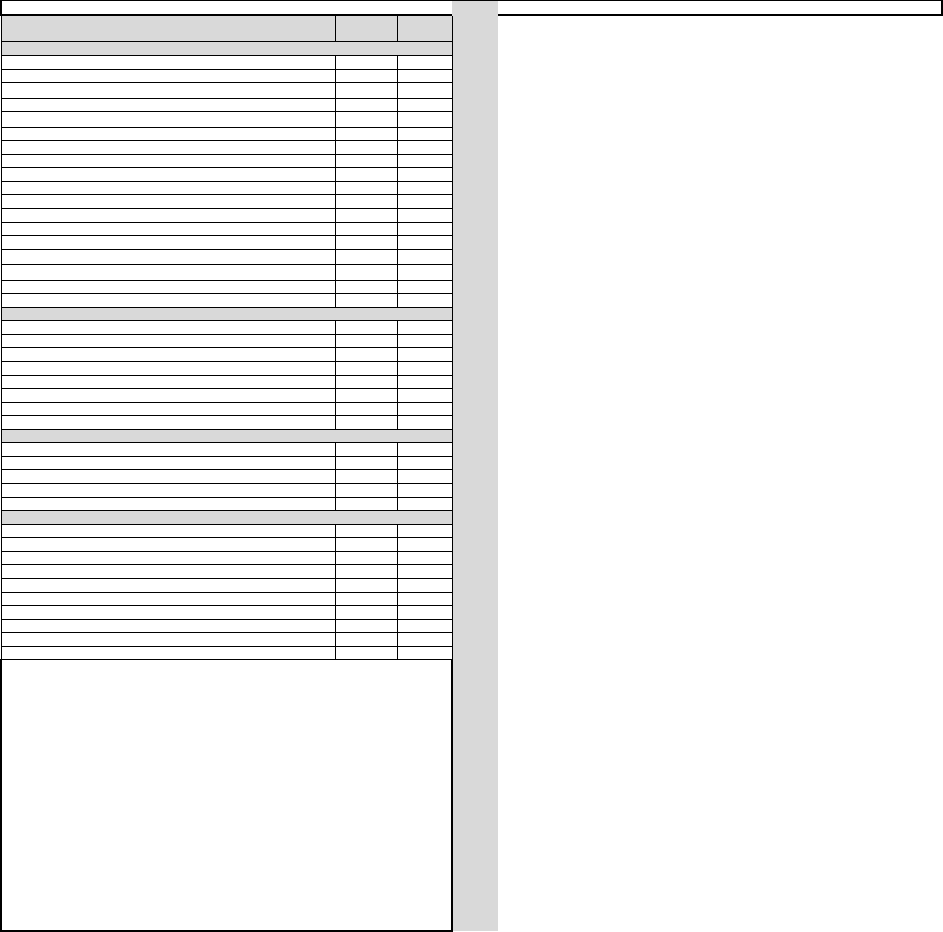

Municipality or County

Location

Code

Rate Municipality or County

Location

Code

Rate

Remainder of County 02-002 6.1875% Springer 09-301 7.5208%

Albuquerque 02-100 7.6250% Springer (Water & Sanitation Facility) 09-321 5.8333%

19 Pueblos District (AISD Property) (1)

a c

02-905 7.7500% Surgarite Canyon - Raton 09-172 5.8333%

19 Pueblos District (AISD Property) (2)

a c

02-906 7.7500%

Edgewood (Bernalillo) 02-334 7.6250% Remainder of County 05-005 5.8750%

Isleta Pueblo (1) 02-221 0.0000% Clovis 05-103 7.9375%

Isleta Pueblo (2)^ use location code 02-002 6.1875% Clovis Airport 05-154 5.8750%

Laguna Pueblo (1) 02-950 6.1875% Grady 05-203 6.6875%

Laguna Pueblo (2) 02-952 6.1875% Melrose 05-402 7.5000%

Los Ranchos de Albuquerque 02-200 7.1875% Texico 05-302 7.3125%

Lower Petroglyphs TID District 02-420 7.6250%

Mesa Del Sol TID District 1 02-606 7.6250% Remainder of County 27-027 6.5000%

Rio Rancho (Bernalillo) 02-647 7.8750% Fort Sumner 27-104 7.8125%

Sandia Pueblo (1) 02-901 6.4375%

Sandia Pueblo (2) 02-902 6.4375% Remainder of County 07-007 6.5000%

Santolina TID District 01 02-621 6.1875% Anthony ^ use location code 07-517 07-507

0.0000%

Santolina TID District 02 02-622 6.1875% Anthony (Water & Sanitation District) Municipality b 07-517 8.3750%

Santolina TID District 03 02-623 6.1875% Co Remainder (Water & Sanitation District) 07-527 6.7500%

Santolina TID District 04 02-624 6.1875% Downtown TIDD - Las Cruces 07-132 8.0625%

Santolina TID District 05 02-625 6.1875% Hatch 07-204 7.5625%

Santolina TID District 06 02-626 6.1875% Las Cruces 07-105 8.0625%

Santolina TID District 07 02-627 6.1875% Mesilla 07-303 7.9375%

Santolina TID District 08 02-628 6.1875% Sunland Park 07-416 8.1875%

Santolina TID District 09 02-629 6.1875%

Santolina TID District 10 02-630 6.1875% Remainder of County 03-003 5.7083%

Santolina TID District 11 02-631 6.1875% Artesia 03-205 7.6458%

Santolina TID District 12 02-632 6.1875% Carlsbad 03-106 7.3958%

Santolina TID District 13 02-633 6.1875% Hope 03-304 6.5833%

Santolina TID District 14 02-634 6.1875% Loving 03-403 7.3833%

Santolina TID District 15 02-635 6.1875%

Santolina TID District 16 02-636 6.1875% Remainder of County 08-008 6.3125%

Santolina TID District 17 02-637 6.1875% Bayard

08-206

7.6250%

Santolina TID District 18 02-638 6.1875% Hurley 08-404 7.3750%

Santolina TID District 19 02-639 6.1875% Santa Clara 08-305 7.3750%

Santolina TID District 20 02-640 6.1875% Silver City 08-107 8.1125%

South Campus TID District 02-430 7.6250%

State Fairgrounds 02-555 6.1875% Remainder of County* 24-024 6.3125%

Upper Petroglyphs TID District 1 02-607 6.1875% Santa Rosa* 24-108 8.3750%

Upper Petroglyphs TID District 2 02-608 6.1875% Vaughn* 24-207 8.4875%

Upper Petroglyphs TID District 3 02-609 6.1875%

Upper Petroglyphs TID District 4 02-610 6.1875% Remainder of County 31-031 5.8750%

Upper Petroglyphs TID District 5 02-611 6.1875% Mosquero (Harding) 31-208 6.6875%

Upper Petroglyphs TID District 6 02-612 6.1875% Roy 31-109 7.0625%

Upper Petroglyphs TID District 7 02-613 6.1875%

Upper Petroglyphs TID District 8 02-614 6.1875% Remainder of County 23-023 5.9375%

Upper Petroglyphs TID District 9 02-615 6.1875% Lordsburg 23-110 7.5000%

Village of Tijeras 02-318 8.0750% Virden 23-209 6.4375%

Winrock Town Center TID District 1 02-035 7.6250%

Winrock Town Center TID District 2 02-036 7.6250% Remainder of County 06-006 5.2500%

Eunice 06-210 7.0625%

Remainder of County 28-028 6.0625% Hobbs 06-111 6.5625%

Pueblo of Acoma (1) 28-923 8.0000% Jal 06-306 7.1875%

Pueblo of Acoma (2) 28-924 8.0000% Lovington 06-405 7.0000%

Reserve 28-130 7.7500% Lovington Industrial Park 06-158 5.2500%

Tatum 06-500 6.5625%

Remainder of County 04-004 6.2708%

Dexter 04-201 7.1458%

Hagerman 04-300 7.3333%

Lake Arthur 04-400 7.3333%

Roswell* 04-101 7.8958%

Location

Remainder of County 33-033 6.5625%

Code

Grants 33-227 7.8750%

Out-of-State Business (R&D Services) - 4.875% 77-777

Laguna Pueblo (1) 33-900 6.5625% Out-of-State Business (All Other) - 4.875% 88-888

Laguna Pueblo (2) 33-902 6.5625%

NOTE KEY

Milan 33-131 7.7500% (1) Sales to tribal entities or members

Pueblo of Acoma (1) 33-909 8.0000% (2) Sales to tribal non-members by tribal non-members

Pueblo of Acoma (2) 33-910 8.0000%

a

Businesses located on Pueblo land within the city limits.

Pueblo of Zuni (1) 33-911 6.5625%

b

Businesses located within the water district and the city limits.

Pueblo of Zuni (2) 33-912 6.5625%

c

Property owned by the 19 Pueblos of NM.

d

Land owned by Alamogordo outside Alamogordo boundaries.

Remainder of County 09-009 5.8333%

^ Indicates overlapping location code

Angel Fire 09-600 7.5208%

Cimarron 09-401 7.8958%

Eagle Nest 09-509 7.6333%

Maxwell 09-202 6.5833%

Raton 09-102 8.2583%

Raton Municipal Airport 09-152 5.8333%

LEA

CATRON

CHAVES

STATE GROSS RECEIPTS TAX RATE = 4.875%

CIBOLA

SPECIAL TAX RATES & REPORTING LOCATIONS

COLFAX

* Indicates rate change due to enactment/expiration of local option taxes and/or change in

the state gross receipts tax rate.

NOTE: See the listing of Special Location Codes used to report certain gross receipts tax

deductions in the GRT Form Instructions located in the current

GRT Filer's Kit at https://www.tax.newmexico.gov/forms-publications/

HIDALGO

GROSSRECEIPTSANDCOMPENSATINGTAXRATESCHEDULE EffectiveJanuary1,2024throughJune30,202

4

BERNALILLO COLFAX - Continued

CURRY

DE BACA

DONA ANA

EDDY

GRANT

GUADALUPE*

HARDING

Municipality or County

Location

Code

Rate Municipality or County

Location

Code

Rate

Remainder of County 26-026 5.2500% Santa Ana Pueblo (1) 29-951 6.1250%

Bonito Lake - Alamogordo

d

26-508 5.2500% Santa Ana Pueblo (2) 29-952 6.1250%

Capitan 26-211 6.5625% Stonegate Communities TIDD 29-038 7.4375%

Carrizozo 26-307 7.2000% Kewa Pueblo (1) 29-973 6.1250%

Corona 26-406 6.6875% Kewa Pueblo (2) 29-974 6.1250%

Ruidoso 26-112 8.1875% Village at Rio Rancho TIDD 29-525 7.4375%

Ruidoso Downs 26-501 7.1875% Zia Pueblo (1) 29-981 6.1250%

Zia Pueblo (2) 29-982 6.1250%

City and County 32-032 7.0625%

Remainder of County 16-016 6.5000%

Remainder of County 19-019 6.6250% Aztec 16-218 8.1875%

Columbus 19-212 8.2500% Bloomfield 16-312 8.1250%

Deming 19-113 8.2500% Farmington 16-121 8.1875%

Kirtland 16-323 6.8125%

Remainder of County 13-013 6.5000%

Gallup 13-114 8.0625% Remainder of County 12-012 6.5833%

Pueblo of Zuni (1) 13-901 6.5000% Las Vegas 12-122 8.1458%

Pueblo of Zuni (2) 13-902 6.5000% Mosquero (San Miguel) 12-418 7.1458%

Pecos 12-313 7.5208%

Remainder of County 30-030 6.5208%

Wagon Mound 30-115 7.5208% Remainder of County 01-001 6.8750%

Edgewood (Santa Fe) 01-320 7.9375%

Remainder of County* 15-015 6.2500% Espanola (Santa Fe) 01-226 8.8125%

Alamogordo* 15-116 8.1875%

Espanola/Santa Clara Grant (1)

a

01-903 8.8125%

Alamogordo Land

d*

15-322 6.2500%

Espanola/Santa Clara Grant (2)

a

01-904 8.8125%

Cloudcroft* 15-213 7.8125% Kewa Pueblo (1) 01-973 6.8750%

Tularosa* 15-308 7.6875% Kewa Pueblo (2) 01-974 6.8750%

Nambe Pueblo (1) 01-951 6.8750%

Remainder of County 10-010 6.4375% Nambe Pueblo (2) 01-952 6.8750%

House 10-407 7.7500% Pojoaque Pueblo (1)* 01-960 7.1250%

Logan 10-309 8.1250% Pojoaque Pueblo (2)* 01-962 7.1250%

San Jon 10-214 8.1250% Pueblo de Cochiti (1) 01-971 6.8750%

Tucumcari 10-117 8.1250% Pueblo de Cochiti (2) 01-972 6.8750%

Pueblo de San Ildefonso (1) 01-975 7.0000%

Remainder of County 17-017 6.6250% Pueblo de San Ildefonso (2) 01-976 7.0000%

Chama 17-118 8.3125% Santa Clara Pueblo (1) 01-901 6.8750%

Espanola (Rio Arriba) 17-215 8.6875% Santa Clara Pueblo (2) 01-902 6.8750%

Espanola/Ohkay Owingeh Pueblo (1)

a

17-943 8.6875% Santa Fe (city) 01-123 8.1875%

Espanola/Ohkay Owingeh Pueblo (2)

a

17-944 8.6875%

Santa Fe Indian School/Nineteen Pueblos of NM (1)

a c

01-907 8.1875%

Espanola/Santa Clara Grant (1)

a

17-903 8.6875%

Santa Fe Indian School/Nineteen Pueblos of NM (2)

a c

01-908 8.1875%

Espanola/Santa Clara Grant (2)

a

17-904 8.6875% Pueblo of Tesuque (1) 01-953 7.1250%

Jicarilla Apache Nation (1) 17-931 6.6250% Pueblo of Tesuque (2) 01-954 7.1250%

Jicarilla Apache Nation (2) 17-932 6.6250%

Ohkay Owingeh Pueblo (1) 17-941 6.6250% Remainder of County 21-021 6.6875%

Ohkay Owingeh Pueblo (2) 17-942 6.6250% Elephant Butte 21-319 7.9375%

Pueblo de San Ildefonso (1) 17-975 7.0000% Truth or Consequences 21-124 8.3750%

Pueblo de San Ildefonso (2) 17-976 7.0000% Truth or Consequences Airport 21-164 6.6875%

Santa Clara Pueblo (1) 17-901 6.6250% Williamsburg* 21-220 8.3750%

Santa Clara Pueblo (2) 17-902 6.6250%

Remainder of County 25-025 6.2500%

Remainder of County 11-011 6.3750% Magdalena 25-221 7.1875%

Causey 11-408 6.8750% Isleta Pueblo (1) 25-321 0.0000%

Dora 11-310 7.1250% Isleta Pueblo (2)^ use location code 25-025 6.2500%

Elida 11-216 7.7500% Pueblo of Acoma (1) 25-933 8.0000%

Floyd 11-502 6.8750% Pueblo of Acoma (2) 25-934 8.0000%

Portales 11-119 7.9375% Socorro (city) 25-125 7.5625%

Socorro Industrial Park 25-162 6.2500%

Remainder of County 29-029 6.1250%

Bernalillo (City) 29-120 6.9375%

Corrales 29-504 7.5625%

Cuba 29-311 8.0625%

Location

Edgewood (Sandoval) 29-335 6.9375%

Code

Jemez Springs 29-217 7.1875%

Out-of-State Business (R&D Services) - 4.875% 77-777

Jemez Pueblo (1) 29-941 6.2500% Out-of-State Business (All Other) - 4.875% 88-888

Jemez Pueblo (2) 29-942 6.2500%

Jicarilla Apache Nation (1) 29-931 6.1250% (1) Sales to tribal entities or members

Jicarilla Apache Nation (2) 29-932 6.1250% (2) Sales to tribal non-members by tribal non-members

Laguna Pueblo (1) 29-921 6.1250%

a

Businesses located on Pueblo land within the city limits.

Laguna Pueblo (2) 29-922 6.1250%

b

Businesses located within the water district and the city limits.

Los Diamantes TIDD 29-530 7.4375%

c

Property owned by the 19 Pueblos of NM.

Pueblo de Cochiti (1) 29-971 6.1250%

d

Land owned by Alamogordo outside Alamogordo boundaries.

Pueblo de Cochiti (2) 29-972 6.1250%

^ Indicates overlapping location code

Rio Rancho (Sandoval) 29-524 7.4375%

Pueblo de San Ildefonso (1) 29-975 7.0000%

* Indicates rate change due to enactment/expiration of local option

taxes and/or change in the state gross receipts tax rate.

Pueblo de San Ildefonso (2) 29-976 7.0000%

San Ysidro 29-409 6.6250%

Sandia Pueblo (1) 29-911 6.4375%

Sandia Pueblo (2) 29-912 6.4375%

SOCORRO

SANDOVAL

STATE GROSS RECEIPTS TAX RATE = 4.875%

SPECIAL TAX RATES & REPORTING LOCATIONS

NOTE KEY

NOTE: See the listing of Special Location Codes used to report certain gross receipts tax

deductions in the GRT Form Instructions located in the current

GRT Filer's Kit at https://www.tax.newmexico.gov/forms-publications/

ROOSEVELT

OTERO*

QUAY

RIO ARRIBA

LOS ALAMOS

SAN JUAN

LUNA

McKINLEY

SAN MIGUEL

SIERRA

LINCOLN SANDOVAL - Continued

GROSSRECEIPTSANDCOMPENSATINGTAXRATESCHEDULE EffectiveJanuary1,2024throughJune30,202

4

MORA

SANTA FE

Municipality or County

Location

Code

Rate

Remainder of County 20-020 7.0000%

El Prado Water and Sanitation District 20-415 7.2500%

El Prado Water and Sanitation District

b

20-425 8.9250%

El Valle de Los Ranchos Water & Sanitation District 20-419 7.2500%

El Valle de Los Ranchos Water & Sanitation District

b

20-429 8.9250%

Picuris Pueblo (1) 20-917 7.0000%

Picuris Pueblo (2) 20-918 7.0000%

Questa 20-222 8.0625%

Questa Airport 20-160 7.0000%

Red River 20-317 8.9250%

Taos (city) 20-126 8.6750%

Taos Airport 20-163 7.0000%

Taos Pueblo (1) 20-913 7.5000%

Taos Pueblo (2) 20-914 7.5000%

Taos/Taos Pueblo (1)

a

20-915 7.5000%

Taos/Taos Pueblo (2)

a

20-916 7.5000%

Taos Ski Valley (all GRT activity in location code 20-430) 20-414 8.9375%

Taos Ski Valley TIDD 20-430 8.9375%

Remainder of County 22-022 6.5000%

Encino 22-410 7.0625%

Estancia 22-503 7.9375%

Isleta Pueblo (1) 22-221 0.0000%

Isleta Pueblo (2)^ use location code 22-022 6.5000%

Moriarty 22-223 7.9375%

Mountainair 22-127 7.6875%

Willard 22-314 7.3125%

Remainder of County 18-018 5.8125%

Clayton 18-128 7.8750%

Des Moines 18-224 7.5000%

Folsom 18-411 7.2500%

Grenville 18-315 7.2500%

Remainder of County 14-014 6.6250%

Belen 14-129 8.0625%

Bosque Farms 14-505 8.3000%

Isleta Pueblo (1) 14-221 0.0000%

Isleta Pueblo (2)^ use location code 14-014 6.6250%

Laguna Pueblo (1) 14-900 6.6250%

Laguna Pueblo (2) 14-902 6.6250%

Los Lunas 14-316 8.4250%

Peralta 14-412 8.3000%

Rio Communities 14-037 8.3000%

Location

Code

Out-of-State Business (R&D Services) - 4.875% 77-777

Out-of-State Business (All Other) - 4.875% 88-888

NOTE KEY

(1) Sales to tribal entities or members

(2) Sales to tribal non-members by tribal non-members

a

Businesses located on Pueblo land within the city limits.

b

Businesses located within the water district and the city limits.

c

Property owned by the 19 Pueblos of NM.

d

Land owned by Alamogordo outside Alamogordo boundaries.

^ Indicates overlapping location code

VALENCIA

STATE GROSS RECEIPTS TAX RATE = 4.875%

SPECIAL TAX RATES & REPORTING LOCATIONS

* Indicates rate change due to enactment/expiration of local option taxes and/or change in

the state gross receipts tax rate.

NOTE: See the listing of Special Location Codes used to report certain gross receipts tax

deductions in the GRT Form Instructions located in the current

GRT Filer's Kit at https://www.tax.newmexico.gov/forms-publications/

UNION

GROSSRECEIPTSANDCOMPENSATINGTAXRATESCHEDULE

TAOS

TORRANCE

EffectiveJanuary1,2024throughJune30,202

4