incometrustone.com

we take another approach

Capital Direct I Income Trust

Confidential Offering Memorandum

March 29, 2024

This Offering Memorandum is confidential. By their acceptance hereof, prospective investors agree that they will not transmit,

reproduce or make available to anyone this Offering Memorandum or any information contained herein.

FORM 45-106F2

Offering Memorandum for Non-Qualifying Issuers

Date March 29, 2024

The Issuer

Name Capital Direct I Income Trust (the “Trus

t

”)

Head Office Suite 305, 555 West 8th Avenue

Vancouver, B.C. V5Z 1C6

Phone # (604) 430-1498

Website Address: www.incometrustone.com

E-mail Address: [email protected]

Fax #: (604) 430-3287

Currently listed or Quote

d

These securities do not trade on any exchange or market.

Reporting issue

r

The Trust is not a reporting issuer.

SEDAR+ file

r

The Trust is not a SEDAR+ filer.

The Offering

Securities offered Trust Units (the “Units”) designated as either Class A, Class C or Class F (each, a “Class”)

Price per security $10 per Uni

t

Minimum/Maximum Offering There is no minimum. You may be the only purchaser. Maximum Offering: $975,000,000

Funds available under the Offering may not be sufficient to accomplish our proposed objective.

Minimum Subscription amoun

t

$5,000

Payment terms Bank draft or certified cheque on Closing. See “Securities Offered – Subscription for Units – Subscription

Procedure” for payment details.

Proposed closing date(s) Continuous Offering until the Maximum Offering is achieved. Closings may occur from time to time as

subscriptions are received.

Income Tax consequences There are important tax consequences to these securities. See “Income Tax Consequences and Certain

Deferred Plan Eligibility”.

Connected Issuer The Trust, the manager of the Trust, Capital Direct Management Ltd. (the “Manager”), Capital

Direct Lending Corp. (the “Mortgage Broker”) (including Capital Direct Atlantic Inc., a subsidiary

controlled by the Mortgage Broker) and Capital Direct II Management Ltd. ("Capital Direct II"),

an inactive, wholly-owned subsidiary of the Mortgage Broker, which is a party to the Loan

Agreement, as defined below, are “connected issuers”, and are “related issuers” of Capital Direct

Financial Ltd. (“CDFL”), as such terms are defined in National Instrument 33-105 – Underwriting

Conflicts (in Québec, Regulation 33-105 respecting Underwriting Conflicts). The Trust, the

Manager, the Mortgage Broker and Capital Direct II have determined that they are connected

issuers and may be related issuers of CDFL by virtue of CDFL’s role as an exempt market dealer

engaged to sell Class A Units and Class C Units offered hereby and based on the fact that the

Manager, the Mortgage Broker, Capital Direct II and CDFL have common directors, officers and

securityholders. In addition, the Trust is managed by the Manager and its activities are overseen

by a Board of Governors consisting of five persons, three of whom are also directors, officers and

securityholders of the Manager, the Mortgage Broker, Capital Direct II and CDFL. See “Risk

Factors – Conflicts of Interest” and “Board of Governors, Management, Promoters and Principal

Holders – Management Experience”.

Compensation Paid to Sellers and

Finders

A person has received or will receive compensation for the sale of securities under this Offering. See

“Compensation Paid to Sellers and Finders”. There is no Selling Agent, however, the Manager reserves

the right to retain one or more selling agents or finders during the course of the Offering. Any sale of

Units must be conducted through a Dealer, which includes CDFL, an Exempt Market Dealer registered

in all of the Provinces and Territories of Canada (the “Jurisdictions”). The Manager will pay to CDFL,

and in its discretion, may pay to other Dealers, the following fees, which fees will be negotiated between

the Manager and the applicable Dealer, however, the maximum fee that the Manager is authorized to pay

to a Dealer, including CDFL is: (i) a commission equal to 1.5% of the gross proceeds received by the

Trust from the sale of Class A Units; and (ii) an ongoing Trailer Fee equal to 1.0% of the gross proceeds

received by the Trust from the sale of Class A Units and Class C Units made by the Trust through the

Dealer. CDFL may pay a commission of 0.3% to dealing representatives of CDFL who facilitate

purchases of Class A Units and Class C Units. No service fees are payable in respect of the Class F Units.

In addition, CDFL will be paid a monthly dealer services fee by the Manager in consideration for

performing dealer services in connection with prospectus exempt purchases made in the Jurisdictions.

Resale restrictions

You will be restricted from selling your securities for an indefinite period. However the Units are retractable as of the last Business Day (as defined below)

of every month, subject to certain restrictions and deferred sales charges. See “Resale Restrictions”.

- 2 -

Conditions on Repurchases

You will have a right to require the Trust to repurchase the securities from you, but this right is qualified by restrictions and fees. As a result, you

might not receive the amount of proceeds that you want. See "The Trust - Material Contracts – Summary of the Declaration of Trust – Redemption

of Units".

Purchasers’ rights

You have 2 (two) Business Days to cancel your agreement to purchase these securities. If there is a misrepresentation in this Offering Memorandum, you

have a right to damages or to cancel the agreement. See “Purchasers’ Rights”.

No securities regulatory authority or regulator has assessed the merits of these securities or reviewed this Offering Memorandum. Any

representation to the contrary is an offence. This is a risky investment. See “Risk Factors”.

TABLE OF CONTENTS

GLOSSARY ............................................................................................................................................................................. I

CANADIAN CURRENCY ..................................................................................................................................................... 1

MARKETING MATERIALS ................................................................................................................................................ 1

FORWARD-LOOKING INFORMATION........................................................................................................................... 1

USE OF AVAILABLE FUNDS .............................................................................................................................................. 1

Available Funds .................................................................................................................................................................... 1

Use of Available Funds ........................................................................................................................................................ 2

Reallocation .......................................................................................................................................................................... 2

THE TRUST ............................................................................................................................................................................ 2

Structure ............................................................................................................................................................................... 2

Investment ............................................................................................................................................................................ 3

Development of the Investment Portfolio ............................................................................................................................. 4

Long Term Objectives .......................................................................................................................................................... 7

Short Term Objectives and How We Intend to Achieve Them ............................................................................................ 9

Material Contracts ................................................................................................................................................................ 9

BOARD OF GOVERNORS, MANAGEMENT, PROMOTERS AND PRINCIPAL HOLDERS ................................. 20

Compensation and Securities Held ..................................................................................................................................... 20

Management Experience .................................................................................................................................................... 22

Penalties, Sanctions, Bankruptcy, Insolvency and Criminal or Quasi-Criminal Matters ................................................... 26

CAPITAL STRUCTURE ..................................................................................................................................................... 27

Long Term Debt ................................................................................................................................................................. 27

Prior Sales ........................................................................................................................................................................... 28

SECURITIES OFFERED ..................................................................................................................................................... 29

Terms of Securities ............................................................................................................................................................. 29

Subscription for Units ......................................................................................................................................................... 29

Trading and Resale Restrictions ......................................................................................................................................... 31

REPURCHASE REQUESTS ............................................................................................................................................... 32

INCOME TAX CONSEQUENCES AND CERTAIN DEFERRED PLAN ELIGIBILITY ........................................... 33

Taxation of the Trust .......................................................................................................................................................... 34

Taxation of Unitholders ...................................................................................................................................................... 35

Investment by Deferred Plans ............................................................................................................................................. 35

COMPENSATION PAID TO SELLERS AND FINDERS ................................................................................................ 36

RISK FACTORS ................................................................................................................................................................... 37

REPORTING OBLIGATIONS ........................................................................................................................................... 42

RESALE RESTRICTIONS .................................................................................................................................................. 42

Manitoba Resale Restrictions ............................................................................................................................................. 43

PURCHASERS’ RIGHTS .................................................................................................................................................... 43

Two Day Cancellation Right .............................................................................................................................................. 43

Rights of Action in the Event of a Misrepresentation ......................................................................................................... 43

FINANCIAL STATEMENTS .............................................................................................................................................. 47

GLOSSARY

The following terms appear throughout this Offering Memorandum. Care should be taken to read each term in the

context of the particular provision of this Offering Memorandum in which such term is used.

(a) “Affiliate” or “Affiliates” means two entities that are affiliated, as described in subsection 1(2) of the B.C.

Securities Act;

(b) “Alberta Real Estate Act” means the Real Estate Act (Alberta);

(c) “Alberta Securities Act” means the Securities Act (Alberta), with all amendments thereto in force from time

to time and any statutes that may be passed which have the effect of supplementing or superseding such

statute;

(d) “Associates” has the same meaning as in the B.C. Securities Act;

(e) “Audit Committee” means the audit committee of the Board of Governors;

(f) “Auditors” means MNP LLP, Chartered Professional Accountants;

(g) “Authorized Interim Investments” means such investments that are “qualified investments” for a trust

governed by a “registered retirement savings plan”, “registered education savings plan”, “tax-free savings

account” or “registered retirement income fund” as those terms are defined in subsection 146(1) of the Tax

Act, and may include shares, bonds, debentures, income trust units, notes, marketable securities and cash,

among other things;

(h) “B.C. Mortgage Brokers Act” means the Mortgage Brokers Act (British Columbia);

(i) “B.C. Securities Act” means the Securities Act (British Columbia);

(j) “Board of Governors” means the board named as such and established pursuant to the Declaration of Trust;

(k) “Business Day” means a day other than a Saturday, Sunday or any day on which the principal office of the

Trust’s bankers located in Vancouver, British Columbia is not open for business during normal banking

hours;

(l) “Calculation Date” means the last Business Day of March, June, September and December;

(m) “Capital Direct II” means Capital Direct II Management Ltd., a company validly existing under the laws of

the Province of British Columbia;

(n) “CDFL” means Capital Direct Financial Ltd., a company validly existing under the laws of the Province of

British Columbia;

(o) “CDOR Loan” means an advance in Canadian Dollars that bears interest at a rate based upon the CDOR

Rate;

(p) “CDOR Rate” means on any day the annual rate of interest which is the rate determined as being the greater

of (i) zero, and (ii) the arithmetic average of the quotations of all institutions listed in respect of the rate for

Canadian Dollar denominated bankers' acceptances for the relevant period displayed and identified as such

on the “Refinitiv CDOR Page” (as defined in the International Swap Dealer Association, Inc. definitions, as

modified and amended from time to time) as of approximately 10:15 A.M. (Vancouver time) on such day;

provided that if such rates are not available on the “Refinitiv CDOR Page” on any particular day, then the

CDOR Rate on that day shall be the average of the rates applicable to Canadian Dollar bankers' acceptances

for the relevant period quoted for customers in Canada by the Lenders as of approximately 10:15 A.M.

(Vancouver time) on such day;

- ii -

(q) “Closing” means a closing of the sale of Units and includes the Initial Closing and such other closings as the

Manager may determine from time to time;

(r) “Cost Sharing and Dealer Services Fee Agreement” means the dealer services and cost sharing agreement

entered into effective February 14, 2020 and amended and restated as of November 1, 2020, May 31 and

November 30, 2021 between CDFL and the Manager;

(s) “Credit Committee” means the credit committee of the Board of Governors;

(t) “Dealer” means a securities dealer or an exempt market dealer registered under the securities legislation of a

jurisdiction in Canada where the Offering Memorandum is filed or where the Offering is being made pursuant

to exemptions from the prospectus requirements available in those jurisdictions;

(u) “Declaration of Trust” means the Declaration of Trust dated June 23, 2006, as amended and restated on

December 8, 2006, February 20, 2007, May 12, 2008, July 14, 2014, January 27, 2016, April 28, 2017 and

January 15, 2022 creating the Trust under the laws of the Province of Ontario;

(v) “Deferred Plans” means registered retirement savings plans, registered retirement income funds, registered

education savings plans, tax-free savings accounts, registered disability savings plans and deferred profit

sharing plans;

(w) “Distribution Payment Date” means in respect of a distribution to the Unitholders, for the first three calendar

quarters of a year, by the 15th day of the month following the Calculation Date for such calendar quarter,

and for the fourth quarter of a year, by March 31 of the year following the Calculation Date for such calendar

quarter;

(x) “Exempt Market Dealer” means a person or company registered in the category of exempt market dealer

under National Instrument 31-103 – Registration Requirements, Exemptions and Ongoing Registrant

Obligations in Québec, Regulation 31-103 respecting Registration Requirements, Exemptions and Ongoing

Registrant Obligations) (collectively, “NI 31-103”);

(y) “Fiscal Year” means each consecutive period of twelve (12) months coinciding with the calendar year and

ending on December 31, provided however that the first Fiscal Year of the Trust will be the period

commencing on June 23, 2006, and ending on December 31, 2006;

(z) “Forced Redemption” means a redemption by the Manager upon a Unitholder becoming a non-resident or a

“designated beneficiary” as defined in section 210 of the Tax Act;

(aa) “Income Participation” means, in respect of the Manager, a distribution in an amount equal to 20% of the

aggregate of Net Income and Net Realized Capital Gains;

(bb) “Initial Closing” means the initial Closing of the sale of the Units offered hereby;

(cc) “Lenders” means a syndicate of lenders led by Canadian Western Bank and their successors and assigns;

(dd) “Lenders’ Loan” means the committed revolving credit facility established by the Lenders for the purpose of

financing the day-to-day operations of the business in the ordinary course, including without limitation, to

fund Mortgages;

(ee) “Loan Agreement” means the $180,000,000 committed loan facilities amended and restated credit agreement

between the Lenders, the Trust, the Mortgage Broker, the Manager and Capital Direct II and Canadian

Western Bank as agent, pursuant to which the Lenders established the Lenders’ Loan;

(ff) “Manager” means Capital Direct Management Ltd., a company validly existing under the laws of the

Province of British Columbia;

- iii -

(gg) “Manager’s Fee” means the monthly management fee payable to the Manager equal to 1/12 of 2% (2% per

annum) of the Net Asset Value of the Trust, payable monthly in arrears, for the Class A Units and the Class

C Units and the monthly management fee payable to the Manager equal to 1/12 of 1% (1% per annum) of

the Net Asset Value of the Trust, payable monthly in arrears, for the Class F Units;

(hh) “Manitoba Securities Act” means The Securities Act (Manitoba);

(ii) “Mortgage” or “Mortgages” means a mortgage, a mortgage of a mortgage or a mortgage of a leasehold

interest (or other like instrument, including an assignment of or an acknowledgement of an interest in a

mortgage), hypothecation, deed of trust, charge or other security interest of or in Real Property used to secure

obligations to repay money by a charge upon the underlying Real Property;

(jj) “Mortgage Broker” means Capital Direct Lending Corp., a company validly existing under the laws of the

Province of British Columbia;

(kk) “Mortgage Broker Agreement” means the agreement dated January 15, 2007 as amended August 21, 2007

and as amended and restated on August 31, 2007, between the Mortgage Broker and the Manager, pursuant

to which the Mortgage Broker will provide its services to the Manager;

(ll) “Net Asset Value” means, on a Valuation Day, the aggregate carrying value of the Trust Property plus

accrued interest on Mortgages on such Valuation Day, less any allowances for impairment losses recorded

against investments in Mortgages;

(mm) “Net Asset Value Per Unit” means, on a Valuation Day, the quotient obtained by dividing the amount equal

to the Net Asset Value on such Valuation Day by the total number of Units, including fractions of Units, then

outstanding;

(nn) “Net Income” of the Trust for a calendar year is equal to the Trust’s income for the year that would be

determined under the Tax Act if:

(i) no amount were included or deducted in respect of capital gains and capital losses,

(ii) there were no gross-up in respect of taxable dividends from corporations resident in

Canada, and

(iii) no amounts were deducted in respect of amounts that became payable to Unitholders;

(oo) “Net Realized Capital Gains” of the Trust for a calendar year is equal to twice the amount, if any, by which

the Trust’s taxable capital gains for the year exceed the sum of:

(i) the Trust’s allowable capital losses for the year,

(ii) the Trust’s net capital losses for prior years which the Trust is permitted to deduct in

computing its taxable income for the year, and

(iii) expenses of the Trust that would otherwise be deductible in arriving at the Trust’s taxable

income for the year, to the extent determined by the Manager,

provided that if there is a change to the percentage of capital gains included in income, the two times factor

will thereafter equal the reciprocal of the new percentage and other amounts referred to in this definition will

be adjusted, to the extent necessary;

(pp) “New Brunswick Securities Act” means the Securities Act (New Brunswick), with all amendments thereto

in force from time to time and any statutes that may be passed which have the effect of supplementing or

superseding such statute;

- iv -

(qq) “Newfoundland and Labrador Securities Act” means the Securities Act (Newfoundland and Labrador), with

all amendments thereto in force from time to time and any statutes that may be passed which have the effect

of supplementing or superseding such statute;

(rr) “Northwest Territories Securities Act” means the Securities Act (Northwest Territories), with all amendments

thereto in force from time to time and any statutes that may be passed which have the effect of supplementing

or superseding such statute;

(ss) “Nova Scotia Securities Act” means the Securities Act (Nova Scotia), with all amendments thereto in force

from time to time and any statutes that may be passed which have the effect of supplementing or superseding

such statute;

(tt) “Nunavut Securities Act” means the Securities Act (Nunavut), with all amendments thereto in force from

time to time and any statutes that may be passed which have the effect of supplementing or superseding such

statute;

(uu) “Offering” means the sale of Units to raise maximum gross subscription proceeds of $975,000,000;

(vv) “Ontario Mortgage Brokers Act” means the Mortgage Brokerages, Lenders and Administrators Act, 2006

(Ontario);

(ww) “Ontario Securities Act” means the Securities Act (Ontario), with all amendments thereto in force from time

to time and any statutes that may be passed which have the effect of supplementing or superseding such

statute;

(xx) “Ordinary Resolution” means a resolution consented to, in writing, by Unitholders holding more than 50%

of all outstanding Units entitled to vote on the matter at issue, or approved by at least 50% of the votes cast

by such Unitholders present in person or by proxy at a meeting of Unitholders which has been duly called

and at which a quorum is present, as provided herein;

(yy) “Person” means any individual, partnership, limited partnership, joint venture, syndicate, sole proprietorship,

company or corporation with or without share capital, unincorporated association, trust, trustee, executor,

administrator or other legal personal representative, regulatory body or agency, government or governmental

agency, authority or entity however designated or constituted;

(zz) “Prime Lending Rate” means the floating rate of interest announced from time to time as Canadian Western

Bank’s prime lending rate for loans denominated in Canadian dollars, adjusted automatically upon any

change by Canadian Western Bank;

(aaa) “Prime Rate Loan” means an advance in Canadian Dollars that bears interest at the Prime Lending Rate;

(bbb) “Prince Edward Island Securities Act” means the Securities Act (Prince Edward Island), with all amendments

thereto in force from time to time and any statutes that may be passed which have the effect of supplementing

or superseding such statute;

(ccc) “Québec Securities Act” means the Securities Act (Québec), with all amendments thereto in force from time

to time and any statutes that may be passed which have the effect of supplementing or superseding such

statute;

(ddd) “Real Property” means land, rights or interest in land (including without limitation leaseholds, air rights and

rights in condominiums, but excluding Mortgages) used for residential purposes and any buildings,

structures, improvements and fixtures located thereon;

(eee) “Redemption” means a redemption of Units by the Trust;

(fff) “Retraction” means a redemption of Units by a Unitholder;

- v -

(ggg) “Return” means, in respect of the Unitholders, a distribution in an amount equal to 80% of the aggregate of

Net Income and Net Realized Capital Gains;

(hhh) “Saskatchewan Securities Act” means the Securities Act, 1988 (Saskatchewan), with all amendments thereto

in force from time to time and any statutes that may be passed which have the effect of supplementing or

superseding such statute;

(iii) “Services Agreement” means the services agreement dated November 7, 2012 between the Manager and

SGGG pursuant to which SGGG provides unitholder record-keeping services to the Manager in relation to

the Trust;

(jjj) “SGGG” means SGGG Fund Services Inc.;

(kkk) “Special Resolution” means a resolution consented to, in writing, by Unitholders holding more than 75% of

all outstanding Units entitled to vote on the matter at issue, or approved by at least 75% of the votes cast by

such Unitholders present in person or by proxy at a meeting of Unitholders which has been duly called for

that purpose and at which a quorum is present, as provided herein;

(lll) “Subscriber” means a subscriber for Units;

(mmm) “Subscription Form” means the subscription form to subscribe for Units;

(nnn) “Subscription Price” means $10.00 per Unit;

(ooo) “Tax Act” means the Income Tax Act (Canada), R.S.C. 1985 (5th Supp.) c.l, as amended from time to time;

(ppp) “Term” means, the period of time from date of issue to the Termination Date of the Units;

(qqq) “Termination Date” means the termination date of the Trust, being the earlier of (i) 25 years from the date of

the Declaration of Trust (January 15, 2047), and (ii) the date on which the Trust is otherwise terminated in

accordance with its terms;

(rrr) “Trailer Fee” means the fee paid by the Manager from time to time following the Closing in respect of Class

A Units and Class C Units sold under this Offering, as more particularly described in the section entitled

“Compensation Paid to Sellers and Finders”;

(sss) “Trust” means Capital Direct I Income Trust, a trust created pursuant to the Declaration of Trust;

(ttt) “Trust Property” means:

(i) all monies, securities, property, assets and investments paid or transferred to and accepted by or in

any manner acquired by the Trustee and held by the Trustee on the trust herein declared,

(ii) all income which may hereafter be accumulated under the powers herein contained, and

(iii) all monies, securities, property, assets or investments substituted for or representing all or any part

of the foregoing,

less any monies, securities, property, assets or investments distributed, expended, sold, transferred or

otherwise disposed of in accordance with the provisions hereof;

(uuu) “Trustee” means Computershare Trust Company of Canada, the trustee named under the Declaration of Trust;

(vvv) “Unanimous Resolution” means a resolution consented to, in writing, by all Unitholders entitled to vote on

the matter at issue, or approved by 100% of the votes cast by Unitholders present in person or by proxy at a

meeting of such Unitholders which has been duly called for that purpose and at which a quorum is present,

as provided herein;

- vi -

(www) “Unit” means a unit of beneficial interest in the Trust and includes any Class A Unit, Class C Unit or Class

F Unit and “Units” means Class A Units, Class C Units and Class F Units;

(xxx) “Unitholders” means those investors whose subscriptions to purchase Class A Units, Class C Units or Class

F Units offered by this Offering Memorandum are accepted by the Trust and thereafter at any particular time

the persons are entered in the register or registers of the Trust as holders of Units and the singular form means

one such registered holder;

(yyy) “Valuation Day” means the last Business Day of each calendar month or any other day on which the Manager

determines valuation is necessary; and

(zzz) “Yukon Securities Act” means the Securities Act (Yukon), with all amendments thereto in force from time

to time and any statutes that may be passed which have the effect of supplementing or superseding such

statute.

CANADIAN CURRENCY

All dollar amounts in this Offering Memorandum, unless otherwise indicated, are expressed in Canadian currency.

MARKETING MATERIALS

In addition to and apart from this Offering Memorandum, the Trust may utilize certain marketing materials in

connection with the Offering, including an executive summary of certain of the material set forth in this Offering

Memorandum. This material may include fact sheets and investor sales promotion brochures, question and answer

booklets, and presentations. All such marketing materials are specifically incorporated by reference into and form an

integral part of this Offering Memorandum. All such marketing materials will be made reasonably available to

prospective purchasers of Units.

Any statement contained in a document incorporated or deemed to be incorporated by reference herein will be deemed

to be modified or superseded for the purposes of this Offering Memorandum to the extent that a statement contained

herein modifies or supersedes such statement. The modifying or superseding statement need not state that it has

modified or superseded a prior statement or include any other information set forth in the document that it modifies

or supersedes. The making of a modifying or superseding statement will not be deemed an admission for any purposes

that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a

material fact or an omission to state a material fact or that is necessary to make another statement not misleading. Any

statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of

this Offering Memorandum.

FORWARD-LOOKING INFORMATION

Prospective Subscribers should be aware that certain statements used in this Offering Memorandum constitute

forward-looking information. Forward-looking information often, but not always, is identified by the use of words

such as “seek”, “anticipate”, “believe”, “plan”, “estimate”, “expect” and “intend” and statements that an event or result

“may”, “will”, “should”, “could” or “might” occur or be achieved or other similar expressions. Forward-looking

information includes, but is not limited to, use of proceeds, regulatory environment and appetite for borrowing, long

and short term objectives, renewal of Mortgage portfolio, additional issuance of Units, acceptance of subscriptions,

investment of proceeds, payment of compensation to Dealers, geographic diversification of Mortgage portfolio and

payment of returns. The forward-looking information that is contained in this Offering Memorandum involve a

number of risks and uncertainties. Should one or more of the risks materialize or should assumptions underlying the

forward-looking statements prove incorrect, actual events or results might differ materially from events or results

projected or suggested in this forward-looking information. Some of these risks and uncertainties are identified under

the heading “Risk Factors”. Additional information regarding these factors and other important factors that could

cause actual events or results to differ materially may be referred to as part of the particular forward-looking

information. Neither the Trust nor the Manager intends, and do not assume any obligations, to update the forward-

looking information.

USE OF AVAILABLE FUNDS

Available Funds

The Trust sells Units on a continuous basis with Closings of this Offering occurring monthly on the last Business Day

of the month in which the subscriptions are received, and at such other times as the Manager may determine. The

available funds will be invested in Mortgages and used for expenses associated with the making of the investments

and the general operation of the Trust. All sales commissions or fees paid to Dealers in connection with the Offering

will be paid by the Manager. The ongoing expenses of the Trust will be primarily the Manager’s Fee, the Manager’s

Income Participation, the annual fee payable to the Trustee pursuant to the Declaration of Trust, fees payable to SGGG

as registrar and transfer agent, fees payable to SGGG pursuant to the Services Agreement, payments to the Mortgage

Broker under the Mortgage Broker Agreement, legal and accounting expenses in connection with the ongoing

operation of the Trust and other Trust related matters, such as meetings of and reporting to Unitholders, Offering

- 2 -

expenses, which will be paid by the Trust and other general and administrative expenses. Investments in Mortgages

will be made as set out in “The Trust – Long Term Objectives – Investment Policies”. Pending investment in

Mortgages, the net proceeds will be invested in Authorized Interim Investments. The Manager will invest the available

funds of this Offering in Mortgages as suitable opportunities arise.

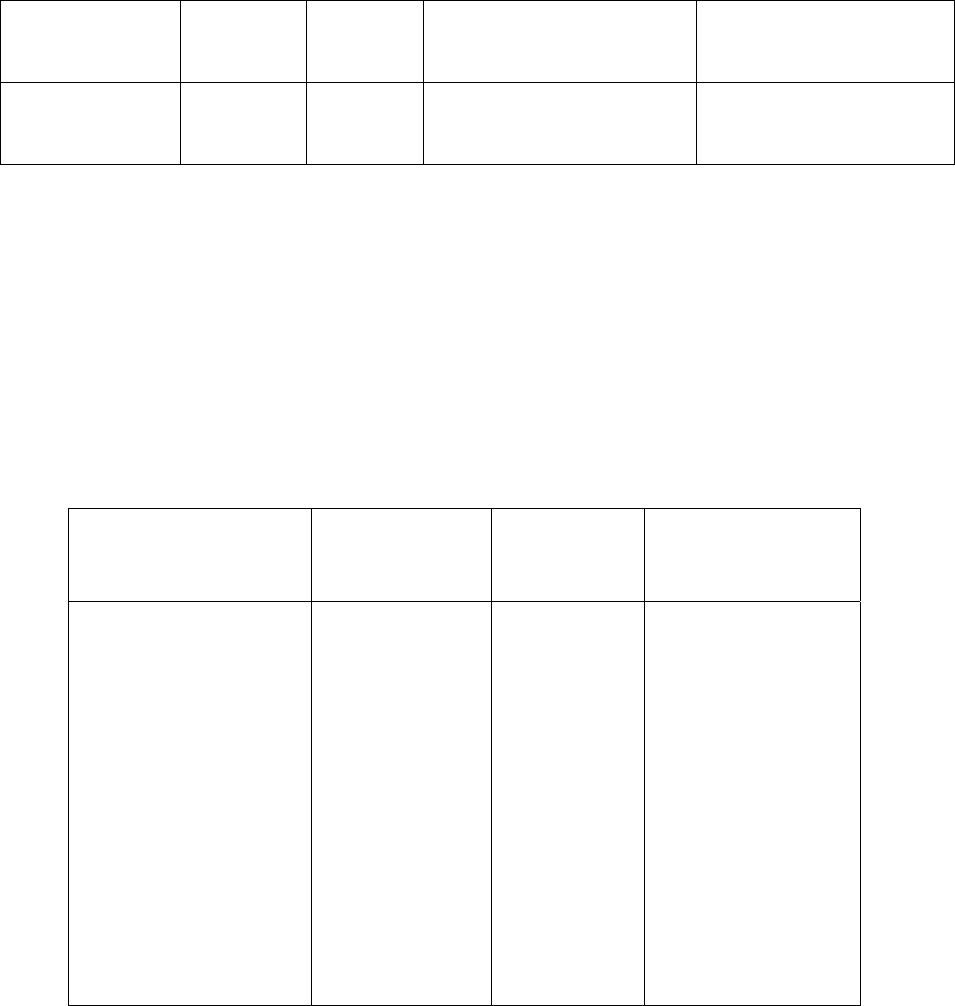

Assuming min. Offering Assuming max. Offering

A Amount to be raised by this Offering $0 $975,000,000

(1)

B Selling commissions and fees $0

(2)

$0

(2)

C Estimated Offering costs (e.g., legal,

accounting and audit)

$0 $0

D Net Proceeds: D = A – (B+C) $0 $975,000,000

E Additional sources of funding required $0 $0

F Working capital deficiency

(3)

$0 $0

G Total: G = (D+E) – F $0 $975,000,000

(1) Although the Trust is authorized to raise a maximum of $975,000,000, the Trust anticipates raising $50,000,000 in the

next 12 months.

(2) The Trust will be selling the Units through Dealers, including CDFL, an Exempt Market Dealer in the Jurisdictions. The

Manager will pay to CDFL, and in its discretion, may pay to other Dealers, the following fees, which fees will be

negotiated between the Manager and the applicable Dealer, however, the maximum fee that the Manager is authorized to

pay to a Dealer, including CDFL is: (i) a commission equal to 1.5% of the gross proceeds received by the Trust from the

sale of Class A Units; and (ii) an ongoing Trailer Fee equal to 1.0% of the gross proceeds received by the Trust from the

sale of Class A Units and Class C Units made by the Trust through the Dealer. No service fees are payable in respect of

the Class F Units, which are intended for fee-based accounts. In addition, CDFL will be paid a monthly dealer services

fee by the Manager in consideration for performing dealer services in connection with prospectus exempt purchases made

in the Jurisdictions. See “Compensation Paid to Sellers and Finders”.

(3) Amounts drawn from time to time on the Lenders’ Loan are not included in calculating working capital deficiency. The

Lenders’ Loan is a committed revolving credit facility used to manage cash flows and as part of the investment program.

It is regularly utilized to make Mortgage loans and to pay expenses in advance of receiving proceeds of Mortgage

repayments and sales and from the proceeds of the sale of Units and hence fluctuates regularly.

Use of Available Funds

Description of intended use of available funds

listed in order of priority

Assuming min. Offering

Assuming max. Offering

(1)

Investment in Mortgages and Working Capital $0 $975,000,000

(1) Although the Trust is authorized to raise a maximum of $975,000,000, the Trust anticipates raising $50,000,000 in the

next 12 months.

Reallocation

We intend to spend the available funds as stated. We will reallocate funds only for sound business reasons.

THE TRUST

Structure

The Trust is an open-end investment trust created under the laws of the Province of Ontario on June 23, 2006.

- 3 -

Although the Trust is qualified as a “mutual fund trust” as defined by the Tax Act, the Trust will not be a “mutual

fund” as defined by applicable securities legislation because the Units are not redeemable on demand or within a

specified period after demand for an amount computed by reference to the value of the proportionate interest in the

whole or in part of the net assets. Units are retractable as of the last Business Day of every month (the “Retraction

Date”) on not less than 21 days notice by the Unitholder at the Net Asset Value Per Unit, plus any accrued and unpaid

Return.

There are three classes of Units (Class A, Class C and Class F) being offered for sale by the Trust pursuant to this

Offering Memorandum. Each Unit within a particular class will be of equal value, however, the value of a Unit in

one class may differ from the value of a Unit in another class. The attributes and characteristics of each Class are

described under the heading “Securities Offered – Terms of Securities”.

The address of the Trust is Suite 305, 555 West 8th Avenue, Vancouver, British Columbia, V5Z 1C6.

Computershare Trust Company of Canada is the trustee (“Trustee”) under the Declaration of Trust. The Manager is

the manager of the Trust under the Declaration of Trust. The principal place of business for the Trustee is located at

800, 324 – 8th Avenue S.W., Calgary, Alberta, T2P 2Z2. The principal place of business of the Manager is located

at Suite 305, 555 West 8th Avenue, Vancouver, British Columbia, V5Z 1C6, and the registered office of the Manager

is located at 2500 Park Place, 666 Burrard Street, Vancouver, British Columbia, V6C 2X8.

Investment

The Trust has been created for the purpose of generating a target quarterly return equal to 80% of the aggregate of Net

Income and Net Realized Capital Gains from interests acquired in a portfolio of, primarily, residential Mortgages.

These Mortgages may be either first position or subsequent ranking Mortgages. The Mortgages to be invested in by

the Trust are a common form of financing within the real estate industry. The underlying Real Property for the

Mortgages will be located in Canada. The Trust may from time to time invest in Mortgages securing more than one

property, which are owned by the same mortgagor, or different mortgagors. In certain circumstances, the Trust may

take alternate or additional security, such as a general security agreement over a mobile home or other personal

property.

The Trust may acquire interests in Mortgages by way of participation agreements. The standard documentation used

with respect to Mortgages will provide that, in the event of a failure by the mortgagor to pay any amount owing under

a Mortgage, the mortgagees will be entitled to enforce the Mortgage in accordance with applicable law. In the event

of a failure by a mortgagor to make a monthly payment of interest or principal, the mortgagees will immediately

communicate with the mortgagor and, failing prompt rectification, will issue a notice of its intent to exercise such

remedy or remedies available to the mortgagees, which the Manager considers appropriate. All legal costs, costs

related to registration of Mortgages and costs relating to obtaining appraisals of Real Property, as allowed by law, will

be for the account of the mortgagors.

It is the intention of the Manager that the net subscription proceeds will be invested as quickly as is reasonably possible

in Mortgages. Pending such investment in Mortgages, cash on hand will be invested in Authorized Interim Investments

only. The Manager may, from time to time, sell investments in Mortgages and reinvest the proceeds or exchange such

investments for other investments in Mortgages. After each Closing, the Manager may establish one or more interest-

bearing accounts for purposes of holding cash of the Trust until so invested.

The Manager has retained the services of the Mortgage Broker to acquire interests in Mortgages and make loans

secured by Mortgages for the Trust. The Manager is responsible for carrying out all the transactions of the Trust,

supervising the investment and Mortgage portfolio of the Trust and for providing management services for the Trust.

See “Board of Governors, Management, Promoters and Principal Holders – Management Experience – The Mortgage

Broker”.

The Mortgage Broker is active in the non-bank real estate lending industry in British Columbia, Alberta and Ontario.

It identifies potential transactions principally through direct to market advertising and, to a lesser extent, through a

network of mortgage brokers, repeat borrowers and its reputation. The Mortgage Broker seeks out, reviews and

presents to the Trust, Mortgage investment opportunities which are consistent with the investment and operating

- 4 -

policies and objectives of the Trust and services such Mortgages on behalf of the Trust. All properties are evaluated

on the basis of location, quality and marketability. In addition, the credit of the borrower and stated income is also

reviewed and, often, personal covenants are obtained from the principals of corporate borrowers. Since 1997, the

Mortgage Broker has successfully originated, underwritten and serviced Mortgage investments aggregating raising

$2.38 billion as of December 31, 2023, and as of such date is placing between $200 million and $260 million in

Mortgages annually and directly administered approximately $449 million in Mortgages on behalf of numerous

investor clients and financial institutions.

The Mortgage Broker will reduce the risks associated with defaulting Mortgages through extensive initial due

diligence and careful monitoring of the Trust’s Mortgage portfolio, active communication with borrowers, the

institution of systemized enforcement procedures on defaulting Mortgages and by turning over the portfolio through

sales. The Mortgage Broker monitors the performance of the Trust’s Mortgage portfolio, including tracking the status

of outstanding payments due, grace periods and due dates, and the calculation and assessment of other applicable

charges. Each member of management of the Mortgage Broker has extensive knowledge and understanding of the

Mortgage and real estate industries that has enabled him to make prudent investment decisions and identify sound

investment opportunities.

Development of the Investment Portfolio

Since its inception in 2006, the Trust has raised capital through private placement Offerings using various prospectus

exemptions including the offering memorandum exemption (the “OM Exemption”) set out in section 2.9 of National

Instrument 45-106 – Prospectus Exemptions (in Québec, Regulation 45-106 respecting Prospectus Exemptions)

(collectively, “NI 45-106”).

Portfolio Summary

As of December 31, 2023, the Trust’s Mortgage portfolio consisted of 2074 Mortgage investments with a combined

net balance of $395 million. The Mortgages mature between 2024 and 2026 and rank in position of collateral from

first to third. Mortgages bear interest at rates ranging between 4.25% and 26% and bear interest at a weighted average

rate of 9.96%. The majority of Mortgage investments are on Real Properties located in British Columbia, Alberta and

Ontario. As of December 31, 2023, the weighted average loan to value (LTV) of the investments was 52.46% LTV.

The average LTV ratio of the Mortgages is calculated for each Mortgage by dividing the total principal amount of the

Mortgage and all other loans ranking in equal or greater priority to the Mortgage by the fair market value of the

property. The weighted average is weighted by the principal amount of each Mortgage.

The Trust invests in senior (1st) Mortgages and in junior (2nd) Mortgages in British Columbia, Alberta, Ontario and

Atlantic Canada, where management feels there is a definable active real estate market. The Mortgage investments of

the Trust relate to Real Property located in British Columbia, Alberta, Ontario and Atlantic Canada. Of the 2074

($395 million) Mortgages, 806 ($175 million) or 44% are in British Columbia, 259 ($43 million) or 11% are in Alberta,

869 ($156 million) or 40% are in Ontario and 140 ($21 million) or 5% are in Atlantic Canada. Mortgage loans are

considered on a case-by-case basis recognizing that the amount of the Mortgage will vary in relation to the value of

the property. The Trust intends to continue to diversify geographically by making investments in Mortgages on Real

Property in areas of Canada where prevailing economic conditions are favourable.

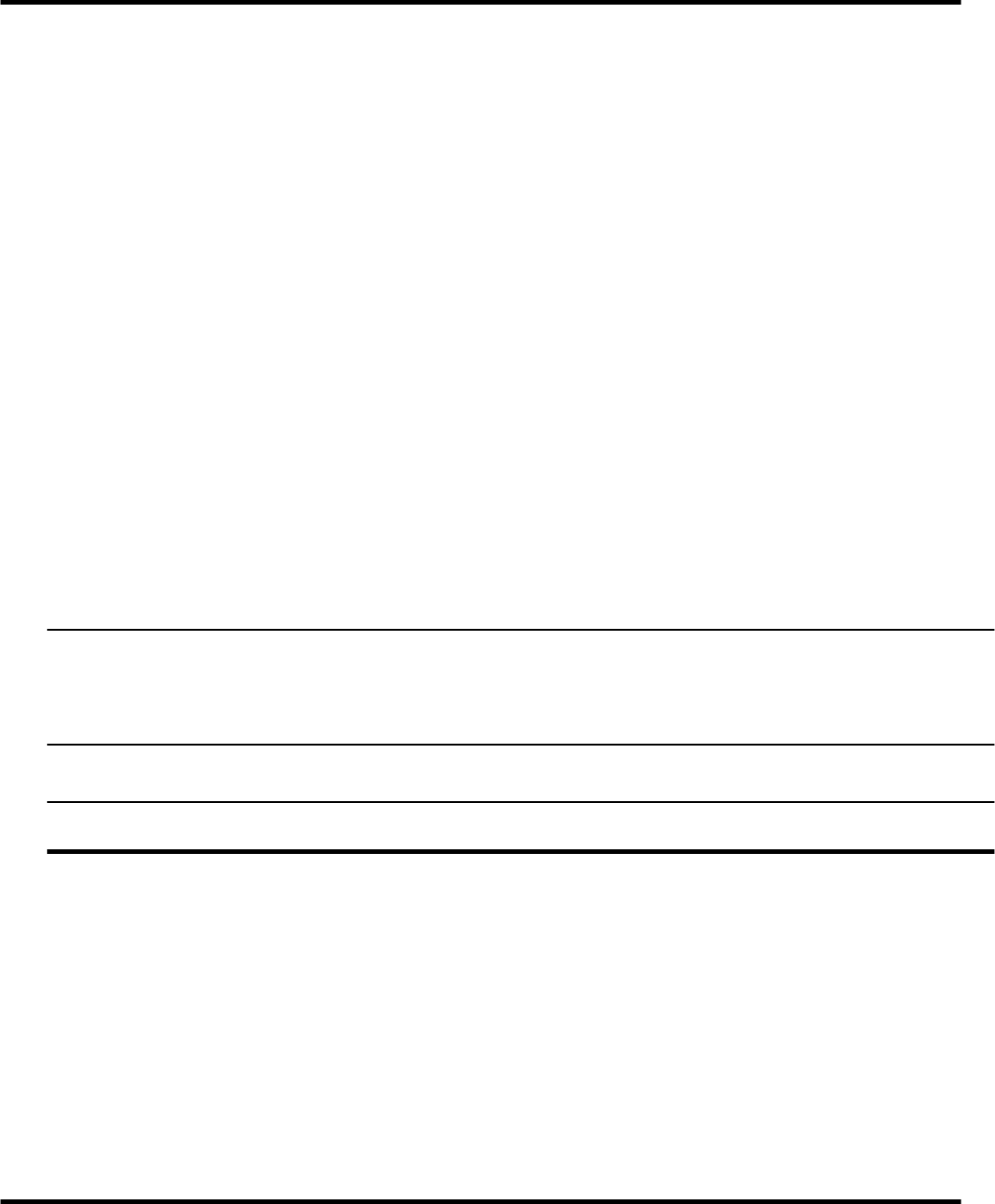

The following table illustrates the dollar value of Mortgages held by the Trust as of December 31, 2022 and December

31, 2023:

December 31,

2022

December 31,

2023

Mortgages $364,338,645 $395,457,663

The following table provides a description of the Trust's Mortgage portfolio as at December 31, 2023 by type of

mortgage, nature of the underlying property, and location of the underlying property:

- 5 -

December 31, 2023

Description

# of

Mortgages

Principal

Amount

% of

Portfolio

Weighted

Average

Interest Rate

Type of Mortgage

First Priorit

y

657 $218,542,791 55.3% 9.27%

Second Priorit

y

1351 $169,975,660 43.0% 12.31%

Third or Lower Priority 66 $6,939,212 1.7% 14.94%

Total 2074 $395,457,663 100.00% 10.63%

Nature of Underlying Property

Residential 2074 $395,457,663 100% 10.63%

Commercial 0 $0 0% 0%

Total 2074 $395,457,663 100.00% 10.63%

Location of Underlying Property

British Columbia 806 $174,866,416 44.0% 10.80%

Alberta 259 $43,311,111 11.0% 10.56%

Atlantic 140 $20,857,055 5.0% 11.23%

Ontario 869 $156,423,081 40.0% 10.39%

Total 2,074 $395,457,663 100.00% 10.63%

The following table provides a description of the Mortgages as at December 31, 2023 that are overdue on payments

or have an impaired value:

December 31, 2023

Description

# of

Mortgages

Outstanding

Amount

% of

Portfolio

Weighted

Average Gross

Interest Rate

Payment more than 90 days overdue

56 $18,140,294 4.59% 10.89%

Mortgages that have an impaired

value

0 $0 0% 0%

Mortgages with financial

accommodations

0 $0 0% 0%

The average credit score of the borrowers, weighted by the principal amount of the Mortgages, is 620 for the main

applicants and 655 for the main applicants and co-applicants.

No Mortgage comprises 10% or more of the total principal amount of the Trust's Mortgages.

Portfolio Performance

The table below shows the portfolio performance for the last 10 years. The performance is calculated by dividing net

income for the year by the net mortgage portfolio balance.

- 6 -

2013 2014 2015 2016 2017 2018

Mort

g

a

g

e Balance $36,139,391 $53,633,836 $88,672,929 $147,121,047 $165,613,676 $182,156,694

Net Income $1,536,217 $2,197,504 $3,691,507 $7,339,429 $10,279,629 $13,315,679

Return on Portfolio 4.25% 4.10% 4.16% 4.99% 6.21% 7.31%

2019 2020 2021 2022 2023

Mort

g

a

g

e Balance $200,483,054 $259,760,322 $334,981,715 $364,338,646 $395,457,663

Net Income $15,372,537 $16,193,008 $17,564,199 $21,397,295 $26,423,407

Return on Portfolio 7.67% 6.23% 5.24% 5.87% 6.68%

Ongoing Disclosure

The Trust makes available annual audited financial statements on the Trust’s website at www.incometrustone.com on

or before April 30 of each calendar year. In addition, the Trust provides to the Trustee and makes reasonably available

to each Unitholder, interim financial statements within 60 days of the end of the interim period and provides

Unitholders with quarterly statements reflecting their investment in the Trust. See “Reporting Obligations”.

Conflicts of Interest

As described more thoroughly under "Risk Factors – Conflicts of Interest", the Manager, the Mortgage Broker, CDFL

and Capital Direct II are related parties and the directors, officers and the securityholders of the Manager, the Mortgage

Broker, CDFL and Capital Direct II are the same individuals. The Manager and the Mortgage Broker are parties to

the Mortgage Broker Agreement, pursuant to which the Manager has retained the services of the Mortgage Broker to

acquire interests in Mortgages and make loans secured by Mortgages for the Trust. The Mortgage Broker seeks out,

reviews and presents to the Trust, Mortgage investment opportunities which are consistent with the investment and

operating policies and objectives of the Trust and services such Mortgages on behalf of the Trust. Any conflict of

interest between the Mortgage Broker and the Manager is mitigated by the fact that the Trust is governed by its own

Board of Governors that has certain independent members and that is required at all times to act in the best interests

of the Trust.

The following is the Trust’s distribution and return during the last two completed financial years:

2022:

Q1 Q2 Q3 Q4 Total

Net Income

allocated to

Unitholders

Class A

Class C

Class F

$1,285,342

(1)

$955,497

(1)

$1,705,931

(1)

$1,344,826

$1,103,703

$1,840,485

$1,409,198

$1,303,829

$1,957,046

$1,493,336

(2)

$1,428,187

(2)

$2,078,137

(2)

$5,532,702

(3)

$4,791,216

(3)

$7,581,599

(3)

Average

annualized rate

of return

Class A

Class C

Class F

6.04%

(1)

6.04%

(1)

7.04%

(1)

6.30%

6.30%

7.30%

6.56%

6.56%

7.56%

6.91%

(2)

6.91%

(2)

7.91%

(2)

6.45%

(3)

6.45%

(3)

7.45%

(3)

(1) The Board of Directors of the Manager unanimously agreed to waive 25% of the distribution to which it was entitled to

for the first quarter of the year ended December 31, 2022, which amount was distributed to Unitholders.

(2) The Board of Directors of the Manager unanimously agreed to waive 50% of the distribution to which it was entitled to

for the fourth quarter of the year ended December 31, 2022, which amount was distributed to Unitholders.

(3) The Manager agreed to waive 18% of the Income Participation it was entitled to during the year ended December 31,

2022, thereby increasing the distribution to Unitholders to 82%.

- 7 -

2023:

Q1 Q2 Q3 Q4 Total

Net Income

allocated to

Unitholders

Class A

Class C

Class F

$1,467,940

(1)

$1,337,968

(1)

$2,108,597

(1)

$1,625,681

$1,357,485

$2,336,922

$1,775,486

$1,500,012

$2,500,272

$1,867,529

(1)

$1,597,538

(1)

$2,699,587

(1)

$6,736,636

(2)

$5,793,003

(2)

$9,645,378

(2)

Average

annualized rate

of return

Class A

Class C

Class F

6.77%

(1)

6.77%

(1)

7.77%

(1)

7.40%

7.40%

8.40%

8.01%

8.01%

9.01%

8.33%

(1)

8.33%

(1)

9.33%

(1)

7.63%

(2)

7.63%

(2)

8.63%

(2)

(1) The Board of Directors of the Manager unanimously agreed to waive 25% of the distribution to which it was entitled to

for each of the first and fourth quarters of the year ended December 31, 2023, which amounts were distributed to

Unitholders.

(2) The Manager agreed to waive 20% of the Income Participation it was entitled to during the year ended December 31,

2023, thereby increasing the distribution to Unitholders to 84%.

The rate of return the Trust earns from its Mortgage investments fluctuates with prevailing market demand for short-

term Mortgage financing. In some cases the Trust’s Mortgage investments may not meet financing criteria for

conventional Mortgages from institutional sources, and as a result, these investments generally earn a higher rate of

return than that normally attainable from conventional Mortgage investments. The Trust attempts to minimize risk

by being prudent in its credit decisions and in assessing the value of the underlying Canadian real estate property

offered as security. The Mortgage Broker, on behalf of the Trust, will not offer a new renewal term for a Mortgage

unless an updated valuation of a property connected to a Mortgage is obtained, when the original appraisal was

obtained more than 38 months after origination. This valuation may be obtained from the tax assessed value, a

PurView online property valuation value, or an updated appraised value, depending on the LTV of the subject

property.

Long Term Objectives

General

The investment goal of the Trust is to make prudent investments in Mortgages, which provide financing for Real

Property situated in Canada to create stable returns for Unitholders with the potential to realize additional benefits

from favourable markets.

The objective for the Trust is to provide a simple and effective way for individual investors to participate in the

lucrative mortgage industry traditionally dominated by all major Canadian banks. Even though this type of investment

has outperformed many other vehicles in terms of capital preservation and returns, ‘pooled mortgage investments’ are

less widely known than other income producing vehicles. The Trust provides a viable addition to or alternative to

other vehicles for the fixed income component of a balanced portfolio.

Investment Policies

The following investment policies are applied by the Trust in selecting Mortgages:

(a) the Trust may invest in Mortgages which may be first or subsequent charges on the security of the

Real Property. The Trust does not intend to restrict itself to investing in senior (first) Mortgages

only and intends to also invest in junior Mortgages such as second and third Mortgages;

(b) regardless of the position of the Mortgages being junior or senior, the Trust will apply its usual level

of diligence on each Real Property as well as the borrower(s), guarantor(s) and covenantor(s) to

assure itself that the aggregate principal of the senior and junior Mortgages fall within the maximum

LTV ratio prescribed by the Trust;

- 8 -

(c) the Trust will invest only in Mortgages on the security of primarily residential Real Property situated

within Canada and once the Trust’s assets reach $10 million, no more than 5% of the Trust’s assets

will be invested in Mortgages on the same property;

(d) the Trust will not directly invest in Real Property, and will be subject to the investment requirements

that must be met for certain trusts, as set out below under paragraph (f). However, the Trust may

hold Real Property acquired as a result of foreclosure and will use its reasonable best efforts to

dispose of such Real Property acquired on foreclosure;

(e) unless approved by the Board of Governors, the Trust will not make loans to, nor invest in securities

issued by the Manager or its Affiliates nor make loans to the directors or officers of the Manager or

their Associates or the members of the Board of Governors;

(f) the Trust may not invest in any asset which in any way does not qualify as a “qualified investment”

as that term is defined in the Tax Act for a trust governed by a Deferred Plan or would disqualify

the Trust as such;

(g) the Trust may co-invest with a third party or third parties in a Mortgage;

(h) the Trust may invest in any Mortgage where the term of the Mortgage exceeds five years;

(i) unless approved by the Board of Governors, the Trust will not make or dispose of an investment in

any Mortgage where the Manager, any member of the Board of Governors, the Mortgage Broker,

any of their respective officers, directors or employees or any respective Affiliate thereof: (i) has or

expects to obtain, insofar as the Trust or any such aforementioned person is aware, directly or

indirectly, an interest in the transaction (except the Mortgage Broker’s fees and charges under the

Mortgage Broker Agreement); (ii) has at any time in the period of 24 months preceding the date of

the transaction had a direct or indirect material financial interest in the Real Property being

mortgaged, acquired or disposed of; or (iii) has an interest in any other Mortgage on the Real

Property being mortgaged, acquired or disposed of;

(j) when not invested in Mortgages, the funds of the Trust are to be placed in Authorized Interim

Investments;

(k) the Trust may only borrow funds in order to acquire or invest in specific Mortgage investments or

Mortgage portfolios in amounts up to the greater of $1,000,000 and 50% of the book value of the

Trust’s portfolio of Mortgages and at an interest rate less than the interest rate charged or yield

earned by the Trust on the overall portfolio of Mortgages; and

(l) the Trust may participate in Mortgages on a syndication basis, subject to the approval by the Credit

Committee of the investment amount and the proposed syndication partners.

The Trust’s Mortgages

The Mortgage Broker is continually renewing its portfolio of committed Mortgage investments, which will be

presented to the Trust from time to time for investment, in accordance with the Mortgage Broker Agreement.

Each of the Trust’s Mortgages will be registered on title against the underlying Real Property securing such Mortgage.

Legal title to each Mortgage will usually be held by and registered in the name of the Mortgage Broker or a wholly-

owned subsidiary of the Mortgage Broker, other than Mortgages held by another entity or other entities holding an

interest in such Mortgages jointly with or in trust for the Trust, with beneficial title to the Trust’s interest being held

by the Trust. Where legal title to a Mortgage is held by and registered in the name of an entity wholly-owned by the

Mortgage Broker, such entity may hold legal title to such Mortgage on behalf of the other beneficial owners of such

Mortgage. Where appropriate, title insurance is obtained. Any title insurance will be held in the name of the Mortgage

Broker and not the Trust.

- 9 -

Short Term Objectives and How We Intend to Achieve Them

The Trust’s objectives for the next 12 months are to raise $50,000,000 pursuant to this Offering, and invest all of the

Offering proceeds in Mortgages and loan securities after the payment of the Trust’s operating expenses.

Material Contracts

The following is a list of contracts which are material to this Offering and to the Trust:

(a) the Declaration of Trust creating the Trust under the laws of the Province of Ontario. See “The

Trust – Material Contracts – Summary of the Declaration of Trust”;

(b) the Mortgage Broker Agreement between the Mortgage Broker and the Manager with respect to the

provision of services by the Mortgage Broker to the Manager. See “The Trust – Material Contracts

– The Mortgage Broker Agreement”;

(c) the Loan Agreement between the Lenders, the Trust, the Mortgage Broker, the Manager and Capital

Direct II, pursuant to which the Lenders established a committed revolving operating loan credit

facility in favour of the Trust for the purpose of financing the investment operations of the Trust.

See “The Trust – Material Contracts – The Loan Agreement”;

(d) the Services Agreement between the Manager and SGGG pursuant to which SGGG provides

unitholder record-keeping services to the Manager in relation to the Trust. See “The Trust – Material

Contracts – The Services Agreement”;

(e) the Cost Sharing and Dealer Services Fee Agreement between the Manager and CDFL. See

“Compensation Paid to Sellers and Finders”; and

(f) the ATB ISDA Agreement. See “The Trust – Material Contracts – The ATB ISDA Agreement”.

Summary of the Declaration of Trust

The following is a summary of the provisions of the Declaration of Trust, which by its nature is not a comprehensive

description of all aspects of the Trust. Potential investors are encouraged to review the full text of the Declaration of

Trust, which is available on request from the Manager.

Redemption of Units

A Unitholder is entitled, as of the Retraction Date to make a request to the Trust to retract all or any of the Unitholder’s

Units in increments of not less than $5,000, by the Unitholder or the Dealer, as applicable, giving written notice or

notice by electronic means, as acceptable to the Manager, to the Manager not less than 21 days prior to the applicable

Retraction Date, of a specified number of Units to be redeemed by the Trust or the dollar amount which the Unitholder

requires to be paid. If a Unitholder elects to retract and holds Units with a value of $5,000 or less, the Unitholder must

retract all of his or her investment.

If more than one Retraction notice is given by a Unitholder in a calendar year, any additional Retraction by such

Unitholder, other than the first Retraction in a calendar year, will be subject to a $65 handling fee.

The Retraction proceeds payable for each Class A Unit retracted, prior to termination of the Trust, will be equal to the

Unitholder’s pro rata portion of the Return, plus the following amounts:

(a) if the Retraction occurs prior to the first anniversary of the acquisition by the Unitholder of such

Class A Units, 95% of the Net Asset Value per Class A Unit on the Retraction Date (Return + 95%

of Net Asset Value – handling fee, if applicable);

- 10 -

(b) if the Retraction occurs on or after the first anniversary but prior to the second anniversary of the

acquisition by the Unitholder of such Class A Units, 96% of the Net Asset Value per Class A Unit

on the Retraction Date (Return + 96% of Net Asset Value – handling fee, if applicable);

(c) if the Retraction occurs on or after the second anniversary but prior to the third anniversary of the

acquisition by the Unitholder of such Class A Units, 97% of the Net Asset Value per Class A Unit

on the Retraction Date (Return + 97% of Net Asset Value – handling fee, if applicable);

(d) if the Retraction occurs on or after the third anniversary but prior to the fourth anniversary of the

acquisition by the Unitholder of such Class A Units, 98% of the Net Asset Value per Class A Unit

on the Retraction Date (Return + 98% of Net Asset Value – handling fee, if applicable);

(e) if the Retraction occurs on or after the fourth anniversary but prior to the fifth anniversary of the

acquisition by the Unitholder of such Class A Units, 99% of the Net Asset Value per Class A Unit

on the Retraction Date (Return + 99% of Net Asset Value – handling fee, if applicable); and

(f) if the Retraction occurs on or after the fifth anniversary of the acquisition by the Unitholder of such

Class A Units, 100% of the Net Asset Value of the Class A Units on the Retraction Date (Return +

100% of Net Asset Value – handling fee, if applicable).

The Retraction proceeds payable for each Class C Unit or Class F Unit retracted, prior to termination of the Trust, will

be equal to the Unitholder’s pro rata portion of the Return, less, if the Retraction occurs on or prior to the 180

th

day

after the acquisition by the Unitholder of such Class C Units or Class F Units, a short term trading fee of 2%, which

will be paid into the Trust (Return + 100% Net Asset Value – 2% short term trading fee, if applicable, – handling fee,

if applicable). If the Retraction occurs after the 180

th

day following the acquisition by the Class C Unitholder of the

Class C Unit or the Class F Unitholder of the Class F Unit, or in the event of death or permanent infirmity of the Class

C Unitholder or Class F Unitholder (and for greater certainty, in the case of jointly held units, of both individuals

jointly holding such units ), the Unitholder of the Class C Unit or Class F Unit will receive 100% of the Net Asset

Value per Class C Unit or Class F Unit on the Retraction Date. Although the Declaration of Trust does not specifically

provide for a waiver of early Retraction fees in the event of the death or permanent infirmity of a Class A Unitholder,

the Manager would reasonably consider also waiving early Retraction fees in respect of Class A Unitholders in such

extraordinary circumstances. Notwithstanding the foregoing, in respect of any Units acquired by the Unitholder

pursuant to the reinvestment of distributions, the date of acquisition of such Units will be deemed to be the date of the

acquisition of the Units in respect of which the distribution was paid. Furthermore, no retraction fees will be payable

upon the Retraction of such Units and the Retraction proceeds payable on the Retraction of such Units will be equal

to 100% of the Net Asset Value Per Unit.

Retraction is subject to certain limitations, as follows:

(a) the obligation of the Trust to retract Units will be subject to the Manager determining in its sole

discretion, acting reasonably, that sufficient funds are available to the Trust for the purposes of

Retraction;

(b) unless otherwise determined by the Manager in its discretion, the aggregate Retraction proceeds to

be paid in respect of the Retraction of Units on any Retraction Date will not exceed 0.833%

(approximately 10% annually) of the Net Asset Value of the Trust on the applicable Retraction Date;

and

(c) unless the Manager has determined to permit a Retraction in excess of 0.833% of the Net Asset

Value of the Trust on the Retraction Date, if by any Retraction Date, the Trust has received notices

of Retraction requiring the Trust to pay aggregate Retraction proceeds in excess of 0.833% of the

Net Asset Value of the Trust on the Retraction Date, then the Retraction of Units will be made pro

rata according to the number of Units specified on the notices for Retraction to the maximum

number of Units subject to Retraction on the Retraction Date, and any Units not retracted will be

eligible for retraction on the next (successive) Retraction Date(s) without the necessity of submitting

a new Retraction notice.

- 11 -

Retractions will be funded out of the proceeds of the repayment in full or sale of Mortgages within the Mortgage

portfolio. Following the receipt of one or more Retraction notices, the Manager will, until the Retraction price in

respect of all Units to be retracted pursuant to such notice(s) has been paid in full, reserve funds for the purpose of

funding Retractions in an amount equal to the Retraction price. The Trustee or Manager on behalf of the Trustee will

pay the Retraction proceeds to Unitholders who have properly submitted Retraction notices up to the full amount of

the Retraction price for the Units to be retracted (after the exclusion of any Units in the circumstances contemplated

by paragraph (c) above) in the order such notices are received by the Manager until the Retraction price has been paid

in full or such proceeds are exhausted.

The Trustee or the Manager on behalf of the Trustee will pay the proceeds for the Units being retracted by the mailing

or delivery of a cheque or by electronic funds transfer in the relevant amount in Canadian funds determined as set out

in the Declaration of Trust (less any amount required to be withheld) to the Unitholder.

Redemption on Death of Unitholder

Upon the Manager being advised in writing of the death of a Unitholder and upon the Manager being provided with

the appropriate documentation in form satisfactory to the Manager, the Retraction of 100% of the Net Asset Value of

the Units will be processed by the Manager at the next Retraction Date if not sooner, subject to any applicable

retraction fees that are not waived by the Manager.

Redemption on Termination

The Trustee will redeem each Unit (“Redemption”) on the termination of the Trust. The proceeds payable for each

Unit to be redeemed pursuant to a Redemption will be equal to the Net Asset Value Per Unit plus the Unitholder’s pro

rata portion of the Return. Fractions of Units may be redeemed as a result of a Redemption. See “The Trust – Material

Contracts – Summary of the Declaration of Trust – Termination of the Trust” for further details on the termination

procedure.

Forced Redemption Upon Non-Residency

At no time may non-residents of Canada be the beneficial owners of Units. If a Unitholder becomes a non-resident

of Canada or otherwise becomes a “designated beneficiary” as defined in section 210 of the Tax Act, the Manager

may at its discretion, either forthwith redeem all or a part of the Units held by such Unitholder (a “Forced

Redemption”), or by written notice require the Unitholder to, within thirty (30) days, transfer the Units to a transferee

who is not a “designated beneficiary” as defined in section 210 of the Tax Act. However, in such situations the

transferability of the Units will be subject to resale restrictions under applicable securities laws. The redemption

proceeds payable for each Unit so redeemed will be the amount which would otherwise have been paid to the

Unitholder as if the Unitholder had given written notice to the Manager of the Retraction of his, her or its Units as

described above under “Redemption of Units”.

Transfers of Units

Units are not transferable, except in the circumstances resulting in Forced Redemption, or otherwise with the consent

of the Manager, which consent may be withheld for any reason or for no reason, and the Manager will have no

obligation to advise a Unitholder requesting a transfer of its reason for refusing to consent to the transfer.

Conversion of Units

Unitholders may convert Units of any class into Units of a different class in any given month by delivering notice of

such conversion to the Manager prior to the last Business Day in any month. Any conversion of a Class A or Class C

Unit to a Class F Unit would require the Unitholder to participate in a fee-based program, in respect of such converted

Class F Units, through an authorized third-party Dealer or broker who has signed an agreement with the Manager.

The Units surrendered for conversion will be converted on the last Business Day of that month. The Unitholder will

receive the number of Units the fair market value of which is equal to the fair market value of the Units to be converted,

both as determined at the time of conversion.

- 12 -

In the case of a conversion of Class A Units, the Unitholder will pay the applicable retraction fee as if such Class A

Units were redeemed at the time of conversion. If a Unitholder pays the applicable retraction fee upon conversion of

its Class A Units, the Unitholder shall not be required to pay any further retraction fees. In the case of a conversion of

Class C Units or Class F Units, the original retraction fees attached to such Units will continue to apply.

Net Asset Value

The Net Asset Value of the Trust and the Net Asset Value Per Unit will be computed by the Manager as at the close

of business on a Valuation Day. The number of Units, the carrying value of the Trust Property and the amount of any

allowances for impairment losses recorded against investments in Mortgages of the Trust shall be calculated by the

Manager subject to the following:

(a) the recorded value of any cash on hand, on deposit or on call, and prepaid expenses shall be the cost

amount thereof;

(b) the recorded value of any money market instruments shall be deemed to be cost plus accrued unpaid

interest;

(c) the recorded value of Mortgages shall be the unpaid principal amount thereof plus accrued unpaid

interest, net of any impairment loss recorded;

(d) all material expenses or liabilities (including fees payable to the Manager and the Mortgage Broker)

of the Trust shall be recorded on an accrual basis; and

(e) the amount of any undistributed income or Net Realized Capital Gains allocated to Units, but not

yet distributed on the Valuation Day, shall not be included in the assets of the Trust.

Powers and Duties of Trustee

The Trustee, subject to the specific limitations contained in the Declaration of Trust, has full, absolute and exclusive

power, control and authority over the assets of the Trust and over the investment and affairs of the Trust to the same

extent as if the Trustee was the sole owner thereof in its own right to do all such acts and things as in its sole judgment

and discretion are necessary or incidental to, or desirable for, the carrying out of any of the purposes of the Trust or

the investment of Trust assets.

Powers and Duties of Manager

The Declaration of Trust grants the Manager the full authority and responsibility to manage the investments and affairs

of the Trust, including all investment management, clerical, administrative, and operational services. The Trustee has

no responsibility for investment management of the Trust Property or for any investment decisions.

Resignation and Removal of the Trustee

The Trustee may resign or be removed by the Manager at any time by notice to the Unitholders and the Manager or

the Trustee, as applicable, not less than 60 days prior to the date that such resignation or removal is to take effect

provided that a successor trustee is appointed or the Trust is terminated.

Trustee’s Fee

For its services, the Trustee will receive an annual fee which shall be paid from the Trust (the

“Trustee’s Fee”). The amount and frequency of such payment of this annual fee will be settled by agreement between

the Trustee and the Manager. Unless other arrangements are agreed upon by the Manager, the Trustee will receive no

other compensation for its services as Trustee.

- 13 -

Manager’s Fee

In consideration for its services in managing the Trust, the Manager will be entitled to receive a Manager’s Fee for

each of the applicable classes of Units, as follows:

Class A: 1/12 of 2% (2% per annum) of the Net Asset Value of the Trust payable monthly in arrears.