Avalara AvaTax for

Microsoft Dynamics 365

for Finance and Operations

Test Drive

Avalara may have patents, patent applications, trademarks, copyrights,

or other intellectual property rights governing the subject matter in this

document. Except as expressly provided in any written license

agreement from Avalara, the furnishing of this document does not give

you any license to these patents, trademarks, copyrights, or other

intellectual property.

© 2018 Avalara, Inc. All rights reserved.

Avalara, AvaTax, Avalara Returns, Avalara CertCapture, AvaTax POS,

AvaPOS, AvaRates, TrustFile, BPObridge, Laserbridge+, Sales Taxll,

Sales TaxPC, SalestaxPC+, StatetaxII, and StatetaxPC are either

registered trademarks or trademarks of Avalara, Inc. in the United States

or other countries.

Contents

Introduction ........................................................................................................... 3

Setting up AvaTax .................................................................................................. 3

Initial Configuration ......................................................................................... 3

Ongoing Configuration and Maintenance ........................................................ 3

Avalara Address Validation .................................................................................... 4

Sales Tax Calculation .............................................................................................. 5

Avalara Tax Codes ............................................................................................ 5

Sales Orders ..................................................................................................... 6

Project Invoices ............................................................................................. 10

Consumers Use Tax Assessment .......................................................................... 14

Vendor Invoices ............................................................................................. 14

Conclusion ........................................................................................................... 17

Avalara AvaTax for Microsoft Dynamics 365 for Finance and Operations

Test Drive

© Avalara Inc. All rights reserved.

Page |

3

Introduction

Thank you for trying the Avalara AvaTax for Microsoft Dynamics 365 for Finance and Operations Test

Drive through Microsoft AppSource. This guide is intended walk you through the basics for using Avalara

to manage sales tax compliance within Microsoft Dynamics 365 for Finance and Operations. With the

powerful combination of Avalara AvaTax and Dynamics 365 for Finance and Operations you can manage:

• Sales tax calculation on sales transactions

• Consumer Use tax calculation on Vendor Invoices

• VAT and GST compliance

• Exemption certificates

• And the filing and remittance of sales tax returns

Feel free to skip to the sections that interest you the most or go through each section in detail. Contact

us with any questions at microsoft@avalara.com. Our sales team would love to hear from you!

Setting up AvaTax

Initial Configuration

When Avalara AvaTax for Microsoft Dynamics 365 for Finance and Operations connector is installed, the

first step is to link your Avalara AvaTax account to Dynamics 365 for Finance and Operations. The AvaTax

Setup Assistant is used for this initial configuration.

For the test drive this work has been completed on your behalf. In addition, an Avalara AvaTax Tax

Profile has been configured. A Tax profile consists of your company information and where you are

required to collect and remit sales tax (nexus).

Ongoing Configuration and Maintenance

Once the AvaTax Setup Assistant is completed, you can adjust your connector configuration settings

through the AvaTax Module within Dynamics 365.

To view the configuration:

Avalara AvaTax for Microsoft Dynamics 365 for Finance and Operations

Test Drive

© Avalara Inc. All rights reserved.

Page |

4

1. Go to Modules > Avalara AvaTax > Setup > Configuration Setting

2. Click on each section on the left-hand side to view the configuration settings

For more detail on all configuration settings check out the Avalara Help Center:

https://help.avalara.com/001_Avalara_AvaTax/Find_Your_Home_Page/AvaTax_Update_for_Microsoft_

Dynamics_365_for_Finance_and_Operations

Avalara Address Validation

Sales tax calculation starts with an accurate address. Avalara validates and converts addresses within

Dynamics 365 to standardized US postal service addresses. While not necessary to have a full address to

calculate tax with AvaTax, a validated address ensures accurate calculation of sales taxes based on the

specific address, as opposed to a broad – and often inaccurate – ZIP Code calculation. And there’s no

doubt that an accurate address also improves product shipment deliverability.

To validate an Address:

1. Go to a customer account

1. Accounts Receivable > Customers > All Customers

2. Choose US-001

3. In the address section, select Add to create a new address

Avalara AvaTax for Microsoft Dynamics 365 for Finance and Operations

Test Drive

© Avalara Inc. All rights reserved.

Page |

5

4. Enter an address name or description and type in the address

5. As an example, you can enter

255 King St

Seattle, WA 98101

6. Select the address validation button:

7. Once selected you will see both the entered address and the validated address:

In this example, the validation adjusts the postal code.

8. At the bottom of the screen, select Accept to correct the address on the customer.

9. Select OK and you will see the address has been updated onto the customer address

record.

Sales Tax Calculation

Avalara Tax Codes

The way AvaTax manages ever-changing tax rules is through an association made right inside of

Dynamics 365 Finance and Operations whereby the products and services you sell are associated to an

Avalara AvaTax for Microsoft Dynamics 365 for Finance and Operations

Test Drive

© Avalara Inc. All rights reserved.

Page |

6

Avalara Tax Code. These codes contain all the logic and rules that govern how the items you sell are

taxed in any jurisdiction where you have an obligation to collect, report, and remit. A full list of our tax

codes for goods and services is located at https://taxcode.avatax.avalara.com/.

There are various ways to associate a tax code to the goods and services that you sell within Dynamics

365 for Finance and Operations. This allows flexibility to use what works best for your specific business

processes. On the left is the full list of associations available and on the right, is what we see typically

used for each process flow:

To associate an Avalara tax code to your goods and services:

1. Go to the Avalara AvaTax Utilities

1. Avalara AvaTax > Utilities > Tax Code Mapping

2. Select New to create a new association of a tax code

3. Select the type of association (Document Type), the data element to map

(Item/Category/Account), and then enter in a tax code from the list of Avalara codes

available.

Sales Orders

Now that we have a taxable customer and an item associated with a tax code, you can enter a sales

order and use those values to see tax calculation by AvaTax.

To create a sales order:

1. Go to the sales order entry screen

1. Accounts Receivable > Orders > All Sales Orders

Quotes/

Sales Orders

/Invoices

:

Item

Item Group

Sales Category

Item Sales Tax Group

Project Invoices:

Fee

Hour

Expense

Project Item

Ledger Account

Vendor Invoices:

Procurement Category

Item

Item Group

Avalara AvaTax for Microsoft Dynamics 365 for Finance and Operations

Test Drive

© Avalara Inc. All rights reserved.

Page |

7

2. Select New to create an order

3. Enter the customer account US-001

4. Feel free to change the delivery address to test a jurisdiction you would like to test. In this

instance of AvaTax, we have selected to calculate tax in all jurisdictions in the United

States and Canada. We also support VAT in many countries, contact

[email protected] to learn more!

5. Select OK

6. In Sales order lines, select an item such as Item number 1000. Be sure to enter a Unit price.

7. To see the tax summary, in the Sales Order tab hit View > Totals

8. You will see the Avalara calculated tax in the Sales Tax section as seen here:

Avalara AvaTax for Microsoft Dynamics 365 for Finance and Operations

Test Drive

© Avalara Inc. All rights reserved.

Page |

8

9. Select OK.

10. In the Sell Tab, you can also select Tax > Sales Tax to see the details of the taxes per line:

11. Select OK.

12. Generate the invoice and post.

Avalara AvaTax for Microsoft Dynamics 365 for Finance and Operations

Test Drive

© Avalara Inc. All rights reserved.

Page |

9

13. Be sure select ‘All’ in the Parameters section to fully invoice the order.

14. Select ok and your invoice is posted to AvaTax and to Dynamics 365.

15. To view the invoice, in the Invoice Tab select Journals > Invoice.

16. You can see the posted sales tax by selecting Posted Sales Tax:

Avalara AvaTax for Microsoft Dynamics 365 for Finance and Operations

Test Drive

© Avalara Inc. All rights reserved.

Page |

10

17. You will see the breakdown of the taxes by jurisdiction:

Project Invoices

If you are using the project module, you can also calculate tax on your invoices generated from Projects.

To create a project invoice:

1. Go to a project

1. Project management and accounting > Projects > All Projects

2. Choose project 000060. This project has been configured as Time and Materials and is

associated to Contract 000060 and customer account US-026

3. Select the type of journal(s) to create for invoicing.

1. On the project select the Journals you would like to create for billing:

Avalara AvaTax for Microsoft Dynamics 365 for Finance and Operations

Test Drive

© Avalara Inc. All rights reserved.

Page |

11

2. To bill project hours, select Hour from the Journals section

3. Once on the Hour Journal screen, select New and then go to the lines:

4. Select New and fill in the appropriate data – Jodi Christianson has been selected here

as the resource, she has a project billing rate assigned. Be sure to enter the number of

hours you would like to bill:

5. You will need to post the journal. Once posted message appears click ok and await the

completion message

Avalara AvaTax for Microsoft Dynamics 365 for Finance and Operations

Test Drive

© Avalara Inc. All rights reserved.

Page |

12

6. Once you have posted, go back to the project and repeat the steps for each Journal

Type. For Item Journal, Item number A0001 has been configured with inventory for

Site 1, warehouse 13. In the Product dimensions tab of the line, enter the Site and

Warehouse before posting

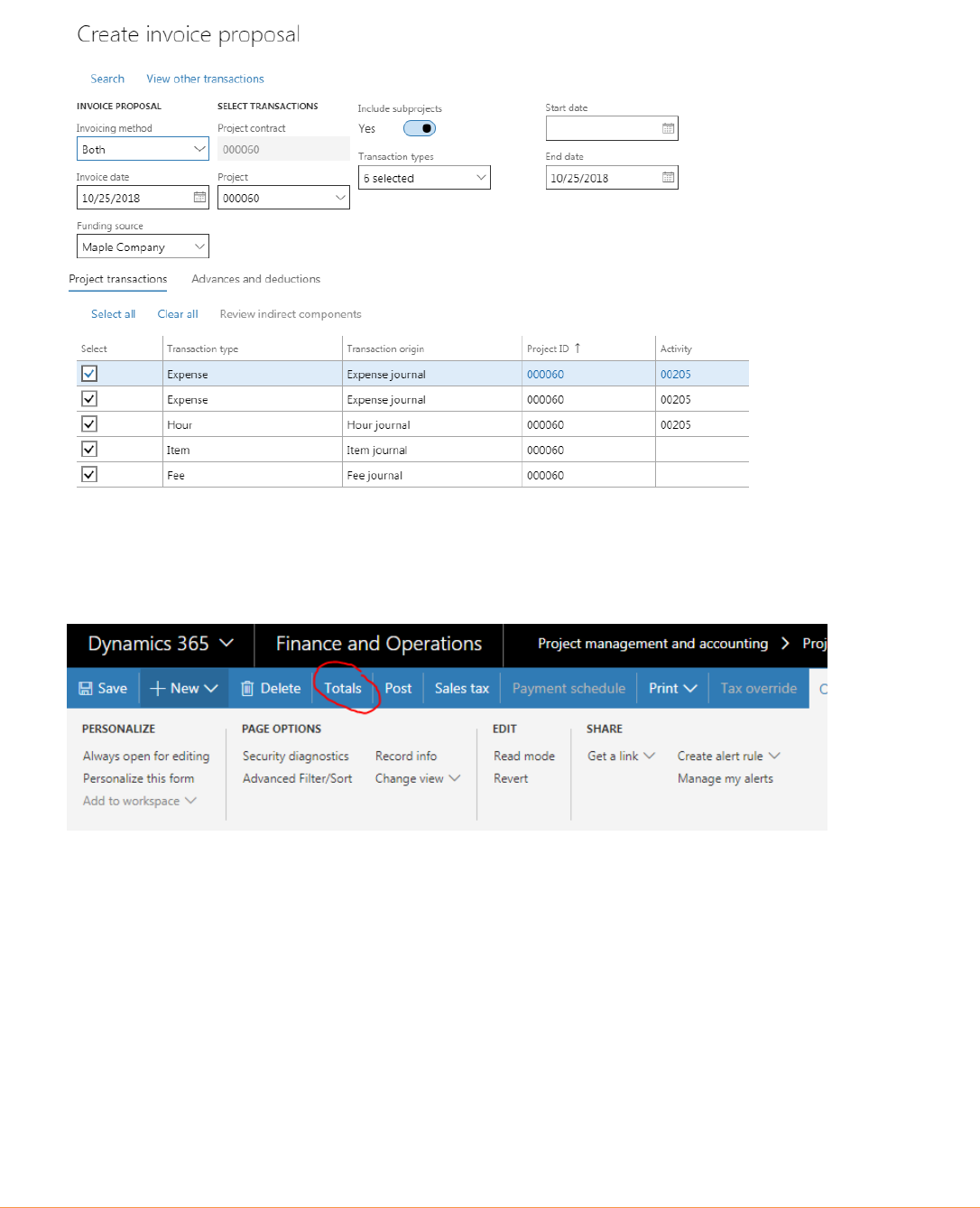

7. Let’s now create an Invoice Proposal. On the Manage tab of the project, select NEW >

Invoice Proposal

8. All of the activity from the Journals will appear as lines to billed

Avalara AvaTax for Microsoft Dynamics 365 for Finance and Operations

Test Drive

© Avalara Inc. All rights reserved.

Page |

13

9. Select OK

10. Click on Totals

11. Sales Tax will be calculated and appear in the native Sales Tax field:

Avalara AvaTax for Microsoft Dynamics 365 for Finance and Operations

Test Drive

© Avalara Inc. All rights reserved.

Page |

14

Consumers Use Tax Assessment

Vendor Invoices

Avalara can calculate tax on Vendor Invoices, compare vendor charged tax, and accrue consumer use tax

that is required to be self-assessed, reported, and remitted to a jurisdiction.

To create a vendor Invoice with a tax self-assessment:

1. Go to Pending Vendor Invoices

1. Accounts Payable > Invoices > Pending Vendor Invoices

2. Select New

3. Enter an Invoice Account, I am using 1001 Acme Office Supplies

4. Enter an Invoice number, description and Invoice date

5. Click Add Line and enter an item number from the list

Avalara AvaTax for Microsoft Dynamics 365 for Finance and Operations

Test Drive

© Avalara Inc. All rights reserved.

Page |

15

NOTE: You can also match the vendor invoice to a Purchase Order.

6. Choose the quantity and Unit price

7. You will notice in the menu of tabs there is a section called Avalara:

8. Go to the tab and click Use tax Assessment:

9. A pop up screen will appear that shows you what the vendor charged vs what AvaTax has

calculated

10. In this case the vendor charged less than what AvaTax calculated. AvaTax will accrue the

undercharged amount as a self-assessment and post to AvaTax for reporting.

11. In the event the vendor overcharges tax, AvaTax will prompt with a message however will

not consider this to be accrued.

12. To enter the vendor charged tax, you can use the standard tax fields to indicate the amount

the vendor has charged. In the Financials section of the invoice:

Avalara AvaTax for Microsoft Dynamics 365 for Finance and Operations

Test Drive

© Avalara Inc. All rights reserved.

Page |

16

13. Go to Tax > Sales Tax

14. Check the Override Calculation checkbox and enter the ‘actual sales tax amount’ charged by

the vendor:

15. Click OK

16. In the Totals, the amount due to the vendor will only include the actual amount.

17. Upon posting the invoice, you will be prompted to accept or reject the Accrual for the self-

assessed consumer use tax:

18. Click yes to accept and post to AvaTax and the self-assessed use tax to the General Ledger:

Avalara AvaTax for Microsoft Dynamics 365 for Finance and Operations

Test Drive

© Avalara Inc. All rights reserved.

Page |

17

Conclusion

Thank you again for trying the Avalara AvaTax for Microsoft Dynamics 365 for Finance and Operations

Test Drive through Microsoft AppSource. We hope that this guide helped to successfully allow you to

preview some of the main features of the AvaTax solution with Dynamics 365 for Finance and

Operations. For additional information and to contact us please reach out to [email protected]om.

We look forward to hearing from you!

Let Avalara be your End-to-end Compliance Solution!

Sales & Use Tax Calculation

•

Maintains tax rules and rates, eliminating tax research and tax table maintenance

•

Uses full address with mapping technology to improve accuracy over ZIP+4 methods

•

Integrates with the Accounts Payable module to self-assess consumer use tax

Managed Returns Filing

•

Manages sales tax prep, filing, payments, and tax notices

•

Handles outlet-based returns in states that require them

•

Integrates sales from multiple channels on a single tax return

Exemption Certificate Management

•

Collects, stores, tracks, reports, and analyzes resale certificates

•

Provides a simple, integrated customer experience across ecommerce and mobile POS

•

Captures certificates by simply snapping a picture with an app on a mobile device

To learn more, visit: https://www.avalara.com/integrations/dynamics-365.html

Contact us at [email protected]om