TENNESSEE GAS PIPELINE

ANNUAL CUSTOMER MEETING

AUGUST 24, 2023

Newport, RI

DISCLOSURE

General – The information contained in this presentation does not purport to be all-inclusive or to contain all information that prospective investors may require. Prospective investors are encouraged to

conduct their own analysis and review of information contained in this presentation as well as important additional information through the Securities and Exchange Commission’s (“SEC”) EDGAR system at

www.sec.gov and on our website at www.kindermorgan.com.

Policies and Procedures –This presentation includes descriptions of our vision, mission and values and various policies, standards, procedures, processes, systems, programs, initiatives, assessments,

technologies, practices, and similar measures related to our operations and compliance systems (“Policies and Procedures”). References to Policies and Procedures in this presentation do not represent

guarantees or promises about their efficacy, or any assurance that such measures will apply in every case, as there may be exigent circumstances, factors, or considerations that may cause implementation of

other measures or exceptions in specific instances.

Forward-Looking Statements – This presentation includes forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 and Section 21E of the Securities

Exchange Act of 1934 (“Exchange Act”). Forward-looking statements include any statement that does not relate strictly to historical or current facts and include statements accompanied by or using words

such as “anticipate,” “believe,” “intend,” “plan,” “projection,” “forecast,” “strategy,” “outlook,” “continue,” “estimate,” “expect,” “may,” “will,” “shall,” and “long-term”. In particular, statements, express or implied,

concerning future actions, conditions or events, including our Policies and Procedures and their efficacy, long term demand for our assets and services, energy-transition related opportunities, including

opportunities related to alternative energy sources, future operating results or the ability to generate revenues, income or cash flow or to pay dividends are forward-looking statements. Forward-looking

statements are not guarantees of performance. They involve risks, uncertainties and assumptions. There is no assurance that any of the actions, events or results of the forward-looking statements will occur,

or if any of them do, what impact they will have on our results of operations or financial condition. Because of these uncertainties, you are cautioned not to put undue reliance on any forward-looking

statement. We disclaim any obligation, other than as required by applicable law, to publicly update or revise any of our forward-looking statements to reflect future events or developments.

Future actions, conditions or events and future results of operations may differ materially from those expressed in these forward-looking statements. Many of the factors that will determine these results are

beyond our ability to control or predict. These statements are necessarily based upon various assumptions involving judgments with respect to the future, including, among others; commodity prices, including

prices for Renewable Identification Numbers under the U.S. Environmental Protection Agency’s Renewable Fuel Standard Program; the timing and extent of changes in the supply of and demand for the

products we transport and handle; national, international, regional and local economic, competitive, political and regulatory conditions and developments; the timing and success of business development

efforts; the timing, cost, and success of expansion projects; technological developments; the condition of capital and credit markets; inflation rates; interest rates; the political and economic stability of oil-

producing nations; energy markets; federal, state or local income tax legislation; weather conditions; environmental conditions; business, regulatory and legal decisions; terrorism; cyber-attacks; and other

uncertainties. Important factors that could cause actual results to differ materially from those expressed in or implied by forward-looking statements include risks and uncertainties described in this presentation

and in our Annual Report on Form 10-K for the year ended December 31, 2021 and our subsequent reports filed with the SEC (under the headings “Risk Factors,” “Information Regarding Forward-Looking

Statements” and elsewhere). These reports are available through the SEC’s EDGAR system at www.sec.gov and on our website at www.kindermorgan.com.

GAAP – Unless otherwise stated, all historical and estimated future financial and other information included in this presentation have been prepared in accordance with generally accepted accounting

principles in the United States ("GAAP").

Non-GAAP – In addition to using financial measures prescribed by GAAP, we use non-generally accepted accounting principles (“non-GAAP”) financial measures in this presentation. Descriptions of our non-

GAAP financial measures, as well as reconciliations of historical non-GAAP financial measures to their most directly comparable GAAP measures, can be found in this presentation under “Non-GAAP

Financial Measures and Reconciliations”. These non-GAAP financial measures do not have any standardized meaning under GAAP and may not be comparable to similarly titled measures presented by other

issuers. As such, they should not be considered as alternatives to GAAP financial measures.

Industry and Market Data – Certain data included in this presentation has been derived from a variety of sources, including independent industry publications, government publications and other published

independent sources. Although we believe that such third-party sources are reliable, we have not independently verified, and take no responsibility for, the accuracy or completeness of such data.

Forward-looking statements / non-GAAP financial measures / industry & market data

BUSINESS UPDATE

Sital Mody

President – Gas Pipeline Group

Leader in North American Energy Infrastructure

4

Note: Volumes per 2023 budget. Business mix based on 2023 budgeted Adjusted Segment EBDA. See Non-GAAP Financial Measures & Reconciliations.

a) Annual capacity at KM share.

Energy infrastructure, especially natural gas pipelines & storage, has a decades-long time horizon moving and storing

the energy of today and tomorrow

Business Mix

62% 15% 12% 11%

Natural gas Products Terminals CO2

CO

2

source fields

Oil fields

RNG plants

RNG plants under development

Landfill gas-to-electricity facilities

CO

2

TERMINALS

Terminals

16 Jones Act tanker

Terminals

PRODUCTS

NATURAL GAS

Storage

Processing

LNG facilities

Operational medium BTU plants

LNG production & fueling facilities

Delivering energy to improve lives & create a better world

Largest natural gas transmission network

— ~70,000 miles of natural gas pipelines move ~40% of U.S. natural gas production

— Have interest in 700 bcf of working storage capacity, ~15% of U.S. natural gas

storage

Largest independent transporter of refined products

— Transport ~1.7 mmbbld

(a)

of refined products to West and East Coast demand

markets

— ~10,000 miles of refined products and crude pipelines

Largest independent terminal operator

— 140 terminals & 16 Jones Act vessels

— Significant provider of refined products storage along the Houston Ship Channel,

near the world’s most complex refining center

Largest CO

2

transport capacity of ~1.5 bcfd

— ~1,500 miles of CO

2

pipelines

— Produce CO

2

and transport to the Permian where it is used for enhanced oil

recovery

Growing Energy Transition Portfolio

— Up to 6.4 bcf

(a)

of RNG production capacity by mid-2024

FUNDAMENTALS UPDATE

Mark Wilson

Director – Marketing & Asset Optimization

LNG

Export

Canada

Southeast

Mexico

Eagle Ford

Shale

Haynesville

Shale

Utica Shale

Marcellus Shale

❑ Large pipeline system with access to

several supply basins and well

positioned to serve new demand

❑ Flexible - ~122 BCF of storage

❑ Direct connected power ~25,859 MW

❑ >500 firm transportation customers

❑ Supply Push – Permian and

Haynesville

❑ Market Pull - LNG export and Power

Generation

System Overview

Long-term Growth Drivers

New

England

Tennessee Gas Pipeline

Asset Optimization Coverage

Bidroom After Hours Hotline – 713-420-4135

❑ Northern Pipelines

❑ Kinder Morgan Louisiana Pipeline (KMLP)

❑ Stagecoach

❑ Tennessee Gas

❑ Southern Pipelines

❑ Elba Express

❑ Purchase/Sale

❑ Midcontinent Express

❑ Daily IT

❑ Park & Loan

❑ Short Term FT

❑ Southern Natural

❑ Park & Loan

❑ Short Term FT

Looking Back

❑ A year ago:

❑ Prompt NYMEX contract trading around ~$8/MMBtu

❑ Unsure if we could fill storage enough to meet demand for the winter

❑ This year:

❑ Prompt NYMEX contract trading around ~2.60/MMBtu

❑ Storage could be full before the end of September

❑ What happened?

What Changed?

$0.00

$1.00

$2.00

$3.00

$4.00

$5.00

$6.00

$7.00

$8.00

$9.00

$10.00

Prompt NYMEX Henry Hub

88

90

92

94

96

98

100

102

104

Jan 22 July 22 Jan 23 July 23

Bcf/day

L48 Production

Looking Forward – What Will Influence the S/D

Balance?

❑ Macro Constraints

❑ Into Northeast

❑ New England / LNG imports – what becomes of the Everett terminal?

❑ Out of Permian – Intrastate builds; low production cost

❑ Out of Appalachia

❑ MVP and intra-basin coal conversions

❑ Will there be additional expansions out of the basin?

❑ Worldwide LNG market / Crisis in Europe – will winter show up in Europe this

year?

❑ Power generation – Gas powered generation growth is tug-of-war

❑ Supply response – can producers ramp production to meet increased LNG and

Power demand?

LNG Capacity by Facility

Peak Nameplate

Capacity (Bcf/d)

Cove Point

0

5

10

15

20

25

30

Jan-16 Jan-17 Jan-18 Jan-19 Jan-20 Jan-21 Jan-22 Jan-23 Jan-24 Jan-25 Jan-26 Jan-27 Jan-28 Jan-29

Elba Island

Sabine Pass

Corpus Christi

Cameron

Freeport

Calcasieu Pass

Golden Pass

Plaquemines

Corpus Christi Stage III

Port Arthur

Rio Grande

ForecastActual

15.17

16.05

17.05

18.13

19.24

20.29

21.27

13.10

14.73

16.37

17.78

19.07

20.34

21.41

5.06

5.49

5.80

5.95

6.20

6.53

6.82

22.21

23.74

21.75

21.20

21.43

22.37

23.11

33.61

34.46

35.24

35.95

37.43

38.92

39.69

94.7

100.1

102.2

105.2

109.8

115.2

119.2

0

20

40

60

80

100

120

140

2022 2023 2024 2025 2026 2027 2028

L48 Production (Bcf/d)

APP NE

Bakken

Other

DJ/Powder

Eagle Ford

Haynesville

Permian

Powder

DJ

Total Production

Production Forecast by Basin

System Flows

❑ Remains the same

❑ High utilization moving gas from

Marcellus/Utica, both South and East

❑ Traditional bottleneck into New

England remains

❑ Steady exports to Canada

❑ Recent Trends

❑ Power growth - PJM in particular

❑ Growing LNG exports

❑ Texas becomes a swing market

common constraint

Looking Forward – What Will Influence the S/D

Balance?

3.9 Bcf/d

4.2 Bcf/d

3.3 Bcf/d

New Cross-TX PL

+4.5 Bcf/d

Haynesville PL

+5.2 Bcf/d

Supply Demand Balance (2023 to 2028)

❑ Supply to E-TX/W-LA (+9.8 Bcf/d)

❑ New Permian to Gulf Pipes will

add 4.5 Bcf/d

❑ Haynesville adds 5.3 Bcf/d

❑ LNG Demand (+11 Bcf/d)

❑ 4.8/d in TX

❑ 2.4/d in W LA

❑ 3.9/d in E LA

❑ New pipe projects will move 5.36

Bcf/d from N LA to W LA

❑ Significant deficit of Gas in Gillis to

Plaquemines coastal corridor

❑ Over 3 Bcf/d more capacity needed

to S LA – especially SE LA

Southeast (‘23-27)

Power: 7.58 Bcf/d (+1.40 Bcf/d)

Res/Comm: 2.22 Bcf/d (+0.2 Bcf/d)

Industrial: 2.78 Bcf/d (+.206 Bcf/d)

Winter Weather Prediction

BUSINESS DEVELOPMENT UPDATE

Preston Troutman

Director – Business Development

Market Opportunities

LNG Export

Power

Northeast

Haynesville

Power

Permian

▪ Continued interest in expansion opportunities

▪ LNG Export

▪ Power Generation

▪ Support for renewables

▪ Coal retirement

▪ Increased utilization of existing assets

▪ Supply push projects

Announced Capital Projects

Successfully Executing on Projects in Key Areas

$1 Billion Backlog – primarily market pull

Northeast

Volume

(MDth/d)

In-

Service

East 300 115 2023

LNG Export

Volume

(MDth/d)

In

-Service

Evangeline Pass 2,000 24/25

Power Generation

Volume

(MDth/d)

In-

Service

Cumberland 245 2025

Sunnyside Supply

30 2024

Mexico

Volume

(MDth/d)

In-

Service

South Texas *345 2023

• Energy Transition

• Supply/Demand dislocation

• Optimization of existing assets

Demand on the Horizon

More Gas-fired generation

0

5

10

15

20

25

30

35

Bcfd

LNG Exports

North America is a net exporter

U.S. +13.9 Bcfd

Can. & Mex. +4.9 Bcfd

0

10

20

30

40

Bcfd

U.S. Power Gen Demand

+4.4 Bcfd

0

10

20

30

40

50

Bcfd

U.S. Res/Ind Demand

Residential & Industrial growth

Res +0.8 Bcfd

Ind +1.3 Bcfd

0

2

4

6

8

10

12

Bcfd

Exports to Mexico

More U.S. Exports to Mexico

Net Demand +2.1 Bcfd

LNG +2.7 Bcfd

Thank You

OPERATIONS UPDATE

Rob Perkins

Vice President – Gas Control

TGP System Update

▪ System wide flows and throughput

▪ Winter Review

▪ Summer Review

▪ Operations expectations

TGP System Overview

100 Line

800 Line

500 Line

200 Line

300 Line

200 Line

87

1

315

245

261

823

527

860

40

204

219

Bear Creek

Colden

Hebron-Ellisburg-Harrison

267

9

110

321

Rivervale

Mahwah

➢ ~11,750 miles of pipe

➢ Active supply/delivery meters ~700

➢ Storage capacity ~117 bcf

➢ Direct connected power ~26,000 MW

➢ LNG deliveries to Cameron, Corpus Christi & Freeport

➢ Mexico exports currently averaging ~0.4 bcf/d

TGP System Overview

Deliveries by Type

Total = 10.71 MMDth/d

Total = 10.44 MMDth/d

TGP System Overview

Deliveries by Zone

TGP System Overview

Receipts by Zone

Winter Review

▪ Overview

▪ Overall mild winter weather with a few periods of extreme weather

▪ System-wide throughput dipped 4% compared to previous winter

▪ Winter Peak was ~12.98 MMDth on February 3, 2023

▪ Power Demand Peak was ~2.77 MMDth/d on December 23, 2022

▪ Supply

▪ Supply in Zone 4 continued to provide 50+% of total system supply this past winter (~5.6

MMDth/d)

▪ Storage withdrawals averaged 0.28 MMDth/d with a peak of 1.56 MMDth

▪ Operational Challenges

▪ h

Winter Review –Weather

*Normal is a 30-year average

Winter Review – Deliveries by Type

2020-2021 2021-2022 2022-2023

YoY Change

LDC

2,079 2,089 1,936 -7%

Power

1,381 1,558 1,626 +4%

Interconnects

5,312 5,593 5,837 +4%

Mexico

802 565 382 -32%

LNG

1,480 1,705 1,218 -29%

Industrial

49 50 63 +25%

TOTAL

11,103 11,559 11,061 -4%

Winter Review – East of Station 261

Winter Review – Storage Withdrawals

~20 Bcf more

storage inventory

withdrawn in

2021/2022 winter

than in 2022/2023

Winter Storm Elliott Summary

▪ Overview

▪ Tennessee system was in good shape heading into the weather event beginning on 12/23/22

▪ Experienced significant supply shortage overnight on 12/23/22 and into 12/24/2022

▪ Scheduling restrictions were responsive and implemented Location Off Rate cuts intraday on

12/24/2023

▪ Linepack dropped close to 2 bcf (~15%) in 12 hours due to supply shortages and peaking

demand related to the extreme weather

▪ Resulted in lower than normal operating pressures across much of the pipeline until recovery

began on 12/26/2022 when demand began to wane

▪ Pipeline and storage facilities performed well throughout the event with no significant

weather related outages

Summer Review

▪ Overview

▪ System-wide throughput through July down 2% to previous summer

▪ Maintenance planning and execution continues to be challenging

▪ Demand

▪ Strong demand across the pipeline once again

▪ Similar demand to 2022 in all delivery sectors

Summer Review – April through July

2021 2022 2023 Change

LDC

1,060 1,079 1,059 -2%

Power

1,489 1,820 1,780 -2%

Interconnects

5,141 5,374 5,293 -1%

Mexico

846 550 572 +4%

LNG

1,407 1,422 1,332 -6%

Industrial

47 44 65 +46%

TOTAL

9,990 10,289 10,101 -2%

Summer Review - Weather

▪ Strong 2023 power gen despite normal to

mild summer across much of the system

▪ 2023 average daily summer power generation

deliveries are 2

nd

highest behind only 2022

*Normal is a 10-year average

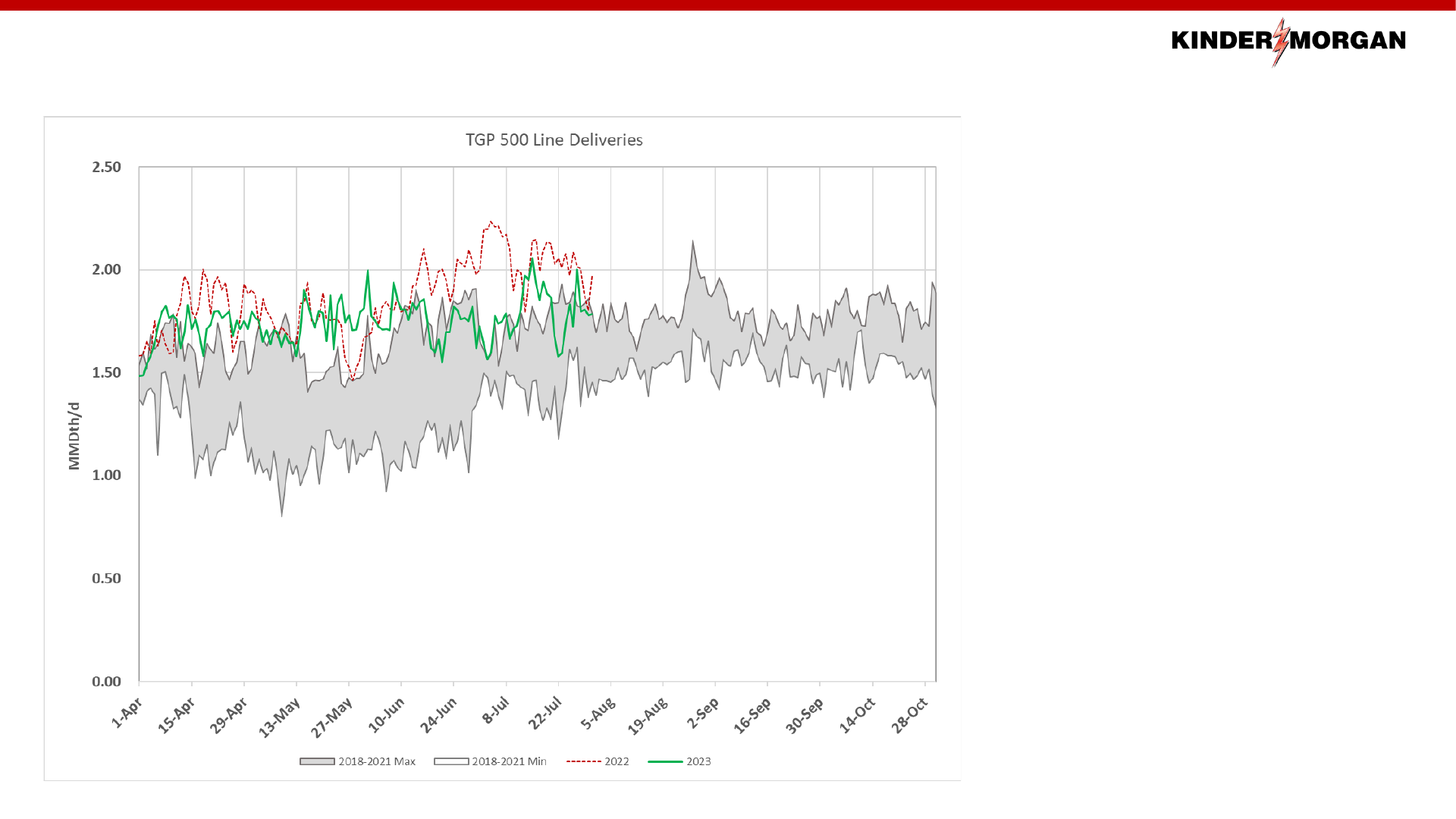

Summer Review

▪ 500 Line summer

deliveries lower than 2022,

however still on the higher

end of historic demand

2023 TGP Maintenance Summary

Zone

L

Zone

0

Zone 2

Zone 3

Zone 4

Zone 5

Zone 6

x

x

x

x

x

x

x

x

▪ High load factor and magnitude of

required maintenance continues to be

challenging

▪ Significant year round effort in

planning and coordinating projects to

minimize impacts as much as possible

Red “X” indicates segment maintenance with a duration

longer than 1 day with a capacity impact greater than 100

mmcf/d

Summer Review – Storage Activity

~7 bcf more storage

inventory injected

through July in 2023

than 2022

Operational Expectations

▪ Continued high utilization system wide

▪ LNG demand is high utilization with no seasonality – increasing load factor in

southern segments

▪ Zone 6 East of Station 261 will continue at capacity during typical winters

▪ Storage injections will be challenging to manage as summer demand wanes

▪ Scheduling maintenance and outages continues to be challenging

▪ Significant coordination effort to minimize customer impact

▪ Multi-year analysis when scheduling known major outages

▪ Continued maintenance and integrity efforts ensure reliability

▪ Routine PHMSA required inspections and maintenance

Kinder Morgan provides energy transportation and storage services

in a safe, efficient and environmentally responsible manner for the

benefit of people, communities and businesses.

TGP Operations Contact List

Gas Control

24 hour and emergency

800-231-2800

Gas Control Manager - Open

Layne Sanders – Director

713-420-5024

Cell – 832-563-5024

Brian Merchant – VP, Gas Control

713-420-5867

Cell – 713-206-0590

Rob Perkins – VP, Pipeline

Management

713-420-5229

Cell – 205-527-0650

Transportation and Storage

24 hour Scheduling Hotline

713-420-4999

Cathy Soape – Manager

713-420-3814

Cell – 713-922-5083

Adam Harris – Manager

713-420-2672

Cell – 281-389-0024

Jennifer Spiller – Manager

713-420-5207

Cell - 832-731-1207

Katie Cornutt – Director

713-420-5648

Cell - 407-902-8027

Gina Mabry – VP

713-420-3685

Cell – 281-744-8666

Commercial/Marketing

Mark Wilson - Director

713-420-7205

Cell – 205-447-2589

Ernesto Ochoa – VP

713-420-1734

Cell – 281-414-3823

Kimberly Watson –

President

713-369-9233

Cell – 713-204-5423

Field Operations

Ron Miller – Director (Northeast)

724-662-6422

Cell – 713-829-2919

Joseph Simonsen – Director (Central)

615-221-1513

Cell – 928-699-0753

Chris Bradberry – Director (Southeast)

205-325-7277

Cell – 205-567-0777

Jess Coleman – Director (South)

701-648-9361

Cell – 701-648-9361

Ron Bessette– VP

713-420-6012

Cell – 413-313-4380

Ken Grubb –COO Gas Pipelines

713-369-8763

Cell – 713-702-1210

REGULATORY UPDATE

Dave Dewey

Vice President – Regulatory Affairs

August 24, 2023

The Federal Energy Regulatory Commission

41

The Commissioners

FERC Developments

◼ Chairman Glick’s term expired in 2022 and he left the Commission

◼ No further developments on nominees for a fifth FERC Commissioner

◼ Commissioner Danly’s term expired June 30, 2023 – Potential for a “package deal”

◼ Danly may serve until Congress adjourns at the end of 2023

◼ There are whispers that Commissioner Danly may not be seeking an additional term

◼ One of the best four-member Commissions in the agency’s history (so far)

FERC Outreach

◼ We invest significant time and effort with our regulators

◼ We focus on being solutions oriented

◼ Good regulatory relationships enable us to provide increased value to our customers

Commissioner

Christie

Commissioner

Danly

Chairman

Phillips

Commissioner

Clements

Possible nominees for fifth

FERC Commissioner

◼ Judy Chang – Former Undersecretary

of Energy & Climate Solutions /

Massachusetts Executive Office of

Energy & Environmental Affairs

◼ Matthew Christiansen – Current FERC

General Counsel

◼ Rick Kessler – Senior Democratic

adviser for the House Energy and

Commerce Committee

Rebalancing the Value Proposition

42

Certificating Transportation Infrastructure

◼ September 1999 – FERC issues certificate policy statement to provide industry certainty

◼ Works flawlessly for almost two decades

◼ February 2018 – FERC decides it wants to revisit its certificate policy statement

◼ February 2022 - Updated Certificate Policy Statement and Interim GHG Policy Statement

◼ New policy statement is essentially a balancing test with a heightened emphasis on (1)

need, (2) analyzing adverse effects, and (3) environmental justice

◼ Project sponsors are responsible for avoiding direct and indirect impacts to the greatest

extent possible

◼ March 2022 – Converted the new policy statements to drafts

Creating Services Customers Need

◼ Renewable Energy = Intermittency

◼ Solutions to Intermittency → Storage, Hourly Services

◼ FERC’s 2nd New England Winter Gas-Electric Forum (June 20, 2023)

◼ Highlighted deep divisions in policymakers’ and stakeholders’ views on energy

Envisioning Services Customers Want

◼ How can we help you to meet your reduced carbon intensity goals & mandates?

◼ Certifying the pipeline

◼ Reducing the carbon intensity of the transportation path

◼ How do we unlock the value proposition?

What problem are we trying to solve?

Canadian

Wildfires

CO

2

Emissions Map

Environmental Justice

43

Roundtable on Environmental Justice and Equity in

Infrastructure Permitting

◼ On March 29, 2023, the FERC held a Commissioner-led roundtable to discuss

environmental justice and equity in its jurisdictional infrastructure permitting

processes

◼ Panel 1: Priorities for Advancing Environmental Justice and Equity in Infrastructure

Permitting

◼ Panel 2: From the Front-Line: Impacted Communities and their Everyday Challenges

◼ Panel 3: Identifying, Avoiding, and Addressing Environmental Justice Impacts

◼ Kinder Morgan participated on Panel 3

◼ Some calls to block pipeline infrastructure solely on the basis of environmental justice

◼ Chairman Phillips encouraged all the feedback but cautioned that FERC has to act

within the law and said a lot what was raised is “nonjurisdictional.”

◼ “We have to approve things that are brought to us and fit within that law” and FERC’s

precedents, he said. “That is a part of the job of FERC whether you like it or not.”

Responsible Infrastructure Development Is Imperative

◼ The industry has always been a good neighbor

◼ There are opportunities for us to be even better

Mountain Valley Pipeline

◼ October 2015 – Certificate application filed

◼ October 2017 – FERC certificate issued

◼ Early-2018 – Construction began (projected

in-service late-2019)

◼ 2018-2023 – Multiple judicial appeals &

stays (primarily 4

th

Circuit Court of Appeals)

◼ July 27, 2023 – U.S. Supreme Court paves

the way for completion of the project

◼ Did the Mountain Valley Pipeline Project

truly affront environmental justice in the

region?

General Legislative/Regulatory Developments

44

Lower Energy Costs Act

◼ On March 30, 2023, the House of Representatives approved by a bipartisan vote H.R. 1,

the Lower Energy Costs Act → First major legislative initiative in the 118

th

Congress

◼ Possesses the ability to improve federal permitting processes for interstate natural gas

pipelines, as well as other energy infrastructure projects.

◼ Clarifies the scope of an agency’s National Environmental Policy Act (NEPA) analyses on

proposed projects and its focus on feasible alternatives

◼ Strengthens the FERC’s primary permitting role on natural gas infrastructure

◼ Recognizes the export of natural gas as being in the public interest

◼ Unlikely to pass in the Senate

Good Neighbor Rule

◼ Environmental Protection Agency (EPA) rule promulgated on March 15, 2023

▪ Aimed at significantly reducing smog-forming nitrogen oxide pollution from power plants

and other industrial facilities in 23 states

▪ Also includes natural gas pipeline compressor stations

▪ The rule as currently written requires compliance by May 1, 2026

◼ Cost of compliance for Kinder Morgan and Tennessee is material

◼ Tennessee has ~200 units impacted by the Rule

◼ Actual compliance timeline projected to extend to more than 6 years

◼ Litigation has been commenced by Kinder Morgan, INGAA, and numerous other parties

What’s on the Horizon?

45

Certainty & Stability

◼ Aiming for a new settlement and moratorium to afford customers, shippers,

and Tennessee a renewed period of regulatory certainty and stability

◼ Certainty and stability provides stakeholders an opportune window of time

to collaborate on future needs

Political Challenges

◼ The climate in Washington, DC is presenting headwinds for the natural gas

and fossil fuels industries

Opportunities

◼ The challenges presented by the winter of 2013-2014 (one of the coldest on record), the Polar Vortex (2019), Winter Storm Uri

(2021), and Winter Storm Elliott (2022) demonstrate the need for natural gas and reliable transportation/storage infrastructure

◼ Americans are embracing renewable energy

◼ 67% of U.S. adults prioritize…

◼ developing alternative energy sources, such as wind and solar, over expanding the production of oil, coal and natural gas

◼ taking steps to become carbon neutral by 2050

◼ At the expense of affordability? Reliability?

◼ The Institute for Energy Research estimates that wind power is about twice as expensive as conventional gas-fired power, and

that solar power is almost three times as expensive

Path toward Solutions

◼ How can we collaborate to shape the views of policymakers (particularly at the state level)?

◼ How can we tailor services to better meet your needs?