An Assessment of Tourist Demand and Use for travel guides:

A focus on the use of new technology such as SMARTPHONES and downloadable “APPs”

Fáilte Ireland Applied Research Scheme

I.T. Sligo, Fáilte Ireland

2012

1

A visitors snapshot of travel guide use for Ireland.

Acknowledgements

The authors of this report wish to acknowledge the following persons and organisations for giving valuable

contributions during the course of the study:

Gabriela Airini, Fáilte Ireland

Martina Bromley Fáilte Ireland North West

Noelle Cawley, Fáilte Ireland North West

Michael Carty Sligo County Council and County Sligo Tourism Strategy Review Group (CSTSR)

First Print 2012

Prepared by:

Dr James Hanrahan,

Department of Marketing Tourism and Sport

School of Business and Social Sciences

I.T. Sligo,

Ash Lane

Sligo

Ireland

Peter D. Krahenbuhl,

Sustainable Travel Consulting

Westport

Co Mayo

The US family

Demographics A family- (Mother retired, father a Pharmacist, the two sons’ doctors and the daughter and son

in law both Ophthalmologists).

Motivation Notre Dame v Navy Game and VFR

Transport Two hire cars.

Duration 7 days

Travel guide use New Irish Travel guide books bought in US. Travel information printed at home prior to

departure from the internet.

A wide assortment of brochures and free maps from Irish travel information centers.

A Sat Nav was hired with the rented cars.

All but one had a smart phone or mobile device with roaming switched off.

Phones used for photos and to upload and share information in free Wi-Fi areas.

Many generic travel apps tripadvisor etc, 2 had downloaded Discover Ireland App before

travelling. No other specific Irish travel apps downloaded.

A set of walkie-talkies were in use to communicate from car to car while traveling around, these

were also bought in the US. A creative way to get around roaming charges!

The Conference traveler

Demographics Male 45-54, from GB

Motivation Came to Ireland for work (conference) adding 3 days to VFR in Galway

Transport Ferry and company car

Duration 5 days

Travel guide use No guide book

Smartphone with roaming switched on (company picking up bill plus expected to be contactable

on work phone)

Travel Apps being used, trip advisor etc.

The Weekend Break

Demographics Two Female teachers 25-34 from Kerry

Motivation Weekend getaway spa retreat and cycle greenway before going back to work.

Transport Private car

Duration 2 days

Travel guide use No guide book

Smartphones with roaming switched on.

Many Apps in use such as Facebook only relevant Irish Travel apps was Trip advisor. However

Travel apps for other destination (i.e.) Barcelona still on phones from last visit. Roaming

switched off when traveling out of Ireland.

2

Table of Contents

1:0 Introduction

2.0 Definitions and Abbreviations

3.0 Background and Linkage to Current Projects

4.0 Research Aims

5.0 Methodology

6.0 Publications and Dissemination

7.0 Key Findings

7.1 Visitor Profile

7.2 Travel Guide Use

7.3 Travel Guide Books

7.4 Smartphone and Mobile Device Use

7.5 Barriers to Smartphone/Mobile Device Use

7.6 “App” Use

8.0 Recommendations

9.0 Conclusion

Bibliography

List of Figures

Fig 1 Growth in smart phone usage

Fig 7.1 Gender

Fig 7.2 Age

Fig 7.3 Nationality

Fig 7.4 Country traveled from

Fig 7.5 Length of visit

Fig 7.6 Trip type

Fig 7.7 What type of travel guide was used

Fig 7.8 Name of travel guide book

Fig 7.9 Year guide book published

Fig 7.10 Price of guide book

Fig 7.11 Where was the book acquired

Fig 7.12 Book satisfaction

Fig 7.13 Do you own a smart phone

Fig 7.14 If no, do you intend to purchase Smartphone and use it traveling

Fig 7.15 Do you use your smart phone while travelling

Fig 7.16 Did you book any element of your trip on your smart phone

Fig 7.17 Frequency of Smartphone use per day while traveling

Fig 7.18 What percentage did you use Smartphone for trip planning

Fig 7.19 What percentage did you use your Smartphone for sharing

Fig 7.20 What are your top fifteen reasons for using your Smartphone on holiday

Fig 7.21 What reduces your Smartphone use on holiday

Fig 7.22 How do you find travel Apps

Fig 7.23 When are you most likely to download a travel App

Fig 7.24 What Travel Apps are you using on holiday

Fig 7.25 Travel App language

Fig 7.26 Where was your Travel App downloaded

Fig 7.27 Travel App price

Fig 7.28 Travel App satisfaction level

List of Tables

Table 1 Travel App survey sites

Table 2 Research timeline

Table 3 Cross section of Travel App prices

3

3

4

5

5

6

7

7

8

8

9

13

14

17

19

20

4

7

7

7

7

7

7

8

9

9

9

9

9

10

10

10

10

11

11

12

12

13

15

15

15

16

16

16

16

5

6

16

3

1.0 Introduction

The use of Smartphone technology, social media and downloadable applications (“apps”) for

mobile devices is growing rapidly, to the point where online use from mobile devices is expected to

surpass traditional computer internet use by 2014. This has become increasingly apparent in the

world’s largest industry – travel and tourism. As a result, many destinations and Irish tourism

business are developing travel apps. This research forms an important baseline study to inform

tourism stakeholders on visitor’s use of travel guides, particularly with regard to mobile devices

such as “Smartphones”, as well as downloadable “apps”. The results give tourism business an

understanding on travel guide use and the visitor experience. There has been a significant rise in

Irish tourism providers creating travel apps. With over a half million apps today, most people avail

themselves of 30 or so, and of that 30, only about ten are used regularly. Many apps seem to reflect

an approach that resembles early websites, copying hard copy versions, without taking advantage of

the unique opportunities mobile applications offer.

This report was commissioned by Fáilte Ireland in order to identify and assess how domestic and

international visitors use traditional travel guides with a focus on the use of mobile devices such as

“Smartphones”, as well as downloadable “apps” when traveling in general and within Ireland.

Valuable enterprise development and market access information from this applied research project

is identified for tourism enterprises, local and regional authorities, as well as for Fáilte Ireland. This

is specific to identification of visitor travel guide use, possible barriers to be overcome and options

for future development, particularly as it relates to the use of traditional traveller information

sourcing vs. future growth and options for technology based application solutions (e.g. apps for

mobile devices such as Smartphones). Regional Authorities and tourism enterprises will gain

valuable insight and guidance with regard to technology based application development and

importantly lessons learned regarding what to avoid.

2.0 Definitions and Abbreviations

For the purposes of the survey, 'Smartphones' are defined, based on a similar study conducted by

Napier University, as “mobile phones with advanced computing and connectivity, for example,

iPhones, Blackberries and those using the Android operating system.”

An “App” is an abbreviation for “application” and in the smartphone and mobile device world it is

the popular consumer shorthand for downloadable mobile applications in smartphones and tablets

after Apple debuted the iPhone 3G in 2008, PCMag (2012).

Augmented Reality (AR) apps can be defined as a live, direct or indirect, view of a physical, real-

world environment whose elements are augmented by computer-generated sensory input such as

sound, video, graphics or GPS data. (Yovcheva, Buhalis, Gatzidis, 2012). A recent report further

illustrates:

As well as a familiarisation tool, technology will be able to offer an alternative experience

of a place. Augmented reality and gamebased applications could make a qualitative

difference to travel. Through the camera lens of a mobile device, locations could be seen

from a completely different perspective: their physical appearance could be augmented with

photos, videos or sounds from the past – or from an alternative, simulated reality. (From

Chaos to Collaboration: How transformative technologies will herald a new era in travel

(Stubbings and Curry, 2012).

Tourists for the purpose of this study have been identified and targeted as holidaymakers, with a

key focus of the study centering on major tourist attractions around the country.

4

3.0 Background and Linkage to Current Projects

There is currently very little international information and knowledge regarding smartphone use in

the travel and tourism industry, particularly as it relates to visitor use of smartphones and related

technology versus more traditional travel guides. In fact there has been no related published

research within the Irish context. The Fáilte Ireland (2012) visitor attitude survey currently gather

tourism information for choosing Ireland as a destination, however this may need to collate

information on smartphone and app usage in the future. Based on the identification of this important

knowledge gap the concept for this project resulted from key issues highlighted during the Fáilte

Ireland 2011 Industry Education Research Forum and the discourse and outcomes from County

Sligo Tourism Strategy Review Group (CSTSR) and Fáilte Ireland North West.

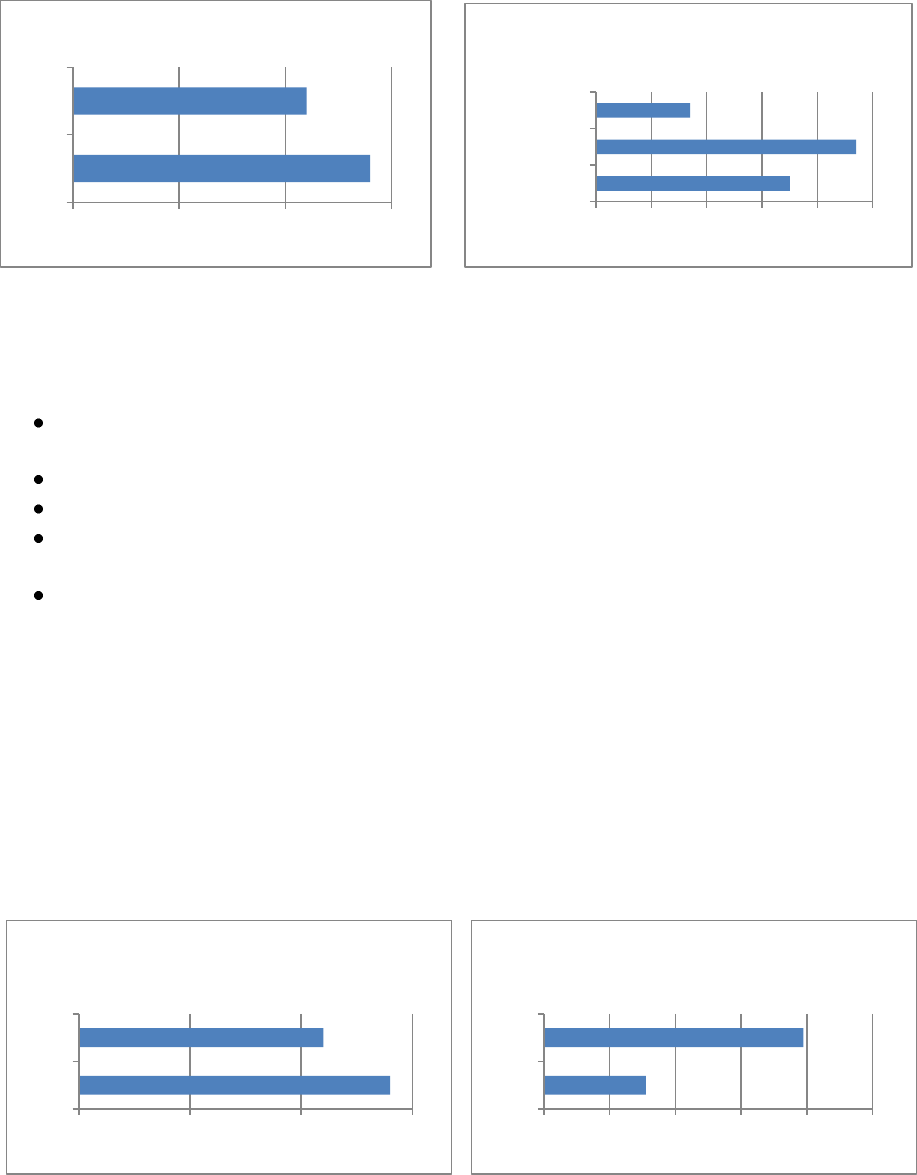

Looking outward the Tourism Ireland report (2011) in this area highlights the growth and use of

Smartphones

Fig 1 Growth in Smartphone usage

Source: (Tourism Ireland, 2011)

Italy and Spain have the highest percentage of Smartphones adopted by the market with Italy

starting high and then slightly decreasing. Spain began their adoption of Smartphones quite strongly

and increased rapidly. Rapid growth in smart phone usage will impact consumers in a number of

ways:

Smartphones will be the new credit card

Consumers will grant access to make personal data

Location based marketing will grow

Online and offline shopping will seamlessly merge

Mobile transactions will grow

Consumers will pay for more mobile services

Mobiles will be the battle ground for loyalty

Internationally, similar research projects were reviewed and integrated where appropriate in order to

increase the robustness of the results, and to identify gaps and solutions. One relevant research

project for example, is the following at the Napier University (2011): An Assessment of Tourist

Demand and Use for downloadable “APP”s for SMARTPHONES and Mobile Device. However,

this project, while allowing for an international perspective, is not specific to tourists within Ireland,

and it was based on a smaller sample size. Other studies cited within this survey and noted in the

bibliography are also relevant with regard to global trends but not locally specific.

5

4.0 Research Aims

The research goals for this applied research project are to identify and assess how domestic and

international tourists use travel guides, particularly with regard to mobile devices such as

Smartphones, as well as related next generation technology such as downloadable apps when

traveling in general and within Ireland. The data gathered will help identify key market travel guide

trends, such as social media use while travelling, and in doing so help to inform the need to improve

and develop new apps and functionality for the tourism industry. The research also identifies any

potential barriers to using mobile devices and travel apps encountered by tourists such as

availability of wifi, roaming charges and reception.

As a result of existing linkages with regional and national industry stakeholders and tourism

authorities, these authorities and associated industry sectors will be able to implement

recommended solutions in order to be on the cutting edge of new technology if needed and enhance

product awareness for domestic and international visitors. New solutions or enhancement of

existing solutions may also be expected to enhance the visitor experience while here in Ireland.

5.0 Methodology

Based on existing team experience combined with literature review of existing relevant studies and

research reports, a questionnaire was developed in order to obtain data through on-site surveying

that would help address the research aims and objectives. The draft survey questions were then

reviewed by IT Sligo Department of Marketing, Tourism and Sport, Fáilte Ireland head office,

Fáilte Ireland North West and Sligo County Council. This linkage will also prove valuable in the

dissemination of results and recommendations. Surveying occured at several major tourism

attractions across the country during peak vistor times in 2012. Survey sites included:

Table 1 Travel App survey sites

Strandhill, Sligo

Drumcliff, Sligo

Westport Tourist Office

Croagh Patrick Visitor Centre, Murrisk

Kylemore Abbey

Cliffs of Moher

Dingle

Ballyhoura

Fota Island

Enniscorthy Co Wexford

New Grange

Bunratty

Clifden

Glendalough/Dublin

Kilkenny Castle

Rock of Cashel

Clonmacnoise

Muckross House - Killarney

Researchers utilised a purposive sampling technique to ensure a comprehensive cross sample of

tourists. Electronic methods of data collection were avoided in order to capture possible future

movements and trends from tourists who may not be currently utilising mobile devices or have

access to electronic surveys. A total of 1100 surveys were distributed, however due to the nature of

the data collection, which was very time consuming and intensive, the uptake of self completed

questionaire was low. However this was counteracted by interviewer completed approach which

also allowed the researcher to get closer to the data and identify trends within the study. Due to the

poor weather only 63% of expected survey returns were achieved. Desk research complimented on

and offline surveying of domestic and international tourists across multiple sectors and

demographics, with a focus on use of technology applications, as well as more traditional sources of

tourism information (e.g. travel guide books).

Integration and assessment of the results, followed by report development, delivery and

dissemination followed. Below table 1.2 provides a summary of the work and associated timeline:

6

Table 2 Research Timeline

Activity 2012

j

f

m

a

m

j

jy

a

s

o

n

d

Task 1: Existing Research Project Review

2

3

4

5

6

7

8

8

9

10

10

10

1a) Desk review & assessment of existing similar research

projects

x

x

Task 2: Identify and Develop Research questions

1a) Meet with local authorities and industry partner stakeholders

x

x

2a) Engage with Fáilte Ireland for input into identification of

relevant questions

x

3a) Develop proposed research questions and methodology

x

x

4a) Vet proposed questions with stakeholders and finalise

x

Task 3: Survey Visitors

4b) Breakdown of visitor demographs and by region

x

4c) Onsite surveys(offline)

x

x

x

Task 4: Assess Survey Results

5a) Integrate Results from Surveys and Research Reviews

x

x

Task 5: Report Development & Delivery

6a) Develop Report, including Impact Assessment

x

x

x

x

6b) Report Delivery and Dissemination (Publishing, etc.)

x

x

x

6.0 Publications and Dissemination

The results and applied industry recommendations are published and disseminated in a number of

ways:

A publication and conference presentation at Tourism Hospitality Research in Ireland

Conference (THRIC) 2013. Research in Ireland Conference: Ulster Business School,

University of Ulster.

o Hanrahan, J. and Krahenbuhl, P. (2012) Tourist Demand and Use for travel guides:

a focus on the use of new technology such as downloadable “APP”s for

SMARTPHONES and Mobile Devices. Tourism Hospitality Research in Ireland

Conference (THRIC) 2013. Research in Ireland Conference: Ulster Business School,

University of Ulster.

An industry report will feed back into the wide tourism industry but specifically the Fáilte

Ireland Business support sector and County Sligo Tourism Strategy Review Group

(CSTSR).

A working group presentation at 2011 Fáilte Ireland Industry Education Research Forum

2012.

7

7.0 Key Findings

The key findings of the report are discussed in context of the current theory and applied tourism

practice in the field. The discussion of the findings will flow from the basic demographic of the

participants to the use of hard copy traditional guides onto the use and adoption of travel apps. This

is then reviewed with a reflection of the barriers associated with travel apps as identified by the

tourist.

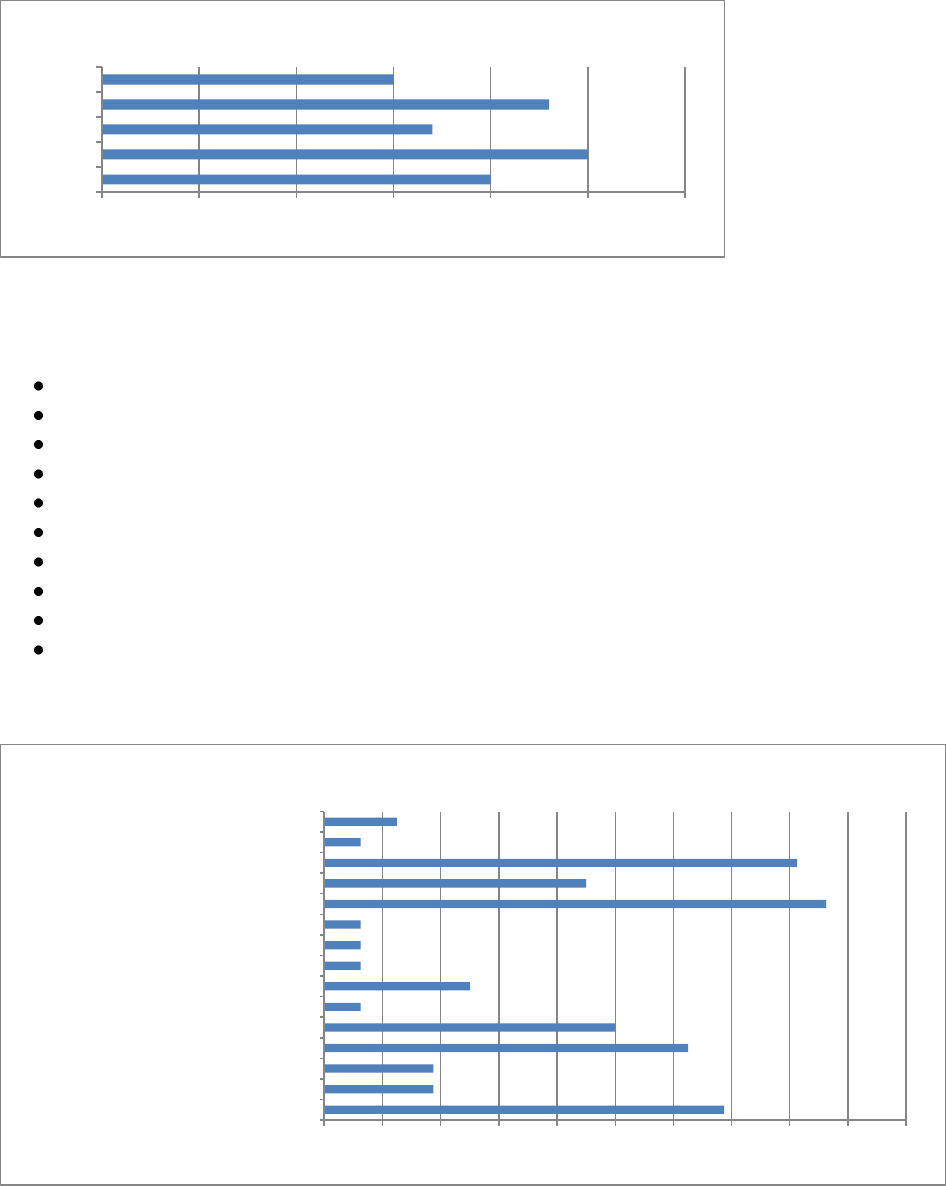

7.1 Visitor Profile

The primary visitor profile data gathered and used during analysis included gender, age, nationality,

what country they travelled from, length of trip and trip type. Below is a summary of the results of

those surveyed:

The visitor demographic generally reflect the current Fáilte Ireland and Tourism Ireland visitor

profiles. Domestic tourists represented the largest percentage of travelers (fig 7.3), which is

significant because domestic smartphone use would typically not be subject to most of the barriers

that other nationalities would face, such as roaming charges. These charges would however be

encountered by the second largest group traveling from the UK. Furthermore the third largest group

0% 20% 40% 60%

Male

Female

Fig 7.1 Gender

0% 10% 20% 30%

18-24

25-34

35-44

45-54

55-64

65+

Fig 7.2 Age

0% 10% 20% 30% 40%

Irish

UK

German

French

Itialian

North America

Other

Fig 7.3 Nationality

0% 20% 40% 60%

Ireland

UK

Germany

France

Italy

North America

Other

Fig 7.4 Country traveled from

0% 10% 20% 30%

Day Trip

weekend/Overnight

3 days, Long wekend

4-7 days

8-13 days

14 days +

Fig 7.5 Length of Visit

0% 10% 20% 30% 40%

Package holiday

Independant

VFR

Family Holiday

Other

Fig 7.6 Trip Type

8

of visitors was from the US. These visitors tended to have the most significant barriers to entry,

including extremely high overseas rates and some incompatible technology. In the middle

categories were other European nationalities, who would tend to have middle of the road barriers to

use. In the “other” category the top respondents were Australia, New Zealand and South Africa,

who showed similar tendencies as visitors from the US. These considerations affected both the

amount of use and variation in the type of use of mobile devices between domestic and foreign

visitors, as explored in the Smartphone and Mobile Device Use section below.

Length of stay also corresponded to type of trip, with longer stays tending to be independent

travelers, who represent nearly 40% of visitation within the survey sample.

7.2 Travel Guide Use

The majority of respondents said they are using a travel guide of some sort. With the most frequent

type of travel guide cited being traditional guide books (37%). This highlights the importance still

placed by tourists on hard copy or tangible travel guides. Perhaps this should be tracked in

longitudinal research in the future to identify changes as smartphone technology becomes more

common place. The second highest response category was tour office information, which was not a

part of the original list of answers but was added due to the high frequency (17%) of responses that

resulted while surveying. This highlights the importance of tourist offices for visitors to Ireland.

The third highest category at 14% was travel apps. Initial speculation was that this would be

considerably higher. However considering how new these are to the tour guide market they are

making a considerable impact in a very short space of time. The use of internet research is still

quite high with some tourists displaying evidence of computer printouts of travel information, again

highlighting the desire for tangible travel information. The combined categorical response of “Book

and app” provided the response rate of 10%. The frequency by type of travel guides used is

summarised below:

7.3 Travel Guide Books

The research captured a vast array of travel guide books. This is evident in Fig 7.8 below which

indicates the percentages of most popular choices for travel guide books cited. Noting that,

Eyewitness, Rough Guide, Guide du Routard Ireland and Frommers were popular with Lonely

Planet and Rick Steves being cited as twice as common as most other guides:

0% 5% 10% 15% 20% 25% 30% 35% 40%

Guide book (hard copy)

Travel App

Tour office information

Maps

Internet Research

Tour Opperators

App and Guide Book

Other

Fig 7.7 What type of Travel guide was used

9

The majority of the respondents were either very satisfied or satisfied with their guide books.

Almost all purchases occurred in their home country, the majority of books were published in 2011

or 2012, and nearly 50% of them were purchased at a price range of €20-29. This indicates that

people who use traditional travel guide books still like to flip pages rather than tap screens and are

willing to pay for high quality guidebooks. This may pose a threat to travel guides in the future or

be a pricing opportunity for travel apps which are low cost or free. This is summarised in the Fig

7.9 to Fig 7.12 below.

7.4 Smartphone and Mobile Device Use

The key differentiator between respondents for the purposes of this project is related to whether or

not they owned a smartphone or other relevant mobile device (e.g. IPad, ITouch, etc.). For those

who answered “no” to owning a smartphone the survey ended after the travel guide questions and

for those who answered “yes” the survey continued on to the end regarding additional questions

0% 5% 10% 15% 20% 25% 30%

Lonely Planet

Rick Steves

Globetrotter

Rough Guide

Eyewitness Backroads Ireland

Tour Club Italy

Reisen - Travel Know How

Frommers

Guide du Routard Ireland

Fodors

Berlitz

Insight Guide Ireland

Pocket Guide to Ireland

Other

Fig 7.8 Name of travel guide book

0% 20% 40% 60% 80%

2011-2012

2009-2010

Older

Fig 7.9 Year Guide Book published

0% 20% 40% 60%

€20-€29

€10-€19

€10 -

Fig 7.10 Price of Guide Book

0% 50% 100% 150%

Ireland

Home country

Fig 7.11 Where was the book aquired

0% 20% 40% 60%

Very satisfied

Sastisfied

So so

Disatisfied

Fig 7.12 Book Satisfaction

10

related to Smartphone use. Furthermore 55% of respondents stated that they do not own a related

mobile device. This, however, may be closely tied to age, noting that a third of respondents were in

the over 50 age category, which may tend to have lower smartphone ownership and use frequency.

The older the age category the less likely they were to use a smartphone. Of those who did not own

a Smartphone, 34% said they intended to own one in the future and use it while traveling and 33%

said they were not planning to, as highlighted in the below charts.

Visitors from the US had the highest percentage of Smartphone ownership (64%), followed by Italy

and Canada (50% respectively), the UK (44%), Ireland (41%), France (32%), and Germany (29%).

Other reports confirm these figures globally. According to the ITB World Travel Monitor:

Up to 40% of international travelers own a smartphone with internet, e-mail and other

functions;

57% have a conventional mobile phone;

Over 40% of smartphone owners use their devices to get destination information;

34% of business travelers / 26% of leisure travelers use them to make booking changes

during their trip;

As many as 37% of international leisure travelers say they use mobile social networks

Targeting Innovation (2012)

Although 45% of respondents in this study do own a smartphone, the rapid growth of this

technology means that these figures will most likely increase significantly in the coming years. All

trends and related reports point toward a full smartphone/mobile device market and an eventual

phase out of more traditional mobile phones in the coming years, so in the future most mobile

phone purchases will include smartphone technology.

For individuals who own smartphones or other related mobile devices, close to 55% of respondents

said that they use their device while travelling in Ireland, and 31.5% of the respondents said that

they booked an element of their trip using their mobile devices.

This includes contacting travel providers directly that visitors may have discovered while

researching on their mobile device. While booking travel on smartphones and related mobile

0% 20% 40% 60%

No

Yes

Fig 7.13 Own a Smart Phone

0% 10% 20% 30% 40% 50%

Yes

No

Dont Know

Fig 7.14 If no, do you intend to

purchase one in the future?

0% 20% 40% 60%

Yes

No

7.15 Do you use your smartphone

while travelling

0% 20% 40% 60% 80% 100%

Yes

No

7.16 Did you book any element of

nnnnnnyour trip on your smartphone

Fig 7.14 If no, do you intend to purchase

one and use it travelling?

11

devices is in its infancy - as other reports highlight consumer concerns such as personal information

security - the growth in mobile bookings is rapidly on the rise. From a recent PhoCusWright report:

Growing from zero just a few years ago, U.S. mobile leisure/unmanaged business travel

gross bookings reached nearly US$2.6 billion in 2011, representing 2.4% of the U.S. online

travel market. By 2013, that share is projected to grow to 6.5%, when mobile bookings

(excluding managed corporate bookings) will represent 2.6% of the total U.S. travel market,

PhoCusWright (2012).

The report goes on to state that U.S. Mobile Travel Bookings are to Top $8 Billion by 2013.

InterContinental Hotel Group (IHG) exemplifies this rapidly evolving trend, having recently

reported a nearly 1,000 percent increase in room night bookings from mobile devices in just over a

year. The group went from under $1 million in monthly revenue to $10 million in just over a year.

In the first five months of 2011, IHG had already surpassed its 2010 total number of room night

bookings from mobile devices. Most guests (65%) who book through a mobile device are staying at

IHG hotels the same night or within one day (Travelmole, 2012). This highlights the growing

importance of short term purchasing when travelers are already in a destination.

Regarding frequency of smartphone/mobile device use, the “once a day” traveler was just over 9%,

with an increased representation of moderate users (2-4 times per day at 24% and 5-7 times per day

at 25%), before dropping off to 5% for the 8-9 times a day users. Then the figures spiked with the

greatest frequency being in the ten plus times per day category (34%). This spike in high use is

related to domestic users who would naturally use their mobile phones more as there are no roaming

charges, as well as business travelers who need to remain connected and whose company pays the

bill.

When asked about mobile use related to trip planning (pre-trip), in holiday use (versus for example,

using other more traditional sources of information such as travel guide books), and vacation

sharing (for example social media that could be during or after the trip), there was a broad range of

responses. With regard to trip planning, 52% of respondents used their mobile devices - including

iPads - under 10% of the time, versus other trip planning activities such as traditional computer

internet research, using travel agents, etc. Furthermore 24% used their devices 10-25% of the time,

so the combined categories mean that 76% of all respondents used their mobile devices less than

25% of the time. This is consistent with a recent PhocusWright report: “Empowering Inspiration:

The Future of Travel Search” that cited information sources of decision to visit the Destination

websites via traditional computer included the following frequency: US - 47%, UK - 48%, Germany

- 52%. However, websites or applications via mobile device were only: US - 8%, UK - 8%,

Germany – 7%, (Rheem, 2012).

When tourists were asked about what percentage they would assign to using their mobile device for

vacation sharing (e.g. social media), the usage figures spread out even further with a much higher

0% 10% 20% 30% 40%

Once a Day

2-4 Times

5-7 Times

8-9 Times

10 times or more

7.17 Frequency of smartphone use

per day while travelling

0% 20% 40% 60%

<10%

10-25%

25-49%

50-75%

75+%

7.18 What % did you use

bbbbbSmartphone for trip planning

12

indication of mobile device use for the likes of sharing their travel experience, for example taking

and sharing photos on facebook, twitter and emailing.

When smartphone users were asked about their top 5 reasons for using their device while on

vacation, responses varied but showed some identifiable characteristics. Among the most

commonly cited smartphone use activities while travelling in Ireland include:

Social media / sharing

Accessing maps/directions eg. Google maps/GPS positioning

Taking photos

Accessing travel information

Accessing destination information

Making calls

Sending texts

Checking / Sending Emails

Surf internet

Music

Below Fig 7.20 summarises the top fifteen responses for smartphone use while travelling in Ireland:

While variation in responses can be explained by demographic differences such as age and gender,

they also vary between domestic vs. other European visitors, and even more so related to tourists

from further abroad such as the US and Australia. Irish holiday goers, who have few barriers to use

other than perhaps Wi-Fi coverage and battery life, tended to use their smartphones across the full

range of uses as they would at home, for example calls, texts and emailing. Visitors from Europe,

and increasingly with tourists from further abroad, who face increasing barriers, used their

0% 5% 10% 15% 20% 25% 30%

<10

10-25%

25-49%

50-75%

75+%

7.19 What % did you use your Smartphone for sharing

0% 2% 4% 6% 8% 10% 12% 14% 16% 18% 20%

Social media / sharing

Using FourSquare, Gowalla, Google Places, etc.

Weather

Maps/directions eg. Google maps/GPS positioning

Photos

Music

Destination information

Info on tourism services

Check reviews/ratings

Post review or rating

Calls

Texts

Email

Surf internet

Other

Fig 7.20 What are your top fifteen reasons for using your smartphone on holiday

13

smartphone devices in different and more limited ways. For example, taking photos and listening to

music or playing games increases – especially with American respondents - whereas social media

use or looking up directions decreased and occurred when the user found a free or low cost Wi-Fi

access zone, for example in their hotel. These are important considerations as it relates to

development of new smartphone and related mobile device applications and solutions. It also

highlights challenges and opportunities in addressing these barriers, for example in creating or

incentivising free Wi-Fi zones, which currently exists in other destinations.

These findings were consistent with other relevant reports:

There are significant differences in the way smartphone users use their phone when

travelling in their home country and when abroad…three-quarters of those surveyed had

used their smartphone when travelling abroad in the previous 12 months. When they are

travelling in their own country, there was a tendency to use a broad range of functions on a

frequent basis, Napier University (2011).

Social media use had a high response rate with both domestic and foreign travelers. Supporting this,

the ITB (International Tourism Board) World Travel Trends Report 2010-2011, notes that “Around

the world more and more travelers are using social media. In the USA, about 52% of the 152

million adult leisure travelers – or some 79 million people - already use social media. US social

media users tend to be active on Facebook, read other social sites, use the internet intensively for

travel information, check out hotels on Trip Advisor and use online travel retailers such as

Travelocity and Expedia. But only a low 20% rely on social sites for leisure travel information and

websites are trusted much more than social networks.” (ITB, 2010) This was highlighted in a

similar survey report by Napier University which found that “For the majority of users in this

survey, the most important use of the smartphone seems to be to keep in touch with family and

friends across all criteria, irrespective of type of activity or where the user is” (Smartphone Use by

Tourism and Travel Consumers, Targeting Innovation Ltd. 2012). This is an important

consideration for development of future solutions, particularly as social media converges with app

technology in the near future.

7.5 Barriers to Smartphone/Mobile Device Use

As discussed above, barriers to mobile device use such as smartphones are relatively low for

domestic travelers, increasing for other European visitors, and becoming increasingly pronounced

for travelers from further abroad such as the US, Canada, Australia, China and South Africa. The

below Fig. 21 summarise the frequency of the top responses to the question about limits to

smartphone use while travelling in Ireland:

0% 5% 10% 15% 20% 25% 30% 35% 40%

Speed of connectivity

Screen size of device

Lack of Wi-Fi access or insufficient connections

Wi-Fi access charges

Roaming charges

Desire to keep technology out of vacation

Lack of apps for the destination in my language

Coverage

Battery

Other please specify

Fig 7.21 What reduces your smartphone use on holiday

14

Roaming charges are identified in this study as the biggest barrier 34% to Smartphone/Mobile

device Use. According to Kroes (2012) European Commission, Vice President for the Digital

Agenda:

“Consumers are fed up with being ripped off by high roaming charges. The new roaming

deal gives us a long-term structural solution, with lower prices, more choice and a new

smart approach for data and Internet browsing. The benefits will be felt in time for the

summer break - and by summer 2014, people can shop around for the best deal."

This may be somewhat addressed for EU travelers as from 1

st

July 2014, customers will have the

option to shop around for the best deal and sign up for a separate mobile contract for roaming,

which may be different from their domestic mobile provider, whilst keeping the same phone

number. Each time the customer crosses a border, his or her phone will switch to the network of the

roaming provider which they have chosen, without any further action on their part. Customers will

also have the option to directly select a local mobile network for data roaming in the country they

are visiting (see IP/11/835). Furthermore as from the 1st July 2012, virtual mobile operators and

resellers, who do not have their own networks will immediately have the right to access other

operators' networks at regulated wholesale prices in order to provide roaming services (together

with national services) to their customers. This will already create more competition between

operators, and so increase the incentives for them to offer customers more attractive roaming prices

and services (Europa, MEMO/12/227, 2012). This is the first time the European Union has tackled

the high cost of roaming at its root, by introducing pro-competitive structural change into the heart

of the market. However, it is important to note this will only relate to EU travelers.

The lack of Wi-Fi access and insufficient connections has been cited by the travelers as the second

largest barrier 25%. Here the solution is in the hands of the various tourism stakeholders to

promote, communicate and develop a network of available Wi-Fi spots for tourists. The coverage in

rural tourism areas has been identified as the third largest 15% barrier followed by a desire to keep

technology out of the traveler’s vacation at 7%. However the cost saving measures being employed

by tourists to keep technology in their vacation far outweigh this barrier.

With regard to smartphone use related cost saving measures employed while travelling in Ireland,

the following activities were found to be significant:

64% switch off some or all services (e.g. turn off roaming)

49% limit their devices to calls / texts only

17% use local country sim card or an international package

68% use other cost saving measures to avoid roaming such as free Wi-Fi zones

27% use no cost saving measures

7.6 “App” Use

As mentioned above in the Travel Guide Use section, only 14% of respondents said that they were

using downloadable “apps” on their mobile devices. However, of the 45% of respondents who do

own a smartphone or related mobile device, when questioned about how they find out about travel

apps, just over twenty 20% of them said they do not use travel apps. This indicates that travel app

use in Ireland may be in its infancy. However is expected to develop significantly as the technology

is growing rapidly and evolving quickly in terms of functionality, user value and market. It also

suggests that travelers with mobile devices such as smartphones are using their devices for a broad

range of activities such as social media, as highlighted in the Smartphone & Mobile Device Use

section above. For respondents who do use apps, over 40% find out about them from the “app

store” on their mobile device, which includes apps that already exist and are complimentary with

15

the device. Respondents between 25-49 years old were the most likely to find apps from the app

store.

Other notable responses to how those surveyed found out about apps include through reviews and

online search. Although over 20% of respondents said that they are most likely to download an app

“When it is free”, there is a much more even spread among other categories such as when they are

“Recommended by a friend”, “Through Ratings” and “Recommended from reliably sourced

literature or website.” This indicates that price is not necessarily the most important factor in

deciding to download an app, though it is significant.

Of the apps identified by respondents (See Fig 7.24), those most commonly cited include Google

Maps, Lonely Planet Ireland, Dublin Pocket Guide, Trip Advisor, Triposo, Tripit, foursquare and

several others. Less common but cited is the Discover Ireland app. Although the research has

identified dozens of Ireland specific travel apps available, none of them were regularly cited other

than the Lonely Planet Ireland app. Due to the low level of overall app use response rate during the

surveying, and because of the large volume of travel apps available, a larger sample size would be

useful in order to more clearly identify travel related app use. The rapid evolution and growth of

this technology suggests that a scaled up survey in a more mature market may more accurately

reflect consumer interests and trends. In addition, since smartphone and app users tend to be

younger, the percentages will increase as the younger demographic groups age, so it may be helpful

to target younger visitors in order to better identify future trends.

Other recent studies indicate that navigation related apps are popular. As identified by Marr, (2012),

Adobe’s Mobile Experience Survey of October 2010 noted that “80% of its research respondents

0% 10% 20% 30% 40% 50%

Reviews

Friends

Press

App Store

Online Search

Other

NA - Don't Use Apps

Fig 7.22 How do you find travel Apps

0% 20% 40%

When its free

Recommended by a friend

Through ratings

Recommended from reliably

sourced literature/site

Fig 7.23 When are you most likely to

download a Travel App

0% 5% 10% 15% 20% 25% 30% 35% 40%

Google Maps

Lonely Planet Ireland

L.P. Dublin City Guide

Booking.com

Discover Ireland

Bridgestone Guide

Trip Advisor

Dublin Pocket Guide

Triposo

Tripit

Foursquare

Fig 7.24 What Travel Apps are you using on holiday

16

accessed maps and directions from their mobile device in the previous 12 months and half

researched places and destinations, while about a quarter of the respondents had initiated travel

bookings from their mobile devices” (Adobe, 2010).

As summarised below, the vast majority of smartphone users who downloaded apps said they were

downloaded in their home country (eighty %), meaning prior to the trip, and 96% of the app users

responded that their apps were in English. 88% of travel app users said that they were “Very

Satisfied” or “Satisfied” with their app.

In terms of price, while close to 85% of app users said their app was free. The relatively low cost of

travel apps may be due to the number of free apps available to travelers visiting Ireland.

Table 3 Cross section of Travel App prices

It is noted for example that the Lonely Planet travel app for Ireland was €1.79 compared to €20.91

for the hardcopy. Furthermore over 92% of the travel apps identified by this research were free, see

0% 50% 100% 150%

German

English

French

Fig 7.25 Travel App Language

0% 20% 40% 60% 80% 100%

Ireland

Home country

Fig 7.26 Where was App

downloaded?

0% 20% 40% 60% 80% 100%

€5+

€2 - €4.99

€0.01 -€1.99

Free

Fig 7.27 Travel App Price

0% 10% 20% 30% 40% 50%

Dissatisfied

So so

Satisfied

Very Satisfied

Fig 7.28 Travel App satisfaction level

17

table 7.1 above. It is worth pointing out that most apps are still quite basic in nature and as this

develops with more features and perhaps A.R. the cost of these apps may rise.

When smartphone users were asked if they use Augmented Reality (AR) apps, only 9% said yes,

58% said no, and 33% said they don’t know. This indicates that augmented reality “lens” approach

to travel related smartphone use is still in very early stages in terms of technology and awareness.

This area is expected to be the high-tech future of Smartphone travel use. It may also be reflective

of the fact that most consumers don’t understand what an “augmented reality” app is, so many of

them may be using it without knowing they are doing so. A recent report commissioned by

Amadeus Group helps to describe the technology is already being applied and why it will become

more mainstream:

At a very functional level, it (augmented reality) will help people make the most of an

unfamiliar place. Intelligent translation services and augmented reality applications that

overlay information about the physical world around us are currently available in only a

small number of areas and used by only a small number of people. Over the next decade,

however, improvements to both the technologies – for example, natural language processing

– and the enabling infrastructure should significantly expand their use Stubbings and Curry

(2012).

The same report goes on to use the example of how an augmented reality app brings the Berlin Wall

back by allowing “anyone to see exactly where the wall once stood 21 years ago using the Layar

app. An average of 175 unique users per week take a look at The Berlin Wall via Layar.”

It is expected that AR apps will not only make travelers lives easier in finding location based

information (for example where to find a bank or to eat), but also enrich the travel experience by

adding to the existing physical world virtual static or dynamic images of past, present and future, as

well as valuable information (for example a story related to a particular period in time).

8.0 Recommendations

It is inevitable that Smartphone and mobile app technology will become the norm. Related mobile

devices are already conventional, although the body of knowledge related to the broad range of how

and why different types of travelers use their mobile devices is extremely limited, particularly as it

relates to Ireland. Nevertheless, challenges have been identified and opportunities exist in

addressing existing barriers and or creating new solutions. Highlighted recommendations as a result

of this study include the following:

Don’t forget about traditional travel guide use such as guide books. At least for now

more traditional guides still dominate or at least compliment this market. Additionally, the

more popular travel guides that are going toward online app technology (e.g. Lonely Planet)

still create content in many traditional ways, primarily by an author visiting the place and

writing about it. So as a destination – as well as independent travel providers - reaching out

directly or through your guests to these authors and publishers will prove valuable.

Cost of travel guides. Tourists are spending money on hard copy traditional travel guides.

However in costing a travel app it would be important to recognise that travellers tend to

download more free travel apps than those you pay for. In many cases the average cost of

travel guide was over 200% more expensive than the travel apps. For example, Lonely

Planet travel app for Ireland was €1.79 compared to €20.91 for the hardcopy.

Create or incentivise free Wi-Fi zones. This currently exists in other destinations and a

lack of free Wi-Fi zones in urban Ireland is frustrating to some visitors, as confirmed when

18

researchers spoke with visitors while surveying. Key tourist towns should consider creating

a social and tourist hub within the community, such as within a mixed commercial

residential neighbourhood. Individual businesses with free Wi-Fi zones also stand to benefit.

However, a balancing act in allowing and facilitating visitors to be “unplugged” is an

important element in helping visitors to leave their work at home and connect more with

their experience.

Promote free Wi-Fi zones. Once free Wi-Fi zones are in place it is essential to

communicate this to tourist. It may be worth changing the traditional adage for tourists

demands from: “A Loo, a View and a Brew”

“A Loo, a View, a Brew, and Wi-Fi too”

Tourist offices should be plugged in and make the visitor experience more interactive.

Consideration should be given to the provision of a free to low-cost Wi-Fi zone. Electronic

virtual displays or online access to Ireland specific tourism information would bring Ireland

up to the forefront of 21st Century visitor experience enhancement with regard to tourist

offices. It would also help to alleviate queues in some busy tourist offices.

Charging stations will help with business. Outlets for charging the often drained

smartphones, iPads, and even laptops are a welcome site to travelers. Make them available

and obvious.

Get familiar with the technology– don’t throw resources at app development or other

online solutions without a thorough understanding of the market, existing technology and

how it is being used. Although tourists will increasingly own and use smartphone

technology and apps, including augmented reality programmes, the technology is evolving

at lightning speed, as is the variety of ways people use them. Market feasibility assessments

are highly recommended before jumping into new enterprise solution development.

Update on an ongoing basis. Although a relatively new concept for most tourism

managers, try mange your app like your website. Ask your app providers to allow you to

make regular updates.

Collect data from your travel app. Ensure you collect vital statistics such as number of

enquiries and bookings made via the app.

Promote your app well, it is noted that over 80% of the travel apps were downloaded in the

tourists home country. This research also highlights that visitors are most likely to download

an app when it is free and second most likely to download an app when it is recommended

by a friend. So the power of buzz or word of mouth is still a key factor in app selection.

Integration of Social networking, reviewing and sharing is King. People love to connect,

including a strong desire for fellow traveler perspectives. This includes not just friends and

family but also anonymous traveler reviews and advice in making travel decisions, setting

expectations, enhancing experience and sharing that experience during and after a trip.

If you have the finance to invest in this area consider next generation functionality.

Although a relatively new, unknown solution for visitors to Ireland, as confirmed in this

study, AR apps were virtually non-existent a couple of years ago and now they are growing

quickly, with most reputable mobile device / app related sources pointing toward this trend.

Other identified trends include mobile travel booking and payment systems, as well as

location-based services such as mobile check-in, boarding passes, etc. This evolving

technology is already profoundly changing travel and tourism service delivery.

19

Develop enterprise solutions based on target demographics and related use patterns.

Type of travel (for example business versus leisure travel, and package holiday versus

independent travel), age, and domestic versus international visitors, among other variables,

dictate a lot. This includes the convergence of apps and social media considerations, as well

as creating solutions that filter through a world already filled with information overload to

provide concise and valuable information and needed services for travelers (for example a

boarding pass check-in). Convenience before complexity is the key.

Always think about independant travel service providers. Ireland is built upon

independant and family owned accommodations, activity providers, tour operators, food

service and other tourism providers. All marketing and visitor experience enhancement

enterprise solutions should be developed with this in mind in order to support the sustainable

development of these small scale providers by connecting travellers directly to them in a

positive, experiential way. Mobile technology can help or hurt SME’s versus larger online

aggregators depending on how it is used.

9.0 Conclusion

By identifying and assessing how domestic and international visitors use travel guides - particularly

traditional travel guides versus mobile devices such as smartphones and apps - when travelling

within Ireland, this project has identified enterprise level, regional and national authority challenges

and opportunities. Next generation smartphone technology is rapidly emerging and soon to be the

norm, although it is a very young field and traditional guides (including tour operators and guide

books) remain strong. There are also many barriers to mobile device use, particularly for non-

domestic travellers, as well as barriers to the development of effective enterprise solutions.

This study found that while only about 45% of domestic and international visitors to Ireland owned

Smartphone/mobile device, the percentages will continue to increase rapidly over time to the point

of full market saturation. For individuals who already own smartphones or other related mobile

devices, close to 55% of respondents said that they use their device while travelling in Ireland, and

31% said that they booked an element of their trip using their mobile devices. These numbers are

expected to increase significantly in the future, identifying the need for a better understanding of

how travelers use their mobile devices. For example, this study and related research also found that

users are extremely cautious of high roaming charges, transferring personal / financial information

via their mobile, and are frustrated by a lack of Wi-Fi access when travelling.

While this rapidly evolving field of next generation travel and tourism related technology is in its

infancy and there is very limited information on user visitor trends, we do know that it is the future

of tech travel, including downloadable apps, and particularly augmented reality apps. We also know

that there are tens of thousands of travel related apps globally, dozens of Ireland specific apps that

have been identified, yet very few of them were identified as being utilized by visitors within

Ireland. This suggests that the development of future solutions should only occur with a thorough

understanding of the market and that in order to gain improved insight, an expanded research

project related to this topic should be considered. If Ireland is to capture a highly elusive, growing

market of people who are already inundated with aggressive online and mobile outlets and

strategies, it must do its best to understand who is already doing what in order to identify the gaps

and capture its target audience. Perhaps best summarised in a recent report, mobile solutions “must

strive to adapt to the consumer on the go, and strike the right balance between simplicity and rich

functionality. The key to success in this early stage of mobile development is to tailor the

experience with a custom fit for mobile needs – serve the right product to the right customer at the

right price at the right time” (Rheem, 2012).

20

Bibliography

Australian Tourism Data Warehouse (ATDW). (2012) Tourism eKit: Mobile Technology for

Tourism.

Arsal, I,. Backman, S., & Baldwin, E. (2008). Influence of an outline travel community on travel

decisions. In P. O’Connor, W. Hopken, & U. Gretzel (Eds), Information and communication

technologies in tourism 2008 (pp82-93). New York, NY: Springer Wien.

Ayeh, K. Julian,. Au, Norman & Law, Rob. (2012) Predicting the intention to use consumer

generated media for travel planning. Tourism Management.

Ajanki, A., Billinghurst, M., Gamper, H., Jarvenpaa, T., Kandemir, M., Kaski, S., Koskela, M.,

Kurimo, M., Laaksonen, J., Puolamaki, K., Ruokolainen, T., & Tossavainen, T. (2010). An

augmented reality interface to contextual information. Virtual Reality, 15(2-3), 455-470.

Athoraya.S. (2011) App-vertising – Effective Communication in a Creative Context, University of

Gothenburg.

Azuma, R., Baillot, Y., Behringer, R., Feiner, S., Julier, S. & MacIntyre, B., (2001). Recent

advances in Augmented Reality. IEEE Computer Graphics & Applications, 21 (6), 34-47.

Adobe Mobile Experience Survey: What Users Want from Media, Finance, Travel & Shopping,

Adobe, 2010, Source: http://www.keynote.com/docs/news/AdobeScene7_MobileConsumer

Survey.pdf

Bellman, Steven; Potter, F. Robert; Treleaven-Hassard, Shiree; Robinson, A. Jenniffer; Varan,

Duane. (2011) The effectiveness of branded Mobile Phone Apps. Journal of interactive marketing.

Publised, Elsevier inc.

Boag, Gregory (2012) Chief Executive Targeting Innovation ltd. Smart phone use by tourism and

travel consumers.

Brown, J., Broderick, A J., & Lee, N. (2007). Word of mouth communication within online

communities: conceptualising the online social network. Journal of interactive marketing, 21 (3), 1-

20.

Clarke, David (2012) Time Out: 50 Must have travel apps: Retrieved from:

http://www.timeout.com/travel/features/1169/50-must-have-travel-apps Accessed 11/10/12

Camagni, R. & Capello, R. (2000). The Role of Inter-SME Networking and Links in Innovative

High-Technology Milieux, in: D. Keeble & F. Williamson (Eds) High-Technology Clusters,

Networking and Collective Learning in Europe, pp. 118–144 Aldershot: Ashgate.

Denis Lacroix, (2012) Chaos to Collaboration: How transformative technologies will herald a new

era in travel, Andy Stubbings & Andrew Curry at The Futures Company, Amadeus IT Group.

Europa, MEMO/12/227, (2012) Digital Agenda: EU reaches preliminary deal on future-proof

roaming solution for mobile phone users http://europa.eu/rapid/press-release_MEMO-12-

227_en.htm

21

eMarketer, (2010, October) Mobile Advertising and marketing:Past the Tipping Point. Retrieved

20/10/2011)

eMarketer, (2011, February) Smart and getting Smarter: Key Mobile devices Trends for Marketers.

Retrieved 12/10/2011)

Empowering Inspiration: The Future of Travel Search, PhocusWright, Feb. 2012, Carroll Rheem,

Sponsored by Amadeus

Fáilte Ireland (2012) visitor attitude survey http://www.failteireland.ie/Research-Statistics/Surveys-

and-Reports/Visitor-Attitudes-Survey)

Hanrahan, J., Krahanbuhn, P., (2011). An assessment fro tourism demand and use for travel guides.

Failte Ireland Applied research Scheme 2011. Presented at 8

th

annual THRIC Conference. Retrieved

12/12/12.

Hotelmarketing.com, (2012). Online travel research. Travel Planning. Retrieved from:

http://www.newmediatrendwatch.com/markets-by-country/18-uk/151-online-travel-

market?showall=1 Accessed 11/12/12

Holzer, Adrian.,& Ondrus, J., (2010). Mobile application market: A developer’s perspective.

Telematics and informatics

Hovland, C.I., Janis, I.L., & Kelley, H.H. (1953). Communication and persuasion. New Havan, CT:

Yale University Press

ITB world travel trends report 2010/2011, prepared by IPK International on behalf of ITB Berlin

Source: http://www.itb-berlin.de/media/itb/itb_media/itb_pdf/worldttr_2010_2011 ~1.pdf

Marketsand markets (2010) Mobile application market. Retrieved from:

http://www.marketsandmarkets.com/pressreleases/mobile-applications-market.asP Accessed

11/12/12

Mediabistro (2012) Cited in online travel market. Travel planning. Retrieved from:

http://www.newmediatrendwatch.com/world-overview/91-online-travel-market Accessed 11/12/12

Marr, K. (2012) Smartphone Use by Tourism and Travel Consumers, Targeting Innovation Ltd.,

January

Napier University (2011): An Assessment of Tourist Demand and Use for downloadable “APP”s

for SMARTPHONES and Mobile Device

Olsson, T., & Väänänen-Vainio-Mattila, K. (2011). Expected User Experience of Mobile

Augmented Reality Services. Proceedings from the 13

th

International Conference on Human

Computer Interaction with Mobile Devices, MHCI2011, Stockholm, Finland.

Okazaki et al. (2007) “How mobile Advertising Works: The Role of Trust in Improving Attitudes

and recall” Journal of Advertising Research, vol 47 (2) pp. 165-178

PCMag, (2012).com; Source: http://www.pcmag.com/encyclopedia_term /0,1237,t=app &i=37 86

5, 0 0.asp)

22

PhoCusWright (2012) Mobile Hits the Mainstream: Technology and Industry Trends, a

PhoCusWright report, Published by Innovation Edition, February.)

Rasinger, J., Fuchs, M., Beer, T., & Hopken, W. (2009). Bulding a mobile tourist guide based on

tourists' on-site information needs. Tourism Analysis, 14, 483-502.

Rheem, C., (2012) Empowering Inspiration: The Future of Travel Search, PhocusWright, Feb.

2012), Researched and Written by Carroll Rheem Sponsored by Amadeus

Schmitt (2009) “Mobile marketing: Is App-Vertising the Answer?” Advertising Age, May 13.

Shankar and Balasubramanian (2009)” Mobile Marketing: A Synthesis and Prognosis”. Journal of

Interactive Marketing, vol 23 (2).

Seo, B.-K., Kim, K., & Park, J. (2011). Augmented Reality-Based On-Site Tour Guide: A Study in

Gyeongbokgung. In Koch, R. (Ed), ACCV 2010 Workshops, Part II, 276–285. Berlin: Springer-

Verlag

Sigala, M. (2007). New Product Development processes in tourism clusters: a knowledge

management approach. Annual International International Council for Hotel, Restaurant and

Institutional Education, (I-CHRIE) Convention “Hospitality and Tourism Education as Big as

Texas”. Dallas, Texas, USA:I –CHRIE, 25-29 July, 2007.

Schonfeld, E.(2008) Top Ten Android Launch Apps http://www.techcrunch.com/2008/ 10/22/top-

ten-android-launch-apps/http://online.wsj.com/article/SB1224777 63884262815.html

Stubbings, A. Curry, A., (2012) From chaos to collaboration: How transformative technologies will

herald a new era in travel, Andy Stubbings & Andrew Curry at The Futures Company.© 2012

Amadeus IT Group

Teemu, A.,(2008.) How Mobile Is Changing Our Society, http://tarina.blogging.fi/2008/10/18/

speaking-at-mobile-monday-amsterdam/

Tourism Ireland (2012) Consumer insights: Consumer and technology trends: Retrieved from:

http://www.tourismireland.com/Home/Consumer-Insights/Consumer-and-technology-trends.aspx

Accessed 11/12/12

Travelmole (2012) Online Travel Market: Travel Planning. Retrieved from:

http://www.newmediatrendwatch.com/markets-by-country/18-uk/151-online-travel-

market?showall=1 Accessed 11/12/12

Trip advisor (2012). Top 10 destinations in Ireland: Travellers choice destination 2012. Retrieved

from: http://www.tripadvisor.co.uk/TravelersChoice-Destinations-cTop-g186591 Accessed

12/12/12

Umlauft, M., Pospischil, G., Niklfeld, G., & Michlayr, E. (2003). Lol@, a mobile tourist guide for

UMTS. Information Technology and Tourism, 5(3), 151-164.

Vafopoulos, M. (2006). “Electronic workspace: Realising the peripheral development of knowledge

volume”, National Network of Research and Technology, e-business forum, work Group H3.

Wingfield, N. (2008) Time to Leave the Laptop Behind The Wall Street Journal.

23

Werthner, H; Klein, S. (1999), Information Technology and Tourism A Challenging Relationship.

Wien u. a. 1999.

Ye, Q., Law, R., Gu, B., & Chen, W. (2011). The influence of user generated content on traveller

behaviour: an empirical investigation on the effects of e-word-of-mouth to hotel online bookings.

Computers in human behaviour, 27(2), 634-639

Yovcheva, Z., Buhalis, D. Gatzidis, C., (2012) Overview of Smartphone Augmented Reality

Applications for Tourism e-Review of Tourism Research, Special Issue – ENTER 2012 Idea

Exchange.