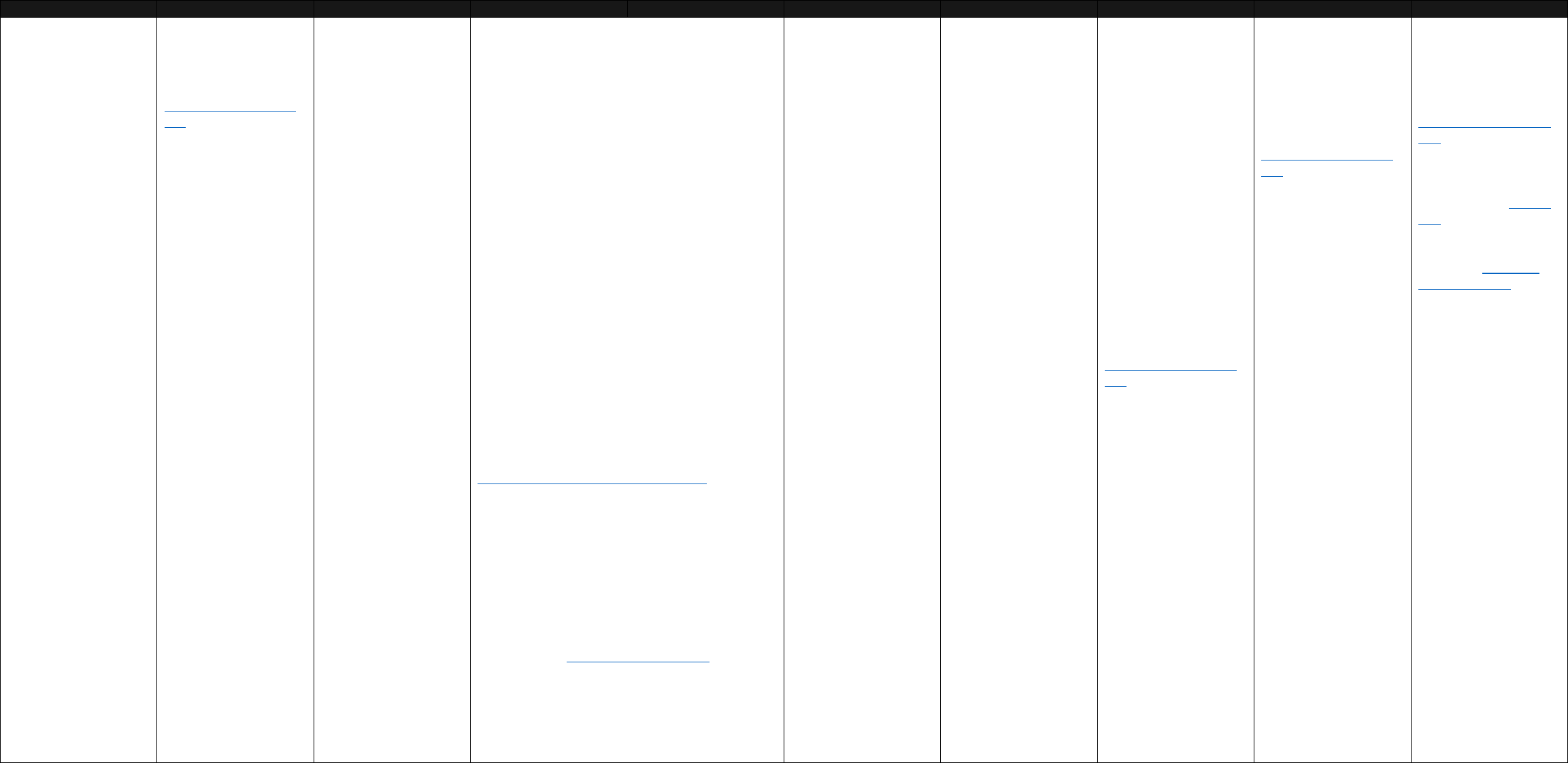

The Pay Equity Project – Fifty-State Pay Equity Law Summary

Alabama Hawaii Massachusetts New Mexico South Dakota

Alaska Idaho Michigan New York Tennessee

Arizona Illinois Minnesota North Carolina Texas

Arkansas

Indiana Mississippi North Dakota Utah

California Iowa Missouri Ohio Vermont

Colorado Kansas Montana Oklahoma Virginia

Connecticut Kentucky Nebraska Oregon Washington

Delaware Louisiana Nevada Pennsylvania West Virginia

Florida Maine New Hampshire Rhode Island Wisconsin

Georgia Maryland New Jersey South Carolina Wyoming

The Pay Equity Project – Fifty-State Pay Equity Law Summary

Page | 1

November 10, 2021

Alabama

Coverage

Protected Classes

Key Provisions

Employer Defenses

Salary History

Retaliation

Remedies/Damages:

Citing References

Alabama

Public and private

employers are covered

by the Equal pay law.

2019 Ala. Laws 519

(H.B. 225)

Sex, Race

Other protections:

Age discrimination 29

C.F.R.

§ 1620.3; 42 U.S.C. §

2000e (b); 42 U.S.C. §

12111(5); 29 U.S.C. §

630

Equal pay law called "Clarke-Figures Equal Pay

Act" (effective Aug. 1, 2019):

Employers cannot pay wage rates to employees of

one sex or race that are lower than wage rates

paid to employees of another sex or race for

equal work that requires equal skill, effort,

education, experience, and responsibility that is

performed in the same establishment and under

similar work conditions, unless the differential is

based on:

a seniority system;

a merit system;

a system that measures earnings by

quantity or quality of production; or

a differential based on any factor other

than sex or race.

Employees that file claims alleging violations of

these provisions must establish

that they were

paid less than someone else for equal work

despite having equal skill, effort, education,

experience, and responsibility; and

that the

applicable wage schedule is not or was not

correlated with any permissible differentials set

forth above.

2019 Ala. Laws 519 (H.B. 225)

Statutory Language (2019 Ala. Laws 519):

"Relating to wages; to prohibit an employer from

paying any of its employees at wage rates less

than those paid to employees of another sex or

race for equal work unless a wage differential is

based upon one or more specified factors."

"(a) An employer, including the state or any of its

political subdivisions, including public bodies, may

not pay any of its

employees at wage rates less

than the rates paid to employees of another sex

or race for equal work within the same

establishment on jobs the performance of which

requires equal skill, effort, education, experience,

and responsibility, and performance under similar

working conditions, except where the payment is

made pursuant to any of the following:

A seniority system.

A merit system.

A system that measures earnings by quantity or 24

quality of production.

A differential based on any factor other than 2 sex

or race.

Employers cannot pay

wage rates to

employees of one sex

or race that are lower

than wage rates paid to

employees of another

sex or race for equal

work that requires

equal skill, effort,

education, experience,

and responsibility that

is performed in the

same establishment

and under similar work

conditions, unless the

differential is based on:

a seniority system;

a merit system;

a system that measures

earnings by quantity or

quality of production; or

a differential based on

any factor other than

sex or race.

Equal pay law (effective

Aug. 1, 2019):

Applicants or

employees may choose

to voluntarily provide

their wage history to

employers. Wage

history means the

wages paid to an

individual for

employment by the

individual's current or

former employer.

Employers cannot

refuse to interview,

hire, promote, or

employ applicants or

employees, or

otherwise retaliate

against applicants or

employees, because

they refuse to provide

their wage history.

2019 Ala. Laws 519

(H.B. 225)

Employers cannot

retaliate against

applicants or

employees because

they refuse to provide

their wage history.

2019 Ala. Laws 519

(H.B. 225)

Employers that violate

the Equal pay law are

liable to the affected

employee for the

amount of wages that

the employee was

deprived as a result of

the violation, plus

interest. If an employee

recovers wages from

an employer under the

salary history

provisions, and also

recovers wages under

federal law for the same

violation, the employee

must return the lesser

of the two amounts to

the employer.

2019 Ala. Laws 519

(H.B. 225)

Equal pay law (effective

Aug. 1, 2019): 2019 Ala.

Laws 519 (H.

B. 225)

Alabama Laws:

http://alisondb.legislatur

e.state.al.

us/acas/ACA

SLoginie.asp

The Pay Equity Project – Fifty-State Pay Equity Law Summary

Page | 2

November 10, 2021

Alabama

Coverage

Protected Classes

Key Provisions

Employer Defenses

Salary History

Retaliation

Remedies/Damages:

Citing References

“(b) An employer shall not refuse to interview, hire,

promote, or employ an applicant for employment, or

retaliate against an

applicant for employment

because the applicant does not provide wage

history. Wage history means the wages paid to an

applicant for employment by the applicant's

current or former employer.

The Pay Equity Project – Fifty-State Pay Equity Law Summary

Page | 3

November 10, 2021

Alaska

Coverage

Protected Classes

Key Provisions

Employer Defenses

Salary History

Retaliation

Remedies/Damages:

Citing References

Alaska

See Fair employment

practices law.

In compensation: Race,

religion, color, or

national origin (which

includes ancestry), age,

physical or mental

disability, sex, marital

status, marital status

changes, pregnancy, or

parenthood.

In the payment of

wages: sex

It is unlawful for an employer to discriminate in

compensation based on race, religion, color, or

national origin, which includes ancestry. It's also

unlawful for an employer to discriminate in

compensation based on age, physical or mental

disability, sex, marital status, marital status

changes, pregnancy, or parenthood, unless a

distinction on that basis is required by business

necessity or a position's reasonable demands.

Employers cannot discriminate based on sex in the

payment of wages. They also cannot pay female

employees in Alaska

at a salary or wage rate that

is less than the salary or wage rate paid to male

employees for comparable work or for work

in the

same operation, business, or line of work at the

same locality. [Note: The Alaska Supreme Court has

interpreted

comparable work to mean substantially

equal work, rather than work of comparable value

to the employer (Alaska State

Commission for

Human Rights v. State, Dept. of Administration, 796

P.2d 458 (Alaska 1990)).]

Employers and their employees cannot aid, abet,

incite, compel, or coerce unlawful discriminatory

acts or try to do so. Alaska Stat. § 18.80.260.

Statutory Language (Alaska Stat. § 18.80.220.

Unlawful Employment Practices):

"(a) Except as provided in (c) of this section, it is

unlawful for (1) an employer to refuse employment

to a person, or to bar a person from employment,

or to discriminate against a person in

compensation or in a term, condition, or privilege

of employment because of the person's race,

religion, color, or national origin, or because of the

person's age, physical or mental disability, sex,

marital status, changes in marital status,

pregnancy, or parenthood when the reasonable

demands of the position do not require distinction

on the basis of age, physical or mental disability,

sex, marital status, changes in marital status,

pregnancy, or parenthood…”

Statutes:

Alaska Stat. § 18.80.220

Alaska Admin. Code tit. 6, § 30.910

Employers can defend

against complaints of

such discrimination by

establishing that:

the distinction is

necessary for safe and

efficient business

operations;

the business purpose is

sufficiently compelling

to override any

disproportionate impact

on employees and

applicants in protected

classes;

the challenged

business practice

efficiently carries out

that business purpose;

and

there is no available or

acceptable policy or

practice that would

accomplish that

business purpose with

less discriminatory

impact.

N/A

See Fair employment

practices law.

See Fair employment

practices law.

Coverage: Alaska Stat.

§§ 18.80.220, 18.80.300

Alaska Admin. Code tit.

6, § 30.985

Pay Discrimination

Prohibitions: Alaska

Stat. §§ 18.80.220,

18.80.260

Alaska Admin. Code tit.

6, § 30.910

Alaska Laws:

http://www.legis.state.a

k.us/basis/folio.asp

Alaska Regulations:

http://www.legis.state.ak

.us/basis/aac.asp

The Pay Equity Project – Fifty-State Pay Equity Law Summary

Page | 4

November 10, 2021

Arizona

Coverage

Protected Classes

Key Provisions

Employer Defenses

Salary History

Retaliation

Remedies/Damages:

Citing References

Arizona

Public and private

employers (and their

agents) that employ

men and women are

covered by the Equal

pay law.

Ariz. Rev. Stat. § 23-

340

Equal pay law:

Sex

Fair employment

practices law:

Race, color, religion,

sex, age (40 and older),

national origin, or

disability.

Equal pay law:

Employers cannot pay employees of one sex at

wage rates that are less than the wage rates paid

to employees of the opposite sex for the same

quality and quantity of the same classification of

work in the same establishment. Wage means

any compensation for work measured by time,

piece, or another basis.

Ariz. Rev. Stat. §§ 23-340 to 23-341

Statutory Language.

23-341. Equal wage rates;

variations; penalties; enforcement

“A. Notwithstanding the other provisions of this

chapter, no employer shall pay any person in his

employ at wage rates less than the rates paid to

employees of the opposite sex in the same

establishment for the same quantity and quality of

the same classification of work, provided, that

nothing herein shall prohibit a variation of rates of

pay for male and female employees engaged in

the same classification of work based upon a

difference in seniority, length of service, ability,

skill, difference in duties or services performed,

whether regularly or occasionally, difference in

the shift or time of day worked, hours of work, or

restrictions or prohibitions on lifting or moving

objects in excess of specified weight, or other

reasonable differentiation, factor or factors other

than sex, when exercised in good faith.”

“G. The burden of proof shall be upon the person

bringing the claim to establish that the

differentiation in rate of pay is based upon the

factor of sex and not upon other differences,

factor or factors.”

Fair employment practices law:

Employers cannot discriminate in compensation

based on race, color, religion, sex, age (40 and

older), national origin, or disability.

Employers can vary

wage rates for male

and female employees

in the same work

classification if these

variations are made in

good faith and based

on differences in:

seniority or length of

service;

ability or skill;

duties or services that

are regularly or

occasionally performed;

the shift or time of day

worked or hours of

work;

restrictions or

prohibitions on lifting or

moving objects in

excess of a specified

weight; or

other reasonable

factors other than sex.

Fair employment

practices law:

Employers can apply

different compensation

standards pursuant to

bona fide seniority or

merit systems, pursuant

to systems that

measure earnings by

production quantity or

quality or to employees

who work in different

locations if these

differences are not the

result of an intent to

discriminate based on

race, color, religion,

sex, or national origin.

Employers also can

differentiate wages or

compensation based

on sex or disability if

these differences are

authorized by the

federal Fair Labor

Standards

Act (29

U.S.C. §§ 206(d), 214).

Ariz. Rev. Stat. §

41-

1463

N/A

See Fair employment

practices law.

Employers that violate

the Equal pay law can

be ordered to pay

employees the amount

of wages owed, for up

to 30 days before

employers received

written notice of

employees' claim, plus

litigation costs.

Ariz. Rev. Stat. §§ 23-

340 to 23-341

Coverage: Equal pay

law: Ariz. Rev. Stat. §

23-340

Fair employment

practices law: Ariz. Rev.

Stat. §§ 41-1461 to

41-

1463

Pay Discrimination

Prohibitions: Equal pay

law: Ariz. Rev. Stat.

§§ 23-340 to 23-341

Fair employment

practices law: Ariz. Rev.

Stat. § 41-1463

Penalties/Remedies:

Equal pay law:

Ariz.

Rev. Stat. §§ 23-340

to

23-341

Arizona Laws:

http://www.azleg.state.a

z.us/ArizonaRevisedSt

atutes.aspc

The Pay Equity Project – Fifty-State Pay Equity Law Summary

Page | 5

November 10, 2021

Arkansas

Coverage

Protected Classes

Key Provisions

Employer Defenses

Salary History

Retaliation

Remedies/Damages:

Citing References

Arkansas

Public and private

employers are covered

by the equal pay

provisions.

Ark. Code Ann. § 11-4-

601

Sex

Equal pay: Employers cannot discriminate solely

based on sex in the payment of wages or

compensation. They must pay employees equal

compensation for equal work.

Ark. Code Ann. § 11-4-601

Statutory Language (Ark. Code Ann. § 11-4-601.

Discrimination on the basis of sex prohibited.)

“(a) Every employer in the state shall pay

employees equal compensation for equal

services, and no employer shall discriminate

against any employee in the matter of wages or

compensation solely on the basis of the sex of the

employee.”

“(b) An employer who violates or fails to comply with

the provisions of this section shall be guilty of a

Class C

misdemeanor, and each day that the

violation or failure to comply continues shall be a

separate offense.”

Wage discrimination:

Employers cannot discriminate in the payment of

wages based on sex. They also cannot pay

female employees at salary or wage rates that are

less than those paid to male employees for

comparable work.

Ark. Code Ann. §§ 11-4-610 to 11-4-611

Statutory Language (Ark. Code Ann. § 11-4-610.

Additional sex discrimination)

“(a) No employer shall discriminate in the payment

of wages as between the sexes or shall pay any

female in his or her employ salary or wage rates

less than the rates paid to male employees for

comparable work.”

“(b) Nothing in §§ 11-4-607 -- 11-4-612 shall

prohibit a variation in rates of pay based upon a

difference in seniority, experience, training, skill,

ability, differences in duties and services

performed, differences in the shift or time of the

day worked, or any other reasonable

differentiation except difference in sex.”

Employers can pay

different wage rates

based on:

differences in seniority,

experience, training,

skill, or ability;

differences in duties

and services

performed;

differences in the shift

or time of day worked;

or

any other reasonable

differentiation other

than sex.

N/A

Wage discrimination:

Employers cannot

discharge or otherwise

discriminate against

employees because

they:

make complaints to their

employer, the Arkansas

Department

of Labor

and Licensing, or any

person alleging

violations of the wage

discrimination

provisions;

initiate or trigger

proceedings related to

the provisions; or

testify or are about to

testify in those

proceedings.

Ark. Code Ann. § 11-4-

608

Employers that violate

the equal pay

provisions are guilty of

a misdemeanor. Each

day of noncompliance

is considered a

separate offense.

Ark. Code Ann. § 11-4-

601

Coverage: Equal pay:

Ark. Code Ann. § 11-4-

601

Pay Discrimination

Prohibitions: Equal pay:

Ark. Code Ann. §

11-4-

601

Retaliation Prohibition:

Wage discrimination:

Ark. Code Ann. §

11-4-

608

Penalties/Remedies:

Equal pay: Ark. Code

Ann. § 11-4-601

Arkansas Laws:

http://www.state.ar.us/

The Pay Equity Project – Fifty-State Pay Equity Law Summary

Page | 6

November 10, 2021

California

Coverage

Protected Classes

Key Provisions

Employer Defenses

Salary History

Retaliation

Remedies/Damages:

Citing References

California

Public and private

employers are covered

by the Equal pay law.

The law does not cover

outside sales

employees or persons

participating in a

national service

program through

assistance provided

under 42 U.S.C. §

12571.

Cal. Lab. Code §§

1171, 1197.5

Public and private

employers are covered

by the wage payment

law.

Cal. Lab. Code §§ 232

to 232.5

Salary history: Public

and private employers

are covered by the

salary history

provisions.

Cal. Lab. Code § 432.3

Equal pay law:

Sex

Fair employment

practices law:

Employers cannot

discriminate in

compensation based

on race, religious

creed, color, national

origin, ancestry,

physical or mental

disability, medical

condition, genetic

information, marital

status, sex, gender,

gender identity, gender

expression, age (40

and older), sexual

orientation, or military

or veteran status,

unless a permissible

defense applies. They

also cannot

discriminate based on

perceived race,

religious creed, color,

national origin,

ancestry, physical or

mental disability,

medical condition,

genetic information,

marital status, sex, age

(40 and older), sexual

orientation, or military

or veteran status, and

cannot discriminate

based on an

association with people

who belong or are

perceived to belong to

these protected

classes. In addition,

employers cannot base

any amount of

compensation on

employees' sex, except

as legally required or

permitted

Equal pay law:

Employers cannot pay employees of one sex at

wage rates that are less than the wage rates paid

to employees of the opposite sex for substantially

similar work (when viewed as a composite of skill,

effort, and responsibility) performed under similar

working conditions. Employers also cannot pay

employees of one race or ethnicity at wage rates

that are less than the wage rates paid to

employees of another race or ethnicity for

substantially similar work (when viewed as a

composite of skill, effort, and responsibility)

performed under similar working conditions.

Until Jan. 1, 2019, employees' prior salary cannot,

by itself, justify any compensation disparity.

Employees' prior salary cannot justify any

compensation disparity; however, employers can

make compensation decisions based on current

employees' existing salary if any resulting wage

differential is justified by one or more of the

factors listed above. Cal. Lab. Code § 1197.5

Statutory Language: Cal. Lab. Code § 1197.5.

Equal wage rates; exceptions; liability; enforcement;

retaliation

“(a) An employer shall not pay any of its employees

at wage rates less than the rates paid to employees

of the opposite

sex for substantially similar work,

when viewed as a composite of skill, effort, and

responsibility, and performed under similar

working conditions, except where the employer

demonstrates:

The wage differential is based upon one or more

of the following factors:

A seniority system.

A merit system.

A system that measures earnings by quantity or

quality of production.

A bona fide factor other than sex, such as

education, training, or experience. This factor shall

apply only if the

employer demonstrates that the

factor is not based on or derived from a sex-based

differential in compensation, is job related with

respect to the position in question, and is

consistent with a business necessity. For

purposes of this subparagraph, “business

necessity” means an overriding legitimate

business purpose such that the factor relied upon

effectively fulfills the business purpose it is

supposed to serve. This defense shall not apply if

the employee demonstrates that an alternative

business practice exists that would serve the

Employers can pay

wage differentials,

based on any of the

following factors, if they

can show that these

factors are reasonably

applied and together

account for the entire

wage differential:

seniority or merit

systems; systems that

measure earnings by

production quantity or

quality; or any bona fide

factor other than sex,

race, or ethnicity, such

as education, training,

or experience.

Employers can base

wage differentials on

any bona fide factor

only if they can show

that the factor is job-

related, is consistent

with business

necessity, and is not

based on sex, race, or

ethnicity. Business

necessity means that

the factor is needed to

effectively fulfill a

legitimate business

purpose. This defense

does not apply if

employees can show

that an alternative

practice could serve the

same business purpose

without producing a

wage differential.

Fair Employment

Discrimination -

Permissible Defenses

Employers can

discriminate if they can

prove one of the

following permissible

defenses and show

that less discriminatory

alternatives are not

available: Business

necessity: If an

apparently neutral

Employers and their

agents cannot seek

information, orally or in

writing, about

applicants' salary,

compensation, or

benefits history.

Employers also cannot

rely on this information

as a factor in

determining whether to

offer applicants

employment or what

salary to offer them.

Applicants are people

seeking employment

with an employer that

they are not employed

by in any capacity or

position.

Applicants can

voluntarily disclose

information about their

salary, compensation,

or benefits history to

employers. If they do,

employers can

consider or rely on this

information in

determining what salary

to offer applicants.

Employers also can ask

applicants about their

salary expectations for

a position. These

provisions do not allow

applicants' prior salary,

by itself (until Jan. 1,

2019), to justify any

compensation disparity.

Employers must

provide a position's pay

scale to applicants who

make a reasonable

request

for this

information. pay scale is

a salary or hourly wage

range. A reasonable

request is a

request

made after applicants

have completed an

initial interview.

Employers cannot

discharge or otherwise

discriminate or retaliate

against employees

because they cause or

assist with the Equal

pay law's enforcement.

Employers also cannot

discharge or otherwise

discriminate or retaliate

against employees in

terms and conditions of

employment because

they engage in

protected conduct

under the law.

Cal. Lab. Code §

1197.5

If employers are sued

by the California

Department of Industrial

Relations or its Division

of Labor Standards

Enforcement, they can

be ordered to:

Pay employees the

amount of unpaid

wages due (plus

interest);

An additional equal

amount in liquidated

damages; and Costs. If

employers willfully

violate the law, the

division also can seek

court orders to stop

violations. Employers

that are sued by

employees can be

ordered to pay:

The amount of unpaid

wages due (plus

interest); An additional

equal amount in

liquidated damages;

Reasonable attorneys'

fees; and Costs. If

employees recover

such wages, interest, or

damages and

also

recover an amount

under the federal Equal

Pay Act for

the same

violation, they must

return the lesser

amount to employers.

Employers and their

officers, agents, or

employees who violate

or fail to comply with

the law are guilty of a

misdemeanor and can

be fined at least $100,

imprisoned for at least

30 days, or both. If they

willfully violate the law's

pay discrimination

prohibitions or willfully

reduce any employee's

wages to comply with

the prohibitions, they

are guilty of a

Coverage: Equal pay

law: Cal. Lab. Code §§

1171, 1197.5 Fair

employment practices

law: Cal. Gov't Code §§

12926 to 12926.05,

12926.2, 12928, 12940;

Cal. Code Regs. tit. 2,

§§

11008 (27-Z Cal.

Regulatory Notice Reg.

1013 (July 10, 2019)),

11027.1 to 11028

Pay Discrimination

Prohibitions: Equal pay

law: Cal. Lab. Code

§ 1197.5

Fair employment

practices law: Cal.

Gov't Code §§ 12940,

12964.5; Cal. Code

Regs. tit. 2, § 11034

Wage Disclosure:

Equal pay law: Cal.

Lab. Code § 1197.5

Salary History: Cal.

Lab. Code § 432.3

Retaliation Prohibition:

Equal pay law: Cal.

Lab. Code § 1197.5

Penalties/Remedies:

Equal pay law: Cal.

Lab. Code §§ 23,

1194.3, 1194.5, 1197.5,

1199 to 1199.5

California Laws:

http://leginfo.legislature.

ca.gov/faces/codes.

xhtml California

Department of Industrial

Relations, Division of

Labor Standards

Enforcement:

http://www.dir.ca.gov/dls

e/dlse.

html

The Pay Equity Project – Fifty-State Pay Equity Law Summary

Page | 7

November 10, 2021

California

Coverage

Protected Classes

Key Provisions

Employer Defenses

Salary History

Retaliation

Remedies/Damages:

Citing References

same business purpose without producing the

wage differential.”

Fair employment practices law:

Employers cannot discriminate in compensation

based on race, religious creed, color, national

origin, ancestry, physical or mental disability,

medical condition, genetic information, marital

status, sex, gender, gender identity, gender

expression, age (40 and older), sexual orientation,

or military or veteran status, unless a permissible

defense applies. They also cannot discriminate

based on perceived race, religious creed, color,

national origin, ancestry, physical or mental

disability, medical condition, genetic information,

marital status, sex, age (40 and older), sexual

orientation, or military or veteran status, and

cannot discriminate based on an association with

people who belong or are perceived to belong to

these protected classes. In addition, employers

cannot base any amount of compensation on

employees' sex, except as legally required or

permitted.

Employers must take reasonable steps to prevent

and promptly correct unlawful discrimination.

Employers cannot aid, abet, incite, compel, or

coerce unlawful discriminatory acts or try to do so.

Releases and nondisparagement agreements:

Employers cannot require employees to do either

of the following in exchange for a raise or bonus:

Sign a release of a claim or right under the Fair

employment practices law. A release of a claim or

right includes a

statement that an employee does

not have any claim or injury against an employer.

It also includes a release of the right to file and

pursue a civil action or complaint with, or to

otherwise notify, a state agency, other public

prosecutor, law enforcement agency, or any court

or other government entity.

Sign a nondisparagement agreement or other

document that appears to deny them the right to

disclose information about unlawful or potentially

unlawful acts in the workplace.

Any such release or agreement is unenforceable.

These provisions do not apply to negotiated

settlement agreements resolving claims under the

Fair employment practices law that employees

filed with a court, administrative agency, or

alternative dispute resolution forum or through

their employer's internal complaint process.

Settlement agreements are negotiated if they are

voluntary, deliberate, and informed; they provide

employment practice is

discriminatory in effect,

employers must prove

that an overriding,

legitimate business

purpose makes this

practice necessary to

safe, efficient business

operations; that the

practice effectively

accomplishes this

purpose; and that no

alternative practice

exists to accomplish

that purpose equally

well with a less

discriminatory impact.

Security regulations:

Employment practices

are

lawful if they

conform to applicable

federal or California

security regulations.

Nondiscrimination plans

or affirmative action

plans: Employment

practices are lawful if

they conform to bona

fide, voluntary

affirmative action plans

(under Cal. Code Regs.

tit. 2, § 11011),

nondiscrimination plans

(under Cal. Gov't Code

§ 12990), or state or

federal court or

administrative agency

orders. Otherwise

legally required:

Employment practices

are lawful if they are

required by state or

federal laws or court

orders.

Cal. Lab. Code § 432.3

misdemeanor and can

be fined up to $10,000,

imprisoned for up to six

months (for a

subsequent offense

after a prior conviction),

or both.

Retaliation prohibition:

Employers that retaliate

against employees for

engaging in protected

conduct can be ordered

to reinstate employees,

reimburse them for lost

wages and benefits

with interest, and

provide other remedies.

Cal. Lab. Code §§ 23,

1194.3, 1194.5, 1197.5,

1199 to 1199.5

The Pay Equity Project – Fifty-State Pay Equity Law Summary

Page | 8

November 10, 2021

California

Coverage

Protected Classes

Key Provisions

Employer Defenses

Salary History

Retaliation

Remedies/Damages:

Citing References

valuable consideration to employees; and

employees are given notice and an opportunity to

retain an attorney or are represented by an

attorney.

Cal. Gov't Code §§ 12940, 12964.5; Cal. Code

Regs. tit. 2, § 11034

The Pay Equity Project – Fifty-State Pay Equity Law Summary

Page | 9

November 10, 2021

Colorado

Coverage

Protected Classes

Key Provisions

Employer Defenses

Salary History

Retaliation

Remedies/Damages:

Citing References

Colorado

Public and private

employers with

employees in Colorado,

employment agencies,

and labor organizations

are covered by the

Equal pay law.

Employees do not

include domestic

service workers. The

law does not apply to

employers that are

exempt from the

federal National

Labor

Relations Act (29 U.S.C.

§ 151).

Colo. Rev. Stat. § 8-5-

101

Equal pay law:

Sex

Fair employment

practices law:

Disability, race, creed,

color, sex, sexual

orientation, religion,

age (40 and older),

national origin, or

ancestry. Sex

discrimination includes

discrimination based on

pregnancy. Sexual

orientation includes

transgender status.

Equal pay law: Employers cannot discriminate

solely based on sex in the amount of wages or

salary paid to employees. Colo. Rev. Stat. § 8-5-

102

Fair employment practices law:

Employers cannot discriminate in compensation

against qualified employees or applicants based

on disability, race, creed, color, sex, sexual

orientation, religion, age (40 and older), national

origin, or ancestry. Sex discrimination includes

discrimination based on pregnancy. Sexual

orientation includes transgender status.

Employers can make individual agreements

regarding compensation or terms, conditions, and

privileges of employment for employees with

disabilities if these agreements are part of a

therapeutic or job training program lasting up to

20 hours per week for up to 18 months.

Colo. Rev. Stat. § 24-34-402

Statutory Language: Colorado’s Equal Pay for Equal

Work Act (SB 19-085) -- Effective Jan 1, 2021. "(1)

An employer shall not discriminate between

employees on the basis of sex, or on the basis of

sex in combination with

another protected status

as described in section 24-34-402 (1)(a), by

paying an employee of one sex a wage rate less

than the rate paid to an employee of a different

sex for substantially similar work, regardless of

job title, based on a composite of skill; effort,

which may include consideration of shift work;

and responsibility, except where the employer

demonstrates each of the following: “(a) that the

wage rate differential is based on: a seniority

system; a merit system; a system that measures

earnings by quantity or quality of production; the

geographic location where the work is performed;

education, training, or experience to the extent that

they are reasonably related to the work in

question; or travel, if the travel is a regular and

necessary condition of the work performed; that

each factor relied on in subsection (1)(a) of this

section is applied reasonably; that each factor

relied on in subsection (1)(a) of this section

accounts for the entire wage rate differential; and

that prior wage rate history was not relied on to

justify a disparity in current wage rates.”

Where the employer

demonstrates each of

the following: (a) that

the wage rate

differential is based on:

a seniority system; a

merit system; a system

that measures earnings

by quantity or quality of

production; the

geographic location

where the work is

performed; education,

training, or experience

to the extent that they

are reasonably related

to the work in question;

or travel, if the travel is

a regular and

necessary condition of

the work performed;

that each factor relied

on in subsection (1)(a)

of this section is

applied reasonably;

that each factor relied

on in subsection (1)(a)

of this section accounts

for the entire wage rate

differential; and that

prior wage rate history

was not relied on to

justify a disparity in

current wage rates.”

Statutory Language:

Colorado’s Equal Pay

for Equal Work Act (SB

19-085)

An employer shall not:

seek the wage rate

history of a prospective

employee or rely on the

wage rate history of a

prospective employee

to determine a wage

rate; discriminate or

retaliate against a

prospective employee

for failing to disclose

the prospective

employee's wage rate

history; discharge, or in

any manner

discriminate or retaliate

against, an employee

for invoking this section

on behalf of anyone or

assisting in the

enforcement of this

subsection (2);

discharge, discipline,

discriminate against,

coerce, intimidate,

threaten, or interfere

with an employee or

other person because

the employee or person

inquired about,

disclosed, compared,

or otherwise discussed

the employee's wage

rate; prohibit, as a

condition of

employment, an

employee from

disclosing the

employee's wage rate;

or require an employee

to sign a waiver or other

document that: (i)

prohibits the employee

from disclosing wage

rate information; or (ii)

purports to deny the

employee the right to

disclose the

employee's wage rate

information.

Equal pay law (Effective

January 1, 2021)

Employers must not

discriminate or retaliate

against a prospective

employee for failing to

disclose their wage

history, or discharge,

discriminate, or retaliate

against an employee

for assisting in the

enforcement of the

wage history provisions

of the Equal pay law.

Employers also must

not discharge,

discipline, discriminate

against, coerce,

intimidate, threaten, or

interfere with an

employee or other

person because the

employee or person

inquired about,

disclosed, compared,

or otherwise discussed

the employee's wage

rate. Colo

. Rev. Stat. §

8-5-102 (2019 Colo.

Sess. Laws. 247 (S.B.

19-085)).

An employer can be

liable for: Legal and

equitable relief, with

may include

employment,

reinstatement,

promotion, pay

increase, payment of

lost wage rates, and

liquidated damages;

and

the employee’s

reasonable costs,

including attorneys’ fees.

Employers that violate

the Equal pay law can

be ordered to pay an

amount equal to the

difference between the

amount of wages or

salary paid to the

complaining employee

and the amount to

which the employee

would have received

had there been no

discrimination.

Employers that willfully

violate the prohibitions

also can be ordered to

pay an additional

amount up to such

wage or salary

difference.

Colo. Rev. Stat. § 8-5-

104

Coverage: Equal pay

law: Colo. Rev. Stat. §

8-5-101

Fair employment

practices law:

https://ccrd.colorado.go

v/regulatory-information

Colo. Rev. Stat. §§ 24-

34-301, 24-34-401 to

24-34-402; 3 Colo.

Code Regs. § 708-1-

10.2

Pay Discrimination

Prohibitions: Equal pay

law: Colo. Rev. Stat.

§ 8-5-102

Fair employment

practices law: Colo. Rev.

Stat. § 24-34-402

Wage Disclosure:

Equal pay law: Colo.

Rev. Stat.

§ 8-5-102

Fair employment

practices law: Colo.

Rev. Stat. § 24-34-402

Penalties/Remedies:

Equal pay law: Colo.

Rev. Stat. § 8-5-104

Colorado Laws:

https://www.colorado.g

ov/

Colorado Department

of Labor and

Employment:

http://www.colorado.go

v/cdle/labor

The Pay Equity Project – Fifty-State Pay Equity Law Summary

Page | 10

November 10, 2021

Connecticut

Coverage

Protected Classes

Key Provisions

Employer Defenses

Salary History

Retaliation

Remedies/Damages:

Citing References

Connecticut

Public and private

employers are covered

by the Equal pay law.

Conn. Gen. Stat. § 31-

75

Equal pay law:

Sex

Fair employment

practices law:

race, color, religious

creed, age, sex, gender

identity or expression,

marital status, national

origin, or ancestry; a

present or past history

of

mental, intellectual,

learning,

or physical

disabilities, including

blindness; or veteran

status, sexual

orientation, or civil

union status.

Equal pay law:

Employers cannot discriminate in compensation

solely based on employees' sex. They also cannot

pay employees of one sex at wage rates that are

lower than the wage rates paid to employees of

the opposite sex for equal work that requires

equal skill, effort, and responsibility under similar

working conditions. Such pay discrimination

occurs when employers adopt discriminatory pay

decisions or practices, employees become subject

to these decisions or practices, or employees

are

affected by the application of the decisions or

practices. A continuing violation occurs each time

wages, benefits, or

other compensation are paid.

Conn. Gen. Stat. §§ 31-75 (see Smart Code® for

the latest cases), 31-76

Statutory Language: Conn. Gen. Stat. Ann. § 31-75.

Discrimination in compensation on the basis of sex.

Prohibited

practices. Employer demonstration

"(a) No employer shall discriminate in the amount of

compensation paid to any employee on the basis of

sex. Any

difference in pay based on sex shall be

deemed a discrimination within the meaning of

this section."

"(b) If an employee can demonstrate that his or

her employer discriminates on the basis of sex by

paying wages to employees at the employer's

business at a rate less than the rate at which the

employer pays wages to employees of the

opposite sex at such business for equal work on a

job, the performance of which requires equal skill,

effort and responsibility, and which are performed

under similar working conditions, such employer

must demonstrate that such differential in pay is

made pursuant to (1) a seniority system; (2) a

merit system; (3) a system which measures

earnings by quantity or quality of production; or

(4) a differential system based upon a bona fide

factor other than sex, such as education, training

or experience. Said bona fide factor defense shall

apply only if the employer demonstrates that such

factor (A) is not based upon or derived from a sex-

based differential in compensation, and (B) is job-

related and consistent with business necessity.

Such defense shall not exist where the employee

demonstrates that an alternative employment

practice exists that would serve the same

business purpose without producing such

differential and that the employer has refused to

adopt such alternative practice."

Fair employment practices law:

Employers can pay

different wage rates

pursuant to seniority or

merit systems, systems

that measure earnings

by production quantity

or quality, or factors

other than sex (such as

education, training, or

experience) if these

factors are job-related

and consistent with

business necessity.

Employers cannot

inquire about

applicants' wage or

salary history, or direct

third parties to inquire

about applicants' wage

or salary history, unless

they disclose such

information voluntarily.

These provisions do not

apply to employers or

their agents if federal or

state law authorizes the

disclosure or

verification of such

information for

employment purposes.

Employers can inquire

about other elements of

an applicant's

compensation structure

as long as they do not

inquire about the value

of the elements of such

compensation

structure.

Wages means

compensation for labor

or services, regardless

of whether the amount

is calculated on a time,

task, piece,

commission, or other

basis.

Conn. Gen. Stat.

§ 31-40z

Employers cannot

discharge or otherwise

discriminate against

employees for opposing

discriminatory

compensation practices

or making complaints,

testifying, or assisting

in proceedings under

the Equal pay law.

Conn. Gen. Stat. § 31-

75

Employers that are

sued by the

Connecticut

Department of Labor

can be ordered to:

pay the difference

between the amount of

wages paid and the

maximum wage paid to

any other employee for

equal work;

pay compensatory

damages; and

pay punitive damages if

violations are

intentional or

committed with reckless

indifference to

employee rights under

the Equal pay law.

Employers that are

sued by employees can

be ordered to:

pay the difference

between the amount of

wages paid and the

maximum wage paid to

any other employee for

equal work;

pay compensatory

damages;

pay punitive damages if

violations are

intentional or

committed with reckless

indifference to

employee rights under

the Equal pay law;

pay attorneys' fees and

costs; and

comply with other court

orders.

Conn. Gen. Stat. §§ 31-

75 to 31-76

Equal pay law: Conn.

Gen. Stat. §§ 31-75 to

31-76

Fair employment

practices law: Conn.

Gen. Stat. §§ 46a-51,

46a-60, 46a-81c

Wage disclosure and

salary history:

https://www.cga.ct.gov/c

urrent/pub/chap_557.ht

mConn. Gen. Stat. §

31-40z

Connecticut Laws:

http://search.cga.state.ct

.

us/r/statute/dtsearch_f

orm.asp

Connecticut Department

of Labor:

http://www.ctdol.state.ct.

us/

The Pay Equity Project – Fifty-State Pay Equity Law Summary

Page | 11

November 10, 2021

Connecticut

Coverage

Protected Classes

Key Provisions

Employer Defenses

Salary History

Retaliation

Remedies/Damages:

Citing References

Unless there is a bona fide occupational

qualification or need, employers cannot

discriminate in compensation based on race,

color, religious creed, age, sex, gender identity or

expression, marital status, national origin, or

ancestry; a present or past history of mental,

intellectual, learning, or physical disabilities,

including blindness; or veteran status, sexual

orientation, or civil union status. Employers and

employees also cannot aid, abet, incite, compel,

or coerce unlawful discriminatory acts or try to do

so.

Conn. Gen. Stat. §§ 46a-60 (see Smart Code®

for the latest cases), 46a-81c

The Pay Equity Project – Fifty-State Pay Equity Law Summary

Page | 12

November 10, 2021

Delaware

Coverage

Protected Classes

Key Provisions

Employer Defenses

Salary History

Retaliation

Remedies/Damages

Citing References

Delaware

Private employers are

covered by the Equal

pay law. Private

employers with four or

more employees are

covered by the law's

mandatory poster

provisions.

Del. Code

Ann. tit. 19, § 1101

Salary history: Public

and private employers

and their agents are

covered by the salary

history provisions.

Del. Code Ann. tit. 19, §

709B

Equal pay law:

Sex

Fair employment

practices law:

race, marital status,

genetic information,

color, age (40 and

older), religion, sex,

pregnancy, sexual

orientation, gender

identity, or national

origin.

Equal pay law:

Employers cannot pay employees of one sex at

wage rates that are lower than the wage rates

paid to employees of the opposite sex for equal

work that requires equal skill, effort, and

responsibility under similar work conditions in the

same workplace. If employers pay wage rate

differentials in violation of these prohibitions, they

cannot reduce any employee's wage rate to

comply with the prohibitions. Employers also

cannot make or use any private agreements with

employees to set aside or avoid the prohibitions.

Employers can pay different wage rates pursuant

to seniority or merit systems, systems that

measure earnings by production quantity or

quality, or any other factor besides sex.

Del. Code Ann. tit. 19, §§ 1107A, 1110

Statutory Language: Del. Code Ann. tit. 19, §

1107A. Differential rate of pay based on gender

prohibited

No employees shall be paid a wage at a rate less

than the rate at which an employee of the

opposite sex in the same establishment is paid for

equal work on a job the performance of which

requires equal skill, effort and responsibility, and

which is performed under similar working

conditions, except where payment is made

pursuant to a differential based on: A seniority

system; A merit system; A system which

measures earnings by quantity or quality of

production; or Any other factor other than sex;

provided, that an employer who is paying a wage

rate differential in violation of this subsection shall

not, in order to comply with this subsection,

reduce the wage rate of any employee.

Fair employment practices law:

Employers cannot discriminate in compensation

based on race, marital status, genetic information,

color, age (40 and older), religion, sex,

pregnancy, sexual orientation, gender identity, or

national origin.

Employers can apply different compensation

standards pursuant to bona fide seniority or merit

systems, pursuant to systems that measure

earnings by production quantity or quality, or to

employees who work in different locations if these

differences are not caused by an intent to

discriminate based on those protected classes.

Del. Code Ann. tit. 19, § 711

N/A

Employers cannot:

screen applicants

based on their

compensation history,

including by requiring

that their prior

compensation satisfy

minimum or maximum

criteria; or

seek applicants'

compensation history

from them or their

current or former

employers.

Compensation includes

monetary wages,

benefits, and other

forms of compensation.

Employers can discuss

and negotiate

compensation

expectations with

applicants, but cannot

request or require their

compensation history.

Employers also can

confirm applicants'

compensation history

after they have

received and accepted

an offer of employment

that

includes the terms

of compensation. Del.

Code Ann. tit. 19, §

709B

Employers cannot

discharge or otherwise

discriminate against

employees because

they:

make complaints or

give information to the

Delaware Department

of Labor pursuant to the

Equal pay law;

initiate or are about to

initiate any proceedings

under the law; or

testify or are about to

testify in such

proceedings.

Del. Code Ann. tit. 19,

§§ 1101, 1112

Employers that violate

the Equal pay law can

be ordered to pay a fine

of $1,000 to $5,000 for

each violation, unpaid

wages, liquidated

damages, reasonable

attorneys' fees, and

costs.

Del. Code Ann. tit. 19,

§§ 1112 to 1113

Coverage: Equal pay

law: Del. Code Ann. tit.

19, § 1101

Fair employment

practices law: Del. Code

Ann. tit. 19, §§ 710 to

711

Pay Discrimination

Prohibitions: Equal pay

law: Del. Code Ann.

tit.

19, §§ 1107A, 1110

Fair employment

practices law: Del. Code

Ann. tit. 19, § 711

Wage Disclosure: Fair

employment practices

law: Del. Code Ann. tit.

19, § 711

Salary History: Del.

Code Ann. tit. 19, §

709B

Retaliation Prohibition:

Equal pay law:

Del. Code Ann. tit. 19,

§§

1101, 1112

Penalties/Remedies:

Equal pay law: Del.

Code Ann. tit. 19, §§

1112 to 1113

Delaware Laws:

http://delcode.delaware

.gov/index.shtml

Delaware Department

of Labor:

http://www.delawarewor

ks.com

The Pay Equity Project – Fifty-State Pay Equity Law Summary

Page | 13

November 10, 2021

Florida

Coverage

Protected Classes

Key Provisions

Employer Defenses

Salary History

Retaliation

Remedies/Damages:

Citing References

Florida

Public and private

employers are covered

by the Equal pay law.

The law does not apply

to employers that are

subject to the

federal

Fair Labor Standards

Act.

Fla. Stat. §§ 1.01,

448.07

Wage payment law:

Public and private

employers with two or

more employees are

covered by the wage

payment law. The law

does not apply to

employers that are

subject to the federal

Fair Labor

Standards

Act.

Fla. Stat. § 448.07

Sex, marital status,

race

Equal pay law:

Employers cannot discriminate based on sex,

marital status, or race in providing equal pay for

equal work. Fla. Stat. § 725.07

Fair employment practices law:

Employers cannot discriminate in compensation

based on race, color, religion, sex, pregnancy,

national origin, age, handicap, or marital status.

National origin includes ancestry. Employers can

take or fail to take any action based on religion,

sex, pregnancy, national origin, age, handicap, or

marital status if the action or inaction is justified

by a bona fide occupational qualification that is

reasonably necessary to job performance.

Employers can observe the terms of bona fide

seniority systems, bona fide employee benefit

plans (such as retirement, pension, or insurance

plans), or systems that measure earnings by

production quantity or quality if these terms are

not designed, intended, or used to evade the Fair

employment practices law. However, such

employee benefit plans or systems that measure

earnings cannot be used to justify a failure to hire

applicants based on factors unrelated to their job

performance ability. Such seniority systems,

employee benefit plans, or systems that measure

earnings also cannot be used to justify

employees' involuntary retirement based on

factors unrelated to their job performance ability.

These provisions do not prohibit employers from

rejecting applicants or discharging employees

who fail to meet their bona fide job requirements.

Fla. Stat. § 760.10

Wage payment law:

Employers cannot discriminate based on sex by

paying employees of one sex at wage rates that

are less than the wage rates paid to employees of

the opposite sex for equal work that requires

equal skill, effort, and responsibility under similar

working conditions. Wages include all

compensation paid by employers or their agents

for work performed by employees, including the

cash value of all compensation paid in any

medium other than cash. Wage rates are the

bases of compensation for work performed by

employees for employers, such as the amount of

time spent, number of operations accomplished,

and quality produced or handled.

Statutory Language: Fla. Stat. Ann. § 448.07. “(2)

Discrimination on basis of sex prohibited.—

Employers can pay

different wage rates

pursuant to:

seniority or merit

systems;

systems that measure

earnings by production

quantity or quality; or

good-faith differentials

based on any

reasonable factor other

than sex.

Fla. Stat. § 448.07

N/A

See Fair employment

practices law.

Employers that violate

the Equal pay law can

be ordered to pay

compensatory

damages, punitive

damages, and

reasonable attorneys'

fees.

Fla. Stat. § 725.07

Equal pay law: Fla.

Stat. §§ 1.01, 448.07,

725.07

Fair employment

practices law: Fla. Stat.

§§ 760.02,

760.10

Florida Laws:

http://www.leg.state.fl.u

s/Statutes/

The Pay Equity Project – Fifty-State Pay Equity Law Summary

Page | 14

November 10, 2021

Florida

Coverage

Protected Classes

Key Provisions

Employer Defenses

Salary History

Retaliation

Remedies/Damages:

Citing References

(a) No employer shall discriminate between

employees on the basis of sex by paying wages

to employees at a rate less than the rate at which

he or she pays wages to employees of the

opposite sex for equal work on jobs the

performance of which requires equal skill, effort,

and responsibility, and which are performed under

similar working conditions, except when such

payment is made pursuant to: A seniority system;

A merit system; A system which measures

earnings by quantity or quality of production; or A

differential based on any reasonable factor other

than sex when exercised in good faith.

(b) No person shall cause or attempt to cause an

employer to discriminate against any employee in

violation of the provisions of this section.”

The Pay Equity Project – Fifty-State Pay Equity Law Summary

Page | 15

November 10, 2021

Georgia

Coverage

Protected Classes

Key Provisions

Employer Defenses

Salary History

Retaliation

Remedies/Damages:

Citing References

Georgia

Public and private

employers are covered

by the Equal pay law if

they have 10 or more

employees.

Ga. Code Ann. § 34-5-2

Sex

Employers cannot pay employees of one sex at

wage rates that are lower than the wage rates

paid to employees of the opposite sex for equal

work that requires equal skill, effort and

responsibility under similar working conditions in

the same workplace. Employers that violate the

Equal pay law cannot reduce any employee's

wage rate to comply with the law.

Statutory Language: Ga. Code Ann. § 34-5-3.

Prohibition of discrimination.

“(a) No employer

having employees subject to any provisions of this

chapter shall discriminate, within any

establishment in which such employees are

employed, between employees on the basis of

sex by paying wages to employees in such

establishment at a rate less than the rate at which

he pays wages to employees of the opposite sex

in such establishment for equal work in jobs which

require equal skill, effort, and responsibility and

which are performed under similar working

conditions, except where such payment is made

pursuant to (1) a seniority system, (2) a merit

system, (3) a system which

measures earnings by

quantity or quality of production, or (4) a differential

based on any other factor other than sex. An

employer who is paying a wage rate differential in

violation of this subsection shall not, in order to

comply with this subsection, reduce the wage rate

of any employee.”

Employers can pay

different wage rates

pursuant to seniority,

merit or piece-rate

systems or any

factor

other than sex. Ga.

Code Ann. §§ 34-5-2,

34-5-3

N/A

Employers cannot

discharge or otherwise

discriminate against

employees because

they file complaints or

participate in

investigations, hearings

or other proceedings

under the Equal pay

law.

Ga. Code Ann. § 34-5-3

Employers that violate

the Equal pay law can

be fined up to

$100. Employers that

are sued can be

ordered to pay any

wages owed to

employees, plus

reasonable attorneys'

fees and costs.

Ga. Code Ann. §§

34-5-

3, 34-5-5

Coverage: Ga. Code

Ann. § 34-5-2

Pay Discrimination

Prohibitions: Ga. Code

Ann. §§ 34-5-2 to

34- 5-

3

Retaliation Prohibition:

Ga. Code Ann. § 34-5-3

Penalties/Remedies:

Ga. Code Ann. §§ 34-5-

3, 34-5-5 Georgia

Laws:

http://www.georgia.gov

Georgia Department of

Labor:

https://dol.georgia.gov/

The Pay Equity Project – Fifty-State Pay Equity Law Summary

Page | 16

November 10, 2021

Hawaii

Coverage

Protected Classes

Key Provisions

Employer Defenses

Salary History

Retaliation

Remedies/Damages:

Citing References

Hawaii

Private employers and

their agents are

covered by the Equal

pay law. The law does

not apply to employees

who work:

for guaranteed

compensation totaling

$2,000 or more per

month;

for their brother, sister,

brother-in-law, sister-in-

law, son, daughter,

spouse, parent, or

parent-in-law;

in a bona fide

executive,

administrative,

supervisory, or

professional capacity;

in a position where their

minimum wage or their

maximum hours without

overtime pay are

determined by the

federal Fair

Labor

Standards Act or Hawaii

law; or

in specific positions that

are excluded from the

definition of “employee”

in Haw. Rev. Stat. §

387-1.

Haw. Rev. Stat. § 387-1

Equal Pay:

Sex, race, religion

Fair employment

practices law:

Sex

Equal pay law:

Employers cannot discriminate in the payment of

wages based on race, religion, or sex. Wages do

not include tips or gratuities. Employers that pay

wage rate differentials in violation of the Equal pay

law cannot reduce any employee's wage rate to

comply with the law. The law cannot be

contravened or set aside through a private

agreement.

Fair employment practices law:

Employers cannot discriminate against employees

based on sex by paying employees of one sex at

wage rates that are less than those paid to

employees of the opposite sex for equal work that

requires equal skill, effort, and responsibility

under similar work conditions in the same

establishment.

Employers also cannot discriminate in

compensation based on:

race, gender identity or expression, sexual

orientation, age, religion, color, disability, marital

status, or arrest and court records;

sex, which includes pregnancy, childbirth, or

related medical conditions;

reproductive health decisions;

ancestry, which includes national origin;

employees' status as victims of domestic or sexual

violence if they notify employers, or employers

have actual knowledge, of this status; or

employees' credit history or credit report.

Employers and their employees cannot aid, abet,

incite, compel, or coerce unlawful discriminatory

practices or try to do so. Haw. Rev. Stat. §§ 378-1

to 378-2.3, 378-3

Haw. Code R. 12-46-1, 12-46-183

Statutory Language: Haw. Rev. Stat. Ann. § 378-

2.3. Equal pay; sex discrimination

“(a) No employer shall discriminate between

employees because of sex, by paying wages to

employees in an establishment at a rate less than

the rate at which the employer pays wages to

employees of the opposite sex in the

establishment for equal work on jobs the

performance of which requires equal skill, effort,

and responsibility, and that are performed under

similar working conditions. Payment differentials

resulting from:

A seniority system; A merit system;

A system that measures earnings by quantity or

quality of production; A bona fide occupational

qualification; or A differential based on any other

Equal Pay:

Employers can vary

wage rates for

employees in the same

work classification

based on seniority,

length of service, shift

or time of day worked,

work hours, or

substantial differences

in duties or services

performed.

Haw. Rev.

Stat. §§ 387-1, 387-4 to

387-4.5

Fair employment

practices law:

Employers can pay

wage differentials

based on:

seniority or merit

systems;

systems that measure

earnings by production

quantity or quality;

bona fide occupational

qualifications; or

other permitted factors

besides sex.

The Fair employment

practices law does not

affect the terms or

conditions of employer-

provided bona fide

retirement, pension,

employee benefit, or

insurance plans that

are not intended to

evade the law's

purpose.

Fair employment

practices law:

Employers and their

employees or agents

cannot inquire about

applicants' salary

history. Employers and

their employees or

agents also cannot rely

on applicants' salary

history to determine

their salary, benefits, or

other compensation

during the hiring

process, including

employment contract

negotiations.

Employers and their

employees or agents

can, without inquiring

about salary history,

engage in discussions

with applicants about

their expectations

regarding salary,

benefits, and other

compensation. If

applicants disclose

their salary history

voluntarily and without

prompting, employers

and their employees or

agents can verify that

history and consider it

in determining

applicants' salary,

benefits, and other

compensation.

The salary history

provisions do not apply

to attempts by

employers and their

employees or

applicants to verify

applicants' disclosure of

non-salary-related

information or to

conduct background

checks. If these

verifications or checks

disclose applicants'

salary history, however,

that disclosure cannot

Employers and their

agents can't discharge

or otherwise

discriminate against

employees because

they:

complain to employers,

the Hawaii Department

of Labor and Industrial

Relations, or anyone

else about their wages

not being paid in

accordance with the

Equal pay law;

initiate or trigger any

proceedings related to

the Equal pay law; or

testify or are about to

testify in those

proceedings.

Haw. Rev. Stat. §§ 387-

1, 387-12

Employers can be

ordered to stop acts or

practices that violate or

will violate the Equal

pay law and to comply

with the law.

Employers that willfully

violate the law or

related orders are guilty

of a misdemeanor and

fined $50 to $500

and/or imprisoned for

up to one year. The

same penalty applies to

employers and their

agents who pay or

agree to pay

employees less than

what they are entitled to

under the law. That

penalty also applies to

employers and their

agents who violate the

law's retaliation

prohibition.

Haw. Rev. Stat. § 387-

12

Coverage: Equal pay

law: Haw. Rev. Stat. §

387-1

Fair employment

practices law: Haw.

Rev. Stat. §§

378-1 to

378-2, 378-3

Pay Discrimination

Prohibitions: Equal pay

law:

Haw. Rev. Stat.

§§ 387-1, 387-4 to 387-

4.5

Fair employment

practices law: Haw.

Rev. Stat.

§§ 378-1 to

378-2.3, 378-3

Haw. Code R. 12-46-1,

12-46-183

Wage Disclosure: Fair

employment practices

law: Haw. Rev. Stat. §

378-2.3

Salary History: Fair

employment practices

law:

Haw. Rev. Stat.

§ 378-2.4

Retaliation Prohibition:

Equal pay law: Haw.

Rev. Stat. §§ 387-1,

387-12

Penalties/Remedies:

Equal pay law: Haw.

Rev. Stat. § 387-12

Hawaii Laws:

http://www.capitol.hawa

ii.gov/

Hawaii Department of

Labor and Industrial

Relations: http:

//labor.hawaii.gov/

The Pay Equity Project – Fifty-State Pay Equity Law Summary

Page | 17

November 10, 2021

Hawaii

Coverage

Protected Classes

Key Provisions

Employer Defenses

Salary History

Retaliation

Remedies/Damages:

Citing References

permissible factor other than sex [,] do not violate

this section.

(b) An employer shall not retaliate or discriminate

against an employee for, nor prohibit an employee

from, disclosing the

employee's wages, discussing

and inquiring about the wages of other

employees, or aiding or encouraging other

employees to exercise their rights under this

section.”

be relied on to

determine their salary,

benefits, or other

compensation during

the hiring process,

including employment

contract negotiations.

Applicants do not

include applicants for

an internal transfer or

promotion with their

current employer.

Inquire means

communicating written,

verbal, or other

questions or

statements to

applicants, their current

or former employers, or

the current or former

employees or agents of

those employers to

obtain applicants' salary

history. It also means

conducting searches of

publicly available

records or reports to

obtain applicants' salary

history. It does not

include informing

applicants, in writing or

otherwise, about a

position's proposed or

anticipated salary or

salary range.

Salary history includes

applicants' current or

prior salary, benefits,

and other

compensation, but

does not include

objective productivity

measures such as

revenue or sales

reports. Haw. Rev.

Stat. § 378-2.4

The Pay Equity Project – Fifty-State Pay Equity Law Summary

Page | 18

November 10, 2021

Idaho

Coverage

Protected Classes

Key Provisions

Employer Defenses

Salary History

Retaliation

Remedies/Damages:

Citing References

Idaho

Public and private

employers are covered

by the Equal pay law.

https://legislature.idaho.

gov/statutesrules/idstat/ti

tle44/t44ch17/sect44-

1701/

Idaho Code Ann. § 44-

1701

Equal pay law: Sex

Fair employment

practices law: race,

color, religion, sex,

national origin, age,

disability

Equal pay law:

Employers cannot discriminate against employees

in the same establishment based on sex.

Specifically, employers cannot pay employees of

one sex wage rates that are lower than the wage

rates paid to employees of the opposite sex for

comparable work that requires comparable skill,

effort, and responsibility.

Statutory Language: Idaho Code Ann. § 44-1702.

Discriminatory payment of wages based upon sex

prohibited

“(1) No employer shall discriminate between or

among employees in the same establishment on

the basis of sex, by paying wages to any

employee in any occupation in this state at a rate

less than the rate at which he pays any employee

of the opposite sex for comparable work on jobs

which have comparable requirements relating to

skill, effort and responsibility. Differentials which

are paid pursuant to established seniority systems

or merit increase systems, which do not

discriminate on the basis of sex, are not within

this prohibition.”

“(2) No person shall cause or attempt to cause an

employer to discriminate against any employee in

violation of this act.”

“(3) No employer may discharge or discriminate

against any employee by reason of any action

taken by such employee to invoke or assist in any

manner the enforcement of this act.”

Fair employment practices law:

Employers cannot discriminate against employees

in compensation based on race, color, religion,

sex, national origin, age, or disability. They also

cannot reduce any employee's wages to comply

with this prohibition. Employers can observe the

terms of bona fide seniority systems if they are not

used to evade the purposes of the Fair

employment practices law.

Idaho Code Ann. § 67-

5909

Employers can pay

differentials pursuant to

established seniority

systems or merit

increase systems that

do not discriminate

based on sex.

Idaho

Code Ann. §§ 44-1701

to 44-1702

N/A

Employers cannot