CMS Manual System

Department of Health & Human

Services (DHHS)

Pub 100-04 Medicare Claims

Processing

Centers for Medicare &

Medicaid Services (CMS)

Transmittal 771 Date: DECEMBER 2, 2005

Change Request 4181

SUBJECT: Revisions to Pub. 100-04, Medicare Claims Processing Manual in

Preparation for the National Provider Identifier (NPI)

I. SUMMARY OF CHANGES: This Change Request creates a new section in chapter 1

of the manual which defines institutional provider indentifiers as they will be used over

the period of the NPI transition. It removes all other references to the Online Survey

Certification & Reporting system (OSCAR) numbers except in those cases where an

OSCAR number will continue to be used in the CMS internal processes.

NEW/REVISED MATERIAL

EFFECTIVE DATE: January 3, 2006

IMPLEMENTATION DATE: January 3, 2006

Disclaimer for manual changes only: The revision date and transmittal number apply

only to red italicized material. Any other material was previously published and

remains unchanged. However, if this revision contains a table of contents, you will

receive the new/revised information only, and not the entire table of contents.

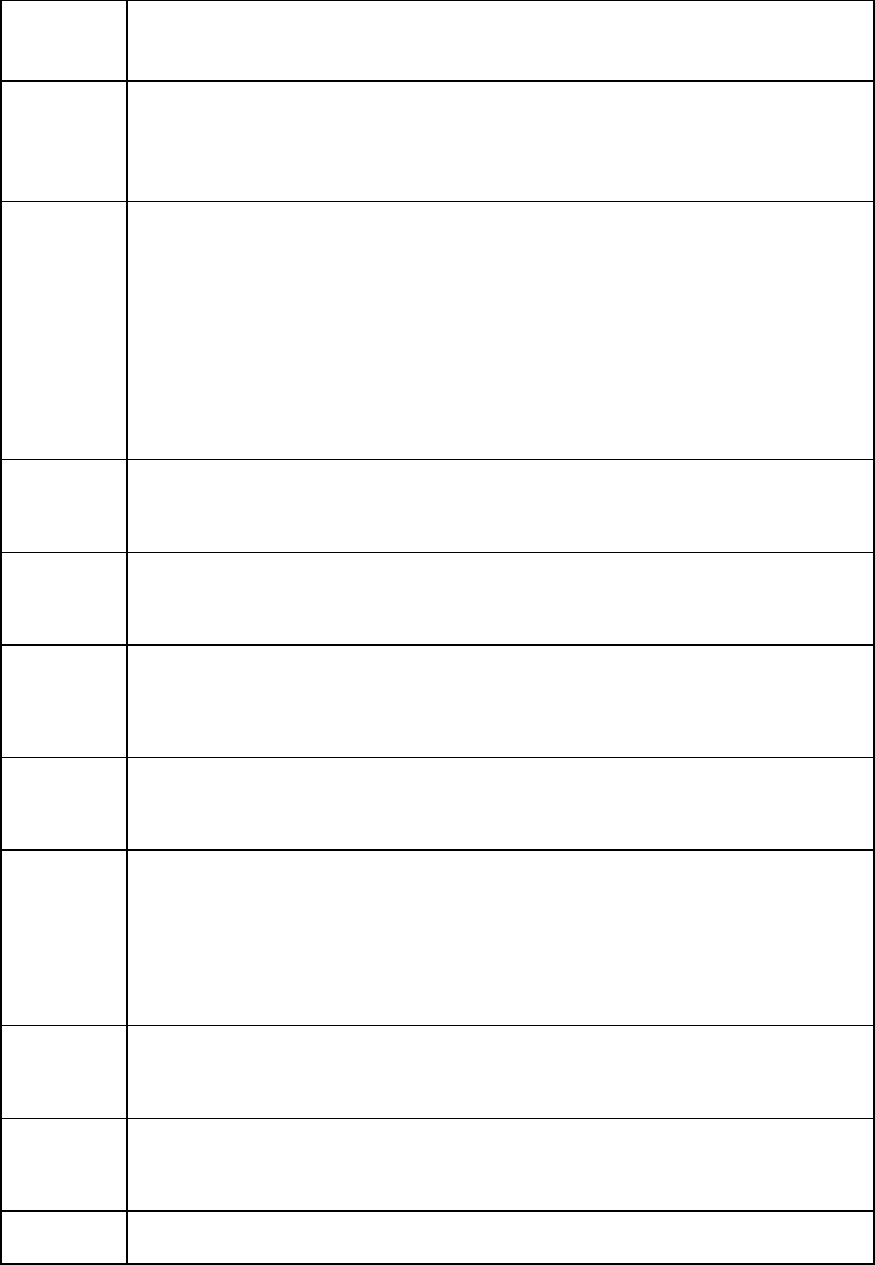

II. CHANGES IN MANUAL INSTRUCTIONS: (N/A if manual is not updated)

R = REVISED, N = NEW, D = DELETED

R/N/D CHAPTER/SECTION/SUBSECTION/TITLE

R

1/Table of Contents

R

1/80.3.2.2/FI Consistency Edits

N

1/160/Identifying Institutional Providers

R

3/20/Payment Under Prospective Payment System (PPS)

Diagnosis Related Groups (DRGs)

R

3/20.8/Payment to Hospitals and Units Excluded from IPPS

for Direct Graduate Medical Education (DGME) and

Nursing and Allied Health (N&AH) Education for Medicare

Advantage (MA) Enrollees

R

3/30.1/Requirements for CAH Services, CAH Skilled

Nursing Care Services and Distinct Part Units

R

3/30.1.2/Payment for Post-Hospital SNF Care Furnished by a

CAH

R

3/60/Swing-Bed Services

R

3/140.2.6/Outlier Payments: Cost-to-Charge Ratios

R

3/150.3/Affected Medicare Providers

R

3/150.13/Billing Requirements Under LTCH PPS

D

3/Addendum/Hospital Reclassifications and Redesignations

by Individual Hospital FY-2003

R

4/30.1/Coinsurance Election

R

4/141/Maryland Waiver Hospitals

R

4/250.2.2/Zip Code Files

R

4/260.1/Special Partial Hospitalization Billing Requirements

for Hospitals, Community Mental Health Centers, and

Critical Access Hospitals

R

4/260.1.1/Bill Review for Partial Hospitalization Services

Provided in Community Mental Health Centers (CMHC)

R

5/10/Part B Outpatient Rehabilitation and Comprehensive

Outpatient Rehabilitation Facility (CORF) Services-General

R

8/10.9/Dialysis Provider Number Series

R

8/60.8/Shared Systems Changes for Medicare Part B Drugs

for ESRD Independent Dialysis Facilities

R

9/10.2/Federally Qualified Health Centers (FQHCs)

R

10/40.1/Request for Anticipated Payment (RAP)

R

10/40.2/HH PPS Claims

R

11/20.1.2/Completing the Uniform (Institutional Provider)

Bill (Form CMS-1450) for Hospice Election

R

11/40.1.3.1/Care Plan Oversight

III. FUNDING:

No additional funding will be provided by CMS; Contractor activities are to be

carried out within their FY 2006 operating budgets.

IV. ATTACHMENTS:

Business Requirements

Manual Instruction

*Unless otherwise specified, the effective date is the date of service.

Attachment - Business Requirements

Pub. 100-04 Transmittal: 771 Date: December 2, 2005 Change Request 4181

SUBJECT: Revisions to Pub. 100-04, Medicare Claims Processing Manual in Preparation for the

National Provider Identifier (NPI)

I. GENERAL INFORMATION

A. Background: The Health Insurance Portability and Accountability Act (HIPAA) of 1996 requires

issuance of a unique NPI to physicians, suppliers, and other providers of health care. The implementing

regulation for that requirement can be found in 45 CFR Part 162, Subpart D (162.402-162.414). Several

articles referencing this initiative have been issued to educate physicians, suppliers, and other providers on

the NPI.

The Medicare Claims Processing Manual contains numerous references to legacy identifiers which have

been used prior to the NPI. In particular, many chapters in this manual refer to the use of the Online

Survey Certification & Reporting system (OSCAR) numbers to identify institutional providers. In

preparation for the NPI, the Medicare Claims Processing Manual has been revised to amend the sections

referencing the 6-digit alpha-numeric provider number (OSCAR) to conform to the future use of a 10 digit

numeric NPI provider number. This Change Request creates a new section in chapter 1 of the manual

which defines institutional provider identifiers as they will be used over the period of the NPI transition.

It removes all other references to OSCAR numbers except in those cases where an OSCAR number will

continue to be used in CMS internal processes.

B. Policy: The implementation of NPIs is required by HIPAA.

II. BUSINESS REQUIREMENTS

“Shall" denotes a mandatory requirement

"Should" denotes an optional requirement

Requirement

Number

Requirements Responsibility (“X” indicates the

columns that apply)

Shared System

Maintainers

F

I

R

H

H

I

C

a

r

r

i

e

r

D

M

E

R

C

F

I

S

S

M

C

S

V

M

S

C

W

F

Other

4181.1 Contractors shall be aware of the revisions to

the Medicare Claims Processing Manual in

regard to the implementation of the NPI as

required by HIPAA.

XX

III. PROVIDER EDUCATION

Requirement

Number

Requirements Responsibility (“X” indicates the

columns that apply)

Shared System

Maintainers

F

I

R

H

H

I

C

a

r

r

i

e

r

D

M

E

R

C

F

I

S

S

M

C

S

V

M

S

C

W

F

Other

None.

IV. SUPPORTING INFORMATION AND POSSIBLE DESIGN CONSIDERATIONS

A. Other Instructions: N/A

X-Ref Requirement # Instructions

B. Design Considerations: N/A

X-Ref Requirement # Recommendation for Medicare System Requirements

C. Interfaces: N/A

D. Contractor Financial Reporting /Workload Impact: N/A

E. Dependencies: N/A

F. Testing Considerations: N/A

V. SCHEDULE, CONTACTS, AND FUNDING

Effective Date*: January 3, 2006

Implementation Date: January 3, 2006

Pre-Implementation Contact(s): Yvonne Young,

(410) 786-1886,

Wil Gehne (410) 786-6148,

Post-Implementation Contact(s): Regional Office

No additional funding will be

provided by CMS; contractor

activities are to be carried out

within their FY 2006 operating

budgets.

*Unless otherwise specified, the effective date is the date of service.

Medicare Claims Processing Manual

Chapter 1 - General Billing Requirements

Table of Contents

(Rev. 771, 12-02-05)

160 - Identifying Institutional Providers

80.3.2.2 - FI Consistency Edits

(Rev.771, Issued: 12-02-05, Effective: 01-03-06, Implementation: 01-03-06)

In order to be processed correctly and promptly, a bill must be completed accurately. FIs

edit all Medicare required fields as shown below. If a bill fails these edits, FIs return it to

the provider for correction. If bill data is edited online, the edits are included in the

software. When FIs receive magnetic tape or paper bills, either directly or through a

billing service, they must ensure that these edits are made. Depending upon special

services billed, FIs may require additional edits.

FL 4. Type of Bill

a. Must not be spaces

b. Must be a valid code for billing. Valid codes are:

First Digit - Type of Facility:

1 - Hospital

NOTE: Hospital-based multi-unit complexes may also have use for

the following first digits when billing non-hospital services:

2 - Skilled Nursing

3 - Home Health

4 - Religious Non-Medical (Hospital)

7 - Clinic or Renal Dialysis Facility (requires special information in

second digit below)

8 - Special Facility or Hospital ASC Surgery (requires special information

in second digit, see below)

Second Digit - Classification (if first digit is 1-5):

1 - Inpatient (Part A)

2 - Hospital-Based or Inpatient (Part B) (includes HHA visits under a Part

B plan of treatment)

3 - Outpatient (includes HHA visits under a Part A plan of treatment and

use of HHA DME under a Part A plan of treatment)

4 - Other (Part B) (includes HHA medical and other health services not

under a plan of treatment, hospital and SNF for diagnostic clinical

laboratory services for “nonpatients”)

8 - Swing bed (used to indicate billing for SNF level of care in a hospital

with an approved swing bed agreement)

Second Digit - Classification (first digit is 7):

1 - Rural Health Clinic (RHC)

2 - Hospital-Based or Independent Renal Dialysis Facility

3 - Free-Standing Provider-Based Federally Qualified Health Center

(FQHC)

4 - Other Rehabilitation Facility (ORF)

5 - Comprehensive Outpatient Rehabilitation Facility (CORF)

6 - Community Mental Health Center (CMHC)

Second Digit - Classification (first digit is 8):

1 - Hospice (Nonhospital-based)

2 - Hospice (Hospital-based)

3 - Ambulatory Surgical Center Service to Hospital Outpatients

4 - Free Standing Birthing Center

5 - Critical Access Hospital (CAH)

Third Digit - Frequency:

A - Admission/Election Notice

B - Hospice/Medicare Coordinated Care Demonstration/Religious Non-

Medical Health Care Institution-Termination/Revocation Notice

C - Hospice Change of Provider

D - Hospice/Medicare Coordinated Care Demonstration/Religious Non-

Medical Health Care Institution-Void/Cancel

E - Hospice Change of Ownership

F - Beneficiary Initiated Adjustment Claim (For FI use only)

G - CWF Initiated Adjustment Claim (For FI use only)

H - CMS initiated Adjustment Claim (For FI use only)

I - FI Adjustment Claim (Other than QIO or Provider) (For FI use only)

J - Initiated Adjustment Claim-Other (For FI use only)

K - OIG Initiated Adjustment Claim (For FI use only)

M - MSP Initiated Adjustment Claim (For FI use only)

P - QIO Adjustment Claim (For FI use only)

0 - Nonpayment/zero claims

1 - Admit Through Discharge Claim

2 - Interim - First Claim

3 - Interim – Continuing Claims (Not valid for PPS bills. Exception: SNF

PPS bills)

4 - Interim – Last Claim (Not valid for PPS bills. Exception: SNF PPS

bills)

5 - Late charge

7 - Correction

8 - Void/Cancel

9 - Final Claim for a Home Health PPS Episode

FL 6. Statement Covers Period (From - Through)

a. Cannot exceed eight positions in either “From” or “Through” portion allowing for

separations (nonnumeric characters) in the third and sixth positions.

b. The “From” date must be a valid date that is not later than the “Through” date.

c. The “Through” date must be a valid date that is not later than the current date.

d. The number of days represented by this period must equal the sum of the covered

days (FL 7) and noncovered days (FL 8), if the type of bill is 11X, 18X, 21X, or

41X.

e. With the exception of Home Health PPS claims, the statement covers period may

not span 2 accounting years.

FL 7. Covered Days

FIs do not need to edit the provider’s bill. They determine the proper number of covered

days in their bill process.

FL 8. Noncovered Days

FIs do not need to edit the provider’s bill. They determine the proper number of

noncovered days in their bill process.

FL 9. Coinsurance Days

FIs do not need to edit the provider’s bill. They determine the proper number of

coinsurance days in their bill process.

FL 10. Lifetime Reserve Days

FIs do not need to edit the provider’s bill. They determine the proper number of lifetime

reserve days in their bill process.

FL 13. Patient’s Address

a. The address of the patient must include:

City

State (P.O. Code)

ZIP

b. Valid ZIP code must be present if the type of bill is 11X, 13X, 18X, 83X or

85X.

c. Cannot exceed 62 positions.

FL 14. Birthdate

a. Must be valid if present.

b. Cannot exceed 10 positions allowing for separations (nonnumeric characters)

in the third and sixth positions.

FL 15. Sex

a. One alpha position.

b. Valid characters are “M” or “F.”

c. Must be present.

FL 17. Admission Date

a. Must be valid if present.

b. Cannot exceed eight positions allowing for separations (nonnumeric characters)

in the third and sixth positions.

c. Present only if the type of bill is 11X, 12X, 18X, 21X, 22X, 32X, 33X, 41X,

81X or 82X.

d. Cannot be later than the “From” portion of Item 6.

FL 19. Type of Admission/Visit

a. One numeric position.

b. Required only if the type of bill is 11X, 12X, 18X, 21X, 22X, or 41X.

c. Valid codes are:

1 - Emergency

2 - Urgent

3 - Elective

4 - Newborn

5 - Trauma Center

9 - Information unavailable

FL 20. Source of Admission.

a. One numeric position

b. Must be present

c. Valid codes are:

1 - Physician referral

2 - Clinic referral

3 - HMO referral

4 - Transfer from a hospital

5 - Transfer from a SNF

6 - Transfer from another health care facility

7 - Emergency room

8 - Court/Law enforcement

9 - Information not available

A - Transfer from a Critical Access Hospital (CAH)

B - Transfer from another Home Health Agency (HHA)

C - Readmission to same Home Health Agency (HHA)

d. Valid codes for Newborns are:

1 - Normal Delivery;

2 - Premature Delivery;

3 - Sick Baby; and

4 - Extramural Birth.

FL 22. Patient Status.

a. Two numeric positions

b. Present on all Part A inpatient, SNF, hospice, home health agency, and

outpatient hospital services. Types of bill: 11X, 12X, 13X, 14X, 18X, 21X,

22X, 23X, 32X, 33X, 34X, 41X, 71X, 73X, 74X, 75X, 76X, 81X, 82X, 83X, or

85X.

c. Valid codes for hospitals, SNFs, HHAs and RNHCIs are:

01 - Discharged to home/self care (routine charge)

02 - Discharged/transferred to other short-term general hospital

03 - Discharged/transferred to SNF

04 - Discharged/transferred to ICF

05 - Discharged/transferred to a non-Medicare PPS children’s hospital or non-

Medicare PPS cancer hospital for inpatient care

06 - Discharged/transferred to home care of organized home health service

organization

07 - Left against medical advice

08 - Discharged/transferred to home under care of a home IV drug therapy

provider

09 - Admitted as an inpatient to this hospital

20 - Expired

30 - Still patient or expected to return for outpatient services

43 - Discharged/transferred to a Federal hospital (effective for discharges on

and after October 1, 2003)

50 - Discharged/transferred to Hospice - home

51 - Discharged/transferred to Hospice - medical facility

61 - Discharged/transferred to a hospital-based Medicare approved swing bed

62 - Discharged/transferred to an inpatient rehabilitation facility including

distinct part units of a hospital

63 - Discharged/transferred to a long-term care hospital (LTCH)

64 - Discharged/transferred to a nursing facility certified under Medicaid but

not certified under Medicare

65 - Discharged/transferred to a psychiatric hospital or psychiatric part unit of a

hospital (effective April 1, 2004)

71 - Discharged/transferred/referred to another institution for outpatient

services as specified by the discharge plan of care (deleted October 1,

2003)

72 - Discharged/transferred/referred to this institution for outpatient services as

specified by the discharge plan of care (deleted October 1, 2003)

d. Valid codes for hospice (81X or 82X) are:

01 - Discharged (left this hospice)

30 - Still patient

40 - Expired at home

41 - Expired in a medical facility such as a hospital, SNF, ICF, or freestanding

hospice

42 - Expired - place unknown

FL 23. Medical Record Number

a. If provided by the hospital, must be recorded by the FI for the QIO.

b. Must be left justified in CWF record for QIO.

FLs 24, 25, 26, 27, 28, 29, and 30. Condition Codes.

a. Each code is two numeric digits.

b. Valid codes are 01, 02, 03, 04, 05, 06, 07, 08, 09, 10, 11, 12, 13, 14, 15, 16, 17,

18, 19, 20, 21, 22, 23, 24, 25, 26, 28, 29, 30, 31, 32, 33, 34, 35, 36, 37, 38, 39,

40, 41, 42, 43, 44, 45, 46, 48, 55, 56, 57, 58, 59, 61, 62, 63, 64, 65, 66, 70, 71,

72, 73, 74, 75, 76, 77, 78, 79, A5-A9, AA-AN, B0-B4, D0-D9, EO, GO, HO.

c. If code 07 is entered, type of bill must not be hospice 81X or 82X.

d. If codes 36, 37, 38, or 39 are entered, the type of bill must be 11X and the

provider must be a non-PPS hospital or exempt unit.

e. If code 40 is entered, the “From” and “Through” dates in FL 6 must be equal,

and there must be a “0” or “1” in FL 7 (Covered Days).

f. Only one code 70, 71, 72, 73, 74, 75, or 76 can be on an ESRD claim.

g. Code C1, C3, C4, C5, or C6 must be present if type of bill is 11X or 18X.

FLs 32, 33, 34, and 35. Occurrence Codes and Dates

a. All dates must be valid.

b. Each code must be accompanied by a date.

c. All codes are two alphanumeric positions.

d. Valid codes are 01-33, 35-37, 40-99, and A0-Z9.

e. If code 20 or 26 is entered, the type of bill must be 11X or 41X. If code 21 or

22 is entered, the type of bill must be 18X or 21X.

f. If code 27 is entered, the type of bill must be 81X or 82X.

g. If code 28 is entered, the first digit in FL 4 must be a “7” and the second digit a

“5.”

h. If code 42 is entered, the first digit in FL 4 must be “8” and the second digit

“1” or “2” and the third digit “1 or 4.”

i. If 01 - 04 is entered, Medicare cannot be the primary payer, i.e., Medicare-

related entries cannot appear on the “A” lines of FLs 58-62.

j. If code 20 is entered:

• Must not be earlier than “Admission” date (FL 17) or later than

“Through” date (FL 6).

• Must be less than 13 days after the admission date (FL 17) if “From”

date is equal to admission date (less than 14 days if billing dates cover

the period December 24 through January 2).

k. If code 21 is entered:

• Cannot be later than “Statement Covers Period” Through date; or

• Cannot be more than 3 days prior to the “Statement Covers Period”

From date.

l. If code 22 is entered, the date must be within the billing period shown in FL 6.

m. If code 31 is entered, the type of bill must be 11X, 21X, or 41X.

n. If code 32 is entered, the type of bill must be 13X, 14X, 23X, 32X, 33X, 34X,

71X, 72X, 73X, 74X, 75X, 81X, or 82X.

FL 36. Occurrence Span Codes and Dates

a. Dates must be valid.

b. Code entry is two alphanumeric positions.

c. Code must be accompanied by dates.

d. Valid codes are 70-79, M0-M5, and WZ-ZZ.

e. If code 70 is entered, the type of bill must be 11X, 18X, 21X, or 41X.

f. If code 71 is entered, the first digit of FL 4 must be “1,” “2,” or “4” and the

second digit must be “1.”

g. If code 72 is entered, the type of bill must be 13X, 14X, 32X, 33X, 34X, 71X,

73X, 74X, or 75X.

h. If code 74 is entered, the type of bill must be 11X, 13X, 14X, 18X, 21X, 34X,

41X, 71X, 72X, 74X, 75X, 81X, or 82X.

i. If code 75 is entered, the first digit of FL 4 must be “1” or “4” and the second

digit must be “1.”

j. If code 76 is entered, occurrence code 31 must be present (inpatient only).

k. If code 76 is entered, occurrence code 32 must be present (outpatient only).

l. If code 76, 77, or M1 is present, the bill type must be 11X, 13X, 14X, 18X,

21X, 34X, 41X, 71X, 72X, 73X, 74X, 75X, 81X, 82X, or 85X.

m. Neither the “From” nor the “Through” portion can exceed eight positions

allowing for separations (nonnumeric characters) in the third and sixth

positions of each field.

n. If code M2 is present, the bill type must be 81X or 82X.

o. Code 79 is for payer use only. Providers do not report this code.

FLs 39, 40, and 41. Value Codes and Amounts.

a. Each code must be accompanied by an amount.

b. All codes are two alphanumeric digits.

c. Amounts may be up to ten numeric positions. (00000000.00)

d. Valid codes are 01-99 and A0-ZZ.

e. If code 06 is entered, there must be an entry for code 37.

f. If codes 08 and/or 10 are entered, there must be an entry in FL 10.

g. If codes 09 and/or 11 are entered, there must be an entry in FL 9.

h. If codes 12, 13, 14, 15, 41, 43, or 47 are entered as zeros, occurrence codes 01,

02, 03, 04, or 24 must be present.

i. Entries for codes 37, 38, and 39 cannot exceed three numeric positions.

j. If the blood usage data is present, code 37 must be numeric and greater than

zero.

FL 42. Revenue Codes.

a. Four numeric positions.

b. Must be listed in ascending numeric sequence except for the final entry, which

must be “0001” for hardcopy claims only.

c. There must be a revenue code adjacent to each entry in FL 47.

d. For hospitals not subject to the outpatient prospective payment system (OPPS)

with types of bill 13X or 83X, the following revenue codes require a 5-position

HCPCS code:

0274, 030X, 031X, 032X, 034X, 035X, 040X, 046X, 0471, 0481, 0482, 061X,

0730, 0732, or 074X.

e. For bill types 32X and 33X the following revenue codes require a 5-position

HCPCS code:

0274, 029X, 042X, 043X, 044X, 055X, 056X, 057X, 0601, 0602, 0603, and 0604.

f. For bill type 34X, the following revenue codes require a 5-position HCPCS

code:

0271-0274, 42X, 43X, 44X, and 0601-0604.

g. For bill type 21X, 32X, 33X, or 11X (IRF facilities) the following revenue

codes require a 5-position HIPPS code:

0022 (SNF only), 0023 (HH only), 0024 (IRFs only).

FL 44. HCPCS Codes.

For bill type 13X or 83X, the HCPCS codes below must be reported with the specific

revenue code shown. These revenue codes can also be reported with other HCPCS

codes.

046X 94010, 94060, 94070, 94150, 94160, 94200, 94240, 94250,

94260, 94350, 94360, 94370, 94375, 94400, 94450, 94620,

94680, 94681, 94690, 94720, 94725, 94750, 94760, 94761,

94762, 94770

0471 92504, 92511, 92541, 92542, 92543, 92544, 92545, 92546,

92547, 92548, 92551, 92552, 92553, 92555, 92556, 92557,

92562, 92563, 92564, 92565, 92567, 92568, 92569, 92571,

92572, 92573, 92575, 92576, 92577, 92579, 92582, 92583,

92584, 92585, 92587, 92588, 92596

0480 93303, 93304, 93307, 93308, 93312, 93314, 93315, 93317,

93320, 93321, 93325, 93350, 93600, 93602, 93603, 93607,

93609, 93610, 93612, 93615, 93616, 93618, 93619, 93620,

93624, 93631, 93640, 93641, 93642, 93501, 93505, 93510,

93511, 93514

0481 93524, 93526, 93527, 93528, 93529, 93539, 93540, 93541,

93542, 93543, 93544, 93545, 93555, 93556, 93561, 93562,

Q0035

0482 93017

0636 Revenue code 0636 relates to the HCPCS code for drugs

requiring detailed coding.

0730 93005, 93024, 93041

0731 93024, 93041, 93225, 93226, 93231, 93232, 93236

0732 93012

074X 95805, 95807, 95808, 95810, 95812, 95813, 95816, 95819,

95822, 95824, 95827, 95829, 95920, 95933, 95950, 95951,

95953, 95954, 95955, 95956, 95957, 95958, 95961, 95962

075X 91000, 91010, 91011, 91012, 91020, 91030, 91034, 91035,

91052, 91055, 91060, 91065, 91122

0920 51736, 51741, 51792, 51795, 51797, 54250, 59020, 59025,

92060, 92065, 92081, 92082, 92083, 92235, 92240, 92250,

92265, 92270, 92275, 92283, 92284, 92285, 92286

0921 54240, 93721, 93731, 93732, 93733, 93734, 93735, 93736,

93737, 93738, 93740, 93770, 93875, 93880, 93882, 93886,

93888, 93922, 93923, 93924, 93925, 93926, 93930, 93931,

93965, 93970, 93971, 93975, 93976, 93978, 93979, 93980,

93981, 93990

0922 95858, 95860, 95861, 95863, 95864, 95867, 95868, 95869,

95872, 95875, 95900, 95903, 95904, 95921, 95922, 95923,

95925, 95926, 95930, 95934, 95936, 95937

0924 95004, 95024, 95027, 95028, 95044, 95052, 95056, 95060,

95065, 95070, 95071, 95078

For bill type 13X or 83X and revenue codes 0360-0369, a 5-position HCPCS code of

10000 - 69979 must be present unless diagnosis code V64.1, V64.2, or V64.3 is present.

For bill type 21X, 32X, 33X, or 11X (IRF facilities), HIPPS field for revenue codes

specific to SNF/HHA/IRF PPS (see item g in FL 44 above).

FL 45. Service Date

a. Six numeric positions, MMDDYY.

b. A single line item date of service (LIDOS) is required on every revenue code

present on outpatient types of bill 13X, 14X, 23X, 24X, 32X, 33X, 34X, 71X,

72X, 73X, 74X, 75X, 76X, 81X, 82X, 83X, and 85X and on inpatient Part B

types of bill 12X and 22X. Exception (LIDOS not required) for CAHs, Indian

Health Service hospitals, and hospitals located in American Samoa, Guam, and

Saipan.

c. When a particular service is rendered more than once during the billing period,

the revenue code and HCPCS code must be entered separately for each service

date.

FL 46. Units of Service

a. Up to seven numeric positions.

b. Must be present for all services with the exception of the HIPPS line item

service. (Exception: Units are required on the HIPPS line for SNF claims)

c. Accommodation units must equal covered days (FL 7) with the exception of the

R No-Pay.

FL 47. Total Charges

a. Up to 10 numeric positions (00000000.00).

b. There must be an entry adjacent to each entry in FL 42.

c. The “0001” amount must be the sum of all the entries for hardcopy only.

FLs 50A, B, and C. Payer Identification

a. "Medicare” must be entered on one of these lines depending upon whether it is

the primary, secondary or tertiary payer.

b. If value codes 12, 13, 14, 15, 16, 41, 42, 43, or 47 are present, data pertaining

to Medicare cannot be entered in Line A of FLs 50-62.

FL 51. Medicare Provider Number

a. A 6-position alpha/numeric field (for CMS use only, effective May 23, 2007,

providers are required to submit only their NPI).

b. Left justified.

FLs 58A, B, and C. Insured’s Name

a. Must be present. Cannot be all spaces.

FLs 60A, B, and C. Certificate/Social Security Number/HI Claim/Identification Number

a. Must be present.

b. Must contain nine numeric characters and at least one alpha character as a

suffix. The first alpha suffix is entered in position 10, the second in position

11, etc. The first three numbers must fall within the range of 001 through 680

or 700 through 728.

c. The alpha suffix must be A through F, H, J, K, M, T, or W. Alpha suffixes A

and T must not have a numeric subscript. Alpha suffixes B, C, D, E, F, M, and

W may or may not have a numeric subscript.

d. If the alpha suffix is H, it must be followed by A, B or C in position eleven.

The numeric subscript (position twelve) must conform with the above for the

A, B, or C suffix to be used.

e. RRB claim numbers must contain either six or nine numeric characters, and

must have one, two, or three character alpha prefix.

f. For prefixes H, MH, WH, WCH, PH and JA only a 6-digit numeric field is

permissible. For all other prefixes, a six or nine numeric field is permissible.

g. Nine numeric character claim numbers must have the same ranges as the SSA

9-position claim numbers.

FL 67. Principal Diagnosis Code.

a. Must be four or five positions left justified with no decimal points. FIs validate

with MCE and OCE programs.

b. Must be valid ICD-9-CM code.

FLs 68-75. Other Diagnosis Codes.

a. If present, must be four or five positions, left justified with no decimal points.

FIs validate with MCE and OCE programs.

FL 80 Principal Procedure Code and Date

a. If present, must be valid ICD-9-CM procedure code. FIs validate with MCE

program.

b. If code is present, date must be present and valid.

c. Date must fall before the “Through” date in FL 6. (In some cases it may be

before the admission date, i.e., where complications and admission ensue from

outpatient surgery.)

FL 81. Other Procedure Codes and Dates.

a. If present, apply edits for FL 80

FL 82. Attending/Referring Physician I.D.

• The UPIN must be present on inpatient Part A bills with a “Through” date of

January 1, 1992, or later. For outpatient and other Part B services, the UPIN

must be present if the “From” date is January 1, 1992, or later. This

requirement applies to all provider types and all Part B bill types.

° Number, last name, and first initial must be present;

° First three characters must be alpha or numeric; and

° If first three characters of UPIN are INT, RES, VAD, PHS, BIA, OTH,

RET, or SLF, exit. Otherwise, the 4th through 6th positions must be

numeric.

FL 83. Other Physician I.D

a. Must be present if:

•

•

•

•

•

•

Bill type is 11X and a procedure code is shown in FLs 80-81;

Bill type is 83X or 13X and a HCPCS code is reported that is subject to the

ASC payment limitation or is on the list of codes the QIO furnishes that

require approval; or

Bill type is 85X and HCPCS code is in the range of 10000 through 69979.

b. If required:

First three characters must be alpha or numeric:

Number, last name and first initial must be present; and

Left justified:

o If first three characters of UPIN are INT, RES, VAD, PHS, BIA,

OTH, RET, or SLF, exit. Otherwise the 4th through 6th positions

must be numeric.

160 - Identifying Institutional Providers

(Rev.771, Issued: 12-02-05, Effective: 01-03-06, Implementation: 01-03-06)

Effective January 3, 2006, the six position alpha-numeric provider number will begin

transitioning to the ten position numeric “National Provider Identifier” (NPI). The

following provides instructions on how the provider number (OSCAR) will be

transitioned to the NPI:

May 23, 2005 through January 2, 2006 Providers continue to submit the current

six position alpha-numeric provider

number. Any claims submitted with only

the NPI number will be returned as

unprocessable.

January 3, 2006 through October 1, 2006 Providers continue to submit the current

six position alpha-numeric provider

number. The NPI number may also be

submitted but must be present with the

current provider number.

October 2, 2006 through May 22, 2007 Providers may submit the current six

position alpha numeric provider number

and/or the NPI number.

Beginning May 23, 2007 Providers must only submit the NPI

number.

References to the six position alpha-numeric number or OSCAR number found

throughout the chapters of the Medicare Claims Processing Manual, on an ongoing

basis, are supplied only for the purpose of CMS internal processing. Therefore, these

references are documented as “for CMS use only”.

NOTE: All other references to “provider number” in the chapters that follow refer to

the usage of identifiers per the table above.

20 - Payment Under Prospective Payment System (PPS) Diagnosis

Related Groups (DRGs)

(Rev.771, Issued: 12-02-05, Effective: 01-03-06, Implementation: 01-03-06)

A General

The Social Security Amendments of 1983 (P.L. 98-21) provided for establishment of a

prospective payment system (PPS) for Medicare payment of inpatient hospital services.

(See

§20.4 for corresponding information for PPS capital payments and computation of

capital and operating outliers for FY 1992.) Under PPS, hospitals are paid a

predetermined rate per discharge for inpatient hospital services furnished to Medicare

beneficiaries. Each type of Medicare discharge is classified according to a list of DRGs.

These amounts are, with certain exceptions, payment in full to the hospital for inpatient

operating costs. Beneficiary cost-sharing is limited to statutory deductibles, coinsurance,

and payment for noncovered items and services. Section 4003 of OBRA of 1990 (P.L.

101-508) expands the definition of inpatient operating costs to include certain

preadmission services. (See

§40.3.)

The statute excludes children's hospitals and cancer hospitals, hospitals located outside

the 50 States. In addition to these categorical exclusions, the statute provides other

special exclusions, such as hospitals that are covered under State reimbursement control

systems. These excluded hospitals and units are paid on the basis of reasonable costs

subject to the target rate of increase limits.

In accordance with Section 1814 (b) (3) of the Act, services provided by hospitals in

Maryland subject to the Health Services Cost Review Commission (provider numbers

21000-21099) are paid according to the terms of the waiver, that is 94% of submitted

charges subject to any unmet Part B deductible and coinsurance.

For discharges occurring on or after April 1, 1988, separate standardized payment

amounts are established for large urban areas and rural areas. Large urban areas are

urban areas with populations of more than 1,000,000 as determined by the Secretary of

HHS on the basis of the most recent census population data. In addition, any New

England County Metropolitan Area (NECMA) with a population of more than 970,000 is

a large urban area.

The OBRA 1987 required payment of capital costs under PPS effective with cost

reporting periods that began October 1, 1991, or later. A 10-year transition period was

provided to protect hospitals that had incurred capital obligations in excess of the

standardized national rate from major disruption. High capital cost hospitals are known

as "hold harmless" hospitals. The transition period also provides for phase-in of the

national Federal capital payment rate for hospitals with capital obligations that are less

than the national rate. New hospitals that open during the transition period are exempt

from capital PPS payment for their first 2 years of operation. Hospitals and hospital

distinct part units that are excluded from PPS for operating costs are also excluded from

PPS for capital costs.

Capital payments are based on the same DRG designations and weights, outlier

guidelines, geographic classifications, wage indexes, and disproportionate share

percentages that apply to operating payments under PPS. The indirect teaching

adjustment is based on the ratio of residents to average daily census. The hospital split

bill, adjustment bill, waiver of liability and remaining guidelines that have historically

been applied to operating payments also apply to capital payments under PPS.

B Hospitals and Units Excluded

The following hospitals and distinct part hospital units (DPU) are excluded from PPS and

are paid on a reasonable cost or other basis:

• Pediatric hospitals whose inpatients are predominately under the age of 18.

• Hospitals located outside the 50 States.

• Hospitals participating in a CMS-approved demonstration project or State

payment control system.

• Nonparticipating hospitals furnishing emergency services have not been affected

by the PPS statute (P.L. 97-21). They are paid under their existing basis.

C Situations Requiring Special Handling

1 - Sole Community Hospitals are paid in accordance with the methods used to

establish the operating prospective rates for the first year of the PPS transition for

operating costs. The appropriate percentage of hospital-specific rate and the

Federal regional rate is applied by the Pricer program in accordance with the

current values for the appropriate fiscal year.

2 - Hospitals have the option to continue to be reimbursed on a reasonable cost basis

subject to the target ceiling rate or to be reimbursed under PPS if the following

are met:

• Recognized as of April 20, 1983, by the National Cancer Institute as

Comprehensive Cancer Centers or Clinical Research Centers;

• Demonstrating that the entire facility is organized primarily for treatment

of, and research on, cancer; and

• Having a patient population that is at least 50 percent of the hospital's total

discharges with a principal diagnosis of neoplastic disease.

The hospital makes this decision at the beginning of its fiscal year. The choice

continues until the hospital requests a change. If it selects reasonable cost subject

to the target ceiling, it can later request PPS. No further option is allowed.

3 - Regional and national referral centers within short-term acute care hospital

complexes. Rural hospitals that meet the criteria have their prospective rate

determined on the basis of the urban, rather than the rural, adjusted standardized

amounts, as adjusted by the applicable DRG weighting factor and the hospital's

area wage index.

4 - Hospitals in Alaska and Hawaii have the nonlabor related portion of the wage

index adjusted by their appropriate cost-of-living factor. These calculations are

made by the Pricer program and are included in the Federal portion of the rate.

5 - Kidney, heart, and liver acquisition costs incurred by approved transplant centers

are treated as an adjustment to the hospital's payments. These payments are

adjusted in each cost reporting period to compensate for the reasonable expenses

of the acquisition and are not included in determining prospective payment.

6 - Religious Nonmedical Health Care Institutions are paid on the basis of a

predetermined fixed amount per discharge. Payment is based on the historical

inpatient operating costs per discharge and is not calculated by "Pricer."

7 - Transferring hospitals with discharges assigned to DRG 385 (Neonates, Died or

Transferred) or DRG 504-511 (burns, transferred to another acute care facility)

have their payments calculated by the Pricer program on the same basis as those

receiving the full prospective payment. They are also eligible for cost outliers.

8 - Nonparticipating hospitals furnishing emergency services are not included in PPS.

9 - Veterans Administration (VA) Hospitals are generally excluded from

participation. Where payments are made for Medicare patients, the payments are

determined in accordance with 38 U.S.C. 5053(d).

10 - A hospital that loses its urban area status as a result of the Executive Office of

Management and Budget redesignation occurring after April 20, 1983, may

qualify for special consideration by having its rural Federal rate phased-in over a

2-year period. The hospital will receive, in addition to its rural Federal rate in the

first cost reporting period, two-thirds of the difference between its rural Federal

rate and the urban Federal rate that would have been paid had it retained its urban

status. In the second reporting period, one-third of the difference is applied. The

adjustment is applied for two successive cost reporting periods beginning with the

cost-reporting period in which CMS recognizes the reclassification.

11 - The payment per discharge under the PPS for hospitals in Puerto Rico is the sum

of:

• 50 percent of the Puerto Rico discharge weighted urban or rural

standardized rate.

• 50 percent of the national discharge weighted standardized rate.

(The special treatment of referral centers and sole community hospitals does not

apply to prospective payment hospitals in Puerto Rico.)

There are special criteria that facilities must meet in order to obtain approval for

payment for heart transplants and special processing procedures for these bills.

(See

§90.2.) Facilities that wish to obtain coverage of heart transplants for their

Medicare patients must submit an application and documentation showing their

initial and ongoing compliance with the criteria. For facilities that are approved,

Medicare covers under Part A all medically reasonable and necessary inpatient

services.

12 - Hospitals with high percentage of ESRD discharges may qualify for additional

payment. These payments are handled as adjustments to cost reports.

13 - Exception payments are provided for hospitals with inordinately high levels of

capital obligations. They will expire at the end of the 10-year transition period.

Exception payments ensure that for FY 1992 and FY 1993:

• Sole community hospitals receive 90 percent of Medicare inpatient capital costs:

• Urban hospitals with 100 or more beds and a disproportionate share patient

percentage of at least 20.2 percent receive 80 percent of their Medicare inpatient

capital costs; and

• All other hospitals receive 70 percent of their Medicare inpatient capital costs.

A limited capital exception payment is also provided during the 10-year capital transition

period for hospitals that experience extraordinary circumstances that require an

unanticipated major capital expenditure. Events such as a tornado, earthquake,

catastrophic fire, or a hurricane are examples of extraordinary circumstances. The capital

project must cost at least $5 million to qualify for this exception.

D DRG Classification

The DRGs are a patient classification system which provides a means of relating types of

patients a hospital treats (i.e., its case mix) to the costs incurred by the hospital. Payment

for inpatient hospital services is made on the basis of a rate per discharge that varies

according to the DRG to which a beneficiary's stay is assigned. All inpatient

transfer/discharge bills from both PPS and non-PPS facilities, including those from

waiver States, long-term care facilities, and excluded units are classified by the Grouper

software program into one of 489 diagnosis related groups (DRGs).

The following DRGs receive special attention:

• DRG No. 468 - Represents a discharge with valid data but where the surgical

procedure is unrelated to the principal diagnosis. This DRG has a weight

assigned and will be paid. The hospital must review the record on each DRG in

the remittance record and where either the principle diagnosis or surgical

procedure was reported incorrectly, prepare an adjustment bill. The FI may elect

to avoid the adjustment bill by returning the bill to the hospital prior to payment.

Further, Quality Improvement Organizations (QIOs) will review all DRG 468

cases.

• DRG No. 469 - Represents a discharge with a valid diagnosis in the principle

diagnosis field, but one not acceptable as a principal diagnosis. Examples include

a diagnosis of diabetes mellitus or an infection of the genitourinary tract during

pregnancy, both unspecified as to episode of care. These diagnoses may be valid,

but they are not sufficient to determine the principal diagnosis for DRG

assignment purposes. FIs will return the claims. The hospital must enter the

corrected principal diagnosis for proper DRG assignment and resubmit the claim.

• DRG No. 470 - Represents a discharge with invalid data. FIs return the claims

for correction of data elements affecting proper DRG assignment. The hospital

resubmits the corrected claim.

When the bills are processed in conjunction with the MCE (see

§20.2.1) coding

inconsistencies in the information and data are identified.

The MCE must be run before Grouper to identify inconsistencies before the bills are

processed through the Grouper.

E Difference in Age/Admission Versus Discharge

HO-415.4

When a beneficiary's age changes between the date of admission and date of discharge,

the DRG and related payment amount are determined from the patient's age at admission.

20.8 - Payment to Hospitals and Units Excluded from IPPS for Direct

Graduate Medical Education (DGME) and Nursing and Allied Health

(N&AH) Education for Medicare Advantage (MA) Enrollees

(Rev.771, Issued: 12-02-05, Effective: 01-03-06, Implementation: 01-03-06)

During the period January 1, 1998 through December 31, 1998, hospitals received 20

percent of the fee-for-service DGME and operating IME payment. This amount increased

by 20 percentage points each consecutive year until it reached 100 percent in calendar

year (CY) 2002.

Non-IPPS hospitals and units may submit their MA claims to their respective FIs to be

processed as no-pay bills so that the MA inpatient days can be accumulated on the

Provider Statistics & Reimbursement Report (PS&R) (report type 118) for DGME

payment purposes through the cost report.

This applies to the following hospitals and units excluded from the IPPS:

• Rehabilitation units

• Psychiatric units

• Rehabilitation hospitals

• Psychiatric hospitals

• Long-term Care hospitals

• Children’s hospitals

• Cancer hospitals

In addition, this applies to all hospitals that operate a nursing or an allied health (N&AH)

program and qualify for additional payments related to their MA enrollees under 42 CFR

§413.87(e). These providers may similarly submit their MA claims to their respective FIs

to be processed as no-pay bills so that the MA inpatient days can be accumulated on the

PS&R (report type 118) for purposes of calculating the MA N&AH payment through the

cost report.

Non-IPPS hospitals, hospitals with rehabilitation and psychiatric units, and hospitals that

operate an approved N&AH program must submit claims to their regular FI in UB-92

format, with condition codes 04 and 69 present on record type 41, fields 4-13, (Form

Locator 24-30). The provider uses Condition code 69 to indicate that the claim is being

submitted as a no-pay bill to the PS&R report type 118 for MA enrollees in non-IPPS

hospitals and non-IPPS units to capture MA inpatient days for purposes of calculating the

DGME and/or N&AH payment through the cost report.

The FI submits the claim to the Common Working File (CWF). The CWF determines if

the beneficiary is a MA enrollee and what his/her plan number and effective dates are.

The plan must be a MA plan, per 42 CFR §422.4. Upon verification from CWF that the

beneficiary is a MA enrollee, the FI adds the MA plan number and an MA Pay Code of

“0” to the claim. For fee-for-service claims that were previously paid and posted to

history for the same period (due to late posting of MA enrollment data), an L-1002

Automatic Cancellation Adjustment Report will be sent to the FI when a DGME-only or

a N&AH-only claim from a non-IPPS hospital or unit is accepted for payment by CWF.

No deductible or coinsurance is to be applied against this claim nor is the beneficiary's

utilization updated by CWF for this stay. If CWF enrollment records do not indicate that

the beneficiary is a MA enrollee, CWF rejects the claim and the FI notifies the hospital of

this reason. The hospital may resubmit the claim after 30 days to see if the enrollment

data has been updated. No interim bills should be submitted for DGME-only or N&AH-

only claims and no Medicare Summary Notices should be prepared for these claims.

The DGME payments are made using the same interim payment calculation FIs currently

employ. Specifically, FIs must calculate the additional DGME payments using the

inpatient days attributable to MA enrollees. As with DGME and N&AH education

payments made under fee-for-service, the sum of these interim payment amounts is

subject to adjustment upon settlement of the cost report. Note that these DGME and/or

N&AH payments apply both to IPPS and non-IPPS hospitals and units.

Teaching hospitals that operate GME programs (see 42 CFR §413.86) and/or hospitals

that operate approved N&AH education programs (see 42 CFR §413.87) must submit

separate bills for payment for MA enrollees. The MA inpatient days are recorded on

PS&R report type 118. For services provided to MA enrollees by hospitals that do not

have a contract with the enrollee’s plan, non-IPPS hospitals and units are entitled to any

applicable DGME and/or N&AH payments under these provisions. Therefore, such

hospitals and units should submit bills to their FI for these cases in accordance with this

section’s instructions. In addition to submitting the claims to the PS&R report type 118,

hospitals must properly report MA inpatient days on the Medicare cost report, Form

2552-96, on worksheet S-3, Part I, line 2 column 4, and worksheet E-3, Part IV, lines

6.02 and 6.06.

30.1 - Requirements for CAH Services, CAH Skilled Nursing Care

Services and Distinct Part Units

(Rev.771, Issued: 12-02-05, Effective: 01-03-06, Implementation: 01-03-06)

A CAH may provide acute inpatient care for a period that does not exceed, as determined

on an annual average basis, 96 hours per patient. The CAH's length of stay will be

calculated by their FI based on patient census data and reported to the CMS regional

office (RO). If a CAH exceeds the length of stay limit, it will be required to develop and

implement a corrective action plan acceptable to the CMS RO, or face termination of its

Medicare provider agreement.

Items and services that a CAH provides to its inpatients are covered if they are items and

services of a type that would be covered if furnished by an acute care hospital to its

inpatients. A CAH may use its inpatient facilities to provide post-hospital SNF care and

be paid for SNF-level services if it meets the following requirements:

1. The facility has been certified as a CAH by CMS;

2. The facility operates up to 25 beds for either acute (CAH) care or SNF swing

bed care (any bed of a unit of the facility that is licensed as a distinct-part SNF is not

counted under paragraph (1) of this section); and

3. The facility has been granted swing-bed approval by CMS.

A CAH that participated in Medicare as a rural primary care hospital (RPCH) on

September 30, 1997, and on that date had in effect an approval from CMS to use its

inpatient facilities to provide post-hospital SNF care, may continue in that status under

the same terms, conditions, and limitations that were applicable at the time those

approvals were granted.

A CAH may establish psychiatric and rehabilitation distinct part units effective for cost

reporting periods beginning on or after October 1, 2004. The CAH distinct part units

must meet the following requirements:

1. The facility distinct part unit has been certified as a CAH by CMS;

2. The distinct part unit meets the conditions of participation requirements for

hospitals;

3. The distinct part unit must also meet the requirements, other than conditions of

participation requirements, that would apply if the unit were established in an acute care

hospital;

4. Services provided in these distinct part units will be paid under the payment

methodology that would apply if the unit was established in an acute care (non-CAH)

hospital paid under the hospital inpatient PPS; Inpatient Rehabilitation Facilities in

CAHs are paid under the Inpatient Rehabilitation Facility PPS (see Pub 100-04, Chapter

3, Section 140 for billing requirements) and the Inpatient Psychiatric Units in CAHs are

paid on a reasonable cost basis until a prospective payment system is created (expected

in 2005);

5. Beds in these distinct part units are excluded from the 25 bed count limit for

CAHs;

6. The bed limitations for each distinct part unit is 10; and

If a distinct part unit does not meet applicable requirements with respect to a cost

reporting period, no payment may be made to the CAH for services furnished in the unit

during that period. Payment may resume only after the CAH has demonstrated that the

unit meets applicable requirements.

30.1.2 - Payment for Post-Hospital SNF Care Furnished by a CAH

(Rev.771, Issued: 12-02-05, Effective: 01-03-06, Implementation: 01-03-06)

The SNF-level services provided by a CAH, are paid at 101% of reasonable cost. Since

this is consistent with the reasonable cost principles, FIs will now pay for those services

at 101% reasonable cost. Hospitals must follow the rules for payment in

§60 for swing-

bed services.

Coinsurance and deductible are applicable for inpatient CAH payment.

All items on Form CMS-1450 are completed in accordance with Chapter 25.

60 - Swing-Bed Services

(Rev.771, Issued: 12-02-05, Effective: 01-03-06, Implementation: 01-03-06)

Swing-bed services require the provider to bill inpatient hospital services and SNF

services separately. The provider must meet the 3-day hospital stay requirement and the

timely transfer requirement. (See Pub. 100-02, Medicare Benefit Policy Manual, Chapter

8.)

Swing-bed hospitals use one provider number when billing for hospital services to

identify hospital swing-bed SNF bills. The following alpha letters identify hospital

swing-bed SNF bills (for CMS use only, effective May 23, 2007, providers are required to

submit only their NPI. NOTE: The swing-bed NPI will be mapped to the 6-digit alpha-

numeric legacy (OSCAR) number.):

• "U" = short-term/acute care hospital swing-bed;

• "W" = long-term hospital swing-bed; and

• "Y" = rehabilitation hospital swing-bed.

A Inpatient Hospital Services in a Swing-Bed

Where there is no change to a SNF level of care, hospitals bill services in accordance

with hospital billing instructions. Where the beneficiary's level of care changes from

hospital to SNF level, the provider shows patient status code 03 on the hospital bill in FL

22 to indicate transfer to a SNF level of care. (This constitutes a discharge for purposes

of Medicare payment for inpatient hospital services under PPS.) The FI indicates in FL 6

the last day of care at the hospital level.

B SNF Services in a Swing-Bed

Services are billed, in accordance with Chapter 25 with the following exceptions:

• The date of admission on the swing-bed SNF bill is the date the patient began to

receive SNF level of care services;

• State level agreements may call for varying types of bill coding in FL 4. CMS

does not perform edits on type of bill coding on bills with 8 in the 2nd digit (bill

classification), in FL 18 of the CWF inpatient record if the record is identified in

FL 1 as hospital or SNF. Therefore, the FI accepts, with subsequent conversion,

any bill type agreed to at the State level to identify swing-bed billing, e.g., 18X,

28X, 11X, 21X. It must be sure the record identification of CWF FL 1 is

consistent with the provider number shown; and

• If the hospital has 50-99 beds, the following additional processing rules apply:

° The hospital may not be paid for more than the number of capped days for

swing bed stays. See subsection

C for determining the limitation.

° When the hospital is notified that a SNF bed is available, the hospital is not

paid for services furnished after the 5-day transfer period (excluding

weekends and holidays). This rule does not apply if the patient's physician

certified within the 5-day period that a transfer to a SNF was not medically

necessary.

° If the physician certified the transfer, occurrence code 26 must be shown.

This code identifies the date a SNF bed became available on or after the date

the patient was healthy enough for transfer.

The FI is responsible for review to ensure that the provider has considered availability of

a SNF bed and obtained appropriate certification. The FI assumes that payment is

appropriate on initial bills and is subject to the cap limitation. The QIO may later deny

the bill and notify the FI.

See Pub. 100-02, Medicare Benefit Policy Manual, Chapter 8 for additional coverage

policy information.

C Application of Capped Amount (50-99) Bed Provider

Payment is limited to swing bed providers of 50 - 99 beds. The cap is determined by

multiplying .15 times the product of the number of days in the cost reporting period and

the average number of licensed beds at the hospital for the period. From its State

licensing agency, the FI determines the number of licensed beds at the beginning of a cost

reporting period or from the date of the swing-bed approval, if later.

In States that do not license beds, hospitals use the total number of hospital beds reported

on their most recent Certificate of Need (CON) (excluding bassinets). If during the cost

reporting period there is an increase or decrease in the number of licensed beds, the FI

multiplies the number of licensed beds for each part of the period by the number of days

for which that number of licensed beds was available. After totaling the results, it

computes 15 percent of the total available licensed bed days to determine the payment

limitation.

The FI maintains a record for each swing-bed provider of 50-99 beds. This record must

contain the following information:

• The number of days that may be paid under the cap;

• The SNF days paid for the period (or the days remaining if the FI prefers); and

• The date the cap is met (not the date the FI records it).

The FI notifies the hospital if a beneficiary's extended care stay cannot be covered

because the cap has been reached. In such a case, the law prohibits payment under Part

A. However, payment may be made under Part B for certain medical and other health

services. (See Chapter 1.)

On each bill from a provider with 50-99 beds, the FI determines whether the provider had

already met the cap limit before the date of admission to the SNF level of care. If an

admission occurs prior to the date the capped days are exhausted, the entire stay is paid

(if otherwise covered) even though the cap is met during the stay.

140.2.6 - Outlier Payments: Cost-to-Charge Ratios

(Rev.771, Issued: 12-02-05, Effective: 01-03-06, Implementation: 01-03-06)

This section describes the appropriate data sources for computing an overall Medicare

facility-specific cost-to-charge ratio (CCR) for the purpose of determining outlier

payments under the IRF PPS. For discharges beginning on or after October 1, 2003, FIs

will use a CCR from the most recent tentative settled cost report or the most recent settled

cost report (whichever is the later period). FIs will use the cost report and the associated

data in determining a facility’s overall Medicare CCR specific to freestanding IRFs of for

IRFs that are distinct part units of acute care hospitals.

The Medicare cost reporting forms contain information on both Medicare inpatient costs

and charges. In addition, Medicare charges should be contained in the provider statistical

and reimbursement (PS&R) report associated with a specific cost reporting period. If the

overall Medicare CCR appears to be substantially out-of-line with similar facilities, the FI

should ensure that the underlying costs and charges are properly reported.

Effective October 1, 2003, an IRF will be assigned the appropriate national average CCR

that falls above three standard deviations from the national mean (upper threshold). CMS

will not use a lower threshold and an IRF will receive their actual CCR, no matter how

low their ratio falls.

For discharges occurring on or after October 1, 2003 and before October 1, 2004, the

upper threshold is 1.461 and the national CCRs are 0.597 for rural IRFs and 0.554 for

urban IRFs. For discharges occurring on or after October 1, 2004, and before October 1,

2005, the upper threshold is 1.461, and the national CCR are 0.636 for rural IRFs and

0.531 for urban IRFs.

The IRF PPS covers operating and capital-related costs and excludes medical education

and nurse anesthetist costs paid for on a reasonable cost basis. Therefore, total Medicare

charges for IRFs will consist of the sum of the inpatient routine charges and the sum of

inpatient ancillary charges (including capital). Total Medicare costs will consist of the

sum of inpatient routine costs (net of private room differential and swingbed) plus the

sum of ancillary costs plus capital-related pass-through costs only.

The provider specific file contains a field for the operating CCR (Field 25; file position

102-105) and for the capital CCR (Field 42; file position 203-206). Because the CCR

computed for the IRF PPS includes routine, ancillary, and capital costs, the CCR for

freestanding IRFs, units, and new providers described below will be entered on the

provider specific file only in field 25; file position 102-105. Field 42; file position 203-

206 of the provider specific file must be zero-filled.

A Calculating Medicare CCRs for Freestanding IRFs

For freestanding IRFs, Medicare charges will be obtained from Worksheet D-4, Column

2, lines 25 through 30 plus line 103 from the cost report (where possible, these charges

should be confirmed with the PS&R data). For freestanding IRFs, total Medicare costs

will be obtained from Worksheet D-1, Part II, line 49 minus (Worksheet D, Part III, col.

8, lines 25 through 30 plus Worksheet D, Part IV, col., line 101). Divide the Medicare

costs by the Medicare charges to compute the CCR.

B - Calculating Medicare CCRs for IRF Distinct Part Units

For IRF distinct part units, total Medicare inpatient routine and ancillary charges will be

obtained from the PS&R report associated with the latest settled cost report. [If PS&R

data is not available, estimate Medicare routine charges by dividing Medicare routine

costs on Worksheet D-1, Part II, line 41, by the result of Worksheet C, Part I, line 31,

column 3 divided by line 31, column 6. Add this amount to Medicare ancillary charges on

Worksheet D-4, column 2, line 103 to arrive at total Medicare charges.] To calculate the

total Medicare costs for distinct part units, data will be obtained from Worksheet D-1,

Part II, line 49 minus (Worksheet D, Part III, col. 8, line 31 plus Worksheet D, Part IV,

col. 7, line 101). Divide the total Medicare costs by the total Medicare charges to

compute the cost-to-charge ratio.

C - Calculating Medicare CCRs for New IRFs

As stated in the final rule, new facilities may receive outlier payments even though they

will not have the historical cost report information needed to compute the estimated cost

that determines if a case is an outlier. Therefore, a national CCR based on the facility

location of either urban or rural will be used. Specifically, for FY 2005, CMS has

estimated a national CCR of 0.636 for rural IRFs and 0.531 for urban IRFs. Unless

otherwise notified, FIs use these national ratios until the facility's actual CCR can be

computed using the first tentative settled or final settled cost report data which will then

be used for the subsequent cost report period.

The CMS will continue to set forth the upper threshold (i.e., 3 standard deviations above

the national geometric mean CCR) and the national CCRs applicable to IRFs in each

year’s annual notice of prospective payment rates published in the Federal Register.

D - Use of More Recent Data for Determining CCRs

In order to arrive at a CCR to be used in the PSF based on tentative settlement data, the

intermediary should review previous adjustments used (if any) in the tentative settlement

and take into consideration the impact of prior audit adjustments on prior period CCR to

determine if they had an impact on the CCR. If these tentative settlement adjustments

have no impact on the CCR, or if no adjustments were made, the tentative settled CCR

will equal the CCR from the IRF’s as-filed cost report. If the adjustments made at

tentative settlement would have an impact on the CCR, the intermediary should compute

a new CCR based on the tentative settlement. (NOTE: If the tentative settlement

adjustments result in a difference in the CCR from the as filed cost report of 20% or less,

then no adjustment to the CCR at tentative settlement is necessary.)

Following the initial update of the CCR for all IRFs for discharges on or after October 1,

2003, FIs should continue to update an IRF’s CCR each time a more recent cost report is

tentatively settled. Revised CCRs must be entered into the PSF not later than 45 days

after the date of the tentative settlement or final settlement used in calculating the CCRs.

Subject to the approval of CMS, CCRs may be revised more often if a change in a

hospital’s operations occurs which materially affects a hospital’s costs or charges.

Revised CCRs will be applied prospectively to all IRF PPS claims processed after the

update.

The CMS may direct FIs to use an alternative CCR to the CCR from the later of the latest

settled cost report or latest tentative settled cost report, if CMS believes this will result in

a more accurate CCR. In addition, if the FI finds evidence that indicates that using data

from the latest settled or tentatively settled cost report would not result in the most

accurate CCR, the FI should contact CMS to seek approval to use a CCR based on

alternative data. Also, a facility will have the opportunity to request that a different CCR

be applied in the event it believes the CCR being applied is inaccurate. The IRF is

required to present substantial evidence supporting its request. Such evidence should

include documentation regarding its costs and charges that demonstrate its claim that an

alternative ratio is more accurate. The regional office must approve any such request

after evaluation by the fiscal intermediary of the evidence presented by the IRF.

E - Reconciling Outlier Payments for IRFs

For discharges occurring in cost reporting periods beginning on or after October 1, 2003,

FI s are to reconcile IRF PPS outlier payments at the time of cost report final settlement

if:

1) Actual CCR is found to be plus or minus 10 percentage points from the CCR used

during that time period to make outlier payments, and

2) Outlier payments exceed $500,000 in that cost reporting period.

The return codes from the PRICER software may be used to identify the cases for which

outlier payments were made in a cost reporting period. These criteria for the IRF PPS

will be reevaluated periodically to assess whether they should be revised.

In the event that these criteria do not identify facilities that are being overpaid (or

underpaid) significantly for outliers, then, based on an analysis of the facility’s most

recent cost and charge data that indicates that the CCR for those facilities are

significantly inaccurate, FIs also have the administrative discretion to reconcile cost

reports of those IRFs. However, FIs must seek approval from their regional office in the

event they intend to reconcile outlier payments for an IRF that does not meet the above-

specified criteria. The CMS will be issuing separate instructions detailing procedures to

follow regarding this reconciliation process and the application of the adjustment for the

time value of money.

F - Notification to Facilities Under the IRF PPS

The FIs are to notify a facility whenever they make a change to its CCR. When a CCR is

changed as a result of a tentative settlement or a final settlement, the change to the CCR

should be included in the notice that is issued to each provider after a tentative or final

settlement is completed.

150.3 - Affected Medicare Providers

(Rev.771, Issued: 12-02-05, Effective: 01-03-06, Implementation: 01-03-06)

LTCHs are certified under Medicare as short-term acute care hospitals and, for

Medicare payment purposes, are generally defined as having an average inpatient length

of stay of greater than 25 days.

Veterans Administration Hospitals, hospitals that are reimbursed under state cost control

systems approved under

42 CFR Part 403, and hospitals that are reimbursed in

accordance with demonstration projects authorized under §402(a) of Public Law 90-248

(42 U.S.C. 1395b-1) or §222(a) of Public Law 92-603 (42 U.S.C. 1395b-1) are not

included in the LTCH PPS. (See 42 CFR §412.22(c).) Payment to foreign hospitals will

be made in accordance with the provisions set forth in

42 CFR 413.74. Currently, two of

the four Maryland LTCHs included on CMS' OSCAR database are presently paid in

accordance with demonstration projects (i.e., the Maryland "Waiver") and therefore not

subject to payments under the LTCH PPS: Levindale Hebrew Geriatric Center and

Deaton Hospital and Medical Center (now known as University Specialty Hospital).

150.13 - Billing Requirements Under LTCH PPS

(Rev.771, Issued: 12-02-05, Effective: 01-03-06, Implementation: 01-03-06)

Billing LTCH PPS Services

Effective with cost reporting periods beginning on or after October 1, 2002, LTCHs are

to incorporate the following so that FIs accurately price and pay a claim under the

LTCH PPS. These claims must be submitted on Type of Bill 11X.

This is a DRG- based payment system; therefore the LTCH DRG is determined by the

grouping of ICD-9-CM codes based on the principal diagnosis, up to eight additional

diagnoses, and up to six procedures performed during the stay, as well as age, sex, and

discharge status of the patient on the claim. Grouper software will determine DRG

assignment.

Each bill from a LTCH must contain the complete diagnosis and procedure coding for

purposes of the GROUPER software. Normal adjustments will be allowed. LTCH

providers submit one admit through discharge claim for the stay. Final PPS payment is

based upon the discharge bill.

30.1 - Coinsurance Election

(Rev.771, Issued: 12-02-05, Effective: 01-03-06, Implementation: 01-03-06)

The transition to the standard Medicare coinsurance rate (20 percent of the APC payment

rate) will be gradual. For those APC groups for which coinsurance is currently a

relatively high proportion of the total payment, the process will be correspondingly

lengthy. The law offers hospitals the option of electing to reduce coinsurance amounts

and advertise their reduced rates for all OPPS services. They may elect to receive a

coinsurance payment from Medicare beneficiaries that is less than the wage adjusted

coinsurance amount per APC. That amount will apply to all services within that APC.

This coinsurance reduction must be offered to all Medicare beneficiaries.

Hospitals should review the list of APCs and their respective coinsurance amounts that is

published in the Federal Register for the applicable year as a final rule. After adjusting

those coinsurance amounts for the wage index applicable to their MSA, hospitals must

notify their FIs if they wish to charge their Medicare beneficiaries a lesser amount. The

election remains in effect until the following calendar year. The first election must be

filed by July 1, 2000, for the period August 1, 2000, through December 31, 2000. Future

calendar year elections must be made by December 1st of the year preceding the calendar

year for which the election is being made.

Because the final rule on OPPS payment rates for 2002 was not published until March 1,

2002, providers were unable to make election decisions for 2002 by December 1

preceding the year the payment rates became effective, the typical deadline for making

such elections. The deadline for providers to make elections to reduce beneficiary

copayments for 2002 was extended until April 1, 2002. The elections are effective for

services furnished on or after April 1, 2002.

The lesser amount elected:

• May not be less than 20 percent of the wage adjusted APC payment amount;

• May not be greater than the inpatient hospital deductible for that calendar year

($812 for 2002); and

• Will not be wage adjusted by the FI or CMS.

Once an election to reduce coinsurance is made, it cannot be rescinded or changed until

the next calendar year. National unadjusted and minimum unadjusted coinsurance

amounts will be posted each year in the addenda of the OPPS final rule (Form

CMS-1005FC) on CMS’ Web site

(http://www.cms.hhs.gov).

This coinsurance election does not apply to partial hospitalization services furnished by

CHMCs, vaccines provided by a CORF, vaccines, splints, casts, and antigens provided by

HHAs, or splints, casts, and antigens provided to a hospice patient for the treatment of a

non-terminal illness. It also does not apply to screening colonoscopies, screening

sigmoidoscopies, or screening barium enemas, or to services not paid under OPPS.

Hospitals must utilize the following format for notification to the FI:

Provider number

1122334455

Provider name XYZ Hospital Effective from 8/1/2000 -

12/31/2000

Provider contact Joe Smith Phone # 123-456-7890

XYZ Hospital elects to reduce coinsurance to the amount shown for the following APCs:

APC____ Coinsurance___.__ APC____ Coinsurance___.__

APC____ Coinsurance___.__ APC____ Coinsurance___.__

APC____ Coinsurance___.__ APC____ Coinsurance___.__

APC____ Coinsurance___.__ APC____ Coinsurance___.__

APC____ Coinsurance___.__ APC____ Coinsurance___.__

APC____ Coinsurance___.__ APC____ Coinsurance___.__

APC____ Coinsurance___.__ APC____ Coinsurance___.__

APC____ Coinsurance___.__ APC____ Coinsurance___.__

APC____ Coinsurance___.__ APC____ Coinsurance___.__

APC____ Coinsurance___.__ APC____ Coinsurance___.__

Return to:

Provider Audit & Reimbursement Dept.

Attn: John Doe

FI Address

The FI must validate that the reduced coinsurance amount elected by the hospital is not

less than 20 percent of the wage adjusted APC amount nor more than the inpatient

deductible for the year of the election, and must send an acknowledgment to the hospital

that the election has been received, within 15 calendar days of receipt.

141 – Maryland Waiver Hospitals

(Rev.771, Issued: 12-02-05, Effective: 01-03-06, Implementation: 01-03-06)

In accordance with §1814 (b)(3) of the Act, services provided by hospitals in Maryland

subject to the Health Services Cost Review Commission are paid according to the terms

of the waiver, that is 94% of submitted charges subject to any unmet Part B deductible

and coinsurance. Payment should not be made under a fee schedule or other payment

method for outpatient items and services provided except the following situations:

• Non-patient laboratory specimens are paid under the clinical diagnostic laboratory

fee schedule (bill type 14X); and

Ambulance services which are subject to the ambulance fee schedule.

250.2.2 - Zip Code Files

(Rev.771, Issued: 12-02-05, Effective: 01-03-06, Implementation: 01-03-06)

The CMS shall provide a file of zip codes for payment for the primary care and specialty

physician scarcity bonus. The file will be effective for claims with dates of service on or

after January 1, 2005. Contractors will be notified by e-mail of the name of the file and

when it will be available for downloading.

Prior to January 1, 2005, CMS will post on its Web site zip codes that are eligible for the

bonus payment. Through regularly scheduled bulletins and list serves, intermediaries

must notify the CAH to verify their zip code eligibility via the CMS Web site.