to various economic facets. It stands as a key driver for employment, generating

opportunities for about 11.1 crore individuals, a gure only surpassed by the

agriculture sector. Remarkably, MSMEs contribute approximately 30% to India’s

Gross Domestic Product or GDP and account for over 48% of exports, alongside

contributing about 45% to the manufacturing output. This sector, encompassing

around 6.34 crore enterprises, is not just a cornerstone for economic growth but

also a hub for innovation and inclusive development. Furthermore, MSMEs play a

vital role in fostering entrepreneurship and self-employment at lower capital costs,

often serving as ancillary units to larger industries. Their expanding domain across

various sectors, producing a diverse range of products and services, positions

them uniquely to meet both domestic and global market demands.

The institutional system for MSME credit in India is a comprehensive network

regulated by the Reserve Bank of India (RBI) and involves various nancial

entities. This network includes scheduled commercial banks encompassing public

sector banks, private sector banks (including small nance banks), foreign banks,

co-operative banks, and regional rural banks, as well as Non-Banking Financial

Companies (NBFCs) and Micro Finance Institutions (MFIs). Additionally, the

Securities and Exchange Board of India (SEBI) oversees entities providing or

mediating equity capital to MSMEs, such as SME Exchanges, angel investors,

venture capital, and private equity. Key apex institutions like the Small Industries

Development Bank of India (SIDBI) and Micro Units Development and Renance

Agency Ltd. (MUDRA) offer sectoral support under the Department of Financial

Services, Government of India. The Ministry of MSME acts as the apex executive

body for policy formulation and administration for these enterprises. Moreover, the

Credit Guarantee Trust for MSMEs (CGTMSE) and National Credit Guarantee

Company (NCGTC) play crucial roles in facilitating credit growth. Digital platforms

10 | State of Micro Enterprise Financing Report 2023

like Trade Receivables Discounting System (TReDS) and OnlinePSB Loans, aided

by credit bureaus and systems like Goods and Services Tax Identication (GSTIN)

and Unique Identication Authority of India (UIDAI), further streamline the

credit ow to MSMEs.

About the Report

The report is fully based on data from Equifax India, one of the leading credit

information companies in the country. The credit bureau records all categories

of loans taken by all classes of borrowers – micronance loans, individual loans,

business loans, and commercial loans.

This report examines data from Equifax, focusing on three types of credit

extended to the MSME sector: Business Loans, Business Loans in Agriculture,

and MUDRA loans up to `25 Lakhs. It was observed that certain data elds in the

records provided by Equifax, particularly those related to ticket sizes and rural-

urban classication, were incomplete and marked as ‘Not Dened’ (ND) in the

tables. However, since the cumulative data for ND categories is negligible, they are

not elaborated upon in this report. The analysis includes a review of the portfolio

and repayment status data as of March 2023, comparing it with the data from

March 2022 and March 2021. The report also investigates the sourcing of credit

or loan sanctions from April 2022 to March 2023, alongside a comparison with

gures from the previous year in these specic credit categories.

The report provides an in-depth insight of credit to the MSME sector in the

country by analysis of data provided by Equifax, focusing on three crucial aspects:

portfolio outstanding, repayment or overdue status, and loan sanction or sourcing.

To gain a comprehensive understanding, the data on these aspects are dissected

through various lenses.

Firstly, the analysis of the portfolio outstanding offers insights into the total

amount of credit currently extended to MSMEs. This measure is crucial for

understanding the scale of lending and the economic weight of the MSME sector

within the credit market.

Secondly, the report examines the repayment or overdue status of these loans.

This aspect is pivotal in assessing the nancial health of MSMEs and their ability

to meet nancial obligations. It provides a window into the creditworthiness and

potential risk factors associated with lending to this sector.

State of Micro Enterprise Financing Report 2023 | 11

Lastly, the analysis of loan sanction or sourcing sheds light on the patterns and

trends in new credit allocation to MSMEs. This aspect reveals how and where

new loans are being originated, which can indicate shifts in lending strategies or

emerging opportunities within the sector.

To add depth to the analysis, the report slices the data through various aspects such

as loan ticket size, which helps in understanding the distribution and utilization

of loans of different sizes. Demographics provide a lens to view how credit

distribution varies among different groups, potentially highlighting inclusivity or

gaps in the lending landscape. The contribution of various lending institutions

is also examined, offering insights into their roles and impact within the MSME

credit market. Additionally, the state-wise share in MSME lending is explored,

uncovering regional disparities and trends.

Overall, this multifaceted analysis not only paints a detailed picture of the current

state of MSME credit but also helps in identifying trends, potential risks, and

opportunities for policy and strategic interventions in the sector.

12 | State of Micro Enterprise Financing Report 2023

2. BUSINESS LOANS

INTRODUCTION

M

icro, Small, and Medium Enterprises (MSMEs) are the lifeblood of

our economy, often dubbed as the backbone of industrial growth and

employment generation. These enterprises, however, need more than just spirit

and vision to thrive; they require capital. Business loans, especially those tailored

for MSMEs, serve this very purpose. This chapter delves into the world of MSME

loans characterized by ticket sizes up to `25 lakhs. By navigating through diverse

loan portfolios, we explore the lending patterns and trends that empower these

enterprises to scale new heights. These loans, modest in size but monumental

in impact, not only support businesses but also stimulate economic growth and

innovation. Welcome to the intricate tapestry of MSME business loans, where

nancial support meets entrepreneurial ambition.

PORTFOLIO

Size-Wise Analysis

Table 1 presents a detailed breakdown of the business loan portfolio segmented

by ticket sizes. The most striking observation is the dominance of loans in the

‘Up to 3 lakh’ category, with 9,950 thousand accounts, representing a substantial

portfolio outstanding (POS) amount of `52,728 crores. This indicates smaller

ticket borrower make a signicant portion of the total borrowers of nancial

institutions. In contrast, while the ‘3 to 5 lakh’ and ‘5 to 7 lakh’ categories have

fewer accounts (962 thousand and 399 thousand respectively), their POS values,

`26,394 crores and `15,621 crores respectively, underscore the signicant nancial

heft these categories carry. The ‘7 to 10 lakh’ category, despite having 577 thousand

accounts, boasts a POS of `34,567 crores, highlighting the larger average loan

amount within this bracket. Similarly, the ‘10 to 15 lakh’, ‘15 to 20 lakh’, and ‘20 to

25 lakh’ categories, with 3.40 lakh, 2.12 lakh and 1.58 lakhd accounts respectively,

have considerable POS values, emphasizing that while these ticket sizes may be

fewer in number, they are substantial in monetary terms.

State of Micro Enterprise Financing Report 2023 | 13

Table 1: Business Loan, Ticket Size wise ‘23

Ticket size `

A/c Amount

Up to 3 lakh 9,950 52,728

3 to 5 lakh 962 26,394

5 to 7 Lakh 399 15,621

7 to 10 lakh 577 34,567

10 to 15 lakh 340 28,938

15 to 20 lakh 212 24,789

20 to 25 lakh 158 23,306

Not Dened * 250 8,539

Grand Total 12,850 214,881

A/c - Number of accounts in ‘000, Amt. – POS in ` Crore

*Not Dened - The data value in particular qualier is blank for these values. Same is

applicable for all further mention of Not Dened.

In summary, while micro-loans are predominant in terms of the number of

borrowers, larger loans, although fewer, constitute a signicant portion of the

overall portfolio balance. This diversity highlights the dynamic nature of the

business lending landscape, catering to a wide range of nancial needs and

business scales.

Which Bucket is Full?

Following graphs provides interesting portrayal of the lending patterns, showcasing

distinctive contrasts between the number of loans and the portfolio outstanding

(POS) for different ticket sizes.

Micro Loans or ‘Up to 3 lakh’ category stands out in terms of volume, representing

a staggering 77% of the total loans by March 2023. However, its contribution to

the POS paints a different narrative. Despite its vast numbers, this category only

accounts for 25% of the total POS in March 2023. This disparity highlights the

essence of micro-nancing: high in quantity but modest in individual loan value.

Mid-Range Loans encompassing the ‘3 to 10 lakh’ brackets, these mid-range loans

collectively make up 14% of the total number of loans in March 2023. Yet, their

inuence on the POS is more pronounced, with a combined contribution of 35%

in March 2023 This emphasizes that these mid-tier loans, while less frequent in

occurrence, possess a heftier individual nancial impact.

Larger Loans, from ‘10 to 25 lakh’ account for roughly 6% of the total number of

loans in March 2023. However, their cumulative footprint in the POS is a robust

14 | State of Micro Enterprise Financing Report 2023

36%. This signicant gap accentuates the pivotal role these larger loans play in the

nancial landscape.

Table 2: Percentage Share of Number of Loans

Ticket Size Mar-21 Mar-22 Mar-23

Up to 3 lakh 63% 56% 77%

3 to 5 lakh 7% 6% 7%

5 to 7 Lakh 3% 3% 3%

7 to 10 lakh 4% 4% 4%

10 to 15 lakh 2% 3% 3%

15 to 20 lakh 1% 2% 2%

20 to 25 lakh 1% 1% 1%

Not Dened 3% 3% 2%

Table 3: Percentage Share of POS

Ticket Size Mar-21 Mar-22 Mar-23

Up to 3 lakh 24% 20% 25%

3 to 5 lakh 13% 12% 12%

5 to 7 Lakh 8% 9% 7%

7 to 10 lakh 16% 18% 16%

10 to 15 lakh 13% 15% 13%

15 to 20 lakh 11% 13% 12%

20 to 25 lakh 9% 11% 11%

Not Dened 5% 2% 4%

Figure 1: Percentage Share Number of Loans Figure 2: Percentage Share of POS

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

Mar-21 Mar-22 Mar-23

0%

5%

10%

15%

20%

25%

30%

Mar-21 Mar-22 Mar-23

State of Micro Enterprise Financing Report 2023 | 15

Across all ticket sizes, the year-to-year trend reveals a general shift towards micro-

loans. The ‘Up to 3 lakh’ category saw a dip from March 2021 to March 2022 but

experienced a signicant surge by March 2023. Mid-range loans (‘3 to 10 lakh’)

remained relatively stable in terms of both loan numbers and POS share over

the years. Larger loans (‘10 to 25 lakh’), while consistent in terms of the number

of loans, showed a slight increase in their POS contribution. The Not Dened

category displayed a downward trend in loan numbers but had a variable POS

share, indicating potential reclassications or shifts in lending dynamics.

The graphs, unveil a multi-layered story of the lending ecosystem. While smaller

ticket sizes reign supreme in terms of sheer numbers, it’s the heft of mid-

range and larger loans that anchors the nancial fulcrum. Their considerable

value, albeit lower in volume, underscores the delicate equilibrium that lenders

maintain.

State-Wise Performance

Some states have high population share but lower MSME credit share. With a 17%

share in population, share of Uttar Pradesh in the number of accounts and credit

amount are 8.5% and 7.5% respectively. This indicates that either the demand

for MSME loans is low, nancial institutions perceive higher risks in extending

credit, or there’s an under penetration of banking services. Despite having a 9%

population share, Bihar’s share in the number of accounts and credit amount is

4.2% and 2.9%, respectively. This could point towards either a lesser number of

MSME establishments or a lack of accessibility to nancial services. Population

share of West Bengal stands at 8%. However, its share in the number of accounts

and credit amount is only 3.5% and 4.2%. This mismatch suggests potential

challenges in credit accessibility or lower demand for credit.

The trend reverses for some states. Despite a 1% population share, Delhi’s share

in the number of accounts and credit amount is 1.5% and 3.8%, respectively.

This might be due to Delhi being a commercial hub with a higher concentration

of businesses needing larger loan sizes. Similarly, Rajasthan with a 6% share in

population, its shares in the number of accounts and credit amount are 4.1% and

6.7%. While Maharashtra’s population and credit account shares match at 9%, its

credit amount share stands higher at 11.6%, indicating that MSMEs in Maharashtra

might be dealing with larger transactional values or have better credit accessibility.

Tamil Nadu stands apart with only 6% population share, but its credit account and

amount shares are 16.1% and 14.1%. This suggests a strong MSME sector and

better nancial integration.

16 | State of Micro Enterprise Financing Report 2023

Figure 3: States percentage share in Business Loan

The graph highlights signicant disparities in the distribution of MSME credit

across states when juxtaposed against population shares. This variance could be

due to regional economic disparities, the nature of industries prevalent in the states,

risk perceptions of banks, or accessibility to nancial services. There’s a visible

trend where some states, despite having substantial populations, have a lower

share of MSME credit. This could be indicative of untapped potential and might

signal a need for more targeted nancial inclusion initiatives. Conversely, certain

states outperform in credit metrics relative to their population, indicating strong

economic activity, better nancial infrastructure, or both. The dynamics between

the number of credit accounts and the credit amount reveal the nature of MSME

loans in states. Some states have a higher number of accounts but lower total

amounts, suggesting many smaller loans, while others show the opposite trend.

Institutions Share

The landscape of MSME lending in the country showcases a diverse participation

of various nancial institutions. Public Sector Undertaking or PSU Banks, with

their vast network and outreach, lead the pack, holding a substantial 35.7% of the

number of MSME loan accounts. This dominance is reected not just in the sheer

number of accounts but also in the loan amounts, where they contribute 32.8%.

Their widespread presence and commitment to fuelling the grassroots level of the

economy are evident in these numbers.

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

16.0%

18.0%

Lakshadweep

Ladakh

Andaman & Nicobar…

Mizoram

Arunachal Pradesh

The Dadra & Nagar…

Nagaland

Sikkim

Chandigarh

Tripura

Meghalaya

Goa

Manipur

Jammu & Kashmir

Puducherry

Uttarakhand

Chhattisgarh

Himachal Pradesh

Jharkhand

Delhi

Punjab

Haryana

West Bengal

Odisha

Kerala

Telangana

Rajasthan

Assam

Bihar

Gujarat

Andhra Pradesh

Madhya Pradesh

Uttar Pradesh

Karnataka

Maharashtra

Tamil Nadu

% Share No of Accounts % share POS % Share population

State of Micro Enterprise Financing Report 2023 | 17

Figure 4: Lenders percentage share in Business Loan

On the other hand, NBFCs, often seen as agile and more adaptive entities, hold

17.3% of the number of accounts. What’s striking is that their contribution to the

loan amount stands at a higher 21.6%. This suggests that while they might have

fewer borrowers compared to PSU Banks, the average loan size or the nature of

enterprises they cater to might be different, leading to larger loan disbursements.

Private Banks have carved out a signicant niche for themselves, holding 14.0%

of the accounts. Their share in the loan amount stands even higher at 19.1%,

indicating a focus on more substantial loans or catering to a segment of MSMEs

requiring larger capital inputs.

In contrast, Foreign Banks seem to have a limited role in the MSME lending

landscape of the country. They account for a mere 0.1% of the number of

accounts and 0.7% of the loan amount. This could be attributed to their selective

presence, specic focus sectors, or strategic business decisions.

Lastly, the Rest of Industry category, which might comprise smaller banks,

cooperatives, and other nancial entities, underscores the importance of diverse

nancial players. With 32.9% of accounts and 25.8% of the loan amount, this

segment solidies the notion that a multi-pronged nancial ecosystem is essential

for the holistic growth of the MSME sector.

Rural/Urban Distribution

In the rural nancial landscape, the prominence of various institutions paints a vivid

picture of grassroots economic empowerment. Dominating this space, the Rest of

Industry category, potentially comprising regional banks and cooperatives, holds

0.1%

17.3%

35.7%

14.0%

32.9%

0.7%

21.6%

32.8%

19.1%

25.8%

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

30.0%

35.0%

40.0%

Foreign Bank NBFC PSU Bank Pvt. Bank Rest of Industr

Number of Accounts Amount

Rest of Industry

18 | State of Micro Enterprise Financing Report 2023

a signicant 39% of the accounts and 36% of the POS. This suggests their deep-

rooted connection to rural communities and commitment to nancial inclusion.

Following closely, PSU Banks underscore the role of traditional banking, holding

34% of accounts and 31% of the POS. Interestingly, NBFCs and Private Banks

have carved niches, with the former’s POS share (20%) outpacing its account share

(16%).

Figure 5: Lenders percentage Share in

Number of accounts of in Rural Area

Figure 6: Lenders percentage Share in POS of

in Rural Area

As seen in the accompanying pie charts, the rural segment showcases a dynamic

blend of institutional engagements, with each entity playing a pivotal role in the

nancial well-being of rural India.

In the semi-urban lending domain, PSU Banks have a prominent presence,

accounting for 38% of the accounts and 34% of the point-of-sale (POS)

transactions. Their leading share demonstrates a consistent engagement with semi-

urban businesses and residents, ensuring a steady ow of nancial services.

Figure 7: Lenders percentage Share in

Number of accounts of in Semi Urban Area

Figure 8: Lenders percentage Share in POS in

Semi Urban Area

Foreign

Bank, 0%

NBFC,

16%

PSU Bank,

34%

Pvt. Bank,

11%

Rest of

Industr,

39%

Foreign

Bank, 0%

NBFC,

20%

PSU Bank,

31%

Pvt. Bank,

13%

Rest of

Industry,

36%

Foreign

Bank, 0%

NBFC,

27%

PSU Bank,

59%

Pvt. Bank,

20%

Rest of

Industry,

50%

Foreign

Bank, 1%

NBFC,

39%

PSU Bank,

65%

Pvt. Bank,

36%

Rest of

Industry,

54%

State of Micro Enterprise Financing Report 2023 | 19

The ‘Rest of Industry’, likely consisting of smaller banks, cooperatives, and regional

institutions, also plays a signicant role, holding 32% of the accounts and 28% of

the POS. Their substantial contribution indicates the importance of diverse nancial

entities in serving the semi-urban populace. Meanwhile, NBFCs account for 17%

of the accounts with a slightly higher 20% of the POS, suggesting they might be

handling larger transactions on average. Private Banks, with 13% of accounts and

18% of POS, also indicate a trend toward more substantial transactions or loans

in this segment. Foreign Banks, in contrast, maintain a minimal footprint in both

accounts and POS, reecting their limited engagement or focus in this region.

Figure 9: Lenders percentage Share in Num-

ber of accounts of in Urban Area

Figure 10: Lenders percentage Share in POS

in Urban Area

In the urban lending sector, PSU Banks lead with 34% of the accounts and a

similar 33% in the point-of-sale (POS) transactions. This highlights their consistent

and widespread presence even in urbanized regions, ensuring businesses and

individuals have adequate access to nancial resources.

Following closely, the ‘Rest of Industry’ category accounts for 25% of the urban

accounts but has a notably lower share in POS at 14%. This could indicate their

engagement with a larger number of smaller accounts or transactions in urban

areas.

NBFCs and Private Banks exhibit a signicant presence in this segment. Both

hold nearly equal shares in POS at 26%, with NBFCs accounting for 20% of

the accounts and Private Banks slightly higher at 21%. Their similar POS shares,

despite the difference in account numbers, suggest that both might be handling

larger average transactions or loans.

Lastly, Foreign Banks maintain a minimal role in the urban accounts with a 0%

share but show a slight presence in the POS with 1%. This suggests that while they

might have fewer accounts, the average transaction or loan size could be larger, or

they might be focusing on niche segments within the urban landscape.

Foreign

Bank, 0%

NBFC,

20%

PSU

Bank,

34%

Pvt.

Bank,

21%

Rest of

Industry,

25%

Foreign

Bank, 1%

NBFC,

26%

PSU Bank,

33%

Pvt. Bank,

26%

Rest of

Industry,

14%

20 | State of Micro Enterprise Financing Report 2023

REPAYMENT

Overdue by Ticket Size

The data reveals distinct patterns in the distribution of overdue business loans

beyond 90 days for the year 2023. The category with loans ‘Up to 3 lakh’ emerges

as a notable concern, holding a dominant 12% share of overdue accounts. This

underscores a trend where smaller loans tend to have a higher likelihood of

becoming overdue.

Table 4: Overdue in Business Loans 90+ DPD as of March ‘23

Ticket size

Number of

A/c's

% of total

A/c's in

ticket size

POS `

Crore

% of total

POS in

ticket size

Average

POS in `

90+ DPD

Up to 3 lakh 1206 12% 8,789 17% 72,869

3 to 5 lakh 84 9% 2,978 11% 354,055

5 to 7 Lakh 25 6% 1.241 8% 488,536

7 to 10 lakh 33 6% 2,511 7% 765,223

10 to 15 lakh 16 5% 1,734 6% 1,055,853

15 to 20 lakh 11 5% 1,490 6% 1,364,942

20 to 25 lakh 8 5% 1,439 6% 1,807,095

Not Dened 6 2% 2,784 33% 4,625,046

Grand Total 1,390 11% 22,966 11% 165,242

A/c - Number of accounts in ‘000, Amt. – POS in ` Crore

Meanwhile, the ‘3 to 5 lakh’ category, which accounts for 9% of the overdue ac-

counts, only contributes 11% to the total overdue amount. This hints at a modestly

better repayment behaviour in this ticket size. Similarly, both the ‘5 to 7 lakh’ and

‘7 to 10 lakh’ categories each hold a 6% share of overdue accounts but contribute

slightly less, 8% and 7% respectively, to the overdue amount. This reinforces the

notion of relatively better repayment behaviours in these brackets. In the higher

ticket sizes, the ‘10 to 15 lakh’, ‘15 to 20 lakh’, and ‘20 to 25 lakh’ loan categories

demonstrate a consistent pattern. Each of these categories contributes nearly 6%

to the total overdue amount, suggesting a uniform risk prole across these larger

loan amounts.

Overdue by Location of Borrower

In assessing the nancial health across different geographies, it’s evident that loan

delinquency is a concern across all areas, albeit to varying degrees. The Rural sec-

tor, while accounting for 9% of loans that are 90+ days past due (DPD), mirrors

this trend in its total current balance with a similar 9% overdue.

State of Micro Enterprise Financing Report 2023 | 21

Table 5: 90+DPD in different Population Group

Rural - Urban A/c % Share Amount % Share

Rural

361 9% 4,517 9%

Semi Urban

703 12% 9,462 9%

Urban

302 11% 8,621 14%

Not Dened

24 15% 365 16%

Grand Total

1,390 11% 22,966 11%

A/c - Number of accounts in ‘000, Amt. – POS in ` Crore

This suggests a consistent repayment behaviour among its borrowers. Semi-Urban

regions exhibit a higher loan delinquency rate of 12%. However, a slightly more

encouraging picture emerges when considering the total current balance; only 9%

is overdue, hinting that larger loans or more creditworthy borrowers might be

more punctual in their repayments. In contrast, the urban sector presents a mixed

scenario. While the loan delinquency is at 11%, a substantial 14% of its total current

balance is overdue, indicating potential challenges with larger loans or higher

value borrowers. This underscores the importance of continuous monitoring and

proactive measures to mitigate the risk in urban settings.

Institution-Wise Overdue

In evaluating the nancial landscape across various lending institutions, distinct

patterns emerge regarding loan delinquency. Foreign Banks, despite having a rel-

atively small presence in terms of account numbers, face a signicant challenge

with 14% of their loans being 90+ days past due (DPD). This becomes even more

pronounced when analysing the amount, as a substantial 21% of their total loan

balance falls into this overdue category. This suggests potential credit risks associ-

ated with their lending policies or clientele.

Table 6: Institution wise 90+ DPD portfolio

Lending Institutions A/c % Share Amount % Share

Foreign Bank

2 14% 290 21%

NBFC 162 7% 5,641 12%

PSU Bank 797 17% 11,581 16%

Pvt. Bank 78 5% 1,216 3%

Re of Induries

350 8% 4,238 7%

Grand Total

1,390 11% 22,966 11%

A/c - Number of accounts in ‘000, Amt. – POS in ` Crore

Non-Banking Financial Companies (NBFCs), on the other hand, have a 7% loan

delinquency rate, which elevates to 12% when considering the overdue balance.

This disparity indicates that while fewer accounts are delinquent, the amounts

22 | State of Micro Enterprise Financing Report 2023

involved are considerably larger, pointing towards the possibility of higher-

value loans being at risk. Public Sector Undertaking (PSU) Banks demonstrate a

higher delinquency rate of 17% in terms of accounts, closely mirrored by a 16%

overdue amount. This alignment in percentages suggests a fairly consistent risk

prole across their loan portfolio. Private Banks showcase the most favourable

scenario, with only 5% of their loans being 90+ DPD, and a mere 3% of their total

loan balance being overdue. This may reect stringent credit policies or effective

recovery mechanisms in place. The ‘Rest of Industries’ segment, encompassing

other miscellaneous lenders, has an 8% loan delinquency rate, which translates to

7% of the overdue balance. This indicates a relatively balanced lending scenario in

this segment.

Performance of States in 90+ DPD Overdue

As of March 2023, the credit performance of various states in India, in relation to

POS under 90+ DPD, when juxtaposed with their share in the national population

as shown in following graph, presents an interesting perspective.

Figure 11: States percentage share in 90+DPD delinquency

States with negligible population contributions, such as Ladakh, Lakshadweep,

The Dadra & Nagar Haveli & Daman & Diu, Andaman & Nicobar Islands, and

others all the way up to Tripura, have varying levels of 90+ DPD POS percentages

but relatively low contributions to the overall 90+ DPD POS.

Himachal Pradesh, Uttarakhand, and Jammu & Kashmir, each with a 1% share in

the population, exhibit 13%, 9%, and 6% of their POS under 90+ DPD respectively.

Delhi, despite its 1% share in the population, has the highest percentage of POS

under 90+ DPD at 26%.

States like Haryana, Chhattisgarh, Punjab, Assam, Jharkhand, Kerala, Telangana,

and Odisha have a population share ranging from 2% to 3%. Among these,

0%

5%

10%

15%

20%

25%

30%

Lakshadweep

Ladakh

Andaman & Nicobar Islands

The Dadra & Nagar Haveli &…

Mizoram

Chandigarh

Sikkim

Arunachal Pradesh

Meghalaya

Nagaland

Goa

Tripura

Manipur

Delhi

Puducherry

Himachal Pradesh

Jammu & Kashmir

Assam

Chhattisgarh

Jharkhand

Uttarakhand

Odisha

Kerala

West Bengal

Gujarat

Punjab

Telangana

Bihar

Rajasthan

Andhra Pradesh

Tamil Nadu

Haryana

Madhya Pradesh

Maharashtra

Uttar Pradesh

Karnataka

%share in number of accounts %share in POS %share in population

State of Micro Enterprise Financing Report 2023 | 23

Chhattisgarh stands out with 12% of its POS under 90+ DPD and an equal

contribution to the overall 90+ DPD POS.

In the 4% to 6% population share range, Andhra Pradesh, Gujarat, Karnataka,

Rajasthan, Tamil Nadu, and Madhya Pradesh exhibit varied 90+ DPD POS

percentages. Rajasthan has an impressive 13% contribution to the overall 90+

DPD POS, despite having only 4% of its POS under the category.

West Bengal, Bihar, and Maharashtra, with population shares ranging from 8%

to 9%, display 17%, 12%, and 12% of their POS under 90+ DPD respectively.

Notably, Bihar contributes a signicant 10% to the overall 90+ DPD POS.

Uttar Pradesh, the state with the largest population share at 17%, has 15% of its

POS under 90+ DPD and contributes 7% to the overall 90+ DPD POS.

In summation, while states with larger populations do have signicant POS

under 90+ DPD, their contribution to the overall 90+ DPD POS isn’t always

proportional. The data suggests that credit discipline varies widely across states,

irrespective of their size or population.

BUSINESS LOAN SOURCING

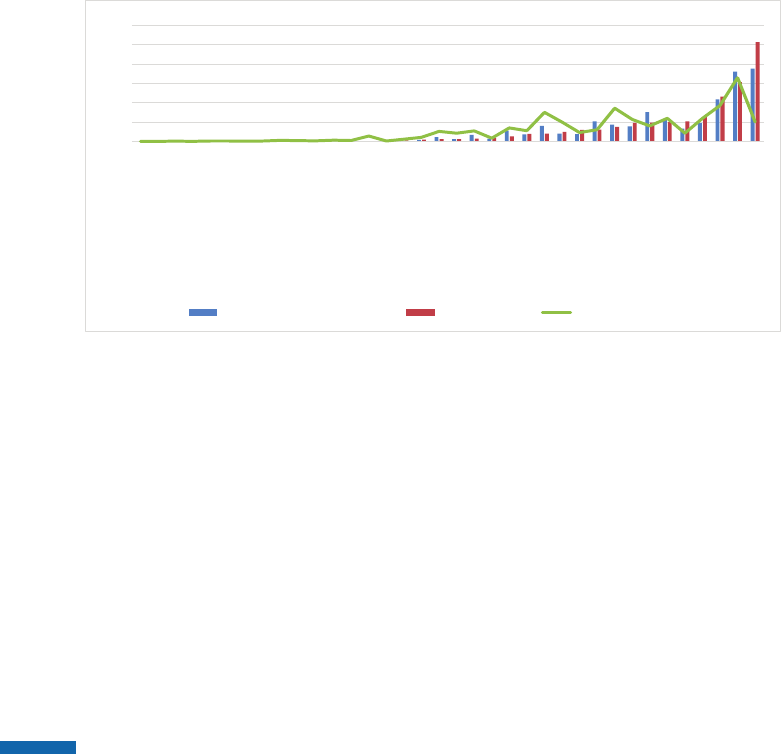

Following graphs shows three years trend in sanctioned number of accounts and

amount for different ticket size buckets.

Figure 12: Three year trend of Number of

Accounts - Ticket wise

Figure 13: Three year trend of Sanction

Amount - Ticket wise

The dominant 0-3L bucket experienced a dip from 87% in 2021 to 80% in 2022

in account share, but rebounded slightly to 82% in 2023. The sanctioned amount,

however, consistently decreased over the years. This suggests that while a there is

large number of borrowers in the small loan bucket the overall amount sanctioned

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2021 2022 2023

0%

5%

10%

15%

20%

25%

30%

35%

2021 2022 2023

24 | State of Micro Enterprise Financing Report 2023

in this category is declining. It possibly indicates that lower ticket size borrowers

within this bracket are increasing.

The 3-5 lakh range showed steady growth in account share, while the sanctioned

amount remained stable. This indicates a consistent demand for loans in this

category without signicant changes in the average loan size. The 3-5 lakh and 3-5

lakh ranges both saw growth in account share, with the 7-10 lakh experiencing an

increase in sanctioned amounts too. This suggests a growing demand as well as

eligibility among borrowers for these middle ticket sizes. The 10-15 lakh category,

despite a stable account share, witnessed growth in the sanctioned amount, hinting

at a trend where borrowers in this bracket are taking larger loans within the range.

The 15-20 lakh and 20-25 lakh categories remained relatively stable, but the

slight uptick in sanctioned amounts over the three years suggests an increasing

condence or need among borrowers to take larger loans, even if the number of

such borrowers hasn’t grown signicantly.

The following table shows trend in loan distribution across various ticket sizes

in FY 2022-23. A vast majority, approximately 82% of the total loan accounts,

fall within the 0-3 lakh ticket size. This indicates a strong need for smaller loans

among borrowers. However, when we shift our focus to the sanction amounts, it’s

evident that while the 0-3 lakh ticket size contributes only about 27% of the total

sanctioned amount. The combined contribution of larger ticket sizes (from 3-25

lakh) is signicant. For instance, the 3-5 lakh, 7-10 lakh, and 10-15 lakh ticket sizes

each contribute between 12% to 15% of the total sanctioned amount, despite

having considerably fewer accounts.

Table 7: Business loan Sanction - Ticket Size Basis - FY 2022-23

Ticket Size A/c Amount

0-3L 4,568 33,141

3L-5L 348 14,695

5L-7L 162 9,538

7L-10L 204 17,828

10L-15L 132 16,427

15L-20L 82 14,635

20L-25L 63 14,328

Grand Total 5,558 120,592

A/c - Number of accounts in ‘000, Amt. – Sanction Amount in ` Crore

Demographics-Wise Sanction

The data on the location-wise sanction of loan amounts over three nancial

years (FY 21 to FY 23) sheds light on the evolving rural-urban divide in credit

distribution. Overall the share is consistent for last 3 years.

State of Micro Enterprise Financing Report 2023 | 25

Figure 14: Location-wise percentage share in Sanction amount - Three year trend

Rural areas, representing the agricultural sectors of the nation, experienced a

minor increase in loan sanctions from 23% in FY 21 to 24% in both FY 22 and

FY 23. This slight increment indicates a positive shift towards enhancing credit

facilities in rural sectors, possibly due to evolving policy measures or emerging

market opportunities.

Semi-urban regions, acting as transitional zones bridging rural and urban areas,

held a steady share of 47% throughout the three years. Their consistent share

underscores a robust and unwavering demand for credit, driven by a blend of both

agricultural and urban-centric activities.

In contrast, urban zones, the epicentres of industrial and service sector activities,

showed a marginal decline from 29% in FY 21 to 28% in the subsequent years.

This minor reduction could hint at a maturing credit demand in urban centres or a

strategic shift by nancial institutions.

In FY23, the loan sanction data underscores a stable lending landscape with semi-

urban areas leading at 47%, reecting their signicant and consistent role in the

economy. Rural areas followed with a 24% share, indicating ongoing support for

sectors typical to these regions without change from the previous year, suggesting

steady growth and investment in rural economies. Urban areas experienced a

nominal decrease to 28%, hinting at either a slight shift in economic dynamics

or a strategic redistribution of credit resources. Overall, the distribution points

towards a balanced credit dispersal with semi-urban areas remaining as pivotal

growth centres, rural areas holding rm to their share, and urban areas showing a

small but notable decrease in their slice of the loan sanction pie.

Table 8: Demographics-Wise Average Loan Sanction Trend

Demographics FY21 FY22 FY23

Not Dened 97,750 204,936 218,077

Rural 95,290 153,174 165,945

Semi Urban 117,618 187,403 207,558

Urban 221,832 252,338 264,373

1%

23%

47%

29%

1%

24%

47%

28%

1%

24%

47%

28%

0%

10%

20%

30%

40%

50%

ND Rural Semi Urban Urban

FY 21 FY 22 FY 23

26 | State of Micro Enterprise Financing Report 2023

Analysing the average loan sanctions across different demographics over the

last three nancial years reveals interesting trends. The Not Dened category

experienced the most dramatic increase in average loan sanctions from FY21 to

FY22 with an approximate growth of 109.65%, indicating a signicant surge in

loan approvals or an increase in the loan amounts during this period. However,

the growth from FY22 to FY23 slowed down to 6.41%, suggesting a possible

stabilization or a plateau in the growth of loan sanctions for this category.

In contrast, Rural and Semi-Urban areas showed consistent growth over the years.

Rural demographics experienced a notable increase of 60.75% in loan sanctions

from FY21 to FY22, followed by an 8.34% rise into FY23. Similarly, Semi-Urban

areas observed a 59.33% jump in the rst period and a 10.75% increase in the

second, showcasing a healthy upward trend in loan sanction amounts. Urban areas,

on the other hand, displayed a more modest growth pattern with a 13.75% increase

from FY21 to FY22 and a 4.77% increase from FY22 to FY23, indicating a more

gradual and steady increase in loan sanctions in these areas. Overall, while each

demographic show growth in loan sanctions, the rates suggest a diverse nancial

landscape with varying degrees of lending activity.

Institution wise Sanction

The percentage shares of loan sanctions by different nancial institutions across

various geographical locations highlight distinct strategies and market focuses.

Foreign banks show a strong urban emphasis with 73% of their loans sanctioned

in urban areas, complemented by 24% in semi-urban and a minimal 2% in rural

areas. This distribution likely reects their focus on urban markets, where there are

higher concentrations of corporate clients and afuent individuals.

Figure 15: Lenders percentage share in population groups

Meanwhile, Non-Banking Financial Companies (NBFCs) display a more distrib-

uted approach, with the largest share of their loans, 44%, going to semi-urban

areas, followed by 33% in urban and 22% in rural locales. NBFCs, known for

lling the gaps left by traditional banking services, appear to be capitalizing on the

diverse opportunities across these regions. Public Sector Banks (PSUs) prioritize

2%

22%

28%

19%

32%

24%

24%

44%

48%

46%

50%

47%

73%

33%

23%

35%

17%

28%

0%

10%

20%

30%

40%

50%

60%

70%

80%

Foreign Bank NBFC PSU Bank Pvt. Bank Rest of Industr Grand Total

Rural Semi Urban Urban

State of Micro Enterprise Financing Report 2023 | 27

rural (28%) and semi-urban (48%) areas, perhaps in line with their mandate for

inclusive banking and support for underbanked sectors, while their urban share is

relatively lower at 23%.

Private Banks allocate loans relatively evenly, with a slightly higher concentration

in semi-urban (46%) and urban areas (35%), and 19% in rural areas. This indicates

a balanced approach, serving a mix of clients from different sectors. The Rest

of the Industry, possibly including smaller banks and other nancial institutions,

leans heavily towards rural (32%) and semi-urban areas (50%), with a signicantly

lesser focus on urban regions (17%), which might suggest a strategic targeting of

niche markets or a specialization in serving less urbanized areas. Overall, the grand

total reects a diversied nancial landscape with 24% of loans in rural, 47% in

semi-urban, and 28% in urban areas, indicating a balanced distribution of credit

across the country.

CONCLUSION ON BL

a. Micro-Loan Dominance: A staggering 77% of business loans fall under the

‘Up to 3 lakh’ ticket size category. However, these numerous small loans

account for only 25% of the total Portfolio Outstanding (POS), reecting

the focused support towards nurturing small-scale MSMEs.

b. POS Disparity: There is a noticeable disparity in the POS contribution of

larger loans, with those above `7 lakh showing a gradual decrease, which

is economically sensible. Concerns arise particularly in the `5 to `7 lakh

bracket and `3 to `5 lakh brackets, where POS stands at 9% and 12%

respectively. Addressing this imbalance by aiming for a gradual reduction in

the POS share of these categories could indicate a healthier MSME sector.

c. Loan Performance Metrics: A signicant portion of the POS, specically

16% within the `0 to `3 lakh category, being in the 90+ DPD bracket is

of high concern. This high rate of delinquency necessitates a thorough

investigation into the underlying causes to mitigate risks.

d. NBFCs in the Lead: The data shows Non-Banking Financial Companies

(NBFCs) having a notable inuence in the business loan category, with a

36% share in total loan sanctions. This underscores the viability of the loan

category as a business venture, driven by competitive market forces rather

than solely by governmental policies.

e. Market Dynamics: The dynamic market behaviour with a shift towards

micro-loans and a diversied lender base. This suggests a need for adaptive

strategies from nancial institutions to accommodate the growing demand

for small ticket loans while managing risk and maintaining economic stability

within the MSME sector.

28 | State of Micro Enterprise Financing Report 2023

3. BUSINESS LOAN AGRICULTURE

B

usiness loans tailored for the agricultural sector play a crucial role in bolstering

the backbone of the rural economy, facilitating a wide array of commercial

activities integral to this industry. Designed to support ventures such as the trading

of agricultural products, dairy operations, and various other agri-businesses,

these loans are pivotal for the growth and sustainability of Agri MSMEs. The

comprehensive analysis provided in the accompanying report offers a detailed

look at the trends, progress, and overall performance of these credit facilities,

highlighting their impact on the agricultural micro, small, and medium enterprises

that drive this vital segment of the economy.

PORTFOLIO

Size-Wise Analysis

The following table number 9 for March 2023 outlines the distribution of busi-

ness loans across various ticket sizes, both in terms of the number of accounts

(in thousands) and the total amounts (in crore rupees). A closer look at the data

reveals that the smallest loan category, ‘Up to 3 lakh’, has the highest volume, with

111.22 lakh accounts. These accounts make up a substantial share of the total

number of loan accounts, signifying a high demand for small-scale nancing, pos-

sibly among micro-entrepreneurs or individuals with modest capital needs.

As we progress to larger loan sizes, the number of accounts diminishes. The ‘3

to 5 lakh’ range comprises 7.69 lakh accounts, holding a 5.48% share of the total

number of accounts, yet these loans account for 14.14% of the total loan amount,

indicating that medium-sized loans contribute signicantly to the nancial volume

of the portfolio. In stark contrast, the ‘20 to 25 lakh’ category, while representing

only 0.15% of the total number of accounts, accounts for a 2.02% share of the

total loan amount, which highlights the impact of larger loans on the nancial

portfolio.

State of Micro Enterprise Financing Report 2023 | 29

Table 9: Business Loan Agri, Ticket Size-Wise

Mar-23

Ticket size `

A/c Amount

Up to 3 lakh

11,122 107,578

3 to 5 lakh 769 28,470

5 to 7 Lakh

259 13,961

7 to 10 lakh

229 17,012

10 to 15 lakh

82 9,139

15 to 20 lakh

43 6,658

20 to 25 lakh

21 4,072

Not Dened 1,496 14,121

Grand Total 14,020 201,012

A/c - Number of accounts in ‘000, Amt. – POS in ` Crore

Overall, the aggregate data with 140.2 lakh accounts and a total amount of

201,012 crores suggest that while a larger number of smaller loans dominate the

count, the nancial share is more evenly distributed across different loan sizes.

This reects a balanced lending ecosystem catering to a wide range of nancial

needs, from small to large scales of business operations.

Which Bucket is Full?

The following tables show the percentage share of the number of accounts by

ticket size and the percentage share of portfolio outstanding by ticket size from

March 2021 to March 2023, we can draw several insights into the behaviour of

borrowers/FIs and the dynamics of the loan portfolio.

Table 10: Trend in BL Agri Loans - Ticket Size Basis

Ticket Size

Bucket

% share of the number of

accounts

% share of Portfolio

outstanding

Mar-21 Mar-21 Mar-22 Mar-23 Mar-22 Mar-23

Up to 3 lakh

82.57% 59.99% 60.32% 53.43% 83.40% 79.98%

3 to 5 lakh 5.27% 14.50% 14.31% 14.14% 5.36% 5.41%

5 to 7 Lakh

1.55% 6.30% 6.27% 7.00% 1.58% 1.83%

7 to 10 lakh

1.28% 6.97% 7.24% 8.45% 1.35% 1.60%

10 to 15 lakh

0.44% 3.84% 3.90% 4.59% 0.47% 0.58%

15 to 20 lakh

0.21% 2.51% 2.69% 3.32% 0.23% 0.30%

20 to 25 lakh

0.10% 1.52% 1.60% 2.15% 0.11% 0.15%

Not Dened

8.57% 4.37% 3.68% 6.93% 7.49% 10.16%

30 | State of Micro Enterprise Financing Report 2023

In both tables, there is a noticeable trend in the ‘Up to 3 lakh’ category, which sees

a decline in both the number of accounts (from 82.57% to 79.98%) and the share

of portfolio outstanding (from 60% to 53%) over the period. This suggests a shift

away from the smallest loan sizes, both in terms of the number of loans and the

total loan value, which could be indicative of borrowers graduating to higher loan

brackets as their businesses grow or as they require more signicant funds for their

activities.

The stability in the ‘3 to 5 lakh’ segment across both tables, holding steady at 14%

for the share of portfolio outstanding and around 5% for the number of accounts,

points to a consistent borrowing pattern in this ticket size. However, an increase in

both the number of accounts and the portfolio share in the ‘5 to 7 lakh’ and ‘7 to

10 lakh’ brackets suggests that a segment of borrowers is opting for larger loans,

which could reect an expansion of business operations or increased capital needs.

Interestingly, the ‘10 to 15 lakh’ and ‘15 to 20 lakh’ categories show a modest

increase in the share of portfolio outstanding compared to the number of

accounts, indicating that while there may not be a large number of loans in these

brackets, the loans that are taken out are for more considerable amounts. This is

also reected in the consistent share of the portfolio outstanding for larger ticket

sizes, despite their lower prevalence in the number of accounts.

Overall, the analysis of these two tables suggests a shift in the agricultural loan

landscape, with a move towards larger loan amounts over time, both in terms of

the number of loans being taken out and the total value of loans outstanding.

This shift could reect broader economic trends, such as ination or the

increasing scale of agricultural operations. It also highlights the importance

of offering a diverse range of loan products to meet the evolving needs of

borrowers in the sector.

State-Wise Distribution

The gure 16 represent states percentage share in of number of loans and POS in

the bar and population in the line graph.

State of Micro Enterprise Financing Report 2023 | 31

Figure 16: State wise percentage of share of Business Loan Agri and Population

The data from the above graph reects the disparities in agricultural business loans

across Indian states, with particular insights into the number of loan accounts

and Portfolio Outstanding (POS) relative to the states’ population shares. States

like Uttar Pradesh and Telangana, for example, show a robust engagement in

agricultural nancing. Uttar Pradesh stands out with 15.9% of loan accounts

and 12.8% of the POS, signicantly higher than its 13% share of the nation’s

population. This suggests a strong agricultural sector within the state that has

substantial nancing needs.

On the other side of the spectrum, states such as Maharashtra and Karnataka,

despite having smaller population shares, exhibit higher percentages of both

loan accounts and POS. Maharashtra, for instance, has a 9% population share

but accounts for 5.7% of loan accounts and 7.6% of the POS. The higher loan

percentages might indicate a focus on larger or more valuable agricultural loans in

these states, pointing to a more developed or commercially oriented agricultural

nancing environment.

Conversely, Bihar presents an interesting case. It has a high population share at 9%,

but its agricultural loan accounts and POS stand at 2.5% and 1.9%, respectively.

This discrepancy could be indicative of challenges such as lower access to credit,

a smaller number of large-scale agricultural operations, or a reliance on informal

lending mechanisms within the state.

The data highlights a complex relationship between a state’s population share and

its agricultural loan distribution, inuenced by various factors including the state’s

economic structure, the prominence of agriculture within the state’s economy,

and the accessibility to nancial services. This variability underscores the need for

tailored agricultural nancing strategies that consider the unique economic and

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

16.0%

18.0%

Lakshadweep

The Dadra & Nagar Haveli…

Chandigarh

Andaman & Nicobar Islands

Mizoram

Sikkim

Arunachal Pradesh

Nagaland

Tripura

Ladakh

Manipur

Delhi

Goa

Puducherry

Meghalaya

Himachal Pradesh

Uttarakhand

Assam

Jammu & Kashmir

Jharkhand

Chhattisgarh

Odisha

Punjab

Bihar

West Bengal

Rajasthan

Madhya Pradesh

Kerala

Gujarat

Haryana

Maharashtra

Karnataka

Andhra Pradesh

Tamil Nadu

Telangana

Uttar Pradesh

%share number of Accounts %share POS %share in population

32 | State of Micro Enterprise Financing Report 2023

agricultural landscapes of each state to ensure equitable access to credit across

India’s diverse agricultural sector.

Institutions Wise Details

The following bar graph depicts the percentage share of lending institutions in the

agricultural sector.

Figure 17: Percent of Share - Lending institution in BL Agri

Public Sector Banks (PSU Banks) dominate the market, holding the majority share

of both the number of accounts and the POS. The percentage of the number of

accounts is slightly higher than that of POS, indicating that while PSU Banks have

a vast customer base, the average loan size per account might be smaller compared

to other institutions.

Private Banks, while having a smaller footprint in terms of the number of accounts

when compared to PSU Banks, show a higher share in the POS. This suggests

that Private Banks might be focusing on larger loans, potentially catering to well-

established agribusinesses or larger-scale farming operations that require more

signicant nancial inputs.

The category of Rest of Industry which could include Non-Banking Financial

Companies (NBFCs), Cooperatives, and other nancial institutions, represents a

modest share in both the number of accounts and POS. Notably, their share of

POS is slightly higher than their share of the number of accounts, which could

imply that these institutions also tend to issue larger loans on average, although

they serve fewer customers than the banks.

NABARD (National Bank for Agriculture and Rural Development), despite its

pivotal role in agricultural development, shows minimal direct involvement in

terms of the percentage of both the number of accounts and POS. This could

reect NABARD’s role as a renancing and development institution rather than

a direct lender, and its efforts might be more focused on policy development and

capacity building in the agricultural sector.

0.1%

17.3%

35.7%

14.0%

32.9%

0.7%

21.6%

32.8%

19.1%

25.8%

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

30.0%

35.0%

40.0%

Foreign Bank NBFC PSU Bank Pvt. Bank Rest of Industr

Number of Accounts Amount

State of Micro Enterprise Financing Report 2023 | 33

Overall, the graph underscores the central role of PSU Banks in agricultural

lending, the signicant presence of Private Banks in terms of loan amounts,

and the complementary roles of other nancial entities in the sector. The

analysis of this data can inform policy decisions, strategic planning for nancial

institutions, and the targeted design of nancial products for the agricultural

sector.

Rural/Urban Distribution

The table provides a comparative snapshot of the percentage share of a Business

Loan Agriculture against the percentage share of the population across different

geographic classications—rural, semi-urban, and urban areas.

In rural areas, there is a slight decrease from 48% of the population to 45% in the

BL Agriculture. This 3% drop might suggest a lower presence or uptake of the

service or metric being measured in rural regions compared to their demographic

weight. This could be due to various factors such as limited access, lower demand,

or other socio-economic barriers.

Table 11: % Share of population group on BL Agri

Population Group

% share of Population group in

Number of accounts

% share of Population

group in POS

Not Dened

2% 2%

Rural 48% 45%

Semi-Urban 45% 47%

Urban 4% 6%

For semi-urban areas, the opposite is true; they represent 45% of the population

but account for 47% in the BL Agriculture This over-representation could indicate

a higher concentration or adoption of the service or metric in these areas, possibly

because these regions strike a balance between rural accessibility and urban facilities.

The urban category shows the most signicant difference, with only 4% of the

population share but accounting for 6% of the BL Agri. This suggests a higher

penetration or relevance of the measured service or metric in urban areas, which

could be attributed to higher income levels, greater availability, or a targeted

approach by service providers toward the urban population.

Overall, the disparities between the geographic classications in the table could

reect inequalities in service provision or economic opportunities between

rural, semi-urban, and urban areas. These differences are crucial for policy

formulation, resource allocation, and targeted interventions by service providers

to ensure equitable access and utilization across different population segments.

34 | State of Micro Enterprise Financing Report 2023

Institutions Share in Different Demographics

Rural Portfolio

The pie charts depict the percentage shares of different nancial entities in rural

areas in two different categories: the number of accounts and the presence in

Point of Sale (POS) locations.

For the number of accounts, Public Sector Undertakings (PSU) Banks hold the

majority with 61%, indicating a strong preference or reliance on government-

owned banks in rural areas for opening accounts. Private Banks account for 7%,

while Non-Banking Financial Companies (NBFCs) have a minimal share of 1%.

The rest of the industry, which may include cooperatives, small nance banks, and

other nancial institutions, accounts for 31%. This suggests a signicant presence

of diverse banking options in rural areas, but a dominant preference for PSU

Banks.

The second chart, illustrating the percentage share in POS in rural areas, shows a

slightly different distribution. PSU Banks still lead with a strong majority at 63%,

slightly up from their share of accounts, indicating that they not only hold the

majority of accounts but also dominate the POS services in these areas. Private

Banks have a slightly higher share here at 8% compared to their share in accounts,

while NBFCs have no share at all. The rest of the industry holds 28%, which is a

minor decrease from their share in the number of accounts.

The near absence of NBFCs in the POS share could imply that NBFCs are either

not focused on or not permitted to provide POS services in rural areas. Overall,

the data suggests that PSU Banks are the backbone of nancial services in rural

areas, with a signicant lead over private entities in both the number of accounts

and POS services. Private Banks and other industry players have a smaller but

Figure 18: Percent of Share in Number of Accounts

in Rural

Figure 19: Percent of Share in POS Rural

NBFC,

1%

PSU Bank,

61%

Pvt. Bank,

7%

Rest of

Industry,

31%

NBFC,

0%

PSU

Bank,

63%

Pvt. Bank,

8%

Rest of

Industry,

28%

State of Micro Enterprise Financing Report 2023 | 35

notable presence, which may indicate competitive services or niche markets within

rural nancial ecosystems.

Semi-Urban Portfolio

The following pie charts represent the distribution of the percentage share in the

number of accounts and Points of Sale (POS) in semi-urban areas, segmented by

different types of banking institutions.

In the rst chart, which shows the percentage share in the number of accounts,

Public Sector Undertakings (PSU) Banks again have the majority with 63%,

demonstrating their prominence in semi-urban banking as well. Private Banks

hold a share of 11%, and Non-Banking Financial Companies (NBFCs) make up a

small fraction at 1%. The Rest of the Industry, which could include micronance

institutions, cooperatives, and other small nancial entities, represents 25% of the

accounts. This indicates that while PSU Banks are the leading choice for account

holders, there is also a considerable portion of the population in semi-urban areas

that opt for various other nancial service providers.

The second chart details the percentage share of POS in semi-urban areas. PSU

Banks have a slightly larger share of 68% in POS services compared to their share

of accounts, suggesting their strong position in the market for daily nancial

transactions. Private Banks maintain an 11% share, identical to their share in the

number of accounts, which may indicate a consistent customer base for both

banking and transactional services. Notably, NBFCs do not have a presence in

the POS segment, hinting at a lack of involvement or inability to compete in this

space. The Rest of the Industry accounts for 21%, showing a slight decline from

the share in the number of accounts.

NBFC,

1%

PSU Bank,

63%

Pvt. Bank,

11%

Rest of

Industry,

25%

NBFC, 0%

PSU Bank,

68%

Pvt. Bank,

11%

Rest of

Industry,

21%

Figure 20: Percent of Share of Number of Accounts

in Semi-Urban

Figure 21: Percent of Share in POS in Semi Urban

36 | State of Micro Enterprise Financing Report 2023

These charts imply that PSU Banks are the dominant nancial service providers

in semi-urban areas, not just in terms of account holding but also in POS

transactions. Private Banks and other industry players have a relatively consistent

but smaller presence across both charts. The complete absence of NBFCs from

the POS segment might reect regulatory restrictions, strategic choices, or

competitive disadvantages in semi-urban markets. The data suggests a stable

market distribution with PSU Banks at the forefront, followed by a modest but

persistent participation from Private Banks and other nancial institutions.

Urban Portfolio

The following pie charts illustrate the distribution of the percentage share in the

number of accounts and Point of Sale (POS) services among various nancial

institutions in urban areas.

NBFC,

1%

PSU

Bank,

67%

Pvt.

Bank,

20%

Rest of

Industry,

11%

NBFC,

0%

PSU

Bank,

66%

Pvt.

Bank,

21%

Rest of

Industry,

13%

In the rst chart, which details the percentage share in the number of accounts,

Public Sector Undertakings (PSU) Banks have a dominant presence with 67% of

the market share, indicating a strong consumer preference or trust in government-

owned banks within urban settings. Private Banks hold a fth of the market at

20%, which suggests a signicant but smaller role compared to PSU Banks. Non-

Banking Financial Companies (NBFCs) have a very small share at 1%, indicating

a marginal presence in the urban account market. The rest of the industry, which

likely includes small nance banks, cooperative banks, and other nancial entities,

accounts for 11% of the market share, pointing towards a moderate diversity of

institutions that urban customers use for banking.

The second chart shows the percentage share of POS in urban areas. Here, PSU

Banks have a slightly lesser share at 66%, which is still the majority, but indicates

Figure 22: Percent of Share of Number of Accounts

in Urban

Figure 23: Percent of Share of POS in Urban

State of Micro Enterprise Financing Report 2023 | 37

a small shift in market dynamics from account holding to transactional services.

Private Banks have a marginally higher share in POS services at 21%, suggesting

that their infrastructure for POS might be more utilized or preferred compared to

their share of account holdings. The rest of the industry also sees a slight increase

in share at 13%, while NBFCs have no share in the POS market, which might

reect a strategic focus away from POS services or a competitive disadvantage in

this area.

These charts collectively suggest that while PSU Banks are the predominant

entities in both the number of accounts and POS services in urban areas, there

is a slight shift in market shares when it comes to transactional services. Private

Banks and the rest of the industry appear to have a somewhat stronger presence

in POS services compared to account holdings. The absence of NBFCs in the

POS services indicates their limited role or absence in this particular urban

nancial service market.

REPAYMENT

Overdue by Ticket Size

The following table presents a comprehensive view of the overdue agricultural

business loans segmented by ticket size for accounts that are more than 90 days

past due. The most striking aspect of the data is the high proportion of overdue

accounts in the ‘Up to 3 lakh’ category, which constitutes 21% of the total number

of accounts and 22% of the total overdue amount in this segment. This suggests a

signicant risk concentration in the smallest loan bracket, implying that such loans

are more likely to become overdue compared to larger loans.

Table 12: 90+ DPD delinquency - Ticket Size basis

Ticket size

Number

of A/c's

% of total

A/c's in

ticket size

POS Rs.

Crore

% of total

POS in

ticket size

Average

POS in `

90+ DPD

Up to 3 lakh

2,280 21% 24,066 22% 105,551

3 to 5 lakh 164 21% 7,449 26% 452,854

5 to 7 Lakh 52 20% 3,373 24% 647,933

7 to 10 lakh 42 19% 3,698 22% 872,211

10 to 15 lakh 16 20% 2,125 23% 1,301,458

15 to 20 lakh 7 17% 1,233 19% 1,735,275

20 to 25 lakh 4 20% 931 23% 2,214,866