Global Offering

Stock Code:00816

IMPORTANT: If you are in any doubt about any of the contents of this prospectus, you should obtain independent professional advice.

JINMAO PROPERTY SERVICES CO., LIMITED

(Incorporated in Hong Kong with limited liability)

GLOBAL OFFERING

Number of Offer Shares under the

Global Offering

: 101,411,500 Shares (subject to the Offer Size

Adjustment Option and the Over-allotment

Option)

Number of Hong Kong Offer Shares : 10,142,000 Shares (subject to reallocation

and the Offer Size Adjustment Option)

Number of International Offer Shares : 91,269,500 Shares (subject to reallocation,

the Offer Size Adjustment Option and the

Over-allotment Option)

Maximum Offer Price : HK$8.14 per Offer Share, plus brokerage of

1.0%, SFC transaction levy of 0.0027%,

Stock Exchange trading fee of 0.005% and

FRC transaction levy of 0.00015%

(payable in full on application in Hong

Kong dollars and subject to refund)

Stock code : 00816

Joint Sponsors, Joint Global Coordinators,

Joint Bookrunners and Joint Lead Managers:

(In alphabetical order)

Joint Global Coordinators, Joint Bookrunners and Joint Lead Managers:

(In alphabetical order)

Joint Bookrunners and Joint Lead Managers:

(In alphabetical order)

Joint Lead Manager:

Hong Kong Exchanges and Clearing Limited, The Stock Exchange of Hong Kong Limited and Hong Kong Securities Clearing Company Limited take no responsibility for the

contents of this prospectus, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in

reliance upon the whole or any part of the contents of this prospectus.

A copy of this prospectus, having attached thereto the documents specified in the section headed “Documents Delivered to the Registrar of Companies and Available for Inspection”

in Appendix VI, has been registered by the Registrar of Companies in Hong Kong as required by Section 38D of the Companies (Winding Up and Miscellaneous Provisions)

Ordinance. The Securities and Futures Commission and the Registrar of Companies in Hong Kong take no responsibility for the contents of this prospectus or any other document

referred to above.

The Offer Price is expected to be determined by agreement between the Joint Representatives (for themselves and on behalf of the Underwriters) and our Company on or around

Thursday, March 3, 2022 and, in any event, not later than Wednesday, March 9, 2022. The Offer Price will not be more than HK$8.14 per Offer Share and is expected to be not

less than HK$7.52 per Offer Share, unless otherwise announced. Applicants under the Hong Kong Public Offering are required to pay, on application, the maximum Offer Price

of HK$8.14 per Hong Kong Offer Share, plus brokerage of 1%, SFC transaction levy of 0.0027%, Stock Exchange trading fee of 0.005% and FRC transaction levy of 0.00015%,

subject to refund if the Offer Price as finally determined is less than HK$8.14 per Offer Share.

If, for any reason, our Company and the Joint Representatives (for themselves and on behalf of the Underwriters) are unable to reach an agreement on the Offer Price on or before

Wednesday, March 9, 2022, the Global Offering will not proceed and will lapse.

The Joint Representatives (for themselves and on behalf of the Underwriters) may, where considered appropriate, based on the level of interest expressed by prospective professional

and institutional investors during the book-building process, and with the consent of our Company, reduce the number of Offer Shares and/or the indicative Offer Price range below

that stated in this prospectus (which is HK$7.52 to HK$8.14 per Offer Share) at any time on or prior to the morning of the last day for lodging applications under the Hong Kong

Public Offering. In such case, notices of the reduction in the number of Offer Shares and/or the indicative Offer Price range will be published on the website of the Stock Exchange

at www.hkexnews.hk and our Company’s website at www.jinmaowy.com as soon as practicable following the decision to make such reduction, and in any event not later than the

morning of the day which is the last day for lodging applications under the Hong Kong Public Offering. Further details are set forth in the sections headed “Structure of the Global

Offering” and “How to Apply for Hong Kong Offer Shares” in this prospectus.

Prior to making an investment decision, prospective investors should consider carefully all of the information set out in this prospectus, including the risk factors set out in the section

headed “Risk Factors” in this prospectus.

The obligations of the Hong Kong Underwriters under the Hong Kong Underwriting Agreement are subject to termination by the Joint Representatives (for themselves and on behalf

of the Hong Kong Underwriters) if certain grounds arise prior to 8:00 a.m. on the Listing Date. Such grounds are set out in the section headed “Underwriting — Underwriting

Arrangements and Expenses — Hong Kong Public Offering — Grounds for Termination” in this prospectus. It is important that you refer to that section for further details.

The Offer Shares have not been and will not be registered under the U.S. Securities Act or any state securities laws in the United States and may not be offered, sold, pledged or

transferred within the United States. The Offer Shares are being offered, sold or delivered outside the United States in offshore transactions in reliance on Regulation S or other

exemption from the registration requirements under the U.S. Securities Act.

ATTENTION

We have adopted a fully electronic application process for the Hong Kong Public Offering. We will not provide printed copies of this document or printed copies of any application

forms to the public in relation to the Hong Kong Public Offering.

This prospectus is available at the websites of the Stock Exchange at www.hkexnews.hk and our website at www.jinmaowy.com. If you require a printed copy of this prospectus,

you may download and print from the website addresses above.

IMPORTANT

February 25, 2022

IMPORTANT NOTICE TO INVESTORS:

FULLY ELECTRONIC APPLICATION PROCESS

We have adopted a fully electronic application process for the Hong Kong

Public Offering. We will not provide printed copies of this prospectus or printed

copies of any application forms to the public.

This prospectus is available at the website of the Stock Exchange at

www.hkexnews.hk under the “HKEXnews > New Listings > New Listing

Information” section, and our website at www.jinmaowy.com. If you require a

printed copy of this prospectus, you may download and print from the website

addresses above.

To apply for the Hong Kong Offer Shares, you may:

(1) apply online through the White Form eIPO service at www.eipo.com.hk;or

(2) apply through CCASS EIPO service to electronically cause HKSCC

Nominees to apply on your behalf, including by:

(i) instructing your broker or custodian who is a CCASS Clearing

Participant or a CCASS Custodian Participant to give electronic

application instructions via CCASS terminals to apply for the Hong

Kong Offer Shares on your behalf; or

(ii) (if you are an existing CCASS Investor Participant) giving electronic

application instructions through the CCASS Internet System

(https://ip.ccass.com) or through the CCASS Phone System by calling

+852 2979 7888 (using the procedures in HKSCC’s “An Operating

Guide for Investor Participants” in effect from time to time). HKSCC

can also input electronic application instructions for CCASS Investor

Participants through HKSCC’s Customer Service Centre at 1/F, One &

Two Exchange Square, 8 Connaught Place, Central, Hong Kong by

completing an input request.

We will not provide any physical channels to accept any application for the Hong

Kong Offer Shares by the public. The contents of the electronic version of this

prospectus are identical to the printed prospectus as registered with the Registrar of

Companies in Hong Kong pursuant to Section 38D of the Companies (Winding Up and

Miscellaneous Provisions) Ordinance.

If you are an intermediary, broker or agent, please remind your customers, clients

or principals, as applicable, that this prospectus is available online at the website

addresses above.

Please refer to “How to Apply for Hong Kong Offer Shares” for further details on

the procedures through which you can apply for the Hong Kong Offer Shares

electronically.

IMPORTANT

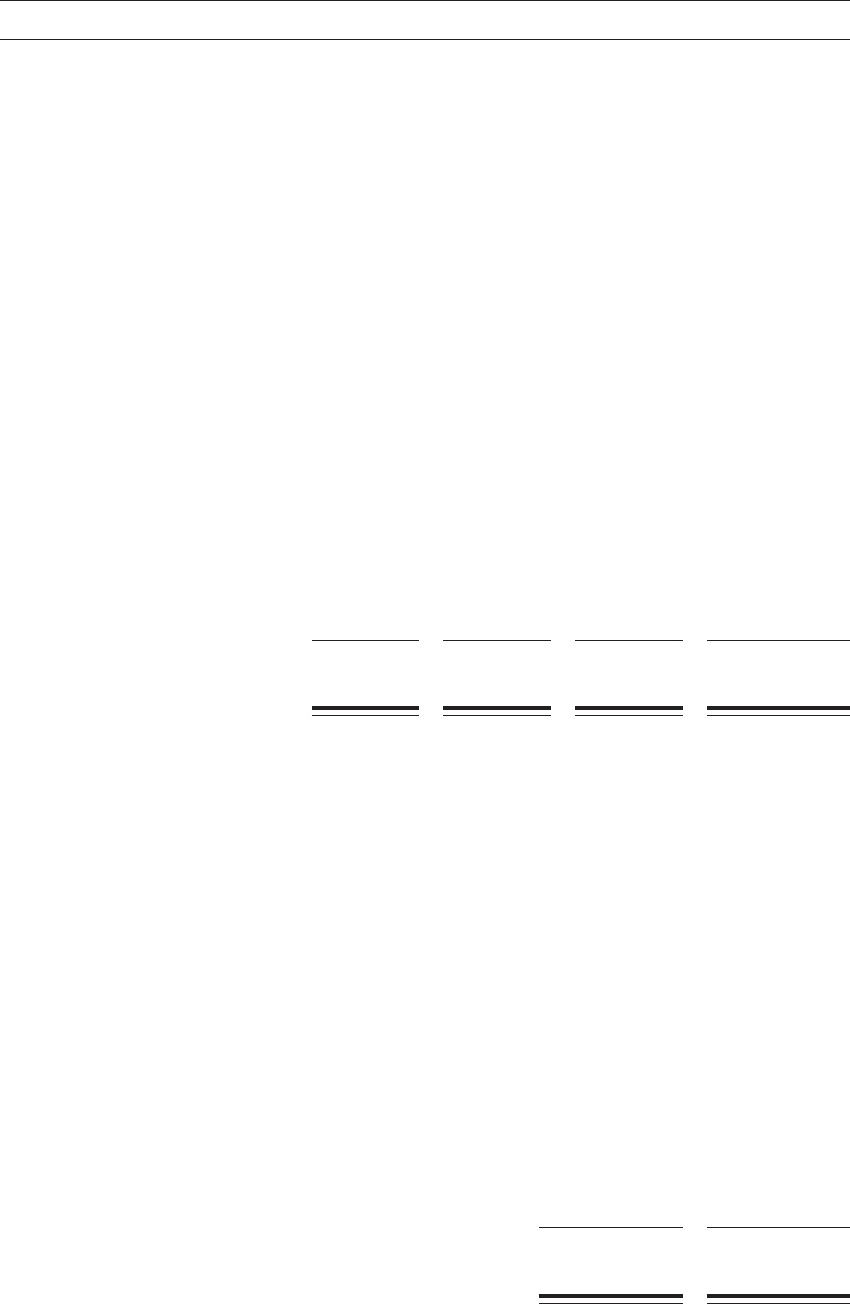

Minimum Application Amount and Permitted Numbers

Your application through the White Form eIPO service or the CCASS EIPO

service must be for a minimum of 500 Hong Kong Offer Shares and in one of the

numbers set out in the table. You are required to pay the amount next to the number you

select.

JINMAO PROPERTY SERVICES CO., LIMITED (Stock Code: 00816)

(HK$8.14 per Hong Kong Offer Share)

NUMBER OF HONG KONG OFFER SHARES THAT MAY BE APPLIED FOR AND PAYMENTS

No. of

Hong Kong

Offer

Shares

applied for

Amount

payable on

application

No. of

Hong Kong

Offer

Shares

applied for

Amount

payable on

application

No. of

Hong Kong

Offer

Shares

applied for

Amount

payable on

application

No. of

Hong Kong

Offer

Shares

applied for

Amount

payable on

application

HK$ HK$ HK$ HK$

500 4,111.02 8,000 65,776.32 150,000 1,233,305.85 1,000,000 8,222,038.99

1,000 8,222.04 9,000 73,998.35 200,000 1,644,407.80 1,500,000 12,333,058.49

1,500 12,333.06 10,000 82,220.39 250,000 2,055,509.75 2,000,000 16,444,077.98

2,000 16,444.07 15,000 123,330.59 300,000 2,466,611.69 2,500,000 20,555,097.48

2,500 20,555.10 20,000 164,440.78 350,000 2,877,713.64 3,000,000 24,666,116.97

3,000 24,666.12 25,000 205,550.98 400,000 3,288,815.59 3,500,000 28,777,136.47

3,500 28,777.13 30,000 246,661.17 450,000 3,699,917.54 4,000,000 32,888,155.96

4,000 32,888.16 35,000 287,771.37 500,000 4,111,019.50 4,500,000 36,999,175.46

4,500 36,999.17 40,000 328,881.56 600,000 4,933,223.40 5,071,000

(1)

41,693,959.72

5,000 41,110.20 45,000 369,991.76 700,000 5,755,427.30

6,000 49,332.23 50,000 411,101.95 800,000 6,577,631.19

7,000 57,554.28 100,000 822,203.90 900,000 7,399,835.09

(1) Maximum number of Hong Kong Offer Shares you may apply for.

IMPORTANT

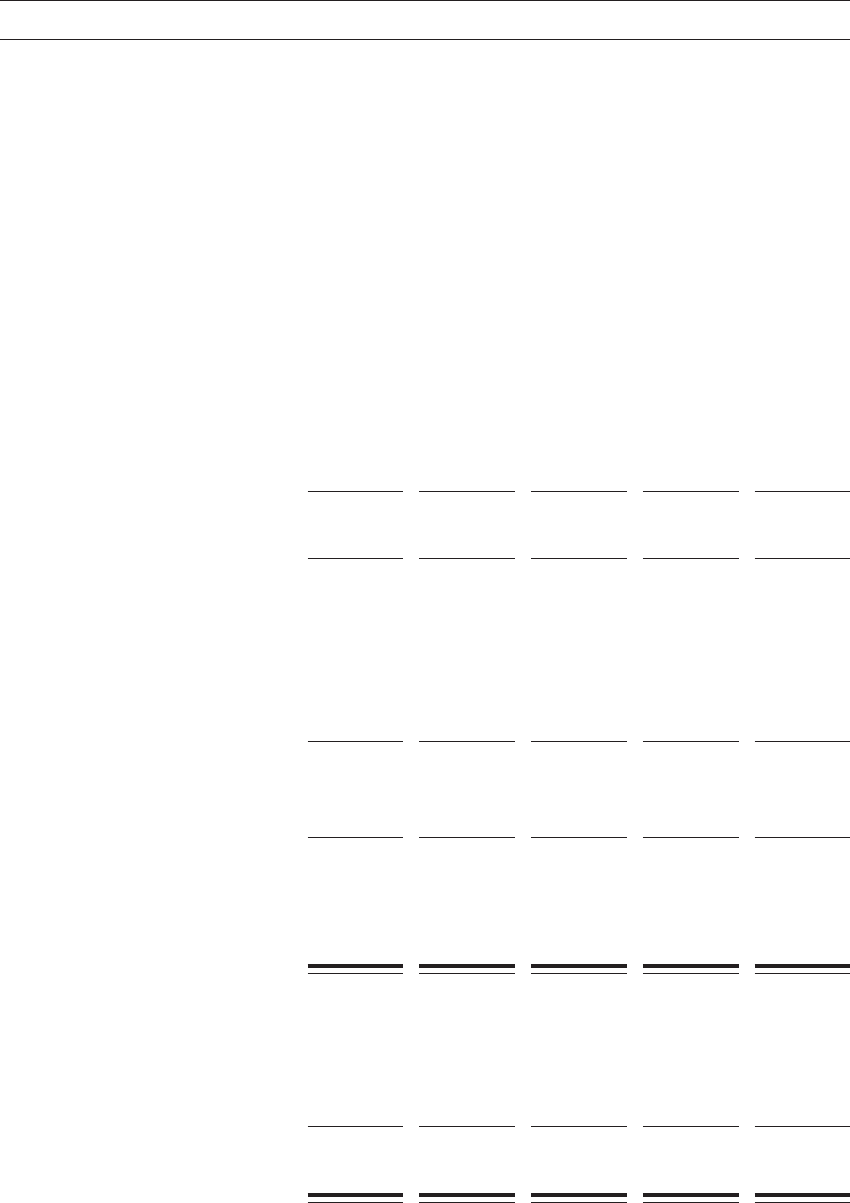

If there is any change in the following expected timetable of the Hong Kong Public

Offering, we will issue an announcement in Hong Kong to be published on the websites

of the Stock Exchange at www.hkexnews.hk and our Company at www.jinmaowy.com.

Hong Kong Public Offering commences .........................9:00 a.m. on Friday,

February 25, 2022

Latest time to complete electronic applications under the

WHITE Form eIPO service through

the designated website www.eipo.com.hk

(2)

...............11:30 a.m. on Wednesday,

March 2, 2022

Application lists open

(3)

................................11:45 a.m. on Wednesday,

March 2, 2022

Latest time for completing payment for White Form eIPO applications

by effecting internet banking transfer(s) or PPS payment transfer(s)

and giving electronic application instructions to HKSCC . . .12:00 noon on Wednesday,

March 2, 2022

Application lists close

(3)

...............................12:00 noon on Wednesday,

March 2, 2022

Expected Price Determination Date

(4)

..................................Thursday,

March 3, 2022

(1) Announcement of the final Offer Price, the level of

indications of interest in the International Offering,

the level of applications in the Hong Kong Public Offering

and basis of allocation of the Hong Kong Offer Shares

under the Hong Kong Public Offering to be published on or before ......Wednesday,

March 9, 2022

(2) Results of allocations in the Hong Kong Public Offering

to be available through a variety of channels as described

in the section headed “How to Apply for Hong Kong

Offer Shares – D. Publication of Results”

in this prospectus from ........................................Wednesday,

March 9, 2022

EXPECTED TIMETABLE

(1)

–i–

(3) Announcement containing (1) and (2) above will be

published on the website of the Company and the

Hong Kong Stock Exchange at our website at

www.jinmaowy.com and www.hkexnews.hk from ...................Wednesday,

March 9, 2022

Results of allocations in the Hong Kong Public Offering

will be available at

www.iporesults.com.hk (alternatively: English

https://www.eipo.com.hk/en/Allotment; Chinese

https://www.eipo.com.hk/zh-hk/Allotment)

with a ‘‘search by ID’’ function from ....................8:00 a.m. on Wednesday,

March 9, 2022

to 12:00 midnight on Tuesday,

March 15, 2022

Despatch/Collection of share certificates or deposit of the share

certificates into CCASS in respect of wholly or partially successful

applications pursuant to the Hong Kong Public Offering

on or before

(5)(6)(7)

.............................................Wednesday,

March 9, 2022

Despatch/Collection of White Form e-Refund payment

instructions/refund cheques in respect of wholly or partially

successful applications if the final Offer Price is less than the maximum

Offer Price per Hong Kong Public Offer Share initially paid on

application (if applicable) or wholly or partially unsuccessful applications

pursuant to the Hong Kong Public Offering on or before .................Wednesday,

March 9, 2022

Despatch of share certificates to Qualifying Jinmao

Shareholders who are entitled to receive Shares

under the Distribution on or before

(8)

...............................Wednesday,

March 9, 2022

Dealings in the Shares on the Hong Kong Stock Exchange

expected to commence at 9:00 a.m. on ...............................Thursday,

March 10, 2022

Despatch of cheques to Non-Qualifying Jinmao Shareholders

(if any) of the net proceeds of the sale of Shares

which they would otherwise receive pursuant to

the Distribution on or before

(9)

......................................Tuesday,

April 12, 2022

EXPECTED TIMETABLE

(1)

–ii–

Notes:

(1) All dates and times refer to Hong Kong local time, except as otherwise stated.

(2) You will not be permitted to submit your application under the WHITE Form eIPO service through the

designated website at www.eipo.com.hk after 11:30 a.m. on the last day for submitting applications. If you

have already submitted your application and obtained a payment reference number from the designated website

prior to 11:30 a.m., you will be permitted to continue the application process (by completing payment of the

application monies) until 12:00 noon on the last day for submitting applications, when the application lists

close.

(3) If there is a “black” rainstorm warning signal or a tropical cyclone warning signal number 8 or above and/or

Extreme Conditions in force in Hong Kong at any time between 9:00 a.m. and 12:00 noon on Wednesday,

March 2, 2022, the application lists will not open and close on that day. See section headed “How to Apply

for Hong Kong Offer Shares” in this prospectus.

(4) The Price Determination Date is expected to be on or around Thursday, March 3, 2022 and in any event, not

later than Wednesday, March 9, 2022. If for any reason, the Offer Price is not agreed between the Joint

Representatives (for themselves and on behalf of the Underwriters) and us by Wednesday, March 9, 2022, the

Global Offering will not proceed and will lapse.

(5) The Share certificates will only become valid at 8:00 a.m. on the Listing Date, which is expected to be

Thursday, March 10, 2022, provided that the Global Offering has become unconditional in all respects at or

before that time. Investors who trade Shares on the basis of publicly available allocation details or prior to the

receipt of the Share certificates or prior to the Share certificates becoming valid do so entirely at their own

risk.

(6) e-Refund payment instructions/refund cheques will be issued in respect of wholly or partially unsuccessful

applications pursuant to the Hong Kong Public Offering and also in respect of wholly or partially successful

applications in the event that the final Offer Price is less than the price payable per Offer Share on application.

Part of the applicant’s Hong Kong identity card number or passport number, or, if the application is made by

joint applicants, part of the Hong Kong identity card number or passport number of the first-named applicant,

provided by the applicant(s) may be printed on the refund cheque, if any. Such data would also be transferred

to a third party for refund purposes. Banks may require verification of an applicant’s Hong Kong identity card

number or passport number before encashment of the refund cheque. Inaccurate completion of an applicant’s

Hong Kong identity card number or passport number may invalidate or delay encashment of the refund cheque.

(7) Applicants who have applied on White Form eIPO for 1,000,000 or more Hong Kong Offer Shares under the

Hong Kong Public Offering and have provided all information required by the Application Form may collect

any refund cheques and/or Share certificates in person from our Company’s Hong Kong Share Registrar,

Computershare Hong Kong Investor Services Limited at Shops 1712-1716, 17th Floor, Hopewell Centre, 183

Queen’s Road East, Wanchai, Hong Kong from 9: 00 a.m. to 1: 00 p.m.. Applicants being individuals who are

eligible for personal collection may not authorize any other person to collect on their behalf. Applicants being

corporations which are eligible for personal collection must attend by their authorized representatives bearing

letters of authorization from their corporations stamped with the corporation’s chop. Both individuals and

authorized representatives of corporations must produce identification and (where applicable) authorization

documents acceptable to our Hong Kong Share Registrar at the time of collection.

EXPECTED TIMETABLE

(1)

– iii –

Applicants who have applied for Hong Kong Offer Shares by giving electronic application instructions to

HKSCC should see “How to Apply for Hong Kong Offer Shares” in this prospectus for details. Uncollected

Share certificates and/or refund cheques will be despatched by ordinary post, at the applicants’ own risk to the

addresses specified in the relevant applications. See “How to Apply for the Hong Kong Offer Shares — A.

Applications for the Hong Kong Offer Shares — 6. Applying through CCASS EIPO Service” in this prospectus

for details.

Applicants who have applied for less than 1,000,000 Hong Kong Offer Shares and any uncollected Share

certificates and/or refund cheques will be despatched by ordinary post at the applicant’s risk, to the address

specified in the relevant applications.

See ‘‘How to Apply for Hong Kong Offer Shares — F. Refund of Application Monies’’ and ‘‘How to Apply

for Hong Kong Offer Shares — G. Despatch/Collection of Share Certificates/E-Refund Payment

Instructions/Refund Cheques’’ in this prospectus.

(8) For Qualifying Jinmao Shareholders whose shareholdings in China Jinmao are held in CCASS, their

entitlements to Shares under the Distribution will be issued in the name of HKSCC Nominees and deposited

into CCASS for credit to their CCASS Investor Participant stock accounts or the stock accounts of their

designated CCASS Participants. For Qualifying Jinmao Shareholders whose shareholdings in China Jinmao are

held in their names on the register of members of China Jinmao, share certificates for Shares under the

Distribution will be despatched by ordinary post to their addresses on the register of members of China Jinmao

at their own risks.

(9) Non-Qualifying Jinmao Shareholders (if any) will be entitled to the Distribution but will not receive Shares.

Instead, the Shares which they would otherwise receive pursuant to the Distribution will be sold by China

Jinmao on their behalf as soon as reasonably practicable after commencement of dealings in the Shares on the

Stock Exchange and they will receive a cash amount equal to the net proceeds of such sale. Further information

is set out in the section headed “The Spin-off and Distribution — Distribution” in this prospectus.

Share certificates for the Hong Kong Offer Shares and Shares to be distributed

pursuant to the Distribution are expected to be issued on Wednesday, March 9, 2022 but

will only become valid evidence of title if the Global Offering has become unconditional

in all respects and neither of the Underwriting Agreements is terminated in accordance

with its terms before 8:00 a.m. on the Listing Date, which is expected to be on on

Thursday, March 10, 2022.

For details of the structure of the Global Offering, including its conditions, and the

procedures for applications for the Hong Kong Offer Shares, see sections headed “Structure of

the Global Offering” and “How to Apply for Hong Kong Offer Shares” in this prospectus,

respectively.

If the Global Offering does not become unconditional or is terminated in accordance with

its terms, the Global Offering will not proceed. In such a case, the Company will make an

announcement as soon as practicable thereafter.

EXPECTED TIMETABLE

(1)

–iv–

IMPORTANT NOTICE TO INVESTORS

This prospectus is issued by us solely in connection with the Hong Kong Public

Offering and does not constitute an offer to sell or a solicitation of an offer to sell or a

solicitation of an offer to buy any security other than the Hong Kong Offer Shares offered

by this prospectus pursuant to the Hong Kong Public Offering. This prospectus may not

be used for the purpose of, and does not constitute, an offer or invitation in any other

jurisdiction or in any other circumstances. No action has been taken to permit a public

offering of the Offer Shares in any jurisdiction other than Hong Kong and no action has

been taken to permit the distribution of this prospectus in any jurisdiction other than

Hong Kong. The distribution of this prospectus and the offering of the Offer Shares in

other jurisdictions are subject to restrictions and may not be made except as permitted

under the applicable securities laws of such jurisdictions pursuant to registration with or

authorization by the relevant securities regulatory authorities or an exemption therefrom.

You should rely only on the information contained in this prospectus and the Application

Forms to make your investment decision. The Hong Kong Public Offering are made solely

on the basis of the information contained and the representations made in this prospectus.

We have not authorized anyone to provide you with information that is different from what

is contained in this prospectus. Any information or representation not contained in this

prospectus must not be relied on by you as having been authorized by us, the Joint

Sponsors, the Joint Representatives, the Joint Global Coordinators, the Joint

Bookrunners, the Joint Lead Managers, any of the Underwriters, any of our or their

respective directors, officers, employees, agents or representatives of any of them or any

other person or party involved in the Global Offering.

Page

EXPECTED TIMETABLE ........................................... i

CONTENTS ....................................................... v

SUMMARY ....................................................... 1

DEFINITIONS ..................................................... 39

GLOSSARY ....................................................... 55

FORWARD-LOOKING STATEMENTS ................................. 58

RISK FACTORS ................................................... 60

THE SPIN-OFF AND DISTRIBUTION ................................. 111

CONTENTS

–v–

INFORMATION ABOUT THIS PROSPECTUS AND

THE GLOBAL OFFERING ......................................... 117

WAIVERS FROM COMPLIANCE WITH THE LISTING RULES AND

EXEMPTIONS FROM COMPLIANCE WITH THE COMPANIES

(WINDING UP AND MISCELLANEOUS PROVISIONS) ORDINANCE ..... 122

DIRECTORS AND PARTIES INVOLVED IN THE GLOBAL OFFERING ..... 128

CORPORATE INFORMATION ....................................... 134

INDUSTRY OVERVIEW ............................................. 136

REGULATIONS .................................................... 159

HISTORY, REORGANIZATION AND CORPORATE STRUCTURE .......... 185

BUSINESS ........................................................ 198

RELATIONSHIP WITH CHINA JINMAO ............................... 310

CONNECTED TRANSACTIONS ...................................... 348

DIRECTORS AND SENIOR MANAGEMENT ............................ 366

SUBSTANTIAL SHAREHOLDERS ..................................... 386

SHARE CAPITAL .................................................. 388

OUR CORNERSTONE INVESTORS ................................... 392

FINANCIAL INFORMATION......................................... 404

FUTURE PLANS AND USE OF PROCEEDS ............................. 483

UNDERWRITING .................................................. 500

STRUCTURE OF THE GLOBAL OFFERING............................ 515

HOW TO APPLY FOR HONG KONG OFFER SHARES ................... 530

APPENDIX I ACCOUNTANTS’ REPORT .......................... I-1

APPENDIX II UNAUDITED PRO FORMA FINANCIAL

INFORMATION .................................. II-1

CONTENTS

–vi–

APPENDIX III PROFIT ESTIMATE ................................ III-1

APPENDIX IV SUMMARY OF ARTICLES OF ASSOCIATION .......... IV-1

APPENDIX V STATUTORY AND GENERAL INFORMATION .......... V-1

APPENDIX VI DOCUMENTS TO BE DELIVERED TO THE

REGISTRAR OF COMPANIES AND AVAILABLE

FOR INSPECTION ............................... VI-1

CONTENTS

– vii –

This summary aims to give you an overview of the information contained in this

prospectus. As it is a summary, it does not contain all the information that may be

important to you and is qualified in its entirety by and should be read in conjunction with,

the full prospectus. You should read the whole prospectus, including the appendices,

before you decide to invest in the Offer Shares. There are risks associated with any

investment. Some of the particular risks in investing in the Offer Shares are set forth in

the section headed “Risk Factors” of this prospectus. You should read that section

carefully before you decide to invest in the Offer Shares.

OVERVIEW

We are a fast-growing upscale property management and city operation service provider

in China. According to China Index Academy, the average property management fee for

properties under our management was significantly higher than the industry average of the Top

100 Property Management Companies in 2018, 2019 and 2020. According to China Index

Academy, we are an industry-leading company in terms of multiple indicators in the three

dimensions of scope of service, service standards and service fees. China Jinmao, our

Controlling Shareholder, is a top tier property developer in China. We provide a full range of

high-quality property management and value-added services to one of the fastest-growing

portfolios of high-end residential properties, according to China Index Academy. We also

manage and operate a diversified and growing portfolio of commercial properties primarily

comprising office buildings and shopping malls, as well as public properties such as schools,

government facilities and other public spaces. As of September 30, 2021, the total GFA under

management was approximately 23.2 million sq.m. According to China Index Academy, the

property management industry in China is highly competitive and fragmented. Our market

share in terms of GFA under management and total revenue in 2020 was approximately 0.07%

and 0.15% of the property management market in China. We were ranked the 5th in terms of

revenue per sq.m. among the Top 100 Property Management Companies headquartered in the

Beijing-Tianjin-Hebei Region in 2020. We were ranked the second in terms of GFA under

management for upscale property management service projects among the Top 100 Property

Management Companies in Beijing in 2020.

Capitalizing on our leading brand reputation, extensive resources and experience, and

comprehensive technological capabilities, together with our business partners, we are

committed to developing a lifestyle service platform that is centered around living and working

activities of property users. Through our platform, we seek to synergize different pillars of our

services to deliver an integrated and elevated living experience, improve property users’

quality of life and vitalize property management for owners.

We are engaged in three business lines, namely (i) property management services, (ii)

value-added services to non-property owners, and (iii) community value-added services. We

also provide city operation services, the scope of which spans across our three business lines.

We were established over 25 years ago to focus on the provision of property management

services in China. In addition to property management services, we offer value-added services

to non-property owners (such as sales assistance, consultancy and other value-added services).

We also offer a variety of community value-added services, which are provided mainly to the

owners and residents of the properties we manage.

SUMMARY

–1–

Our contracted GFA reached 45.7 million sq.m. as of September 30, 2021, covering 47

cities in 22 provinces, autonomous regions and municipalities in China, 67.8% of which are in

first-tier and second-tier cities in China. As of the Latest Practicable Date, our property

management portfolio covered residential properties and a wide range of non-residential

properties, including commercial properties (such as office buildings and shopping malls) and

public and other properties (such as schools, government facilities and other public spaces).

Our total GFA under management as of September 30, 2021 was 23.2 million sq.m. across 35

cities in 20 provinces, autonomous regions and municipalities in China, encompassing 96

residential projects and 41 non-residential projects. As of September 30, 2021, our GFA under

management for residential properties and non-residential properties was approximately 19.7

million sq.m. and 3.5 million sq.m., representing 85.0% and 15.0% of our total GFA under

management, respectively. Our GFA under management refers to contracted GFA of properties

for which we have started to provide property management services pursuant to the relevant

property management service contracts, whereas our contracted GFA refers to GFA under

management and GFA to be managed by us under operating property management contracts,

including both delivered and undelivered GFA.

We experienced rapid growth during the Track Record Period. Our revenue increased

from RMB574.5 million in 2018 to RMB788.3 million in 2019 and further to RMB944.2

million in 2020, representing a CAGR of 28.2% from 2018 to 2020. Our revenue in the nine

months ended September 30, 2020 and 2021 was RMB665.3 million and RMB1,048.7 million,

respectively. Meanwhile, our profit for the year increased from RMB17.5 million in 2018 to

RMB22.6 million in 2019 and further to RMB77.1 million in 2020, representing a CAGR of

110.0% from 2018 to 2020. Our profit for the nine months ended September 30, 2020 and 2021

was RMB53.3 million and RMB109.4 million, respectively.

BUSINESS MODEL

Our business includes the following three business lines:

• Property management services. We provide a range of property management

services to property owners and residents, as well as property developers, including,

among others, security, cleaning, greening, gardening and repair and maintenance

services for the operation of common area facilities. Our property management

portfolio covers residential properties, in particular, high-end ones, and a wide range

of non-residential properties, including (i) commercial properties, such as office

buildings and shopping malls, and (ii) public and other properties, such as schools,

government facilities and other public spaces.

• Value-added services to non-property owners. We provide value-added services to

non-property owners, including (i) sales assistance services to property developers

to assist with their sales and marketing activities at property sales venues and

display units, and (ii) consultancy and other value-added services such as pre-

delivery and consultancy services, mainly to property developers.

SUMMARY

–2–

• Community value-added services. We provide community value-added services

mainly to property owners and residents of our managed properties to address their

daily lifestyle needs, which mainly consist of: (i) platform services for interior

decoration, (ii) community living services such as housekeeping, new retail and

catering services, (iii) community space operation services such as elevator

advertising services and car park space management services, and (iv) real estate

brokerage services.

Additionally, we provide city operation services in multiple forms to assist governments

and enterprises in the optimization, innovation and distribution of urban resources and the

delivery of value-added public services to citizens. The service scope of our city operation

services spans across our three business lines.

The following table sets out the breakdown of our revenue by business line for the periods

indicated:

For the year ended December 31,

For the nine months ended

September 30,

2018 2019 2020 2020 2021

(RMB’000) (%) (RMB’000) (%) (RMB’000) (%) (RMB’000) (%) (RMB’000) (%)

Revenue

Property management

services 335,117 58.3 462,277 58.6 567,481 60.1 409,498 61.6 578,238 55.2

— Residential properties 164,568 28.6 201,501 25.6 276,914 29.3 199,400 30.0 335,210 32.0

— Non-residential properties 170,549 29.7 260,776 33.0 290,567 30.8 210,098 31.6 243,028 23.2

Value-added services to

non-property owners 178,613 31.1 250,838 31.8 294,401 31.2 198,982 29.9 371,624 35.4

Community value-added

services

(1)

60,773 10.6 75,208 9.6 82,328 8.7 56,842 8.5 98,823 9.4

Total revenue 574,503 100.0 788,323 100.0 944,210 100.0 665,322 100.0 1,048,685 100.0

Note:

(1) Includes gross rental income from investment properties operating leases.

Our overall revenue increased from RMB574.5 million in 2018 to RMB788.3 million in

2019, further to RMB944.2 million in 2020 and our revenue increased from RMB665.3 million

in the nine months ended September 30, 2020 to RMB1,048.7 million in the nine months ended

September 30, 2021, due to an increase in revenues generated from our three business lines as

we expanded our business scale.

SUMMARY

–3–

Our revenue from property management services increased throughout the Track Record

Period, mainly attributable to an increase in our GFA under management, which was 10.2

million sq.m., 12.7 million sq.m., 17.7 million sq.m. and 23.2 million sq.m. as of December 31,

2018, 2019 and 2020 and September 30, 2021. Our revenue from value-added services to

non-property owners increased from RMB178.6 million in 2018 to RMB250.8 million in 2019

and further to RMB294.4 million in 2020, primarily due to an increase in the number of sales

activities conducted by property developers to whom we provided services. Our revenue from

value-added services to non-property owners increased from RMB199.0 million in the nine

months ended September 30, 2020 to RMB371.6 million in the same period of 2021 primarily

due to increased revenue from preliminary planning and design services and post-delivery

services as we expanded our service offerings. Our revenue from community value-added

services increased from RMB60.8 million in 2018 to RMB75.2 million in 2019 and further to

RMB82.3 million in 2020 primarily due to increased revenue from community space operation

services and platform services for interior decoration as we managed more projects. Our

revenue from community value-added services increased from RMB56.8 million in the nine

months ended September 30, 2020 to RMB98.8 million in the same period in 2021 primarily

due to an increase in the number of communities under our management as a result of our

expansion of business scale.

The following table sets out the breakdown of our revenue by source of projects for the

periods indicated:

For the year ended December 31, Nine months ended September 30,

2018 2019 2020 2020 2021

Revenue Revenue Revenue Revenue Revenue

Amount % Amount % Amount % Amount % Amount %

(RMB in thousands, except percentages)

Property management

services 335,117 58.3 462,277 58.6 567,481 60.1 409,498 61.6 578,238 55.2

— Properties developed by

Jinmao Group and

Sinochem Group (and

their respective joint

ventures and associates) 308,277 53.6 431,282 54.7 524,854 55.6 380,716 57.3 534,714 51.0

— Properties developed by

Independent Third Parties 26,840 4.7 30,995 3.9 42,627 4.5 28,782 4.3 43,524 4.2

Value-added services to

non-property owners 178,613 31.1 250,838 31.8 294,401 31.2 198,982 29.9 371,624 35.4

— Properties developed by

Jinmao Group and

Sinochem Group (and

their respective joint

ventures and associates) 176,539 30.7 247,956 31.4 284,019 30.1 192,601 28.9 360,499 34.4

— Properties developed by

Independent Third Parties 2,074 0.4 2,882 0.4 10,382 1.1 6,381 1.0 11,125 1.0

Community value-added

services 60,773 10.6 75,208 9.6 82,328 8.7 56,842 8.5 98,823 9.4

— Properties developed by

Jinmao Group and

Sinochem Group (and

their respective joint

ventures and associates) 59,921 10.5 74,547 9.5 81,604 8.6 56,702 8.5 97,347 9.3

— Properties developed by

Independent Third Parties 852 0.1 661 0.1 724 0.1 140 0.0 1,476 0.1

Total 574,503 100.0 788,323 100.0 944,210 100.0 665,322 100.0 1,048,685 100.0

SUMMARY

–4–

The following table sets out the breakdown of our revenue by type of properties for the

periods indicated:

For the year ended December 31, Nine months ended September 30,

2018 2019 2020 2020 2021

Revenue Revenue Revenue Revenue Revenue

Amount % Amount % Amount % Amount % Amount %

(RMB in thousands, except percentages)

Property management

services 335,117 58.3 462,277 58.6 567,481 60.1 409,498 61.6 578,238 55.2

— Residential properties 164,568 28.6 201,501 25.6 276,914 29.3 199,400 30.0 335,210 32.0

— Non-residential properties 170,549 29.7 260,776 33.0 290,567 30.8 210,098 31.6 243,028 23.2

Value-added services to

non-property owners 178,613 31.1 250,838 31.8 294,401 31.2 198,982 29.9 371,624 35.4

— Residential properties 167,972 29.2 236,522 30.0 280,418 29.7 187,567 28.2 352,463 33.6

— Non-residential properties 10,641 1.9 14,316 1.8 13,983 1.5 11,415 1.7 19,161 1.8

Community value-added

services 60,773 10.6 75,208 9.6 82,328 8.7 56,842 8.5 98,823 9.4

— Residential properties 28,813 5.0 31,861 4.0 40,342 4.3 30,957 4.7 62,785 6.0

— Non-residential properties 31,960 5.6 43,347 5.6 41,986 4.4 25,885 3.8 36,038 3.4

Total 574,503 100.0 788,323 100.0 944,210 100.0 665,322 100.0 1,048,685 100.0

The following table sets out the breakdown of our revenue by types of ultimate paying

customers for the periods indicated:

For the year ended December 31, Nine months ended September 30,

2018 2019 2020 2020 2021

Revenue Revenue Revenue Revenue Revenue

Amount % Amount % Amount % Amount % Amount %

(RMB in thousands, except percentages)

Property management

services 335,117 58.3 462,277 58.6 567,481 60.1 409,498 61.6 578,238 55.2

— Jinmao Group and

Sinochem Group (and

their respective joint

ventures and associates) 95,020 16.5 90,509 11.5 102,611 10.9 78,009 11.7 105,609 10.1

— Independent Third Parties 240,097 41.8 371,768 47.1 464,870 49.2 331,489 49.9 472,629 45.1

Value-added services to

non-property owners 178,613 31.1 250,838 31.8 294,401 31.2 198,982 29.9 371,624 35.4

— Jinmao Group and

Sinochem Group (and

their respective joint

ventures and associates) 164,457 28.6 232,210 29.5 279,610 29.6 190,796 28.7 353,669 33.7

— Independent Third Parties 14,156 2.5 18,628 2.3 14,791 1.6 8,186 1.2 17,955 1.7

Community value-added

services 60,773 10.6 75,208 9.6 82,328 8.7 56,842 8.5 98,823 9.4

— Jinmao Group and

Sinochem Group (and

their respective joint

ventures and associates) 20,540 3.6 28,546 3.6 28,568 3.0 19,661 3.0 24,527 2.3

— Independent Third Parties 40,233 7.0 46,662 6.0 53,760 5.7 37,181 5.5 74,296 7.1

Total 574,503 100.0 788,323 100.0 944,210 100.0 665,322 100.0 1,048,685 100.0

SUMMARY

–5–

Our revenue generated from value-added services to non-property owners attributable to

property developers which are related parties increased in the nine months ended

September 30, 2021 compared to the same period of 2020 primarily due to an increase in

revenue generated from preliminary planning and design services and post-delivery services

provided to Jinmao Group and its joint ventures and associates.

The following table sets out the breakdown of our gross profit and gross profit margin by

business line for the periods indicated:

For the year ended December 31,

For the nine months ended

September 30,

2018 2019 2020 2020 2021

Gross

profit

Gross

profit

margin

Gross

profit

Gross

profit

margin

Gross

profit

Gross

profit

margin

Gross

profit

Gross

profit

margin

Gross

profit

Gross

profit

margin

(RMB’000) (%) (RMB’000) (%) (RMB’000) (%) (RMB’000) (%) (RMB’000) (%)

Property management

services 37,105 11.1 54,868 11.9 100,978 17.8 77,831 19.0 101,163 17.5

Value-added services to

non-property owners 48,373 27.1 68,558 27.3 101,170 34.4 64,231 32.3 171,157 46.1

Community value-added

services

(1)

29,556 48.6 28,097 37.4 32,641 39.6 21,739 38.2 38,575 39.0

Total/Overall 115,034 20.0 151,523 19.2 234,789 24.9 163,801 24.6 310,895 29.6

Note:

(1) Includes gross rental income from investment properties operating leases.

Our overall gross profit margin decreased to 19.2% in 2019 from 20.0% in 2018 primarily

due to decreased gross profit for community value-added services as a result of increased

investments in our smart management systems. Our overall gross profit margin increased to

24.9% in 2020 from 19.2% in 2019 primarily due to (i) the higher gross profit margin of our

property management business, as detailed below, and (ii) increased revenue from pre-delivery

services and community space operation services, which typically generate a higher gross

profit margin compared to other services we offered. Our overall gross profit margin increased

to 29.6% in the nine months ended September 30, 2021 from 24.6% in the same period in 2020

primarily due to the contribution from our new consultancy and other value-added service

offerings such as preliminary planning and design services and post-delivery services which

typically have higher profit margin.

For analysis of the trend in our gross profit margin of each business line during the Track

Record Period, see “Financial Information — Period to Period Comparison”.

SUMMARY

–6–

The following table sets out the breakdown of gross profit and gross profit margin by

source of projects for the periods indicated:

For the year ended December 31, Nine months ended September 30,

2018 2019 2020 2020 2021

Gross

profit

Gross

profit

margin

Gross

profit

Gross

profit

margin

Gross

profit

Gross

profit

margin

Gross

profit

Gross

profit

margin

Gross

profit

Gross

profit

margin

(RMB’000) (%) (RMB’000) (%) (RMB’000) (%) (RMB’000) (%) (RMB’000) (%)

Property management

services 37,105 11.1 54,868 11.9 100,978 17.8 77,831 19.0 101,163 17.5

— Properties developed

by Jinmao Group and

Sinochem Group (and

their respective joint

ventures and

associates) 38,548 12.5 54,557 12.6 97,375 18.6 75,386 19.8 97,410 18.2

— Properties developed

by Independent Third

Parties -1,443 -5.4 311 1.0 3,603 8.5 2,445 8.5 3,753 8.6

Value-added services to

non-property owners 48,373 27.1 68,558 27.3 101,170 34.4 64,231 32.3 171,157 46.1

— Properties developed

by Jinmao Group and

Sinochem Group (and

their respective joint

ventures and

associates) 47,149 26.7 67,115 27.1 97,266 34.2 61,852 32.1 169,429 47.0

— Properties developed

by Independent Third

Parties 1,224 59.0 1,443 50.1 3,904 37.6 2,379 37.3 1,728 15.5

Community value-added

services 29,556 48.6 28,097 37.4 32,641 39.6 21,739 38.2 38,575 39.0

— Properties developed

by Jinmao Group and

Sinochem Group (and

their respective joint

ventures and

associates) 29,650 49.5 28,043 37.6 32,551 39.9 21,661 38.2 38,177 39.2

— Properties developed

by Independent Third

Parties -94

(1)

-11.0 54 8.2 90 12.4 78 55.7 398 27.0

Total 115,034 20.0 151,523 19.2 234,789 24.9 163,801 24.6 310,895 29.6

Note:

(1) This is attributable to our one-off and non-recurring cleaning services provided to a government facility and

not representative of our revenue model for community value-added services.

For analysis of the trend in our gross profit margin by source of projects during the Track

Record Period, see “Financial Information — Key Factors Affecting our Results of Operations

— Business Mix”.

SUMMARY

–7–

The following table sets out the breakdown of gross profit and gross profit margin by type

of properties for the periods indicated:

For the year ended December 31, Nine months ended September 30,

2018 2019 2020 2020 2021

Gross

Profit

Gross

Profit

Margin

Gross

Profit

Gross

Profit

Margin

Gross

Profit

Gross

Profit

Margin

Gross

Profit

Gross

Profit

Margin

Gross

Profit

Gross

Profit

Margin

(RMB’000) (%) (RMB’000) (%) (RMB’000) (%) (RMB’000) (%) (RMB’000) (%)

Property management

services 37,105 11.1 54,868 11.9 100,978 17.8 77,831 19.0 101,163 17.5

— Residential properties 2,712 1.6 5,301 2.6 36,788 13.3 33,729 16.9 54,159 16.2

— Non-residential

properties 34,393 20.2 49,567 19.0 64,190 22.1 44,102 21.0 47,004 19.3

Value-added services to

non-property owners 48,373 27.1 68,558 27.3 101,170 34.4 64,231 32.3 171,157 46.1

— Residential properties 44,758 26.6 63,136 26.7 93,647 33.4 57,656 30.7 159,366 45.2

— Non-residential

properties 3,615 34.0 5,422 37.9 7,523 53.8 6,575 57.6 11,791 61.5

Community value-added

services 29,556 48.6 28,097 37.4 32,641 39.6 21,739 38.2 38,575 39.0

— Residential properties 12,031 41.8 3,581 11.2 14,524 36.0 12,155 39.3 24,819 39.5

— Non-residential

properties 17,525 54.8 24,516 56.6 18,117 43.2 9,584 37.0 13,756 38.2

Total 115,034 20.0 151,523 19.2 234,789 24.9 163,801 24.6 310,895 29.6

For analysis of the trend in our gross profit margin by type of properties during the Track

Record Period, see “Financial Information — Key Factors Affecting our Results of Operations

— Business Mix”.

We manage a diverse portfolio of properties covering residential properties, in particular,

high-end ones, and non-residential properties, including (i) commercial properties, such as

office buildings, skyscrapers and shopping malls, and (ii) public and other properties, such as

schools, government facilities and other public spaces. The following table sets out the

breakdowns of our revenue from property management services by property type:

For the year ended December 31,

For the nine months ended

September 30,

2018 2019 2020 2020 2021

Revenue Revenue Revenue Revenue Revenue

(RMB’000) (%) (RMB’000) (%) (RMB’000) (%) (RMB’000) (%) (RMB’000) (%)

Residential properties 164,568 49.1 201,501 43.6 276,914 48.8 199,400 48.7 335,210 58.0

Non-residential properties 170,549 50.9 260,776 56.4 290,567 51.2 210,098 51.3 243,028 42.0

Total 335,117 100.0 462,277 100.0 567,481 100.0 409,498 100.0 578,238 100.0

SUMMARY

–8–

The following table sets out the breakdowns of our (i) GFA under management, and (ii)

number of properties under management by geographic region, as of the dates indicated:

As of December 31, As of September 30,

2018 2019 2020 2021

GFA under

management

Number of

properties

under

management

GFA under

management

Number of

properties

under

management

GFA under

management

Number of

properties

under

management

GFA under

management

Number of

properties

under

management

(’000

sq.m.) (%)

(’000

sq.m.) (%)

(’000

sq.m.) (%)

(’000

sq.m.) (%)

Eastern region

(1)

3,034.4 29.7 22 4,304.1 34.0 28 8,048.2 45.6 45 12,690.3 54.6 76

Northern region

(2)

2,649.8 25.9 16 2,640.8 20.9 20 3,109.4 17.6 25 3,362.0 14.5 27

Central region

(3)

2,013.5 19.7 7 2,581.1 20.4 9 2,834.1 16.0 12 3,130.3 13.5 13

Southern region

(4)

1,131.8 11.1 2 1,735.4 13.7 4 1,971.8 11.2 6 2,022.1 8.7 8

Southwestern

region

(5)

1,393.6 13.6 4 1,399.2 11.0 5 1,587.1 9.0 8 1,776.6 7.6 11

Northwestern

region

(6)

– – – – – – 100.9 0.6 1 259.5 1.1 2

Total 10,223.1 100.0 51 12,660.6 100.0 66 17,651.5 100.0 97 23,240.8 100.0 137

Notes:

(1) “Eastern region” refers to Shanghai, Zhejiang province, Jiangsu province, Jiangxi province, Shandong

province, Fujian province and Anhui province;

(2) “Northern region” refers to Beijing, Tianjin, Shanxi province, Hebei province and the central area of Inner

Mongolia (Hohhot, Baotou and Ulanqab);

(3) “Central region” refers to Hubei province, Hunan province and Henan province;

(4) “Southern region” refers to Guangxi Zhuang autonomous region, Guangdong province and Hainan province;

(5) “Southwestern region” refers to Chongqing, Sichuan province, Yunnan province, Guizhou province and Tibet;

(6) “Northwestern region” refers to Gansu province, Ningxia Hui autonomous region, Shaanxi province, Xinjiang

Uygur autonomous region and the western area of Inner Mongolia autonomous region (Alxa League, Bayannur,

Wuhai and Ordos).

During the Track Record Period, the properties under our management were principally

developed by Jinmao Group and Sinochem Group and their joint ventures and associates while

the rest were developed or owned by other independent-third-party property developers.

SUMMARY

–9–

The following table sets out the breakdown of our Group’s (i) contracted GFA, (ii)

undelivered GFA, and (iii) number of properties for contracted GFA by source of projects as

of the dates indicated:

As of December 31,

As of

September 30,

2018 2019 2020 2021

Contracted GFA (’000

sq.m.) 21,861.2 30,788.4 40,525.5 45,730.2

— Properties developed by

Jinmao Group and

Sinochem Group (and

their respective joint

ventures and associates) 20,823.2 29,950.5 37,835.9 41,379.0

— Properties developed by

Independent Third Parties 1,038.0 837.9 2,689.6 4,351.2

Undelivered GFA (’000

sq.m.) 11,638.1 18,127.8 22,874.0 22,489.4

— Properties developed by

Jinmao Group and

Sinochem Group (and

their respective joint

ventures and associates) 11,638.1 18,026.9 22,343.1 21,260.3

— Properties developed by

Independent Third Parties – 100.9 530.9 1,229.1

Number of properties for

contracted GFA 107 148 190 228

— Properties developed by

Jinmao Group and

Sinochem Group (and

their respective joint

ventures and associates) 99 137 164 188

— Properties developed by

Independent Third Parties 8 11 26 40

SUMMARY

–10–

The following table sets out the breakdowns of our Group’s (i) contracted GFA, (ii)

undelivered GFA, and (iii) number of properties for contracted GFA by type of properties as

of the dates indicated:

As of December 31,

As of

September 30,

2018 2019 2020 2021

Contracted GFA (’000

sq.m.) 21,861.2 30,788.4 40,525.5 45,730.2

— Residential properties 19,461.8 27,559.4 36,444.9 41,355.4

— Non-residential properties 2,399.4 3,229.0 4,080.6 4,374.8

Undelivered GFA (’000

sq.m.) 11,638.1 18,127.8 22,874.0 22,489.4

— Residential properties 11,591.8 17,129.5 21,989.1 21,592.1

— Non-residential properties 46.3 998.3 884.9 897.3

Number of properties for

contracted GFA 107 148 190 228

— Residential properties 85 118 152 182

— Non-residential properties 22 30 38 46

The following tables set out the breakdowns of our (i) revenue from property management

services by source of projects, and (ii) GFA under management, and number of properties under

management by source of projects for the periods or as of the dates indicated:

For the year ended December 31,

For the nine months ended

September 30,

2018 2019 2020 2020 2021

Revenue Revenue Revenue Revenue Revenue

(RMB’000) (%) (RMB’000) (%) (RMB’000) (%) (RMB’000) (%) (RMB’000) (%)

Properties developed by

Jinmao Group and

Sinochem Group (and their

respective joint ventures

and associates)

(1)

308,277 92.0 431,282 93.3 524,854 92.5 380,716 93.0 534,714 92.5

Properties developed by

Independent Third

Parties

(2)

26,840 8.0 30,995 6.7 42,627 7.5 28,782 7.0 43,524 7.5

Total 335,117 100.0 462,277 100.0 567,481 100.0 409,498 100.0 578,238 100.0

SUMMARY

–11–

Notes:

(1) “Properties developed by Jinmao Group and Sinochem Group (and their respective joint ventures and

associates)” refers to properties solely developed by Jinmao Group or Sinochem Group or jointly developed

by Jinmao Group or Sinochem Group and other parties.

(2) “Properties developed by Independent Third Parties” refers to properties that were not developed by Jinmao

Group or Sinochem Group, either solely or jointly with other parties.

As of December 31, As of September 30,

2018 2019 2020 2021

GFA under

management

Number of

properties

under

management

GFA under

management

Number of

properties

under

management

GFA under

management

Number of

properties

under

management

GFA under

management

Number of

properties

under

management

(’000

sq.m.) (%)

(’000

sq.m.) (%)

(’000

sq.m.) (%)

(’000

sq.m.) (%)

Properties developed by

Jinmao Group and

Sinochem Group (and their

respective joint ventures

and associates)

(1)

9,185.1 89.8 43 11,923.7 94.2 56 15,492.8 87.8 76 20,118.7 86.6 105

Properties developed by

Independent Third Parties

(2)

1,038.0 10.2 8 736.9 5.8 10 2,158.7 12.2 21 3,122.1 13.4 32

Total 10,223.1 100.0 51 12,660.6 100.0 66 17,651.5 100.0 97 23,240.8 100.0 137

Notes:

(1) “Properties developed by Jinmao Group and Sinochem Group (and their respective joint ventures and

associates)” refers to properties solely developed by Jinmao Group or Sinochem Group or jointly developed

by Jinmao Group or Sinochem Group and other parties.

(2) “Properties developed by Independent Third Parties” refers to projects not developed by Jinmao Group or

Sinochem Group, either solely or jointly with other parties.

Based on information available to us, as of December 31, 2018, 2019 and 2020 and June

30, 2021, we managed approximately 91.0%, 93.0%, 89.0% and 89.0% of the total GFA of the

properties developed by Jinmao Group and its joint ventures and associates. To the best of our

knowledge, as the properties developed by Sinochem Group and its joint ventures and

associates are mainly for self-use purposes, Sinochem Group does not maintain GFA data for

such properties, and therefore our managed GFA as a percentage of the total GFA of the

properties developed by Sinochem Group and its joint ventures and associates is not available.

SUMMARY

–12–

The following table sets out the expiration schedule of our preliminary property

management service contracts for residential properties as of September 30, 2021:

Preliminary property management service

contracts for residential properties

Contracted GFA Number of contracts

(’000 sq.m.) (%) (%)

Property management service contracts

without fixed term

(1)

25,048.7 62.5 138 67.3

Property management service contracts

under which we provided services

beyond contract expiration

(2)

4,385.4 10.9 19 9.3

Property management service contracts

with fixed terms expiring in

— Year ending December 31, 2021 261.5 0.6 3 1.5

— Year ending December 31, 2022 679.0 1.7 4 1.9

— Year ending December 31, 2023

and beyond 9,730.3 24.3 41 20.0

Sub-total 10,670.8 26.6 48 23.4

Total 40,104.9 100.0 205 100.0

Notes:

(1) A property management service contract without fixed term primarily refers to a preliminary property

management service contract entered into with the property developer which does not have a fixed term

and can be terminated when the property owners’ association is formed and the property owners select

the property service provider with a replacement property management service contract entered into by

the property owners’ association.

(2) We continued to provide services under these property management service contracts despite their

expired contract terms as of September 30, 2021. This was mainly because the relevant property owners’

general meetings of such properties are yet to be convened or the property owners’ associations are yet

to be formed to renew our property management service contracts or to select a replacing property

management service provider, or that we are still in the negotiation process with the property owners’

associations for the renewal of our engagement.

SUMMARY

–13–

The following table sets out the expiration schedule of our property management service

contracts for residential properties entered into with property owners’ associations as of

September 30, 2021:

Property management service contracts for

residential properties entered into with

property owner ’s associations

Contracted GFA Number of contracts

(’000 sq.m.) (%) (%)

Property management service contracts

without fixed term ————

Property management service contracts

under which we provided services

beyond contract expiration 103.3 8.3 4 36.4

Property management service contracts

with fixed terms expiring in

— Year ending December 31, 2021 106.2 8.5 1 9.1

— Year ending December 31, 2022 182.0 14.5 1 9.1

— Year ending December 31, 2023

and beyond 858.9 68.7 5 45.4

Sub-total 1,147.1 91.7 7 63.6

Total 1,250.4 100.0 11 100.0

The following table sets out the expiration schedule of our property management service

contracts for non-residential properties as of September 30, 2021:

Property management service contracts

for non-residential properties

Contracted GFA Number of contracts

(’000 sq.m.) (%) (%)

Property management service contracts

without fixed term 1,172.3 26.8 10 19.6

Property management service contracts

under which we provided services

beyond contract expiration 189.0 4.3 3 5.9

Property management service contracts

with fixed terms expiring in

— Year ending December 31, 2021 1,255.0 28.7 10 19.6

— Year ending December 31, 2022 574.4 13.1 12 23.5

— Year ending December 31, 2023 and

beyond 1,184.1 27.1 16 31.4

Sub-total 3,013.5 68.9 38 74.5

Total 4,374.8 100.0 51 100.0

SUMMARY

–14–

During the Track Record Period, we terminated two property management service

contracts which did not match with our profitability criteria on a voluntary basis.

OUR CUSTOMERS AND SUPPLIERS

We have a large, growing and loyal customer base primarily consisting of (i) property

owners and residents for our property management and community value-added services, (ii)

property developers for our value-added services to non-property owners and property

management service, and (iii) other customers such as advertising companies for our

community value-added services. We typically do not grant a credit term to individual

customers for our property management services and other customers for our community

value-added services. We typically grant a credit term of 90 days to 180 days to property

developers.

China Jinmao is the Controlling Shareholder of our Company for the purpose of the

Listing Rules. Sinochem Group is an indirect controlling shareholder of China Jinmao and

consolidated the accounts of China Jinmao and its subsidiaries during the Track Record Period.

When calculating our five largest customers for the Track Record Period, we aggregated

revenue contribution from customers under common control and their subsidiaries, joint

ventures and associates. As a result, our single largest customer during the Track Record Period

was Sinochem Group and its subsidiaries, joint ventures and associates, which include China

Jinmao and its subsidiaries (excluding our Group), joint ventures and associates. For further

details, see “Connected Transactions” and Note 29 of the Accountants’ Report in Appendix I

to this prospectus. For the years ended December 31, 2018, 2019 and 2020 and the nine months

ended September 30, 2021, revenue from our single largest customer in each year/period for

the Track Record Period amounted to RMB280.0 million, RMB351.3 million, RMB410.8

million and RMB483.8 million, representing 48.7%, 44.6%, 43.5% and 46.1% of our total

revenue, respectively. For the same periods, revenue from our five largest customers in each

year/period for the Track Record Period, in aggregate amounted to RMB336.6 million,

RMB405.6 million, RMB461.8 million and RMB528.4 million, representing 58.5%, 51.5%,

48.8% and 50.4% of our total revenue, respectively.

Starting from 2020, we proactively reinforced our efforts to seek property management

engagements for projects developed by property developers that are Independent Third Parties,

in order to benefit more from economies of scale, gain additional revenue sources, diversify

our property management portfolio, and reduce reliance on our single largest customer,

Sinochem Group. As of September 30, 2021, our contracted GFA from properties developed by

Independent Third Parties was 4.4 million sq.m.

During the Track Record Period, most of our five largest suppliers were sub-contractors

providing cleaning, product purchasing and security services. For the years ended December

31, 2018, 2019 and 2020 and the nine months ended September 30, 2021, purchase from our

single largest supplier in each year/period for the Track Record Period amounted to RMB22.4

million, RMB52.9 million, RMB63.0 million and RMB125.1 million, representing 10.7%,

16.7%, 15.6% and 24.0% of our total purchase amount, respectively. For the years ended

December 31, 2018, 2019 and 2020 and the nine months ended September 30, 2021, purchase

SUMMARY

–15–

from our five largest suppliers in each year/period for the Track Record Period, amounted to

in aggregate RMB76.3 million, RMB121.8 million, RMB148.5 million and RMB193.9 million,

representing 36.4%, 38.4%, 36.9% and 37.1% of our total purchase amount, respectively.

COMPETITVE STRENGTHS

Our competitive strengths include the following:

• We are a leading and well-recognized comprehensive property management service

provider in China with a strong focus on core cities.

• Leveraging the support from our Controlling Shareholder, China Jinmao, we have

achieved a remarkable project pipeline and will continue to capitalize on highly

visible and sustainable growth opportunities.

• We are also a leader in the high-end property management services market and

provide premium property management services.

• As a pioneer in city operation service sector in China, we are well positioned to

rapidly scale up and further diversify our city operation property portfolio and

service offerings.

• Our advanced technology and digitalization have enabled us to deliver smart

property management.

• We have an experienced, visionary and pragmatic management team and a

comprehensive talent development system.

BUSINESS STRATEGIES

Our business strategies include the following:

• Further expand and diversify our portfolio under management through various

channels, achieving economies of scale.

• Continue to focus on select major cities with high growth potential, optimize our

premium services and further improve our brand recognition and influence.

• Further develop a wide variety of distinguished new value-added services to

diversify our sources of income and to increase our customer loyalty.

• Continue to enhance our technological capabilities, thereby increasing service

quality and operational efficiency.

• Continue to improve our talent training and incentive mechanisms to support

sustainable and rapid growth of our business.

SUMMARY

–16–

SUMMARY OF FINANCIAL INFORMATION

The following tables set out our summary of financial informations for the Track Record

Period and should be read together with our consolidated financial information, including the

accompanying notes thereto, as set out in the Accountants’ Report included in Appendix I to

this prospectus. Our historical results presented below are not necessarily indicative of the

results that may be expected for any future period.

Consolidated statements of profit or loss

For the year ended December 31,

For the nine months

ended September 30,

2018 2019 2020 2020 2021

(RMB’000) (RMB’000) (RMB’000) (RMB’000) (RMB’000)

Revenue 574,503 788,323 944,210 665,322 1,048,685

Cost of sales (459,469) (636,800) (709,421) (501,521) (737,790)

Gross profit 115,034 151,523 234,789 163,801 310,895

Other income and gains 11,746 74,712 74,908 58,630 41,048

Selling and distribution

expenses (2,301) (954) (1,808) (1,185) (10,213)

Administrative expenses (82,346) (117,150) (134,920) (95,633) (148,702)

Other expenses, net (5,606) (4,441) (1,258) (32) (6,256)

Finance costs (10,165) (70,280) (64,186) (51,021) (33,537)

Profit before tax 26,362 33,410 107,525 74,560 153,235

Income tax expense (8,875) (10,786) (30,401) (21,231) (43,884)

Profit for the year/period 17,487 22,624 77,124 53,329 109,351

Attributable to:

— Owners of the parent 17,487 22,624 77,124 53,329 108,702

— Non-controlling interests ––––649

17,487 22,624 77,124 53,329 109,351

SUMMARY

–17–

Consolidated statements of comprehensive income

Year ended December 31,

Nine months ended

September 30,

2018 2019 2020 2020 2021

(RMB’000) (RMB’000) (RMB’000) (RMB’000) (RMB’000)

PROFIT FOR THE

YEAR/PERIOD 17,487 22,624 77,124 53,329 109,351

OTHER COMPREHENSIVE

LOSS

Other comprehensive loss that

will not be reclassified to

profit or loss in subsequent

periods:

Exchange differences on

translation of financial

statements of the Company ––––(2)

OTHER COMPREHENSIVE

LOSS FOR THE

YEAR/PERIOD, NET OF TAX ––––(2)

TOTAL COMPREHENSIVE

INCOME FOR THE

YEAR/PERIOD 17,487 22,624 77,124 53,329 109,349

Attributable to:

Owners of the parent 17,487 22,624 77,124 53,329 108,700

Non-controlling interests ––––649

17,487 22,624 77,124 53,329 109,349

Our net profit increased from RMB53.3 million in the nine months ended September 30,

2020 to RMB109.4 million in the nine months ended September 30, 2021. The increase was

primarily attributable to increased revenue from our all three business lines as we expanded our

business scale and service offerings.

Our net profit increased from RMB22.6 million in 2019 to RMB77.1 million in 2020. The

significant increase was primarily attributable to (i) increased revenue from our property

management services and (ii) enhanced economies of scale and effective cost-control

measures.

SUMMARY

–18–

Our net profit increased from RMB17.5 million in 2018 to RMB22.6 million in 2019. The

increase was primarily attributable to increased revenue from our property management

services and value-added services to non-property owners.

For details, see “Financial Information — Period to Period Comparison”.

Non-HKFRS Measures

To supplement our consolidated financial statements which are presented in accordance

with HKFRS, we also presented adjusted profit and total comprehensive income, adjusted net

profit margin and adjusted gearing ratio as additional financial measures. See “Financial

Information — Non-HKFRS Measures” for detailed definitions and methods of calculation.

These non-HKFRS measures eliminate the effect of borrowings and loans due from

related parties and borrowings related to the ABS arrangement, which are not related to our

ordinary course of business. We believe that these non-HKFRS measures facilitate comparison

of our financial performance and position by eliminating the impact of items, and therefore

provide more useful information to investors and others in understanding and evaluating our

consolidated results of operations and financial position in the same manner as our

management. Our presentation of these non-HKFRS measures may not be comparable to

similarly titled measures presented by other companies. The use of these measures has

limitations as an analytical tool, and you should not consider them in isolation from, or as a

substitute for analysis of, our results of operations or financial condition as reported under

HKFRS.

The following table reconciles our adjusted profit during the Track Record Period

presented to the most directly comparable financial measure calculated and presented in

accordance with HKFRS:

For the year ended December 31,

For the nine months

ended September 30,

2018 2019 2020 2020 2021

(RMB

’000)

(RMB

’000)

(RMB

’000)

(RMB

’000)

(RMB

’000)

Profit for the year/period 17,487 22,624 77,124 53,329 109,351

Less:

— Other income and

gains related to

borrowings and loans

due from related

parties 9,864 69,991 63,750 50,803 32,408

Add:

— Finance costs related

to borrowings and

loans due from the

third parties 9,864 69,991 63,750 50,803 32,841

Adjusted profit 17,487 22,624 77,124 53,329 109,784

SUMMARY

–19–

The following table reconciles our adjusted total equity as of the dates indicated to the

most directly comparable financial measure calculated and presented in accordance with

HKFRS:

As of December 31,

As of

September 30,

2018 2019 2020 2021

(RMB

’000)

(RMB

’000)

(RMB

’000)

(RMB

’000)

Total equity 79,655 107,831 49,134 145,494

Less:

— Other income and gains

and finance costs

related to interest-

bearing borrowing – – – (433)

Adjusted total equity 79,655 107,831 49,134 145,927

The following table reconciles our adjusted interest-bearing borrowings and lease

liabilities as of the dates indicated to the most directly comparable financial measure calculated

and presented in accordance with HKFRS:

As of December 31,

As of

September 30,

2018 2019 2020 2021

(RMB

’000)

(RMB

’000)

(RMB

’000)

(RMB

’000)

Sum of long-term and

short-term interest-

bearing borrowings and

lease liabilities 1,346,825 1,220,460 1,098,788 26,452

Less:

— Borrowings related to

the 2018 ABS 1,341,000 1,214,997 1,080,992 –

Adjusted interest-bearing

borrowings and lease

liabilities 5,825 5,463 17,796 26,452

Our adjusted gearing ratio is nil during the Track Record Period.

SUMMARY

–20–

The following table sets forth the impact of the 2018 ABS on our net profits and net profit

margins after excluding the other income and finance costs and our gearing ratios after

excluding interest-bearing borrowings in relation to the 2018 ABS from our financial results

during the Track Record Period as of the dates and for the periods indicated:

As of and for the years ended

December 31,

As of and for

the nine months

ended September 30,

2018 2019 2020 2020 2021

(RMB’000, except for the percentages)

Before adjusting for

the 2018 ABS:

Profit for the

year/period 17,487 22,624 77,124 53,329 109,351

Net profit margin

(1)

3.0% 2.9% 8.2% 8.0% 10.4%

Gearing ratio

(2)

1,683.5% 1,126.8% 2,200.1% N/A –

After adjusting for

the 2018 ABS:

Profit for the

year/period 17,487 22,624 77,124 53,329 109,784

Net profit margin

(1)

3.0% 2.9% 8.2% 8.0% 10.5%

Gearing ratio

(2)

–––N/A–

Notes:

(1) Net profit margin is calculated based on our profit for the year/period divided by our total revenue in

the same year/period, multiplied by 100%.

(2) Gearing ratio is calculated based on interest-bearing borrowings excluding lease liabilities divided by

total equity, multiplied by 100%.

For details, see “Financial Information — Indebtedness — Borrowings — 2018 ABS” and

“Financial Information — Non-HKFRS Measures”.

SUMMARY

–21–

Summary of consolidated statements of financial position

As of December 31,

As of

September 30,

2018 2019 2020 2021

(RMB’000) (RMB’000) (RMB’000) (RMB’000)

NON-CURRENT ASSETS

Property, plant and equipment 10,916 17,889 33,615 38,245

Investment properties 14,510 11,640 10,590 9,459

Right-of-use assets 1,926 2,433 15,970 24,982

Intangible assets 192 6,155 7,084 6,108

Deferred tax assets 1,578 1,607 2,457 4,085

Other receivables and

other assets 1,215,623 1,086,022 941,593 3,374

Total non-current assets 1,244,745 1,125,746 1,011,309 86,253

CURRENT ASSETS

Inventories 6,400 5,493 5,199 5,044

Trade receivables 88,801 155,291 203,713 451,537

Prepayments, other receivables

and other assets 440,526 544,576 644,196 515,762