Financial Aid Handbook

for

Tennessee Board of Regents

Tennessee Colleges of

Applied Technology

Nashville, Tennessee, 2018-2019

Revised: August 2018

2

TCAT FINANCIAL AID HANDBOOK 2018-2019 Page 2

MANUAL LAY-OUT

Administrative Requirements

Policies-eligibility

Title IV Programs:

Federal Pell

Policies

Calculations

Awarding

Federal SEOG and FWS

Policies

Calculations

Awarding

State Programs: TSAA,WNTSG, TN PROMISE, TCAT RECONNECT

Policies

Calculations

Awarding

Fiscal Policies

Institutional Cost of Attendance Budgets

Disbursement

Refund/Return of Title IV Funds

Professional Judgment

Reporting

Verification

Glossary

Personnel Listing

3

TCAT FINANCIAL AID HANDBOOK 2018-2019 Page 3

TABLE OF CONTENTS

Purpose ........................................................................................................................................... 6

Tennessee Colleges of Applied Technology Financial Aid Committee ........................................... 7

TCAT Financial Aid Advisory Board Members ................................................................................. 7

Administrative Responsibilities of Financial Aid Administrators at Tennessee Colleges of Applied

Technology ...................................................................................................................................... 8

Financial Aid Committee (campus) ..................................................................................... 8

Professional Organizations ................................................................................................. 8

Needs Analysis Services ...................................................................................................... 9

Administrative "Things" to Keep in the Financial Aid Office .......................................................... 9

Student File Components ............................................................................................................. 12

General Policies ............................................................................................................................. 13

Enrollment Status ............................................................................................................. 13

Academic Year Definition .................................................................................................. 13

Program Eligibility ............................................................................................................. 13

Student Eligibility .............................................................................................................. 14

Ability to Benefit ........................................................................................................................... 15

Satisfactory Progress and Attendance for Financial Aid ............................................................... 17

Title IV Programs:

Grants ................................................................................................................................ 20

Federal Pell Grant ................................................................................................. 20

Pell Grant Calculation Examples ........................................................................... 21

Year-Round Pell (150%) .................................................................................................... 27

Lifetime Eligibility Units LEU)............................................................................................28

Unusual Enrollment History (UEH) ...................................................................................28

Transfer Student's Award Calculation .......................................................................................... 28

Transfer Monitoring Requirements .............................................................................................. 29

Campus Based: FSEOG & FWS………………………………………………………………………………………………….30

Federal Supplemental Educational Opportunity Grant ........................................................... 30

Matching Requirements ................................................................................................... 31

Federal Work Study Program ........................................................................................................ 31

4

TCAT FINANCIAL AID HANDBOOK 2018-2019 Page 4

State Programs: TSAA, WNTSG, TN PROMISE & TCAT RECONNECT ............................................. 32

TSAA Eligibility ……………………………………………………………………………………………………………..33

Calculations of TSAA ......................................................................................................... 34

Certification....................................................................................................................... 34

Wilder-Naifeh Technical Skills Grant ................................................................................ 34

WNTSG Eligibility ............................................................................................................... 35

Retention of WNTSG ......................................................................................................... 35

Calculations of WNTSG ..................................................................................................... 36

Certification....................................................................................................................... 36

Over awards ................................................................................................................... 37

Refunds ................................................................................................................... 38

Change in Status ............................................................................................................... 40

Transfer of Students ......................................................................................................... 41

Leave of Absence .............................................................................................................. 41

Military Mobilization ......................................................................................................... 42

Appeal Procedures for WNTSG ......................................................................................... 42

IRP Appeals ................................................................................................................... 43

Appeals of IRP Decision ..................................................................................................... 43

TN PROMISE/TCAT RECONNECT.....…………………………………………………………………………….. 44

Institutional Cost of Attendance Budgets ..................................................................................... 51

Budget Components ......................................................................................................... 51

Budget Construction ......................................................................................................... 53

Packaging ...................................................................................................................................... 54

Disbursement Procedures ............................................................................................................ 55

Credit Memo and Cash Disbursements for Federal Pell and FSEOG ................................ 55

Federal Work Study Disbursements ................................................................................. 56

Disbursement of Checks ............................................................................................................... 57

Assignment of Student Account Numbers ................................................................................... 57

The Tennessee Board of Regents Refund of Maintenance Fees Policy ........................................ 58

Eligibility for Refunds ........................................................................................................ 60

Calculation of a Refund ..................................................................................................... 60

Bookstore Refund Policy ............................................................................................................... 58

Return of Title IV Funds Policy ...................................................................................................... 58

Return of Title IV Funds Calculation ................................................................................. 59

Applying Return of Title IV Funds Policy and TBR Refund Policy .................................................. 64

5

TCAT FINANCIAL AID HANDBOOK 2018-2019 Page 5

Return of Title IV Funds Calculation Worksheets ......................................................................... 65

Return of Title IV Funds Notification Requirements and Deadlines ............................................. 68

Sample Notification Letters .............................................................................................. 69

Reporting Overpayments .............................................................................................................. 73

Referral to Department of Education ........................................................................................... 74

Overpayment Referral Form ............................................................................................. 75

Referral Notice Letter ....................................................................................................... 76

Professional Judgment .................................................................................................................. 77

Student Consumer Information Guide ......................................................................................... 78

Reporting....................................................................................................................................... 80

Audit Requirements ...................................................................................................................... 83

Accounting and Reconciliation "Hints" ......................................................................................... 84

TCAT Responsibilities to Shared Service Center ........................................................................... 84

Verification .................................................................................................................................... 84

TN E Campus ................................................................................................................................. 89

Glossary ......................................................................................................................................... 91

TCAT Contact Persons ................................................................................................................... 94

6

TCAT FINANCIAL AID HANDBOOK 2018-2019 Page 6

PURPOSE

The purpose of this manual is to provide the basic guidelines for the administration of financial

aid at the Tennessee Board of Regents' Tennessee Colleges of Applied Technology and to

designate and correlate the responsibilities between the Tennessee Colleges of Applied

Technology and TBR Service Center.

Disbursement Plan for Tennessee Colleges of Applied Technology

* An academic year is represented by 1296 hours and 43.2 weeks. (1296 hours per

academic year divided by 30 hours per week = 43.2 weeks per academic year) [Rounds

to 44 weeks]

* Each academic term students will be assessed fees. Students enrolling or completing

between term’s beginning and ending dates will pay a prorated fee for that term based

upon the fee schedule. Fees must be paid during registration before a student will be

officially admitted to class. Thereafter, the fee must be paid at the beginning of each

term.

* For financial aid purposes, the payment period for programs that are one academic year

or less in length will be half an academic year or half the length of the program

respectively. For any remaining portion of a program that is more than half an academic

year but less than a full academic year, the payment period will be half of the remaining

hours in the program. If the remaining portion of the program is less than half an

academic year the payment period will be the remainder of the program.

Multiple disbursements may be made within the payment period.

* Students enrolling in programs that are less than an academic year will be awarded on a

prorated basis. (Pell Formula Four)

* The scheduled award is always based on a full-time student attending a full academic

year.

This manual is to be used in conjunction with Title IV regulations, Federal Student Aid

Handbook, Department of Education guidelines, State regulations, and institutional policies.

7

TCAT FINANCIAL AID HANDBOOK 2018-2019 Page 7

TENNESSEE COLLEGES OF APPLIED TECHNOLOGY

FINANCIAL AID COMMITTEE

The TCAT Financial Aid Committee was formed to develop and keep current the policies and

procedures manual and to provide training for the TCATs Financial Aid Officers. Currently, the

committee meets prior to each regional meeting (three times per year) and after each regional

meeting. The committee is also available at the request of the TBR Board Office for such

meetings as deemed necessary.

The TCAT Financial Aid Committee is made up of one TCAT financial aid officer from each of the

three grand regions of the State of Tennessee, East, Middle and West. In addition, there will be

a representative from the Tennessee Board of Regents.

The committee members from the TCATs will serve a four-year term. In the third year of their

term the committee member will serve as the committee chairperson. The fourth year of the

term will be spent as the past-chairperson. The past-chairperson is responsible for choosing

the new committee member to represent their region.

TCAT FINANCIAL AID ADVISORY BOARD MEMBERS

Jo Wallace, Chair, Tennessee College of Applied Technology – McKenzie

Alison Nunley, Tennessee College of Applied Technology-Crossville

Emily Wilson, Tennessee College of Applied Technology-Dickson

Chelle Travis, Tennessee Board of Regents

Julie Marlatt, Tennessee Board of Regents

8

TCAT FINANCIAL AID HANDBOOK 2018-2019 Page 8

ADMINISTRATIVE RESPONSIBILITIES OF FINANCIAL AID

ADMINISTRATORS AT TENNESSEE COLLEGES OF APPLIED TECHNOLOGY

Financial Aid Advisory Committee (on your campus)

The Financial Aid Advisory Committee should be appointed annually and meet at least once

annually. This committee will also serve as an appeal committee for students who request a

hearing. This committee must include, but is not limited to, two faculty members, two

students, one administrator and one clerical person with the Financial Aid Administrator as a

nonvoting member.

Professional Organizations

Through membership in professional organizations, the financial aid administrator is provided

with the information needed to successfully run the institution's aid programs. The financial aid

office has a broad responsibility for awarding, administering and coordinating virtually all

financial aid funds which flow through the institution and for acquiring those funds from the

federal, state and private sources. Critical to performing these responsibilities successfully is a

thorough understanding and continuous monitoring of regulations, legislation and philosophies

which affect the delivery of student aid. The professional staff which is current on these issues

is in a position to recommend appropriate action to the President of the institution and to

speak with authority in disseminating information to other departments of the institution.

There are three professional organizations to which aid administrators and the institution could

belong: Tennessee Association of Student Financial Aid Administrators (TASFAA-TN), Southern

Association of Student Financial Aid Administrators (SASFAA), and the National Association of

Student Financial Aid Administrators (NASFAA).

Through membership in these organizations, the aid administrator will be provided the most

current information on the administration of financial aid on a timely basis. These

organizations also provide many guides and manuals on developing an effective financial aid

office, as well as periodic workshops.

Through active participation in these professional organizations, the administrator comes in

contact with a vast network of financial aid administrators who can serve as resource persons

or as sounding boards in many instances. This interaction increases job performance.

9

TCAT FINANCIAL AID HANDBOOK 2018-2019 Page 9

Needs Analysis Services

Students must apply for all financial aid programs utilizing the FAFSA (Free Application for

Federal Student Aid). This service allows students to apply for all types of federal and state aid

(TSAA, WNTSG, TN Promise & TCAT Reconnect) and federal aid programs, (FWS, FSEOG, Federal

PELL). The information received once processed provides the necessary documentation to

establish a student's financial need.

The FAFSA online web address is: www.fafsa.gov

ADMINISTRATIVE "THINGS" TO KEEP IN THE FINANCIAL AID OFFICE

All schools should maintain the following administrative files and manuals in easily accessible

paper or electronic files. Many of the documents are located on the Department of Education

Information for Financial Aid Professionals web site. (http://ifap.ed.gov) Accessibility to this

web site is required.

Documents from the Department of Education are not mailed in hard copy, therefore, the TCAT

Financial Aid Committee recommends that the financial aid officer participate in the

Subscriptions System provided through the IFAP web site. This system will provide you, via

email, with a list of publications that have been added to the web site for the week. To

subscribe to this system, go to the IFAP web site and click on My IFAP. Then follow the

directions to register.

As a registered IFAP member, you are automatically enrolled for the weekly subscription

email service.

ON THE WEB – http://ifap.ed.gov

1. Office of Student Financial Aid (OSFA) guides.

a. Index of Regulations

b. Legislative Update for Federal Student Assistance Programs

c. Aid Administrator's Guide to IRS Forms and Schedules

2. The Blue Book (Accounting, Record keeping and Reporting by Post-secondary

Educational Institutions for Federally Funded Student Financial Aid Programs)

3. Audit Guide for Student Financial Assistance Programs

4. U.S. Department of Education - Higher Education Act of 1965 as Amended, Titles IV and

XII.

5. Title IV Regulations and Updates

10

TCAT FINANCIAL AID HANDBOOK 2018-2019 Page 10

6. Federal Registers

7. Dear Colleague/Partner Letters

9. Policy and Procedures Manual for TSAC

(https://clipslink.tsac.tn.gov/signon/SignOn.aspx)

10. All Federal Student Aid Handbooks (Federal Pell program manuals, calculation manuals;

handbooks published by USDE, etc.)

11. Verification Guide

12. Department of Education Action Letters

13. "Questions and Answers" (published by DOE periodically)

14. NASFAA Newsletters and Federal Monitors will be located on the NASFAA web site

www.nasfaa.org

HARD COPIES – OFFICE DOCUMENTS

15. Program Participation Agreements (past and present) plus all accompanying

certifications – Drug-free workplace, etc.

16. Letter of Eligibility (ECAR)

a. all materials and applications used to establish eligibility

b. signed letter from DOE certifying eligibility

17. Federal Application for Funds/Operations (kept on a fiscal year basis) FISAP

a. data to substantiate the information submitted on original application.

b. copy of signed original application

18. Notification of Final Funding Levels, as well as any Appeals Notification (kept per fiscal

year basis)

19. Student Budget Construction Explanations (kept per fiscal year). Include documentation

of budget components.

20. Student Consumer Information (see Consumer Info Guide on page 61)

11

TCAT FINANCIAL AID HANDBOOK 2018-2019 Page 11

21. TCAT Financial Aid Administrative Policies and Procedures Manual

22. Any audit reports and responses

23. A master list of all students receiving aid and the amounts received should be done on a

fiscal year basis. This is used for audits and reconciliation’s for end of the year reports.

This may be used in preparing the Financial Aid Office's FISAP.

24. Individual Student Files (active and inactive)

25. Drug Abuse Plan, Drug Free Workplace and Campus Information, Campus Crime

Statistics Report, and Student Right-to-Know data

26. Tracking and Disclosure requirements such as Satisfactory Progress reports, Lifetime

Eligibility Used (LEU)

NOTE: From time to time, additional material will be received which must be kept on

file.

REFERENCE: The Financial Aid Committee recommends that all financial aid records be

retained for five (5) years from the end of the award year in which the FISAP is

submitted. For example: FISAP is submitted September 30, 2018 for the year

ending June 30, 2018; records will be kept through 2023-2024. (Federal audits

may ask to see last 5 years)

12

TCAT FINANCIAL AID HANDBOOK 2018-2019 Page 12

STUDENT FILE COMPONENTS

The student's Financial Aid file will normally include:

1. Institutional Financial Aid Application if required by institution

2. It is required that a "Student Ledger” be kept in each student's file to help keep track of

awards and charges through the fiscal year.

3. NSLDS Transfer monitoring alerts received for any transfer student

4. Institutional Student Information Record (ISIR), Student Aid Report (SAR), or SAR

Information Acknowledgment Form

5. Verification Information and appropriate copies (refer to the USDOE Application and

Verification Guide)

6. Award(s) calculations

7. Award(s) or Non-award Notification (Accept or Decline response by student is not

required.)

8. Any pertinent material involved in FWS awards, such as job contracts, interview sheets,

job descriptions, payroll data, W-4's, approved INS documentation (I-9) ***May be kept

in the HR Office

9. Documentation of Dependency Status (where necessary)

10. Any pertinent material involved in Federal Pell awards, such as the SAR/ISIR, payment

documents, verification materials, etc.

11. State Agency Eligibility (TSAA, WNTSG, TN Promise and TCAT Reconnect) Schools can

access their electronic roster on the EGrands website.

12. FSEOG Awards require no specific documentation other than notification of the award

and the determination of exceptional financial need. (Federal Pell eligibility)

NOTE: From time to time, additional materials will be received which you must keep

on file.

13

TCAT FINANCIAL AID HANDBOOK 2018-2019 Page 13

GENERAL POLICIES

Enrollment Status

For purposes of awarding aid the following are the definitions of enrollment status: (Has to

meet eligible student and eligible program definition)

1. Full-time - any student enrolled and attending classes for a minimum of 30 hours

per week.

2. 3/4 Time - any student enrolled and attending classes for a minimum of 23-29

hours a week.

3. 1/2 Time - any student enrolled and attending classes for a minimum of 15-22

hours a week.

4. Any student enrolled less than 15 hours a week is considered a less than half

time student.

Academic Year Definition

An academic year is represented by 1296 hours with a minimum of forty (40) weeks. There

may be exceptions at institutions that have more or less than 1296 hours within an academic

year.

Program Eligibility

If a program is being offered by an eligible institution, it would have to meet the same

requirements for an eligible program as any other program at that institution in order for

students to receive Title IV Financial Aid Assistance. There are four major components to the

eligible program definition for Title IV Financial Assistance:

1. Regular student status

2. Certificate or Diploma

3. Minimum length of instructional time as prescribed by federal regulations

4. Accreditation by a USDE approved agency

Should an eligible institution offer a program of study either as a part of WIOA or Special

Industry on its own behalf which does not meet the regulatory definition of an eligible program,

that program of study is not eligible for purposes of Title IV Federal Aid. If fifty percent (50%) or

more of a program is taught at an off-site location, the location must be approved by the

accrediting agency and notification provided to the U.S. Department of Education via the

eligibility web site (www.eligicert.ed.gov). Eligibility begins from the date of accrediting agency

approval.

14

TCAT FINANCIAL AID HANDBOOK 2018-2019 Page 14

Student Eligibility

In order for a student to receive financial assistance from federal or state financial aid

programs, the student must:

* be enrolled as a regular student in an eligible program (Refer to Federal Guidelines for

exceptions).

* be a U.S. citizen/national or an eligible noncitizen.

* be making satisfactory academic progress in accordance with institutional policy.

* not be in default on a Federal Perkins/National Direct Student Loan, Federal Family

Education Loan, Federal Direct Student Loan, Income Contingent Loan or a Consolidated

Loan or must have documented satisfactory repayment arrangements if in default.

Note: Satisfactory repayment arrangements only clears eligibility for Federal Grants

* not owe a refund or repayment on a Federal Pell Grant, Tennessee Student Assistance

Award, Federal Supplemental Educational Opportunity Grant, Byrd Scholarship, or a

Wilder-Naifeh Technical Skills Grant or must have documented satisfactory repayment

arrangements.

* have a federal confirmation statement of registration compliance indicating either that

the student has registered with the Selective Service or that the student is not required

to register.

* have completed a statement of educational purpose saying that the student will use the

money only for expenses related to attending the school. (Usually collected on the

FAFSA).

* have a High School Diploma, GED, approved Home School certification, or be beyond

the age of compulsory school attendance in Tennessee and have the ability to benefit

from the education or training offered as prescribed by the US Department of

Education. (See Federal Student Aid Handbook Vol 1 Chap 1)

* Must not have been convicted of any drug related offense while receiving Title IV Aid.

15

TCAT FINANCIAL AID HANDBOOK 2018-2019 Page 15

ABILITY TO BENEFIT

Refer to FSA Handbook Volume 1, Chapter 1

If a student does not qualify to study at the postsecondary level; refer to FSA Handbook Vol 1

Chap 1 under Academic Qualification; then that student must complete one of the ability-to-

benefit (ATB) alternatives.

Students may become eligible for Title IV aid through the ATB alternatives in one of two ways.

If a student first enrolled in an eligible postsecondary program prior to July 1, 2012, the

student may enroll in any eligible program and can become eligible through one of the

ATB alternatives.

However, if a student first enrolled in an eligible postsecondary program on or after July

1, 2012, the student may only become eligible through one of the ATB alternatives if the

student is enrolled in an “eligible career pathway program.” See below for more details

about eligible career pathway programs.

An ATB student need not be enrolled concurrently in both the eligible postsecondary program

and the component for attaining a high school diploma or its recognized equivalent.

The ATB alternatives include:

• Passing an independently administered Department of Education approved ATB test

(see chart at the end of the ATB section in the FSA Handbook Vol 1, Chap 1).

• Completing at least 6 credit hours or 225 clock hours that are applicable toward a Title

IV-eligible degree or certificate offered by the postsecondary institution (neither

remedial nor developmental coursework count toward this requirement. The coursework

must demonstrate that the student has the ability to benefit from the postsecondary

program in which the student is enrolled or intends to enroll, but need not be applicable

to the specific degree or program in which the student is enrolled).

• Completing a State process approved by the Secretary of Education. Note: To date, no

State process has been submitted for the Secretary’s approval.

Eligible Career Pathway Programs: (Note: TCATs do not currently have an eligible Career

Pathways Program)

An “eligible career pathway program” means a program that combines rigorous and high-

quality education, training, and other services that:

1. Align with the skill needs of industries in the economy of the State or regional economy

involved;

16

TCAT FINANCIAL AID HANDBOOK 2018-2019 Page 16

2. Prepares an individual to be successful in any of a full range of secondary or postsecondary

education options, including apprenticeships registered under the Act of August 16, 1937

(commonly known as the “National Apprenticeship Act”; 50 Stat. 664, chapter 663; 29 U.S.C. 50

et seq.);

3. Includes counseling to support an individual in achieving the individual’s education and

career goals;

4. Includes, as appropriate, education offered concurrently with and in the same context as

workforce preparation activities and training for a specific occupation or occupational cluster;

5. Organizes education, training, and other services to meet the particular needs of an

individual in a manner that accelerates the educational and career advancement of the

individual to the extent practicable;

6. Enables an individual to attain a high school diploma or its recognized equivalent, and at least

one recognized postsecondary credential; and

7. Helps an individual enter or advance within a specific occupation or occupational cluster.

You must make a determination on whether a program meets these criteria, and you are

responsible for documenting that your career pathway program(s) meet each of the

requirements described above. The Department does not require that you receive approvals or

endorsements from a State or local workforce agency to fulfill these requirements, although

that may be one way that you document your compliance.

You must maintain documentation that each eligible career pathway program that you use

as a basis for determining a student’s eligibility under the ATB alternatives meets the above

requirements. This must include documentation that the program(s) in question include

workforce preparation activities and training for a specific occupation or occupational cluster,

and that the program is aligned with the skill needs of the U.S. state or regional economy in

which your school is located.

17

TCAT FINANCIAL AID HANDBOOK 2018-2019 Page 17

SATISFACTORY PROGRESS FOR FINANCIAL AID

A. To make satisfactory progress a student must:

1. Successfully complete 67% of cumulative scheduled hours (pace of completion).

All periods of enrollment for a student’s program will be included in determining

the cumulative scheduled hours used for SAP, regardless of receipt of Title IV aid

for the prior enrollments.

2. Must maintain a minimum cumulative passing grade of “C” or higher if specified

by the program and as published by the institution. CFR 668.34

B. Satisfactory progress will be evaluated at the expected end of a student’s payment

period. If the student fails to make satisfactory progress, the student will be placed on

financial aid warning for the next payment period. If the student fails to make

satisfactory progress for the next payment period, financial aid will be suspended.

There is no appeals process for financial aid satisfactory progress. In order to reestablish

eligibility for federal aid, a student must make satisfactory academic progress at the

next evaluation date. Once a student’s aid has been suspended, eligibility for state

grants cannot be reestablished.

C. Remedial Courses – Any courses considered ‘remedial’ are included in the student’s

normal program of study and are included in the students SAP calculation.

D. Program Changes - Changes in program will not affect SAP because a student will then

have a new program length and new payment periods.

E. Transfer Credit – Students who receive credit for hours completed for previous

education (other institutions, life experience, work credit, dual enrollment, etc.) will

have their program length reduced. A student that receives transfer credit will have a

maximum timeframe calculated based on the reduced program length. The hours and

grades for transfer credits will not be included when determining satisfactory academic

program (SAP)

F. Repeats

Program Repeats – Any student who completes an entire clock hour program and later

re-enrolls to take that same program again or to take another program may be paid for

repeating coursework regardless of the amount of time between completions of the

first program and beginning the same program or another program. The hours and

grades for the prior enrollment will not be included when determining satisfactory

academic progress for the new enrollment.

18

TCAT FINANCIAL AID HANDBOOK 2018-2019 Page 18

Course Repeats The repeated course grade will be counted along with the previously

assigned grade. Repeated course hours will count toward total cumulative hours (pace

of progression).

G. Withdrawals

Reentry within 180 days – A student who withdraws from a clock hour or credit hour

non-term program and reenters within 180 days is considered to remain in the same

payment period when he/she returns and, subject to conditions imposed by ED, is

eligible to receive FSA funds for which he/she was eligible prior to withdrawal, including

funds that were returned under R2T4 rules. The repeated course grade will be counted

along with the previously assigned grade. Repeated course hours will count toward

total cumulative hours (pace of progression).

Reentry after 180 days and transfer students – Generally, you must calculate new

payment periods for a clock hour or credit hour non-term program for:

* A student who withdraws and then reenters the same program at the same institution

after 180 days: the repeated course grade will be counted along with the previously

assigned grade. Repeated course hours will count toward total cumulative hours (pace of

progression), or

* A student who withdraws from a program and then enrolls in a new program at the

same institution, or at another institution within any time period. The student

establishes a new maximum timeframe based on the new program length. Hours and

grades from the previous program are not included when evaluating SAP for the new

program.

* Note: SAP Must be evaluated at the point of reentry regardless of the length of time

between enrollments. If the student’s previous hours + the number of hours required to

complete the program is greater than the maximum number of hours, then the student is

not eligible for Title IV aid.

For example – A student enrolls in Welding (1296 hour program) and completes 700

hours. Student returns 2 years later. Instructor requires student to retake entire

program. Student could not complete the program in 150% (1944 hours) as 1296 +700 =

1996 hours. Therefore, this student would not be eligible for Title IV aid upon re-entry.

19

TCAT FINANCIAL AID HANDBOOK 2018-2019 Page 19

H. Maximum Time Frame (this is for maximum timeframe only, cannot pay Title IV Aid for

more than 100% of the student’s program length)

Students may continue to receive Federal and State Aid at the pace of 67% or greater

until they have been enrolled 150% of their scheduled hours.

For example: A full-time student enrolled in a 1296 hours (12 months) program

progressing at a rate of 67% may take 1944 hours (18 months) to successfully complete

the 1296 hours. (Student would still only be paid Title IV aid for 1296 hours)

A student may receive aid while enrolled in this program, up to the point you

determine the student cannot complete the program within 150% (our maximum

timeframe for SAP). The student fails SAP for maximum timeframe at the evaluation

point where they can no longer graduate within the maximum timeframe - not at the

point where they actually hit the number of hours or weeks that make up the

maximum timeframe (this point is actually earlier than the actual maximum

timeframe).

If the student’s previous hours + the number of hours required to complete the

program is greater than the maximum number of hours, then the student is not

eligible for Title IV aid.

Example – A student enrolls in Welding (1296 hour program) and completes 700

hours. The student returns two (2) years later, and the instructor requires the student to

retake the entire program. The student could not complete the program in 150% (1944

hours) as 1296 +700 = 1996 hours. Therefore, this student would not be eligible for Title

IV aid upon re-entry.

I. Notification

Students will be notified of any evaluations that impact eligibility of Title IV aid.

Note: Students receiving Tennessee State Aid may not appeal unsatisfactory progress.

******************************************************************************

20

TCAT FINANCIAL AID HANDBOOK 2018-2019 Page 20

TITLE IV FEDRAL PROGRAMS: GRANTS, WORK-STUDY AND LOANS

GRANTS

FEDERAL PELL GRANT -

A Federal Pell Grant helps undergraduates pay for their education after high

school. For the Federal Pell Grant Program, an undergraduate is one who has

not earned a bachelor's or first professional degree.

For many students, Federal Pell Grants provide a "foundation" of financial aid, to

which aid from other Federal and non-Federal sources may be added.

ELIGIBILITY -

To determine if a student is eligible, the Department of Education uses a

standard formula, passed into law by Congress, to evaluate the information

reported on the Free Application for Federal Student Aid (FAFSA). The formula

produces an Expected Family Contribution (EFC) number. The SAR or ISIR

contains this number and will show whether the student is eligible.

The student must also meet general eligibility requirements.

PELL GRANT CALCULATION PROCEDURES

1. An academic year is represented by 1296 hours and 43.2 weeks. (1296 hours per

academic year divided by 30 hours per week = 43.2 weeks per academic year. [Rounds

to 44 weeks]

2. Students enrolling in programs for less than an academic year will be awarded on a

prorated basis.

3. The scheduled award is always based on a full-time student attending a full academic

year.

4. Fees must be paid during registration before a student will be officially admitted to

class. Students enrolling or completing between the academic term’s beginning and

ending dates will pay a prorated fee for that academic term based upon the fee

schedule.

21

TCAT FINANCIAL AID HANDBOOK 2018-2019 Page 21

5. For financial aid purposes, the payment period for programs that are one academic year

or less in length will be half an academic year or half the length of the program

respectively. For any remaining portion of a program that is more than half an academic

year but less than a full academic year, the payment period will be half of the remaining

hours in the program. If the remaining portion of the program is less than half an

academic year the payment period will be the remainder of the program. Multiple

disbursements may be made within the payment period.

6. Prior to the second payment period and subsequent payment periods, confirm the

student’s continuing eligibility by checking satisfactory academic progress (SAP).

**Students must also complete the hours and weeks in the first payment period in

order to progress to the next payment period (payment period progression) in order to

be eligible for the next payment period disbursement.

7. The scheduled award is determined by using the annual federal payment schedule for a

full-time student. On the full-time schedule, locate the row for the cost of attendance

(use a 12 month budget) and move across to the *appropriate EFC column. This amount

represents the scheduled award for a full academic year.

*Per the Department of Education’s Federal Regulations, always use the 9-

month EFC when determining the Federal Pell Grant scheduled award.

Example

Expected Family Contribution

Cost of

0

1

101

201

301

401

501

601

701

801

901

1001

1101

Attend.

to

to

to

to

to

to

to

to

to

to

to

to

to

0

100

200

300

400

500

600

700

800

900

1000

1100

1200

3200-3299

$

$

$

$

$

$

$

$

$

$

$

$

$

3300-99999

$

$

$

$

$

$

$

$

$

$

$

$

$

8. Students attending less than half time must be paid Pell if all other eligibility

requirements are met.

22

TCAT FINANCIAL AID HANDBOOK 2018-2019 Page 22

9. Formula 4 of Pell payment calculations is performed in the following manner:

Annual Award x the lesser of:

Weeks of instructional time for a full-time student to complete hours in payment period

Weeks of instructional time in program's definition of academic year

OR

Number of Hours enrolled for the payment period = Disbursement payment period

Number of Hours in program's definition of academic year

SAMPLES ON FOLLOWING PAGES

23

TCAT FINANCIAL AID HANDBOOK 2018-2019 Page 23

Sample 1: Full time student who enrolls for a full academic year in a 2160 clock hour program.

Academic Term

Summer

Fall

Spring

Summer

Fall

Award Year

09-10/09-10

10-11/10-11

10-11/10-11

10-11/10-11

11-12/11-12

Hours Enrolled

432

216 / 216

432

432

432

Payment Period

648 hours/ 22 weeks

648 hours/ 22 weeks

432 hours

432 hours

Payment Amt

$2775 (10-10)

$2775

$1850 (11-12)

$1850 (11-12)

a. Determine award for the year based on EFC, Cost of Attendance, and Federal Pell

Payment Schedule.

b. Scheduled X Lesser of: # of weeks in Payment Period

Award # of weeks in academic year

Or

# of Hours in payment period = Expected Award for Payment Period

# of Hours in Academic Year

1. EFC = 0000, Cost of Attendance = $8444, Scheduled 09-10 Award Maximum = $5350

Scheduled 10-11 Award Maximum = $5550. Assume same Award Maximum for 11-12.

2. $5550 x 21.6 or 648 = $2775 Expected Disbursement for payment period

43.2 1296 **in this case the weeks and hours are the same %

3. Payment periods may continue into the next academic term. Student would not be

eligible for another disbursement until they have successfully completed both the hours

and weeks in the first payment period (648 hours and 21.6 weeks). The remainder of the

program (1512 hours) is more than a full academic year (1296 hours) therefore, a second

payment period of 648 hours should be scheduled, provided SAP has been met. Since the

remainder of the program (864 hours) is less than a full academic year (1296 hours) but

more than one half of an academic year (648 hours), the remaining period would be divided

into two equal payment periods of 432 hours each. *Payment periods that crossover July 1

are subject to crossover rules. The award would be $2775 for the first payment period

(648 hours and 21.6 weeks). As the student reaches the end of the first payment period

(648 hours and 21.6 weeks), SAP must be evaluated. If SAP has been met and when 648

clock hours of instruction have been successfully completed, the second disbursement

should be awarded. (If SAP has not been met, then the student should be issued a “financial

aid warning” and the second disbursement cannot be awarded until the student has

successfully completed 648 clock hours of instruction.) In this case the Financial Aid

Administrator (FAA) would check SAP again at the end of the second payment period. If SAP

was met, the FAA would continue with payment period 3 after the successful completion of

24

TCAT FINANCIAL AID HANDBOOK 2018-2019 Page 24

1296 clock hours. If SAP was not met, the student would lose financial aid eligibility. Also, in

this case the Financial Aid Administrator (FAA) would check SAP again at the end of the third

payment period. If SAP was met, the FAA would continue with payment period 4 after the

successful completion of 1728 clock hours.

REMINDER: Federal Pell funds must be disbursed out of the same fiscal year within each

payment period.

Sample 2: Full time student who enrolls with 204 hours remaining in Summer academic term in

a 1728 clock hour program.

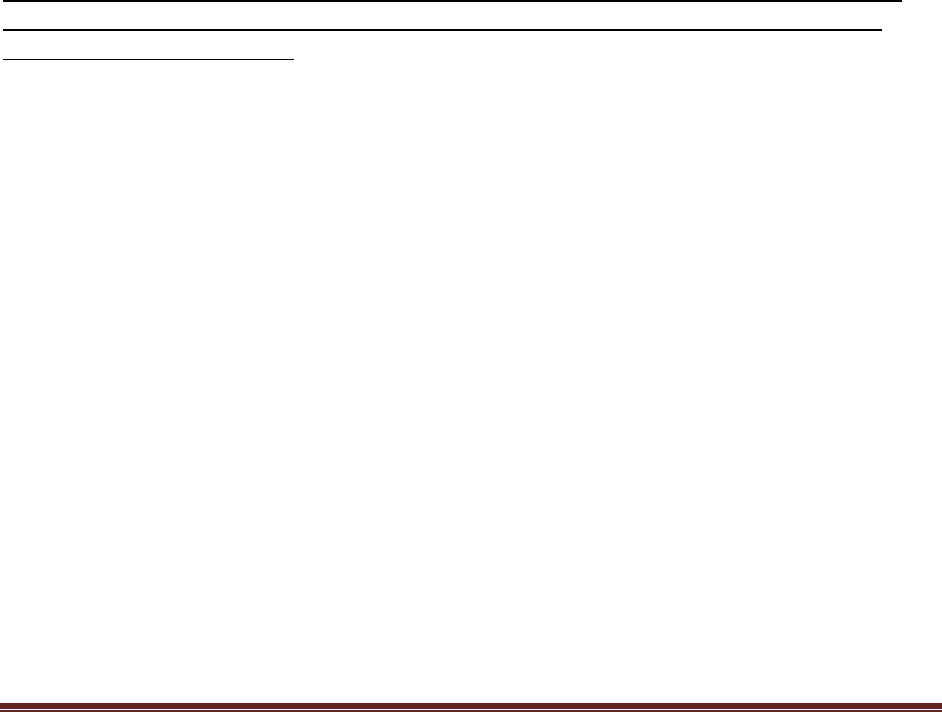

Academic

Term

Summer

Fall

Spring

Summer

Fall

Award Year

09-10/09-10

10-11/10-11

10-11/10-11

10-11/10-11

11-12/11-12

Hours

Enrolled

204

432

12

420

228

204

228

Payment

Period

648 hours/ 22 weeks

648 hours/ 22 weeks

432 hrs/15 wks

Payment Amt

$2775 (10-11)

$2775 (10-11)

$1850 (11-12)

a. Determine award for the year based on EFC, Cost of Attendance, and Federal Pell Payment

Schedule.

b. Scheduled x Lesser of Weeks in Payment Period or Number of Hours Enrolled = Expected Award

Award Weeks in Academic Yr Number of Hrs in Academic Yr for Payment Period

1. EFC = 0000, Cost of Attendance = $8444, Scheduled 09-10 Award Maximum = $5350 per

academic year

Scheduled 10-11 Award Maximum = $5550 per academic year. Assume same Award

Maximum for 11-12.

2. $5550 x 21.6 or 648 = $2775 Expected Disbursement for payment period

43.2 1296 ** in this case the weeks and hours are the same %

25

TCAT FINANCIAL AID HANDBOOK 2018-2019 Page 25

3. Payment periods may continue into the next academic term. Student would not be eligible

for another disbursement until they have successfully completed both the hours and weeks in

the first payment period (648 hours and 21.6 weeks). *Payment periods that crossover July 1

are subject to crossover rules. The award would be $2775 for the first payment period (648

hours and 21.6 weeks). As the student reaches the end of the first payment period (648 hours

and 21.6 weeks), SAP must be evaluated. If SAP has been met and when 648 clock hours of

instruction have been successfully completed, the second disbursement should be awarded. (If

SAP has not been met, then the student should be issued a “financial aid warning” and the

second disbursement cannot be awarded until the student has successfully completed 648

clock hours of instruction.) In this case the Financial Aid Administrator (FAA) would check SAP

again at the end of the second payment period. If SAP was met, the FAA would continue with

payment period 3 after the successful completion of 1296 clock hours. If SAP was not met, the

student would lose financial aid eligibility.

REMINDER: Federal Pell funds must be disbursed out of the same fiscal year within each

payment period.

Sample 3: Full time student who enrolls with 204 hours remaining in Summer academic term in

an 864 clock hour program

a. Determine award for the year based on EFC, Cost of Attendance, and Federal Pell Payment

Schedule.

Academic

Term

Summer

Fall

Spring

Summer

Fall

Award Year

09-10/09-10

10-11/10-11

10-11/10-11

10-11/10-11

11-12/11-12

Hours

Enrolled

204

228

204

228

Payment

Period

432

432

Payment Amt

$1850 (10-11)

$1850 (10-11)

b. Scheduled x Lesser of Weeks in Payment Period or Number of Hours Enrolled = Expected Award

Award Weeks in Academic Yr Number of Hrs in Academic Yr for Payment Period

1. EFC = 0000, Cost of Attendance = $8444, Scheduled 09-10 Award Maximum = $5350 per

academic year

Scheduled 10-11 Award Maximum = $5550 per academic year. Assume same Award

Maximum for 11-12.

2. $5550 x 14.4 or 432 = $1850 Expected Disbursement for payment period

43.2 1296 ** in this case the weeks and hours are the same %

26

TCAT FINANCIAL AID HANDBOOK 2018-2019 Page 26

3. Payment periods may continue into the next academic term. Student would not be eligible

for another disbursement until they have successfully completed both the hours and weeks in

the first payment period (432 hours and 14.4 weeks). *The entire program (864 hours) is less

than an academic year (1296 hours) but more than one half of an academic year and will be

divided into two payment periods of 432 hours. *Payment periods that crossover July 1 are

subject to crossover rules. The award would be $1850 for the first payment period (432 hours

and 14.4 weeks). As the student reaches the end of the first payment period (432 hours and

14.4 weeks), SAP must be evaluated. If SAP has been met and when 432 clock hours of

instruction have been successfully completed, the second disbursement should be awarded. (If

SAP has not been met, then the student should be issued a “financial aid warning” and the

second disbursement cannot be awarded until the student has successfully completed 432

clock hours of instruction.)

REMINDER: Federal Pell funds must be disbursed out of the same fiscal year within each

payment period.

Sample 4: Full time student who enrolls for a full academic year in a 1918 clock hour program.

Academic

Term

Summer

Fall

Spring

Summer

Fall

Award Year

09-10/09-10

10-11/10-11

10-11/10-11

10-11/10-11

11/12/11-12

Hours

Enrolled

432

216

216

432

432

190

Payment

Period

648 hours/ 22 weeks

648 hours/22 weeks

622 hours/ 21 weeks

Payment Amt

$2775 (10-11)

$2775 (10-11)

$2664 (11/12)

a. Determine award for the year based on EFC, Cost of Attendance, and Federal Pell Payment

Schedule.

b. Scheduled X Lesser of: # of weeks in Payment Period

Award # of weeks in academic year

Or

# of Hours in payment period = Expected Award for

# of Hours in Academic Year Payment Period

27

TCAT FINANCIAL AID HANDBOOK 2018-2019 Page 27

1. EFC = 0000, Cost of Attendance = $8444, Scheduled 09-10 Award Maximum = $5350

Scheduled 10-11 Award Maximum = $5550. Assume same Award Maximum for 11-12.

2. $5550 x 21.6 or 648 = $2775 Expected Disbursement for payment period

43.2 1296 ** in this case the weeks and hours are the same %

3. Payment periods may continue into the next academic term. Student would not be

eligible for another disbursement until they have successfully completed both the hours

and weeks in the first payment period (648 hours and 21.6 weeks). *Payment periods that

crossover July 1 are subject to crossover rules. The award would be $2775 for the first

payment period (648 hours and 21.6 weeks). As the student reaches the end of the first

payment period (648 hours and 21.6 weeks), SAP must be evaluated. If SAP has been met

and when 648 clock hours of instruction have been successfully completed, the second

disbursement should be awarded. (If SAP has not been met, then the student should be

issued a “financial aid warning” and the second disbursement cannot be awarded until the

student has successfully completed 648 clock hours of instruction.) In this case the

Financial Aid Administrator (FAA) would check SAP again at the end of the second payment

period. The remainder of the program (622 hours and 20.73 weeks) is less than one half of

an academic year (1296 hours) the third payment period will be for the remaining hours

(622). If SAP was met, the FAA would continue with payment period 3 after the successful

completion of 1296 clock hours. If SAP was not met, the student would lose financial aid

eligibility.

YEAR-ROUND PELL GRANT (150%)

This provision is effective beginning with the 2017–2018 award year it allows a student to

receive Federal Pell Grant funds for up to 150% of the student’s Pell Grant Scheduled Award for

an award year.

To be eligible for the additional Pell Grant funds, the student must be otherwise eligible to

receive Pell Grant funds for the payment period and must be enrolled at least half-time, in the

payment period(s) for which the student receives the additional Pell Grant funds in excess of

100% of the student’s Pell Grant Scheduled Award.

For a student who is eligible for the additional Pell Grant funds, the institution must pay the

student all of the student’s eligible Pell Grant funds, up to 150% of the student’s Pell Grant

Scheduled Award for the award year. Note that the provisions of the new law state that any Pell

Grant received will be included in determining the student’s Pell Grant duration of eligibility

and Lifetime Eligibility Used (LEU)

(For additional guidance see Dear Colleague GEN-17-06 dated June 19, 2017)

(Year-Round Pell might be used if a student only needs to complete a few extra hours as in

Cosmetology, student transfers from another institution and used Pell; or may not be eligible

for Pell in the next fiscal year)

28

TCAT FINANCIAL AID HANDBOOK 2018-2019 Page 28

LIFETIME ELIGIBILITY UNITS (LEU)

Federal regulations placed a maximum lifetime eligibility regarding the receipt of Title IV funds.

The lifetime eligibility units (LEU) are the equivalent of 6 full Pell awards for each student or a

total of 600%. ISIRs indicate the amount of Pell Grant used or it can be found on COD. If the

student is getting close to 600% a “C” code will show on the ISIR and the student’s Pell award

may need to be reduced, as award cannot exceed 600%.

UNUSUAL ENROLLMENT HISTORY (UEH)

This guidance describes the Department’s efforts to prevent fraud and abuse in the Federal Pell

Grant program by identifying students with unusual enrollment histories, and describes how

institutions must resolve the resulting ISIR “C” codes for students with these enrollment

histories. DCL ID: GEN – 13 – 09

TRANSFER STUDENT'S AWARD CALCULATION

For a transfer student, the entitlement limitation is calculated in terms of the percentage of

entitlement used at each school attended during the award year rather than in terms of the

dollar amount disbursed. This ensures that the student who transfers from a high cost

institution to a low cost institution is not denied a Federal Pell Grant because the amount

received at the first institution exceeds the amount for which the student is eligible at the

second institution. The percentage used is determined by dividing the amount disbursed at

each school by the Scheduled Award for the educational program in question at the school.

If a transfer student's first term at the second institution starts before the last term at the first

institution ends, the student may receive a Federal Pell Grant award for the overlapping period

of time from both institutions, assuming the student is no longer enrolled at the first institution.

A transfer student is required to repay any amount received in an award year which exceeds

the scheduled Federal Pell Grant, which may include the 150% Pell Award.

Schools are not required to respond to or request a paper Financial Aid Transcript to obtain the

financial aid history of transfer students. Schools are required to obtain this information from

NSLDS.

Students who receive credit for hours completed for previous education (another institution,

life experience credit, work credit, dual enrollment, etc.) will have their program length reduced

and payment periods will be adjusted accordingly.

For purposes of calculating payment periods ONLY, the length of the program is the number of

clock or credit hours and weeks of instructional time the student has remaining in the program

he/she reenters or he/she transfers into. If the remaining hours and weeks constitute half of an

29

TCAT FINANCIAL AID HANDBOOK 2018-2019 Page 29

academic year or less, the remaining hours constitute one payment period. In this

circumstance, the student may be paid for repeating coursework, if the student is receiving

credit for repeating the course. However, you may consider the student who transfers from

one program to another at the same institution to remain in the same payment period if the

following conditions apply:

* the student is continuously enrolled at the institution

* the coursework in the payment period out of which the student transfers is

substantially similar to the coursework into which the student transfers

* the payment periods are substantially similar in length of weeks of instruction and

clock or credit hours

* there are little or no changes in institutional charges associated with the payment

period, and

* the credits from the payment period out of which the student transfers are accepted

for credit in the new program.

TRANSFER MONITORING REQUIREMENT

A school must inform NSLDS about all its mid-year transfers (students who transfer from one

school to another during the same award year), including those for whom the school accesses

NSLDS directly. A school may inform NSLDS about a student at any time it determines that a

student may be transferring to the school and seeking Title IV aid, but it must do so prior to

disbursing any Title IV aid to the student. The school informs NSLDS by entering student

identifiers and other information on the Transfer Monitoring pages at the NSLDS web site

www.NSLDSFAP.ed.gov or by sending a batch file with that information to NSLDS.

The Transfer Monitoring Process is designed to provide schools with the most current relevant

data about the financial aid history of its transfer students – especially its mid-year transfers.

The new regulations that became effective on July 1, 2001 (34 CFR 668.19) as published in the

Federal Register on November 1, 2000, require the school to:

Inform NSLDS of its mid-year transfer students.

Wait at least 7 days after informing NSLDS before disbursing Title IV aid to those

students so that NSLDS can perform its monitoring function.

Access any Alerts sent to the school by NSLDS as a result of the monitoring function.

Review the mid-year transfer students’ revised financial aid history.

Make any necessary adjustments to scheduled disbursements.

Determine if the student is responsible for repaying any Title IV aid that was disbursed

prior to the school’s receipt of the revised history.

30

TCAT FINANCIAL AID HANDBOOK 2018-2019 Page 30

CAMPUS-BASED: FSEOG & FWS

FEDERAL SUPPLEMENTAL EDUCATIONAL OPPORTUNITY GRANT (FSEOG)

Student Eligibility

To be eligible to receive FSEOG funds, students must show exceptional financial need and meet

other general eligibility requirements for Title IV programs. Exceptionally needy students are

those who have the lowest expected family contribution (EFC) and are eligible to receive

Federal Pell Grant funds in the current award year. Since students are admitted on an ongoing

basis throughout the year, the lowest EFC may mean the lowest EFC for groups of applicants

whose aid is being packaged at the same time.

FSEOG awards are restricted to undergraduate students only. Students who have already

received a Bachelor's Degree may not receive FSEOG.

Written selection procedures must be developed to ensure that FSEOG recipients are selected

on the basis of the lowest EFC and Pell Grant priority requirements over the entire award year.

For institutions which enroll students as often as monthly or weekly, FSEOG funds can be

reserved for use throughout the award year and selection practices can be applied in a manner

which would assure that a reasonable consistency over the entire award year results.

Award Amounts

The maximum Federal Supplemental Educational Opportunity Grant (FSEOG) for a full academic

year is usually $4,000. The minimum FSEOG amount is $100, but you may prorate this amount

if the student is enrolled for less than an academic year.

Frequency and Amount of FSEOG Disbursements

If you’re awarding an FSEOG for a full academic year, you must pay a portion of the grant

during each payment period.

To determine the amount of each disbursement, you would usually divide the total FSEOG

award by the number of payment periods the student will attend. However, you are allowed to

pay an FSEOG in unequal amounts if the student has costs or resources that are different for

different payment periods. You may make payments within a payment period in whatever

installments will best meet the student’s needs.

Example of Prorating a FSEOG Award

Award is $100 for the academic year. Divided by two for payment periods = $50/payment

period. Student only attends half of the academic year. Award is $50 for that payment period.

31

TCAT FINANCIAL AID HANDBOOK 2018-2019 Page 31

Matching

As stated in the Federal Student Aid Handbook, the non-federal share of FSEOG must be made

from the school’s own resources. These resources may include:

1. institutional scholarships and grants;

2. waivers of tuition and fees;

3. state scholarships and grants; and

4. funds from foundations or other charitable organizations.

Dear Colleague Letter CB-06-03 states “The Department has determined that all state

scholarships and grants, except for the Leveraging Educational Assistance Partnership (LEAP)

and the Special Leveraging Educational Assistance Partnership (SLEAP) program awards are

eligible funds that may be used to meet the nonfederal share requirement. LEAP and SLEAP

grants, for this purpose, are defined as the federal LEAP and SLEAP allocations plus the

minimum required state matching amount. The balance of State grant amounts are considered

non-LEAP and non-SLEAP awards and therefore can be used to meet the FSEOG nonfederal

share requirement.

*Note: If a school chooses to match SEOG with state scholarships, Part IV, section C of

the FISAP will be reported differently. When the funds are matched with institutional

monies, the match is reported as “cash outlay contributed”. If state grants are used, the

match is reported as “other resources designated”.

The federal share may not exceed 75%.

THE FEDERAL WORK-STUDY PROGRAM

Eligibility to receive Federal Work Study (FWS) funds is based on general student eligibility

requirements. Each Tennessee College of Applied Technology must make FWS jobs reasonably

available to all eligible students at the school. To the maximum extent practicable, a school

must provide FWS jobs that complement and reinforce each recipient’s educational program or

career goals the primary use of FWS funds is to pay students for on-and-off campus

employment.

FWS funds must be matched as the federal share may not exceed 75% for on campus

employment. The federal share of FWS wages may not be used for fringe benefits. A Tennessee

College of Applied Technology that provides its match in non-cash forms (e.g. tuition and fees,

or books and supplies) must carefully document the cash equivalent of this contribution.

Job placement under the FWS program has some restrictions. FWS workers may not:

32

TCAT FINANCIAL AID HANDBOOK 2018-2019 Page 32

* Displace regular workers,

* Be involved in recruiting potential students,

* Be involved in political or religious activity,

* Be paid less than federal minimum wage.

Institutions are required to use at least seven percent (7%) of its FWS initial and supplemental

allocations for an award year to pay the federal share of wages to students employed in

community service jobs. In addition, schools must employ at least one student in a reading

tutoring or a family literacy project. This requirement can be waived by the Secretary if

enforcing it would create a hardship for students at the institution. *Schools must submit a

request for this waiver each year.

An institution must make FWS employment reasonably available to all eligible students and

have selection procedures which are uniformly applied, in writing and maintained in the

school's files. All FWS workers must complete the Employment Eligibility Verification Form

(Form I-9) and provide supporting documentation within three days of the hire.

A Tennessee College of Applied Technology has four options for establishing wage rates for the

FWS program.

1. Pay the federal minimum wage to all student workers,

2. Pay a higher than minimum wage rate to all FWS students,

3. Pay different hourly wage rates for different types of jobs depending upon skill

level and rates paid to non-FWS employees doing the same or comparable work,

4. Develop a range of wage rates for each type of position.

FWS students must be paid at least once a month. The Tennessee College of Applied

Technology is responsible for paying the employer's share of social security and/or workmen's

compensation and applicable local, state and federal taxes. The Financial Aid Administrator

must continually monitor student's need based employment and actual earnings against their

awards to prevent overpayments. Time records for students paid on an hourly basis must show

the hours each student worked in clock time sequence or the total hours worked per day.

State Programs: Tennessee Student Assistance Award,

Wilder-Naifeh Technical Skills Grant, Tennessee Promise and TCAT Reconnect

The state aid programs are administered by the Tennessee Student Assistance Corporation

(TSAC). The following policies and procedures are intended to be used in conjunction with the

policies and procedures provided to institutions by TSAC. Students apply for the State Programs

by completing the FAFSA and indicating TN Residency. Students must reapply each year.

33

TCAT FINANCIAL AID HANDBOOK 2018-2019 Page 33

Tennessee Student Assistance Award (TSAA) –

The application date for the State programs will be accepted until funds are expended.

The TSAA is a grant awarded to Tennessee’s most needy students.

Eligibility –

Must be a Tennessee resident and a U.S. Citizen

Must meet all general eligibility requirements for Title IV aid

Must attend an approved Tennessee post-secondary institution

Must be enrolled at least half-time

Must have an EFC within the specified eligible range

Retention of TSAA-

Must continue to meet all eligibility requirements as stated above

Must reapply each year using the FAFSA

Must maintain satisfactory progress according to standards used for Title IV purposes.

Calculation of TSAA Award-

The maximum TSAA award is set each year by TSAC based on the available funding. It is best to

file the FAFSA within the first couple of months of opening to ensure TSAA eligibility.

TCAT Award Formula for TSAA for 2018-2019

Student must be enrolled for at least 15 hrs per week to be eligible for TSAA.

Definition: 30 hour = full time

29- 23 hours = 3/4 time

22 - 15 hours = 1/2 time

14 or less hours = less than 1/2 time (ineligible for TSAA)

Example: ¾ time x $1000 = $750/3 = $250 per term

½ time x $1000 = $500/3 = $167 per term

Less than ½ time = $0/3 = $0 per term

34

TCAT FINANCIAL AID HANDBOOK 2018-2019 Page 34

The maximum number of TSAA payments a student may receive is limited by their program

type and length as follows:

6 month - 11 month program 2 TSAA payments

12 month - 17 month program 3 TSAA payments

18 month - 24 month program 6 TSAA payments

Certification –

Schools will certify eligible students via the e*GRandS certification roster. The financial aid

administrator will certify the student’s eligibility status, enrollment status, program type, and

the TSAA award amount. A certification roster will be completed for each term. The financial

aid administrator may certify students for payment throughout the term as students enroll and

become eligible for payment. Once the financial aid administrator submits a certification

roster, TSAC will normally deliver the funds to the institution within two weeks. (ACH electronic

funds transmittal is recommended.)

Note: A student must be currently enrolled at the time the financial aid administrator

completes the certification roster. If a student withdraws from school prior to the certification

roster being completed, the student is not eligible to receive the TSAA award for the term,

unless the TSAA award was applied to student charges or the student has a balance owed on

their account. If, so, the school may certify the TSAA award up to the amount owed or the

amount of the TSAA award.

NOTE: Reconciliation Roster must be submitted to TSAC each trimester and at the end of each

fiscal year showing TSAA funds are balanced. TSAC will not release additional monies to

your school unless the reconciliation rosters are received.

Wilder-Naifeh Technical Skills Grant (WNTSG) –

Application Receipt Dates are:

July 1, Summer

November. 1, Fall

March 1, Spring

The Wilder-Naifeh Technical Skills Grant is part of the Tennessee Education Lottery Scholarship

program (TELS). The WNTSG is a grant that is available only to Tennessee residents that

attend a Tennessee College of Applied Technology. This program became effective for the Fall

term 2004.

35

TCAT FINANCIAL AID HANDBOOK 2018-2019 Page 35

Eligibility Criteria:

Must be a Tennessee resident one year prior to application deadline. State residency is

determined using TBR promulgated rules; TBR Rules 0240-2-2.

Must be a U.S. Citizen or permanent resident

Must be in compliance with Selective Service requirements

Must be in compliance with federal drug-free rules and laws for receiving financial aid.

Must not be in default on a federal student loan

Must not owe a financial aid refund or overpayment

Must not be incarcerated.

Must meet the enrollment requirements for both the school and the program. (Do not

have to have a high school diploma or GED if not required for enrollment in the school

or program.)

Must be enrolled in a program leading to a certificate or diploma. Continuing education

and supplemental certificate programs are not eligible.

Note: Students may enroll as full-time or part-time. There is no income limit for eligibility. A

student with a bachelor’s degree may be eligible to receive the WNTSG.

Retention of WNTSG –

Must continue to meet all eligibility requirements as stated above.

Must reapply each year using the FAFSA.

Must maintain continuous enrollment (unless a leave of absence is

granted).

o Continuous enrollment as defined by TCAT: WNTSG must be

certified for each trimester.

Example: a student enrolls Fall 2017, WNTSG is certified

for but the student withdrawals prior to the end of the

term. Then reenrolls Spring 2018, the student will remain

eligible for WNTSG.

Must maintain satisfactory progress according to standards used for Title

IV purposes. Failure to maintain satisfactory progress is NOT appeal

able.

May receive the WNTSG for all coursework required for completion of

the certificate or diploma program.

Maximum time frame of 5 years from first disbursement.

NOTE: Once the student becomes ineligible for the WNTSG, for any reason, the

student shall not be eligible to regain the WNTSG.

36

TCAT FINANCIAL AID HANDBOOK 2018-2019 Page 36

Calculation of WNTSG Award –

The maximum WNTSG award will be $2,000 per fiscal year. This amount is subject to availability

of funds from the Tennessee Education Lottery Scholarship program on a fiscal year basis.

The WNTSG will be paid each term in the academic year. The amount of the award will be

prorated based on the number of scheduled hours for each term not to exceed $667 per term

up to $2,000 per academic award year. To determine the amount of the WNTSG use the

following formulas:

Formula A Scheduled hrs for term x $2000 = Award

Hours in program (greater than 1296)

Formula B Scheduled hrs for term x $2000 = Award

1296

Note: Programs that are less than a term in length will receive the respective trimester amount ($667

or $666) or the actual cost of tuition/fees, whichever is less, in WNTSG funds.

1. If a student enrolls for summer 2018 and AGD is between 5/1/19 and 6/30/19 and all

WNTSG funds are paid from 18-19, use Formula A (will allow WNTSG funds to be paid for 4

terms.)

2. If student’s AGD is not between 5/1/18 and 6/30/19, use Formula B. (will allow WNTSG

funds to be paid for 3 terms. Either summer 18 will be paid from 17/18 funds or summer 19

will be paid from 19-20 funds.)

3. Any certificate or diploma granting program less than a term in entire program length, use

Formula C.

4. Pay WNTSG funds in whole dollars rounding up or down as needed. You must have a valid

ISIR for the award year that you are going to use to pay the student. (Verification process

must be completed)

5. For programs less than a full term (less than 432 hours) WNTSG will pay either the full $667

or the amount of calculated fees; whichever is less.

Certification –

Schools will certify eligible students via the e*GRandS certification roster. The financial aid

administrator will certify both the student’s eligibility status and the WNTSG award amount. A

certification roster will be completed for each term.

37

TCAT FINANCIAL AID HANDBOOK 2018-2019 Page 37

The financial aid administrator may complete a certification roster as early as 10 days prior to

the beginning of a term. As with TSAA certification rosters, the financial aid administrator may

certify students for payment throughout the term as students enroll and become eligible for

payment.

Once the financial aid administrator submits a certification roster, TSAC will normally deliver

the funds to the institution within two weeks via ACH electronic funds transmittal.

Awards Made in Error –

When a TELS award has been awarded in error, the school will cancel the award and inform the