Asha Rani

Session Details

This session covers the following:

• Meaning of annuity

• Types of annuity

• Ordinary annuity- future and present value

• Application of ordinary annuity for various

purpose

Asha Rani

Meaning of Annuity

Annuity is a series of equal payments made at usually equal interval of time or in other word

an annuity is a periodic amount of money that is paid at regular intervals

The concept of annuity can be used to turn the one time lump sum payment into payments of

smaller denomination in future time period for our convenience.

Examples of annuity:

• Instalment payment – leasing agreement, Repayment of loan

• Regular deposits to saving bank account

• Insurance premium

• Hire purchase agreements etc.

Asha Rani

Types of annuity

Annuity

Ordinary

Annity

Annuity Due

Deferred

annuity

Perpetuity

Asha Rani

Ordinary annuity

Ordinary annuity is defined as the annuity where the payment is made at the end of

each payment interval.

Ordinary annuity is series of payments which possess the following characteristics:

1) Amount of payment should be same

2) Interval time between the payment should be same

3) Payment should be made at the end of each period

Asha Rani

Ordinary annuity

Future value of ordinary annuity – refers to the value that is

compounding till the end of its term/duration or it is also

defined as the sum of future value of all the periodic payments

at the end of annuity.

Present value of ordinary annuity – refers to the sum of

discounted value of each periodic payment at the given rate of

interest. Also termed as capital value.

Asha Rani

Future value of ordinary annuity

The formula for the future value of an ordinary annuity

• OR

• Where,

=Future value of annuity at the end of each period

• R= Regular payment at the end of each payment interval

= interest rate per period

= number of period for which annuity will lasts

= tabulated value of future value of Interest rate factor annuity (FVIFA)

Asha Rani

Derivation of Future value

of ordinary annuity will be

given in the next slide

Asha Rani

Present value of ordinary annuity

The formula for the Present value of an ordinary annuity

P

• OR

P

• Where,

=Future value of annuity at the end of each period

• R= Regular payment at the end of each payment interval

= interest rate per period

= number of period for which annuity will lasts

= tabulated value of present value of Interest rate factor annuity (PVIFA)

Asha Rani

Derivation of Present value of

ordinary annuity given in the

next slide

Asha Rani

ILLUSTRATIVE PROBLEMS

1) At six-month interval, A deposited ₹2000 in a saving account which credit

interest at 10% p.a. compounded semi-annually. The first deposit was made

when A’ s son was six-month-old and the last deposit was made when his son

was 8 years old. The money remained in the account and was presented to the

son on his 10

th

birthday. How much did he receive?

2) Mr. X purchases a house for ₹2, 00,000. He agrees to pay for the house in 5

equal installments at the end of each year. If the money is worth 5% p.a.

effective, what would be size of each investment? In case X makes a down

payment of ₹50, 000 what would be the size of each installment?

Asha Rani

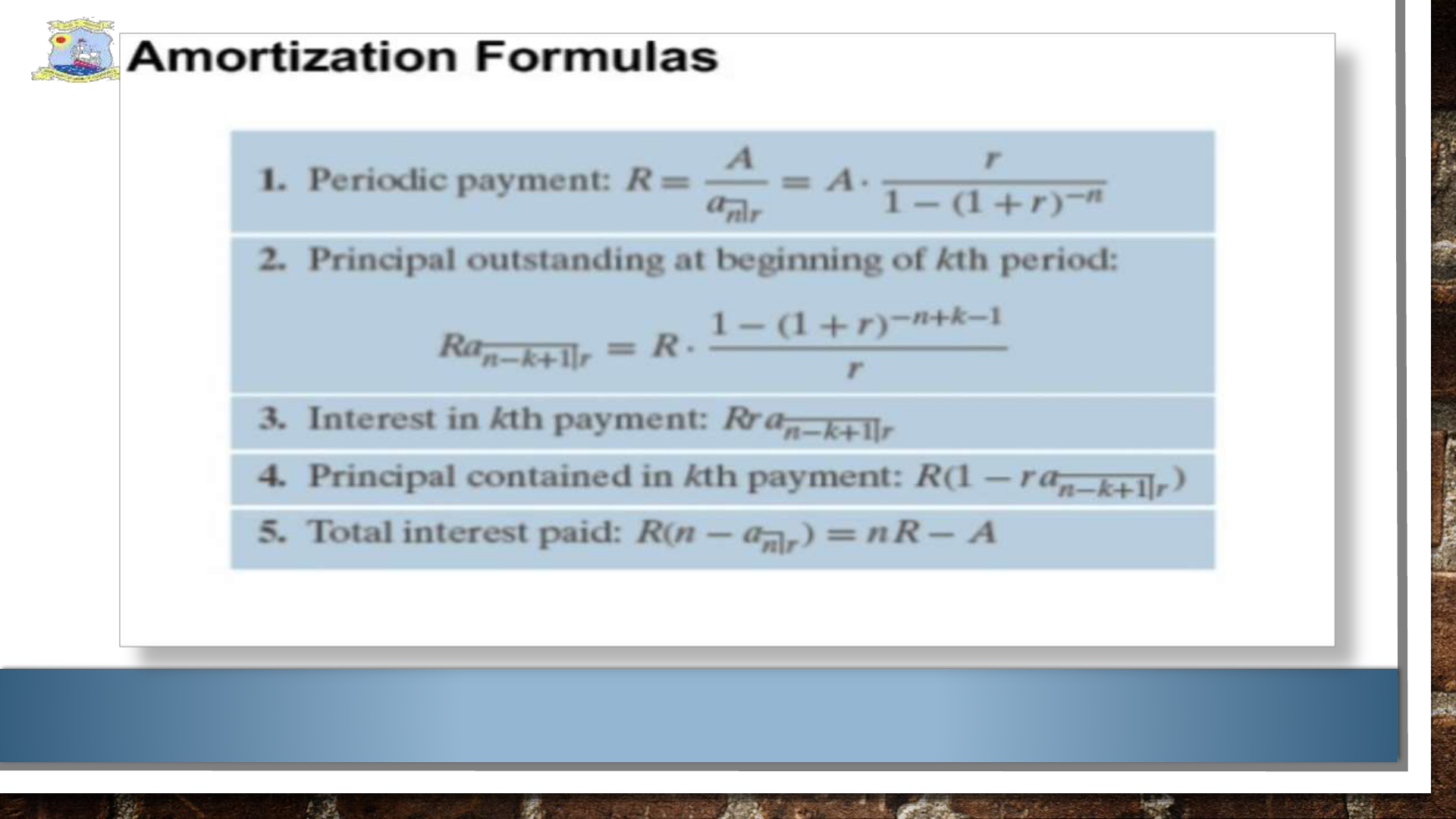

Amortization of loan

Amortization refers to the repayment of loan through a fixed repayment schedule in regular

payment over a period of time. Each payment includes both interest on the outstanding

amount of loan and principal amount.

This is done by applying the concept of present value of an annuit y. Suppose a loan of

Rs. A has been taken at a interest rate i % which is to be repaid in n regular payment , payable

at the end of each payment interval , then the value of R regular installment can be obtained as

follows:

• A

• A

• R = A /

A loan is amortized if both the capital and interest are paid by a sequence

of periodic payments.

Asha Rani

Asha Rani

ILLUSTRATIVE PROBLEM

3. Mr. X took a loan of ₹80,000 payable in 10 semiannual

installments, rate of interest being 8% p.a. compounded

semiannually, find:

• The amount of each installment;

• Loan outstanding after 4

th

payment;

• Interest component of 5

th

payment; and

• Loan repaid after four payments.

Asha Rani

LEASING DECISIONS

Once a firm has evaluated the economic viability of an asset as an investment and

accepted/selected the proposal, it has to consider alternate methods of financing the

investment

the firm may consider leasing of the asset rather than buying it. Hence, lease financing

decisions relating to leasing or buying options primarily involve comparison between the

cost of debt-financing and lease financing.

Evaluation of lease financing decisions involves the following steps:

• (i) Calculate the present value of net-cash flow of the buying option, called NPV (B).

• (ii) Calculate the present value of net cash flow of the leasing option, called NPV (L)

• (iii) Decide whether to buy or lease the asset or reject the proposal altogether by applying the following criterion:

• (a) If NPV (B) is positive and greater than the NPV (L), purchase the asset.

Asha Rani

Capital expenditure decisions

In capital expenditure decisions a company has to

make choice between two machines, both can be used

to improve operation by saving in labour costs.

Given the time value of money , we can use the concept

of annuity to determined the net annual savings of

each machine and then decide which machine to buy.

Asha Rani

ILLUSTRATIVE PROBLEM

4) Machine A costs ₹ 10,000 and has a useful life

of 8 years. Machine B costs ₹8000 and has a useful

life of 6 years. Suppose machine a generates an

annual labour saving of ₹ 2000 which machine B

generate an annual saving of ₹1800. Assuming the

time value of money is 10% p.a., find which

machine is preferable?

Asha Rani

Valuation of Bond

A bond is generally a security for a debt, in which the person who is issuing

holds a debt against the person who has taken the loan and thereby is

obliged to pay the interest and the principal amount.

Usually, bonds are issued for longer periods which are usually greater than

one year and which upon maturity, will be paid upon the principal amount

(redemption value) or the periodical interest.

The process of determining these bonds is called bond valuation. It is used

to determine the theoretical price or fair price or intrinsic price of the

bonds.

Asha Rani

THE FORMULAE FOR COMPUTING THE VALUE OF BOND

• Where,

• D =the periodic dividend payment

= the yield rate per period

• RV= the redemption price

• v= the purchase price

= number of period before redemption

Asha Rani

5) A ₹1000 bond paying annual dividends at the

8.5% will be redeemed at par at the end of 10

years. Find the purchase price of this bond if the

investor wishes a yield rate of 8%.

Illustrative Problem

Asha Rani

CONTINUOUS COMPOUNDED ANNUITY

Continuous compounding is compounding that is constant. One way some try to visualize

the concept of continuous compounding is that is fluid, constantly compounding moment by

moment, as opposed to daily, monthly, quarterly, or annually.

The future value of annuity with continuous compounding formula is the sum of future cash

flows with interest. The sum of cash flows with continuous compounding can be shown as

• This is considered a geometric series as the cash flows are all equal. The common ratio for this example is

. To

solve this continuous compounding series summation will be denoted by integration. So the formula will be

• Similarly,

Asha Rani

ILLUSTRATIVE PROBLEMS

6) An annuity of ₹500 p.a. is flowing continuously for 10

years. Find its future value if the rate of interest is 10%

compounded continuously

7) Find the capital value of a uniform income stream of ₹ R

per year for m years, reckoning interest continuously at

100r% per year. What will be the result if income is forever?

B.Com. (Hons.) IInd Year

Business Mathematics, Section A and H Asha Rani

Questions for Ordinary Annuity

Ques:1. At six-month interval, A deposited ₹2000 in a saving account which

credit interest at 10% p.a. compounded semi-annually. The first deposit was made

when A’ s son was six-month-old and the last deposit was made when his son

was 8 years old. The money remained in the account and was presented to the son

on his 10

th

birthday. How much did he receive?

Ques:2. An annuity of ₹500 p.a. is flowing continuously for 10 years. Find its

future value if the rate of interest is 10% compounded continuously.

Ques:3. Mr. X deposits in his son’s account ₹1000 times his son age at the end

of each birthday. Find the balance accumulated at the 10

th

birthday, if the rate of

interest is 10% p.a. compounded annually.

Ques:4. A man requires ₹ 2, 00,000 to purchase a house after 5 years. He has an

opportunity to invest the fund in an account which can earn 6% p.a. compounded

quarterly. Find how much be deposited at the end of each quarter so as to have

the required amount at the end of 5 years.

Ques:5. Mr. X purchases a house for ₹2, 00,000. He agrees to pay for the house

in 5 equal installments at the end of each year. If the money is worth 5% p.a.

effective, what would be size of each investment? In case X makes a down

payment of ₹50, 000 what would be the size of each installment?

Ques:6. What should be the monthly sales volume of a company if it desires to

earn 12% annual returns convertible monthly on its investment of ₹ 2,00,000?

Monthly costs are ₹3, 000. The investment will have eight-year life with no scrap

value?

Ques:7. Mr. X sells his old car for ₹ 100,000 to buy a new one costing ₹ 2,58,000.

He pays ₹ x cash and balance by payment of ₹7000 at the end of each mount for

18 months. If the rate of interest is 9% compounded monthly, find x.

Ques:8. Find the capital value of a uniform income stream of ₹ R per year for m

years, reckoning interest continuously at 100r% per year. What will be the result

if income is forever?

Ques:9. According to an investment proposal, an initial investment of ₹ 1,00,000

is expected to yield a uniform income stream of ₹ 10,000 p.a. if the money is

worth 8% p.a. compounded continuously, what is the expected payback period,

i.e. after what time, the initial investment will be recovered?

Ques:10. If the present value and amount of an ordinary annuity of ₹1 p.a. for n

years are ₹8.1109 and ₹12.0061 respectively, Find the rate of interest and the

value of n without consulting the compound interest table.

B.Com. (Hons.) IInd Year

Business Mathematics, Section A and H Asha Rani

Ques:11. Mr. X took a loan of ₹80,000 payable in 10 semiannual installments,

rate of interest being 8% p.a. compounded semiannually, find:

1) The amount of each installment;

2) Loan outstanding after 4

th

payment;

3) Interest component of 5

th

payment; and

4) Loan repaid after four payments.

Ques:12. Mr. M borrowed ₹10, 00,000 from a bank to purchase a house and

decided to repay by monthly equal installment in 10 years. The bank charges

interest at 9% compounded monthly. The bank calculated his EMI as ₹12, 668.

Find the principal and the interest paid in Ist and IInd year.

Ques:13. Machine A costs ₹ 10,000 and has a useful life of 8 years. Machine B

costs ₹8000 and has a useful life of 6 years. Suppose machine a generates an

annual labour saving of ₹ 2000 which machine B generate an annual saving of

₹1800. Assuming the time value of money is 10% p.a., find which machine is

preferable?

Ques:14. Find the purchase of a ₹ 1000 bond, redeemable at the end of 10 years

at ₹1100 and paying annual dividends at 4% if the yield rate is to be 5% p.a.

effective.

Ques:15. A ₹1000 bond paying annual dividends at the 8.5% will be redeemed

at par at the end of 10 years. Find the purchase price of this bond if the investor

wishes a yield rate of 8%.