Executive Summary 2Fayetteville-Springdale-Rogers, Arkansas-Missouri Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Fayetteville-Springdale-Rogers, Arkansas-Missouri

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Executive Summary

Housing Market Area Description

The Fayetteville-Springdale-Rogers Housing Market

Area (hereafter, Fayetteville HMA) includes Benton,

Madison, and Washington Counties in northwest

Arkansas and McDonald County in southwest Missouri.

The HMA, in the Ozark Mountains, is coterminous

with the Fayetteville-Springdale-Rogers, AR-MO

Metropolitan Statistical Area (MSA). The HMA draws

residents and visitors for its numerous state parks,

more than 500 miles of lake shoreline, and a wide

array of entertainment and sports events, including

University of Arkansas (UA) football games and shows

at several local art centers.

The current population of the HMA is estimated

at 600,000.

Tools and Resources

Find interim updates for this metropolitan area, and select geographies nationally, at PD&R’s

Market-at-a-Glance tool.

Additional data for the HMA can be found in this report’s supplemental tables.

For information on HUD-supported activity in this area, see the Community Assessment Reporting Tool.

Executive Summary 3Fayetteville-Springdale-Rogers, Arkansas-Missouri Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Fayetteville-Springdale-Rogers, Arkansas-Missouri

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Market Qualifiers

The Fayetteville HMA economy expanded at a

fast pace during the past year and has completely

recovered from severe job losses that occurred

during April 2020 from the COVID-19 pandemic.

By September 2021, the HMA economy recovered

all the 26,100 jobs lost in April 2020, and since

May 2020, nonfarm payrolls have increased

by 40,100 jobs (monthly data, not seasonally

adjusted). During the 12 months ending July 2022,

nonfarm payrolls increased in all 11 job sectors.

The professional and business services sector led

job growth, with gains that accounted for nearly

one-third of the total increase in nonfarm payrolls

during the period. During the 3-year forecast

period, nonfarm payrolls are expected to increase

an average of 2.6 percent annually.

The home sales vacancy rate is currently

estimated at 1.2 percent, down from 3.8 percent

in April 2010 when conditions were soft. The

current supply of homes for sale is down

considerably compared with April 2010, when

the supply of home inventory was 12.9 months.

During the 12 months ending July 2022, new

and existing home sales in the HMA totaled

17,550, down 5 percent compared with a year

earlier (CoreLogic, Inc., with adjustments by the

analyst). The average price for a home increased

23 percent to $325,900, representing the

largest increase in the average sale price since

at least 2001. During the next 3 years, demand

is estimated for 14,000 new homes. The 4,400

homes currently under construction will satisfy

a portion of that demand.

Rental market conditions are tight in the HMA as of

August 1, 2022, compared with soft conditions in

April 2010. The apartment market is also tight, with

an average vacancy rate of 2.3 percent during the

second quarter of 2022, down from 2.5 percent a

year earlier and from a second-quarter peak of 7.8

percent during the second quarter of 2009 (CoStar

Group). The average apartment rent during the

second quarter of 2022 increased 12 percent to

$970 from a year earlier, representing the fastest

increase in the average apartment rent since at

least 2001. During the forecast period, demand is

estimated for 6,475 new rental units. The 4,300

units currently under construction are expected to

satisfy part of that demand.

Economy

Strong: During the 12 months

ending July 2022, nonfarm payrolls

in the Fayetteville HMA increased

by 14,600, or 5.5 percent, to

281,200 jobs.

Rental Market

Tight: The rental vacancy rate is

currently estimated at 6.5 percent,

down from 13.9 percent in 2010.

Sales Market

Tight: The HMA had a 1.5-month

supply of homes for sale in July

2022, up from 1.2 months a year

earlier but still down from 3.7 months

in July 2019, when conditions were

balanced (CoreLogic, Inc.).

TABLE OF CONTENTS

Economic Conditions 4

Population and Households 10

Home Sales Market 14

Rental Market 19

Terminology Definitions and Notes 23

3-Year Housing Demand Forecast

Sales Market Rental Market

Fayetteville HMA

Total Demand 14,000 Homes 6,475 Units

Under Construction 4,400 Homes 4,300 Units

Notes: Total demand represents estimated production necessary to achieve a balanced market at the end of the forecast period. Units under

construction as of August 1, 2022. The forecast period is August 1, 2022, to August 1, 2025.

Source: Estimates by the analyst

Economic Conditions 4Fayetteville-Springdale-Rogers, Arkansas-Missouri Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Fayetteville-Springdale-Rogers, Arkansas-Missouri

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Economic Conditions

Largest Sector: Professional and Business Services

Nonfarm payroll growth, led by gains in the professional and business

services sector, has been strong in the Fayetteville HMA during most

of the past two decades, with annual increases in nonfarm payrolls of

2.0 percent or greater during 16 of the past 21 years.

Primary Local Economic Factors

The economy of the Fayetteville HMA benefits considerably from its largest

employers—Walmart Inc. (Walmart), Tyson Foods, Inc. (Tyson), and UA, which

account for a combined 15 percent of jobs in the HMA (Table 1). Walmart,

the largest retailer in the world with a workforce of 2.30 million worldwide,

employs 29,600 workers throughout the HMA; 15,000 of those employees

work at its corporate headquarters in the city of Bentonville in Benton County.

In addition, an estimated 1,600 Walmart suppliers maintain corporate offices

locally and employ an estimated combined workforce of more than 10,000

people in the HMA. Tyson, one of the largest food manufacturing companies

in the nation, is the second largest employer in the HMA, with 7,500 workers,

of which 2,000 are employed at its corporate headquarters in the city of

Springdale, which straddles Benton and Washington Counties. Along with

their headquarters facilities, Walmart and Tyson have various support,

distribution, data processing, and operational facilities (retail stores and

manufacturing plants, respectively) throughout the HMA, with jobs distributed

among numerous sectors. With 4,775 full-time employees at its main campus

in the city of Fayetteville, UA is the third largest employer. UA generates

$1.4 billion in economic activity in the HMA annually (University of Arkansas).

The professional and business services sector in the HMA significantly

impacts the local economy. The sector was the largest during the 12 months

ending July 2022, with 56,100 jobs, or one-fifth of all nonfarm payroll jobs,

compared with 15 percent nationally (Figure 1). Corporate headquarters for

many companies are often included in this sector, even if those firms have

essential activities carried out at other facilities that are in one or more other

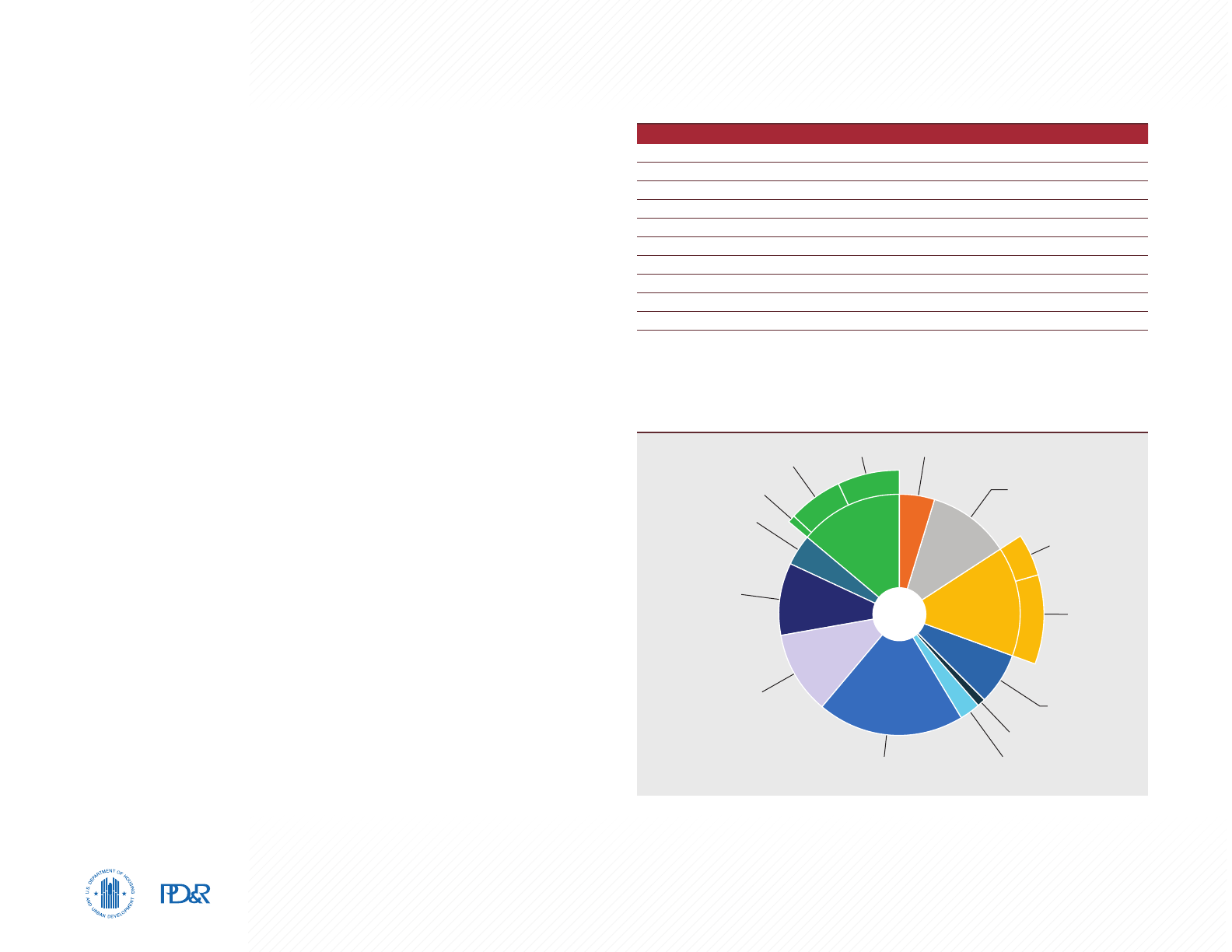

Education & Health

Services 11%

Mining, Logging, & Construction 5%

Manufacturing 11%

Transportation

& Utilities 7%

Information 1%

Financial Activities 3%

Professional & Business

Services 20%

Leisure &

Hospitality 10%

Other Services 4%

Federal 1%

State 6%

Local 7%

Total

281.2

Government

14%

Wholesale 5%

Retail 10%

Trade 15%

Figure 1. Share of Nonfarm Payroll Jobs in the Fayetteville HMA, by Sector

Notes: Total nonfarm payroll is in thousands. Percentages may not add to 100 percent due to rounding.

Based on 12-month averages through July 2022.

Source: U.S. Bureau of Labor Statistics

Table 1. Major Employers in the Fayetteville HMA

Name of Employer Nonfarm Payroll Sector Number of Employees

Walmart Inc. Multiple Sectors 29,600

Tyson Foods, Inc. Multiple Sectors 7,500

University of Arkansas Government 4,775

Washington Regional Medical Center Education & Health Services 3,200

J.B. Hunt Transport Services, Inc. Transportation & Utilities 3,000

Simmons Foods, Inc. Manufacturing 2,600

Mercy Northwest Arkansas Education & Health Services 2,300

Northwest Health Education & Health Services 2,200

McKee Foods Corporation Manufacturing 1,800

Arvest Bank Financial Activities 1,800

Notes: The U.S. Bureau of Labor Statistics classifies headquarters and support facilities of large corporations

into nonfarm payroll sectors that may differ from those of the corporations’ main line of business. Excludes

local school districts.

Sources: Employers; local chambers of commerce

Economic Conditions 5Fayetteville-Springdale-Rogers, Arkansas-Missouri Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Fayetteville-Springdale-Rogers, Arkansas-Missouri

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

sectors. The sector has added the greatest

number of jobs since 2001, accounting for

27 percent of all new jobs during the period; it

was also the fastest growing sector since

2001 (Figure 2). The strong job growth in the

professional and business services sector, which

offers higher wages than most other sectors,

contributed to an average annual increase in

wages in the HMA of 4.0 percent from 2002

through 2010 and 3.7 percent from 2011 through

2021 (Bureau of Labor Statistics Quarterly Census

of Employment and Wages). Nationally, wages

increased an average of 2.9 percent annually

from 2002 through 2010 and an average of

3.4 percent annually from 2011 through 2021

by comparison. The average annual wage of

workers in the professional and business services

sector in the HMA was $112,100 in 2021, up

an average of 4.2 percent annually compared

with 2010. By comparison, the average wage

nationally in the sector was $90,100 in 2021,

an average increase of 3.7 percent annually

compared with 2010. The high concentration

of corporate headquarters and offices in the

HMA contributed to a higher annual wage in

the professional and business services sector

compared with the nation.

2020 Recession and Recovery

The effects of COVID-19 were significant in the

HMA. On a monthly basis, nonfarm payrolls

declined by 26,100 jobs, or 9.6 percent, during

Note: Current data are based on the 12 months ending July 2022.

Source: U.S. Bureau of Labor Statistics

April 2020, a period that partly coincided with the recent national recession (not seasonally adjusted).

Although job losses occurred in every sector, declines were greatest in sectors in which jobs could not be

performed remotely. Nonfarm payroll decreases were greatest in the leisure and hospitality sector, which

declined by 10,600 jobs, or 39.1 percent, accounting for 41 percent of all job losses during April 2020.

Contributing to the job losses in the sector, local municipalities implemented numerous measures to slow

the spread of COVID-19, including restrictions on business hours and capacity limits at restaurants and

retail stores. These restrictions were lifted by the spring of 2021, which contributed to the HMA economy

regaining all the jobs lost during April 2020 by September 2021. Monthly job growth from May 2020 to

September 2021 was greatest in the leisure and hospitality sector, which gained 10,700 jobs, or 64.8

percent, compared with April 2020. The HMA recovered from COVID-19-related job losses much faster

than the nation, which did not fully recover job losses until May 2022.

Total Nonfarm Payroll Jobs

Goods-Producing Sectors

Mining, Logging, & Construction

Manufacturing

Service-Providing Sectors

Wholesale & Retail Trade

Transportation & Utilities

Information

Financial Activities

Professional & Business Services

Education & Health Services

Leisure & Hospitality

Other Services

Government

-20.00 0.00 20.00 40.00 60.00 80.00 100.00 120.00 140.00

Change in Jobs (%)

Figure 2. Sector Growth in the Fayetteville HMA, 2001 to Current

Economic Conditions 6Fayetteville-Springdale-Rogers, Arkansas-Missouri Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Fayetteville-Springdale-Rogers, Arkansas-Missouri

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Current Conditions—

Nonfarm Payrolls

During the 12 months ending July 2022, nonfarm

payrolls in the HMA increased by 14,600, or

5.5 percent, to 281,200 jobs compared with

a 1.3-percent increase a year earlier (Table 2).

Although job growth occurred in every sector

during the period, gains were greatest in the

professional and business services sector, up by

4,700, or 9.1 percent, compared with an increase

of 1.0 percent a year earlier. Widespread hiring

in back-office and corporate-level positions

contributed to job growth in the sector. Job growth

was also strong in the leisure and hospitality

and the wholesale and retail trade sectors,

which increased by 2,500 and 2,300 jobs, or

10.1 and 5.8 percent, to 27,200 and 41,700 jobs,

respectively. Two-thirds of the increase in the

wholesale and retail trade sector occurred in the

retail trade subsector, which increased by 1,500,

or 5.6 percent, to 28,500 jobs compared with a

Table 2. 12-Month Average Nonfarm Payroll Jobs (1,000s) in the Fayetteville HMA, by Sector

12 Months Ending

July 2021

12 Months Ending

July 2022

Absolute Change Percentage Change

Total Nonfarm Payroll Jobs 266.6 281.2 14.6 5.5

Goods-Producing Sectors 44.4 45.4 1.0 2.3

Mining, Logging, & Construction 13.6 13.9 0.3 2.2

Manufacturing 30.8 31.5 0.7 2.3

Service-Providing Sectors 222.2 235.8 13.6 6.1

Wholesale & Retail Trade 39.4 41.7 2.3 5.8

Transportation & Utilities 18.4 19.6 1.2 6.5

Information 1.9 2.1 0.2 10.5

Financial Activities 8.8 9.0 0.2 2.3

Professional & Business Services 51.4 56.1 4.7 9.1

Education & Health Services 29.9 30.7 0.8 2.7

Leisure & Hospitality 24.7 27.2 2.5 10.1

Other Services 9.8 9.9 0.1 1.0

Government 37.9 39.5 1.6 4.2

Notes: Based on 12-month averages through July 2021 and July 2022. Numbers may not add to totals due to rounding. Data are in thousands.

Source: U.S. Bureau of Labor Statistics

4.8-percent increase a year earlier. Gains in both the leisure and hospitality and the wholesale and retail

trade sectors generally followed national trends. Nationally, the leisure and hospitality and the wholesale

and retail trade sectors increased 13.9 and 2.9 percent, respectively, and the gains in the retail trade

subsector accounted for 73 percent of job growth in the wholesale and retail trade sector.

Economic Conditions 7Fayetteville-Springdale-Rogers, Arkansas-Missouri Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Fayetteville-Springdale-Rogers, Arkansas-Missouri

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

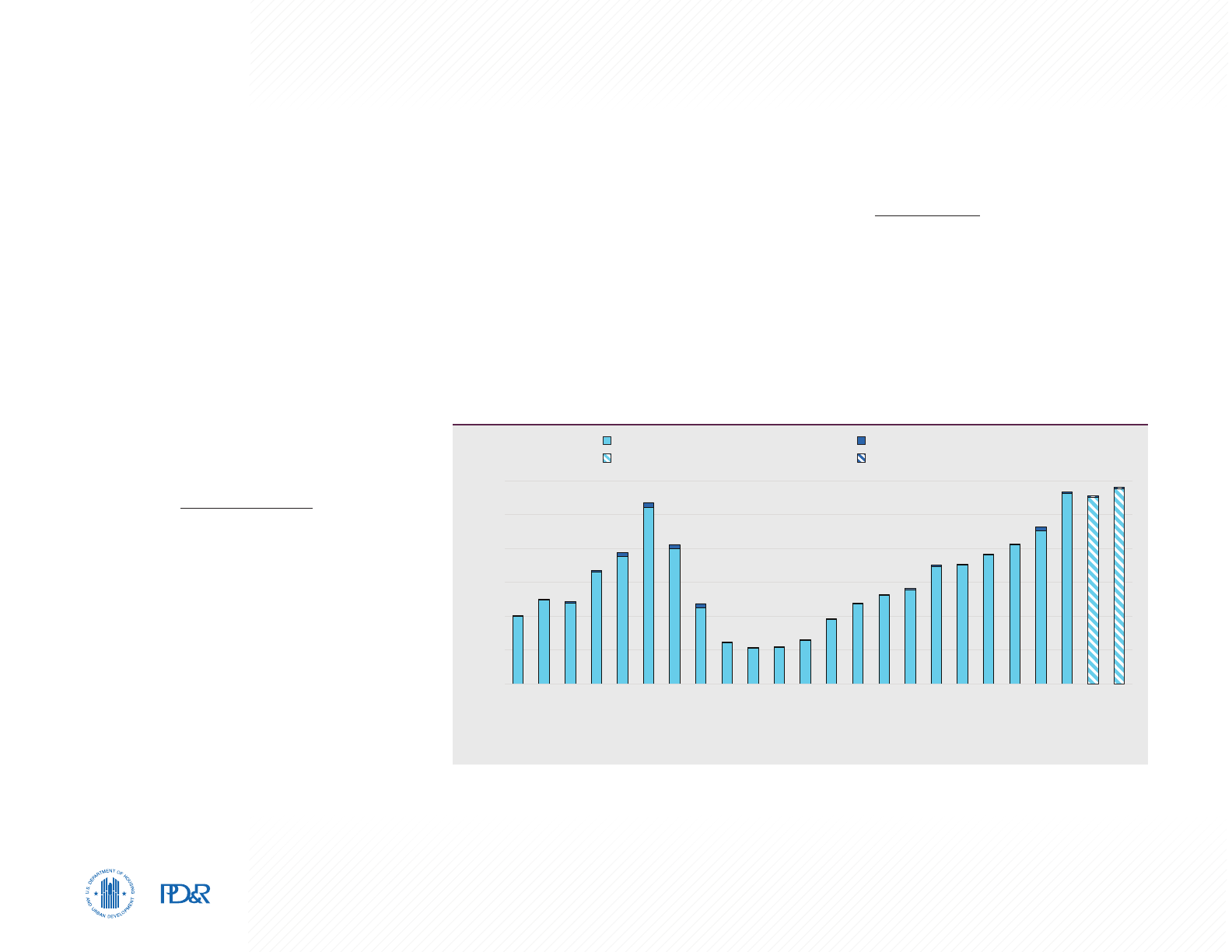

Economic Periods of Significance

2001 Through 2006

From 2001 through 2006, the HMA economy

expanded at a strong pace, with nonfarm payrolls

increasing by an average of 7,200 jobs, or 4.0

percent, annually to 205,400 jobs (Figure 3).

The professional and business services and the

wholesale and retail trade sectors led job growth

during this period. The professional and business

services sector gained an average of 1,300 jobs,

or 4.9 percent, annually because of widespread

hiring at corporate offices. The wholesale and

retail trade sector also increased by an average

of 1,300 jobs, or 4.8 percent, annually. Job

growth was also strong in the transportation

and utilities sector, which gained an average

of 1,100 jobs, or 7.8 percent, annually during

the same period. Several Walmart distribution

center expansions near the city of Bentonville

contributed to gains in the sector.

2007 Through 2009

During 2007, job growth in the HMA slowed

to an increase of 2,800, or 1.4 percent, before

nonfarm payrolls declined during 2008 and

2009 by an average of 4,300, or 2.1 percent,

annually because of the effects of the Great

Recession. Job declines during 2008 and 2009

were greatest in the transportation and utilities

sector, which decreased by an average of 1,600,

or 9.7 percent, annually, and widespread layoffs

resulted in a decrease in the manufacturing sector by an average of 1,500 jobs, or 4.9 percent, annually.

In addition, significant declines in home construction resulted in fewer jobs in the mining, logging,

and construction sector, which also decreased by an average of 1,500 jobs, or 13.5 percent, annually.

Reflecting national trends, an increase in the education and health services sector, which gained an

average of 1,000 jobs, or 4.9 percent, annually, partially offset nonfarm payroll losses during the period.

2010 Through 2016

In 2010, the economy in the HMA began to recover, and nonfarm jobs surpassed prerecession payroll

levels by late 2012. From 2010 through 2013, nonfarm payrolls increased by an average of 3,800 jobs,

or 1.9 percent, annually to 214,800. The professional and business services sector led job gains with

an average annual increase of 2,000, or 5.5 percent, partly because of an increase in back-office and

corporate-level positions. Economic expansion was strong from 2014 through 2016, when nonfarm payrolls

increased by an average of 10,300 jobs, or 4.6 percent, annually, with job growth occurring in every

National Recession Nonfarm Payrolls

Jul-00

Jul-01

Jul-02

Jul-03

Jul-04

Jul-05

Jul-06

Jul-07

Jul-08

Jul-09

Jul-10

Jul-11

Jul-12

Jul-13

Jul-14

Jul-15

Jul-16

Jul-17

Jul-18

Jul-19

Jul-20

Jul-21

Jul-22

300

275

250

225

200

175

150

Nonfarm Payrolls (in Thousands)

Note: 12-month moving average.

Sources: U.S. Bureau of Labor Statistics; National Bureau of Economic Research

Figure 3. 12-Month Average Nonfarm Payrolls in the Fayetteville HMA

Economic Conditions 8Fayetteville-Springdale-Rogers, Arkansas-Missouri Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Fayetteville-Springdale-Rogers, Arkansas-Missouri

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Unemployment Trends

The average unemployment rate in the HMA has been less than the

national rate since at least 2000 (Figure 4). From 2000 through 2008,

the unemployment rate averaged 3.5 percent in the HMA compared with

5.1 percent nationally. During 2009 and 2010, the average unemployment

rate increased considerably and reached 6.5 percent by the end of 2010

compared with the national rate of 9.6 percent. The unemployment rate

subsequently declined during each of the next 9 years to 2.5 percent in

2019. Nationally, the unemployment rate decreased from 2011 through

2019 to reach 3.7 percent. During the 12 months ending July 2022, the

average unemployment rate in the HMA was 2.4 percent. By comparison,

the average rate a year earlier was 3.7 percent, and the recent peak of

4.8 percent occurred during the 12 months ending February 2021 due to

widespread layoffs stemming from the effects of COVID-19. Nationally, the

unemployment rate during the 12 months ending July 2022 was 4.0 percent,

down from a recent peak of 8.7 percent during the 12 months ending

March 2021. Relatively strong resident employment growth in the HMA,

payroll sector. The professional and business services sector led job growth,

increasing by an average of 2,700, or 6.1 percent, annually. An expansion

in 2014 at Serco Inc. in the city of Rogers resulted in 1,000 new back-office

positions and contributed to the sector gain. Serco Inc., with 1,600 employees,

provides contract services for the federal government. Job growth was also

strong from 2014 through 2016 in the wholesale and retail trade sector, which

increased by an average of 1,800, or 5.0 percent, annually. The opening of

16 new Walmart stores during the period contributed to the increase. The

leisure and hospitality and the education and health services sectors each

increased by an average of 1,100 jobs, or 4.9 and 4.3 percent, respectively.

Widespread hiring at 11 new hospitals in the HMA contributed to an increase

in the education and health services sector during the period.

2017 Through 2019

The HMA economy continued to expand from 2017 through 2019, albeit at a

slower pace compared with the previous period. Nonfarm payrolls increased

by an average of 6,300 jobs, or 2.5 percent, annually. The government sector

led job growth during the period, with an average annual increase of 1,100,

or 3.2 percent. More than 80 percent of the gains in the sector occurred in

the state government subsector, which increased by an average of 900, or

6.2 percent, annually. Gains were also strong in the manufacturing sector,

which increased by an average of 1,000 jobs, or 3.4 percent, annually.

Simmons Foods, Inc., the sixth largest employer in the HMA with 2,600

workers, opened a new processing facility in 2019, resulting in 700 new

jobs, contributing to the gains in the manufacturing sector.

10.0

9.0

8.0

7.0

6.0

5.0

4.0

3.0

2.0

1.0

0.0

Jul-00

Jul-01

Jul-02

Jul-03

Jul-04

Jul-05

Jul-06

Jul-07

Jul-08

Jul-09

Jul-10

Jul-11

Jul-12

Jul-13

Jul-14

Jul-15

Jul-16

Jul-17

Jul-18

Jul-19

Jul-20

Jul-21

Jul-22

Unemployment Rate (%)

Fayetteville HMA Nation

Note: Based on the 12-month moving average.

Source: U.S. Bureau of Labor Statistics

Figure 4. 12-Month Average Unemployment Rate in the

Fayetteville HMA and the Nation

Economic Conditions 9Fayetteville-Springdale-Rogers, Arkansas-Missouri Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Fayetteville-Springdale-Rogers, Arkansas-Missouri

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

which has averaged 2.4 percent annually since 2001 compared with an

average annual increase of 0.6 percent nationally, has contributed to

relatively low unemployment rates compared with the nation.

Forecast

During the 3-year forecast period, nonfarm payrolls are expected to increase

by an average of 2.6 percent annually. Job growth is expected to be slower

during the first year of the forecast period, partly because of expected adverse

impacts on the local economy from high inflation and increased interest rates,

including reduced business and consumer spending. Job growth is expected

to strengthen each year during the second and third years of the forecast

period and is expected to be strong in several sectors, including the education

and health services sector. In July 2022, Mercy Northwest Arkansas, the

seventh largest employer in the HMA, announced expansion plans totaling

$500 million that include several new hospitals and clinics throughout the

HMA. The professional and business services sector is expected to increase

partly because of several planned expansions, including the relocation of

Tyson corporate staff from several offices in other areas of the nation to its

corporate headquarters in 2023 that will result in 1,000 new jobs in the HMA.

Walmart is currently building a new corporate headquarters campus in the city

of Bentonville. The new campus is expected to be complete in 2024 and will

include 12 office buildings on 350 acres.

Population and Households 10Fayetteville-Springdale-Rogers, Arkansas-Missouri Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Fayetteville-Springdale-Rogers, Arkansas-Missouri

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Population and

Households

Current Population: 600,000

Population growth has been strong in

the Fayetteville HMA during the past

2 decades, averaging 2.5 percent annually

since 2000, with net in-migration occurring

every year and accounting for 69 percent

of the increase.

Current Population Facts

The current population of the Fayetteville HMA

is an estimated 600,000, reflecting an average

increase of 11,100, or 2.1 percent, annually

since 2010 (Table 3). During this period, net

in-migration accounted for 69 percent of the

population growth (Figure 5). The growing

economy, scenic vistas, numerous recreational

lakes, and the relatively affordable cost of living

have drawn residents to the HMA, which ranked

seventh in the U.S. News & World Report Best

Places to Live in 2022–2023 and eighth in the

U.S. News & World Report Most Affordable Places

to Live in 2022–2023.

Population Trends

During the 2000s, the population in the HMA

increased by an average of 11,600, or 2.9 percent,

annually, with an average annual net in-migration

of 7,875 people, or 68 percent of the population

2000–2001

2001–2002

2002–2003

2003–2004

2004–2005

2005–2006

2006–2007

2007–2008

2008–2009

2009–2010

2010–2011

2011–2012

2012–2013

2013–2014

2014–2015

2015–2016

2016–2017

2017–2018

2018–2019

2019–2020

2020–2021

2021–Current

Current–Forecast

18,000

16,000

14,000

12,000

10,000

8,000

6,000

4,000

2,000

0

Population Change

Net Natural Change Net Migration Population Growth

Figure 5. Components of Population Change in the Fayetteville HMA, 2000 Through the Forecast

Notes: Data displayed are average annual totals. The forecast period is from the current date (August 1, 2022) to August 1, 2025.

Sources: U.S. Census Bureau; current to forecast—estimates by the analyst

Table 3. Fayetteville HMA Population and Household Quick Facts

Population

Quick Facts

2010 Current Forecast

Population 463,204 600,000 642,900

Average Annual Change 11,600 11,100 14,300

Percentage Change 2.9 2.1 2.3

Household

Quick Facts

2010 Current Forecast

Households 173,054 224,250 241,100

Average Annual Change 4,100 4,150 5,625

Percentage Change 2.7 2.1 2.4

Notes: Average annual changes and percentage changes are based on averages from 2000 to 2010, 2010 to current, and current to forecast.

The forecast period is from the current date (August 1, 2022) to August 1, 2025.

Sources: 2000 and 2010—2000 Census and 2010 Census; current and forecast—estimates by the analyst

Population and Households 11Fayetteville-Springdale-Rogers, Arkansas-Missouri Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Fayetteville-Springdale-Rogers, Arkansas-Missouri

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

growth (U.S. Census Bureau decennial census

counts). Population growth was strong from 2002

to 2007, averaging 13,800 people, or 3.5 percent,

annually because of strong job growth during

most of the period (U.S. Census Bureau population

estimates as of July 1). Net in-migration accounted

for 72 percent of the population growth during

that period, averaging 9,975 people a year. From

2007 to 2010, the population increased by an

average of 9,700, or 2.2 percent, annually. Net

in-migration accounted for approximately 56

percent of the population growth, or an average

of 5,400 people annually, even though nonfarm

payrolls declined during much of the period. Job

seekers were drawn to the HMA during the period

because of the relatively low unemployment rate

compared with the nation. Increased enrollment at

UA—which grew by an average of 640 students,

or 3.5 percent, annually, of which 92 percent

relocated from outside the HMA—also contributed

to population growth from 2007 to 2010 (UA

enrollment data; Figure 6). From 2010 to 2017, the

population increased by an average of 10,500, or

2.1 percent, annually. Net in-migration averaged

6,850 people and accounted for 65 percent of

the population growth during the period. Strong

job growth in the HMA during most of the period

and increased enrollment at UA—which gained

an average of 1,050 students, or 4.6 percent,

annually, with 86 percent of those students having

relocated from outside the HMA—contributed

to population growth. Relatively slower job

2000–2001

2001–20 02

2002–2003

2003–2004

2004– 2005

2005–2006

2006–2007

2007–2008

2008–2009

2009–2010

2010–2011

2011–2012

2012–2013

2013–2014

2014–2015

2015–2016

2016–2017

2017–2018

2018–2019

2019– 2020

2020–2021

2021–Current

12,000

10,000

8,000

6,000

4,000

2,000

0

Change in Non-HMA Student Enrollment Non-Student Net In-Migration Net In-Migration

Note: Enrollment changes are based on fall semester enrollments.

Sources: U.S. Census Bureau; University of Arkansas

Figure 6. University of Arkansas Student Enrollment and Net Migration Trends in the Fayetteville HMA

growth contributed to population growth moderating slightly in the HMA from 2017 to 2019 to an average

increase of 9,825 people, or 1.8 percent, annually, with net in-migration averaging 6,150 people annually

and accounting for 63 percent of population growth. Enrollment at UA increased an average of 290, or 1.1

percent, annually, which contributed to the slower population growth compared with the previous period.

Since 2019, population growth in the HMA has been strong, averaging 13,300 people, or 2.3 percent,

annually. Net in-migration averaged 10,550 people annually and accounted for 79 percent of population

growth since 2019. The relatively faster recovery of the local economy and lower unemployment rates in the

HMA compared with the nation contributed to strong net in-migration during the period. Net natural increase

slowed to average 2,750 people annually compared with an average increase of 3,650 annually from 2010

to 2019, mostly because of an elevated number of deaths stemming from the effects of COVID-19 during

part of the period.

Population and Households 12Fayetteville-Springdale-Rogers, Arkansas-Missouri Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Fayetteville-Springdale-Rogers, Arkansas-Missouri

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Population by Geography

As of July 2021, Benton County was the most

populous county in the HMA, with 50 percent of

the population (U.S. Census Bureau population

estimates as of July 1). Benton County also

accounted for 60 percent of the population

growth from April 2010 to July 2021, increasing

an average of 2.5 percent annually (U.S. Census

Bureau decennial census counts; U.S. Census

Bureau population estimates as of July 1).

Washington County accounted for 43 percent of

the HMA population in 2021. The population of

Washington County increased an average of 1.9

percent annually from 2010 to 2021, representing

39 percent of the population growth during the

period. The combined population of the remaining

two counties accounted for 7 percent of the

HMA population in 2021 and only 1 percent of

the population growth from 2010 to 2021. The

city of Fayetteville, with a population of 95,200

as of 2021, was the most populous city in the

HMA. Springdale, Rogers, and Bentonville, with

respective populations of 87,600, 71,100, and

56,700, were the second, third, and fourth largest

cities in the HMA. Among the largest cities,

Bentonville had the fastest population growth rate

and the second greatest increase in the number of

people from 2010 to 2021, averaging 4.3 percent,

or 1,900, annually. The city of Fayetteville had

the greatest increase in number of people,

averaging 1,925, or 2.3 percent, annually. From

2010 to 2021, the cities of Fayetteville and

Bentonville accounted for a combined 36 percent

of the HMA population growth.

Household Growth Trends

An estimated 224,250 households are currently in the HMA, representing an average annual increase of

4,150 households, or 2.1 percent, since April 2010, a similar pace to the population growth during the same

period. The number of households increased an average of 2.7 percent annually during the 2000s, a slower

pace compared with population growth during the same period. An increase in households doubling up

and a delay in new household formation in the late 2000s, a result of the Great Recession, contributed to

the slower pace of household growth, reflecting national trends (U.S. Census Bureau).

Households by Tenure

Currently, an estimated 138,700 owner households are in the HMA, representing an average increase of

1.9 percent annually since 2010. By comparison, renter households increased an average of 2.5 percent

annually since 2010 to 85,550. Tighter mortgage lending standards and an increased propensity to rent,

particularly during the early to mid-2010s, contributed to renter households increasing at a faster pace

since 2010 compared with owner households. The current homeownership rate is estimated to be

61.9 percent, down from 63.3 and 66.6 percent in 2010 and 2000, respectively (Figure 7).

75.0

71.0

67.0

63.0

59.0

55.0

250,000

200,000

150,000

100,000

50,000

0

2000 2010 Current

Homeownership Rate (%)

Households

RenterOwner Homeownership Rate

66.6

63.3

61.9

Figure 7. Households by Tenure and Homeownership Rate in the Fayetteville HMA

Note: The current date is August 1, 2022.

Sources: 2000 and 2010—2000 Census and 2010 Census; current—estimates by the analyst

Population and Households 13Fayetteville-Springdale-Rogers, Arkansas-Missouri Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Fayetteville-Springdale-Rogers, Arkansas-Missouri

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

University of Arkansas

Student Households

UA has a notable impact on the HMA housing

market. UA provides on-campus housing for

approximately 6,200 students, or 21 percent

of the 29,100 students enrolled as of the fall

2021 semester. The remaining students make

up an estimated 7,650 households, of which

approximately 7,200 are renter households; those

students reside in the local housing market,

primarily in Washington County. Off-campus UA

student households account for an estimated

3 percent of HMA households overall and

8 percent of all renter households in the HMA.

Forecast

During the forecast period, the population of the HMA is expected to increase by an average of 14,300,

or 2.3 percent, annually. Net in-migration is expected to increase during the second and third years, as

the economy expands at a slightly faster pace compared with the first year. The number of households

in the HMA is expected to increase by an average of 5,625, or 2.4 percent, annually during the forecast

period, a slightly faster pace compared with population growth. An increasing proportion of residents

aged 65 and older, who tend to have smaller households, contribute to the slightly faster pace. The

population of residents in the HMA aged 65 and older accounted for 13.3 percent of the total population

in 2021 compared with 11.2 percent in 2010 (U.S. Census Bureau). The proportion of residents aged

65 and older is expected to continue increasing during the forecast period.

Home Sales Market 14Fayetteville-Springdale-Rogers, Arkansas-Missouri Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Fayetteville-Springdale-Rogers, Arkansas-Missouri

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Home Sales Market

Market Conditions: Tight

Increases in home sales during most years

since 2010 and a significant decrease in the

inventory of homes for sale have contributed

to tighter sales market conditions in the

Fayetteville HMA compared with 2010.

Current Conditions

The home sales market in the Fayetteville HMA

is currently tight, with an estimated vacancy rate

of 1.2 percent, down from 3.8 percent in April

2010, when conditions were soft (Table 4). The

home sales vacancy rate had decreased before

the onset of the pandemic, partly because of

increased home sales demand stemming from net

in-migration and job growth each year during the

2010s. Recently, home sales market conditions

have tightened further, partly because of a

significant decline in the number of homes for

sale. During July 2022, the number of available

homes for sale represented a 1.5-month supply

compared with 1.2 months a year earlier and

1.5 months in July 2020 (CoreLogic, Inc.). By

comparison, the supply of homes available

for sale was 3.7 months in July 2019 and 12.9

months in April 2010. Tighter home sales market

conditions in the past 2 years have also been due

to increased home sales demand during most of

the period stemming partly from low mortgage

interest rates. The average interest rate for a 30-year fixed-rate mortgage was 3.0 and 3.1 percent during

2021 and 2020, representing the lowest and second lowest average rates for any year during the past

50 years, respectively (Freddie Mac). However, that rate has increased significantly during the past

several months, reaching 5.4 percent during July 2022 and contributing to diminished home sales

demand in the HMA during the most recent months.

Current Home Sales and Prices

During the 12 months ending July 2022, new and existing home sales totaled 17,550 homes in the HMA

(CoreLogic, Inc., with adjustments by the analyst). That number was down 5 percent compared with

a year earlier, when home sales increased 14 percent from the previous year to 18,550, a level that

represents the largest number of home sales during a 12-month period in the HMA since at least 2000.

The average home sales price during the 12 months ending July 2022 was $325,900, representing an

increase of $60,350, or 23 percent, the greatest increase in the average home price since at least 2001.

By comparison, the average home price increased 14 percent during the 12 months ending July 2021. The

decreased inventory of homes for sale placed upward pressure on home prices, which contributed to

strong increases in the average home price during the past 2 years. New home sales decreased 8 percent

to 2,925 during the 12 months ending July 2022 compared with a 7-percent increase a year earlier. The

Table 4. Home Sales Quick Facts in the Fayetteville HMA

Home Sales

Quick Facts

Fayetteville HMA Nation

Vacancy Rate 1.2% NA

Months of Inventory 1.5 2.0

Total Home Sales 17,550 7,050,000

1-Year Change -5% -7%

New Home Sales Price $348,700 $465,600

1-Year Change 23% 15%

Existing Home Sales Price $321,400 $395,300

1-Year Change 23% 12%

Mortgage Delinquency Rate 0.9% 1.4%

NA = data not available.

Notes: The vacancy rate is as of the current date; home sales and prices are for the 12 months ending July 2022; and months of inventory and

mortgage delinquency data are as of July 2022. The current date is August 1, 2022.

Sources: Vacancy rate—estimates by the analyst; months of inventory, mortgage delinquency rate, home sales, and prices—CoreLogic, Inc.

Home Sales Market 15Fayetteville-Springdale-Rogers, Arkansas-Missouri Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Fayetteville-Springdale-Rogers, Arkansas-Missouri

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

average price for a new home increased 23 percent to $348,700 compared

with a 4-percent increase a year earlier. The greatest portion of new homes

sold was at prices ranging from $251,000 to $350,000 (Zonda; Figure 8).

Existing home sales decreased 5 percent to 14,650 homes compared with

a gain of 16 percent a year earlier (CoreLogic, Inc., with adjustments by the

analyst). The average existing home price increased 23 percent to $321,400

compared with a 17-percent increase a year earlier. Distressed sales accounted

for nearly 3 percent of existing home sales during the 12 months ending

July 2022, nearly unchanged from a year earlier but down from a peak of

33 percent during the 12 months ending October 2009.

Because of increases in mortgage interest rates since the beginning of 2022

and record-level home price growth, home sales have declined at a much faster

pace most recently. During the 3 months ending July 2022, new and existing

30

25

20

15

10

5

0

$150k or

Below

$151k to

$250k

$251k to

$350k

$351k to

$450k

$451k to

$650k

$651k or

Above

Share of Sales (%)

Existing Home Sales New Home Sales

Note: New and existing sales include single-family homes, townhomes, and condominium units.

Source: Zonda

Figure 8. Share of Overall Sales by Price Range During the 12 Months

Ending July 2022 in the Fayetteville HMA

home sales declined 15 percent compared with the same period a year earlier.

New home sales decreased 10 percent during the most recent 3 months, and

existing home sales decreased 16 percent. Of existing home sales, resales

declined 18 percent, and distressed sales increased 51 percent. During the

3 months ending July 2022, distressed sales accounted for nearly 4 percent

of existing home sales, up from 2 percent in the same period a year earlier.

Home Sales Trends

New and existing home sales were strong from 2001 through 2005 in the

HMA, increasing by an average of 1,900, or 18 percent, annually to 16,800

homes (Figure 9). New home sales were particularly strong during the period,

increasing an average of 50 percent annually compared with an average

annual increase in existing home sales of 15 percent. Strong job and population

growth contributed to increased home sales demand in the HMA during the

20,000

18,000

16,000

14,000

12,000

10,000

8,000

6,000

4,000

2,000

0

Jul-01

Jul-02

Jul-03

Jul-04

Jul-05

Jul-06

Jul-07

Jul-08

Jul-09

Jul-10

Jul-11

Jul-12

Jul-13

Jul-14

Jul-15

Jul-16

Jul-17

Jul-18

Jul-19

Jul-20

Jul-21

Jul-22

Sales Totals

Existing Home Sales New Home Sales

Source: CoreLogic, Inc., with adjustments by the analyst

Figure 9. 12-Month Sales Totals by Type in the Fayetteville HMA

Home Sales Market 16Fayetteville-Springdale-Rogers, Arkansas-Missouri Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Fayetteville-Springdale-Rogers, Arkansas-Missouri

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

period. Relaxed mortgage lending standards also

contributed to the increase in home sales. In 2005,

adjustable-rate mortgages, which can be used as

a tool to qualify more borrowers, accounted for 22

percent of all home mortgages in the HMA (Zonda).

Home sales declined from 2006 through 2010

by an average of 1,925, or 16 percent, annually

to 7,100 (CoreLogic, Inc., with adjustments by

the analyst). During the period, new home sales

decreased an average of 23 percent annually, and

existing home sales declined an average of 15

percent annually. The significant decrease in home

sales during the period resulted from the housing

crisis, a slowing local economy in 2007, and job

losses during 2008 and 2009. Tighter mortgage

lending standards also contributed to declining

home sales during the period. The portion of

adjustable-rate mortgages decreased each year

from 2006 through 2009 to reach 3 percent of

all home loans in the HMA during 2009, before

increasing slightly to 4 percent by 2010 (Zonda).

Strong job and population growth, increased

wages, and somewhat easier access to credit

contributed to an average increase in home sales

of 1,300, or 13 percent, annually from 2011 through

2016 to 14,900 (CoreLogic, Inc., with adjustments

by the analyst). Demand for new homes was strong

during the period, resulting in an average increase

in new home sales of 19 percent annually. Slower

job and population growth contributed to home

sales easing during 2017 to an increase of 420, or

3 percent, to 15,350, with no increase in new home

sales and existing home sales increasing 3 percent.

Home sales slowed further during 2018 and 2019 to an average increase of 210, or 1 percent, annually.

However, new home sales increased an average of 12 percent annually during the period, while existing

home sales were relatively unchanged. Increased home sales demand, stemming from decreasing mortgage

interest rates and strong population growth, contributed to an increase in home sales during 2020 of 1,950,

or 12 percent, to 17,700. New home sales demand was especially strong, with an increase in new home sales

of 23 percent compared with a 10-percent increase in existing home sales.

Home Sales Price Trends

The average price for new and existing homes in the HMA increased nearly every year from 2001 through

2006, with an average increase of $10,850, or 8 percent, annually (Figure 10). Decreased home sales

demand contributed to the average home sales price declining from 2007 through 2009 by an average

of $7,700, or 5 percent, annually to $148,100. A growing portion of lower priced distressed sales, which

increased from 1 percent of total home sales in 2006 to 29 percent in 2009, also contributed to the

decrease in the average home price. The average distressed sales price in 2009 was 24 percent less

than the average price for resales and 41 percent below the average price for new homes. During 2010

and 2011, the average home price fluctuated but was generally stable compared with 2009. During 2010

350,000

300,000

250,000

200,000

150,000

100,000

Jul-01

Jul-02

Jul-03

Jul-04

Jul-05

Jul-06

Jul-07

Jul-08

Jul-09

Jul-10

Jul-11

Jul-12

Jul-13

Jul-14

Jul-15

Jul-16

Jul-17

Jul-18

Jul-19

Jul-20

Jul-21

Jul-22

Average Sales Price ($)

New Home Sales Existing Home Sales

Figure 10. 12-Month Average Sales Price by Type of Sale in the Fayetteville HMA

Source: CoreLogic, Inc., with adjustments by the analyst

Home Sales Market 17Fayetteville-Springdale-Rogers, Arkansas-Missouri Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Fayetteville-Springdale-Rogers, Arkansas-Missouri

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

and 2011, the average home price increased an

average of less than 1 percent annually, before

increasing from 2012 through 2019 an average of

5 percent annually to $222,100. The average home

price increased every year from 2012 through

2019. During the period, increases ranged from

a 9-percent increase in 2016, when home sales

demand was strong, to an increase of 1 percent in

2017, when home sales demand had moderated.

Reflecting strong home sales demand and a

significant decrease in the inventory of homes

available for sale, the average price for a home

increased 10 percent during 2020 to $244,800.

Delinquent Mortgages and

Real Estate Owned Properties

In July 2022, 0.9 percent of home loans in

the HMA were seriously delinquent (90 or

more days delinquent or in foreclosure) or had

transitioned into real estate owned (REO) status;

that percentage is down from 1.8 percent a

year earlier and below the 7.0-percent peak in

January 2010 (CoreLogic, Inc.). The percentage

of seriously delinquent mortgages and REO

properties increased significantly during the

early stages of the COVID-19 pandemic, as

weakened economic conditions made it more

difficult for many homeowners to stay current

on their mortgage payments, and a large number

of home mortgages were placed in forbearance.

By October 2020, the percentage reached a

recent peak of 2.6 percent. Improved local

economic conditions contributed to the decrease in the percentage of seriously delinquent mortgages

and REO properties in July 2022 compared with a year earlier.

Sales Construction Trends

Home sales construction activity, as measured by the number of building permits issued for sales

housing, including single-family homes, townhomes, and condominiums, was strong in the HMA from

2001 through 2005, when homebuilding increased an average of 22 percent annually to 5,375 homes

permitted (Figure 11). Home builders responded to strong home sales demand during the period, which

stemmed from job and population growth and relaxed mortgage lending standards. Home construction

activity declined an average of 33 percent annually from 2006 through 2009 because of decreased home

sales demand stemming from tightening lending standards and, by 2008, a contracting local economy.

During 2010, home construction activity remained relatively stable, albeit moderate, increasing 2 percent

6,000

5,000

4,000

3,000

2,000

1,000

0

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

12 ME Jul 2021

12 ME Jul 2022

Single-Family Homes/Townhomes

Single-Family Homes/Townhomes 12 ME

Condominiums

Condominiums 12 ME

Figure 11. Annual Sales Permitting Activity in the Fayetteville HMA

12 ME = 12 months ending.

Sources: U.S. Census Bureau, Building Permits Survey; 2000–21—final data and estimates by the analyst; past 24 months of data—preliminary

data and estimates by the analyst

Home Sales Market 18Fayetteville-Springdale-Rogers, Arkansas-Missouri Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Fayetteville-Springdale-Rogers, Arkansas-Missouri

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

to approximately 1,075 homes permitted. Increased home sales demand

stemming from job and population growth contributed to homebuilding

increasing an average of 22 percent annually from 2011 through 2016 to 3,500

homes permitted. During 2017, home construction activity slowed because

of moderating new home sales demand. The number of homes permitted

increased only 1 percent. Home construction activity increased an average

of 8 percent annually during 2018 and 2019, as home builders responded to

increased demand for new homes during the same period. Increased new home

sales demand also contributed to an increase in home construction activity

during 2020. Homebuilding increased by 480, or 12 percent, to 4,625 permits.

Current Sales Construction Activity

Strong home sales demand in the HMA during most of the past 2 years

contributed to a significant increase in home construction activity. During

the 12 months ending July 2022, homebuilding reached a record 5,800

homes permitted, up 5 percent compared with a year earlier, when home

construction activity increased 25 percent from the previous year and was

at that time at a record level (preliminary data). Currently, an estimated 4,400

homes are under construction in the HMA. The Aurora master-planned

community is currently under construction in the city of Bentonville. The

community will include 245 single-family homes on 72 acres at buildout.

Amenities at Aurora will include two community swimming pools, an Elevate

Fitness Course, and a bike repair station. Two-, three-, and four-bedroom

homes, ranging in size from 2,100 to 3,450 square feet, are offered at the

community, with prices ranging from $435,000 to $725,000. Thirty-five

homes have sold in the community, and 9 homes are currently for sale. In

the city of Fayetteville, construction is nearing completion at the Magnolia

Park residential community, which will include approximately 110 single-family

homes at buildout. Since opening in 2021, 85 new three- and four-bedroom

homes have sold in the community. Three homes, ranging in size from 2,100

to 2,350 square feet, are currently for sale starting at $450,200, and an

additional 11 home sites are available for construction.

Forecast

Demand is expected for 14,000 new homes in the HMA during the next 3 years

(Table 5). New home sales demand is expected to increase slightly each year

of the forecast period, partly because of increasing employment and net in-

migration during the second and third years. The 4,400 homes currently under

construction will meet most of the demand during the first year.

Table 5. Demand for New Sales Units in the Fayetteville HMA

During the Forecast Period

New Homes

Demand 14,000 Homes

Under Construction 4,400 Homes

Note: The forecast period is from August 1, 2022, to August 1, 2025.

Source: Estimates by the analyst

Rental Market 19Fayetteville-Springdale-Rogers, Arkansas-Missouri Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Fayetteville-Springdale-Rogers, Arkansas-Missouri

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Rental Market

Market Conditions: Tight

Strong job and population growth during

most years since 2010 have contributed

to currently tight rental market conditions

compared with soft conditions in 2010.

Current Conditions

The rental housing market in the Fayetteville HMA

is tight, with a current overall rental vacancy rate

estimated at 6.5 percent (Table 6). Rental market

conditions have tightened since April 2010, when

the rental vacancy rate was 13.9 percent and

conditions were soft. The apartment rental market

is also currently tight compared with 2010, when

conditions were soft. The average apartment

vacancy rate during the second quarter of 2022

was 2.3 percent, down slightly from 2.5 percent

a year earlier and down from 4.1 percent 2 years

earlier (CoStar Group; Figure 12). By comparison,

the average apartment vacancy rate was 6.8

percent in the second quarter of 2010. In 2021,

occupied single-family rental homes in the HMA

accounted for an estimated 43.1 percent of the total

number of occupied rental units (2021 American

Community Survey 1-year data; estimates by the

analyst). Single-family rental home vacancy rates

are often higher than apartment vacancy rates,

partly because amenities and services—such as

clubhouses, swimming pools, and lawn service—

are typically offered at apartments but not at

single-family rental homes. During July 2022, the

average vacancy rate for professionally

managed

Rental Market

Quick Facts

2010 (%) Current (%)

Rental Vacancy Rate

13.9 6.5

2010 (%) 2021 (%)

Occupied Rental Units by Structure

Single-Family Attached & Detached

40.1 43.1

Multifamily (2–4 Units)

17.7 11.2

Multifamily (5+ Units)

36.3 39.8

Other (Including Mobile Homes)

5.9 5.9

Apartment

Market

Quick Facts

2Q 2022 YoY Change

Apartment Vacancy Rate

2.3 -0.2

Average Rent

$970 12%

Studio

$874 19%

One-Bedroom

$848 12%

Two-Bedroom

$1,001 12%

Three-Bedroom

$1,334 12%

2Q = second quarter. YoY= year-over-year.

Notes: The current date is August 1, 2022. Percentages may not add to 100 due to rounding.

Sources: 2010 vacancy rate—2010 Census; current vacancy rate—estimate by the analyst; occupied rental units by structure—2010 and 2021

American Community Survey, 1-year data and estimates by the analyst; apartment data—CoStar Group

Table 6. Rental and Apartment Market Quick Facts in the Fayetteville HMA

2Q = second quarter.

Source: CoStar Group

Average Monthly Rent Vacancy Rate

8.0

7.0

6.0

5.0

4.0

3.0

2.0

1.0

1,000

950

900

850

800

750

700

650

2Q 2007

2Q 2008

2Q 2009

2Q 2010

2Q 2011

2Q 2012

2Q 2013

2Q 2014

2Q 2015

2Q 2016

2Q 2017

2Q 2018

2Q 2019

2Q 2020

2Q 2021

2Q 2022

Vacancy Rate (%)

Average Monthly Rent ($)

Figure 12. Apartment Rents and Vacancy Rates in the Fayetteville HMA

Rental Market 20Fayetteville-Springdale-Rogers, Arkansas-Missouri Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Fayetteville-Springdale-Rogers, Arkansas-Missouri

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

single-family rental units was 6.1 percent, up 0.2 percentage points from

July 2021 (CoreLogic, Inc.). During the same period, the average rent for

professionally managed two-bedroom, single-family homes increased

14 percent to $1,355. The average apartment rent during the second quarter

of 2022 increased 12 percent to $970 compared with a 5-percent increase a

year earlier (CoStar Group). The current level of apartment rent growth in the

HMA represents the fastest pace since at least 2001. Tight apartment market

conditions stemming from a relatively fast recovery of the local economy

and strong net in-migration contributed to the strong rent growth during the

past year. A limited inventory of homes for sale, strong home price growth,

and by 2022, increasing mortgage interest rates, also contributed to strong

apartment demand and rent growth during the past year.

Current Apartment Conditions by Geography

The average apartment vacancy rates during the second quarter of 2022

among the four most populous cities in the HMA ranged from 2.1 percent

in the city of Fayetteville to 4.0 percent in the city of Bentonville. Average

apartment rents ranged from $851 in the city of Fayetteville to $1,130 in the

city of Bentonville. Rent growth during the second quarter of 2022 ranged

from 7 percent in the city of Fayetteville to 14 percent each in the cities of

Bentonville, Springdale, and Rogers. The average apartment vacancy rate

at properties within 1 mile of the UA main campus, excluding off-campus

student apartments, was 1.7 percent, and the average rent increased

4 percent to $1,002.

Apartment Vacancy Trends

Apartment market conditions in the HMA were generally slightly tight to

tight during the early to mid-2000s because of an expanding local economy

and net in-migration during the period. The average apartment vacancy rate

began to increase by the second quarter of 2007, however, and reached

a second-quarter peak of 7.8 percent by the second quarter of 2009, as

apartment market conditions softened partly because of a slowing local

economy in 2007 and job losses during 2008 and 2009. From the second

quarter of 2010 to the second quarter of 2016, increased UA student

enrollment, population growth, and an expanding local economy—combined

with moderate apartment construction activity during most of the period—

contributed to a significant decline in the average apartment vacancy rate,

which reached 2.4 percent by the second quarter of 2016, when apartment

market conditions were tight. An increased preference to rent among residents

during the period also contributed to the decrease in the average apartment

vacancy rate. Moderating job and population growth and a significant number

of new apartment units added to the existing apartment supply contributed

to apartment market conditions transitioning to slightly tight during the late

2010s. Although the average apartment vacancy rate remained relatively low,

it increased to 3.7 percent by the second quarter of 2019. Nearly 5,500 new

apartment units were completed and added to the existing apartment supply

from the second quarter of 2017 through the second quarter of 2019, which

contributed to the increased rate. During the second quarter of 2020, the

average apartment vacancy rate increased slightly to 4.1 percent, partly due

to job losses that occurred because of the effects of COVID-19. Apartment rent

growth in the HMA was generally steady albeit moderate during the 2010s,

with the average apartment rent increasing an average of 2 percent annually to

$813 by the second quarter of 2019 compared with $681 in the second quarter

of 2010. Rent growth slowed to 1 percent in the second quarter of 2020,

reflecting a slight decline in apartment demand during the same period.

Off-Campus Student Apartments

The supply of off-campus student apartments in the HMA increased

significantly during the past decade. Although UA has added on-campus

housing to accommodate an additional 850 students since 2010, UA

enrollment increased by 9,200 students during the same period. Since

2010, private developers have responded to strong enrollment growth at

UA during most of the period by building 16 off-campus student apartment

communities in the HMA, with a combined 7,975 beds in 2,525 units,

Rental Market 21Fayetteville-Springdale-Rogers, Arkansas-Missouri Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Fayetteville-Springdale-Rogers, Arkansas-Missouri

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

accounting for 14 percent of rental construction

activity. As of the second quarter of 2022, off-

campus student apartments had an average

vacancy rate of 9.6 percent compared with a

vacancy rate of 12.0 percent a year earlier and an

average rate of 12.1 percent from 2010 through

2020 (CoStar Group). The off-campus student

apartment average rent increased 4 percent

to $671 per bed in the second quarter of 2022

compared with a 1-percent increase a year earlier

and an average increase of 1 percent annually

from 2011 to 2020. By comparison, the average

off-campus student apartment vacancy rate

nationally was 8.8 percent in the second quarter

of 2022, down from 12.6 percent a year earlier,

and the average rent also increased 4 percent

to $758 per bed.

Rental Construction Activity

Rental construction activity during the 2000s in

the HMA, as measured by the number of rental

units permitted, was strongest from 2003 through

2006, averaging 2,425 units annually (Figure 13).

Weakening apartment market conditions from

2007 through 2009 and job losses in 2008 and

2009 contributed to rental construction activity

decreasing by an average of 51 percent annually

from 2007 through 2011 to only 55 units permitted.

Rental construction activity occurred at a moderate

pace from 2012 through 2014, averaging 740

units permitted annually, as builders were slow to

respond to improving economic and rental market

conditions. Off-campus student apartment construction accounted for 58 percent of rental construction

activity during the period. From 2015 through 2017, rental construction activity increased compared with

the previous period, averaging 1,450 units permitted each year, as builders responded to strong demand

stemming from strong job and population growth during most of the period. Rental construction activity

surged during 2018 and 2019 in the HMA, when an average of 2,925 units were permitted annually, as

builders responded to relatively low average apartment vacancy rates and consistent rent growth. Nearly

20 percent of rental construction activity in the HMA occurred at two large apartment developments, with a

combined 1,100 units, in the city of Bentonville.

Also, 600 off-campus student apartment units were built in

the city of Fayetteville, accounting for 10 percent of rental construction activity in the HMA during the period.

Rental construction activity in the HMA remained strong in 2020 but slowed compared with the previous

2 years. In 2020, rental construction activity totaled

2,100 units permitted, three-fourths of which occurred

in Benton County in the cities of Bentonville and Rogers.

3,500

3,000

2,500

2,000

1,500

1,000

500

0

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

12 ME Jul 2021

12 ME Jul 2022

Rental Units Rental Units 12 ME

Figure 13. Annual Rental Permitting Activity in the Fayetteville HMA

12 ME = 12 months ending.

Note: Includes apartments and units intended for rental occupancy.

Sources: U.S. Census Bureau, Building Permits Survey; 2000–21—final data and estimates by the analyst; past 24 months of data—preliminary

data and estimates by the analyst

Rental Market 22Fayetteville-Springdale-Rogers, Arkansas-Missouri Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Fayetteville-Springdale-Rogers, Arkansas-Missouri

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

New Construction Activity

During the 12 months ending July 2022, rental construction activity in the

HMA increased 20 percent to an estimated 2,400 units permitted compared

with a 16-percent decrease a year earlier (preliminary data; estimates by

the analyst). A low average apartment vacancy rate and strong rent growth

contributed to the increase in rental construction activity during the past

year. Currently, an estimated 4,300 rental units are under construction.

Construction on Dodson Pointe Apartment Homes in the city of Rogers is

expected to be completed in the fall of 2022. The development is expected

to include 240 market-rate one- and two-bedroom units. Rents are expected

to start at $1,040 and $1,340 for one- and two-bedroom units, respectively.

The Reserve at Springdale apartment community is also slated to open in the

fall of 2022 in the city of Springdale and is expected to include 170 market-

rate one-, two-, and three-bedroom units. Rents at The Reserve at Springdale

are expected to start at $899 for one-bedroom units, $1,019 for two-bedroom

units, and $1,179 for three-bedroom units. The Retreat at Fayetteville, an off-

campus student apartment community near the UA main campus, is currently

under construction and expected to be completed in the fall of 2023. The

community is expected to offer 585 beds in 140 two-, four-, and five-bedroom

units when complete. Anticipated amenities at The Retreat at Fayetteville will

include an academic lounge, group study rooms, and an outdoor theater.

Forecast

During the forecast period, demand is estimated for 6,475 new rental units in the

HMA (Table 7). Demand is expected to increase slightly in the second and third

years of the forecast period because of greater net in-migration. The 4,300 units

currently under construction are expected to satisfy a portion of demand.

Note: The forecast period is August 1, 2022, to August 1, 2025.

Source: Estimates by the analyst

Rental Units

Demand 6,475 Units

Under Construction 4,300 Units

Table 7. Demand for New Rental Units in the Fayetteville HMA

During the Forecast Period

Terminology Definitions and Notes 23Fayetteville-Springdale-Rogers, Arkansas-Missouri Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Fayetteville-Springdale-Rogers, Arkansas-Missouri

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Terminology Definitions and Notes

A. Definitions

Building Permits

Building permits do not necessarily reflect all residential building activity that occurs in a housing market area. Some units are constructed or created

without a building permit or are issued a different type of building permit. For example, some units classified as commercial structures are not reflected

in the residential building permits. As a result, the analyst, through diligent fieldwork, makes an estimate of this additional construction activity. Some

of these estimates are included in the discussions of single-family and multifamily building permits.

Demand

The demand estimates in the analysis are not a forecast of building activity. They are the estimates of the total housing production needed to achieve

a balanced market at the end of the 3-year forecast period given conditions on the as-of date of the analysis, growth, losses, and excess vacancies.

The estimates do not account for units currently under construction or units in the development pipeline.

Distressed Sales Short sales and real estate owned (REO) sales.

Existing Home

Sales

Include resales, short sales, and REO sales.

Forecast Period 8/1/2022–8/1/2025—Estimates by the analyst.

Home Sales/

Home Sales

Prices

Includes single-family, townhome, and condominium sales.

Net Natural

Increase

Resident births minus resident deaths.

Terminology Definitions and Notes 24Fayetteville-Springdale-Rogers, Arkansas-Missouri Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Fayetteville-Springdale-Rogers, Arkansas-Missouri

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Rental Market/

Rental Vacancy

Rate

Includes apartments and other rental units, such as single-family, multifamily, and mobile homes.

Resales

Resales are home closings that have no ties to either new home closings (builders) or foreclosures. They are homes that were previously constructed

and sold to an unaffiliated third party.

Seriously

Delinquent

Mortgages

Mortgages 90+ days delinquent or in foreclosure.

B. Notes on Geography

1.

The metropolitan statistical area definition noted in this report is based on the delineations established by the Office of Management and Budget (OMB)

in the OMB Bulletin dated April 10, 2018.

2. Urbanized areas are defined using the U.S. Census Bureau 2010 Census Urban and Rural Classification and the Urban Area Criteria.

C. Additional Notes

1.

This analysis has been prepared for the assistance and guidance of HUD in its operations. The factual information, findings, and conclusions may

also be useful to builders, mortgagees, and others concerned with local housing market conditions and trends. The analysis does not purport to

make determinations regarding the acceptability of any mortgage insurance proposals that may be under consideration by the Department.

2.

The factual framework for this analysis follows the guidelines and methods developed by the Economic and Market Analysis Division within HUD.

The analysis and findings are as thorough and current as possible based on information available on the as-of date from local and national sources.

As such, findings or conclusions may be modified by subsequent developments. HUD expresses its appreciation to those industry sources and state

and local government officials who provided data and information on local economic and housing market conditions.

Terminology Definitions and Notes 25Fayetteville-Springdale-Rogers, Arkansas-Missouri Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Fayetteville-Springdale-Rogers, Arkansas-Missouri

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Contact Information

Randall Goodnight, Economist

Oklahoma City HUD Field Office

405–609–8525

D. Photo/Map Credits

Cover Photo Adobe Stock