Employment Tax for

Indian Tribal Governments

Publication 4268 (Rev. 8-2022) Catalog Number 37833J Department of the Treasury Internal Revenue Service www.irs.gov

Tax Exempt & Government Entities

INDIAN TRIBAL GOVERNMENTS

2

Table of Contents

Chapter 1

Introduction to Employment Tax for Indian Tribal Governments .............................................. 1

Chapter 2

Employee or Independent Contractor ......................................................................................... 4

Chapter 3

Treatment of Certain Payments ................................................................................................... 9

Chapter 4

Tipped Employees ..................................................................................................................... 18

Chapter 5

Employee Business Expense Reimbursements .......................................................................24

Chapter 6

Fringe Benefits ............................................................................................................................ 27

Chapter 7

Retirement Plans ........................................................................................................................31

Chapter 8

Cafeteria Plans ............................................................................................................................ 40

Chapter 9

Scholarships & Educational Assistance ...................................................................................41

Chapter 10

Earned Income Tax Credit ........................................................................................................44

Chapter 11

Employment Taxes .....................................................................................................................45

Chapter 12

Preparation of Payroll Checks ................................................................................................... 57

Chapter 13

Form 941, Employer’s Quarterly Federal Tax Return ...............................................................62

Chapter 14

Form 943, Agricultural Employees ............................................................................................76

Chapter 15

Form 940, Employer’s Annual Federal Unemployment (FUTA) Tax Return ............................ 81

Chapter 16

Form 945, Annual Return of Withheld Federal Income Tax.....................................................84

Chapter 18

Electronic Filing Requirements for Form W-2, Wage and Tax Statement .............................. 92

Chapter 19

Reporting Compensation & Non-Compensation Payments on Form 1099-MISC &

Form 1099-NEC ..........................................................................................................................95

3

Chapter 20

Records Retention ................................................................................................................... 100

Chapter 21

Penalties ................................................................................................................................... 103

Chapter 22

IRS Notices and Letters ...........................................................................................................107

Chapter 23

The Collection Process ............................................................................................................110

Glossary of Terms ...................................................................................................................... 113

1

Chapter 1

Introduction to Employment Tax for Indian Tribal Governments

The office of Indian Tribal Governments (ITG) at the Internal Revenue Service was established

to help Indian tribes address their federal tax matters. ITG uses partnership opportunities with

Indian tribal governments, tribal associations and other federal agencies to respectfully and

cooperatively meet the needs of the Indian tribal governments and the federal government, and

to simplify the tax administration process.

This publication provides information and tips for maintaining good records, preparing payroll,

and filing and depositing employment taxes. It is provided for general information only and

should not be cited as legal authority.

Visit www.irs.gov/tribes for further information on any of the topics covered in this publication.

Are Federally Recognized Tribal Governments Subject to Employment Taxes?

Generally, Indian tribes in their role as employers are subject to federal employment tax laws and

procedures. It is a well-established principle of tax law that in the ordinary affairs of life, Indians

are U.S. citizens and are subject to the payment of federal income taxes.

Where a business enterprise or political subdivision of an Indian tribe is organized and operated

by the tribe itself, the enterprise is considered a private tribal activity. When workers perform

services in the employ of a private tribal activity, these services also constitute employment.

The federal statutes, regulations, case law, revenue rulings and other sources of tax authority

establish the role of Indian tribal governments as employers. As such, tribal governments are

required to follow substantially the same procedures as other employers. There are some special

provisions that apply to tribal governments addressed in later chapters of this publication. If you have

questions about anything contained in or omitted from this publication, go to www.irs.gov/tribes

.

Employment Tax Requirements

Employers are required to withhold and pay employment taxes. Employment taxes include

income tax, Social Security and Medicare taxes (also known as Federal Insurance Contributions

Act (FICA) taxes) withheld from an employee’s wages, plus the employer’s share of FICA taxes

and federal unemployment (FUTA) taxes, when applicable. The withheld (employee’s) portion of

employment taxes is referred to as “trust fund” taxes. FUTA is addressed in Chapter 15.

In addition to your responsibilities for withholding, depositing and reporting federal taxes,

your state taxing authority or tribal governmental taxing agency may also have tax reporting

requirements. This publication is designed to assist you in complying with federal tax

requirements. You should contact your state and, in some cases, tribal taxing agencies for

information concerning state and tribal tax requirements.

Who is an Employee?

Employees are defined in the Treasury Regulations as every individual who performs services

subject to the will and control of an employer, both as to what is to be done and how it is to be

done. The right to discharge or to fire an employee is an important indicator that the person

having the right to discharge is an employer. The employee may have considerable discretion

and freedom of action as long as the employer has the legal right to control both the method

and the result of the employee’s work.

2

Chapter 1: Introduction to Employment Tax for Indian Tribal Governments

www.irs.gov/tribes

An employee may be called a partner, an agent or an independent contractor and still meet the

criteria of an employee. The description is immaterial if the legal relationship of employer and

employee exists. Managers and other supervisory personnel are employees. A corporate officer

is an employee.

Tribal council members are employees, but receive special treatment for purposes of

employment taxes. Tribal council members and other situations unique to Indian tribes are

discussed in Chapter 3.

Who is an Employer?

The Treasury Regulations define an employer as any person for whom an employee performs

or performed any service. An employer may be an individual, a corporation, a partnership,

a trust, an estate, an Indian tribe, educational institutions, organizations, federal/state/local

governmental entities and other entities.

In addition to this publication, we offer a number of products and services to assist you.

Workshops

1

available for presentation at your location

Employment Tax

Gaming Tax

Tip Reporting & Tip Agreements

Title 31 (Bank Secrecy Act Overview & Compliance)

The “ITG Tax Kit” is a webpage available at www.irs.gov/government-entities/indian-tribal-

governments/itg-tax-kit, which contains the following forms, publications and web links for

additional services that are the most useful to tribal entities (The freely available Adobe Acrobat

Reader software is required to view, print and search the forms and publications):

Forms

Form W-2 - Wage and Tax Statement

Form W-2G - Certain Gambling Winnings

Form W-3 - Transmittal of Wage and Tax Statements

Form W-4 - Employee’s Withholding Certicate

Form W-9 - Request for Taxpayer Identication Number and Certication

Form 11-C - Occupational Tax and Registration Return for Wagering

Form 720 - Quarterly Federal Excise Tax Return

Form 730 - Monthly Tax Return for Wagers

Form 940 - Employer’s Annual Federal Unemployment (FUTA) Tax Return

Form 941 - Employer’s Quarterly Federal Tax Return

1 Additional topics not listed can be provided as requested/needed

3

Chapter 1: Introduction to Employment Tax for Indian Tribal Governments

www.irs.gov/tribes

Form 941-X - Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund

Form 941-X-Instructions

Form 944- Employer’s Annual Federal Tax Return

Form 944- Instructions

Form 945 - Annual Return of Withheld Federal Income Tax

Form 1042 - Annual Withholding Tax Return for U.S. Source Income of Foreign Persons

Form 1042-S - Foreign Person’s U.S. Source Income Subject to Withholding

Form 1096 - Annual Summary and Transmittal of U.S. Information Returns

Form 1099-INT - Interest Income

Form 1099-MISC - Miscellaneous Income

Form 1099-NEC - Nonemployee Compensation

Form 5754- Statement by Person(s) Receiving Gambling Winnings

Form 8027- Employer’s Annual Information Return of Tip Income and Allocated Tips

Form 13551- Application to Participate in the IRS Acceptance Agent Program

Publications

Publication 15 - (Circular E), Employer’s Tax Guide

Publication 15-A- Employer’s Supplemental Tax Guide

Publication 15-B- Employer’s Tax Guideto Fringe Benets

Publication 15-T- Federal Income Tax Withholding Methods

Publication 515- Withholding of Tax on Nonresident Aliens and Foreign Entities

Publication 509 - Tax Calendars

Publication 526 - Charitable Contributions

Publication 531 - Reporting Tip Income

Publication 1281- Backup Withholding for Missing and IncorrectName/TIN(s)

Publication 3908- Gaming Tax Law and Bank Secrecy Act Issues for Indian Tribal Governments

Publication 4268 - Employment Tax for Indian Tribal Governments4

Publication 5343 - Helpful Hints for Indian Tribes and Tribal Entities to Avoid Penalties on Federal

Tax Deposits and Information Returns

Publication 5424 - Income Tax Guide for Native American Individuals and Sole Proprietors

Services

SSA/IRS Reporter- Information for employers who le business returns

EFTPS: The Electronic Federal Tax Payment System - The easiest way to pay your federal taxes

Electronic Filing Options for Business and Self-Employed Taxpayers - Information for

businesses and self-employed taxpayers who le and pay electronically

4

Chapter 2

Employee or Independent Contractor

It is critical that the tribe and its wholly-owned entities correctly determine whether the

individuals providing services for them are employees or independent contractors.

Generally, you must withhold income taxes, withhold and pay Social Security and Medicare

taxes, and pay unemployment tax on wages paid to an employee. You do not generally have to

withhold or pay any taxes on payments to independent contractors.

Employees

A person who works for you may be classified as a common law employee, a statutory

employee or an independent contractor. The classification of the worker determines which forms

you must file and which taxes you must pay. Note: Wholly-owned tribal government entities

may be exempt from federal unemployment taxes. Please refer to Chapter 15 for further

information.

Internal Revenue Code (IRC) Section 3121(d)(2) defines “employee” as “any individual who, under

the usual common law rules applicable in determining the employer/employee relationship,

has the status of an employee.” The “usual common law rules” referred to in the statute and the

regulations, are those factors to which the courts have looked over the years to decide whether

a person is an employee.

Generally, an employer/employee relationship exists when the person for whom services are

performed has the right to control and direct the individual who performs the services. This

control includes the result to be accomplished by the work, the details and means by which that

result is accomplished. That is, an employee is subject to the will and control of the employer

not only as to what will be done but how it will be done. It is not necessary the employer actually

direct or control the manner in which the services are performed; it is sufficient the employer has

the right to do so. The right to discharge is also an important factor indicating that an employer/

employee relationship exists.

In determining whether a worker is an employee or an independent contractor under the

common law rules, three main categories must be considered:

1) Behavioral control,

2) Financial control, and

3) Relationship of the parties.

1) Behavioral control—Facts that show whether there is a right to direct or control how the

worker does the work include:

Instruction the business gives to the worker, such as:

How, when or where to do the work

What tools or equipment to use

What assistants to hire to help with the work

Where to purchase supplies and services

What work must be performed by a specified individual

What order or sequence to follow

Type of training the business gives the worker

5

Chapter 2: Employee or Independent Contractor

www.irs.gov/tribes

2) Financial control—Facts that show whether there is a right to direct or control the business

part of the work include:

Signicant investment—the extent of the worker’s investment

Expenses—the extent to which the worker has unreimbursed business expenses

Opportunity for prot or loss—the extent to which the worker can realize a prot or loss

The extent to which the worker makes services available to others

How the business pays the worker

3) Relationship of the parties—Facts that illustrate how the business and worker perceive their

relationship include:

Employee benets—whether the business provides the worker with employee-type benets

Written contracts describing the relationship

The permanency of the relationship

The extent to which services performed by the worker are a key aspect of the business

Even after evaluating the above factors, there will be times when it is difficult to determine

whether an individual is a common law employee or self-employed and should be treated as

an independent contractor. Many individuals who have personal service contracts with tribal

governments may be employees rather than independent contractors. The mere existence of a

contract does not mean the individual is not an employee.

It’s important to the worker that the employment status be determined as quickly as possible so

the earnings can be properly reported. To request a determination from the IRS as to whether a

worker is an employee, file a Form SS-8, Determination of Worker Status for Purposes of Federal

Employment Taxes and Income Tax Withholding. Further information is provided in Chapter 3.

Some workers may be considered statutory employees (even though they are considered

independent contractors under the common law rules) if they fall into any one of four categories

and they meet three additional conditions. The law defines certain workers as employees by

statute. These categories include:

Drivers who distribute certain food products or deliver laundry or dry cleaning,

Full-time life insurance sales agents,

Individuals who work at home on materials and goods you supply and must be returned to you,

and

Full-time traveling or city salespersons who turn in orders to you from wholesalers, retailers,

contractors, or operators of hotels, restaurants or other similar establishments.

See Publication 15-A, Section 1, Who are Employees? for further information.

Independent Contractors

The general rule is that an individual is an independent contractor if the payer has the right

to control or direct only the result of the work, but not what will be done and how it will be

done. The earnings of a person who is working as an independent contractor are subject to

self-employment tax. A Form 1099-NEC, Nonemployee Compensation, should be furnished to

independent contractors and filed with the IRS.

An individual is not an independent contractor if they perform services that can be controlled

by a payer (what will be done and how it will be done). This applies even if individuals are given

freedom of action. What matters is that the employer has the legal right to control the details of

how the services are performed. If an employer/employee relationship exists (regardless of what

6

Chapter 2: Employee or Independent Contractor

www.irs.gov/tribes

the relationship is called), the individual is not an independent contractor and their earnings are

generally not subject to self-employment tax.

Misclassification of Employees

If you classify an employee as an independent contractor and you have no reasonable basis

for doing so, you will be held liable for employment taxes for that worker (IRC Section 3509). In

some instances, you may have reasonable basis for not treating a worker as an employee and

may be entitled to relief under Section 530 of the Revenue Act of 1978.

If you have a reasonable basis for not treating a worker as an employee, you may be relieved

from having to pay employment taxes for that worker. To get this relief, you must file all required

federal information returns on a basis consistent with your treatment of the worker. You (or your

predecessor) must not have treated any worker holding a substantially similar position as an

employee for any period beginning after 1977.

Workers who believe they have been improperly classified as independent contractors by an

employer can use Form 8919, Uncollected Social Security and Medicare Tax on Wages, to

figure and report (on their Form 1040) the employee’s share of uncollected Social Security and

Medicare taxes due on their compensation.

The Voluntary Classification Settlement Program (VCSP) is an optional program that provides

taxpayers with an opportunity to reclassify their workers as employees for future tax periods for

employment tax purposes with partial relief from federal employment taxes for eligible taxpayers

who agree to prospectively treat their workers (or a class or group of workers) as employees.

To participate in this voluntary program, the taxpayer must meet certain eligibility requirements,

apply to participate in the VCSP by filing Form 8952, Application for Voluntary Classification

Settlement Program, and enter into a closing agreement with the IRS. For more information go

to: Voluntary Classification Settlement Program | Internal Revenue Service.

Misclassified Workers to File Social Security Tax Form

Form 8919 is used to figure and report an employee’s share of the uncollected Social Security

and Medicare taxes due on their compensation if they were an employee but their employer

treated them as an independent contractor. By filing this form, their Social Security earnings will

be credited to the employee’s Social Security record.

Generally, a worker who receives a Form 1099 for services provided as an independent

contractor must report the income on Schedule C, Profit or Loss from Business, and pay

self-employment tax on the net profit, using Schedule SE, Self-Employment Tax. However,

sometimes the worker is incorrectly treated as an independent contractor when they are actually

an employee. When this happens, Form 8919 will be used by workers who performed services

for an employer but the employer did not withhold the worker’s share of Social Security and

Medicare taxes.

In addition, the worker must meet one of several criteria indicating they were an employee while

performing the services. The criteria include:

The worker has led Form SS-8 and received a determination letter from the IRS stating they are

an employee of the rm.

The worker has been designated as a Section 530 employee by their employer or by the IRS

prior to January 1, 1977.

The worker has received other correspondence from the IRS that states they are an employee.

7

Chapter 2: Employee or Independent Contractor

www.irs.gov/tribes

The worker was previously treated as an employee by the rm and they are performing services

in a similar capacity and under similar direction and control.

The worker’s co-workers are performing similar services under similar direction and control and

are treated as employees.

The worker’s co-workers are performing similar services under similar direction and control and

led Form SS-8 for the rm and received a determination that they were employees.

The worker has led Form SS-8 with the IRS and has not yet received a reply.

NOTE: In the past, misclassified workers often used Form 4137, Social Security and Medicare

Tax on Unreported Tip Income, to report their share of Social Security and Medicare taxes.

Misclassified workers should no longer use this form. Instead, Form 4137 should now only be

used by tipped employees to report Social Security and Medicare taxes on allocated tips and

tips not reported to their employers.

Examples of Employees

Example 1: The tribal business pays Tom $500 per week to clean the tribal office complex.

Tom only works for the tribe. He doesn’t have the right to hire or fire any assistants, and he is

required to personally do the work. The tribe provides Tom’s supplies and tools. Based on these

facts, Tom is considered an employee and the tribe should withhold income and employment

taxes. Tom will be issued a Form W-2.

Example 2: Bill works as a deputy for the tribal police department. When Bill is off-duty, he has

been repairing the roof of the tribal hospital. Bill doesn’t do roofing for other customers. The

tribe determined when the work was to be done, provided the supplies needed and determined

how Bill will be paid. Based on these facts, Bill is considered an employee of the tribe for both

jobs and should be issued a Form W-2 showing the withheld income and employment taxes.

Example of an Independent Contractor

The tribe pays Paul $1,000 per week to clean the bingo halls. Paul operates his own janitorial

service providing cleaning services to numerous entities. He has the right to hire and fire his

own employees and provides his own supplies. The tribe doesn’t have the right to control

Paul. Therefore, Paul is not an employee of the tribe and would be issued a Form 1099-NEC,

Nonemployee Compensation, to report his compensation.

If you have a question about the treatment of any of your workers, see Topic No. 762,

Independent Contractor vs. Employee, at www.irs.gov/taxtopics/tc762, Publication 15A,

Employer’s Supplemental Tax Guide, or go to www.irs.gov/tribes and click on the “Employment

Tax for Tribes” link.

8

Chapter 2: Employee or Independent Contractor

www.irs.gov/tribes

Agricultural Labor (Farm Work)

There are special rules for Social Security and Medicare withholding on agricultural workers.

Employment taxes for farmworkers must be filed on Form 943, Employer’s Annual Federal Tax

Return for Agricultural Employees, and must be separate from other workers’ employment taxes

filed on Form 941. See Publication 51, Section 4, Social Security and Medicare Taxes, for more

information.

Crew Leaders

A crew leader is an employer of farmworkers. A crew leader is a person who furnishes and pays

(either on their own behalf or on behalf of the farm operator) workers to do farm work for the

farm operator. If there is no written agreement between you and the farm operator stating that

you are their employee and if you pay the workers (either for yourself or for the farm operator),

then you are a crew leader. Crew leaders are independent contractors and should be issued

Form 1099-NEC, Nonemployee Compensation, to report the nonemployee compensation.

References

Publication 15, (Circular E), Employer’s Tax Guide

Publication 15-A, Employer’s Supplemental Tax Guide

Publication 15-T, Federal Income Tax Withholding Methods

Publication 51, (Circular A), Agricultural Employer’s Tax Guide

Publication 1779, Independent Contractor or Employee

Form SS-8, Determination of Worker Status for Purposes of Federal Employment Taxes and

Income Tax Withholding

Form 8919, Uncollected Social Security and Medicare Tax on Wages

Form 8952, Application for Voluntary Classication Settlement Program (VCSP)

9

Chapter 3

Treatment of Certain Payments

In this chapter, we’ll discuss how certain payments are treated. Some of these payments are

specific to Indian tribes, while others are not. For example, payments made from fishing rights-

related activities and payments made to tribal council members are tribal specific issues.

Payments made to elected and appointed officials and those payments made as bonuses

apply to all employers. The proper treatment of these payments for withholding and reporting

purposes is sometimes confusing.

The next four sections of this chapter discuss payments for fishing rights-related activities, tribal

council members, bonuses and payments to elected and public officials. If you have questions

about any of these payments, or how they are to be treated, go to www.irs.gov/tribes and click

on the “Employment Tax for Tribes” link. See also Publication 15 and Publication 15A.

Fishing Rights-Related Activities

Any income derived by a member of an Indian tribe, either directly or through a “qualified Indian

entity” (defined later in this chapter), or by a “qualified Indian entity” from a fishing-rights related

activity of that member’s or entity’s tribe is exempt from federal and state taxation (income tax,

income tax withholding, FICA, unemployment tax and self-employment tax).

Wages are not exempt if paid by an employer who is not a member of the same tribe or is not a

qualified Indian entity. Wages are also not exempt if paid to an employee who is not a member

of the tribe whose fishing rights are exercised. Tribal members must fish in their own waters to

be exempt.

Fishing rights-related activity means an activity (including aquaculture) directly related to

harvesting, processing or transporting fish harvested in the exercise of recognized fishing

rights of the tribe or to selling fish, but only if members of the tribe perform substantially all the

harvesting.

A recognized fishing right must have been secured as of March 17, 1988, by a treaty between

the tribe and the United States, by an Executive Order or an Act of Congress.

As an employer exercising fishing rights-related activities you should:

Verify your status as a qualied Indian entity.

Verify your employee’s proof of tribal membership.

Verify time allocated to shing versus non-shing activity. For example, consider a game warden

that is responsible for protecting other wildlife and has other duties, as well as patrolling the

treaty waters of his tribe. His employer should verify the percentage of time he engages in shing

rights-related activities of his tribe.

Maintain records to support each employee’s time allocation.

Maintain records to support the 90% gross receipts rule (dened later in this chapter).

Tax Return Preparation

Do not include exempt wages on Form 941, Form 940 or Form W-2.

Wages paid for non-shing activities are subject to all applicable employment taxes and

employment tax reporting, including Form W-2.

If only shing rights-related income is paid to an individual, no Form W-2 is required.

A letter stating the amount and tax-exempt nature of an employee’s wages may be issued to the

employee to be used for various non-tax purposes, such as bank loans.

Chapter 3: Treatment of Certain Payments

10

www.irs.gov/tribes

Special Definitions

A “qualified Indian entity” is 100% owned by a federally recognized Indian tribe or tribal

members, and substantially all management functions are performed by tribal members. It may

be jointly owned by more than one tribe or members of more than one tribe.

90% rule for processors and transporters - If the entity engages to any extent in any

substantial processing or transporting of fish, then at least 90% of the annual gross receipts of

the entity must be derived from the exercise of protected fishing rights of tribes whose members

own at least 10% of the equity interests in the entity.

Note: If a processor or transporter fails to meet the 90% rule, all income from that year is

taxable.

Examples of categories of tribal employees whose wages may be exempt or partially exempt:

Fishers, processors (including smoking), transporters

Hatchery workers

Environmental and conservation workers

Enforcement staff and tribal court personnel

Support staff, for example, secretary, accounting, payroll

Program director, executive director

Fishery biologist

Fishery aide

Fishery and habitat policy analyst

Water quality biologist

Habitat inventory and assessment technician

Legislative analyst

Information and education services

Data analyst

Policy analyst

Public information staff

Tribal Council Members

Revenue Ruling 59-354 sets forth a limited employment tax exception for amounts paid to tribal

council members for services performed by them as council members. Revenue Ruling 59-354

holds that while these amounts are includible in the council member’s gross income, they do not

constitute wages for purposes of FICA, FUTA and federal income tax withholding. Note: Tribes

with voluntary agreements under Section 218A of the Social Security Act should see Tribal

Social Security Fairness Act of 2018, below.

Tribal officials are liable for federal income tax on these wages, and some may voluntarily

have this tax withheld to avoid making quarterly estimated tax payments or personal year-end

deficiencies.

Council members’ salaries will be shown in box 1, Wages, tips, other compensation, of the Form

W-2. Additionally, in box 14, Other, you should include “Revenue Ruling 59-354” and the total

amount subject to Revenue Ruling 59-354. This will show why there are no amounts listed in the

boxes for federal income tax withheld (box 2) or FICA (boxes 3, 4 and 7).

Chapter 3: Treatment of Certain Payments

11

www.irs.gov/tribes

Note: If the tribal council member requests to have federal income taxes withheld, box 2 will

reflect these voluntarily-withheld amounts. Voluntary withholding of FICA taxes to receive Social

Security and Medicare credit isn’t generally permitted, except as provided under the Tribal

Social Security Fairness Act of 2018 discussed in the next section.

Exhibit 3.1 (at the end of this chapter) is a sample of a Form W-2 for a tribal council member.

Tribal council members may receive two Forms W-2, one for tribal council member wages

and one for services performed in another capacity. See Form W-2 instructions for further

information.

Part of your responsibility as an employer is to provide the council member with either a copy

of Revenue Ruling 59-354 or a statement advising them that their W-2 is treated differently

(such as, salaries do not constitute wages for purposes of FICA or federal withholding taxes per

Revenue Ruling 59-354).

Tribal Social Security Fairness Act of 2018

The Tribal Social Security Fairness Act of 2018 allows federally recognized Indian tribes to

extend Social Security coverage to tribal council positions voluntarily through an agreement with

the Commissioner of Social Security under Section 218A of the Social Security Act.

Under this new legislation, if a tribe chooses to enter into an agreement for coverage, then all

tribal council positions are covered. Coverage will apply to any current and future tribal council

members and cannot be terminated once granted.

Interested tribes need to complete the Tribal Council Member Coverage Agreement to

request coverage. Tribes will communicate directly with SSA regional specialists to execute the

agreements. Coverage is effective the month after the month the agreement is signed, unless the

tribe requests a later effective date.

Tribes may request retroactive coverage for periods for which they have already paid FICA taxes

and not received a refund. Retroactivity can go back as far as needed without limit as long

as FICA taxes were paid. If you did not pay FICA during the retroactive period, you will not be

charged. You cannot pay into the retroactive period.

Visit the SSA at www.ssa.gov/people/aian/ for more information on the Tribal Social Security

Fairness Act

Claim for Over Collected Employee Social Security and Medicare Taxes

If the Indian tribal government withheld Social Security taxes and Medicare taxes from a

tribal council member’s salary, those over collected taxes may be refunded to the tribal

council member in one of two ways: 1) by the tribal council member filing Form 843, Claim for

Refund and Request for Abatement, or 2) the tribal government may file Form 941-X, Adjusted

Employer’s Quarterly Federal Tax Return or Claim for Refund, and refund the member’s share of

FICA taxes (to correct prior period Forms 941).

When filing Form 941-X, a written statement must be obtained from each tribal council employee

stating that the employee has not claimed, and will not claim, refund or credit for the amount of

over collection. The Indian tribal government can make a claim for both the employer and the

employee shares of Social Security and Medicare taxes for those employees who provide the

required written statements.

Chapter 3: Treatment of Certain Payments

12

www.irs.gov/tribes

For those employees who do not provide statements, you (as the employer) can make a claim for

only the employer’s share of Social Security and Medicare taxes.

Next, complete the Form 941-X for each Form 941 being corrected. When completing the Form

941-X, be sure to complete Part 1 by checking the appropriate boxes and signing at the bottom

of Part 5. The tribe then reimburses the council members for their share of the Social Security

and Medicare taxes.

Finally, complete Form W-2c, Corrected Wage and Tax Statement, for each employee for whom

adjustments were made to Social Security and Medicare taxes. This corrects the previous

Form W-2 filed. Submit the Forms W-2c along with the Form W-3c to the Social Security

Administration.

Benefit Payments for Training or Retraining

Revenue Ruling 63-136 addresses the issue of benefit payments, received by individuals

undergoing training or retraining under the Area Redevelopment Act (75 Stat. 47-63), or the

Manpower Development and Training Act of 1962 (76 Stat. 23-33). Examples of state-funded

retraining programs are the Job Training Partnership Act (JTPA) and the Work Investment Act

(WIA). A tribe may establish its own work employment program.

As stated in Revenue Ruling 63-136, these benefit payments are not taxable. The payments

are intended to aid the recipients in their efforts to acquire new skills to prepare them for

better employment opportunities. As such, the payments fall into the same category as other

unemployment relief payments and are not includible in the recipient’s gross income.

Bonuses

Bonuses that the tribe pays an employee are includable in the employee’s income and are

shown as wages on Form W-2. If the bonuses are paid to the employee in the form of goods or

services, the fair market value of the goods or services will be added to the employee’s income.

Bonuses are considered supplemental wages paid in addition to the employee’s regular wages.

How you withhold on bonuses depends on whether the bonus is identified as a separate

payment from regular wages.

Bonus Combined with Regular Wages

If you pay bonuses with regular wages but do not specify the amount of each, withhold income

tax as if the total were a single payment for a regular payroll period.

Bonus Identified Separately from Regular Wages

If you pay bonuses separately (or combine them in a single payment and specify the amount of

each), the income tax withholding method depends partly on whether you withhold income tax

from your employee’s regular wages.

If you withheld income tax from an employee’s regular wages, you can use one of the following

methods for the bonus:

a) Withhold a flat 22% (no other percentage allowed).

b) Add the bonus and regular wages for the most recent payroll period this year. Figure the

income tax withholding as if the total were a single payment. Subtract the tax already withheld

from the regular wages. Withhold the remaining tax from the bonus.

Chapter 3: Treatment of Certain Payments

13

www.irs.gov/tribes

If you did not withhold income tax from the employee’s regular wages, use method b, above.

(This would occur, for example, when the value of the employee’s withholding allowances

claimed on Form W-4 is more than the wages.)

Regardless of the method you use to withhold income tax on bonuses, they are subject to Social

Security, Medicare and FUTA (if applicable) taxes.

Example 1: – Form W-4 after 2020 You pay Sharon a base salary on the first of each month.

She is single and didn’t complete Steps 2, 3 or 4 on the Form W-4. Her July 1 pay is $2,000.

Using the current wage bracket tables, you withhold $95 using the standard rate. On July 15 you

pay Sharon a bonus of $1,000. Electing to use supplemental payment method b, you:

1) Add the bonus amount to the amount of wages from the most recent pay date ($1,000 +

$2,000 = $3,000).

2) Determine the amount of withholding on the combined $3,000 ($213 using the wage bracket

tables).

3) Subtract the amount withheld from wages on the most recent pay date from the combined

withholding amount ($213 - $95 = $118).

4) Withhold $118 from the bonus payment.

Example 2: The facts are the same as above, except you elect to use the flat rate method of

withholding on the bonus. You withhold 22% of $1,000, or $220, from Sharon’s bonus payment.

Example 3: – Form W-4 Prior to 2020 You pay John a base salary on the first of each month.

His most recent Form W-4 is from 2018. He is single and claimed one withholding allowance. He

didn’t enter an amount for additional withholding. His July 1 pay is $1,000. You decide to use the

Wage Bracket Method of withholding. Using Worksheet 3 and the withholding tables in section 3

of Pub. 15-T, you withhold $29 from this amount. In August John receives his salary and a bonus

of $500, which you combine with regular wages and don’t identify separately. You withhold

based on the total of $1500. The correct amount of withholding from the tables is $78.

Stipend Payments

A stipend is a fixed sum of money paid periodically for services or to defray expenses. The

fact that remuneration is termed a “fee” or “stipend” rather than salary or wages is immaterial.

Wages are generally subject to employment taxes and should be reported on Form W-2. Refer

to Publication 15 (Circular E), Employer’s Tax Guide, section 5, Wages and Other Compensation,

for rules on accountable and nonaccountable plans for employee business expenses.

Stipends or fees paid to an employee or an independent contractor are generally reportable.

However, if the stipend is intended to be a reimbursement of expenses and the requirements for

an accountable plan are met, the stipend may not be reportable.

Elected and Public Officials

To determine whether an elected or public official is an employee, tribal governments would

apply the ‘common law’ factors. The tribal government should use the three-prong test to

determine whether a common law employment relationship exists. The three prongs are:

1) Behavioral control;

2) Financial control; and

3) The relationship of the parties.

Chapter 3: Treatment of Certain Payments

14

www.irs.gov/tribes

Each determination is based upon its unique facts and circumstances. If there is any question

whether a person is a public official, obtain a copy of, or a reference to, the statute or ordinance

relating to the establishment of the position.

For more information on employer-employee relationships, refer to Chapter 2 of Publication

15 and Chapter 2 of Publication 15-A, Employer’s Supplemental Tax Guide. If you would

like the IRS to determine whether services are performed as an employee or independent

contractor, you may submit Form SS-8, Determination of Worker Status for Purposes of Federal

Employment Taxes and Income Tax Withholding.

Election Workers

If an election worker’s compensation is subject to withholding of FICA tax, reporting is required

for all compensation, regardless of the amount. If an election worker’s compensation is not

subject to withholding of FICA tax, information reporting is required for payments that aggregate

$600 or more in a calendar year. See Revenue Ruling 2000-6 to determine when an election

worker’s compensation is subject to withholding of FICA tax.

In the following examples, all the wages paid have been for services as an election worker only.

1) If wages paid during the year are less than $600, no Form W-2 is required. The wages are

not subject to FICA or federal income tax withholding. The election worker must report the

earnings as wages.

2) If wages paid during the year are between $600 and $1,999, file a Form W-2. FICA and federal

income tax withholding are not required. The election worker must report the earnings as

wages.

3) If wages are equal to or greater than $2,000 for 2022 (this amount is indexed for inflation), a

W-2 must be issued. The wages are subject to FICA, but not federal income tax withholding.

The election worker must report the earnings as wages.

For later years, see Special Rules for Various Types of Services and Payments in Publication 15

for the FICA wage requirement for Election Workers.

Chapter 3: Treatment of Certain Payments

15

www.irs.gov/tribes

Per Capita Payments

When a tribe distributes revenue to all its members or groups of members, it has provided a

per capita payment. Under IGRA, a federally recognized Indian tribe may use net revenues from

Class II or Class III gaming activities to make per capita payments to its tribal members only if

four conditions are met:

1. It must prepare a plan to allocate revenues only for IGRA authorized uses to:

fund tribal government operations or programs,

provide for the general welfare of the Indian tribe and its members,

promote tribal economic development,

donate to charitable organizations, or

fund local government and agency operations.

2. T

he Secretary of the Interior must approve the revenue’s use, particularly when it’s for funding tribal

government operations or programs and for promoting tribal economic development.

3. The tribe must protect and preserve minors’ and other legally incompetent persons’ interests

who are entitled to receive any of the per capita payments. The tribe disperses these

payments to their parents or legal guardian for their health, education or welfare, under a plan

approved by the Secretary and the tribe’s governing body.

4. The per capita payments are subject to federal taxation and tribes notify members of this tax

liability when payments are made.

Gaming Distributions to Minors

The IGRA requires protections of the minors’ interests for gaming revenue distribution. To satisfy

this requirement, many tribes establish trusts for minors and legal incompetents. A tribe may

serve as the grantor and owner of the trust.

Revenue Procedure 2011-56 clarifies that deposits into a trust are taxable at the time the

deposits are made. If the funds are left in the trust account until the beneficiary reaches the

age of majority the principal and interest are not reported as taxable income to the beneficiary.

The revenue procedure states that when an IGRA trust earns money or receives a deposit,

the beneficiaries are not required to include those amounts in their gross income. However,

beneficiaries who receive trust distributions would include the amounts as taxable income when

actually or constructively received.

Example: Jane, a minor, is a member of a federally recognized tribe. The tribe creates a trust for

her. She cannot receive any distributions from the trust before she reaches age 18. Therefore,

Jane does not include the trust’s income as part of her gross income. She is not in constructive

receipt of the funds placed in trust or income earned by the trust, because she doesn’t have

the unqualified right to receive immediate payment. As a result, the accumulated per capita

distributions and the related income are not taxable. However, if the tribe gives the trustee

(Jane’s legal guardian) approval to access the funds, those funds become taxable.

Chapter 3: Treatment of Certain Payments

16

www.irs.gov/tribes

Withholding Requirements of Distributions from Net Gaming Revenue

Per capita distributions from gaming are subject to federal taxation under IRC Section 3402(r).

Tribes must notify its members of the tax liability when it makes the payments, reporting the

per capita distributions on Form 1099-MISC, Miscellaneous Income. When the tribal members

receive their Forms 1099-MISC, they report the income on the “Other Income” line of their Form

1040, U.S. Individual Income Tax Return, and include a description as “Indian gaming profits.”

These distributions are also subject to withholding. The Social Security number of all payees

should be secured prior to making payments. Otherwise, the tribe is potentially liable for backup

withholding provisions under IRC Section 3406.

In the payments section of Form 1040, the payee should report any withholding reflected on

Form 1099 as “federal income tax withheld from Forms W-2 or 1099.” The tribe determines

the withholding amount based on the total payment to the tribal member for the year.

Publication ublication 15-T, Federal Income Tax Withholding Methods contains the withholding

tables (identified as “Tables for Withholding on Distributions of Indian Gaming Profits to

TribalMembers”). The tribe is potentially liable for the difference between the amount required to

be withheld under the tables and the amount actually withheld.

The withholding tables are revised each year and generally published in January. There is a

threshold for requiring withholding which often changes annually. Once the threshold distribution

amount is reached, withholding is required between 10-24%.

Example: A tribe distributes $28,000 of per capita payments to tribal members during 2022.

A regular monthly per capita payment of $1,500 is issued during the months January through

December. During December, an additional per capita payment is made of $10,000, for a

cumulative distribution of $9,000.

The computation for withholding on monthly per capita payments would be based on the $1,500

monthly payment for January to November and for December, the aggregate payment amount

of $11,500. Using the tables for 2022 for monthly distributions, payments of $1,500 are subject

to 10% withholding on the amount over $1,079, or $42.10 (.10 x $421). The December payment

would be $1,267.79 plus 24% of the amount over 8,502, or $1,987.31 ($1,267.79 + $719.52 (.24 x

($11,500 - $8502))).

To avoid incorrect withholding, payments during a chosen distribution period should be

aggregated as in the example above.

Form SS-8

Occasionally, an Indian tribal government will be unable to determine whether a worker is

an employee or is self-employed and should be treated as an independent contractor. Many

individuals who have personal service contracts with Indian tribal governments may be

employees rather than independent contractors. The existence of a contract does not mean

that the individual performing the service is not an employee. It is important to the worker that

the employment status be determined as soon as possible so the earnings can be properly

reported.

If no clear resolution is possible, consider filing a Form SS-8 with the IRS for a determination.

A Form SS-8 is used to gather information to determine whether a worker is an employee for

federal employment taxes.

Chapter 3: Treatment of Certain Payments

17

www.irs.gov/tribes

All pertinent facts about the individual’s work arrangement should be obtained and submitted

to the IRS on a Form SS-8. A Form SS-8 may be submitted by the tribal government or by

the worker. If a contract has been executed between the worker and the entity, a copy of the

contract should be furnished with the Form SS-8. When a Form SS-8 is submitted to the IRS, all

the facts are analyzed and the determination of a worker’s status is presented to the employer in

the form of a determination or letter ruling.

Several problems arise for a worker when incorrectly treated as an independent contractor. To

begin with, the worker would probably pay more taxes (that is, Self-Employment Contributions Act

(SECA) taxes) than if the worker were being treated correctly as an employee. As an employee, only

the employee’s portion of the Social Security and Medicare taxes are withheld and paid from the

employee’s wages. As an independent contractor, the worker is not eligible for any unemployment

benefits or other benefit plans that the worker would have as an employee. Also, as an independent

contractor, the worker may have to pay estimated tax payments each quarter.

References

Internal Revenue Code Section 7873

Publication 15, (Circular E), Employer’s Tax Guide

Publication 15-A, Employer’s Supplemental Tax Guide

Publication 15-T, Federal Income Tax Withholding Methods

Revenue Ruling 59-354

Revenue Ruling 63-136

Revenue Ruling 2000-6

Form 843, Claim for Refund and Request for Abatement

Form 941-X, Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund

Exhibit 3.1

Sample Form W-2 for Tribal Council Member

Note: The below sample Form W-2 only applies to tribes that do not have an agreement

under Section 218A of the Social Security Act with the Commissioner of Social Security.

18

Chapter 4

Tipped Employees

Tips are Wages

Tips are defined as wages under IRC Sections 3121(a) and 3401(a). Tips received by an

employee in the course of employment should be reported to the employer whether received

directly from customers or indirectly in the form of shared tips or tip-outs from fellow employees.

For purposes of FICA, the term “wages” means all remuneration for employment, including the

cash value of all remuneration (including benefits) paid in any medium other than cash (unless

specifically excepted). For purposes of federal income tax withholding, the term “wages” is

similar to the one for FICA.

All tips your employees receive are taxable income subject to federal income tax. Cash tips

include tips received directly from customers, tips from other employees under any tip-sharing

arrangement and charged tips (for example, credit and debit card charges) that are distributed to

the employee. Both directly and indirectly tipped employees must report tips received to you.

Cash tips of $20 or more an employee receives in a calendar month while working for any one

employer are wages subject to FICA and income tax withholding. Cash tips include charged tips,

and tips paid by check or other cash equivalents. Even though these tips are taxable income,

tips of less than $20 received by an employee during a calendar month while working for a

particular employer are not wages for FICA or federal income tax withholding purposes. Once

the amount of tips received in a calendar month reaches $20 from any one employer, the entire

amount of tips received must be reported to the employer and included in wages (not just the

amount over $20).

An employee who receives $20 or more in cash tips must report those tips in writing to you by

the tenth day following the month in which the tips are received (or more often if required by the

employer). Employees who receive tips of less than $20 in a calendar month are not required to

report their tips to you but must report these amounts as income on their tax returns and pay

taxes, if any.

Service Charges

Service charges added to a bill or fixed by the employer that the customer must pay will not

constitute a tip when paid to an employee, but rather constitute non-tip wages. These non-tip

wages are subject to Social Security, Medicare and federal income tax withholding. Common

examples of service charges (sometimes called auto-gratuities) in service industries are:

Large party charge (restaurant),

Bottle service charge (restaurant and night-club),

Room service charge (hotel and resort),

Contracted luggage assistance charge (hotel and resort), and

Mandated delivery charge (pizza or other retail deliveries).

These service charges are treated as wages and are includible on Form W-2.

Large Food and Beverage Establishments

If you operate a large food or beverage establishment, you must file Form 8027, Employer’s

Annual Information Return of Tip Income and Allocated Tips, for each calendar year, and may be

Chapter 4: Tipped Employees

19

www.irs.gov/tribes

required to allocate tips to your employees. A large food or beverage establishment is a food or

beverage operation where:

Food and beverages are provided for consumption on the premises,

Tipping is a customary practice, and

There are more than 10 employees who work more than 80 hours on a typical business day.

For the Form 8027 filing requirement:

Casino buffets are included if tipping is customary.

Ten or more employees include all employees at the establishment, not just the tipped

employees.

If you own more than one establishment, you must le a separate Form 8027 for each

establishment.

If there is more than one business operating within a single building, and if the receipts for the

businesses are recorded separately, then each business should le a separate Form 8027.

File Form 8027 by the last day of February for the preceding calendar year. However, if you file

electronically, the due date is March 31, for the preceding calendar year. You may request an

extension on Form 8809, Application for Extension of Time to File Information Returns, if you

file the request before the due date of the return. Refer to Publication 1239, Specifications for

Electronic Filing of Form 8027, to file electronically.

Allocated Tips

IRC Sections 6053(c)(2) and (3) require large food and beverage establishments to allocate tips

to those employees who report tips of less than 8% of gross receipts to them (or a lower rate

approved by the IRS). You may base the allocation on each employee’s share of gross receipts

or share of total hours worked, or on a written agreement between you and your employees.

You are required to report the amount allocated on Form W-2 in the box labeled “Allocated Tips”

for each employee to whom you allocated tips. Penalties may be imposed for both failing to file

and failing to furnish a correct Form W-2 for each form on which you fail to include this required

information. Do not withhold income, Social Security or Medicare taxes on allocated tips, since

your employee did not report these amounts to you. See Exhibit 4.1 for an example.

Whether or not you are required to allocate tips, your employees must continue to report all tips

to you, and you must use the amounts they report to figure payroll taxes.

Tip Rate Reduction Requests

You may request a reduced allocation rate by submitting a petition that clearly demonstrates that

a rate less than 8% should apply. Refer to Instructions for Form 8027 on how to apply.

IRC Section 3121(q)

IRC Section 3121(q) provides that tips are deemed to have been paid by the employer for

purposes of FICA tax and requires that employers withhold both the employer and employee

shares of FICA. It also provides that unreported tips are subject to employer FICA tax. IRC

Section 3121(q) allows the IRS to assess the employer’s share of FICA taxes on reported tips

(for example, where the employee did not furnish a statement reporting the tips or to the extent

the statement is inaccurate or incomplete). When determining the employer’s additional FICA tax

liability, the tips are deemed paid on the date the Notice and Demand is made to the employer

by the IRS.

Chapter 4: Tipped Employees

20

www.irs.gov/tribes

Employer’s General Responsibilities

The employer is responsible for deducting and depositing the employee’s FICA tax on tips

included in the written report furnished by the employee to the extent that collections can be

made from the employee’s wages (under the employer’s control, excluding tips) on or after the

time the written statement is furnished.

Additional FICA Tax Payable

An employee’s regular pay may not be enough for the employer to withhold all the taxes an

employee owes on the regular pay and reported tips. If this happens an employee may give the

employer more money to cover the taxes.

If the employee’s pay under the employer’s control, including any additional money given by

the employee, is not enough to cover all the taxes, Treasury Regulations Section 31.3102-3(a)(1)

clarifies the sequence the employer must follow when paying over the withheld taxes:

1) All taxes (FICA, federal withholding, and state and local) on regular pay, exclusive of tips

2) Social Security and Medicare taxes on reported tips

3) Federal, state and local taxes on reported tips

The employer must furnish to the employee a written statement showing the amount of

employee FICA on tips that exceeds the tax the employer can collect from the wages under the

control of the employer. The statement is provided on the employee’s Form W-2. The employee

is required to report and pay over to the IRS the portion of employee tax that the employer was

unable to withhold due to the lack of employee wages available to cover the liability.

Example: Employee taxes on wages and tips exceed regular wages:

Grady is a blackjack dealer for a tribal casino. He routinely receives tips as a part of his

compensation as a dealer. The casino pays him a salary of $200 per week. He receives tips in

cash each day that he works.

Grady keeps a daily tip record and reports tips to his employer every other Friday. He has a Form

W-4, Employee’s Withholding Allowance Certificate, on file with his employer (the casino) from 2018.

It reflects that he is single with one exemption. For the two-week period ending April 12, Grady

reported $1,200 in cash tips to his employer. His regular wages for the same two-week period are

$400. The casino tip policy allows Grady to keep his cash tips at the time he receives them.

The following computation illustrates that Grady’s total withholding for wages and tips exceeds

his regular wages, causing him to owe taxes to his employer.

Gross Regular Pay .........................................................................................$400.00

Tips Reported .............................................................................................. $1,200.00

Deductions Deductions from

Gross Regular Pay

Deductions from

Tip Income

Total

FICA $30.60 $91.80 $122.40

Federal Withholding $100.00* $200.00* $300.00*

State Withholding $26.00 $78.00 $104.00

Total $156.60 $369.80 $526.40

Net Paycheck Zero**

* The withholding amounts are for this example only. The withholding tables were not consulted

for federal or state withholding taxes.

Chapter 4: Tipped Employees

21

www.irs.gov/tribes

**The employee owes the amount of tax that exceeds his regular paycheck ($526.40 – $400.00 =

$126.40).

Because all tips are taxable wages to the employee, this situation creates a withholding shortfall

for Grady. The withholding on his wages plus his tips exceeds his biweekly paycheck from his

regular salary.

If Grady does not make arrangements with his employer to pay all his FICA and withholding, his

taxes will be applied in the following order:

1) Withholding on regular wages (FICA, federal income, state income) ($156.60)

2) FICA withholding tax on tips ($91.80)

3) Federal income tax withholding ($151.60 of the $200 due)

Net paycheck = $0 ($400 less $156.60, $91.80 and $151.60)

Grady owes $48.40 in federal income tax withholding and $78 in state withholding.

Because Grady’s regular pay is not enough for his employer to withhold all the taxes he owes

on his regular pay plus his reported tips, he may give his employer money until the close of the

calendar year to pay the rest of the taxes.

His employer may also collect any taxes that remain unpaid from his next paycheck. If

withholding taxes remain uncollected at the end of the year, Grady may be subject to a penalty

for underpayment of estimated tax.

In the example, Grady’s regular paycheck paid all his FICA (Social Security and Medicare taxes).

This is not always the case; sometimes an employee may owe Social Security and Medicare

taxes uncollected at the end of the year. These uncollected taxes will be shown in box 12 of

Form W-2 and must be reported on the employee’s Form 1040, U.S. Individual Income Tax

Return.

Employer Tip Employment Tax Responsibilities

Include tips as wages, withholding FICA and federal income tax, and include on Form 941 and

Form W-2

Allocate tips when required

File the information report, Form 8027, if required

Employer and Employees’ Recordkeeping Responsibilities (Specific to Large Food

and Beverage Establishments)

The written statement furnished by the employee to the employer for tips received by the

employee must be signed by the employee and should disclose:

The name, address and SSN of the employee.

The name and address of the employer.

The period for which, and the date on which, the statement is furnished. If the statement is for a

calendar month, the month and year should be specied. If the statement is for a period of less

than one calendar month, the beginning and ending dates of the period should be shown (for

example, January 1 through January 8, 20XX).

The total amount of tips received by the employee during the period covered by the statement,

which are required to be reported to the employer.

Chapter 4: Tipped Employees

22

www.irs.gov/tribes

No particular form is required; however, Form 4070 (included in Publication 1244, Employee’s

Daily Record of Tips and Report to Employer) may be used unless the employer provides some

other form.

If the employer chooses to use another form, the form must meet the requirements of Treasury

Regulation Section 31.6053-1(b)(2)(ii):

The form is to be used solely for the purpose of reporting tips,

It meets the requirements of subparagraph (1) (of the regulations as listed above), and

A blank copy must be made available to the employee for completion and retention by the

employee.

In lieu of a special form for tip reporting, Treasury Regulation Section 31.6053-1(b)(2)(ii) provides

that an employer may provide regularly used forms (such as time cards) for the employees

to use in reporting tips. The form must include the period for which, and the date on which,

the statement is furnished, the total amount of tips the employee received and identifying

information, which will ensure identification of the employee by the employer.

Tip Rate Determination and Education Program (Tip Agreements)

The IRS began its Tip Rate Determination/Education Program (TRD/EP) for businesses where

tip income is customary to improve and ensure compliance by employers and employees with

statutory provisions on tip income. Employers may participate in the TRD/EP. The program

primarily consists of voluntary tip compliance agreements developed to improve tip income

reporting by helping taxpayers to understand and meet their tip reporting responsibilities. These

voluntary tip compliance agreements offer many benefits for the employer and the employee.

Employers in the food and beverage industry or industries with tipped employees other than the

gaming industry may enter into a Tip Rate Determination Agreement (TRDA). Businesses in the

gaming industry may enter into a Gaming Industry Tip Compliance Agreement (GITCA).

The IRS will assist applicants in understanding and meeting the requirements for participation.

For more information about GITCA and TRDA agreements, search for Market Segment

Understandings (MSU) by using keyword “MSU tips” on IRS.gov.

References

Publication 15, (Circular E), Employer’s Tax Guide

Publication 15-T, Federal Income Tax Withholding Methods

Publication 531, Reporting Tip Income

Instructions for Form W-2, Box 1 and box 8

Publication 3148, Tips on Tips - A Guide to Tip Income Reporting for Employees Who Receive

Tip Income

Publication 3144, Tips on Tips - A Guide to Tip Income Reporting for Employers in Businesses

Where Tip Income is Customary

Instructions for Form 941, Line 5b, Taxable Social Security Tips

Form 8027 and instructions, Employer’s Annual Information Return of Tip Income and Allocated

Tips

Publication 1239, Specications for Electronic Filing of Form 8027, Employer’s Annual

Information Return of Tip Income and Allocated Tips

Chapter 4: Tipped Employees

23

www.irs.gov/tribes

References for your employees

Publication 1244, Employee’s Daily Record of Tips and Report to Employer (This publication

includes Form 4070, Employee’s Report of Tips to Employer, and Form 4070A, Employee’s Daily

Record of Tips.)

Form 4137, Social Security and Medicare Tax on Unreported Tip Income

Exhibit 4.1,

Form W-2, Wage and Tax Statement, showing allocated tips

24

Chapter 5

Employee Business Expense Reimbursements

Publication 15, (Circular E), Employer’s Tax Guide, defines employee business expense

reimbursements. A reimbursement or allowance arrangement is a system by which you

pay the advances, reimbursements, and charges for your employees’ business expenses.

The reimbursement policy of the employer will determine the proper tax treatment of these

reimbursed employee business expenses. This chapter addresses the two basic types of

reimbursement arrangements that can exist between an employer and an employee and how

you handle these reimbursements for income tax purposes.

There are two general types of expense reimbursement plans that an employer may use to

reimburse employees for out-of-pocket business expenses:

1) An accountable plan, and

2) A nonaccountable plan.

The principal difference is whether employees are required to substantiate expenses

(accountable plan) to their employer for the amounts they incur for job related expenses, or not

(nonaccountable plan).

Accountable Plan

Amounts paid under an accountable plan are not wages and are not subject to income tax

withholding and payment of Social Security, Medicare, State Unemployment Tax Act (SUTA) and

Federal Unemployment Tax Act (FUTA) taxes.

To qualify as an accountable plan, the plan must contain the following features:

The employee’s expenses must be incurred in connection with services as an employee with no

personal expenses.

The employee must substantiate expenses to the employer within a reasonable period of time

from when the expenses were incurred.

The employer must require that any excess advance or reimbursement over the actual

substantiated expense be returned within a reasonable period of time.

If the expenses covered by this arrangement are not substantiated, or amounts in excess

of expenses are not returned within a reasonable period of time, the amount is treated as

paid under a nonaccountable plan. A reasonable period of time depends on the facts and

circumstances. It is considered reasonable if the employees:

1) Receive the advance within 30 days of the time they incur the expense.

2) Adequately account for the expenses within 60 days after the expenses were paid or incurred.

3) Return any amounts in excess of expenses within 120 days after the expense was paid or

incurred.

Also, it is considered reasonable if you give your employees a periodic statement (at least

quarterly) that asks them to either return or adequately account for outstanding amounts and

they do so within 120 days.

Chapter 5: Employee Business Expense Reimbursements

25

www.irs.gov/tribes

Nonaccountable Plan

Simply stated, a reimbursement plan that doesn’t meet the requirements for an accountable

plan is a nonaccountable plan. Under a nonaccountable reimbursement plan, the employee is

generally not required to substantiate any expenses to the employer. Payments to your employee

for travel and other necessary expenses of your business under a nonaccountable plan are

treated as supplemental wages subject to income tax withholding, Social Security, Medicare,

SUTA and FUTA taxes. The payments are treated as paid under a nonaccountable plan if:

Your employee is not required to or does not substantiate timely those expenses to you with

receipts or other documentation, or

You advance an amount to your employee for business expenses and your employee is not

required to or does not return timely any amount not used for business expenses.

See Section 7 of Publication 15 for more information on supplemental wages.

Per Diem or Other Fixed Allowance

A per diem allowance is a fixed amount of daily reimbursement an employer gives an employee

for lodging, meals and incidental expenses when the employee is away from home on business.

You may reimburse your employees by travel days, miles or some other fixed allowance. In these

cases, your employee is considered to have accounted to you if the payments do not exceed

rates established by the federal government. The standard mileage rates are updated annually.

See www.irs.gov/tax-professionals/standard-mileage-rates for the current rates.

The federal per diem rates for meals and lodging in the continental U.S. are published by the

U.S. General Services Administration (GSA).

Per diem allowances may be used only if the time, place and business purpose of the travel

are substantiated by adequate records or other evidence. An employee can satisfy the

substantiation requirements for business vehicle expenses in two general ways:

1) An employee can submit periodically to the employer a log of business miles driven. The

expense is deemed substantiated to the extent of the standard mileage rate.

2) An employee can submit documentation of actual vehicle expenses (gas, maintenance,

insurance and so on) with support for the percentage of business use of the vehicle (for

example, a log showing both business and personal mileage).

If the per diem or allowance exceeds the federal rate, and you do not require your employees to

return the difference between the two rates, you must report the excess amount as wages. This

excess amount is subject to income tax withholding, and payment of Social Security, Medicare

and FUTA taxes. Report the nontaxable (substantiated) portion of the per diem or mileage

allowance in box 12 of Form W-2 using code L.

Example: The tribe sent an employee on a five-day business trip to Phoenix and gave the

employee a $400 advance to cover meals and incidental expenses ($80 per day). The federal per

diem for meals and incidental expenses for Phoenix is $51.75 for the first and last day of travel

and $69 for non-travel days. The tribe does not require the employee to return the difference

between the advance and the federal per diem rate allowed for Phoenix:

Chapter 5: Employee Business Expense Reimbursements

26

www.irs.gov/tribes

Per Diem Daily Rates Total

Advance travel payment $400.00

First and last day per diem ($69.00 x 0.75) $51.75 $103.50

3 non-travel days $69.00 $207.0 0

Total federal diem allowed $310.50

Taxable per diem $89.50

The $89.50 excess federal per diem amount will be included in box 1 on Form W-2. Box 12 will

show $310.50 using code L.

References

Publication 15, (Circular E), Employer’s Tax Guide

Publication 15-B, Employer’s Tax Guide to Fringe Benets

Publication 463, Travel, Gift, and Car Expenses

Publication 5137, Fringe Benet Guide

Instructions for Forms W-2 and W-3

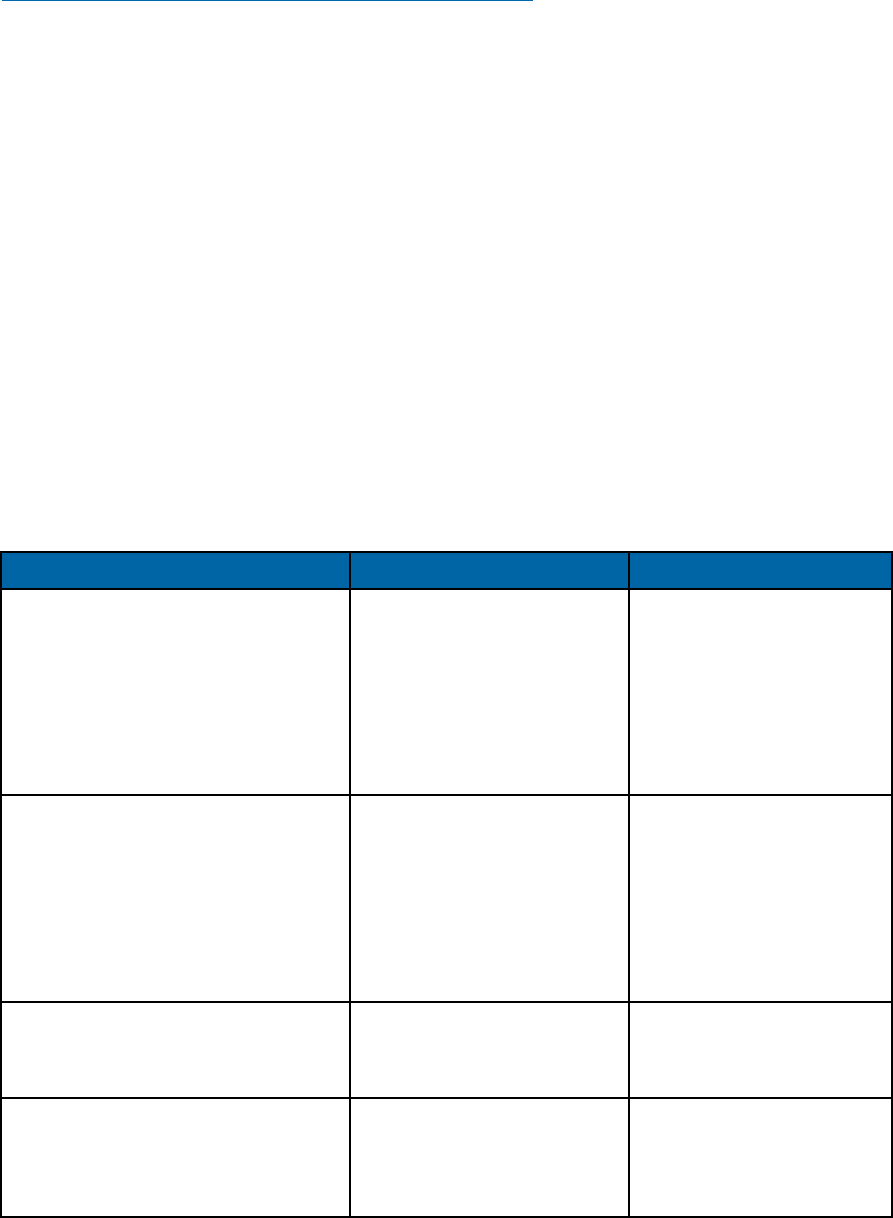

Exhibit 5.1 - Reporting Reimbursements Table

Reporting Reimbursements

If the type of reimbursement (or other expense

allowance) arrangement is under

Then the employer reports on Form W-2:

An ACCOUNTABLE PLAN with:

Actual expense reimbursement

Adequate accounting made and excess returned

No amount.

Actual expense reimbursement

Adequate accounting and return of excess both

required but excess not returned

The excess amount as wages in box 1.

Per diem or mileage allowance up to the federal

rate

Adequate accounting and excess returned

No amount.

Per diem or mileage allowance up to the federal

rate

Adequate accounting and return of excess both

required but excess not returned

The excess amount as wages in box 1. The

amount up to the federal rate is reported only in

box 12 – it is not reported in box 1.

Per diem or mileage allowance exceeds the

federal rates

Adequate accounting up to the federal rate only

and excess not returned

The excess amount as wages in box 1. The

amount up to the federal rate is reported only in

box 12 – it is not reported in box 1.

A NONACCOUNTABLE PLAN with:

Either adequate accounting or return of excess, or

both, not required by plan

The entire amount as wages in box 1.

No reimbursement plan The entire amount as wages in box 1.

27

Chapter 6

Fringe Benefits

Publication 15-B, Employer’s Tax Guide to Fringe Benefits, addresses the question, “Are fringe

benefits taxable?” If you provide your employees with a taxable fringe benefit, the benefit is