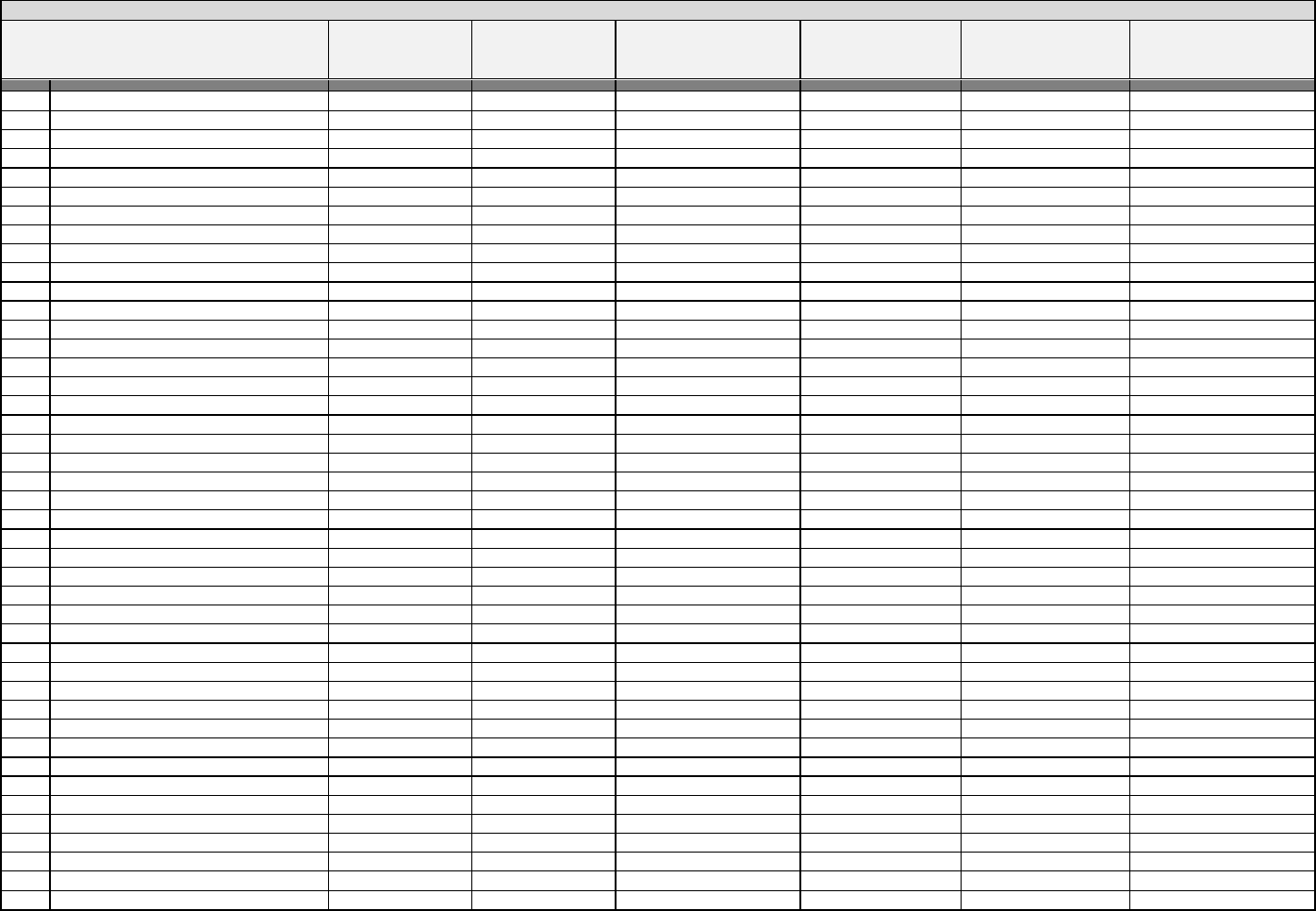

Table of Equalized Valuations

Original Certification October 1, 2022

Amended by the New Jersey Tax Court

(Chapter 86, Laws of 1954) January 30, 2023

John J. Ficara, Acting Director

Division of Taxation

Department of the Treasury

State of New Jersey

Property Administration

3 John Fitch Way,

P.O. Box 251

Trenton, NJ 08695-0251

http://www.state.nj.us/treasury/taxation/

Amended Table of Equalized Valuations 2022

(As Amended by Tax Court Appeals)

*EXCLUSIVE OF CLASS II RAILROAD PROPERTY

**REVISED TOTALS AS AMENDED BY TAX COURT OF NEW JERSEY

1 2 3 4 5 6

COUNTY AND DISTRICT

AGG. ASSESSED

VALUATION

REAL PROP. *

AVE. RATIO

ASSESSED TO

TRUE VALUE

AGG. TRUE VALUE

REAL PROP. *

ASSESSED VALUE

CLASS II R. R.

PROPERTY

ASSESSED VALUE

ALL PERS.

PROPERTY

EQUALIZED

VALUATION

ATLANTIC COUNTY

0101 ABSECON CITY

720,397,500

84.01 857,513,986 0 857,513,986

0102 ATLANTIC CITY CITY

2,406,379,413

75.51 3,186,835,403 0 3,186,835,403

0103 BRIGANTINE CITY

3,404,663,000

73.57 4,627,787,141 0 4,627,787,141

0104 BUENA BORO

288,024,700

89.07 323,368,923 0 323,368,923

0105 BUENA VISTA TWP

645,205,650

93.85 687,486,042 0

1,069,268

688,555,310

0106 CORBIN CITY CITY

51,006,800

82.98 61,468,788 0 61,468,788

0107 EGG HARBOR CITY

198,937,400

78.05 254,884,561 0 254,884,561

0108 EGG HARBOR TWP

4,079,087,650

80.27 5,081,708,795 0

7,774,773

5,089,483,568

0109 ESTELL MANOR CITY

156,915,300

77.42 202,680,573 0

831,047

203,511,620

0110 FOLSOM BORO

174,740,100

87.02 200,804,528 0 200,804,528

0111 GALLOWAY TWP

2,741,320,300

76.21 3,597,061,147 0

100

3,597,061,247

0112 HAMILTON TWP

2,036,506,200

75.92 2,682,437,039 0

8,086,723

2,690,523,762

0113 HAMMONTON TOWN

1,395,771,100

86.54 1,612,862,376 0 1,612,862,376

0114 LINWOOD CITY

931,071,000

88.13 1,056,474,526 0 1,056,474,526

0115 LONGPORT BORO

1,904,351,600

78.56 2,424,072,811 0 2,424,072,811

0116 MARGATE CITY CITY

3,858,574,400

68.31 5,648,623,042 0 5,648,623,042

0117 MULLICA TWP

458,006,400

74.78 612,471,784 0 612,471,784

0118 NORTHFIELD CITY

867,036,960

87.20 994,308,440 0 994,308,440

0119 PLEASANTVILLE CITY

793,188,400

87.08 910,873,220 0 910,873,220

0120 PORT REPUBLIC CITY

115,900,200

71.87 161,263,671 0 161,263,671

0121 SOMERS POINT CITY

1,134,603,833

78.10 1,452,757,789 0

100

1,452,757,889

0122 VENTNOR CITY

2,095,551,980

82.80 2,530,859,879 0 2,530,859,879

0123 WEYMOUTH TWP

162,884,300

80.92 201,290,534 0

651,316

201,941,850

TOTAL ATLANTIC COUNTY

30,620,124,186 77.78 39,369,894,998 0 18,413,327 39,388,308,325

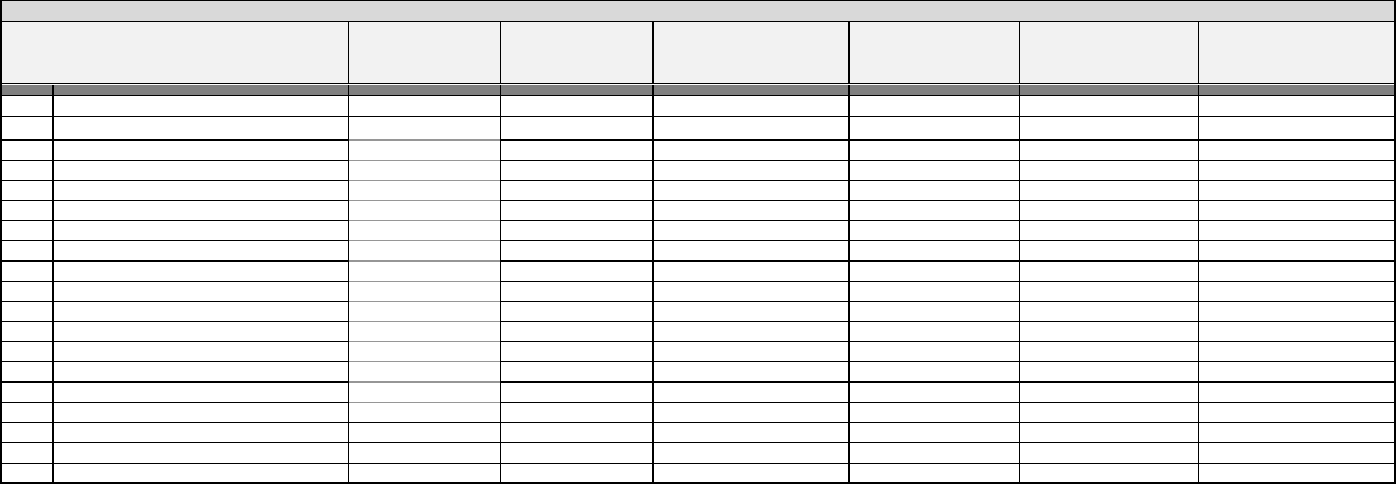

Amended Table of Equalized Valuations 2022

(As Amended by Tax Court Appeals)

*EXCLUSIVE OF CLASS II RAILROAD PROPERTY

**REVISED TOTALS AS AMENDED BY TAX COURT OF NEW JERSEY

1 2 3 4 5 6

COUNTY AND DISTRICT

AGG. ASSESSED

VALUATION

REAL PROP. *

AVE. RATIO

ASSESSED TO

TRUE VALUE

AGG. TRUE VALUE

REAL PROP. *

ASSESSED VALUE

CLASS II R. R.

PROPERTY

ASSESSED VALUE

ALL PERS.

PROPERTY

EQUALIZED

VALUATION

BERGEN COUNTY

0201 ALLENDALE BORO 1,919,652,300 92.48 2,075,748,594 0 100,000 2,075,848,594

0202 ALPINE BORO 1,993,262,800 106.00 1,880,436,604 0 0 1,880,436,604

0203 BERGENFIELD BORO 2,717,204,600 71.93 3,777,567,913 0 87,730 3,777,655,643

0204 BOGOTA BORO 644,806,400 64.05 1,006,723,497 0 0 1,006,723,497

0205 CARLSTADT BORO 2,799,859,000 99.50 2,813,928,643 0 4,413,386 2,818,342,029

0206 CLIFFSIDE PARK BORO 2,976,517,500 76.43 3,894,436,085 0 5,759,805 3,900,195,890

0207 CLOSTER BORO 2,410,251,900 93.46 2,578,912,797 0 100,000 2,579,012,797

0208 CRESSKILL BORO 2,276,071,900 84.35 2,698,366,212 0 0 2,698,366,212

0209 DEMAREST BORO 1,352,691,900 76.68 1,764,073,944 0 82,810 1,764,156,754

0210 DUMONT BORO 1,692,763,240 66.05 2,562,851,234 0 0 2,562,851,234

0211 ELMWOOD PARK BORO 2,097,212,700 78.15 2,683,573,512 0 89 2,683,573,601

0212 E. RUTHERFORD BORO 2,552,528,700 97.63 2,614,492,164 0 4,589,279 2,619,081,443

0213 EDGEWATER BORO 4,072,168,155 101.06 4,029,455,922 0 1,993,757 4,031,449,679

0214 EMERSON BORO 1,212,242,300 80.13 1,512,844,503 0 779,764 1,513,624,267

0215 ENGLEWOOD CITY 4,529,617,800 76.38 5,930,371,563 0 0 5,930,371,563

0216 ENGLEWOOD CLIFFS BORO 3,534,427,800 90.74 3,895,115,495 0 1,745,565 3,896,861,060

0217 FAIRLAWN BORO 4,315,115,300 69.90 6,173,269,385 0

760 6,173,270,145

0218 FAIRVIEW BORO 1,548,905,700 89.56 1,729,461,478 0 1,556,645 1,731,018,123

0219

FORT LEE BORO** 6,624,249,820 91.62 7,230,135,145 0 8,161,821 7,238,296,966

0220 FRANKLIN LAKES BORO 4,440,997,000 91.43 4,857,264,574 0 0 4,857,264,574

0221 GARFIELD CITY 2,160,174,500 65.96 3,274,976,501 0 0 3,274,976,501

0222 GLEN ROCK BORO 2,418,336,300 83.11 2,909,801,829 0 0 2,909,801,829

0223 HACKENSACK CITY 6,838,342,900 96.04 7,120,307,060 0 0 7,120,307,060

0224 HARRINGTON PARK BORO 940,855,350 79.23 1,187,498,864 0 0 1,187,498,864

0225 HASBROUCK HGHTS BORO 2,004,004,900 89.01 2,251,437,928 0 1,185,800 2,252,623,728

0226 HAWORTH BORO 816,381,700 79.26 1,030,004,668 0 572,451 1,030,577,119

0227 HILLSDALE BORO 1,705,060,200 81.17 2,100,603,918 0 5,819,616 2,106,423,534

0228 HOHOKUS BORO 1,190,479,400 80.16 1,485,128,992 0 100 1,485,129,092

0229 LEONIA BORO 1,242,052,500 71.17 1,745,191,092 0 720,729 1,745,911,821

0230 LITTLE FERRY BORO 1,249,090,200 81.78 1,527,378,577 0 100,000 1,527,478,577

0231 LODI BORO 2,007,563,900 68.66 2,923,920,623 0 74,160 2,923,994,783

0232 LYNDHURST TWP 2,702,806,850 65.66 4,116,367,423 0 3,767,452 4,120,134,875

Amended Table of Equalized Valuations 2022

(As Amended by Tax Court Appeals)

*EXCLUSIVE OF CLASS II RAILROAD PROPERTY

**REVISED TOTALS AS AMENDED BY TAX COURT OF NEW JERSEY

1 2 3 4 5 6

COUNTY AND DISTRICT

AGG. ASSESSED

VALUATION

REAL PROP. *

AVE. RATIO

ASSESSED TO

TRUE VALUE

AGG. TRUE VALUE

REAL PROP. *

ASSESSED VALUE

CLASS II R. R.

PROPERTY

ASSESSED VALUE

ALL PERS.

PROPERTY

EQUALIZED

VALUATION

0233

MAHWAH TWP**

5,786,065,340 78.27 7,392,443,261 0 0 7,392,443,261

0234 MAYWOOD BORO 1,648,785,200 88.02 1,873,193,820 0 80,380 1,873,274,200

0235 MIDLAND PARK BORO 1,082,821,500 76.59 1,413,789,659 0 0 1,413,789,659

0236 MONTVALE BORO 2,096,317,870 82.78 2,532,396,557 0 2,182,455 2,534,579,012

0237 MOONACHIE BORO 964,906,200 90.35 1,067,964,804 0 1,261,206 1,069,226,010

0238 NEW MILFORD BORO 1,600,941,300 64.70 2,474,406,955 0 890,825 2,475,297,780

0239 NORTH ARLINGTON BORO 2,089,658,200 84.70 2,467,128,926 0 2,266,574 2,469,395,500

0240

NORTHVALE BORO** 869,805,900 80.77 1,076,892,287 0 908,803 1,077,801,090

0241 NORWOOD BORO 1,226,608,600 85.93 1,427,450,948 0 0 1,427,450,948

0242 OAKLAND BORO 2,917,123,943 87.07 3,350,320,366 0 0 3,350,320,366

0243 OLD TAPPAN BORO 1,726,433,100 89.00 1,939,812,472 0 1,118,587 1,940,931,059

0244 ORADELL BORO 1,805,005,800 89.04 2,027,185,310 0 1,700,271 2,028,885,581

0245 PALISADES PARK BORO 3,467,855,500 87.25 3,974,619,484 0 816,599 3,975,436,083

0246 PARAMUS BORO 10,981,000,720 85.92 12,780,494,320 0 6,007,091 12,786,501,411

0247 PARK RIDGE BORO 1,575,000,715 74.40 2,116,936,445 0 1,346,005 2,118,282,450

0248 RAMSEY BORO 3,521,568,200 85.58 4,114,942,977 0 300,000 4,115,242,977

0249 RIDGEFIELD BORO 2,471,342,200 107.43 2,300,420,925 0 1,262,735 2,301,683,660

0250 RIDGEFIELD PARK VILLAGE 1,601,349,300 85.23 1,878,856,389 0 0 1,878,856,389

0251 RIDGEWOOD VILLAGE 5,870,235,600 75.75 7,749,485,941 0 0 7,749,485,941

0252 RIVEREDGE BORO 1,482,363,299 70.14 2,113,434,986 0 4,467,427 2,117,902,413

0253 RIVERVALE TWP 2,118,733,300 91.03 2,327,511,040 0 1,311,441 2,328,822,481

0254 ROCHELLE PARK TWP 959,972,500 84.10 1,141,465,517 0 0 1,141,465,517

0255 ROCKLEIGH BORO 220,805,842 94.21 234,376,225 0 0 234,376,225

0256 RUTHERFORD BORO 2,727,218,000 77.49 3,519,445,090 0 10,392,277 3,529,837,367

0257 SADDLE BROOK TWP 2,658,193,300 88.17 3,014,850,062 0

0 3,014,850,062

0258 SADDLE RIVER BORO 2,572,089,556 102.02 2,521,162,082 0 0 2,521,162,082

0259 SO HACKENSACK TWP 871,042,000 104.24 835,612,049 0 0 835,612,049

0260 TEANECK TWP 5,230,667,600 73.05 7,160,393,703 0 0 7,160,393,703

0261 TENAFLY BORO 4,036,371,900 80.39 5,020,987,561 0 0 5,020,987,561

0262 TETERBORO BORO 467,878,500 73.27 638,567,627 0 759,000 639,326,627

0263

UPPER SADDLE RIV BORO** 2,277,637,802 76.02 2,996,103,396 0 100,000 2,996,203,396

0264 WALDWICK BORO 1,630,254,800 83.95 1,941,935,438 0 100,000 1,942,035,438

0265 WALLINGTON BORO 963,303,800 69.08 1,394,475,680 0 1,239,999 1,395,715,679

0266 WASHINGTON TWP 1,631,277,500 77.94 2,092,991,404 0 694,871 2,093,686,275

0267 WESTWOOD BORO 2,148,297,500 94.49 2,273,571,277 0 0 2,273,571,277

0268 WOODCLIFF LAKE BORO 2,158,961,700 86.71 2,489,864,721 0 1,801,606 2,491,666,327

0269 WOOD RIDGE BORO 1,440,352,400 79.02 1,822,769,425 0 932,386 1,823,701,811

0270 WYCKOFF TWP 4,773,523,800 93.77 5,090,672,710 0 0 5,090,672,710

TOTAL BERGEN COUNTY

174,657,465,802 83.18 209,970,578,578 0 83,552,257 210,054,130,835

Amended Table of Equalized Valuations 2022

(As Amended by Tax Court Appeals)

*EXCLUSIVE OF CLASS II RAILROAD PROPERTY

**REVISED TOTALS AS AMENDED BY TAX COURT OF NEW JERSEY

1 2 3 4 5 6

COUNTY AND DISTRICT

AGG. ASSESSED

VALUATION

REAL PROP. *

AVE. RATIO

ASSESSED TO

TRUE VALUE

AGG. TRUE VALUE

REAL PROP. *

ASSESSED VALUE

CLASS II R. R.

PROPERTY

ASSESSED VALUE

ALL PERS.

PROPERTY

EQUALIZED

VALUATION

BURLINGTON COUNTY

0301 BASS RIVER TWP

174,003,900

86.24 201,767,045 0

90

201,767,135

0302 BEVERLY CITY

118,583,700

79.89 148,433,721 0

116,589

148,550,310

0303 BORDENTOWN CITY

338,412,100

79.73 424,447,636 0

532,861

424,980,497

0304 BORDENTOWN TWP

1,324,759,767

76.44 1,733,071,385 0

3,110,501

1,736,181,886

0305 BURLINGTON CITY

603,693,300

79.55 758,885,355 0

92

758,885,447

0306 BURLINGTON TWP

2,444,816,350

78.15 3,128,363,852 0

2,420,001

3,130,783,853

0307 CHESTERFIELD TWP

839,792,150

83.57 1,004,896,673 0

1,146,242

1,006,042,915

0308 CINNAMINSON TWP

1,621,784,800

71.42 2,270,771,213 0

81

2,270,771,294

0309 DELANCO TWP

415,959,800

78.93 526,998,353 0

86

526,998,439

0310 DELRAN TWP

1,434,784,600

73.48 1,952,619,216 0

87

1,952,619,303

0311 EASTAMPTON TWP

491,383,800

74.85 656,491,383 0

452,307

656,943,690

0312 EDGEWATER PARK TWP

598,179,760

83.99 712,203,548 0

100

712,203,648

0313 EVESHAM TWP

5,279,859,681

81.39 6,487,111,047 0

17,221,987

6,504,333,034

0314 FIELDSBORO BORO

52,527,900

85.99 61,086,057 0

50,519

61,136,576

0315 FLORENCE TWP

1,294,928,200

92.58 1,398,712,681 0

100

1,398,712,781

0316 HAINESPORT TWP

772,076,305

79.76 967,999,379 0

1,050,836

969,050,215

0317 LUMBERTON TWP

1,376,740,523

85.97 1,601,419,708 0

1,894,498

1,603,314,206

0318 MANSFIELD TWP

1,013,507,400

74.57 1,359,135,577 0

1,772,702

1,360,908,279

0319 MAPLE SHADE TWP

1,312,228,270

79.62 1,648,113,878 0

85

1,648,113,963

0320 MEDFORD TWP

3,078,802,500

75.16 4,096,331,160 0

5,420,307

4,101,751,467

0321 MEDFORD LAKES BORO

451,333,000

73.82 611,396,640 0

281,809

611,678,449

0322 MOORESTOWN TWP

4,112,144,634

76.90 5,347,392,242 0

78

5,347,392,320

0323 MT HOLLY TWP

645,961,100

83.27 775,742,885 0

5,710,750

781,453,635

0324 MT LAUREL TWP

5,825,435,000

79.36 7,340,517,893 0

84

7,340,517,977

0325 NEW HANOVER TWP

64,380,000

56.04 114,882,227 0 114,882,227

0326 NO HANOVER TWP

438,007,843

93.69 467,507,571 0

958,611

468,466,182

0327 PALMYRA BORO

479,124,945

75.86 631,591,016 0

85

631,591,101

0328 PEMBERTON BORO

100,365,800

79.66 125,992,719 0 125,992,719

0329 PEMBERTON TWP

1,481,070,050

81.50 1,817,263,865 0

2,287,490

1,819,551,355

0330 RIVERSIDE TWP

435,198,100

81.00 537,281,605 0

100

537,281,705

0331 RIVERTON BORO

242,924,900

74.89 324,375,618 0

100

324,375,718

0332 SHAMONG TWP

660,825,200

76.44 864,501,832 0

1,093,984

865,595,816

0333 SOUTHAMPTON TWP

991,284,300

67.09 1,477,544,045 0

1,877,602

1,479,421,647

0334 SPRINGFIELD TWP

386,543,600

72.52 533,016,547 0

910,471

533,927,018

0335 TABERNACLE TWP

695,130,200

76.30 911,048,755 0

84

911,048,839

0336 WASHINGTON TWP

95,767,600

83.63 114,513,452 0

85

114,513,537

0337 WESTAMPTON TWP

1,178,446,400

85.55 1,377,494,331 0

1,811,384

1,379,305,715

0338 WILLINGBORO TWP

1,892,378,000

79.23 2,388,461,441 0

99

2,388,461,540

0339 WOODLAND TWP

154,270,100

88.43 174,454,484 0

94

174,454,578

0340 WRIGHTSTOWN BORO

38,769,150

72.27 53,644,873 0

90

53,644,963

TOTAL BURLINGTON COUNTY 44,956,184,728 78.69 57,127,482,908 0 50,123,071 57,177,605,979

Amended Table of Equalized Valuations 2022

(As Amended by Tax Court Appeals)

*EXCLUSIVE OF CLASS II RAILROAD PROPERTY

**REVISED TOTALS AS AMENDED BY TAX COURT OF NEW JERSEY

1 2 3 4 5 6

COUNTY AND DISTRICT

AGG. ASSESSED

VALUATION

REAL PROP. *

AVE. RATIO

ASSESSED TO

TRUE VALUE

AGG. TRUE VALUE

REAL PROP. *

ASSESSED VALUE

CLASS II R. R.

PROPERTY

ASSESSED VALUE

ALL PERS.

PROPERTY

EQUALIZED

VALUATION

CAMDEN COUNTY

0401 AUDUBON BORO 710,483,304 81.50 871,758,655 0 1,290,847 873,049,502

0402 AUDUBON PARK BORO 20,700,000 99.89 20,722,795 0 287,938 21,010,733

0403 BARRINGTON BORO 494,578,400 76.66 645,158,362 0 868,800 646,027,162

0404 BELLMAWR BORO 794,088,600 89.39 888,341,649 0 888,341,649

0405 BERLIN BORO 767,314,500 85.53 897,129,078 0 4,230,325 901,359,403

0406 BERLIN TWP 636,639,600 80.82 787,725,316 0 1,559,235 789,284,551

0407 BROOKLAWN BORO 120,416,300 79.64 151,200,779 0 100 151,200,879

0408 CAMDEN CITY 1,689,157,400 82.28 2,052,938,017 0 26,257,083 2,079,195,100

0409 CHERRY HILL TWP 8,005,308,800 75.35 10,624,165,627 0 17,544,800 10,641,710,427

0410 CHESILHURST BORO 89,164,000 87.18 102,275,751 0 321,735 102,597,486

0411 CLEMENTON BORO 251,413,970 81.37 308,976,244 0 308,976,244

0412 COLLINGSWOOD BORO 1,073,055,600 77.93 1,376,948,030 0 1,376,948,030

0413 GIBBSBORO BORO 226,543,200 82.89 273,305,827 0 273,305,827

0414 GLOUCESTER CITY 520,532,950 79.75 652,705,893 0 652,705,893

0415 GLOUCESTER TWP 4,524,737,800 80.21 5,641,114,325 0 6,073,487 5,647,187,812

0416 HADDON TWP 1,294,222,500 75.46 1,715,110,655 0 963,600 1,716,074,255

0417 HADDONFIELD BORO 2,352,222,800 86.31 2,725,318,967 0 5,036,689 2,730,355,656

0418 HADDON HEIGHTS BORO 843,395,600

92.67 910,106,399 0 877,519 910,983,918

0419 HI NELLA BORO 38,055,800 85.20 44,666,432 0 44,666,432

0420 LAUREL SPRINGS BORO 116,268,300 84.29 137,938,427 0 89 137,938,516

0421 LAWNSIDE BORO 209,630,900 93.40 224,444,218 0 389,584 224,833,802

0422 LINDENWOLD BORO 613,965,800 84.85 723,589,629 0 200 723,589,829

0423 MAGNOLIA BORO 265,301,400 76.09 348,667,893 0 348,667,893

0424 MERCHANTVILLE BORO 241,291,200 78.47 307,494,839 0 307,494,839

0425 MOUNT EPHRAIM BORO 278,146,400 75.47 368,552,272 0 85 368,552,357

0426 OAKLYN BORO 252,820,300 73.63 343,365,883 0 343,365,883

0427 PENNSAUKEN TWP 2,353,610,300 71.31 3,300,533,305 0 4,900,723 3,305,434,028

0428 PINE HILL BORO 442,973,900 72.24 613,197,536 0 435,200 613,632,736

0430 RUNNEMEDE BORO 501,676,200 76.18 658,540,562 0 1,069,300 659,609,862

0431 SOMERDALE BORO 338,512,100 73.47 460,748,741 0 460,748,741

0432 STRATFORD BORO 408,025,000 78.25 521,437,700 0 91 521,437,791

0433 TAVISTOCK BORO 17,165,200 95.43 17,987,216 0 1,096 17,988,312

0434 VOORHEES TWP 3,199,064,714 76.57 4,177,960,969 0 7,262,443 4,185,223,412

0435 WATERFORD TWP 707,842,100 72.11 981,614,339 0 82 981,614,421

0436 WINSLOW TWP 2,692,545,700 77.59 3,470,222,580 0

4,924,500 3,475,147,080

0437 WOODLYNNE BORO 65,989,500 77.05 85,645,036 0 79,158 85,724,194

TOTAL CAMDEN COUNTY 37,156,860,138 78.34 47,431,609,946 0 84,374,709 47,515,984,655

Amended Table of Equalized Valuations 2022

(As Amended by Tax Court Appeals)

*EXCLUSIVE OF CLASS II RAILROAD PROPERTY

**REVISED TOTALS AS AMENDED BY TAX COURT OF NEW JERSEY

1 2 3 4 5 6

COUNTY AND DISTRICT

AGG. ASSESSED

VALUATION

REAL PROP. *

AVE. RATIO

ASSESSED TO

TRUE VALUE

AGG. TRUE VALUE

REAL PROP. *

ASSESSED VALUE

CLASS II R. R.

PROPERTY

ASSESSED VALUE

ALL PERS.

PROPERTY

EQUALIZED

VALUATION

CAPE MAY COUNTY

0501 AVALON BORO 9,541,301,700 68.13 14,004,552,620 0 976,433 14,005,529,053

0502 CAPE MAY CITY 2,948,578,600 67.34 4,378,643,600 0 0 4,378,643,600

0503 CAPE MAY POINT BORO 475,020,100 67.90 699,587,776 0 0 699,587,776

0504 DENNIS TWP 896,627,800 78.33 1,144,679,944 0 1,555,435 1,146,235,379

0505 LOWER TWP 3,696,639,600 65.15 5,674,043,899 0 3,959,309 5,678,003,208

0506 MIDDLE TWP 2,806,800,400 82.06 3,420,424,567 0 8,110,082 3,428,534,649

0507 NORTH WILDWOOD CITY 2,664,641,300 70.15 3,798,490,805 0 0 3,798,490,805

0508 OCEAN CITY CITY 12,297,544,300 67.27 18,280,874,535 0 0 18,280,874,535

0509 SEA ISLE CITY CITY 4,857,779,900 60.16 8,074,767,121 0 0 8,074,767,121

0510 STONE HARBOR BORO 4,976,349,700 66.62 7,469,753,377 0 0 7,469,753,377

0511 UPPER TWP 1,892,524,400 73.67 2,568,921,406 0 0 2,568,921,406

0512 WEST CAPE MAY BORO 523,108,500 57.71 906,443,424 0 0 906,443,424

0513 WEST WILDWOOD BORO 218,103,400 67.11 324,993,891 0 0 324,993,891

0514 WILDWOOD CITY 1,405,212,700 65.78 2,136,230,921 0 0 2,136,230,921

0515 WILDWOOD CREST BORO 2,345,000,000 75.66 3,099,392,017 0 0 3,099,392,017

0516 WOODBINE BORO 177,607,400 98.16 180,936,634 0 837,702 181,774,336

TOTAL CAPE MAY COUNTY 51,722,839,800 67.91 76,162,736,537 0 15,438,961 76,178,175,498

Amended Table of Equalized Valuations 2022

(As Amended by Tax Court Appeals)

*EXCLUSIVE OF CLASS II RAILROAD PROPERTY

**REVISED TOTALS AS AMENDED BY TAX COURT OF NEW JERSEY

1 2 3 4 5 6

COUNTY AND DISTRICT

AGG. ASSESSED

VALUATION

REAL PROP. *

AVE. RATIO

ASSESSED TO

TRUE VALUE

AGG. TRUE VALUE

REAL PROP. *

ASSESSED VALUE

CLASS II R. R.

PROPERTY

ASSESSED VALUE

ALL PERS.

PROPERTY

EQUALIZED

VALUATION

CUMBERLAND COUNTY

0601 BRIDGETON CITY 485,597,000 80.20 605,482,544 0 3,848,356 609,330,900

0602 COMMERCIAL TWP 271,125,300 97.06 279,337,832 0 0 279,337,832

0603 DEERFIELD TWP 192,890,600 80.54 239,496,648 0 599,822 240,096,470

0604 DOWNE TWP 161,084,400 105.11 153,253,163 0 0 153,253,163

0605 FAIRFIELD TWP 316,818,300 99.28 319,115,935 0 721,618 319,837,553

0606 GREENWICH TWP 75,309,500 91.44 82,359,471 0 531,790 82,891,261

0607 HOPEWELL TWP 306,239,600 81.24 376,956,672 0 735,009 377,691,681

0608 LAWRENCE TWP 228,573,400 92.73 246,493,476 0 1,118,640 247,612,116

0609 MAURICE RIVER TWP 291,491,300 89.99 323,915,213 0 626,380 324,541,593

0610 MILLVILLE CITY 1,458,130,800 73.41 1,986,283,613 0 4,238,034 1,990,521,647

0611 SHILOH BORO 32,417,800 85.58 37,880,112 0 122,555 38,002,667

0612 STOW CREEK TWP 107,625,400 76.35 140,963,196 0 459,165 141,422,361

0613 UPPER DEERFIELD TWP 642,261,800 80.33 799,529,192 0 1,535,786 801,064,978

0614 VINELAND CITY 3,857,392,600 79.08 4,877,835,862 0 0 4,877,835,862

TOTAL CUMBERLAND COUNTY 8,426,957,800 80.50 10,468,902,929 0 14,537,155 10,483,440,084

Amended Table of Equalized Valuations 2022

(As Amended by Tax Court Appeals)

*EXCLUSIVE OF CLASS II RAILROAD PROPERTY

**REVISED TOTALS AS AMENDED BY TAX COURT OF NEW JERSEY

1 2 3 4 5 6

COUNTY AND DISTRICT

AGG. ASSESSED

VALUATION

REAL PROP. *

AVE. RATIO

ASSESSED TO

TRUE VALUE

AGG. TRUE VALUE

REAL PROP. *

ASSESSED VALUE

CLASS II R. R.

PROPERTY

ASSESSED VALUE

ALL PERS.

PROPERTY

EQUALIZED

VALUATION

ESSEX COUNTY

0701

BELLEVILLE TWP**

3,088,787,300

81.98 3,767,732,740 0

6,298,783

3,774,031,523

0702 BLOOMFIELD TWP

5,300,647,500

85.89 6,171,437,304 0

8,004,100

6,179,441,404

0703 CALDWELL BORO TWP

1,041,944,900

77.58 1,343,058,649 0

3,051,497

1,346,110,146

0704 CEDAR GROVE TWP

2,227,617,600

83.82 2,657,620,616 0

1,496,669

2,659,117,285

0705 EAST ORANGE CITY

4,819,579,200

96.61 4,988,695,994 0

12,269,700

5,000,965,694

0706 ESSEX FELLS TWP

753,012,800

92.49 814,155,909 0

251,451

814,407,360

0707 FAIRFIELD TWP

3,189,320,700

84.12 3,791,394,080 0

7,796,800

3,799,190,880

0708 GLEN RIDGE TWP

1,717,587,900

75.89 2,263,259,850 0

799,427

2,264,059,277

0709

IRVINGTON TWP**

1,860,639,700

62.44 2,979,884,209 0

6,564,353

2,986,448,562

0710 LIVINGSTON TWP

8,550,838,300

89.38 9,566,836,317 0

11,493,011

9,578,329,328

0711 MAPLEWOOD TWP

3,882,712,600

77.90 4,984,226,701 0

2,315,461

4,986,542,162

0712 MILLBURN TWP

9,814,557,900

91.04 10,780,489,785 0

7,297,228

10,787,787,013

0713 MONTCLAIR TWP

7,120,172,300

72.47 9,824,992,825 0

9,003,189

9,833,996,014

0714

NEWARK CITY**

12,421,381,800

81.83 15,179,496,273 0

80,580,592

15,260,076,865

0715 NORTH CALDWELL TWP

1,892,667,900

87.63 2,159,840,123 0

554,300

2,160,394,423

0716 NUTLEY TWP

3,259,396,300

69.50 4,689,778,849 0

7,460

4,689,786,309

0717 ORANGE CITY TWP

2,271,410,300

109.75 2,069,622,141 0

3,493,800

2,073,115,941

0718 ROSELAND BORO

1,649,265,800

88.46 1,864,419,851 0

1,552,759

1,865,972,610

0719 SOUTH ORANGE VILLAGE TWP

2,832,274,500

77.11 3,673,031,384 0

4,514,992

3,677,546,376

0720 VERONA TWP

2,388,353,700

79.77 2,994,050,019 0

1,465,846

2,995,515,865

0721 WEST CALDWELL TWP

2,304,320,600

82.67 2,787,372,203 0

1,367,971

2,788,740,174

0722 WEST ORANGE TWP

5,506,337,000

78.22 7,039,551,266 0

9,301,100

7,048,852,366

TOTAL ESSEX COUNTY 87,892,826,600 82.61 106,390,947,088 0 179,480,489 106,570,427,577

Amended Table of Equalized Valuations 2022

(As Amended by Tax Court Appeals)

*EXCLUSIVE OF CLASS II RAILROAD PROPERTY

**REVISED TOTALS AS AMENDED BY TAX COURT OF NEW JERSEY

1 2 3 4 5 6

COUNTY AND DISTRICT

AGG. ASSESSED

VALUATION

REAL PROP. *

AVE. RATIO

ASSESSED TO

TRUE VALUE

AGG. TRUE VALUE

REAL PROP. *

ASSESSED VALUE

CLASS II R. R.

PROPERTY

ASSESSED VALUE

ALL PERS.

PROPERTY

EQUALIZED

VALUATION

GLOUCESTER COUNTY

0801 CLAYTON BORO

471,806,100

75.96 621,124,408 0

1,349,667

622,474,075

0802 DEPTFORD TWP

2,843,512,480

81.71 3,480,005,483 0

5,741,775

3,485,747,258

0803 EAST GREENWICH TWP

1,251,892,500

81.00 1,545,546,296 0

0

1,545,546,296

0804 ELK TWP

379,648,400

80.03 474,382,607 0

1,110,641

475,493,248

0805 FRANKLIN TWP

1,237,711,200

75.24 1,645,017,544 0

2,063,354

1,647,080,898

0806 GLASSBORO BORO

1,318,462,200

83.43 1,580,321,467 0

6,755,774

1,587,077,241

0807 GREENWICH TWP

723,625,142

90.92 795,892,149 0

0

795,892,149

0808 HARRISON TWP

1,537,765,100

79.44 1,935,756,672 0

2,751,847

1,938,508,519

0809 LOGAN TWP

1,649,740,340

82.37 2,002,841,253 0

0

2,002,841,253

0810 MANTUA TWP

1,374,129,000

71.63 1,918,370,794 0

0

1,918,370,794

0811 MONROE TWP

2,777,194,100

78.49 3,538,277,615 0

0

3,538,277,615

0812 NATIONAL PARK BORO

160,415,800

83.74 191,564,127 0

325,351

191,889,478

0813 NEWFIELD BORO

134,192,900

80.49 166,719,965 0

0

166,719,965

0814 PAULSBORO BORO

341,013,200

87.71 388,796,260 0

0

388,796,260

0815 PITMAN BORO

789,681,200

100.33 787,083,823 0

0

787,083,823

0816 SO HARRISON TWP

395,866,900

75.23 526,208,826 0

0

526,208,826

0817 SWEDESBORO BORO

172,831,100

76.62 225,569,173 0

0

225,569,173

0818 WASHINGTON TWP

4,732,998,115

78.78 6,007,867,625 0

5,270,560

6,013,138,185

0819 WENONAH BORO

216,925,400

82.84 261,860,695 0

0

261,860,695

0820 WEST DEPTFORD TWP

2,221,597,800

79.28 2,802,217,205 0

4,699,328

2,806,916,533

0821 WESTVILLE BORO

233,406,600

77.27 302,066,261 0

220,402

302,286,663

0822 WOODBURY CITY

624,068,465

83.49 747,476,901 0

5,643,492

753,120,393

0823 WOODBURY HEIGHTS BORO

249,081,200

79.53 313,191,500 0

616,211

313,807,711

0824 WOOLWICH TWP

1,420,257,010

84.20 1,686,766,045 0

0

1,686,766,045

TOTAL GLOUCESTER COUNTY 27,257,822,252 80.30 33,944,924,694 0 36,548,402 33,981,473,096

Amended Table of Equalized Valuations 2022

(As Amended by Tax Court Appeals)

*EXCLUSIVE OF CLASS II RAILROAD PROPERTY

**REVISED TOTALS AS AMENDED BY TAX COURT OF NEW JERSEY

1 2 3 4 5 6

COUNTY AND DISTRICT

AGG. ASSESSED

VALUATION

REAL PROP. *

AVE. RATIO

ASSESSED TO

TRUE VALUE

AGG. TRUE VALUE

REAL PROP. *

ASSESSED VALUE

CLASS II R. R.

PROPERTY

ASSESSED VALUE

ALL PERS.

PROPERTY

EQUALIZED

VALUATION

HUDSON COUNTY

0901 BAYONNE CITY 7,526,926,600 83.13 9,054,404,667 0 7,497,277 9,061,901,944

0902 EAST NEWARK BORO 157,393,700 63.58 247,552,218 0 122,994 247,675,212

0903 GUTTENBERG TOWN 783,586,075 64.35 1,217,693,978 0 507,541 1,218,201,519

0904 HARRISON TOWN 1,538,362,638 89.44 1,719,994,005 0 2,044,882 1,722,038,887

0905 HOBOKEN CITY 11,875,940,200 65.88 18,026,624,469 0 5,993,678 18,032,618,147

0906

JERSEY CITY CITY** 40,889,213,020 82.91 49,317,588,976 0 62,929,044 49,380,518,020

0907 KEARNY TOWN 1,126,327,250 20.03 5,623,201,448 0 2,185,160 5,625,386,608

0908 NORTH BERGEN TWP 9,828,208,397 100.51 9,778,338,869 0 9,271,757 9,787,610,626

0909 SECAUCUS TOWN 2,846,020,125 48.49 5,869,292,895 0 3,840,357 5,873,133,252

0910 UNION CITY CITY 1,546,590,660 29.59 5,226,734,235 0 5,554,122 5,232,288,357

0911 WEEHAWKEN TWP 4,090,748,584 98.52 4,152,201,161 0 3,234,984 4,155,436,145

0912 WEST NEW YORK TOWN 927,799,225 24.59 3,773,075,336 0 851,873 3,773,927,209

TOTAL HUDSON COUNTY 83,137,116,474 72.92 114,006,702,257 0 104,033,669 114,110,735,926

Amended Table of Equalized Valuations 2022

(As Amended by Tax Court Appeals)

*EXCLUSIVE OF CLASS II RAILROAD PROPERTY

**REVISED TOTALS AS AMENDED BY TAX COURT OF NEW JERSEY

1 2 3 4 5 6

COUNTY AND DISTRICT

AGG. ASSESSED

VALUATION

REAL PROP. *

AVE. RATIO

ASSESSED TO

TRUE VALUE

AGG. TRUE VALUE

REAL PROP. *

ASSESSED VALUE

CLASS II R. R.

PROPERTY

ASSESSED VALUE

ALL PERS.

PROPERTY

EQUALIZED

VALUATION

HUNTERDON COUNTY

1001 ALEXANDRIA TWP 720,352,700 81.26 886,478,833 0 159,949 886,638,782

1002 BETHLEHEM TWP 527,129,499 78.58 670,818,909 0 94 670,819,003

1003 BLOOMSBURY BORO 89,766,600 81.46 110,197,152 0 95 110,197,247

1004 CALIFON BORO 147,530,108 86.08 171,387,207 0 100 171,387,307

1005 TOWN OF CLINTON 423,128,100 91.86 460,622,796 0 0 460,622,796

1006 CLINTON TWP 2,157,596,300 89.43 2,412,609,080 0 0 2,412,609,080

1007 DELAWARE TWP 806,509,730 78.46 1,027,924,713 0 0 1,027,924,713

1008 EAST AMWELL TWP 672,447,700 78.39 857,823,319 0 841,090 858,664,409

1009 FLEMINGTON BORO 497,614,920 100.34 495,928,762 0 0 495,928,762

1010 FRANKLIN TWP 545,677,500 95.23 573,010,081 0 1,403,600 574,413,681

1011 FRENCHTOWN BORO 151,828,409 76.05 199,642,878 0 0 199,642,878

1012 GLEN GARDNER BORO 139,678,463 72.01 193,970,925 0 0 193,970,925

1013 HAMPTON BORO 121,944,436 95.47 127,730,634 0 0 127,730,634

1014 HIGH BRIDGE BORO 343,660,000 82.24 417,874,514 0 0 417,874,514

1015 HOLLAND TWP 629,263,441 78.36 803,041,655 0 1,188,633 804,230,288

1016 KINGWOOD TWP 624,317,974 84.23 741,206,190 0 1,437,091 742,643,281

1017 LAMBERTVILLE CITY 839,618,392 87.93 954,871,366 0

0 954,871,366

1018 LEBANON BORO 280,573,003 96.41 291,020,644 0 0 291,020,644

1019 LEBANON TWP 930,222,353 84.81 1,096,830,979 0 94,882 1,096,925,861

1020 MILFORD BORO 115,848,641 83.21 139,224,421 0 175,574 139,399,995

1021 RARITAN TWP 4,260,254,500 82.67 5,153,325,874 0 0 5,153,325,874

1022 READINGTON TWP 3,310,837,200 88.16 3,755,486,842 0 592,163 3,756,079,005

1023 STOCKTON BORO 91,342,000 85.28 107,108,349 0 0 107,108,349

1024 TEWKSBURY TWP 1,576,842,200 88.23 1,787,195,058 0 0 1,787,195,058

1025 UNION TWP 708,538,232 71.98 984,354,310 0 0 984,354,310

1026

WEST AMWELL TWP** 616,331,283 96.30 640,011,717 0 637,446 640,649,163

TOTAL HUNTERDON COUNTY 21,328,853,684 85.11 25,059,697,208 0 6,530,717 25,066,227,925

Amended Table of Equalized Valuations 2022

(As Amended by Tax Court Appeals)

*EXCLUSIVE OF CLASS II RAILROAD PROPERTY

**REVISED TOTALS AS AMENDED BY TAX COURT OF NEW JERSEY

1 2 3 4 5 6

COUNTY AND DISTRICT

AGG. ASSESSED

VALUATION

REAL PROP. *

AVE. RATIO

ASSESSED TO

TRUE VALUE

AGG. TRUE VALUE

REAL PROP. *

ASSESSED VALUE

CLASS II R. R.

PROPERTY

ASSESSED VALUE

ALL PERS.

PROPERTY

EQUALIZED

VALUATION

MERCER COUNTY

1101 EAST WINDSOR TWP

2,853,297,800

79.90 3,571,086,108 0

4,289,845

3,575,375,953

1102 EWING TWP

3,270,431,275

85.74 3,814,358,847 0

14,976,422

3,829,335,269

1103 HAMILTON TWP

8,737,351,350

83.39 10,477,696,786 0

26,466,000

10,504,162,786

1104 HIGHTSTOWN BORO

392,879,100

73.49 534,602,123 0

3,222,092

537,824,215

1105 HOPEWELL BORO

318,574,800

85.59 372,210,305 0 372,210,305

1106 HOPEWELL TWP

3,878,045,310

84.74 4,576,404,661 0

6,076,246

4,582,480,907

1107 LAWRENCE TWP

4,686,397,800

85.45 5,484,374,254 0

6,723,265

5,491,097,519

1108 PENNINGTON BORO

525,531,200

85.78 612,650,035 0

2,118,491

614,768,526

1111 TRENTON CITY

2,204,483,410

74.89 2,943,628,535 0

15,600,425

2,959,228,960

1112 ROBBINSVILLE TWP

2,656,127,900

81.68 3,251,870,593 0

2,929,578

3,254,800,171

1113 WEST WINDSOR TWP

6,005,986,592

81.05 7,410,224,049 0

10,913,029

7,421,137,078

1114 PRINCETON

7,230,354,952

77.40 9,341,543,866 0

8,366,303

9,349,910,169

TOTAL MERCER COUNTY 42,759,461,489 81.62 52,390,650,162 0 101,681,696 52,492,331,858

Amended Table of Equalized Valuations 2022

(As Amended by Tax Court Appeals)

*EXCLUSIVE OF CLASS II RAILROAD PROPERTY

**REVISED TOTALS AS AMENDED BY TAX COURT OF NEW JERSEY

1 2 3 4 5 6

COUNTY AND DISTRICT

AGG. ASSESSED

VALUATION

REAL PROP. *

AVE. RATIO

ASSESSED TO

TRUE VALUE

AGG. TRUE VALUE

REAL PROP. *

ASSESSED VALUE

CLASS II R. R.

PROPERTY

ASSESSED VALUE

ALL PERS.

PROPERTY

EQUALIZED

VALUATION

MIDDLESEX COUNTY

1201 CARTERET BORO** 2,489,932,183 70.19 3,547,417,272 0 0 3,547,417,272

1202 CRANBURY TWP 1,929,830,000 90.03 2,143,541,042 0 2,025,023 2,145,566,065

1203 DUNELLEN BORO 798,480,700 94.27 847,014,639 0 0 847,014,639

1204 EAST BRUNSWICK TWP 1,911,369,950 22.16 8,625,315,659 0 2,188,943 8,627,504,602

1205 EDISON TWP 7,346,196,900 38.14 19,261,135,029 0 5,762,100 19,266,897,129

1206 HELMETTA BORO 186,543,500 70.05 266,300,500 0 178,606 266,479,106

1207 HIGHLAND PARK BORO 594,068,800 37.49 1,584,606,028 0 42 1,584,606,070

1208 JAMESBURG BORO 239,603,100 45.44 527,295,555 0 1,258,336 528,553,891

1209 METUCHEN BORO 1,098,324,300 36.70 2,992,709,264 0 0 2,992,709,264

1210 MIDDLESEX BORO 490,809,784 23.62 2,077,941,507 0 497,992 2,078,439,499

1211 MILLTOWN BORO 444,241,700 39.21 1,132,980,617 0 0 1,132,980,617

1212 MONROE TWP 8,249,811,000 70.07 11,773,670,615 0 5,909,313 11,779,579,928

1213 NEW BRUNSWICK CITY 3,506,933,350 87.87 3,991,047,400 0 10,000,000 4,001,047,400

1214 NORTH BRUNSWICK TWP 2,547,776,200 40.83 6,239,961,303 0 0 6,239,961,303

1215 OLD BRIDGE TWP 3,561,673,400 35.30 10,089,726,346 0 3,129,137 10,092,855,483

1216 PERTH AMBOY CITY 3,408,014,100 82.08 4,152,063,962 0 5,304,357 4,157,368,319

1217 PISCATAWAY TWP 8,587,037,000 80.92 10,611,760,999 0

23,080,672 10,634,841,671

1218

PLAINSBORO TWP** 4,492,784,400 93.09 4,826,280,374 0 7,578,094 4,833,858,468

1219 SAYREVILLE BORO 2,332,345,500 39.41 5,918,156,559 0 42 5,918,156,601

1220 SOUTH AMBOY CITY 901,241,600 76.52 1,177,785,677 0 0 1,177,785,677

1221 SOUTH BRUNSWICK TWP 4,166,026,200 37.74 11,038,755,167 0 6,926,446 11,045,681,613

1222 SOUTH PLAINFIELD BORO 1,458,994,991 32.59 4,476,818,015 0 1,615,150 4,478,433,165

1223 SOUTH RIVER BORO 1,513,486,100 81.92 1,847,517,212 0 0 1,847,517,212

1224 SPOTSWOOD BORO 749,098,800 72.95 1,026,866,073 0 0 1,026,866,073

1225 WOODBRIDGE TWP 3,192,520,600 22.38 14,265,060,769 0 3,777,573 14,268,838,342

TOTAL MIDDLESEX COUNTY 66,197,144,158 49.24 134,441,727,583 0 79,231,826 134,520,959,409

Amended Table of Equalized Valuations 2022

(As Amended by Tax Court Appeals)

*EXCLUSIVE OF CLASS II RAILROAD PROPERTY

**REVISED TOTALS AS AMENDED BY TAX COURT OF NEW JERSEY

1 2 3 4 5 6

COUNTY AND DISTRICT

AGG. ASSESSED

VALUATION

REAL PROP. *

AVE. RATIO

ASSESSED TO

TRUE VALUE

AGG. TRUE VALUE

REAL PROP. *

ASSESSED VALUE

CLASS II R. R.

PROPERTY

ASSESSED VALUE

ALL PERS.

PROPERTY

EQUALIZED

VALUATION

MONMOUTH COUNTY

1301 ABERDEEN TWP

2,635,977,990

92.48 2,850,322,221 0

0

2,850,322,221

1302 ALLENHURST BORO

800,668,300

82.02 976,186,662 0

330,877

976,517,539

1303 ALLENTOWN BORO

193,735,300

97.17 199,377,689 0

0

199,377,689

1304 ASBURY PARK CITY

2,331,404,980

93.89 2,483,123,847 0

0

2,483,123,847

1305 ATLANTIC HIGHLANDS BORO

1,053,112,200

97.23 1,083,114,471 0

1,873,737

1,084,988,208

1306 AVON BY THE SEA BORO

1,374,021,500

94.30 1,457,074,761 0

0

1,457,074,761

1307 BELMAR BORO

1,753,089,100

74.27 2,360,426,956 0

0

2,360,426,956

1308 BRADLEY BEACH BORO

1,753,906,800

92.19 1,902,491,377 0

0

1,902,491,377

1309 BRIELLE BORO

1,980,641,200

92.96 2,130,638,124 0

0

2,130,638,124

1310 COLTS NECK TWP

3,297,685,800

93.20 3,538,289,485 0

4,557,243

3,542,846,728

1311 DEAL BORO

3,205,943,000

83.14 3,856,077,700 0

1,020,518

3,857,098,218

1312 EATON TOWN BORO

2,559,242,700

77.52 3,301,396,672 0

7,546,692

3,308,943,364

1313 ENGLISHTOWN BORO

324,074,100

102.22 317,035,903 0

0

317,035,903

1314 FAIRHAVEN BORO

2,104,140,600

88.32 2,382,405,571 0

518,952

2,382,924,523

1315 FARMINGDALE BORO

191,731,200

93.31 205,477,655 0

0

205,477,655

1316 FREEHOLD BORO

1,287,415,100

92.65 1,389,546,789 0

0

1,389,546,789

1317 FREEHOLD TWP

7,482,540,200

89.49 8,361,314,337 0

0

8,361,314,337

1318 HAZLET TWP

2,954,723,800

90.19 3,276,110,212 0

1,815,653

3,277,925,865

1319 HIGHLANDS BORO

889,250,800

95.74 928,818,467 0

449,412

929,267,879

1320 HOLMDEL TWP

4,830,125,500

95.65 5,049,791,427 0

7,333,671

5,057,125,098

1321 HOWELL TWP

8,450,898,900

89.51 9,441,290,247 0

0

9,441,290,247

1322 INTERLAKEN BORO

385,218,500

87.24 441,561,784 0

108,660

441,670,444

1323 KEANSBURG BORO

826,706,700

98.31 840,918,218 0

540,505

841,458,723

1324 KEYPORT BORO

904,674,400

88.49 1,022,346,480 0

5,274,669

1,027,621,149

1325 LITTLE SILVER BORO

1,927,538,151

97.39 1,979,195,144 0

1,270,759

1,980,465,903

1326 LOCH ARBOUR VILLAGE

321,021,000

155.85 205,980,751 0

74,003

206,054,754

1327 LONG BRANCH CITY

6,077,321,400

83.63 7,266,915,461 0

0

7,266,915,461

1328 MANALAPAN TWP

8,409,902,400

94.50 8,899,367,619 0

0

8,899,367,619

1329 MANASQUAN BORO

2,036,021,100

66.73 3,051,133,074 0

0

3,051,133,074

Amended Table of Equalized Valuations 2022

(As Amended by Tax Court Appeals)

*EXCLUSIVE OF CLASS II RAILROAD PROPERTY

**REVISED TOTALS AS AMENDED BY TAX COURT OF NEW JERSEY

1 2 3 4 5 6

COUNTY AND DISTRICT

AGG. ASSESSED

VALUATION

REAL PROP. *

AVE. RATIO

ASSESSED TO

TRUE VALUE

AGG. TRUE VALUE

REAL PROP. *

ASSESSED VALUE

CLASS II R. R.

PROPERTY

ASSESSED VALUE

ALL PERS.

PROPERTY

EQUALIZED

VALUATION

1330

MARLBORO TWP

7,301,546,320

76.92 9,492,389,912 0

0

9,492,389,912

1331 MATAWAN BORO

1,331,071,700

95.46 1,394,376,388 0

0

1,394,376,388

1332 MIDDLETOWN TWP

13,489,015,400

98.10 13,750,270,540 0

15,076,519

13,765,347,059

1333 MILLSTONE TWP

1,908,290,860

81.30 2,347,221,230 0

6,031,459

2,353,252,689

1334 MONMOUTH BEACH BORO

1,815,973,200

89.71 2,024,270,650 0

0

2,024,270,650

1335 NEPTUNE TWP

5,068,182,700

94.87 5,342,239,591 0

0

5,342,239,591

1336 NEPTUNE CITY BORO

740,648,300

88.72 834,815,487 0

0

834,815,487

1337 OCEAN TWP

6,625,540,557

84.18 7,870,682,534 0

4,765,890

7,875,448,424

1338 OCEANPORT BORO

1,514,975,000

88.22 1,717,269,327 0

1,191,711

1,718,461,038

1339 RED BANK BORO

2,653,454,400

93.42 2,840,349,390 0

9,389,982

2,849,739,372

1340 ROOSEVELT BORO

97,698,000

93.12 104,916,237 0

119,877

105,036,114

1341 RUMSON BORO

4,550,096,100

95.42 4,768,493,083 0

1,288,127

4,769,781,210

1342 SEA BRIGHT BORO

974,038,300

85.29 1,142,031,070 0

564,483

1,142,595,553

1343 SEA GIRT BORO

2,820,739,500

90.83 3,105,515,248 0

0

3,105,515,248

1344 SHREWSBURY BORO

1,371,980,700

92.04 1,490,635,267 0

1,285,145

1,491,920,412

1345 SHREWSBURY TWP

82,448,000

124.68 66,127,687 0

122,683

66,250,370

1346 LAKE COMO BORO

611,123,400

108.29 564,339,644 0

0

564,339,644

1347 SPRING LAKE BORO

5,452,512,100

89.99 6,059,020,002 0

0

6,059,020,002

1348 SPRING LAKE HEIGHTS BORO

1,546,955,000

93.00 1,663,392,473 0

0

1,663,392,473

1349 TINTON FALLS BORO

4,277,077,400

92.99 4,599,502,527 0

3,851,437

4,603,353,964

1350 UNION BEACH BORO

798,779,700

93.67 852,759,368 0

516,560

853,275,928

1351 UPPER FREEHOLD TWP

1,461,420,800

88.14 1,658,067,620 0

0

1,658,067,620

1352 WALL TWP

6,145,149,000

76.00 8,085,722,368 0

0

8,085,722,368

1353 WEST LONG BRANCH BORO

2,012,663,300

95.57 2,105,957,204 0

2,459,444

2,108,416,648

TOTAL MONMOUTH COUNTY 146,994,112,458 89.05 165,078,093,951 0 79,378,668 165,157,472,619

Amended Table of Equalized Valuations 2022

(As Amended by Tax Court Appeals)

*EXCLUSIVE OF CLASS II RAILROAD PROPERTY

**REVISED TOTALS AS AMENDED BY TAX COURT OF NEW JERSEY

1 2 3 4 5 6

COUNTY AND DISTRICT

AGG. ASSESSED

VALUATION

REAL PROP. *

AVE. RATIO

ASSESSED TO

TRUE VALUE

AGG. TRUE VALUE

REAL PROP. *

ASSESSED VALUE

CLASS II R. R.

PROPERTY

ASSESSED VALUE

ALL PERS.

PROPERTY

EQUALIZED

VALUATION

MORRIS COUNTY

1401 BOONTON TOWN 1,101,252,100 77.15 1,427,416,850 0 0 1,427,416,850

1402 BOONTOWN TWP 874,607,500 83.62 1,045,930,997 0 0 1,045,930,997

1403 BUTLER BORO 1,089,687,600 91.36 1,192,740,368 0 615,350 1,193,355,718

1404 CHATHAM BORO 2,127,618,300 73.99 2,875,548,452 0 1,039,181 2,876,587,633

1405 CHATHAM TWP 3,325,922,900 81.38 4,086,904,522 0 1,699,669 4,088,604,191

1406 CHESTER BORO 429,887,200 98.53 436,300,822 0 9,420 436,310,242

1407 CHESTER TWP 1,816,544,100 90.12 2,015,694,740 0 431,464 2,016,126,204

1408 DENVILLE TWP 3,077,790,700 82.00 3,753,403,293 0 0 3,753,403,293

1409 DOVER TWP 1,303,674,000 78.73 1,655,879,588 0 0 1,655,879,588

1410 EAST HANOVER TWP 2,526,704,300 71.81 3,518,596,714 0 7,669 3,518,604,383

1411 FLORHAM PARK BORO 3,637,929,200 94.46 3,851,290,705 0 4,102,053 3,855,392,758

1412 HANOVER TWP 3,845,632,800 75.98 5,061,375,099 0 0 5,061,375,099

1413 HARDING TWP 2,100,196,800 89.92 2,335,628,114 0 1,318,028 2,336,946,142

1414 JEFFERSON TWP 2,844,523,500 91.97 3,092,881,918 0 100 3,092,882,018

1415 KINNELON BORO 2,106,464,900 93.58 2,250,977,666 0 0 2,250,977,666

1416 LINCOLN PARK BORO 1,358,710,500 82.51 1,646,722,215 0 0 1,646,722,215

1417 MADISON BORO 3,597,854,700 81.53 4,412,921,256 0

0 4,412,921,256

1418 MENDHAM BORO 1,263,375,400 88.91 1,420,959,847 0 2,333,706 1,423,293,553

1419 MENDHAM TWP 1,955,971,000 93.83 2,084,590,216 0 1,456,656 2,086,046,872

1420 MINE HILL TWP 448,644,000 80.04 560,524,738 0 0 560,524,738

1421 MONTVILLE TWP 4,509,360,700 84.15 5,358,717,409 0 2,879,338 5,361,596,747

1422 MORRIS TWP 5,426,750,138 89.69 6,050,563,204 0 0 6,050,563,204

1423 MORRIS PLAINS BORO 1,371,168,200 84.09 1,630,596,028 0 0 1,630,596,028

1424 MORRISTOWN TOWN 2,299,632,050 78.16 2,942,210,914 0 55,063 2,942,265,977

1425 MOUNTAIN LAKES BORO 1,278,893,400 89.29 1,432,291,858 0 803,200 1,433,095,058

1426 MOUNT ARLINGTON BORO 735,399,300 78.88 932,301,344 0 0 932,301,344

1427 MOUNT OLIVE TWP 3,285,501,700 82.35 3,989,680,267 0 0 3,989,680,267

1428 NETCONG BORO 318,920,400 96.37 330,933,278 0 0 330,933,278

1429 PARSIPPANY TR HLS TWP 7,293,263,600 76.72 9,506,339,416 0 404,650 9,506,744,066

1430 LONG HILL TWP 1,837,319,200 94.89 1,936,262,198 0 4,230,126 1,940,492,324

1431 PEQUANNOCK TWP 2,369,974,700 74.64 3,175,207,262 0 100 3,175,207,362

1432 RANDOLPH TWP 4,372,769,500 87.96 4,971,315,939 0 5,829,678 4,977,145,617

1433 RIVERDALE BORO 919,069,800 88.27 1,041,202,900 0 5,127,574 1,046,330,474

1434 ROCKAWAY BORO 791,462,900 86.99

909,832,050 0 92 909,832,142

1435 ROCKAWAY TWP 4,615,515,400 88.71 5,202,925,713 0 0 5,202,925,713

1436 ROXBURY TWP 3,511,915,600 82.18 4,273,443,174 0 0 4,273,443,174

1437 VICTORY GARDENS BORO 70,895,600 72.45 97,854,520 0 0 97,854,520

1438 WASHINGTON TWP 2,815,182,300 86.68 3,247,787,610 0 0 3,247,787,610

1439 WHARTON BORO 794,084,700 89.75 884,774,039 0 0 884,774,039

TOTAL MORRIS COUNTY 89,450,070,688 83.88 106,640,527,243 0 32,343,117 106,672,870,360

Amended Table of Equalized Valuations 2022

(As Amended by Tax Court Appeals)

*EXCLUSIVE OF CLASS II RAILROAD PROPERTY

**REVISED TOTALS AS AMENDED BY TAX COURT OF NEW JERSEY

1 2 3 4 5 6

COUNTY AND DISTRICT

AGG. ASSESSED

VALUATION

REAL PROP. *

AVE. RATIO

ASSESSED TO

TRUE VALUE

AGG. TRUE VALUE

REAL PROP. *

ASSESSED VALUE

CLASS II R. R.

PROPERTY

ASSESSED VALUE

ALL PERS.

PROPERTY

EQUALIZED

VALUATION

OCEAN COUNTY

1501 BARNEGAT TWP 2,587,370,000 74.42 3,476,713,249 0 0 3,476,713,249

1502 BARNEGAT LIGHT BORO 1,044,756,900 78.55 1,330,053,342 0 0 1,330,053,342

1503 BAY HEAD BORO 1,642,367,500 75.21 2,183,708,948 0 0 2,183,708,948

1504 BEACH HAVEN BORO 2,141,434,300 68.12 3,143,620,523 0 0 3,143,620,523

1505 BEACHWOOD BORO 817,782,400 69.52 1,176,326,812 0 714,116 1,177,040,928

1506 BERKELEY TWP 5,286,144,700 69.75 7,578,702,079 0 6,159,513 7,584,861,592

1507 BRICK TWP 10,505,100,600 72.89 14,412,265,880 0 10,220,222 14,422,486,102

1508 TOMS RIVER TWP 20,212,809,800 93.87 21,532,768,510 0 30,746,845 21,563,515,355

1509 EAGLESWOOD TWP 234,974,700 81.47 288,418,682 0 0 288,418,682

1510 HARVEY CEDARS BORO 1,320,140,100 77.58 1,701,650,039 0 0 1,701,650,039

1511 ISLAND HEIGHTS BORO 371,966,600 77.41 480,514,921 0 184,661 480,699,582

1512 JACKSON TWP 6,921,225,100 69.25 9,994,548,881 0 6,513,973 10,001,062,854

1513 LACEY TWP 3,981,007,600 77.27 5,152,074,026 0 0 5,152,074,026

1514 LAKEHUSRT BORO 143,206,300 71.11 201,387,006 0 1,336,255 202,723,261

1515 LAKEWOOD TWP 10,744,753,700 70.98 15,137,720,062 0 0 15,137,720,062

1516 LAVALETTE BORO 2,392,260,100 75.84 3,154,351,398 0 0 3,154,351,398

1517 LITTLE EGG HARBOR TWP 2,348,313,428 72.35 3,245,768,387 0

0 3,245,768,387

1518 LONG BEACH TWP 10,509,841,700 81.20 12,943,154,803 0 0 12,943,154,803

1519 MANCHESTER TWP 4,233,609,500 74.47 5,684,986,572 0 5,147,618 5,690,134,190

1520 MANTOLOKING BORO 1,513,539,600 71.60 2,113,882,123 0 0 2,113,882,123

1521 OCEAN TWP 1,339,793,200 72.76 1,841,387,026 0 0 1,841,387,026

1522 OCEAN GATE BORO 226,746,200 67.29 336,968,643 0 68,115 337,036,758

1523 PINE BEACH BORO 251,594,800 66.06 380,858,008 0 160,900 381,018,908

1524 PLUMSTED TWP 782,700,600 72.07 1,086,028,306 0 0 1,086,028,306

1525 POINT PLEASANT BORO 3,344,789,200 73.53 4,548,876,921 0 0 4,548,876,921

1526 PT PLEASANT BEACH BORO 2,048,679,200 74.64 2,744,747,053 0 0 2,744,747,053

1527 SEASIDE HEIGHTS BORO 672,615,500 72.21 931,471,403 0 0 931,471,403

1528 SEASIDE PARK BORO 1,160,077,000 77.65 1,493,981,970 0 0 1,493,981,970

1529 SHIP BOTTOM BORO 1,420,957,500 70.66 2,010,978,630 0 195,892 2,011,174,522

1530 SOUTH TOMS RIVER BORO 229,135,100 76.06 301,255,719 0 339,292 301,595,011

1531 STAFFORD TWP 4,358,485,800 67.05 6,500,351,678 0 0 6,500,351,678

1532 SURF CITY BORO 1,991,891,700 75.46 2,639,665,651 0 916,904 2,640,582,555

1533 TUCKERTON BORO 432,978,800 77.85 556,170,584 0 0 556,170,584

TOTAL OCEAN COUNTY 107,213,049,228 76.41 140,305,357,835 0 62,704,306 140,368,062,141

Amended Table of Equalized Valuations 2022

(As Amended by Tax Court Appeals)

*EXCLUSIVE OF CLASS II RAILROAD PROPERTY

**REVISED TOTALS AS AMENDED BY TAX COURT OF NEW JERSEY

1 2 3 4 5 6

COUNTY AND DISTRICT

AGG. ASSESSED

VALUATION

REAL PROP. *

AVE. RATIO

ASSESSED TO

TRUE VALUE

AGG. TRUE VALUE

REAL PROP. *

ASSESSED VALUE

CLASS II R. R.

PROPERTY

ASSESSED VALUE

ALL PERS.

PROPERTY

EQUALIZED

VALUATION

PASSAIC COUNTY

1601 BLOOMINGDALE BORO

731,323,600

68.90 1,061,427,576 0

0

1,061,427,576

1602 CLIFTON CITY

5,346,354,400

42.07 12,708,234,847 0

6,315,636

12,714,550,483

1603 HALEDON BORO

506,658,600

59.95 845,135,279 0

0

845,135,279

1604 HAWTHORNE BORO

2,629,140,400

86.29 3,046,865,685 0

919

3,046,866,604

1605 LITTLE FALLS TWP

1,538,304,700

78.90 1,949,689,100 0

4,609,700

1,954,298,800

1606 NORTH HALEDON BORO

1,190,494,450

77.72 1,531,773,610 0

822

1,531,774,432

1607 PASSAIC CITY

2,930,338,300

59.01 4,965,833,418 0

10,414,192

4,976,247,610

1608 PATERSON CITY

6,064,968,854

59.35 10,218,987,117 0

13,181,928

10,232,169,045

1609 POMPTON LAKES BORO

1,190,101,800

77.48 1,536,011,616 0

0

1,536,011,616

1610 PROSPECT PARK BORO

263,609,600

58.89 447,630,498 0

145,000

447,775,498

1611 RINGWOOD BORO

1,455,784,400

72.25 2,014,926,505 0

0

2,014,926,505

1612 TOTOWA BORO

2,469,529,900

70.94 3,481,152,946 0

0

3,481,152,946

1613 WANAQUE BORO

1,115,573,900

68.52 1,628,099,679 0

0

1,628,099,679

1614 WAYNE TWP

5,279,130,400

44.88 11,762,768,271 0

0

11,762,768,271

1615 WEST MILFORD TWP

2,732,764,800

71.22 3,837,074,979 0

100

3,837,075,079

1616 WOODLAND PARK BORO

1,691,100,600

77.40 2,184,884,496 0

828

2,184,885,324

TOTAL PASSAIC COUNTY 37,135,178,704 58.74 63,220,495,622 0 34,669,125 63,255,164,747

Amended Table of Equalized Valuations 2022

(As Amended by Tax Court Appeals)

*EXCLUSIVE OF CLASS II RAILROAD PROPERTY

**REVISED TOTALS AS AMENDED BY TAX COURT OF NEW JERSEY

1 2 3 4 5 6

COUNTY AND DISTRICT

AGG. ASSESSED

VALUATION

REAL PROP. *

AVE. RATIO

ASSESSED TO

TRUE VALUE

AGG. TRUE VALUE

REAL PROP. *

ASSESSED VALUE

CLASS II R. R.

PROPERTY

ASSESSED VALUE

ALL PERS.

PROPERTY

EQUALIZED

VALUATION

SALEM COUNTY

1701 ALLOWAY TWP

284,814,900

85.94 331,411,333 0 640,220 332,051,553

1702 CARNEYS POINT TWP

665,340,900

85.25 780,458,534 0 0 780,458,534

1703 ELMER TWP

105,605,800

86.19 122,526,743 0 0 122,526,743

1704 ELSINBORO TWP

115,410,200

101.46 113,749,458 0 425,095 114,174,553

1705 LOWER ALLOWAY CREEK TWP

226,944,400

71.36 318,027,466 0 687,741 318,715,207

1706 MANNINGTON TWP

173,688,900

95.16 182,523,014 0 1,064,708 183,587,722

1707 OLDMANS TWP

276,937,100

95.90 288,776,955 0 0 288,776,955

1708 PENNS GROVE BORO

134,190,500

84.32 159,144,331 0 0 159,144,331

1709 PENNSVILLE TWP

979,124,215

88.73 1,103,487,225 0 1,903,503 1,105,390,728

1710 PILESGROVE TWP

466,183,400

83.79 556,371,166 0 0 556,371,166

1711 PITTSGROVE TWP

603,786,800

83.48 723,271,203 0 921,007 724,192,210

1712 QUINTON TWP

183,933,750

82.61 222,653,129 0 812,242 223,465,371

1713 SALEM CITY

121,578,750

74.13 164,007,487 0 1,984,304 165,991,791

1714 UPPER PITTSGROVE TWP

340,171,900

93.15 365,187,225 0 0 365,187,225

1715 WOODSTOWN BORO

279,667,500

89.33 313,072,316 0 0 313,072,316

TOTAL SALEM COUNTY 4,957,379,015 86.30 5,744,667,585 0 8,438,820 5,753,106,405

Amended Table of Equalized Valuations 2022

(As Amended by Tax Court Appeals)

*EXCLUSIVE OF CLASS II RAILROAD PROPERTY

**REVISED TOTALS AS AMENDED BY TAX COURT OF NEW JERSEY

1 2 3 4 5 6

COUNTY AND DISTRICT

AGG. ASSESSED

VALUATION

REAL PROP. *

AVE. RATIO

ASSESSED TO

TRUE VALUE

AGG. TRUE VALUE

REAL PROP. *

ASSESSED VALUE

CLASS II R. R.

PROPERTY

ASSESSED VALUE

ALL PERS.

PROPERTY

EQUALIZED

VALUATION

SOMERSET COUNTY

1801 BEDMINSTER TWP 2,517,899,900 96.11 2,619,810,530 0 6,113,100 2,625,923,630

1802 BERNARDS TWP 7,191,601,000 93.16 7,719,623,229 0 8,258,900 7,727,882,129

1803 BERNARDSVILLE BORO 2,333,221,800 98.32 2,373,089,707 0 5,174,570 2,378,264,277

1804 BOUND BROOK BORO 1,063,743,500 100.02 1,063,530,794 0 7,831,400 1,071,362,194

1805 BRANCHBURG TWP 3,717,493,600 88.01 4,223,944,552 0 4,781,600 4,228,726,152

1806 BRIDGEWATER TWP 9,744,315,900 88.03 11,069,312,621 0 10,077,200 11,079,389,821

1807 FAR HILLS BORO 432,012,000 99.06 436,111,448 0 442,500 436,553,948

1808 FRANKLIN TWP 12,507,140,000 93.21 13,418,238,386 0 17,540,778 13,435,779,164

1809 GREEN BROOK TWP 1,614,787,100 96.06 1,681,019,259 0 729,936 1,681,749,195

1810 HILLSBOROUGH TWP 7,135,697,400 90.10 7,919,752,941 0 3,488,595 7,923,241,536

1811 MANVILLE BORO 1,081,120,600 97.85 1,104,875,422 0 2,073,200 1,106,948,622

1812 MILLSTONE BORO 58,887,300 91.13 64,619,006 0 0 64,619,006

1813 MONTGOMERY TWP 3,979,165,198 72.38 5,497,603,203 0 2,008,000 5,499,611,203

1814 NORTH PLAINFIELD BORO 1,518,717,658 68.27 2,224,575,447 0 1,164,727 2,225,740,174

1815 PEAPACK GLADSTONE BORO 785,120,100 98.13 800,081,626 0 0 800,081,626

1816 RARITAN BORO 1,211,435,013

75.43 1,

606,038,729 0 1,290,300 1,607,329,029

1817 ROCKY HILL BORO 144,812,300 105.43 137,353,979 0 402,800 137,756,779

1818 SOMERVILLE BORO 1,153,098,900 75.28 1,531,746,679 0 8,548,314 1,540,294,993

1819 SO BOUND BROOK BORO 331,269,526 76.50 433,032,060 0 888,223 433,920,283

1820 WARREN TWP 4,838,612,800 98.29 4,922,792,553 0 5,990,700 4,928,783,253

1821 WATCHUNG BORO 1,907,162,300 96.10 1,984,560,146 0 1,338,600 1,985,898,746

TOTAL SOMERSET COUNTY 65,267,313,895 89.61 72,831,712,317 0 88,143,443 72,919,855,760

Amended Table of Equalized Valuations 2022

(As Amended by Tax Court Appeals)

*EXCLUSIVE OF CLASS II RAILROAD PROPERTY

**REVISED TOTALS AS AMENDED BY TAX COURT OF NEW JERSEY

1 2 3 4 5 6

COUNTY AND DISTRICT

AGG. ASSESSED

VALUATION

REAL PROP. *

AVE. RATIO

ASSESSED TO

TRUE VALUE

AGG. TRUE VALUE

REAL PROP. *

ASSESSED VALUE

CLASS II R. R.

PROPERTY

ASSESSED VALUE

ALL PERS.

PROPERTY

EQUALIZED

VALUATION

SUSSEX COUNTY

1901 ANDOVER BORO

67,134,600 80.88 83,005,193 0 0 83,005,193

1902 ANDOVER TWP

652,380,900 74.99 869,957,194 0 1,706 869,958,900

1903 BRANCHVILLE BORO

128,135,600

90.14 142,151,764 0

0

142,151,764

1904 BYRAM BORO

926,776,700

78.30 1,183,622,861 0

0

1,183,622,861

1905 FRANKFORD TWP

739,612,800

80.82 915,135,857 0

0

915,135,857

1906 FRANKLIN BORO

392,892,300

72.87 539,168,794 0

1,890

539,170,684

1907 FREDON TWP

435,977,500

88.68 491,630,018 0

0

491,630,018

1908 GREEN TWP

433,035,900

75.88 570,685,161 0

0

570,685,161

1909 HAMBURG BORO

251,121,600

75.43 332,920,058 0

0

332,920,058

1910 HAMPTON TWP

607,320,400

76.26 796,381,327 0

0

796,381,327

1911 HARDYSTON TWP

1,076,583,600

81.55 1,320,151,563 0

0

1,320,151,563

1912 HOPATCONG BORO

1,421,418,700

69.83 2,035,541,601 0

0

2,035,541,601

1913 LAFAYETTE TWP

329,486,000

82.94 397,258,259 0

0

397,258,259

1914 MONTAGUE TWP

357,386,500

81.71 437,384,041 0

0

437,384,041

1915 NEWTON TOWN

599,007,500

76.17 786,408,691 0

424

786,409,115

1916 OGDENSBURG BORO

194,351,600

80.97 240,029,147 0

0

240,029,147

1917 SANDYSTON TWP

225,895,600

70.75 319,287,067 0

0

319,287,067

1918 SPARTA TWP

3,063,881,400

78.13 3,921,517,215 0

0

3,921,517,215

1919 STANHOPE BORO

296,246,900

76.08 389,388,670 0

0

389,388,670

1920 STILLWATER TWP

406,965,500

71.39 570,059,532 0

0

570,059,532

1921 SUSSEX BORO

123,966,100

81.51 152,086,983 0

0

152,086,983

1922 VERNON TWP

2,805,181,600

90.41 3,102,733,768 0

2,326,708

3,105,060,476

1923 WALPACK TWP

2,338,150

89.43 2,614,503 0

5,626

2,620,129

1924 WANTAGE TWP

1,211,228,100

84.03 1,441,423,420 0

0

1,441,423,420

TOTAL SUSSEX COUNTY 16,748,325,550 79.60 21,040,542,687 0 2,336,354 21,042,879,041

Amended Table of Equalized Valuations 2022

(As Amended by Tax Court Appeals)

*EXCLUSIVE OF CLASS II RAILROAD PROPERTY

**REVISED TOTALS AS AMENDED BY TAX COURT OF NEW JERSEY

1 2 3 4 5 6

COUNTY AND DISTRICT

AGG. ASSESSED

VALUATION

REAL PROP. *

AVE. RATIO

ASSESSED TO

TRUE VALUE

AGG. TRUE VALUE

REAL PROP. *

ASSESSED VALUE

CLASS II R. R.

PROPERTY

ASSESSED VALUE

ALL PERS.

PROPERTY

EQUALIZED

VALUATION

UNION COUNTY

2001 BERKELEY HEIGHTS TWP**

1,850,356,770

50.08 3,694,801,857 0

949,104

3,695,750,961

2002 CLARK TWP

3,234,035,400

96.49 3,351,679,345 0

1,207,957

3,352,887,302

2003 CRANFORD TWP

1,670,333,100

32.27 5,176,117,447 0

2,134,364

5,178,251,811

2004 ELIZABETH CITY

934,926,600

7.69 12,157,693,108 0

1,480,495

12,159,173,603

2005 FANWOOD BORO

1,260,242,100

86.61 1,455,076,896 0

457,450

1,455,534,346

2006 GARWOOD BORO

746,546,000

87.11 857,015,268 0

455,320

857,470,588

2007 HILLSIDE TWP

904,041,800

34.66 2,608,314,484 0

648,273

2,608,962,757

2008 KENILWORTH BORO

828,021,800

38.78 2,135,177,411 0

538,068

2,135,715,479

2009

LINDEN CITY**

2,734,948,400

35.21 7,767,533,087 0

2,614,524

7,770,147,611

2010 MOUNTAINSIDE BORO

1,892,507,200

87.60 2,160,396,347 0

1,473,696

2,161,870,043

2011 NEW PROVIDENCE BORO

1,461,755,092

43.55 3,356,498,489 0

2,311,605

3,358,810,094

2012 PLAINFIELD CITY

1,196,996,156

31.60 3,787,962,519 0

4,356,045

3,792,318,564

2013 RAHWAY CITY

1,450,623,600

41.16 3,524,352,770 0

51

3,524,352,821

2014 ROSELLE BORO

799,895,560

41.62 1,921,901,874 0

2,303,688

1,924,205,562

2015 ROSELLE PARK BORO

1,061,324,800

65.93 1,609,775,216 0

560,206

1,610,335,422

2016 SCOTCH PLAINS TWP

1,016,887,300

20.09 5,061,659,034 0

753,785

5,062,412,819

2017 SPRINGFIELD TWP

4,011,278,100

98.58 4,069,058,734 0

2,743,684

4,071,802,418

2018 SUMMIT CITY

3,234,918,200

38.00 8,512,942,632 0

2,811,937

8,515,754,569

2019

UNION TWP**

1,039,421,300

10.70 9,714,217,757 0

1,223,658

9,715,441,415

2020 WESTFIELD TOWN

8,409,224,920

91.74 9,166,366,819 0

6,912,903

9,173,279,722

2021 WINFIELD TWP

16,566,700

100.10 16,550,150 0

92,950

16,643,100

TOTAL UNION COUNTY 39,754,850,898 43.16 92,105,091,244 0 36,029,763 92,141,121,007

Amended Table of Equalized Valuations 2022

(As Amended by Tax Court Appeals)

*EXCLUSIVE OF CLASS II RAILROAD PROPERTY

**REVISED TOTALS AS AMENDED BY TAX COURT OF NEW JERSEY

1 2 3 4 5 6

COUNTY AND DISTRICT

AGG. ASSESSED

VALUATION

REAL PROP. *

AVE. RATIO

ASSESSED TO

TRUE VALUE

AGG. TRUE VALUE

REAL PROP. *

ASSESSED VALUE

CLASS II R. R.

PROPERTY

ASSESSED VALUE

ALL PERS.

PROPERTY

EQUALIZED

VALUATION

WARREN COUNTY

2101 ALLAMUCHY TWP

599,931,000

71.08 844,022,228 0

0

844,022,228

2102 ALPHA BORO

216,910,870

89.27 242,982,939 0

244,868

243,227,807

2103 BELVIDERE TOWN

126,771,172

53.83 235,502,827 0

50

235,502,877

2104 BLAIRSTOWN TWP

704,688,700

82.21 857,181,243 0

2,386,261

859,567,504

2105 FRANKLIN TWP

413,575,012

84.02 492,234,006 0

744,496

492,978,502

2106 FRELINGHUYSEN TWP

290,111,878

87.44 331,783,941 0

608,907

332,392,848

2107 GREENWICH TWP

595,632,260

71.23 836,209,827 0

667,495

836,877,322

2108 HACKETTSTOWN TOWN

1,024,205,400

89.47 1,144,747,290 0

100

1,144,747,390

2109 HARWICK TWP

157,157,100

70.25 223,711,174 0

588,492

224,299,666

2110 HARMONY TWP

470,116,900

69.52 676,232,595 0

318,824

676,551,419

2111 HOPE TWP

217,976,900

73.22 297,701,311 0

1,099,810

298,801,121

2112 INDEPENDENCE TWP

504,923,900

72.75 694,053,471 0

0

694,053,471

2113 KNOWLTON TWP

258,174,640

66.67 387,242,598 0

906,271

388,148,869

2114 LIBERTY TWP

267,716,300

78.06 342,962,209 0

0

342,962,209

2115 LOPATCONG TWP

1,012,371,150

92.69 1,092,211,835 0

918,456

1,093,130,291

2116 MANSFIELD TWP

699,899,550

76.84 910,853,136 0

0

910,853,136

2117 OXFORD TWP

157,596,600

69.74 225,977,344 0

0

225,977,344

2119 PHILLIPSBURG TOWN

709,065,425

78.87 899,030,588 0

2,536,944

901,567,532

2120 POHATCONG TWP

343,552,850

76.60 448,502,415 0

565,958

449,068,373

2121 WASHINGTON BORO

367,650,672

66.22 555,195,820 0

0

555,195,820

2122 WASHINGTON TWP

684,116,276

75.70 903,720,312 0

0

903,720,312

2123 WHITE TWP

555,321,218

81.91 677,965,106 0

0

677,965,106

TOTAL WARREN COUNTY 10,377,465,773 77.91 13,320,024,215 0 11,586,932 13,331,611,147

Amended Table of Equalized Valuations 2022

(As Amended by Tax Court Appeals)

*EXCLUSIVE OF CLASS II RAILROAD PROPERTY

**REVISED TOTALS AS AMENDED BY TAX COURT OF NEW JERSEY

1 2 3 4 5 6

COUNTY AND DISTRICT

AGG. ASSESSED

VALUATION

REAL PROP. *

AVE. RATIO

ASSESSED TO

TRUE VALUE

AGG. TRUE VALUE

REAL PROP. *

ASSESSED VALUE

CLASS II R. R.

PROPERTY

ASSESSED VALUE

ALL PERS.

PROPERTY

EQUALIZED

VALUATION

STATE TOTALS

ATLANTIC COUNTY 30,620,124,186 77.78 39,369,894,998 0 18,413,327 39,388,308,325

BERGEN COUNTY ** 174,657,465,802 83.18 209,970,578,578 0 83,552,257 210,054,130,835

BURLINGTON COUNTY 44,956,184,728 78.69 57,127,482,908 0 50,123,071 57,177,605,979

CAMDEN COUNTY 37,156,860,138 78.34 47,431,609,946 0 84,374,709 47,515,984,655

CAPE MAY COUNTY 51,722,839,800 67.91 76,162,736,537 0 15,438,961 76,178,175,498

CUMBERLAND COUNTY 8,426,957,800 80.50 10,468,902,929 0 14,537,155 10,483,440,084

ESSEX COUNTY ** 87,892,826,600 82.61 106,390,947,088 0 179,480,489 106,570,427,577

GLOUCESTER COUNTY 27,257,822,252 80.30 33,944,924,694 0 36,548,402 33,981,473,096

HUDSON COUNTY ** 83,137,116,474 72.92 114,006,702,257 0 104,033,669 114,110,735,926

HUNTERDON COUNTY ** 21,328,853,684 85.11 25,059,697,208 0 6,530,717 25,066,227,925

MERCER COUNTY 42,759,461,489

81.62 52,390,650,162 0 101,681,696 52,492,331,858

MIDDLESEX COUNTY ** 66,197,144,158

49.24 134,441,727,583 0 79,231,826 134,520,959,409

MONMOUTH COUNTY 146,994,112,458 89.05 165,078,093,951 0 79,378,668 165,157,472,619

MORRIS COUNTY 89,450,070,688 83.88 106,640,527,243 0 32,343,117 106,672,870,360

OCEAN COUNTY 107,213,049,228 76.41 140,305,357,835 0 62,704,306 140,368,062,141

PASSAIC COUNTY 37,135,178,704 58.74 63,220,495,622 0 34,669,125 63,255,164,747

SALEM COUNTY 4,957,379,015 86.30 5,744,667,585 0 8,438,820 5,753,106,405

SOMERSET COUNTY 65,267,313,895 89.61 72,831,712,317 0 88,143,443 72,919,855,760

SUSSEX COUNTY 16,748,325,550 79.60 21,040,542,687 0 2,336,354 21,042,879,041

UNION COUNTY ** 39,754,850,898 43.16 92,105,091,244 0 36,029,763 92,141,121,007

WARREN COUNTY 10,377,465,773 77.91 13,320,024,215 0 11,586,932 13,331,611,147

STATE TOTALS

1,194,011,403,320 75.23 1,587,052,367,587 0 1,129,576,807 1,588,181,944,394