SAMSUNGSDICO.,LTD.ANDSUBSIDIARIES

ConsolidatedFinancialStatements

December31,2023and2022

(WithIndependentAuditors’ReportThereon)

Contents

Page

IndependentAuditors’Report 1

ConsolidatedStatementsofFinancialPosition 5

ConsolidatedStatementsofComprehensiveIncome6

ConsolidatedStatementsofChangesinEquity 7

ConsolidatedStatementsofCashFlows9

NotestotheConsolidatedFinancialStatements 10

152, Teheran-ro, Gangnam-gu, Seoul 06236

(Yeoksam-dong, Gangnam Finance Center 27th Floor)

Republic of Korea

1

Independent Auditors’ Report

BasedonareportoriginallyissuedinKorean

TotheShareholdersandBoardofDirectorsof

SamsungSDICo.,Ltd.:

Opinion

WehaveauditedtheconsolidatedfinancialstatementsofSamsungSDICo.,Ltd.anditssubsidiaries(“theGroup”),

which comprise the consolidated statement s of financial position as of December 31, 2023 and 2022, the

consolidatedstatementsofcomprehensiveincome,changesinequityandcashflowsfortheyearsthenended,and

notes,comprisingofmaterialaccountingpolicyinformationandotherexplanatoryinformation.

In our opinion, the accompanying consolidated financial statemen ts present fairly, in all material respects, the

consolidated financial position of the Group as of December 31, 2023 and 2022, and its consolidated financial

performance and its consolidated cash flows for the years then ended in accordance with Korean International

FinancialReportingStandards(“K‐IFRS”).

Wealsoh aveaudited,inaccordancewithKoreanStandardsonAuditing(KSAs),,theGroup'sInternalControlover

Financial Reporting for consolidation purposes as of December 31,2023 based on the criteria established in the

Conceptual Framework for Designing and Operating Internal Control over Financial Reporting issued by the

Operating Committee of Internal Control overFinancialReportingin theRepublicof Korea,and ourreportdate d

February 23, 2024 expressed an

unmodified opin i on o n the effectiveness of the Group’s internal control over

financialreporting.

BasisforOpinion

Weconductedourauditsin accordancewithKSAs.Ourresponsibilitiesunderthosestandardsarefurtherdescribed

intheAuditors’ResponsibilitiesfortheAuditoftheConsolidatedFinancialStatementssectionofourreport.We

are independent oftheGroupinaccordancewith theethicalrequirementsthata rerelevant toour audit ofthe

consolidatedfinancialstatements in RepublicofKorea,andwehavefulfilled our other et hical responsibilities in

accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and

appropriatetoprovideabasisforouropinion.

KeyAuditMatters

Keyauditmattersarethosemattersthat,inourprofessionaljudgment,wereofmostsignificanceinourauditofthe

consolidatedfinancialstatementsasofandfortheyearendedDecember31,2023.Thesematterswereaddressed

inthecontextofourauditoftheconsolidatedfinancialstatementsasawhole,andinformingouropinionthereon,

andwedonotprovideaseparateopiniononthesematters.

A.Theexistenceofautomotivebatteryrevenue

1)Risk

The Group recognizes automotive battery revenue when it transfers the risk and control over the good to the

customer. The Group’s automotive battery revenue is consistently increasing, and the expectat ions of external

stakeholdersarehigh.

As described in no te 4, the amount of automotive battery revenue is significant in the consolidated financial

statementsandthemanagement’sincentivetoincreasetherevenueishigh,wehavedeterminedtheexistenceof

automotivebatteryrevenueasakeyauditmatter.

ssssssssssssssssssssssssssss

2

2)Howthematte rwasaddressedinouraudit

Theprimaryproceduresweperformedtoaddressthiskeyauditmatterincludedthefollowing:

‐ Obtained an understanding of the Group’s processes related to automotive battery revenue recognition and

evaluatedthe designandoperatingeffectivenessofcorrespondinginternalcontrols.

‐Inspectedtheautomotivebatterycontracts withcustomersonasamplebasisandassessedtheappropriatenessof

thetimingofcontroltransferandcorrespondingrevenuerecognitioninaccordancewithK‐IFRSNo.1115.

‐Assessed theexistenceofautomotivebatteryrevenue

andtheappropriatenessofthetimingofautomotivebattery

revenuerecognition,byinspectingtheexternalevidenceonasamplebasis.

B.TheAppropriatenessofestimationofallowanceforinventoryvaluation

1)Risk

TheGroupassessesthenetrealizablevalueandobsolescenceofinventory.Theevaluationincludesmanagement’s

judgementandestimates.Asdescribedinnote9totheconsolidatedfinancialstatements,consideringtheamount

of allowance for inve ntories is significantin the consolidatedfinancialstatements andthereis uncertainty in the

estimates andjudgmentsusedbymanagement,weidentifiedtheappropriatenessofestimationofallowancefor

inventoryvaluationasakeyauditmatter.

2)Howthematte rwasaddressedinouraudit

Theprimaryproceduresweperformedtoaddressthiskey auditmatterincludedthefollowing:

‐ObtainedanunderstandingoftheGroup’sprocessesrelatedtoinventoryvaluationandevaluatedthedesignand

operatingeffectivenessofcorrespondinginternalcontrols.

‐ Evaluated the reasonableness of the Group’saccounting policies andmethodology and assumptions applied to

estimatetheinventoryvaluationandperformedrecalculations.

‐Assessedtheaccuracyofinventoryagingdataonasamplebasis.

‐Evaluatedtheappropriatenessofthe underlyingdatausedfortheestimationofthenetrealizablevalueofinventory

onasamplebasis.

OtherMatter

TheproceduresandpracticesutilizedintheRepublico f Koreatoauditsuchconsolidatedfinancialstatementsmay

differfromthosegenerallyacceptedandappliedin

othercountries.

ResponsibilitiesofManagementandThoseChargedwithGovernancefortheConsolidatedFinancialStatements

Managementis responsibleforthepreparation andfairpresentationoftheconsolidatedfinancialstate ments in

accordance with K‐IFRS, and for such internal control as management determines is necessary to enable the

preparationofconsolidatedfinancialstatementsthatarefreefrommaterialmisstatement,whetherduetofraud

orerror.

Inpreparingtheconsolidatedfinancialstatements,managementisresponsibleforassessingtheGroup’sabilityto

continueasagoingconcern,disclosing,asapplicable,mattersrelatedtogoingconcernandusingthegoingconcern

basis of accounting unless managementeither intends to liquidatethe Group orto cease operations,or hasno

realisticalternativebuttodoso.

ThosechargedwithgovernanceareresponsibleforoverseeingtheGroup’sfinancialreportingprocess.

ssssssssssssssssssssssssssss

3

Auditors’ResponsibilitiesfortheAuditoftheConsolidatedFinancialStatements

Ourobjectivesaretoob tainreasonableassuranceaboutwhethertheconsolidatedfinancialstatementsasawhole

arefreefrommaterialmisstatement,whetherduetofraudorerror,andtoissueanauditors’reportthatincludes

ouropinion.Reasonableassuranceisahighle velofassurancebutisnotaguaranteethatanauditconductedin

accordancewithKSAswillalwaysdetectamaterialmisstatementwhenitexists.Misstatementscan arisefromfraud

or error and are considered material if, individually or in the aggregate, they could reasonably be expected to

influencetheeconomicdecisionsofuserstakenonthebasisoftheseconsolidatedfinancialstatements.

As part of an audit in accordance with KSAs, we exercise professional judgment and maintain professional

skepticismthroughouttheaudit.Wealso:

• Identifyan dassesstherisksofmaterialmisstate mentoftheconsolidatedfinancialstatements,whether

duetofraudorerror,design and performaudit proceduresresponsiveto those risks, and obtain audit

evidencethatissufficienta n dappropriatetoprovideabasisforouropinion.Theriskofnotdetectinga

material misstatement resulting from fraud is higher than for one resulting from

error, as fraud may

involvecollusion,forgery,intentionalomi s si o n s ,misrepresentations,ortheoverrideofinternalcontrol.

• Obtainanunderstandingofinternalcontrolrelevanttotheauditinordertodesignauditpro ceduresth at

areappropriateinthecircumstances.

• Evaluatetheappropriatenessofaccountingpoliciesusedinthepreparationoftheconsolidatedfinancial

statements and the reasonableness of accounting estimates and related disclosures made by

management.

• Conclude on the appropriateness of management’s use of the going concern basis of accounting and,

based on the audit evidence obtained, whether a material uncertainty exists related to events or

conditionsthatmaycastsignificant doubt onthe Group’s ability tocontinueasa goingconcern.If we

concludethatamaterialuncertaintyexists,wearerequiredtodrawattentioninourauditors’reportto

therelateddisclosuresintheconsolidatedfinancialstatemen tsor,ifsuchdisclosuresareinadequate,to

modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our

auditors’report.However, future events orconditionsmay cause the Groupto cease to co ntinueas a

goin gconcern.

• Evaluate the overall presentation, structure and content of the consolidated financial statements,

including the

disclosures, and whether the consolidatedfinancial statements represent theunderlying

transactionsandeventsinamannerthatachievesfairpresentation.

• Obtainsufficientappropriateauditevidenceregardingthefinancialinformationoftheentitiesorbusiness

activities within the Group to express an opin i o n on the consolidated financial statements. We are

responsible for the direction, supervision and performance of the group audit. We remain solely

responsibleforourauditopinion.

4

Wecommunicate with thosecharged with governance regarding, among ot h e r matters,the planned scopeand

timingoftheauditandsignificantauditfindings,includinganysignificantdeficienciesininternalcontrolthatwe

identifyduringouraudit.

We also provide those chargedwith governance with a statement that we h ave complied with relevant ethical

requirementsregardingindependence,andcommunicatewiththemallrelationshipsandothermattersthatmay

reasonablybethoughttobearonourindependence,andwhereapplicable,relatedsafeguards.

Fromthematterscommunicate dwiththosechargedwithgovernance,wedeterminethosemattersthatwereof

mo stsignificanceintheauditoftheconsolidatedfinancialstatementsofthecurrentperiodandarethereforethe

key audit matters. We describe these matters in our auditors’ report unless law or regulation precludes public

disclosureaboutthematterorwhe n,inextremelyrarecircumstances,wedeterminethatamattershouldnotbe

communicated in our report because the adverse consequences of doing so would reasonably be expected to

outweighthepublicinterestbenefitsofsuchcommunication.

Theengagementpartnerontheauditresultinginthisindependentauditors’reportisCha,Jeong‐Hwan.

Seoul,Korea

February

23,2024

ThisreportiseffectiveasofFebruary23,2024,theauditreportdate.Certainsubsequenteventsorcircumstances,

whichmayoccur betweentheauditreportdateandthe timeofreadingthisreport,couldhaveamaterialimpact

onthe accompanyingconsolid ated financial statementsan dnotesthereto.Accordingly,thereadersof the audit

report should understand that the above audit report has not been update d to reflect the impact of such

subsequenteventsorcircumstances,ifany.

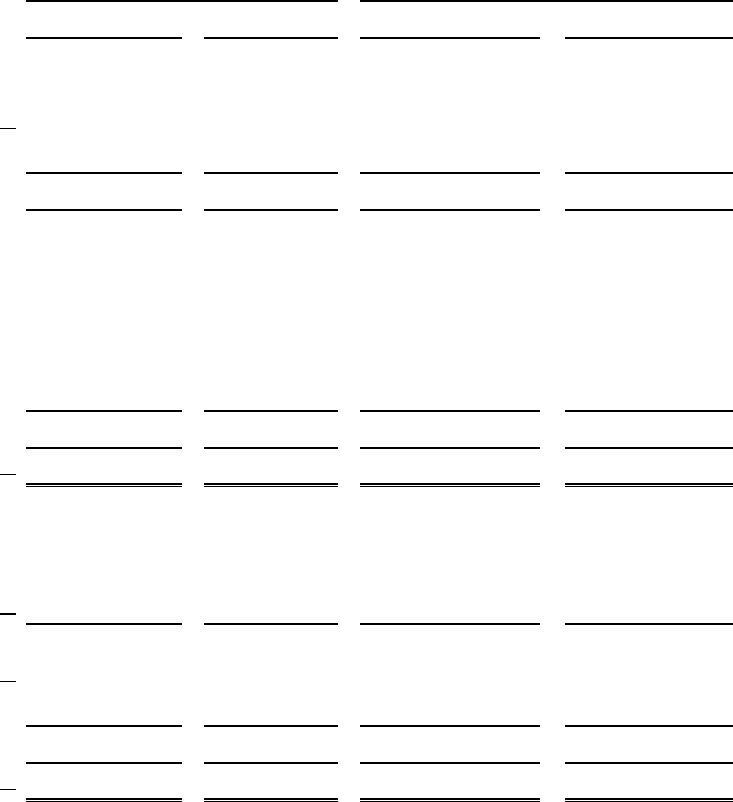

SAMSUNGSDICO.,LTD.ANDSUBSIDIARIES

ConsolidatedStatementsofFinancialPosition

AsofDecember31,2023and2022

5

(Inthousandsofwon) Note 2023 2022

Assets

Cashandcashequivalents 5,7 W

1,524,461,361 2,614,271,850

Tradeandotherreceivables,net 5,8,32 3,402,869,055 2,933,814,799

Inventories,net 9 3,297,368,930 3,204,515,835

Otherinvestments 5,10 602,098,501 534,662,104

Othercurrentassets 11 353,200,052 335,800,401

Currentderivativeassets 5,20 7,031,294 28,637,386

Currentassets

9,187,029,193 9,651,702,375

Long‐termtradeandotherreceivables,net 5,8,32 33,739,219 6,879,322

Investmentsinassociatesandjointventure 12 9,996,233,433 8,940,282,255

Property,plantandequipment,net 6,13,31 11,893,348,077 8,965,469,799

Intangibleassets,net 6,14 858,929,747 814,931,163

Investmentproperty 6,15 147,320,486 147,558,866

Deferredtaxassets 29 211,071,364 168,913,514

Othernon‐current

invest ments,includingderivatives 5,10,20 1,364,181,993 1,245,883,337

Othernon‐currentassets 11 93,180,479 137,715,011

Non‐currentderivativeassets 5,20 ‐ 6,070,438

Employeebenefitassets 19 253,826,202 172,119,091

Non‐currentassets

24,851,831,000 20,605,822,796

Totalassets W 34,038,860,193 30,257,525,171

Liabilities

Tradeandotherpayables 5,16,31,32 W

4,538,845,024 4,285,754,046

Incometaxpayable 29 101,894,653 229,613,881

Advancereceived 6

607,331,856 230,132,847

Unearnedrevenue 6

18,823,553 78,688,354

Short‐termborrowings 5,17,34 2,868,274,952 2,851,183,214

Derivativeliabilities 5,20 ‐ 57,510

Provisions 18,20 383,763,099 331,508,976

Currentliabilities

8,518,933,137 8,006,938,828

Non‐currenttradeandotherpayables 4,16,31,32 541,922,917 697,531,225

Long‐termadvancereceived 6 61,184,782 50,623,505

Long‐termborrowings 5,17,34 2,849,524,920 2,297,040,000

Netemployeebenefitliabilities 19 2,276,047 2,005,410

Non‐currentderivativeliabilities 5,20 ‐ 82,319

Long‐termprovisions 18,20 93,140,664 91,878,306

Deferredtaxliabilities 29 2,064,627,748 1,893,923,422

Non‐currentliabilities

5,612,677,078 5,033,084,187

Totalliabilities

W

14,131,610,215 13,040,023,015

Equity

Sharecapital 1,21 W

356,712,130 356,712,130

Sharepremium 21 5,001,974,693 5,001,974,693

Othercomponentsofequity 22 (345,131,584) (345,131,584)

Accumulatedothercomprehensiveincome 23,29 1,162,152,893 1,003,816,893

Retainedearnings 24 12,335,665,246 10,468,351,381

EquityattributabletoownersoftheParentCompany 18,511,373,378 16,485,723,513

Non‐controllinginterests 33

1,395,876,600 731,778,643

Totalequity

19,907,249,978 17,217,502,156

Seeaccompanyingnotestotheconsolidatedfinancialstatements.

SAMSUNGSDICO.,LTD.ANDSUBSIDIARIES

ConsolidatedStatementsofComprehensiveIncome

FortheyearsendedDecember31,2023and2022

6

(Inthousandsofwon,exceptpershareinformation) Note

20232022

Revenue 6,32 W 22,708,300,498 20,124,069,516

Costofsales 9,19,26,32 (18,726,384,091) (15,903,322,834)

Grossprofit

3,981,916,407 4,220,746,682

Selling,generalandadministrativeexpenses 14,19,25,26,32

(2,348,547,442) (2,412,733,669)

Operatingprofit 6

1,633,368,965 1,808,013,013

Othernon‐operatingincome 27,32

76,645,597 62,998,019

Othernon‐operatingexpenses 27,32

(50,310,957) (206,316,946)

Financeincome 28

1,055,087,475 1,390,645,973

Financecosts 28

(1,245,885,498) (1,442,761,340)

Shareofincomeofassociatesandjointventure 12

1,017,238,435 1,039,696,670

Profitbeforeincometax

2,486,144,017 2,652,275,389

Incometa xex pense 29

(420,097,455) (612,913,941)

Profitfortheyear 24,30

2,066,046,562 2,039,361,448

Othercomprehensiveincome

Itemsthatwillnotbereclassifiedtoprofitorloss:

Remeasurementofnetdefinedbenefitliabilities 19,24,29

(99,099,458) 87,645,869

Gain(loss)onvaluationoffinancialassetsatFVOCI 10

88,659,820 (166,678,917)

Relatedtax 29

15,507,203 (3,040,696)

Itemsthatareormaybereclassifiedtoprofitorloss:

Gainonvaluationofderivativesinstrumentsforcashflowhedge 20

(23,111,866) (67,984,703)

Changeinequityofequity‐methodaccountedinvestees 12

(16,687,756) (9,615,209)

Foreignoperations–foreigncurrencytranslationdifferences

90,240,991 17,859,070

Relatedtax 29

10,507,100 1,937,146

Othercomprehensiveincomefortheyear ,netoftax

66,016,034 (139,877,440)

Totalcomprehensiveincomefortheyear W 2,132,062,596 1,899,484,008

Profitattribut ableto:

OwnersoftheParentCompany 30 W

2,009,207,126 1,952,148,536

Non‐controllinginterests 33

56,839,436 87,212,912

Totalcomprehensiveincomeattributableto:

OwnersoftheParentCompany

2,094,600,653 1,848,403,992

Non‐controllinginterests 33

37,461,943 51,080,016

Earningspershare 30

Basicearningspershare‐Ordinaryshare W

30,044 29,191

Basicearningspershare‐Preferredshare

30,094 29,241

Seeaccompanyingnotestotheconsolidatedfinancialstatements

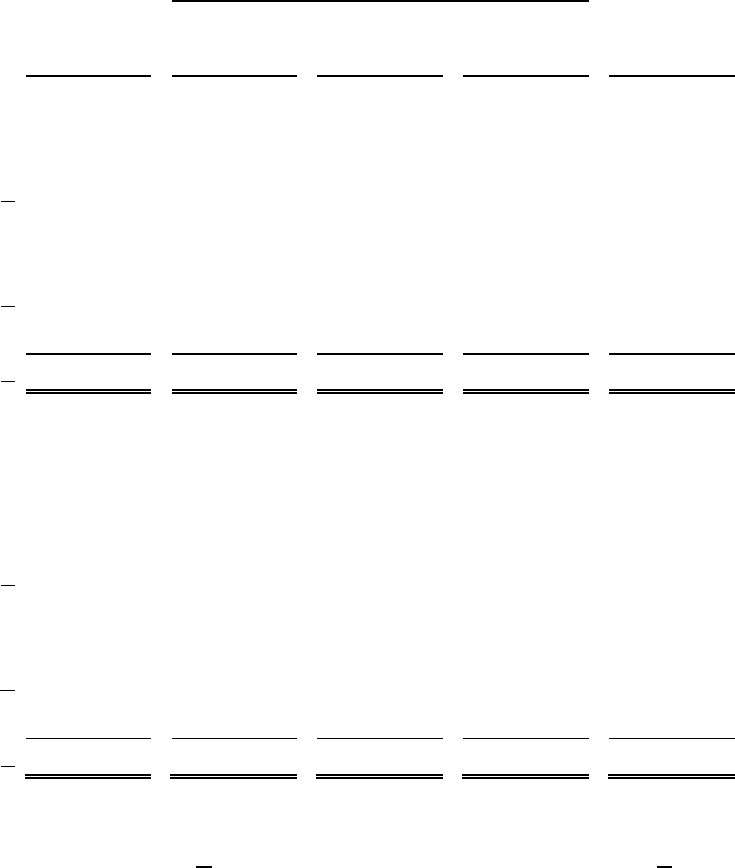

SAMSUNGSDICO.,LTD.ANDSUBSIDIARIES

ConsolidatedStatementsofChangesinEquity

FortheyearsendedDecember31,2023and2022

7

(Inthousandsofwon)

Sharecapital

Capitalsurplus

Othercapital

Accumulated

other

comprehensive

income

Retainedearnings

Non‐controlling

interests

Totalequity

BalanceatJanuary1,2022 W 356,712,130 5,001,974,693 (345,131,584) 1,174,235,558 8,516,473,334 492,435,184 15,196,699,315

Comprehensiveincome

Profitfortheyear

‐ ‐ ‐ ‐ 1,952,148,536 87,212,912 2,039,361,448

Remeasurementsofthedefinedbenefit

plan ‐ ‐ ‐ ‐ 66,674,121 ‐ 66,674,121

Gainonvaluationofderivatives

instrumentsforcashflowhedge ‐ ‐ ‐ (52,195,555) ‐ ‐ (52,195,555)

Changesinfairvaluesoffinancialassetsat

FVOCI ‐ ‐ ‐ (148,747,865) ‐ ‐ (148,747,865)

Changein

equityofequity‐accounted

investees ‐ ‐ ‐ (23,467,212) ‐ ‐ (23,467,212)

Foreignoperations–foreigncurrency

translationdifferences ‐ ‐ ‐ 53,991,967 ‐ (36,132,896) 17,859,071

Totalcomprehensiveincome ‐ ‐ ‐ (170,418,665) 2,018,822,657 51,080,016 1,899,484,008

Transactionswithshareholders

directlyrecognizedinequity

Dividendstoownersofthecompany ‐ ‐ ‐ ‐ (66,944,610) (2,553,941) (69,498,551)

Capital contribution from non‐controlling

interest

‐ ‐ ‐ ‐ ‐ 191,354,614 191,354,614

Capitalreductionofnon‐controlling

interest

‐ ‐ ‐ ‐ ‐ (537,230) (537,230)

BalanceatDecember31,2022 W

356,712,130 5,001,974,693 (345,131,584) 1,003,816,893 10,468,351,381 731,778,643 17,217,502,156

Seeaccompanyingnotestotheconsolidatedfinancialstatements.

SAMSUNGSDICO.,LTD.ANDSUBSIDIARIES

ConsolidatedStatementsofChangesinEquity

FortheyearsendedDecember31,2023and2022,Continued

8

(Inthousandsofwon)

Capitalstock

Capitalsurplus

Othercapital

Accumulated

other

comprehensive

income

Retainedearnings

Non‐controlling

interests

Totalequity

BalanceatJanuary1,2023 W 356,712,130 5,001,974,693 (345,131,584) 1,003,816,893 10,468,351,381 731,778,643 17,217,502,156

Comprehensiveincome

Profitfortheyear

‐ ‐ ‐ ‐ 2,009,207,126 56,839,436 2,066,046,562

Remeasurementsofthedefinedbenefit

plan ‐ ‐ ‐ ‐ (72,942,473) ‐ (72,942,473)

Gainonvaluationofderivatives

instrumentsforcashflowhedge ‐ ‐ ‐ (17,010,333) ‐ ‐ (17,010,333)

Changesinfairvaluesoffinancialassetsat

FVOCI ‐ ‐ ‐ 78,010,037 ‐ ‐ 78,010,037

Changein

equityofequity‐accounted

investees ‐ ‐ ‐ (12,282,188) ‐ ‐ (12,282,188)

Foreignoperations–foreigncurrency

translationdifferences ‐ ‐ ‐ 109,618,484 ‐ (19,377,493) 90,240,991

Totalcomprehensiveincome ‐ ‐ ‐ 158,336,000 1,936,264,654 37,461,943 2,132,062,596

Transactionswithshareholders

directlyrecognizedinequity

Dividendstoownersofthecompany ‐ ‐ ‐ ‐ (68,950,789) (2,605,626) (71,556,415)

Capital contribution from non‐controlling

interest

‐ ‐ ‐ ‐ ‐ 629,241,640 629,241,640

BalanceatDecember31,2023 W 356,712,130 5,001,974,693 (345,131,584) 1,162,152,893 12,335,665,246 1,395,876,599 19,907,249,977

Seeaccompanyingnotestotheconsolidatedfinancialstatement.

SAMSUNGSDICO.,LTD.ANDSUBSIDIARIES

ConsolidatedStatementsofCashFlows

FortheyearsendedDecember31,2023and2022

9

(Inthousandsofwon) Note 20232022

Cashflowsfromoperatingactivities

ProfitfortheyearW

2,066,046,562 2,039,361,448

Adjustmentsforexpense(benefit) 34 1,497,883,704 1,415,752,593

Changesinassetsandliabilities 34 (938,384,206) (500,717,670)

Interestreceived80,023,127 34,121,360

Interestpaid(221,312,632) (81,139,252)

Dividendsreceived17,095,214 12,250,892

Incometa xespaid(397,830,255) (278,533,207)

Netcashprovidedbyoperatingactivities 2,103,521,514 2,641,096,164

Cashflowsfrominvestingactivities

Decreaseinotherinvestments2,889,653,378 223,573,857

Proceedsfromdisposalofproperty,plantandequipment11,714,680 20,379,233

Proceedsfromdisposalofintangibleassets‐1,122,015

Disposalofsubsidiariesandaffiliates2,000,000 19,709,386

Increaseingovernmentgrants99,099,063 52,827,228

Acquisitionofotherinvestments(3,003,927,026) (408,355,803)

Acquisitionofproperty,plantandequipment(4,048,246,716) (2,808,898,170)

Acquisitionofintangibleassets(12,458,762) (4,583,865)

Acquisitionofsubsidiariesandaffiliates(42,680,000) (42,010,000)

Netcashusedininvestingactivities (4,104,845,383) (2,946,236,119)

Cashflowsfromfinancingactivities

Proceedsfromshort‐termborrowings4,049,049,429 1,239,602,699

Proceedsfromlong‐termborrowings1,005,861,108 807,737,420

Capitalcontributionfromnon‐controllinginterest629,241,640 191,354,614

Dividendspaid(71,550,149) (69,498,551)

Repaymentofdebentures(220,000,000) ‐

Repaymentofshort‐termborrowings(3,990,031,780) (1,508,607,082)

Repaymentoflong‐termborrowings(463,850,373) (1,296,152)

Capitalreductionfromnon‐controllinginterest‐

(29,750)

Repaymentofleaseliabilities(36,058,841) (30,563,962)

Netcashprovidedbyfinancingactivities 902,661,034 628,699,236

Netincreaseincashandcashequivalents (1,098,662,835) 323,559,281

CashandcashequivalentsatJanuary12,614,271,850 2,325,692,348

Effectoffluctuationsinexchangerateoncashheld8,852,346 (34,979,779)

CashandcashequivalentsatDecember31 W

1,524,461,361 2,614,271,850

Seeaccompanyingnotestotheconsolidatedfinancialstatements.

SAMSUNGSDICO.,LTD.ANDSUBSIDIARIES

NotestotheConsolidatedFinancialStatements

FortheyearsendedDecember31,2023and2022

10

1. ReportingEntity

SamsungSDICo.,Ltd.(the“ParentCompany”orthe“Company”)wasincorporatedonJanuary20,1970underthe

laws of the Republic of Korea with paid‐in capital of ₩200 million, and its head office is

located in Gi‐heung,

Gyeong‐giDo.

TheconsolidatedfinancialstatementscomprisetheCompany,itssubsidiaries(togetherreferredtoasthe“Group”

andindividuallyas“Groupentities”)andtheGroup’sinterestsinassociates.In1979,theParentCompanywaslisted

on the Koreanstock exchange market, and its shares arelisted

asdepositary receiptson the LuxembourgStock

Exchange.

ThemajorbusinesssegmentsandlocationsofdomesticproductionfacilitiesoftheParentCompanyareasfollows.

Business

Majorproductlines

DomesticLocations

Energysolutions

Automotivebattery,

ESS(EnergyStorageSystem),

Small‐sizedli‐ionbattery

Ulsan,Cheon‐an

ElectronicmaterialsSemi‐conductoranddisplaymaterialsCheong‐ju,Gumi

Inadditiontotheselocalbusinesslocations,theParentCompanyalsohas20subsidiariesoperatingintheUnited

States,China,Germany,Hungary,andsoon.

UnderitsArticlesof Incorporation,theParentCompany isauthorizedtoissue200,000thousand shares

withpar

valueof ₩5,000.Asof December31,2023,70,382,426shares ofstock (including 1,617,896sharesof preferred

stock) have been issued and are outstanding, and the Parent Company’s paid‐in‐capital amounts to ₩356,712

million.ThelargestshareholderoftheParentCompanyisSamsungElectronicsCo.,Ltd.(ownership

:19.13%).The

ParentCompanyisallowedtoretireitsstocksthroughaboardresolutionwithinitsprofitavailablefordividendsto

its shareholders. Pursuant to the resolution made by the board of directors on October 18, 2004, the Parent

Companyretired 930,000sharesofordinarystockand30,000sharesof

preferredstock,which were acquired at

₩99,333 million on December 8, 2004 by appropriating retained earnings. The par value of outstanding shares

is₩351,912million (₩343,823 millionfor common stockand₩8,089 million for preferred stock,excluding the

retiredshares)anditdiffersfromtheGroup’spaid‐in

‐capitalduetotheshareretirement.

Under itsArticlesof Incorporation, the Parent Company isauthorized to issue30,000 thousandshares of non‐voting

preferredstock.HoldersofpreferredsharesissuedbeforeFebruary28,1997areentitledtoreceivingadditional dividends

of1%ofitsparvaluepe rannum.As

ofDecember31,20231,617,896sharesofno n‐cumulativeandnon‐votingpreferred

stocksare eligiblefortheseadditionaldivide nds.

SAMSUNGSDICO.,LTD.ANDSUBSIDIARIES

NotestotheConsolidatedFinancialStatements

FortheyearsendedDecember31,2023and2022

11

2. BasisofPreparation

The consolidated financial statements have been prepared in accordance with Korean International Financial

ReportingStandards(“K‐IFRS”),asprescribedintheActonExternalAuditsofCorporationsintheRepublicofKorea.

Theconsolidatedfinancialstatements

wereauthorizedforissuebytheBoardofDirectorsonJanuary30,2024and

willbesubmittedforapprovaltogeneralshareholdersmeetingtobeheldonMarch20,2024.

(1) Basis of measurement

Theconsolidatedfinancialstatementshavebeenpreparedonahistoricalcostbasis,exceptforthefollowing:

‐ Financial instrumentsmeasuredatfairvalue.

‐ Liabilitiesfordefinedbenefitplansrecognizedatthenetofthetotalpresentvalueofdefinedbenefitobligationsless

thefai rvalue

ofplanassets.

(2) Functional and presenta tion currency

TheseconsolidatedfinancialstatementsarepresentedinKoreanwon,whichistheParentCompany’sfunctional

currencyandthecurrencyoftheprimaryeconomicenvironmentinwhichtheGroupoperates.

(3) Use of estimates and judgments

Thepreparationoftheconsolidatedfinancial

statementsinconformitywithK‐IFRSrequiresmanagementtouse

estimatesandassumptionsthataffecttheapplicationofaccountingpoliciesandthereportedamountsofassets,

liabilities,income,andexpensesbasedonthemanagement’sbestjudgment.Actualresultsmaydifferfromthese

estimates.

Estimates and underlying assumptions are reviewed on

an ongoing basis. Change in accounting estimates is

recognizedduringtheperiodinwhichthechangeismadeandduringanyfutureperiodsitmayaffect.

Informationaboutcriticaljudgmentsinapplyingaccountingpoliciesthathavethemostsignificanteffectonthe

amountsrecognizedintheconsolidatedfinancialstatementsisincluded

inthefollowingnotes:

‐Note4:Consolidation:whethertheGrouphasde factocontroloveraninvestee;

‐Note12:Investmentsinasso ciates:whethertheGrouphassignificantinfluenceoveraninvestee;and

‐Note31:Leaseterm :whethertheGroupisreasonablycertain toexerciseextensionoptions

Information about

uncertainties of assumptions and estimation that have a significant risk of resulting in a

materialadjustmentwithinthenextfinancialyearisincludedinthefollowingnotes:

‐Note9:InventoryAllowanceforvaluation‐Keyassumptionsofnetrealizablevaluemeasurement

‐Note14:IntangibleAssets‐key assumptions underlyingre coverableamounts

‐Note18:Provi sions‐keyassumptionsaboutlikelihoodandmagni tudeofanoutflowofresources;and

‐Note19:measurementofdefinedbenefitobligations:keyactuarialassumpti ons

SAMSUNGSDICO.,LTD.ANDSUBSIDIARIES

NotestotheConsolidatedFinancialStatements

FortheyearsendedDecember31,2023and2022

12

2. BasisofPreparation,Continued

(4) Fair value measurement

Group’saccountingpoliciesanddisclosuresrequirethemeasurementoffairvalues,forbothfinancialandnon‐

financialassetsandliabilities.TheGrouphasanestablishedcontrolframeworkwithrespectto

themeasurement

offairvalues.Thisincludesavaluationteamthathasoverallresponsibilityforoverseeingallsignificantfairvalue

measurements,includingLevel3fairvalues,andtheresultsarereporteddirectlytotheCFO.

The valuationteam regularly reviews significant unobservableinputs andvaluation adjustments.If thirdparty

information,

such asbrokerquotesor pricingservices,isusedtomeasurefairvalues,thenthevaluationteam

measurestheevidenceobtainedfromthethirdpartiestosupporttheconclusionthatsuchvaluationsmeetthe

requirementsofK‐IFRS,includingthelevelinthefairvaluehierarchyinwhichsuchvaluationsshould

beclassified.

SignificantvaluationissuesarereportedtotheGroup’sAuditCommittee.

Whenmeasuringthefairvalueofanassetoraliability,theGroupusesmarketobservabledataasfaraspossible.

Fairvaluesarecategorizedintodifferentlevelsinthefairvaluehierarchybasedontheinputsused

inthevaluation

techniquesasfollows.

‐ Level1:quotedprices(u nadj uste d)inaccessibleactivemarketsforidenticalassetsor liabilities

‐ Level2:inputsotherthanquotedpricesincludedinLevel1thatareobservablefo rtheassetorliability,

eitherdirectly(i.e. asprices)orindirectly(i. e.derivedfrom

price)

‐ Level3:inputsfortheassetorliabilitythatarenotbasedonobservablemarketdata(unobservableinputs)

Iftheinputsusedtomeasurethefairvalueofanassetoraliabilitymightbecategorizedindifferentlevelsofthe

fairvaluehierarchy,thenthe fair value

measurementiscategorizedinitsentiretyinthesamelevelofthefair

value hierarchy as the lowestlevel input that is significant to the entire measurement. The Group recognized

transfersbetweenlevelsofthefairvaluehierarchyattheendofthereportingperiodduringwhichthechange

hasoccurred.

Furtherinformationabouttheassumptionsmadeinmeasuringfairvaluesisincludedinfollowingnote:

‐ Note5:Fina ncial RiskManagement

SAMSUNGSDICO.,LTD.ANDSUBSIDIARIES

NotestotheConsolidatedFinancialStatements

FortheyearsendedDecember31,2023and2022

13

3. ChangesinAccountingPolicies

(1) GlobalMinimumTax

TheGroupappliedtheamendmentstotheInternationalTaxReform‐Pillar2ModelRules(CorporateTax,K‐IFRSNo.

1012)fromJanuary1,2023.Theseamendmentsincludeamandatoryruletemporarily

ex emptingdeferredincome

taxaccountingtreatmentfortheGlobalMinimumTax.Italsorequiresadditionaldisclosureofexposureinformation

relatedtoPillar2 CorporateTax.TheimpactoftheseamendmentsontheGroupisexplainedinNote29.

(2) Materialaccountingpoliciesinformation

Thegroupappliedtheamendmentsto

disclosuresofaccountingpolicies(K‐IFRSNo.1001,'Presentationoffinancial

statements') from January 1, 2023. These amendments do not result in a change to the accounting policies

themselvesbutimpacttheaccountingpolicyinformationdisclosedintheseconsolidatedfinancialstatements.The

amendmentsrequirethedisclosureof'material'accountingpoliciesratherthan

'significant ' accountingpolicies.

Also, by providing guidelines for applying materiality to accounting policy disclosures, it enables users of the

consolidatedfinancialstatementstounderstandcompany‐specificaccountingpolicyinformation.Themanagement

of the Group has reviewed the accounting policies and updated material accounting policy(previous year:

significantaccountingpolicies)informationdisclosed

inNote4inaccordancewiththeseamendments.

SAMSUNGSDICO.,LTD.ANDSUBSIDIARIES

NotestotheConsolidatedFinancialStatements

FortheyearsendedDecember31,2023and2022

14

4. MaterialAccountingPolicies

MaterialaccountingpoliciesappliedbytheGroupinpreparingitsconsolidatedfinancialstatementsinaccordance

with K‐IFRS are described below. The Group has consistently applied the following accounting policies to all

periods presented in these consolidated financial statements except for the changes in accounting policies

explainedinNote3.

The group applied the amendments to disclosures of accounting policies(K‐IFRS No. 1001, 'Presentation of

financialstatements')fromJanuary1,2023.Theseamendmentsrequirethedisclosureof'material'accounting

policies, not 'significant' accounting policies. These amendments do not result in a change to the accounting

policies themselves but impact the accounting

policy information disclosed in these consolidated financial

statements.

(1)Basisofconsolidation

1)Subsidiaries

If a member of the Group uses accounting policies other than those adopted in the consolidated financial

statements for like transactions and eventsin similar circumstances, appropriate adjustments are made to its

financialstatementsinpreparing

theconsolidatedfinancialstatements.

Non‐controlling interests (“NCI”) are measured at their proportionate share of the acquiree’s identifiable net

assetsattheacquisitiondate.

SAMSUNGSDICO.,LTD.ANDSUBSIDIARIES

NotestotheConsolidatedFinancialStatements

FortheyearsendedDecember31,2023and2022

15

4. MaterialAccountingPolicies,Continued

(1)Consolidation,continued

1) Subsidiaries,continued

(i) The list of subsidiaries as of December31, 2023and2022 are as follows: All subsidiaries’ fiscal year end is

December31.

Percentageof

ownership(*1)

Subsidiaries

Location

Primarybusiness

2023

2022

SamsungSDIJapanCo.,Ltd.("SDIJ")JapanSupportingsalesandpurchaseinJapan 100.0% 100.0%

SamsungSDIAmerica,Inc.("SDIA")U.S.A.Manufacturingautomotivebatteries

Supportingsalesofautomotiveand

ESSbatteries

Marketresearchofsmall‐sized

rechargeablebattery

91.7% 91.7%

StarPlusEnergyLLC.("STARPLUS")U.S.A.Manufacturingandsalesofautomotive

battery

51.0% 51.0%

SamsungSDIHungaryZrt.("SDIHU")HungaryManufacturingandsalesofautomotive

battery

100.0% 100.0%

SamsungSDI

EuropeGmbH("SDIEU")GermanySupportingsalesandpurchasein

Europe

100.0% 100.0%

SamsungSDIBatterySystemsGmbH("SDIBS")AustriaManufacturingandsalesofautomotive

battery

100.0% 100.0%

SamsungSDIVietnamCo.,Ltd.("SDIV")VietnamManufacturingandsalesof

rechargeablebattery

100.0% 100.0%

SamsungSDIEnergyMalaysiaSdn,Bhd.("SDIEM") MalaysiaManufacturingandsales

of

rechargeablebattery

100.0% 100.0%

SamsungSDIIndiaPvt.("SDII")IndiaManufacturingandsalesof

rechargeablebattery

100.0% 100.0%

SamsungSDI(HongKong)Ltd.("SDIHK") HongKongSupportingsalesofrechargeable

battery

97.6% 97.6%

SubsidiaryofSDIHK

TianjinSamsungSDICo.,Ltd.("TSDI")ChinaManufacturingandsalesof

rechargeablebattery

78.0% 78.0%

SamsungSDIChina

Co.,Ltd.("SDIC")ChinaSupportingsalesandpurchaseinChina 100.0% 100.0%

Samsung SDI‐ARN (Xi'An) Power Battery Co., Ltd.

("SAPB")

ChinaManufacturingandsalesofautomotive

battery

65.0% 65.0%

SamsungSDI(Tianjin)BatteryCo.,Ltd.("SDITB”)

ChinaManufacturingandsalesof

rechargeablebattery

80.0% 80.0%

STMCo.,Ltd.("STM")KoreaManufacturingand

salesofcathode

activematerialforrechargeable

battery

100.0% 100.0%

SamsungSDIWuxiCo.,Ltd.("SDIW")ChinaManufacturingandsalesofelectronic

materialsproducts

100.0% 100.0%

NovaledGmbH("NOVALED")GermanyManufacturingandsalesofelectronic

materialsproducts

50.1% 50.1%

SVIC15Fund("SVIC15")KoreaInvestmentsinnewtechnology

venturebusiness

99.0% 99.0%

SVIC24

Fund("SVIC24")KoreaInvestmentsinnewtechnology

venturebusiness

99.0% 99.0%

SVIC49Fund("SVIC49")KoreaInvestmentsinnewtechnology

venturebusiness

99.0% 99.0%

(*1) Effective ownership interest has been measured based on ownership of the Parent Company and its

subsidiariesconsideringthecontrolstructure.Theownershipinterestsofsubsidiariesthatdonotissuesharesin

accordancewiththerelevantlocallawsandregulationsarecalculatedbasedontheinvestmentamounts.

SAMSUNGSDICO.,LTD.ANDSUBSIDIARIES

NotestotheConsolidatedFinancialStatements

FortheyearsendedDecember31,2023and2022

16

4.MaterialAccountingPolicies,Continued

(1)Consolidation,continued

1) Subsidiaries,continued

(ii) Summarized financial information of subsidiaries as of and for the year ended December 31, 2023 are as

follows:

(

Inthousandso

f

won

)

Subsidiaries AssetsLiabilitiesEquityRevenue

Netprofit

(loss)

STM660,539,765

220,117,123

440,422,642

1,433,095,355

57,159,562

SVIC24 18,593,282

12,331,492

6,261,790

‐

(292,448)

SVIC15 22,824,631

3,212

22,821,419

‐

(552,453)

SVIC49 54,561,776

255,267

54,306,509

‐

3,802,029

SDIJ 6,906,796

2,233,363

4,673,433

10,623,368

476,389

SDIA 400,102,600

303,333,653

96,768,947

1,411,465,746

32,013,670

STARPLUS 1,798,731,227

182,982,358

1,615,748,869

‐

(30,189,536)

NOVALED 735,813,983

7,491,964

728,322,019

113,746,672

45,066,855

SDIHU 7,837,660,949

6,222,472,369

1,615,188,580

8,554,123,495

190,136,045

SDIEU 30,013,685

13,003,476

17,010,209

54,939,720

6,237,042

SDIBS 318,100,290

156,984,856

161,115,434

252,937,573

23,849,693

SDIV 326,970,230

107,379,059

219,591,171

1,013,875,685

31,654,814

SDIEM 1,874,176,164

1,320,494,881

553,681,283

1,520,447,108

41,896,127

SDII

21,265,151

7,508,008

13,757,143

5,745,964

3,820,094

SDIW 601,642,075

160,965,459

440,676,616

1,018,279,160

30,840,966

TSDI 672,728,883

290,457,389

382,271,494

543,405,719

14,005,315

SDIHK 843,025,347

140,855,031

702,170,316

1,741,993

37,883,135

SDIC 19,363,561

6,364,036

12,999,525

27,455,973

3,728,866

SAPB 816,895,510

278,682,396

538,213,114

1,176,833,427

82,621,180

SDITB

1,207,356,995

691,018,488

516,338,507

2,122,676,565

57,194,803

2)Transactionseliminatedonconsolidation

Intra‐groupbalances,includingincomeandexpensesandanyunrealizedincomeandexpensesarisingfromintra‐

grouptransactions,areeliminated.Meanwhile,unrealizedgainsarisingfromtransactionswithequity‐accounted

investeesareeliminatedagainsttheinvestmenttotheextentoftheGroup’sinterestintheinvestee.

Unrealized

losses are eliminatedin the same wayasunrealized gains,but only tothe extentthat thereis noevidenceof

impairment.

3)Businesscombinationundercommoncontrol

Combination of entities and business under common control recognizes the acquired assets and liabilities

obtained at book values of consolidated financial

statements of ultimate controlling company. The Group

recognizesthedifferencebetweenthenetbookvalueacquiredandconsiderationtransferredinsharepremium.

SAMSUNGSDICO.,LTD.ANDSUBSIDIARIES

NotestotheConsolidatedFinancialStatements

FortheyearsendedDecember31,2023and2022

17

4.MaterialAccountingPolicies,Continued

(2)Foreigncurrency

1)ForeigncurrencyTransactions

Exchangedifferencesarisingon thesettlementofmonetaryitemsorontranslatingmonetaryitems,exceptfor

translationdifferencesfromnetinvestmentinforeignoperationandfromfinancialliabilities

designatedtocash

flowhedges,arerecognizedinprofitorlossintheperiodinwhichtheyarise.Ifprofitorlossfromnon‐monetary

itemsis regarded asothercomprehensive income thenthe exchangerate change effects are treated as other

comprehensiveincome,whereregardedascurrentprofitor

lossthentreatedascurrentprofitorloss.

2)ForeignOperations

The assets and liabilities of foreign operations, whose functional currency is not the currency of a

hyperinflationaryeconomy,aretranslatedtopresentationcurrencyatexchangeratesatthereportingdate.The

incomeandexpensesofforeignoperationsaretranslatedto

functionalcurrencyatexchangeratesatthedates

ofthetransactions.Foreigncurrencydifferencesarerecognizedinothercomprehensiveincome.

(3)Cashandcashequivalents

TheGroupclassifiesinvestmentassetswithamaturityofwithin3monthsfromtheacquisitiondateascashand

cashequivalents.

(4)Financialinstruments

1)Recognitionandinitialmeasurement

Tradereceivablesanddebtsecuritiesissuedareinitiallyrecognizedwhentheyareoriginated.Allotherfinancial

assets and financial liabilities are initially recognized when the Group becomes a party to the contractual

provisionsoftheinstrument.

SAMSUNGSDICO.,LTD.ANDSUBSIDIARIES

NotestotheConsolidatedFinancialStatements

FortheyearsendedDecember31,2023and2022

18

4.MaterialAccountingPolicies,Continued

(4)Financialinstruments,continued

2) Subsequentmeasurement

Businessmodelassessment

TheGroupassessestheobjectiveofthebusinessmodelinwhichafinancialassetisheldataportfoliolevelthat

best reflects the way

the business is managed, and information is provided to management. The information

consideredincludes:

–

thestatedpoliciesandobjectivesfortheportfolioandtheoperationofthosepoliciesinpractice.Theseinclude

whethermanagement’sstrategyfocusesonearningcontractualinterestincome,maintainingaparticularinterest

rateprofile,matchingthe

durationofthefinancialassetstothedurationofanyrelatedliabilitiesorexpectedcash

outflowsorrealizingcashflowsthroughthesaleoftheassets;

–

howtheperformanceoftheportfolioisevaluatedandreportedtotheGroup’smanagement;

–

therisksthataffecttheperformanceofthebusiness

model(andthefinancialassetsheldwithinthatbusiness

model)andhowthoserisksaremanaged;

–

howmanagersofthebusinessarecompensated–e.g.whethercompensationisbasedonthefairvalueofthe

assetsmanagedorthecontractualcashflowscollected;and

–

thefrequency,volumeand

timingofsalesoffinancial assetsinpriorperiods,thereasonsforsuchsalesand

expectationsaboutfuturesalesactivity.

Transfers of financial assets to third parties in transactions that do not qualify for derecognition are not

consideredsalesforthispurpose,consistentwiththeGroup’scontinuingrecognitionoftheassets.

Financialassetsthatareheldfortradingoraremanagedandwhoseperformanceisevaluatedonafairvaluebasis

aremeasuredatFVTPL.

Assessmentwhethercontractualcashflowsaresolelypaymentsofprincipalandinterest

Inassessingwhetherthecontractualcash flowsaresolelypaymentsofprincipalandinterest,

theGroupconsiders

thecontractualtermsoftheinstrument.Thisincludesassessingwhetherthefinancialassetcontainsacontractual

termthatcouldchangethetimingoramountofcontractualcashflowssuchthatitwouldnotmeetthiscondition.

Inmakingthisassessment,theGroupconsiders:

–

contingenteventsthatwould

changetheamountortimingofcashflows;

–

termsthatmayadjustthecontractualcouponrate,includingvariable

‑

ratefeatures;

–

prepaymentandextensionfeatures;and

–

termsthatlimittheGroup’sclaimtocashflowsfromspecifiedassets(e.g.non

‑

recoursefeatures).

3)Derecognition

TheGroupderecognizes

afinancialassetwhenthecontractualrightstothecashflowsfromthefinancialasset

expire,orittransferstherightstoreceivethecontractualcashflowsinatransactioninwhichsubstantiallyallof

therisksandrewardsofownershipofthefinancialassetaretransferredorinwhichthe

Groupneithertransfers

norretainssubstantiallyalloftherisksandrewardsofownershipanditdoesnotretaincontrolofthefinancial

asset.

4)Offsetting

Financialassetsandfinancialliabilitiesareoffset,andthenetamountispresentedinthestatementoffinancial

positionwhen,andonlywhen,

theGroupcurrentlyhasalegallyenforceablerighttosetofftheamountsandit

intendseithertosettlethemonanetbasisortorealizetheassetandsettletheliabilitysimultaneously.

SAMSUNGSDICO.,LTD.ANDSUBSIDIARIES

NotestotheConsolidatedFinancialStatements

FortheyearsendedDecember31,2023and2022

19

4.MaterialAccountingPolicies,Continued

(5)Non‐derivativefinancialliabilities

TheGroup classifies financial liabilities into FVTPL or other financial liabilities based on the substance of the

contractualtermsandthedefinitionoffinancialliabilities.Recognitionontheconsolidated

statementoffinancial

positionoccurswhentheGroupbecomesapartytothecontract.

(6)Derivatives

Derivativefinancialinstrumentsandhedgeaccounting

Accountingpoliciesrelatedtoderivativefinancialinstrumentsandhedgeaccounting,aswellasinformationon

riskmanagementactivitiesareincludedinNote20.

(7)Property,plantand

equipment

Property,plant and equipment, exceptfor land, are depreciatedon astraight‐line basisoverestimated useful

lives that appropriately reflect the pattern in which the asset’s future economic benefits are expected to be

consumed.

TheestimatedusefullivesoftheGroup’sproperty,plantandequipmentareasfollows:

Usefullives(years)

Buildings 10~60

Structures 10~40

Machineries 5~10

Vehicles 4~5

Tools,furniture,andfixtures 1~5

Subsequentcostsarerecognizedinthecarryingamountofproperty,plantandequipmentifitisprobablethat

futureeconomicbenefitsassociatedwiththeitemwillflowtotheGroup.

(8)

Intangibleasset

Intangible assets are measured initially at cost and, subsequently, are carried at cost less accumulated

amortizationandaccumulatedimpairmentlosses.

Amortization of intangible assets except for goodwill is calculated on a straight‐line basis over the estimated

useful lives of intangible assets from the datethat they are

available foruse. The residual value of intangible

assetsiszero.

Theestimatedusefullivesofthegroup’sassetsareasfollows:

Usefullives(years)

Industrialpropertyrights 5~10

Othersintangibleassets 4~20

(9)Investmentproperty

Investmentpropertyismeasuredinitiallyatitscostandtransactioncostsareincludedintheinitialmeasurement.

Subsequently,investmentpropertyiscarriedatdepreciatedcostlessanyaccumulatedimpairmentlosses.

Investment property, exceptfor land, aredepreciated on a straight‐line basis

over estimated useful lives that

appropriatelyreflectthepatterninwhichtheasset’sfutureeconomicbenefitsareexpectedtobeconsumed.

SAMSUNGSDICO.,LTD.ANDSUBSIDIARIES

NotestotheConsolidatedFinancialStatements

FortheyearsendedDecember31,2023and2022

20

4.MaterialAccountingPolicies,Continued

(10)Inventories

The cost of inventories is based on specific method for materials in transit, moving average method for raw

materials and sub‐materials and gross average method (monthly moving average method) for all

the other

inventories,and includes expendituresforacquiring theinventories, productionorconversion costs and other

costsincurredinbringingthemtotheirexistinglocationandcondition.Inthecaseofmanufacturedinventories

andwork inprogress, costincludesan appropriateshare of productionoverheadsbasedon normal operating

capacity.

(11)Impairment

1)Impairmentoffinancialassets

TheGrouprecognizeslossallowancesforECLson:

–

financialassetsmeasuredatamortizedcost;

The Group measuresloss allowancesat an amountequal to lifetime ECLs, except forthe following, which are

measuredat12

‑

monthECLs:

–

debtsecuritiesthatare

determinedtohavelowcreditriskatthereportingdate;and

–

otherdebtsecuritiesandbankbalancesforwhichcreditrisk(i.e.theriskofdefaultoccurringovertheexpected

lifeofthefinancialinstrument)hasnotincreasedsignificantlysinceinitialrecognition.

Lossallowancesfortradereceivables and contractassets

arealways measured at an amountequaltolifetime

ECLs.

SAMSUNGSDICO.,LTD.ANDSUBSIDIARIES

NotestotheConsolidatedFinancialStatements

FortheyearsendedDecember31,2023and2022

21

4.MaterialAccountingPolicies,Continued

(11)Impairment,continued

1)Impairmentoffinancialassets,continued

TheGroupassumesthatthecreditriskonafinancialassethasincreasedsignificantlyifitismorethan30days

pastdue.

TheGroup

considersafinancialassettobeindefaultwhen:

–

theborrower is unlikely to payits credit obligations to the Groupin full, without recourse bythe Group to

actionssuchasrealizingsecurity(ifanyisheld);or

–

thefinancialassetismorethan90dayspast

due.

① Credit‐impairedfinancialassets

Ateachreportingdate,theGroupassesseswhetherfinancialassetscarriedatamortizedcostanddebtsecurities

at FVOCI are credit

‑

impaired. A financial asset is ‘credit

‑

impaired’ when one or more events that have a

detrimentalimpactontheestimatedfuturecashflows

ofthefinancialassethaveoccurred.

Evidencethatafinancialassetiscredit

‑

impairedincludesthefollowingobservabledata:

– significantfinancialdifficultyoftheborrowerorissuer;

– abreachofcontractsuchasadefaultorbeingmorethan90dayspastdue;

– therestructuringofa

loanoradvancebytheGroupontermsthattheGroupwouldnotconsiderotherwise;

–

itisprobablethattheborrowerwillenterbankruptcyorotherfinancialrestructuring;or

– thedisappearanceofanactivemarketforasecuritybecauseoffinancialdifficulties.

② PresentationofallowanceforECL

inthestatementoffinancialposition

Lossallowancesforfinancialassetsmeasuredatamortizedcostaredeductedfromthegrosscarryingamountof

theassets.

FordebtsecuritiesatFVOCI,thelossallowanceischargedtoprofitorlossandisrecognizedinOCI.

③ Write‐off

Thegross

carryingamountofafinancialassetiswrittenoffwhentheGrouphasnoreasonableexpectationsof

recoveringafinancialassetinitsentiretyoraportionthereof.TheGroupexpectsnosignificantrecoveryfrom

the amount written off. However, financial assets that are written off could still be subject to

enforcement

activitiesinordertocomplywiththeGroup’sproceduresforrecoveryofamountsdue.

(12)Employeebenefits

1)Otherlong‐termemployeebenefits

Thepresentvalueoftheliabilityrelatedtootherlong‐termemployeebenefitsisdeterminedbydiscountingthe

expected future cash flows using the interest

rate of high‐quality corporate bonds that have maturity dates

approximatingthetermsoftheGroup’sobligationsandthataredenominatedinthesamecurrencyinwhichthe

benefitsareexpectedtobepaid.

SAMSUNGSDICO.,LTD.ANDSUBSIDIARIES

NotestotheConsolidatedFinancialStatements

FortheyearsendedDecember31,2023and2022

22

4.MaterialAccountingPolicies,Continued

(12)Employeebenefits, Continued

2)Definedbenefitplans

TheGroup’snetobligationis calculatedannuallybyanindependentactuaryusingtheprojectedunitcreditmethod.

(13)Provisions

The warranty provision (quality assurance) is

recognized when products or services are sold or provided. It is

estimatedbasedonpastincidencedata,calculatingallpossibleoutcomesandtheirassociatedprobabilities.

(14)Revenuefromcontractswithcustomers

ThemainprofitsoftheGrouparegeneratedbytheenergysolutionbusinesssector,whichsellssmallbatteries,

mediumandlargebatteries,andthe electronicmaterialsbusiness unit,which sells semiconductoranddisplay

materials.

TheGroup’saccountingpoliciesforrevenuestreamareasfollows:

Typeofproduct/

service

Nature,timingofsatisfactionofperformanceobligation,

significantpaymentterms

SalesofGoods

Controlistransferredatthe

timeproductisdeliveredtoandistakenoverbythecustomer.

Thegrouprecognizesrevenuewhencontrolistr ansferred,andinvoicesareissued.

UnderK‐IFRSNo.1115,revenueisrecognizedonlytotheextentthatitishighlyprobablethat

nosignificantreductionincumulativerevenuewilloccur.Sincecertain

customersareeligible

for price discounts such as sales incentives based on their purchase volume, revenue is

recognized as the amount reflecting those estimated price discounts in accordance with

contractterms.

Royalty

The Group provides customers with licenses, including patented technology, and receives

royaltiesmonthlyorquarterly,dependingonthevolumeofproduction(orsales)ofproducts

usingthetechnology.

Under K‐IFRS No.1115, royalty based on sales volume or production is recognized when

subsequentsalesorproductionactivitiesoccur.

Development

Service

The Group provides services for developing products that meet customer requirements.

Intangible outputs generated by such development services are identified as separate

performance obligations, and control is transferred to the customer at the time of final

approval of the customer. Therefore, costs associated revenue from the contract with

the

customerarerecognizedwhenthedeliverablespromisedtothecustomeraredelivered.

(15)Governmentgrants

GovernmentgrantswhichareintendedtocompensatetheGroupforexpensesincurredarerecognizedasother

income(governmentgrants)inprofitorlossovertheperiodsinwhichtheGrouprecognizestherelated

costsas

expenses. If the Group has receivedgovernment grants whose primary condition is that the Group purchase,

constructorotherwiseacquirelong‐termassets,theamountsaredeductedincalculatingthecarryingamountof

theasset.Thegrantisrecognizedinprofitorlossoverthelifeofadepreciable

assetasareductiontodepreciation

expense.

SAMSUNGSDICO.,LTD.ANDSUBSIDIARIES

NotestotheConsolidatedFinancialStatements

FortheyearsendedDecember31,2023and2022

23

4.MaterialAccountingPolicies,Continued

(16)Financeincomeandcosts

Financeincomecomprisesinterestincomeonfundsinvested(includingavailable‐for‐salefinancialassets),

TheGroup’sfinanceincomeandfinancecostsinclude:

–

interestincome;

–

interestexpense;

–

thenetgainorlossonfinancialassetsatFVTPL;

–

theforeigncurrencygainorlossonfinancialassetsandfinancialliabilities;

–

impairmentlosses(andreversals)oninvestmentsindebtsecuritiescarriedatamortizedcostorFVOCI;

–

thenetgainorlossonthedisposaloffinancialassets

measuredatamortizedcost;

–

hedgeineffectivenessrecognizedinprofitorloss;and

–

paymentguaranteefee;and

Interestincomeorexpenseisrecognizedusingtheeffectiveinterestmethod.

(17)Incometaxes

TheGlobalMinimumTaxpaidinaccordancewithPillar2rulesisthecorporatetaxsubjecttothe

application of

CorporateTax(K‐IFRSNo.1012).TheGroupappliestemporaryrelieffromdeferredtaxaccountingtreatmentdue

totheimpactoftheGlobalMinimumTax.TheGroupwillaccountforthecurrenttaxwhenthePillar2corporate

taxisincurred.

(18)Operatingsegment

TheGroupconsists

ofenergysolutionsegmentandelectronicmaterialssegment,eachbeingthestrategicsales

unitoftheGroup.Strategicsalesunitsareoperatedseparatelybecauseeachsegmentismanufacturingdifferent

productsrespectivelyandrequiresdifferenttechnologiesandmarketingstrategies.

The performance of the operating segment is assessed based on profit attributable to

owners of the Parent

Company of each segment, which is considered to be useful for the management to compare the Group’s

performanceinaspecificsegmentwithothercompaniesinthesameindustry.

SAMSUNGSDICO.,LTD.ANDSUBSIDIARIES

NotestotheConsolidatedFinancialStatements

FortheyearsendedDecember31,2023and2022

24

4.MaterialAccountingPolicies,Continued

(19)EmissionsRights

TheGroupaccountsforgreenhousegasesemissionrightandtherelevantliabilityasbelowpursuanttotheAct

onAllocationandTradingofGreenhouseGasEmission.

1)GreenhouseGasesEmission

Right

GreenhouseGasesEmissionRightconsistsofemissionallowanceswhichareallocatedfromthegovernmentfree

ofchargeorpurchasedfromthemarket.Freeallocationallowancesaremeasured and recognizedatzeroand

purchased emission permits are recognized at acquisition cost by adding other costs directly related to the

acquisition

andnormallyincurred.

Emissionrightsheldforthepurposeofperformingtheobligationisclassifiedasintangibleassetandisinitially

measuredatcostandafterinitialrecognition,arecarriedatcostlessaccumulatedimpairmentlosses.Partstobe

submittedtothegovernmentwithinoneyearfromtheendof

thereportingperiodareclassifiedascurrentassets.

Emissionrightsheldforshort‐swingprofitsareclassifiedascurrentassetandaremeasuredatfairvaluewithany

changesinfairvaluerecognizedasprofitorlossintherespectivereportingperiod.

TheGroupderecognizesanemissionrightassetwhen

theemissionallowanceisunusable,disposedorsubmitted

togovernmentinwhichthefutureeconomicbenefitsarenolongerexpectedtobeprobable.

2)Emissionliability

Emissionliabilitiesarepresentobligationstosubmitemissionpermitstothegovernmentandaremeasuredby

adding up the carrying amount of the

emission permits and the estimated expenditure required to meet the

obligationsforexcessemission.Emissionliabilitiesarederecognizedwhensubmittedtothegovernment.

(20)Lease

1)Asalessee

Atcommencementor on modificationof a contractthatcontains a leasecomponent,the Groupallocatesthe

considerationinthe

contracttoeachleasecomponentbasedonitsrelativestand‐aloneprices.However,forthe

leasesofpropertytheGrouphaselectednottoseparatenon‐leasecomponentsandaccountfortheleaseand

non‐leasecomponentsasasingleleasecomponent.

The lease liability is initially measured at the present

value of the lease payments that are not paid at the

commencement date, discounted usingthe interest rateimplicit inthe lease or, if that rate cannotbe readily

determined,theGroup'sincrementalborrowingrate.

TheGrouphaselectednottorecognizeright‐of‐useassetsandleaseliabilitiesfor

leasesoflow‐valueassetsand

short‐term leases. The Group recognize the lease payments associated with these leases as an expense on a

straight‐linebasisovertheleaseterm.TheGrouppresentsright‐of‐useassetsthatdonotmeetthedefinitionof

investmentpropertyin'property,plantand

equipment'andleaseliabilitiesintradeand otherpayables'inthe

statementoffinancialposition.

SAMSUNGSDICO.,LTD.ANDSUBSIDIARIES

NotestotheConsolidatedFinancialStatements

FortheyearsendedDecember31,2023and2022

25

4.MaterialAccountingPolicies,Continued

(20)Lease,Continued

2)Asalessor

Whenthe Groupacts asa lessor,it determinesat lease inception whether each leaseis afinance lease or an

operatinglease. To classifyeachlease,

theGroup makes an overallassessmentof whether theleasetransfers

substantiallyalltherisksandrewardsincidentaltoownershipoftheunderlyingasset.Aspartofthisassessment,

theGroupconsiderscertainindicatorssuchaswhethertheleaseisforthemajorpartoftheeconomiclifeofthe

asset.

(21)Newstandardsandinterpretationsnotyetadopted

ThefollowingnewstandardhasbeenpublishedbutisnotmandatoryfortheGroupforannualperiodbeginning

onJanuary1,2023,andtheGrouphasnotearlyadoptedthem:

‐K‐IFRS1001‘PresentationofFinancialStatements’‐Current/non‐currentclassification

ofliabilities.

ThefollowingnewandamendedstandardsarenotconsideredtohaveanysignificantimpactontheGroup:

‐Saleandleasebacktransactions(K‐IFRSNo.1116'Lease')

‐LackofExchangeability(K‐IFRSNo.1021'TheEffectsofChangesinForeignExchangeRates')

SAMSUNGSDICO.,LTD.ANDSUBSIDIARIES

NotestotheConsolidatedFinancialStatements

FortheyearsendedDecember31,2023and2022

26

5.FinancialRiskManagement

TheGrouphasexposuretothecreditrisk,liquidityriskandmarketrisk.Thisnotepresentsinformationaboutthe

Group’s exposure to each of the above risks, the Group’s objectives, policies, and pr ocesses for measuring and

managing risk, andthe Group’s management of capital. Furtherquantitativedisclosuresareincluded throughout

theseconsolidatedfinancialstatements.

(1)Creditrisk

CreditriskistheriskoffinanciallosstotheGroupifacustomerorcounterpartytoafinancialinstrumentfailsto

meet its contractual obligations. The Group’s exposure

to credit risk is influenced mainly by the individual

characteristics of each customer. Most customers have been transacting with the Group for many years and

impairmentlosshasnotoccurredveryoften.Inaddition,theGroupreviewscreditratingofnewcustomersprior

tothedeterminationofpaymenttermsandalso

re‐examinesthecreditratingofexistingcustomersonaregular

basis.

TheGroup setsallowances forestimated losses fromaccountsreceivable andfinancialassets.In addition, the

Group reports presentconditions andcountermeasures of delayed recovery for the financialassets andtakes

reasonablestepsdependingonthereasonsfor

delayinordertomanagethecreditrisk.Inaddition,theGroup

hedgescreditrisksbyenteringintoinsurancecontractsforsomefinancialassets.

1)Exposuretocreditrisk

Thecarryingamountoffinancialassetsrepresentsthemaximumcreditexposure.TheGrouplimitsitsexposure

tocredit risk bydepositing

cash and cash equivalentsinfinancial institutions thathave ahighcredit rate.The

maximumexposure to credit riskatthereportingdate as ofDecember31,2023and2022are summarized as

follows:

(Inthousandsofwon) 2023 2022

Cashandcashequivalents W

1,523,001,371

2,612,660,171

Tradeandotherreceivables,net

3,300,525,044

2,824,178,592

Governmentbonds

329,030

232,805

Non‐derivativefinancialinstruments

550,107,808

483,088,601

Guaranteedeposits

108,433,754

92,869,643

Total W

5,482,397,007

6,013,029,812

SAMSUNGSDICO.,LTD.ANDSUBSIDIARIES

NotestotheConsolidatedFinancialStatements

FortheyearsendedDecember31,2023and2022

27

5.FinancialRiskManagement,Continued

(1)Creditrisk,continued

2)Impairmentloss

TheagingoftradeandotherreceivablesandrespectiveimpairedamountsasofDecember31,2023and2022are

asfollows:

(2)Liquidityrisk

Liquidity risk

is the risk that the Group will encounter difficulty in meeting the obligations associated with its

financialliabilitiesthataresettledbydeliveringcashoranotherfinancialasset.TheGroup’sapproachtomanaging

liquidityistoensure,asfaraspossible,thatitwillalwayshaveenoughliquiditytomeet

itsliabilitieswhendue,

under both normal and stressed conditions, without incurring unacceptable losses or risking damage to the

Group’sreputation.

TheGroupmonitorsitscashflowsthroughlong‐termandshort‐termmanagementstrategiesandensuresithas

sufficientcashondemandtomeetexpectedoperationalexpenses.Thisexcludesthe

potentialimpactofextreme

circumstancesthatcannotreasonablybepredicted.

The Group establishes short‐term and long‐term cash management plans to manage liquidity risk. The Group

matchesmaturitystructuresoffinancialassetsandliabilitiesthroughanalyzingandreviewingcashflowbudget

andactualcashflow.Managementbelievesthatthe

Groupcanredeemitsfinancialliabilitiesthroughoperating

cashflowsandcashinflowsoffinancialassets.

MaturityanalysisoffinancialliabilitiesasofDecember31,2023isasfollows:

(Inthousandsofwon)

Carryingamount

Contractual

Cashflow1Yearorless

Morethan1year

andlessthan

5years

Morethan5

years

Tradeandother

payable(*) W 4,639,646,03 0 4,673,527,636 4,098,308,261 555,707,306 19,512,069

Short‐termborrowings2,868,274,952 2,891,483,090 2,891,483,090 ‐ ‐

Long‐termborrowings 2,849,524,920 3,144,774,094 124,735,225 3,020,038,869 ‐

Total W

10,357,445,902 10,709,784,820 7,114,526,576 3,575,746,175 19,512,069

(*)

Trade and other payable

includes cash flowsrelated to lease liabilities. More details are includedin Note 31

Lease.

2023

2022

(In thousands

ofwon)

Gross Not‐impaired Impairment

Gross Not‐impaired Impairment

Notpastdue W 3,150,695,296

3,150,695,296

‐

2,732,455,088

2,732,455,088

‐

Past due 1‐30

days

93,111,042

93,111,042

‐

91,736,918

91,700,098

36,820

Pastdue31‐60

days

54,187,841

54,187,841

‐

22,058

22,058

‐

Past due over

61days

2,530,865

2,530,865

‐

1,655

1,348

307

Total

W

3,300,525,044

3,300,525,044

‐

2,824,215,719

2,824,178,592

37,127

SAMSUNGSDICO.,LTD.ANDSUBSIDIARIES

NotestotheConsolidatedFinancialStatements

FortheyearsendedDecember31,2023and2022

28

5.FinancialRiskManagement,Continued

(3)Marketrisk

Marketrisk is the riskthatchanges inmarketprices, such asforeignexchangerates, interest ratesand equity

priceswillaffectthevalueofitsholdingsoffinancialinstrumentsor

riskoffluctuationsincashflows.Theobjective

ofmarketriskmanagementistomanageandcontrolmarketriskexposureswithinacceptableparameters,while

optimizingthereturn.

1)Exchangeraterisk

The Group has exposure to the exchange rate risk for the sale, purchase, and borrowing of currencies not

denominated

infunctionalcurrency.MaincurrenciesusedforthesetransactionsareUSD,EURandetc.TheGroup

continuouslymonitors changesin futureexchangeratesandmanages them tominimize the impactofforeign

exchangeriskontheGroup.

Carryingamountsofmonetaryassetsandliabilitiesexpressedasotherthanfunctionalcurrencyas

ofDecember

31,2023and2022areasfollows:

(Inthousandsofwon) Financialassets

Financialliabilities

2023

2022

2023

2022

Currency

USD W 4,463,088,496

5,122,251,285

4,431,197,780

5,079,489,325

EUR

77,228,589

321,095,099

64,824,267

223,497,365

etc.

368,801,920

310,992,927

521,102,756

365,614,866

(*)Theamountsofassetsandliabilitiesbycurrencyarethefiguresbeforeinternaltransactionsareeliminated.

ThefollowingexchangerateswereappliedduringtheyearsendedDecember31,2023and2022:

(Inwon)

Averagerate

Reportingdatespotrate

Currency

2023

2022

2023

2022

USD W 1,306.12

1,291.15

1,289.40

1,267.30

EUR

1,412.67

1,357.35

1,426.59

1,351.20

Effectsonincome(loss)afterincometaxesasaresultofchangeinexchangerateasofDecember31,2023and

2022areasfollows:

(Inthousandsofwon) 2023

2022

Currency

Ifincreasedby

5%

Ifdecreasedby

5%

Ifincreasedby

5%

Ifdecreasedby

5%

USD W 1,173,578

(1,173,578)

1,573,640

(1,573,640)

EUR

456,479

(456,479)

3,591,597

(3,591,597)

etc.

(5,604,671)

5,604,671

(2,010,087)

2,010,087

SAMSUNGSDICO.,LTD.ANDSUBSIDIARIES

NotestotheConsolidatedFinancialStatements

FortheyearsendedDecember31,2023and2022

29

5.FinancialRiskManagement,Continued

(3)Marketrisk,continued

2)Interestraterisk

(i)TheinterestrateprofileoftheGroup’sinterest‐bearingfinancialinstrumentsasofDecember31,2023and2022

aresummarizedasfollows:

(Inthousandsofwon)

2023

2022

Fixedinterestrate:

Assets

Short‐term&Long‐term

FinancialAssets W 550,107,808

483,088,601

Sub‐total

550,107,808

483,088,601

Liabilities

Short‐termborrowings W 1,183,024,326

1,472,578,128

Long‐termborrowings

213,988,500

405,360,000

Sub‐total

1,397,012,826

1,877,938,128

Variableinterestrate:

Liabilities

Short‐termborrowings W

1,685,250,626 1,378,605,086

Long‐termborrowings

2,635,536,420

1,891,680,000

Sub‐total

4,320,787,046

3,270,285,086

(ii)Cashflowsensitivityanalysisforvariablerateinstruments

Underassumptionthatallothervariablesremainconstant,changeofonepercentpointininterestratewould

haveincreased (decreased)incomeafterincometaxesbytheamountsshownbelowasofDecember31,2023

and2022.

(Inthousandsofwon)

2023

2022

Ifincreased

Ifdecreased

Ifincreased

Ifdecreased

by1% by1% by1% by1%

Variablerateinstruments

W

(31,800,993)

31,800,993

(24,069,298)

24,069,298

SAMSUNGSDICO.,LTD.ANDSUBSIDIARIES

NotestotheConsolidatedFinancialStatements

FortheyearsendedDecember31,2023and2022

30

5.FinancialRiskManagement,Continued

(3)Marketrisk,continued

3)Othermarketpricerisk

MarketpriceriskarisesfromtheequityinstrumentsatfairvaluethattheGrouppossesses.Majorinvestments

withintheportfolioaremanagedseparatelyandtheapproval

oftheBoardofDirectorsisnecessaryforsignificant

acquisitionordisposaldecisions.

TheeffectonnetassetswhenthepriceoflistedequityfinancialassetsthattheGrouppossesseschangedbyfive

percentpointsasofDecember31,2023isasfollows:

(Inthousandsofwon)

2023

Ifincreasedby5% Ifdecreasedby5%

Impactonnetassets

W

43,933,111

(43,933,111)

(4)Capitalmanagement

TheGroup’scapitalmanagementistomaintainasoundcapitalstructureandtomaximizeshareholders’profit.

TheGroupusesfinancialratiossuchasdebtratioandnetborrowingsratioasacapitalmanagementindicatorto

achievetheoptimumcapitalstructure.Debttoequityratioiscalculatedas

totaldebtdividedbytotalequityand

netborrowingstoequityratioiscalculatedasnetborrowingsdividedbytotalequity.

(Inthousandsofwon) 2023 2022

Debttoequityratio:

Totalliabilities W 14,131,610,215

13,040,023,015

Totalequity

19,907,249,978

17,217,502,156

Debttoequityratio

70.99%

75.74%

Netborrowingstoequityratio:

Borrowings W 5,717,799,872

5,148,223,214

Less:Cashandcashequivalents

(1,524,461,361)

(2,614,271,850)

Less:Short‐termfinancialinstruments

(550,068,407)

(483,069,101)

Netborrowings W 3,643,270,104

2,050,882,263

Netborrowingstoequityratio

18.30%

11.91%

SAMSUNGSDICO.,LTD.ANDSUBSIDIARIES

NotestotheConsolidatedFinancialStatements

FortheyearsendedDecember31,2023and2022

31

5.FinancialRiskManagement,Continued

(5)Fairvalues

1)Fairvalueversuscarryingamounts

Thefairvaluesoffinancialassetsandliabilities,togetherwiththecarryingamountsshowninthestatementof

financialposition,asofDecember31,2023

and2022aresummarizedasfollows:

(Inthousandsofwon)

2023

2022

Carryingamount Fairvalue

Carryingamount

Fairvalue

Financialassets:

Assetscarriedatfairvalue

EquityInstruments W

1,307,409,902

1,307,409,902

1,204,354,393

1,204,354,393

Derivativefinancialassets

7,031,294

7,031,294

34,707,824

34,707,824

Subtotal

1,314,441,196

1,314,441,196

1,239,062,217

1,239,062,217

Assetscarriedatamortizedcost

Cashandcashequivalents

1,524,461,361

(*1)

2,614,271,850

(*1)

Tradereceivablesandotherreceivables

3,300,525,044

(*1)

2,824,178,592

(*1)

Governmentbonds

329,030

(*1)

232,805

(*1)

Financialinstruments

550,107,808

(*1)

483,088,601

(*1)

Guaranteedeposits

108,433,754

(*1)

92,869,643

(*1)

Subtotal 5,483,856,997 6,014,641,491

Totalfinancialassets W 6,798,298,193

7,253,703,708

Financialliabilities:

Liabilitiescarriedatfairvalue

Derivativefinancialliabilities W

‐

‐

139,830

139,830

Liabilitiescarriedatamortizedcost

Borrowings W 5,717,799,872

(*1)

5,148,223,214

(*1)

Tradeandotherpayables(*2)

4,639,646,030

(*1)

4,535,542,047

(*1)

Subtotal

10,357,445,902

9,683,765,261

Totalfinancialliabilities W 10,357,445,902

9,683,905,091

(*1)Bookvalueisareasonableapproximationoffairvalue,soithasbeenexcludedfromthefairvaluedisclosure.

(*2)Includingleaseliabilities

SAMSUNGSDICO.,LTD.ANDSUBSIDIARIES

NotestotheConsolidatedFinancialStatements

FortheyearsendedDecember31,2023and2022

32

5.FinancialRiskManagement,Continued

(5)Fairvalues,continued

2)Fairvaluehierarchy

TheGroupclassifiesconsolidatedfinancialinstrumentscarriedatfairvalueinthestatementoffinancialposition

accordingto fair valuehierarchywhich reflects significance of inputvariables

used. The different levelsof fair

valuehierarchyhavebeendefinedasfollows:

“Level1”indicatesquotedpricesinactivemarketsforidenticalassetsorliabilities.Instrumentsincludedin“Level

1”aremostlycomposedoflistedequitysecuritiesthatareclassifiedasFVOCIfinancialassets.

TheGroupusesavaluation

techniquetoestimatefairvaluesoffinancialinstrumentswhicharenottradedinan

activemarket.Ifthesignificantinputswhicharerequiredforafairvaluemeasurementareobservabledirectlyor

indirectlyinamarket,thefairvalueinputisclassedas“Level2”.TheGrouptradesderivativessuchas

currency

forwardsandcommodityfuturesandmeasuresthefairvalueofthederivativesusingchangesinpricesthatare

directlyorindirectlyobservableinthemarket.TheGroupincludesthefairvalueofthesederivativesas“Level2”.

Ontheotherhand,ifthesignificantinputsarenotbasedon

observablemarketdata,thefairvalueinputforthat

instrumentisclassedas“Level3”.

Amongunlistedequitysecurities,thefairvaluesofSamsungVentureInvestmentCorporation,iMarketAsia,and

theKoreaEconomicDailyCo.,Ltdarecalculatedusingdiscountedcashflowmodelwithintheincomeapproach

method. Other evaluated equity

securities were valued based on fair value calculated using the per‐share

evaluated amount determined by the net asset value method. These unlisted equity securities are classed as

“Level3”.

ThevaluationtechniquesusedinmeasuringLevel3fairvalue,aswellasthesignificantunobservableinputsused

areas

follows:

Valuation

techniques

Significant

unobservableinputs

Inter‐relationshipbetweenkey

unobservableinputsandfairvalue

measurement

Financialassets

atFVPL

Discounted

cashflow

method,Net

assetmethod

Discountrate,

Perpetualgrowthrate,

Netasset

Theestimatedfairvaluewould

increases(decreases)ifthediscount

rateswerelower(higher),

perpetual

rateswerehigher(lower),andnetasset

valuewerehigher(lower).

SAMSUNGSDICO.,LTD.ANDSUBSIDIARIES

NotestotheConsolidatedFinancialStatements

FortheyearsendedDecember31,2023and2022

33

5.FinancialRiskManagement,Continued

(5)Fairvalues,continued

ThefairvaluesoffinancialinstrumentsbasedonthefairvaluehierarchyasofDecember31,2023and2022are

summarizedasfollows:

(Inthousandsofwon)

Level1

Level2

Level3

Total

December31,2023:

Financialassets

Equityinstruments W

1,193,834,547

‐

113,575,355

1,307,409,902

Derivativeassets

‐

7,031,294

‐

7,031,294

December31,2022:

Financialassets

EquityInstruments W 1,093,132,877

‐

111,221,516

1,204,354,393

Derivativeassets

‐

34,707,824

‐

34,707,824

Financialliabilities

Derivativeliabilities‐139,830‐139,830

(6)Transferoffinancialassetsandothers

TheGroup received cashandtransferred trade receivables to financialinstitutions. As theGroupcontinuesto

retainsubstantiallyalltherisksand rewardsofownership,thetradereceivableshavenotbeenderecognizedfrom

thestatementoffinancialposition. The amountreceivedat

thetimeof transfer was recognizedas short‐term

borrowings.FinancialassetstransferredbutnotderecognizedasofDecember31,2023and2022,areasfollows:

(Inthousandsofwon)

Tradereceivables

2023

2022

Carryingamountofassets

W

1,183,024,326

1,252,676,717

Carryingamountofassociatedliabilities

1,183,024,326

1,252,676,717

SAMSUNGSDICO.,LTD.ANDSUBSIDIARIES

NotestotheConsolidatedFinancialStatements

FortheyearsendedDecember31,2023and2022

34

6.SegmentsInformation

(1)Operatingsegments

1)Themainbusinessesbysegmentareasfollows:

Segment

Mainbusiness

Energysolutions

Manufacturingandsalesofsecondarybatteriessuchasautomotivebatteries.

Electronicmaterial

Manufacturingandsalesofsemi‐conductoranddisplaymaterials

2)Theoperatingsegmentsoftheconsolidatedgrouparedecidedbymanagement,whichisestablishedforstrategic

decision making. Management reviews the operating income for each operating segment in order to allocate

resources to each segment and assess the segments’ performance. Sales consist mostly of sales of goods. The

following

tableprovidesinformationforeachreportablesegmentfortheyearsendedDecember31,2023and2022.

2023

(Inthousandsofwon)

Energysolutions

Electronic

material