227 North Bronough Street, Suite 5000

Tallahassee, Florida 32301

850.488.4197 • 850.488.9809 Fax

www.floridahousing.org

Florida Housing Finance

Corporation’s

Mortgage Credit Certificate

(MCC) Program

Lender Training for

Loan Officers, Processors,

Underwriters,

Closers & Post Closers

2018 Mortgage Credit Certificate Program

This training is to help you understand what a Mortgage Credit Certificate (MCC) is as well as what

steps you will need to take in originating an MCC with your mortgage loan.

This training is also designed so that you may print the document and use it continuously as a

reference tool. However, please keep in mind that information may be updated periodically by

Florida Housing. These changes will be noted in the MCC Lender Guide as well as through email

notification.

2

2018 Mortgage Credit Certificate Program

Please allow 30-40 minutes to thoroughly review the material

provided and to complete all requirements.

Today, you will …

1) Review the 57 pages of PDF training materials to

familiarize yourself with the Program and your role.

2) Upon completion, contact your Systems Access

Administrator regarding Lender Portal Training and

access to the Lender Portal found at

https://mccprogram.floridahousing.org

3

2018 Mortgage Credit Certificate Program

Training Agenda

What is a Mortgage Credit Certificate?

Your role in the MCC Tax Credit Process

Resources and Need to Know Information

MCC Lender Quiz and User Registration

4

2018 Mortgage Credit Certificate Program

What is a Mortgage Credit Certificate?

5

2018 Mortgage Credit Certificate Program

What is a Mortgage Credit Certificate?

A mortgage credit certificate, or MCC, is a non-refundable federal income tax credit which

can be paired with a lender’s first mortgage. The MCC reduces an eligible borrower’s

federal income taxes and, in effect, creates additional income for the borrower to use in

making mortgage payments or applying towards other household expenses.

Florida Housing’s Program offers a tax credit amount of up to 30%, based on the loan

amount. Homeowners with the MCC are allowed to use a percentage of their actual

mortgage interest as a direct federal tax credit, resulting in a dollar-for-dollar reduction of

their annual federal income tax liability.

6

2018 Mortgage Credit Certificate Program

Will my Borrower Benefit from the MCC?

The MCC is a federal tax credit that borrowers claim when filing their annual taxes with

the IRS. Borrowers should have sufficient tax liability to claim the federal credit.

Borrowers who do not have a sufficient tax liability could not claim the MCC tax credit

annually.

Using an MCC for a borrower with no tax liability will result in a “phantom income” and

would not assist in your borrower’s ability to repay.

7

2018 Mortgage Credit Certificate Program

How to Calculate the Amount of MCC Benefit?

The credit rate is determined by the loan amount as indicated below.

Lenders will 1) multiply the credit rate by the mortgage interest paid by the borrower

for that given tax year to determine the MCC tax credit amount.

Then lenders will 2) divide that tax credit amount by 12 to determine the monthly benefit amount.

Florida Housing offers the lender a tool to assist in calculating this amount. (The Tax Credit

Worksheet.)

8

2018 Mortgage Credit Certificate Program

How to Calculate the Amount of MCC Benefit

Example 1: Consider a Borrower with a Loan Amount of $250,000

This borrower would receive a $1,250 benefit on their federal tax returns

towards their tax liability which also equates to a monthly benefit of

$104.17. This $104.17 could be used towards their monthly mortgage obligation

.

9

2018 Mortgage Credit Certificate Program

How to Calculate the Amount of MCC Benefit

Example 2: Consider a Borrower with a Loan Amount of $180,000

This borrower would receive a $1,800 benefit on their federal tax returns

towards their tax liability which also equates to a monthly benefit of

$150.00. This $150.00 could be used towards their monthly mortgage obligation.

10

2018 Mortgage Credit Certificate Program

How to Calculate the Amount of MCC Benefit

Example 3: Consider a Borrower with a Loan Amount of $95,000

This borrower would receive a $1,425 benefit on their federal tax returns

towards their tax liability which also equates to a monthly benefit of

$118.75. This $118.75 could be used towards their monthly mortgage obligation.

11

2018 Mortgage Credit Certificate Program

What Exactly is a Mortgage Credit Certificate?

The Florida Housing MCC Tax Credit should not be confused with any of the below.

A down payment assistance program.

A housing grant program.

A mortgage loan of any type.

Remember, the MCC is a federal tax credit.

Borrowers will claim the MCC when filing their federal tax returns on an annual basis by

completing IRS Tax Form 8396 with the assistance of their tax professional.

12

2018 Mortgage Credit Certificate Program

What is the Role of the Loan Officer and Processor?

13

2018 Mortgage Credit Certificate Program

What is the role of the Loan Officer and Processor?

Loan Officers/Processors are responsible for initially verifying that the borrower is eligible to participate in

the Mortgage Credit Certificate Program.

Borrowers must meet 5 requirements in order to be eligible for the Program.

1) Total household income must meet the Program Income Limits.

2) Property purchase price must satisfy the Program Purchase Price Limits.

3) Borrowers must be First Time Home Buyers.

4) Borrowers must complete a homebuyer education course.

5) Borrowers should have sufficient tax liability.

14

2018 Mortgage Credit Certificate Program

What is the role of the Loan Officer and Processor?

Income Limits

The Florida Housing MCC Program maintains strict income limits which must be adhered

to in determining borrower eligibility.

The MCC Program considers the total current gross annual income of each occupant over

the age of 18 (the Household Income). Once the Household Income is determined,

compare that to the Income Limits to determine if your borrower qualifies.

The Income Limits for the MCC Program can be found on our webpage at

www.floridahousing.org/MCC

15

2018 Mortgage Credit Certificate Program

What is the role of the Loan Officer and Processor?

Purchase Price Limits

The Florida Housing MCC Program also maintains strict Purchase Price Limits which must be adhered to in

determining borrower eligibility.

The Purchase Price limit considers the final acquisition amount (the sales contract price),

not the loan amount.

The Purchase Price limits for the MCC Program can be found on our webpage at

www.floridahousing.org/MCC

16

2018 Mortgage Credit Certificate Program

What is the role of the Loan Officer and Processor?

First Time Homebuyer

The definition of a First Time Homebuyer is a person who has not owned and occupied their primary

residence within the last three years. Borrowers who may own investment properties are eligible for the

program. This requirement is for borrowers and spouse, even if spouse is not on the loan.

Exceptions to the First Time Homebuyer requirement are made for military veterans (with a valid DD-214)

and those borrowers who may be looking to purchase a home located in a Federally Designated Targeted

Area. Targeted areas are identified by census tracts which are available in the Lender Guideline.

17

2018 Mortgage Credit Certificate Program

What is the role of the Loan Officer and Processor?

First Time Homebuyer

Lenders should review and provide the most recent three (3) years tax documents to ensure the borrowers

satisfy the First Time Homebuyer requirement.

Borrowers must not have owned and occupied their primary residence within the last three years.

Lenders should be reviewing tax returns and transcripts for mortgage interest or any credits that would

claimed for homestead property.

18

2018 Mortgage Credit Certificate Program

What is the Role of the Loan Officer and Processor?

Federally Designated Targeted Areas

Federally Designated Targeted Areas means those areas within the State identified as Qualified Census Tracts

and Areas of Chronic Economic Distress. Borrowers purchasing in these areas are exempt from the First

Time Homebuyer requirement. Higher Purchase Price and Income Limits apply to these census tracts.

In order to determine if a property is designated a Federally Designated Targeted Area, lenders will review

the census tract data from the appraisal and compare to the census tract list through U.S. Census Bureau’s

website at

http://factfinder2.census.gov OR in the Lender Guideline OR through our MCC Program

Wizard. The Wizard is located on our homepage at www.floridahousing.org.

19

2018 Mortgage Credit Certificate Program

• When trying to determine if your borrower is

purchasing in a Federally Designated

Targeted Area, check Page 2 of your Appraisal,

under the “Subject” Section, and “Census

Tract”. If this number reflects on the U.S.

Census Bureau’s website OR on our website

through the MCC Program Wizard OR in the

Lender Guide, then your borrower may be

exempt from the First Time Homebuyer

requirement. This would mean you do not need

to collect tax returns or transcripts for the last

three years and higher Income Limits and

Purchase Limits apply (refer to the Lender

Guideline).

2018 Mortgage Credit Certificate Program

What is the Role of the Loan Officer and Processor?

Homebuyer Education

• Once it has been determined that your borrower is eligible to participate in the Florida Housing MCC Program, they

will need to complete homebuyer education course. We will accept face-to-face homebuyer education if provided by a

HUD approved counseling agency, a unit of local government that provides pre-purchase homebuyer education in

FL, or a counseling agency designated by a unit of local government to provide homebuyer education on their behalf.

Refer to www.hud.gov for a list of approved education providers by county.

• Online HBE is permitted if provided by a HUD approved agency, a unit of local government that provides pre-

purchase homebuyer education in FL, a mortgage insurance provider, or an Agency or GSE sponsored course.

• Florida Housing does NOT maintain a list of homebuyer education providers.

• The certificate for the education course must be provided by the borrower to the lender before the closing of the

loan.

• Homebuyer education certificates are valid for 2 years from date of completion.

21

2018 Mortgage Credit Certificate Program

What is the Role of the Loan Officer and Processor?

Using the MCC with other Products

Florida Housing MCC uses the same funding source as mortgage revenue bond programs. As such, the MCC may never

be used with any other Florida Housing government programs. This means you cannot use the MCC with the FL

Housing FL First or Military Heroes First Mortgage Loan Programs. EVER.

The Florida Housing MCC may be used in conjunction with all lender offered conventional and government products.

You can also use the MCC with the Florida Housing HFA Preferred/PLUS Conventional First Mortgage Loan Program

but be sure you adhere to the more stringent MCC Program requirements. MCC considers Household Income while the

HFA Preferred does not.

The MCC can also be used with other agency DPA and grant programs provided that you are following those program

guidelines when doing so.

22

2018 Mortgage Credit Certificate Program

What is the Role of the Loan Officer and Processor?

New Construction

Lenders may choose to pair the Florida Housing Mortgage Credit Certificate with new construction

properties. Due to the extended timelines generally included with new construction homes, Loan Officers

and Processors must reserve the MCC to as close to the closing date as possible.

Lenders should also email Florida Housing at

FLMCCInquiries@hilltopsecurities.com

so that the file may be documented.

Failure to do so may result in the timeline expiration and subsequent cancellation of the MCC reservation.

23

2018 Mortgage Credit Certificate Program

What is the Role of the Loan Officer and Processor?

Once it has been determined that your borrower is eligible for the Program, you will reserve the MCC for the

borrower in the Florida Housing MCC reservation system.

Steps to accessing the reservation system are included towards the end of this training.

Keep in mind that you will need to reserve the MCC for your borrower as close to the actual closing date as

possible. This will ensure that your lending team can meet the program timelines

required for issuance of the MCC.

The Florida Housing MCC Program follows a 60 day reservation to MCC issuance timeline.

24

2018 Mortgage Credit Certificate Program

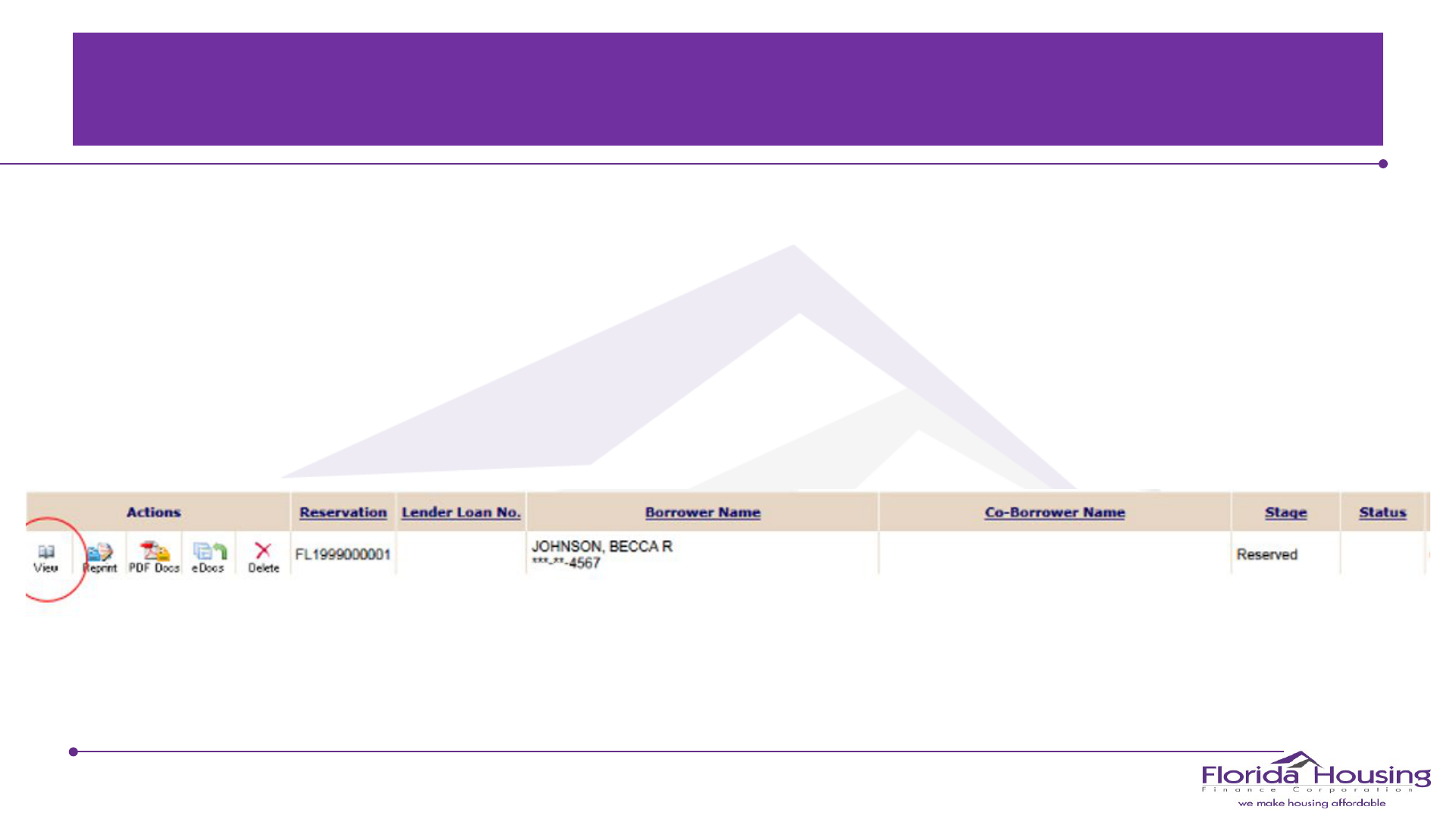

What is the Role of the Loan Officer and Processor?

Landing Page

Upon logging in to the Florida Housing reservation system, you will be brought to a landing page. From here

you will be able to perform two very important functions.

1) You will have the ability to create new reservations by selecting the applicable light gray button to the far

right of the page.

2) You will have the ability to manage your individual/lender pipeline and keep up to date with the status

of your particular reservations.

3) In order to monitor the status of your MCC reservations, click the “View” icon to the left of your

Borrower’s Name.

25

2018 Mortgage Credit Certificate Program

What is the role of the Loan Officer and Processor?

Once the Loan Officer/Processor has completed the reservation, the pre-closing documents will become

through the “PDF docs” icon.

The Loan Officer/Processor should print and review the Recapture Brochure, Mortgagor Affidavit, Notice

to Buyer and Notice Regarding Collection of Social Security Numbers with the borrower(s). The

borrower(s) should sign all applicable docs at this time. The Seller Affidavit may be signed before closing

and submitted with pre-closing compliance review package. If not, it will become a closing condition.

Please note the Mortgagor Affidavit will become a closing condition if cannot be notarized prior to closing

by borrower(s)/mortgagor(s).

Forms such as the Tax Credit Worksheet and Income Calculation Worksheet are tools to assist Lender and

are located in “Program Documents”.

26

2018 Mortgage Credit Certificate Program

27

2018 Mortgage Credit Certificate Program

MCC Reservation Status

1) RESERVED

Once the Loan Officer/Processor has reserved the MCC, the status will reflect as Reserved.

2) PRE-COMPLIANCE REVIEW

Upload the Pre-Compliance Review Package per the checklist located in the Lender Portal. Once

Hilltop has reviewed and approved the file, the status will appear as Pre-CloseRvw – either

Approved or Incomplete

3) POST-COMPLIANCE REVIEW

Upload the Post-Closing Review Package per the checklist located in the Lender Portal. Once

Hilltop has reviewed and approved the file, the status will appear either Approved or Incomplete.

4) MCC ISSUED/CANCELLED

Once the post-closing compliance review ha been completed and approved by Hilltop, MCC

Issued or Cancelled will reflect as status. Files must be approved by day 60 of reservation or risk

cancellation.

28

2018 Mortgage Credit Certificate Program

What is the Role of the Loan Officer and Processor?

Reserving the MCC for your Borrower

The MCC Reservation collects all of the required loan information from the Lender and is located in the

Lender Portal.

Do not attempt to complete this form until all loan data is available. Note, the 60 day timeline begins the day

the reservation is made.

The Hilltop Securities Reservation System will generate a Reservation Confirmation

when the MCC is reserved.

Please keep in mind that the Reservation Confirmation is not an approval or issuance of the MCC. This is

merely a confirmation that the reservation has been made for your borrower(s).

29

2018 Mortgage Credit Certificate Program

What is the Role of the Loan Officer and Processor?

Reissuing a Refinanced Loan with MCC

Effective October 1, 2015, borrowers who have previously been issued a Florida Housing Mortgage Credit

Certificate can now maintain the certificate in the event that they refinance their first mortgage loan.

This option is reserved for refinances only.

Please submit the Refinance Package Documents into the Lender Portal in the “Mortgage Credit

Certificate” package space, then submit.

There is a Reissuance Fee of $250 made payable to Hilltop Securities. The funds may be wired at the time the

package is uploaded into the reservation system.

Please refer to the MCC Lender Guide for specific requirements.

30

2018 Mortgage Credit Certificate Program

What is the Role of the Loan Officer and Processor?

Reissuing a Refinanced Loan with MCC

When reserving a reservation to reissue an existing MCC, the Loan Officer/Processor must provide the

borrower’s original Mortgage Credit Certificate.

31

2018 Mortgage Credit Certificate Program

What is the Role of the Loan Officer and Processor?

Notice to Buyer and Recapture Tax

When the MCC reservation has been made and confirmed, it is important to discuss the Recapture Brochure

and the potential of Recapture Tax with your borrower.

As an overview, all of the following conditions must be in effect to activate Recapture Tax.

• The home is sold within nine years of the original mortgage loan closing date.

• The borrower has a net gain on the sale of the property.

• The initial qualifying annual Household income increases the federal threshold limit as prescribed by the

federal tax code at the time of sale.

All Recapture Tax details can be found in the MCC Program Lender Guide.

32

2018 Mortgage Credit Certificate Program

What is the Role of the Loan Officer and Processor?

Checklist for Loan Officer and Processor

Confirm Borrower Eligibility by reviewing the following:

Purchase Price

Total Household Income

First Time Homebuyer Eligibility

Substantial Tax Liability

Enter all required loan data into the Hilltop Securities MCC Lender Portal and Reserve the MCC.

Review Recapture Tax information with the borrower.

33

2018 Mortgage Credit Certificate Program

What is the Role of the Underwriter?

34

2018 Mortgage Credit Certificate Program

What is the Role of the Underwriter?

Underwriters are the overriding authority and are responsible for reviewing all

data entered into the MCC reservation system.

Underwriters are responsible for and reviewing and validating data accuracy.

35

FHFC Homebuyer Tax Credit Program (MCC) 2017

What is the role of the Underwriter?

First Steps

The first step of the Underwriter is to review the information entered by Loan Officer or Processor.

This information can be found on the Reservation Confirmation located in the Loan Status tab “View” icon

next to the “Borrower Name”.

36

2018 Mortgage Credit Certificate Program

What is the Role of the Underwriter?

Underwriters should be checking first and foremost for Income.

1) Income of each occupant and then 2) income for the Household.

Has the total gross annual income been calculated correctly? Income which is consistent and likely to

continue should be considered towards the borrower’s or occupant’s income.

A detailed breakdown of how to view income for self employed borrowers is available in the

MCC Program Lender Guide and is a valuable asset when calculating income.

All person over the age of 18 and taking residence in the home must have their

income counted towards the Household Income.

37

2018 Mortgage Credit Certificate Program

What is the Role of the Underwriter?

Options

Ultimately, Underwriters have 3 options they can chose from during the Reservation process:

1) Complete the Underwriter Form to be uploaded with the Pre-Closing package

2) Edit Reservation by emailing changes to FLMCCInquiries@Hilltopsecurities.com

3) Cancel Reservation

38

2018 Mortgage Credit Certificate Program

What is the Role of the Underwriter?

Submit Pre-Closing Package

Generate the checklist and auto-populate documents found in the “PDF Docs icon by the Borrower’s Name.

Upload, save and submit documents in “eDocs icon”.

39

2018 Mortgage Credit Certificate Program

What is the Role of the Underwriter?

Cancel this Reservation

Underwriters may determine that a borrower is not eligible to participate in the Florida Housing MCC

Program. When this occurs, Underwriters can cancel the reservation:

1. Loan Status Tab

2. Locate Loan to be cancelled

3. Click on the “View” icon

4. Click the “Cancel” button in the upper left hand corner

40

2018 Mortgage Credit Certificate Program

What is the Role of the Loan Officer and Processor?

41

Quick Quiz: The Florida Housing MCC Program reviews

only the borrower net income for qualifying. True or False?

2018 Mortgage Credit Certificate Program

What is the Role of the Loan Officer and Processor?

42

False! Remember, the Florida Housing MCC Program

requires that total household gross annual income be

reviewed to determine borrower eligibility.

2018 Mortgage Credit Certificate Program

What is the Role of the Closing Team?

43

2018 Mortgage Credit Certificate Program

What is the Role of the Closing Team?

The closing team is directly responsible for the post-closing document submission portion of the MCC

compliance process. The final role of the lender is to submit all completed and required loan documents and

FL Housing MCC Program documents electronically into the Lender Portal found at

https://mccprogram:floridahousing.org.

Please submit within 30 days of closing and check for any post-closing condition within 24-48 hours of

package upload.

44

2018 Mortgage Credit Certificate Program

How to Generate Pre or Post Closing MCC Program Documents

Generate the applicable auto-populated documents found in the

“PDF Docs” icon by the Borrower’s Name.

Upload, save and submit documents in “eDocs Icon” in either Pre-Closing or Post-Closing Package space.

45

2018 Mortgage Credit Certificate Program

How to Generate/ Pull FL Housing Program Documents

It is imperative to follow the guidelines detailed below. 75% of the pended MCC compliance reviews are due

to the deficiencies indicated below.

1) Manual edits on any Florida Housing documents will not be accepted.

2) Lender typed data on any Florida Housing documents will not be accepted.

46

2018 Mortgage Credit Certificate Program

Compliance Review Fee

After closing, the MCC Compliance Review Fee should be wired

to Hilltop Securities, Inc. in the amount of $450.

Wire instructions will be listed in on the post-closing checklist.

Lenders will want to ensure that this Compliance Review Fee is noted on the Closing Disclosure.

The Compliance Review Fee can be submitted from the lender, borrower or title company.

47

2018 Mortgage Credit Certificate Program

Timeline

The MCC reservation is valid for 30 days during which time the pre-closing compliance package should be

uploaded for review in the Lender Portal.

The reservation will be subject to cancellation if the pre-closing package is not received by day 30.

The post-closing package should be submitted 30 days after closing for review, approval and issuance of the

actual Mortgage Credit Certificate (MCC).

MCC Program documents should be executed pre-closing.

48

2018 Mortgage Credit Certificate Program

What’s Next?

Remember, a reservation is not an approval. Lenders are recommended to review the

Florida Housing MCC Pipeline regularly to ensure that all steps have been taken towards

the approval of the Mortgage Credit Certificate.

The reservation statuses in the MCC Lender Portal are updated approximately every 10-15 minutes.

49

2018 Mortgage Credit Certificate Program

What’s Next? Deficiencies Found

If a file submitted from the Lender is found to have deficiencies, Hilltop Securities Staff will contact the

Lender points of contact via email.

Hilltop Securities Staff will assist Lenders in resolving deficiencies.

All deficiencies must be resolved prior to the reservation expiration date or risk cancellation of reservation.

50

2018 Mortgage Credit Certificate Program

Original Submissions

The FL Housing MCC Program requires that all documents be submitted electronically into the Hilltop

Securities Lender Portal.

No paper files will be accepted.

51

2018 Mortgage Credit Certificate Program

What’s Next? Deficiencies Found

If a pre or post closing file submitted from the Lender is found to have deficiencies, the lender may access

the deficiencies in the Lender Portal by clicking the “View” icon.

Any questions regarding defies should be directed to Hilltop Securities at

flmccinquiries@hilltopsecurities.com

All defies must be resolved prior to the reservation expiration date or risk cancellation of reservation. This

means your borrower will not receive the MCC benefit.

52

2018 Mortgage Credit Certificate Program

What’s Next? Cancellation

The purpose of pre-compliance review is to ascertain before closing that the borrower meets the Program

guideline. The Lender will be alerted to this during the loan review process.

It will be the responsibility of the Lender to notify the borrower.

Should a Lender decide to cancel a reservation any time before closing, they may do so in the Loan Status

tab, “View” icon by clicking the “Cancel” button.

53

MCC Process – Start to Finish

Processor/Loan Officer

• Confirm Borrower Eligibility

• Reserve MCC in Lender Portal

• Review Recapture Tax with Borrower

Underwriter

• Confirm Loan Data

• Verify Borrower Liability

• Upload Pre-Close Package in Lender Portal

Closing Team

• Generate required documents from the Lender Portal

• Ensure Original documents are executed

• Submit Compliance File to Florida Housing for review

Florida Housing Compliance Team

• Review Compliance File submitted by lender

• Approve and Issue MCC reservation

• Mail Copy to Borrower and Lender

2018 Mortgage Credit Certificate Program

Resources and Need to Know Information

55

2018 Mortgage Credit Certificate Program

New User Registration

Please keep in mind, users should only be granted Lender Portal

access after they have taken MCC Program and Lender Portal

Training.

Access to the Lender Portal will not be approved prior to

completion of the training.

Systems access must not be shared. Each person playing a role in

the Program must have their own specific log in information.

Lenders will contact their organization’s access administrator to

request a new password in the event that the initial password

needs to be reset.

56

2018 Mortgage Credit Certificate Program

Florida Housing Webpage

Not only is the Florida Housing webpage

where you will log in to the Lender Portal,

but you will also find Income and Purchase

Limits, information on Homebuyer

Education and Federally Designated

Targeted Areas as well as our Lender

Training and Lender Guideline.

Lenders can also access marketing

materials.

57