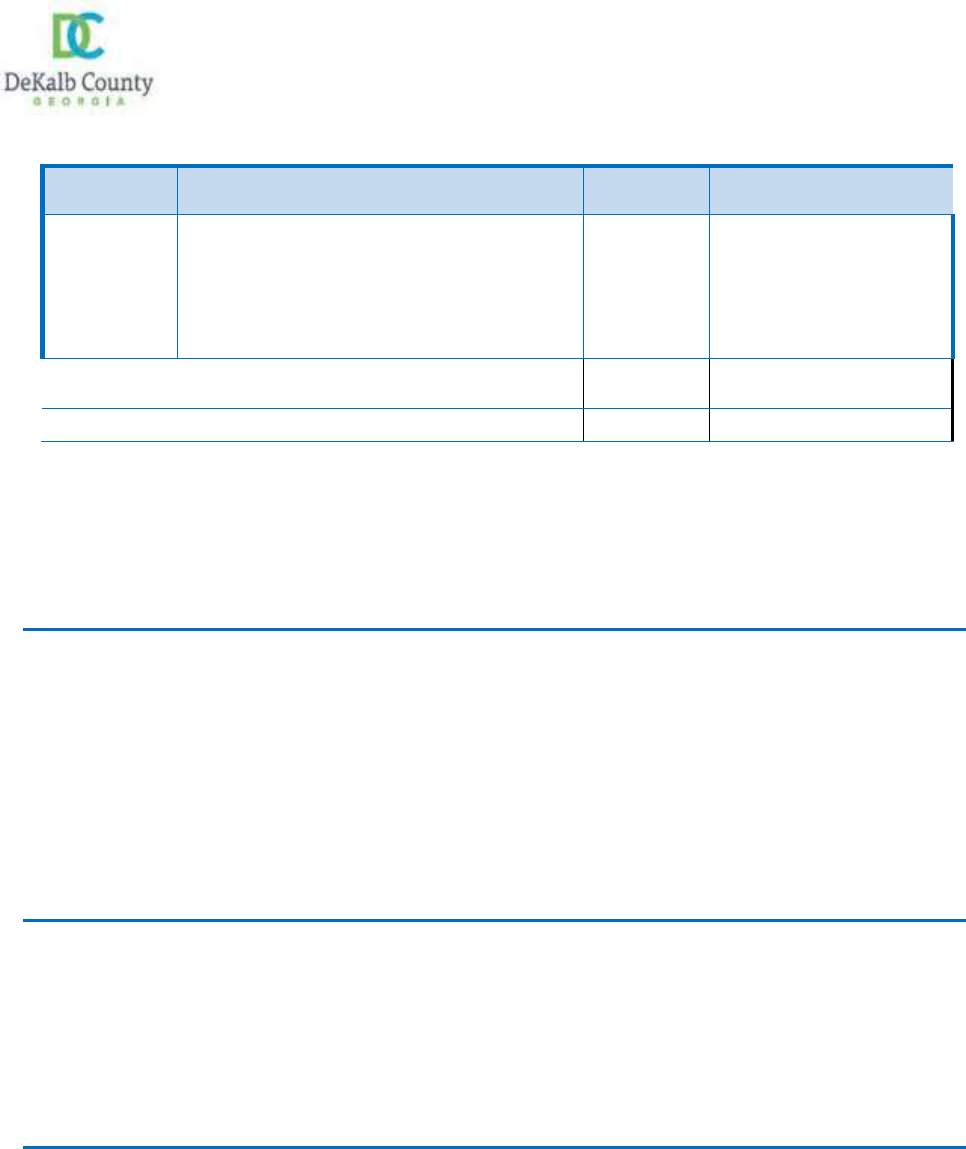

Table of Contents

Page 1 of 3

Office of Independent Internal Audit

Procedures Manual

Table of Contents

Chapter 1 - Introduction

Procedure 1.01 - Internal Audit Authority

Procedure 1.02 - Types of Audits Performed

Procedure 1.03 - Government Auditing Standards

Procedure 1.04 - Audit Process Overview

Procedure 1.05 - Handling Confidential and Sensitive Information of Information

Exempt from Public Disclosure

Procedure 1.06 - TeamMate Audit Management Software

Procedure 1.07 - Non-audit Services: Contract Reviews

Chapter 2 - Project Initiation and Planning

Procedure 2.01 - Annual Audit Plan

Procedure 2.02 - Staff Assignments, Independence and Ethical Principles

Procedure 2.03 - Engagement Planning

Procedure 2.04 - Engagement Letter

Procedure 2.05 - Entrance Conference

Chapter 3 - Audit Fieldwork

Procedure 3.01 - Engagement Evidence and Fieldwork

Procedure 3.02 -Auditor Responsibilities Regarding Fraud

Procedure 3.03 - Audit Workpapers

Procedure 3.04 - Fieldwork Verification Conference

Table of Contents

Page 2 of 3

Chapter 4 - Communicating Results

Procedure 4.01 - Draft Report

Procedure 4.02 - Technical Review of Draft Report

Procedure 4.03 - Exit Conference and Issuing Draft Report

Procedure 4.04 - Issuing Final Audit Report

Procedure 4.05 - Post Engagement Client Survey

Chapter 5 -

Quality Assurance

Procedure 5.01 - Roles and Responsibilities in Ensuring Quality

Procedure 5.02 - Post-Project Evaluation

Procedure 5.03 - Continuous Development and CPE

Procedure 5.04 - Quality Control Review Process

Procedure 5.05 - Annual Internal Quality Assurance Self-Assessment

Procedure 5.06 - Peer Review

Procedure 5.07 - Project Completion & Closeout

Procedure 5.08 - Post Engagement Client Survey

Chapter 6 - Audit Follow-up

Procedure 6.01 -Audit Follow-up and Reporting

Chapter 7 - Record Retention

Procedure 7.01 - Open Record Requests

Procedure 7.02 - Workpaper Retention

Chapter 8 - General Administrative

Procedure 8.01 - Recruiting and Professional Development

Procedure 8.02 - Time Keeping and Flexible Work Schedule

Table of Contents

Page 3 of 3

Procedure 8.03 - Safety Policy

Appendix

Appendix A-

GA Law 3826 Local and Special Acts and Resolutions, Vol. II

DeKalb County - Independent Internal Audits- No. 206 (House Bill No.

599)

Appendix B - DeKalb County, Georgia - Code of Ordinances / Organizational Act

Section10A- Independent Internal Audit

Appendix C-

THE OPEN RECORDS ACT 50-18-70

Procedure 1.01

Page

1

of

8

Office of Independent Internal Audit

Audit Function

Procedures Manual

I

I

Chapter 1

Procedure 1.01

-

Internal Audit Charter/Authority

Purpose:

This procedure establishes the Chief Audit Executive (CAE) and Office of Independent

Internal Audit (OIIA)

1

Charter/Authority.

Authority:

House Bill 599 (2015 Ga. Laws 3826) enacted by the Georgia General Assembly signed

into Law on May 12, 2015

2

,

and the Government Auditing Standards (GAS) also known

as the "Yellow Book" promulgated by the Comptroller General of the United States and

published by the United States Government Accountability Office.

Applicability:

This Internal Audit Charter/Authority applies to the CAE and all OIIA staff members.

1

OIIA (Office of Independent Internal Audit) referenced herein refers to the Office of Internal Audit as documented in House Bill 599

(2015 Ga. Laws 3826)

2

Incorporated into DeKalb County, Georgia - Code of Ordinances/ Organizational Act Section10A- Independent Internal Audit

subject

r

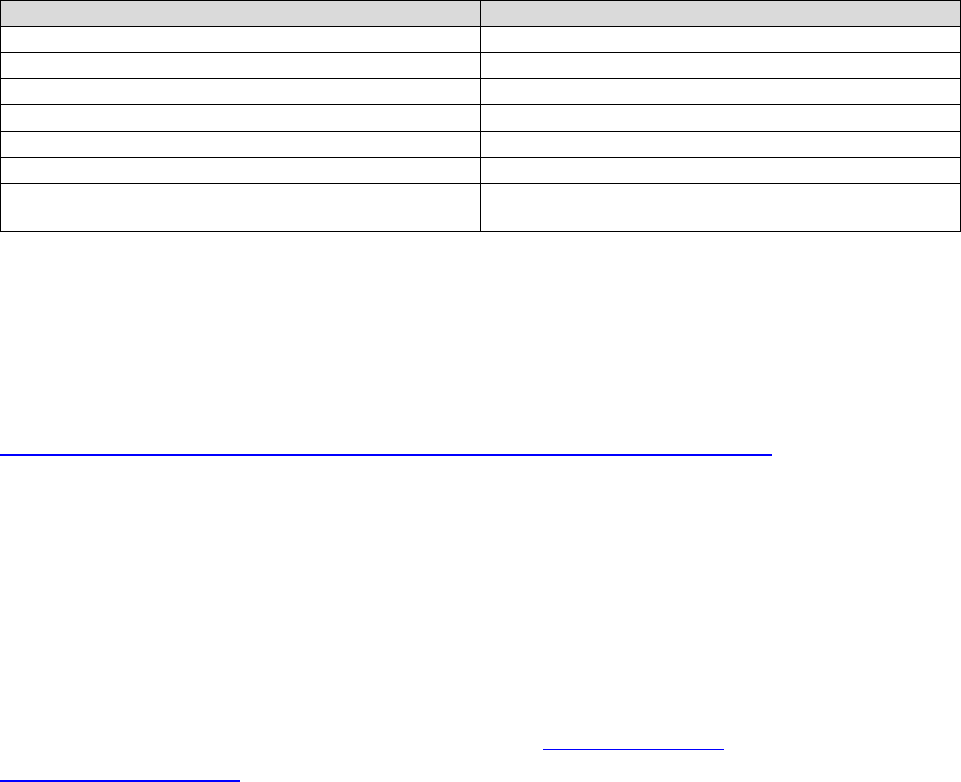

Introduction

r

Procedure

Number

Procedure Number 1.01

References

House Bill 599(2015 Ga. Laws 3826);

DeKalb County, Georgia

-

Code of

Ordinances

/

Organizational Act

Section10A- Independent Internal

Audit; GAS 2.01-2.10 Complying

with GAGAS; GAS 2.16-2.19 Stating

compliance with GAGAS in the Audit

Report; GAS 3.17-3.57

Independence; GAS 5.44 Monitoring

of Quality

Issue

Date:

06/24/2019

Approved: John L. Greene, Chief Audit Executive

Effective:

07/01/2019

Approved: Audit Oversight Committee approved

on 12/16/2016

Amended:

02/28/2020

Procedure 1.01

Page

2

of

8

Internal Audit:

I.

Introduction

The OIIA was established in accordance with House

Bill

599, enacted by the

Georgia General Assembly, signed into Law on May 12, 2015 and incorporated into

DeKalb County, Georgia - Code of Ordinances/ Organizational Act Section1QA-

Independent Internal Audit (See Appendix A

-HB

599 (2015 Ga. Laws 3826) and

Appendix B-DeKalb County, Georgia - Code of Ordinances

I

Organizational Act

Section10A- Independent Internal Audit).

The OIIA shall consist of the GAE and those assistants, employees, and personnel

as deemed necessary by the GAE for the efficient and effective administration of the

affairs of the office, and over whom the GAE shall have the sole authority to appoint,

employ, and remove.

II.

OFFICE OF INDEPENDENT INTERNAL AUDIT MISSION, VISIONS AND VALUES

Mission Statement (why we exist and what we do)

Our purpose (why we exist) is to provide independent, objective, insightful,

nonpartisan assessment of the stewardship or performance of policies, programs

and operations in promoting efficiency, effectiveness, and integrity in DeKalb

County.

Our promise (what we do) is to accomplish this through financial audits, performance

audits, inquiries, investigations, and reviews.

Vision Statement (where we are going)

Excellence in our products and services as we promote positive change throughout

DeKalb County with an inspired team that strives for continuous improvement.

Procedure 1.01

Page

3

of

8

Ill. Standards for the Office of Independent Internal Audit

The OIIA audits will be prepared pursuant to DeKalb County, Georgia - Code of

Ordinances / Organizational Act Sec. 10A. - Independent Internal Audit, Georgia

Statues. The OIIA staff members will follow 2018 Government Auditing Standards

(GAS) for all audits performed by the OIIA. OIIA staff members are responsible for

familiarizing themselves with and adhering to GAS. Those standards require that we

plan and perform the audit to obtain sufficient, appropriate evidence to provide a

reasonable basis for our findings and conclusions based on our audit objectives.

Procedure 1.01

Page

4

of

8

IV. Authority

HB 599 and DeKalb County, Georgia - Code Ordinances/Organizational Act

Section10A- Independent Internal Audit provide safeguards consistent with GAS

3.54c

3

to mitigate structural threats to independence as defined in GAS 3.30g

4

.

The

GAE will report to an independent Audit Oversight Committee (AOC). The AOC

consist of five voting members. The committee:

•

Ensures the independence of the OIIA.

•

Selects no fewer than two or more three nominees for the position of GAE for

approval by the DeKalb Board of Commissioners.

•

Provides suggestions and comments for the annual audit plan.

•

Proposes the internal audit budget and recommend the budget to the DeKalb

County Board of Commissioners for approval.

•

Receives communications from the GAE on the internal audit activity's

performance relative to its plan and other matters.

•

Provides general oversight and guidance.

•

Consults with GAE on technical issues.

•

Coordinates with contracted audit efforts and other consulting engagements.

The OIIA has unrestricted access to employees, information, and records including

electronic data within their custody regarding powers, duties, activities, organization,

property, financial transactions, contracts, and methods of business required to

conduct an audit or otherwise perform audit duties. In addition, all officers and

employees of DeKalb County shall provide access for the OIIA to inspect all

property, equipment, and facilities within their custody. If such officers or employees

fail to provide or produce such access and information, the GAE may initiate a

search to be made and exhibits to be taken from any book, paper, or record of any

such official or employee or outside contractor or subcontractor, except as governed

by statute. The GAE shall have the authority to issue subpoenas and may apply to

the Superior Court of DeKalb County for the enforcement of any subpoena issued by

the GAE.

V. Independence and Objectivity

The OIIA is completely independent and is not subject to control or supervision of

the Chief Executive Officer (CEO), the Board of Commissioners (BOC), or any other

official, employee, department, or agency of the county government. The position of

the GAE is nonpartisan.

The GAE will ensure that the OIIA remains free from all conditions that threaten the

ability of internal auditors to carry out their responsibilities in an unbiased manner,

3

GAS 3.54C- "appointed by someone other than a legislative body, so long as the appointment is confirmed by a

legislative body and removal from the position is subject to oversight or approval by a legislative body and reports

the results of audits to and is accountable to a legislative body."

4

GAS 3.30g "structural threat - the threat that an audit organization's placement within a government entity, in

combination with the structure of the government entity being audited, will impact the audit organization's ability

to perform work and report results objectively."

Procedure 1.01

Page

5

of

8

including matters of audit selection, scope, procedures, frequency, timing, and report

content. If the chief audit executive determines that independence or objectivity may

be impaired in fact or appearance, the details of impairment will be disclosed to

appropriate parties including the AOC.

Internal auditors will maintain an unbiased mental attitude that allows them to

perform engagements objectively and in such a manner that they believe in their

work product, that no quality compromises are made, and that they do not

subordinate their judgment on audit matters to others.

Internal auditors will have no direct operational responsibility or authority over any of

the activities audited. Accordingly, internal auditors will not implement internal

controls, develop procedures, install systems, prepare records, or engage in any

other activity that may impair their judgment, including:

•

Assessing specific operations for which they had responsibility within the

previous year.

•

Performing any operational duties for DeKalb County.

•

Initiating or approving transactions external to OIIA.

•

Directing the activities of any DeKalb County employee not employed by the

OIIA, except to the extent that such employees have been appropriately

assigned to auditing teams or to otherwise assist internal auditors.

Where the CAE has or is expected to have roles and/or responsibilities that fall

outside of internal auditing, safeguards will be established to limit impairments to

independence or objectivity.

Internal auditors will:

•

Disclose any impairment of independence or objectivity, in fact or appearance,

to appropriate parties.

•

Exhibit professional objectivity in gathering, evaluating, and communicating

information about the activity or process being examined.

•

Make balanced assessments of all available and relevant facts and

circumstances.

•

Take necessary precautions to avoid being unduly influenced by their own

interests or by others in forming judgments.

The CAE will confirm to the AOC, at least annually, the organizational independence

of the OIIA.

The CAE will disclose to the AOC any interference and related implications in

determining the scope of internal auditing, performing work, and/or communicating

results.

Procedure 1.01

Page

6

of

8

VI. Duties & Responsibilities

In accordance with HB599 (2015 Ga. Laws 3826) and DeKalb County, Georgia -

Code of Ordinances/ Organizational Act Section10A- Independent Internal Audit,

the OIIA is responsible for conducting financial and performance audits of all

departments, offices, boards, activities, agencies and programs of the County

independently and objectively to determine whether:

1. Activities and programs being implemented have been authorized by this

Act, Georgia law, or applicable federal law or regulations and are being

conducted and funds expended in compliance with applicable laws.

2. The department, office, board, or agency is acquiring, managing,

protecting, and using its resources, including public funds, personnel,

property, equipment, and space, economically, efficiently, effectively, and

in a manner consistent with the objectives intended by the authorizing

entity or enabling legislation.

3. The entity, programs, activities, functions, or policies are effective,

including the identification of any causes of inefficiencies or uneconomical

practices.

4. The desired results or benefits are being achieved.

5. Financial and other reports are being provided that disclose fairly,

accurately, and fully all information required by law, to ascertain the nature

and scope of programs and activities, and to establish a proper basis for

evaluating the programs and activities including the collection of,

accounting for, and depositing of, revenues and other resources.

6. Management has established adequate operating and administrative

procedures and practices, systems or accounting internal control systems,

and internal management controls.

7. Indications of fraud, abuse, or illegal acts are valid and need further

investigation.

In addition, the OIIA:

•

Coordinates and monitors auditing performed by certified public accounting

firms or other organizations employed under contract by the governing

authority to assist with audit related activities.

•

Participates with the AOC in the selection of the external audit firm.

•

Follows up on audit recommendations to monitor the status of corrective

action.

The chief audit executive has the responsibility to:

•

Submit a one- to five-year audit schedule at the beginning of each fiscal year

to the AOC and the BOC for review and comment. The schedule shall include

the proposed plan, and the rationale for the selections, for auditing

departments, offices, boards, activities, programs, policies, contractors,

subcontractors, and agencies for the period. This schedule may be amended

Procedure 1.01

Page

7

of

8

after review with the AOC and the BOC, but the CAE shall have final authority

to select the audits planned.

•

Select audit areas and audit objectives, determine the audit scope and the

timing of audit work. The CAE shall consult with federal and state auditors

and external auditors so that the desirable audit coverage is provided, and

audit efforts are properly coordinated.

•

Submit an annual report to the AOC, CEO, and the BOC indicating audits

completed, major findings, corrective actions taken by administrative

managers, and significant issues which have not been fully addressed by

management. The annual report, in written or some other retrievable form,

shall be made available to the public through the county website within ten

(10) days of submission to the commission.

•

Follow up on audit recommendations to determine if corrective action has

been taken. The OIIA shall request periodic status reports from audited

agencies regarding actions taken to address reported deficiencies and audit

recommendations.

•

Review and adjust the internal audit plan, as necessary, in response to

changes in DeKalb County's risks, operations, programs, systems, and

controls.

•

Communicate to AOC any significant interim changes to the internal audit

plan.

•

Ensure the OIIA collectively possesses or obtains the knowledge, skills, and

other competencies needed to meet the requirements of the internal audit

charter.

•

Ensure conformance of the OIIA with the general requirements for complying

with generally accepted government auditing standards (GAGAS) that are

applicable to all GAGAS engagements.

VII. Quality Assurance and Improvement Program

The OIIA will maintain a quality assurance and improvement program that covers

all aspects of the OIIA. The program will include an evaluation of the OIIA's

conformance with the Standards. The program will also assess the efficiency and

effectiveness of the OIIA and identify opportunities for improvement. The CAE

should include a statement in the Annual report that "The Office's internal quality

control and assurance program is ongoing and includes continuous supervision

and internal reviews of audit work to ensure accuracy and compliance with

standards and internal policies and procedures."

The audit organization should analyze and summarize the results of its

monitoring process at least annually, with identification of any systemic or

repetitive issues needing improvement, along with recommendations for

corrective action. The audit organization should communicate to the relevant

Procedure 1.01

Page

8

of

8

engagement manager, and other appropriate personnel, any deficiencies noted

during the monitoring process and recommend appropriate remedial action.

5

The audit activities of the OIIA shall be subject to a peer review in accordance

with applicable government auditing standards by a professional, nonpartisan

objective group utilizing guidelines endorsed by the Association of Local

Government Auditors (ALGA).

The peer review shall use applicable government auditing standards to evaluate

the quality of audit effort and reporting. Specific quality review areas shall include

staff qualifications, adequacy of planning and supervision, sufficiency of work

paper preparation and evidence, and the adequacy of systems for reviewing

internal controls, fraud and abuse, program compliance, and automated systems.

The peer review shall also assess the content, presentation, form, timelines, and

distribution of audit reports. The commission shall pay for the costs of the peer

review.

A copy of the written report of such independent review shall be furnished to the

CAE, BOC and AOC.

VIII. Chief Audit Executive Provisions

The term of office of the Chief Audit Executive shall be five (5) years and until his

or her successor is qualified and appointed. The CAE shall be limited to a

maximum of two (2) terms in office. In addition, the position of the CAE shall be

nonpartisan. Qualifying for election to a public office shall constitute a resignation

from the position as of the date of qualifying.

5

GAS 5.44-Requirements: Monitoring of Quality, page 91

Procedure

1.01

Page 1 of 8

Office of Independent Internal Audit

Audit Function

Procedures Manual

Subject

Introduction

Procedure

Number

Procedure Number 1.01

References

House Bill 599(2015 Ga. Laws 3826);

DeKalb County, Georgia

-

Code of

Ordinances

/

Organizational Act

Section10A- Independent Internal

Audit; GAS 2.01-2.10 Complying

with GAGAS; GAS 2.16-2.19 Stating

compliance with GAGAS in the Audit

Report; GAS 3.17-3.57

Independence; GAS 5.44 Monitoring

of Quality

Issue

Date:

06/24/2019

Approved: John L. Greene, Chief Audit Executive

Effective:

07/01/2019

Chapter 1

Procedure 1.01 -

Internal Audit Charter/Authority

Purpose:

This procedure establishes the Chief Audit Executive (CAE) and Office of Independent

Internal Audit (OIIA)

1

Charter/Authority.

Authority:

House Bill 599 (2015 Ga. Laws 3826) enacted by the Georgia General Assembly signed

into Law on May 12, 2015

2

,

and the Government Auditing Standards (GAS) also known

as the "Yellow Book" promulgated by the Comptroller General of the United States and

published by the United States Government Accountability Office.

Applicability:

This Internal Audit Charter/Authority applies to the CAE and all OIIA staff members.

1

OIIA (Office of Independent Internal Audit) referenced herein refers to the Office of Internal Audit as documented in House Bill 599

(2015 Ga. Laws 3826)

2

Incorporated into DeKalb County, Georgia -

Code of Ordinances/ Organizational Act Section10A- Independent Internal Audit

Procedure

1.01

Page 2 of 8

Internal Audit:

I.

Introduction

The OIIA was established in accordance with House

Bill

599, enacted by the

Georgia General Assembly, signed into Law on May 12, 2015 and incorporated into

DeKalb County, Georgia - Code of Ordinances/ Organizational Act Section10A-

independent Internal Audit (See Appendix A

-HB

599 (2015 Ga. Laws 3826) and

Appendix B- DeKalb County, Georgia - Code of Ordinances

I

Organizational Act

Section10A- Independent Internal Audit).

The OIIA shall consist of the GAE and those assistants, employees, and personnel

as deemed necessary by the GAE for the efficient and effective administration of the

affairs of the office, and over whom the GAE shall have the sole authority to appoint,

employ, and remove.

II.

OFFICE OF INDEPENDENT INTERNAL AUDIT MISSION, VISIONS AND VALUES

Mission Statement (why we exist and what we do)

Our purpose (why we exist) is to provide independent, objective, insightful,

nonpartisan assessment of the stewardship or performance of policies, programs

and operations in promoting efficiency, effectiveness, and integrity in DeKalb

County.

Our promise (what we do) is to accomplish this through financial audits, performance

audits, inquiries, investigations, and reviews.

Vision Statement (where we are going)

Excellence in our products and services as we promote positive change throughout

DeKalb County with an inspired team that strives for continuous improvement.

Procedure

1.01

Page 3 of 8

Ill. Standards for the Office of Independent Internal Audit

The OIIA audits will be prepared pursuant to DeKalb County, Georgia - Code of

Ordinances/ Organizational Act Sec. 10A. - Independent Internal Audit, Georgia

Statues. The OIIA staff members will follow 2018 Government Auditing Standards

(GAS) for all audits performed by the OIIA. OIIA staff members are responsible for

familiarizing themselves with and adhering to GAS. Those standards require that we

plan and perform the audit to obtain sufficient, appropriate evidence to provide a

reasonable basis for our findings and conclusions based on our audit objectives.

Procedure

1.01

Page 4 of 8

IV. Authority

HB 599 and DeKalb County, Georgia - Code Ordinances/Organizational Act

Section1DA- Independent Internal Audit provide safeguards consistent with GAS

3.54c

3

to mitigate structural threats to independence as defined in GAS 3.30g

4

.

The

GAE will report to an independent Audit Oversight Committee (AOC). The AOC

consist of five voting members. The committee:

•

Ensures the independence of the OIIA.

•

Selects no fewer than two or more three nominees for the position of GAE for

approval by the DeKalb Board of Commissioners.

•

Provides suggestions and comments for the annual audit plan.

•

Proposes the internal audit budget and recommend the budget to the DeKalb

County Board of Commissioners for approval.

•

Receives communications from the GAE on the internal audit activity's

performance relative to its plan and other matters.

•

Provides general oversight and guidance.

•

Consults with GAE on technical issues.

•

Coordinates with contracted audit efforts and other consulting engagements.

The OIIA has unrestricted access to employees, information, and records including

electronic data within their custody regarding powers, duties, activities, organization,

property, financial transactions, contracts, and methods of business required to

conduct an audit or otherwise perform audit duties. In addition, all officers and

employees of DeKalb County shall provide access for the OIIA to inspect all

property, equipment, and facilities within their custody. If such officers or employees

fail to provide or produce such access and information, the GAE may initiate a

search to be made and exhibits to be taken from any book, paper, or record of any

such official or employee or outside contractor or subcontractor, except as governed

by statute. The GAE shall have the authority to issue subpoenas and may apply to

the Superior Court of DeKalb County for the enforcement of any subpoena issued by

the GAE.

V. Independence and Objectivity

The OIIA is completely independent and is not subject to control or supervision of

the Chief Executive Officer (CEO), the Board of Commissioners (BOC), or any other

official, employee, department, or agency of the county government. The position of

the GAE is nonpartisan.

The GAE will ensure that the OIIA remains free from all conditions that threaten the

ability of internal auditors to carry out their responsibilities in an unbiased manner,

3

GAS 3.54C- "appointed by someone other than a legislative body, so long as the appointment is confirmed by a

legislative body and removal from the position is subject to oversight or approval by a legislative body and reports

the results of audits to and is accountable to a legislative body."

4

GAS 3.30g "structural threat - the threat that an audit organization's placement within a government entity, in

combination with the structure of the government entity being audited, will impact the audit organization's ability

to perform work and report results objectively."

Procedure

1.01

Page 5 of 8

including matters of audit selection, scope, procedures, frequency, timing, and report

content. If the chief audit executive determines that independence or objectivity may

be impaired in fact or appearance, the details of impairment will be disclosed to

appropriate parties including the AOC.

Internal auditors will maintain an unbiased mental attitude that allows them to

perform engagements objectively and in such a manner that they believe in their

work product, that no quality compromises are made, and that they do not

subordinate their judgment on audit matters to others.

Internal auditors will have no direct operational responsibility or authority over any of

the activities audited. Accordingly, internal auditors will not implement internal

controls, develop procedures, install systems, prepare records, or engage in any

other activity that may impair their judgment, including:

•

Assessing specific operations for which they had responsibility within the

previous year.

•

Performing any operational duties for DeKalb County.

•

Initiating or approving transactions external to OIIA.

•

Directing the activities of any DeKalb County employee not employed by the

OIIA, except to the extent that such employees have been appropriately

assigned to auditing teams or to otherwise assist internal auditors.

Where the GAE has or is expected to have roles and/or responsibilities that fall

outside of internal auditing, safeguards will be established to limit impairments to

independence or objectivity.

Internal auditors will:

•

Disclose any impairment of independence or objectivity, in fact or appearance,

to appropriate parties.

•

Exhibit professional objectivity in gathering, evaluating, and communicating

information about the activity or process being examined.

•

Make balanced assessments of all available and relevant facts and

circumstances.

•

Take necessary precautions to avoid being unduly influenced by their own

interests or by others in forming judgments.

The GAE will confirm to the AOC, at least annually, the organizational independence

of the OIIA.

The GAE will disclose to the AOC any interference and related implications in

determining the scope of internal auditing, performing work, and/or communicating

results.

Procedure

1.01

Page 6 of 8

VI.

Duties & Responsibilities

In accordance with HB599 (2015 Ga. Laws 3826) and DeKalb County, Georgia -

Code of Ordinances/ Organizational Act Section10A- Independent Internal Audit,

the OIIA is responsible for conducting financial and performance audits of all

departments, offices, boards, activities, agencies and programs of the County

independently and objectively to determine whether:

1. Activities and programs being implemented have been authorized by this

Act, Georgia law, or applicable federal law or regulations and are being

conducted and funds expended in compliance with applicable laws.

2. The department, office, board, or agency is acquiring, managing,

protecting, and using its resources, including public funds, personnel,

property, equipment, and space, economically, efficiently, effectively, and

in a manner consistent with the objectives intended by the authorizing

entity or enabling legislation.

3. The entity, programs, activities, functions, or policies are effective,

including the identification of any causes of inefficiencies or uneconomical

practices.

4. The desired results or benefits are being achieved.

5. Financial and other reports are being provided that disclose fairly,

accurately, and fully all information required by law, to ascertain the nature

and scope of programs and activities, and to establish a proper basis for

evaluating the programs and activities including the collection of,

accounting for, and depositing of, revenues and other resources.

6. Management has established adequate operating and administrative

procedures and practices, systems or accounting internal control systems,

and internal management controls.

7. Indications of fraud, abuse, or illegal acts are valid and need further

investigation.

In addition, the OIIA:

•

Coordinates and monitors auditing performed by certified public accounting

firms or other organizations employed under contract by the governing

authority to assist with audit related activities.

•

Participates with the AOC in the selection of the external audit firm.

•

Follows up on audit recommendations to monitor the status of corrective

action.

The chief audit executive has the responsibility to:

•

Submit a one- to five-year audit schedule at the beginning of each fiscal year

to the AOC and the BOC for review and comment. The schedule shall include

the proposed plan, and the rationale for the selections, for auditing

departments, offices, boards, activities, programs, policies, contractors,

subcontractors, and agencies for the period. This schedule may be amended

Procedure

1.01

Page 7 of 8

after review with the AOC and the BOC, but the CAE shall have final authority

to select the audits planned.

•

Select audit areas and audit objectives, determine the audit scope and the

timing of audit work. The CAE shall consult with federal and state auditors

and external auditors so that the desirable audit coverage is provided, and

audit efforts are properly coordinated.

•

Submit an annual report to the AOC, CEO, and the BOC indicating audits

completed, major findings, corrective actions taken by administrative

managers, and significant issues which have not been fully addressed by

management. The annual report, in written or some other retrievable form,

shall be made available to the public through the county website within ten

(10) days of submission to the commission.

•

Follow up on audit recommendations to determine if corrective action has

been taken. The OIIA shall request periodic status reports from audited

agencies regarding actions taken to address reported deficiencies and audit

recommendations.

•

Review and adjust the internal audit plan, as necessary, in response to

changes in DeKalb County's risks, operations, programs, systems, and

controls.

•

Communicate to AOC any significant interim changes to the internal audit

plan.

•

Ensure the OIIA collectively possesses or obtains the knowledge, skills, and

other competencies needed to meet the requirements of the internal audit

charter.

•

Ensure conformance of the OIIA with the general requirements for complying

with generally accepted government auditing standards (GAGAS) that are

applicable to all GAGAS engagements.

VII. Quality Assurance and Improvement Program

The OIIA will maintain a quality assurance and improvement program that covers

all aspects of the OIIA. The program will include an evaluation of the OIIA's

conformance with the Standards. The program will also assess the efficiency and

effectiveness of the OIIA and identify opportunities for improvement. The CAE

should include a statement in the Annual report that "The Office's internal quality

control and assurance program is ongoing and includes continuous supervision

and internal reviews of audit work to ensure accuracy and compliance with

standards and internal policies and procedures."

The audit organization should analyze and summarize the results of its

monitoring process at least annually, with identification of any systemic or

repetitive issues needing improvement, along with recommendations for

corrective action. The audit organization should communicate to the relevant

Procedure

1.01

Page 8 of 8

engagement manager, and other appropriate personnel, any deficiencies noted

during the monitoring process and recommend appropriate remedial action.

5

The audit activities of the OIIA shall be subject to a peer review in accordance

with applicable government auditing standards by a professional, nonpartisan

objective group utilizing guidelines endorsed by the Association of Local

Government Auditors (ALGA).

The peer review shall use applicable government auditing standards to evaluate

the quality of audit effort and reporting. Specific quality review areas shall include

staff qualifications, adequacy of planning and supervision, sufficiency of work

paper preparation and evidence, and the adequacy of systems for reviewing

internal controls, fraud and abuse, program compliance, and automated systems.

The peer review shall also assess the content, presentation, form, timelines, and

distribution of audit reports. The commission shall pay for the costs of the peer

review.

A copy of the written report of such independent review shall be furnished to the

CAE, BOC and AOC.

VIII. Chief Audit Executive Provisions

The term of office of the Chief Audit Executive shall be five (5) years and until his

or her successor is qualified and appointed. The CAE shall be limited to a

maximum of two (2) terms in office. In addition, the position of the CAE shall be

nonpartisan. Qualifying for election to a public office shall constitute a resignation

from the position as of the date of qualifying.

5

GAS 5.44-Requirements: Monitoring of Quality, page 91

Procedurel.02

Page 1 of 6

Office of Independent Internal Audit

Audit Function

Procedures Manual

I

I

Chapter 1

Procedure 1.02

-

Types of Audits Performed

Purpose:

This procedure defines the different types of work that the Office of Independent Internal

Audit (OIIA) can be perform depending on the objectives. Engagements may have a

combination of objectives that include more than one type of work. In cases where

different standards could apply to an objective, auditors should consider users' needs

and the auditors' knowledge, skills, and experience in deciding which standards to

follow.

Authority:

Government Auditing Standards(GAS) GAS 2.01-2.04;GAS 2.07-2.08, Financial Audits;

GAS 2.09, Attestation Engagements; GAS 2.10-2.11, Performance Audits; GAS 2.12,

Nonaudit Services (professional services other than audits or attestation engagements)

GAS 3.33-3.59, Independence When Performing Nonaudit Services

ApplicabiIity:

Most of the OIIA engagements will follow performance audit standards. If the team

decides other standards are applicable, the team will document the decision following

the initial planning meeting (See Chapter 2 Procedure 2.03).

Subject

Introduction

Procedure

Number

1.02

References

GAS 2.01-2.04, 2.07-2.08-Financial

Audits, 2.09,-Attestation Engagements,

2.10-2.11- Performance Audits, 2.12-

Nonaudit Services,3.33-3.59,

Independence When Performing

Nonaudit Services

Issue

Date:

Effective:

Approved: John L. Greene, Chief Audit Executive

Amended:

Procedurel.02

Page 2 of 6

Types of Audits:

I.

Financial Audits

The primary purpose of a financial audit is to provide reasonable assurance about

whether an entity's reported financial condition, results or use of resources are

presented fairly in accordance with recognized criteria - such as financial statement

audits, management letters, single audits, or special reports for portions of financial

statements or reviewing interim financial information.

While the OIIA does not conduct the annual audit of the DeKalb County financial

statements, the OIIA may conduct financial audits in conjunction with other audit

objectives. GAS incorporates American Institute of Certified Public Accountants'

(AICPA) Statements on Auditing Standards (SAS). GAS also prescribes general

standards and additional fieldwork and reporting standards beyond those provided

by the AICPA when performing financial audits.

OIIA performs audits related to the achievement of one or more financial assertions

(existence or occurrence, completeness, valuation and allocation, rights and

obligations, presentation, disclosure). In addition, provide reasonable assurance

related to the design and operation of key control related to financial activities and

the efficiency and effectiveness of the processes. Other types of financial audits

include auditing compliance with applicable compliance requirements relating to one

or more government programs.

II.

Attestation Engagements

The primary purpose of an attestation engagement is to provide a specified level of

assurance about whether a management report or assertion is consistent with stated

criteria that are the responsibility of another party. Attestation engagements may

cover a broad range of financial or non-financial subjects and can be part of financial

or performance audits; however, lower levels of assurance (review or agreed-upon

procedure) engagements should not be used for reporting on internal controls or

compliance with provisions of laws and regulations. Possible subjects of attestation

engagements include:

•

Internal control over financial reporting.

•

Compliance with requirements of specified laws, regulation, rules,

contracts or grants.

•

Prospective financial statements or pro-forma financial information.

•

The accuracy and reliability of reported performance measures.

•

The allowability and reasonableness of proposed contract amounts that

are based on detailed costs.

Procedurel.02

Page 3 of 6

For attestation engagements, GAS incorporates AICPA Statements on Standards

for Attestation Engagements (SSAE). GAS also prescribes general standards and

additional fieldwork and reporting standards beyond those provided by the AICPA

for attestation engagements.

The OIIA does not conduct attestation engagements.

Ill.

Performance Audits

The primary purpose of a performance audit is to provide objective analysis so that

management and those charged with governance and oversight can use the

information to improve program performance and operations and contribute to

public accountability. A performance audit provides findings or conclusions based

on an evaluation of sufficient, appropriate evidence against criteria. Performance

audits may be broad or narrow in scope and encompass a variety of objectives,

including assessing program efficiency, effectiveness, equity, internal control

(Guidance from Committee of Sponsoring Organization Internal Control Integrated

Framework), compliance with legal or other requirements, and objectives related to

prospective analyses.

IV. Information Systems Audits

The primary purpose of an Information Systems (IS) audit is provide assurance

related to the design and operation of general control activities or specific

application control activities. Information Systems can be broken down into two

broad categories as it relates to auditing.

1.

The first category is auditing of IS general controls. Evaluation of IS general

controls may include:

•

Logical access controls over infrastructure, applications, and data.

•

System development life cycle controls.

•

Program change management controls.

•

Data center physical security controls.

•

System and data backup and recovery controls.

•

Computer operation controls.

2.

The second category of IS auditing also includes Information System (IS)

application control. IS application control auditing evaluates the internal control

environment over individual computer applications or programs. Evaluations of

existing applications may include a review to:

•

Ensure the input data is complete, accurate, and valid.

•

Ensure the internal processing produces the expected results.

•

Ensure the processing accomplishes the desired tasks.

•

Ensure output reports are protected from disclosure.

Procedurel.02

Page 4 of 6

Also, Information Techonology auditing focuses on the organization's Information

Security Program. This program should be designed to protect the information and

systems that support the operations and assets of the organization. To safeguard each

system at DeKalb County is to ensure that the following security objectives can be

realized for their information:

•

Confidentiality - Protecting information from unauthorized access and disclosure.

•

Integrity - Assuring the reliability and accuracy of information and IT resources by

guarding against unauthorized information modification or destruction.

•

Availability - Defending information systems and resources to ensure timely and

reliable access and use of information.

These audits are conducted in accordance with applicable standards set forth by

professional associations representing internal auditors such as the Information

Systems Audit and Control Association (ISACA) and other professional information

systems organizations, which the auditor should also be mindful of Government

Auditing Standards.

V. Professional Services Other than Audits

GAS does not cover nonaudit services and requires audit organizations to

communicate with requestors and those charged with governance that such work

does not constitute an audit conducted in accordance with GAS. Further, GAS

recognizes that certain nonaudit services impair an audit organization's

independence and limits nonaudit services that may be provided (GAS 3.45; 3.50-

3.58). For nonaudit services not specifically prohibited, GAS requires audit

organizations to evaluate threats to independence and to apply safeguards to

reduce any identified threat to an acceptable level (GAS 3.34-3.39).

It is OIIA policy not to take on nonaudit services that could impair our organizational

independence to conduct audits. If the GAE or Audit Oversight Committee

determines that it is in the DeKalb County's best interest to provide limited advisory

services to management that are beyond the scope of routine activities identified in

GAS 3.40-3.41, the GAE or OIIA staff is responsible for documenting:

•

Consideration of threats to independence that require the application of

safeguards (GAS 3.24).

•

Objectives of the nonaudit service.

•

Services to be performed.

•

The auditor's responsibilities.

•

Any limitations of the nonaudit service (GAS 3.39).

The OIIA staff member assigned to provide the service is responsible for

documenting management's assurance that it:

Procedurel.02

Page 5 of 6

•

Assumes all management responsibilities.

•

Has designated a qualified individual to oversee the service.

•

Will evaluate the adequacy and results of the service.

•

Accepts responsibility for the results of the service (GAS 3.37).

The OIIA may provide targeted and limited advice to management consistent with

GAS 3.40-3.41. Such advice should generally be communicated in writing, signed

by the CAE, and a record kept in the correspondence file. OIIA staff members may

from time to time serve on DeKalb County committees or task forces in a purely

advisory capacity with the CAE approval. Specific actions to avoid is:

•

Voting on any issues that include internal controls, program objectives,

etc.

•

Participating in designing or implementing internal controls.

•

Fulfilling a management function or making a management decision, for

example:

o

Setting policies and strategic direction for the audited entity;

o

Directing and accepting responsibility for the actions of the audited

entity's employees in the performance of their routine, recurring

activities;

o

Having custody of an audited entity's assets;

o

Reporting to those charged with governance on behalf of

management;

o

Deciding which of the auditor's or outside third party's

recommendations to implement;

o

Accepting responsibility for the management of an audited entity's

project;

o

Providing services that are intended to be used as management's

primary basis for making decisions that are significant to the subject

matter of the audit;

o

Developing an audited entity's performance measurement system

when that system is material or significant to the subject matter of

the audit

•

Accepting responsibility, such as a director or member of management, of

a program that may be audited.

•

Seeking employment with the organization(s) for which the nonaudit

service is being rendered.

Providing information, training, and technical assistance to the DeKalb County

Board of Commissioners or other external oversight bodies or conducting other

types of independent work, such as investigating hotline complaints and following

Procedurel.02

Page 6 of 6

up on open audit recommendations, does not impair the organization's

independence to conduct audits.

Procedure 1.03

Page 1 of 3

Office of Independent Internal Audit

Audit Function

Procedures Manual

Subject

Introduction

Procedure

Number

1.03

References

Government Auditing Standards, 2011

Revision

Issue

Date:

Effective:

Approved: John L. Greene, Chief Audit Executive

Amended:

Chapter 1

Procedure 1.03 -

Government Auditing Standards

Purpose:

The Office of Independent Internal Audit (OIIA) is committed to achieving a high level of

audit quality by performing its audit work in accordance with the Government Auditing

Standards.

Authority:

Government Auditing Standards (GAS),

1

also known as the "Yellow Book" promulgated

by the Comptroller General of the United States and published by the United States

Government Accountability Office (GAO).

ApplicabiIity:

The OIIA staff members will follow GAS for all financial and performance audits and

attestation engagements performed by the OIIA. OIIA staff members are responsible for

familiarizing themselves with and adhering to GAS

Generally Accepted Government Auditing Standards (GAGAS):

I.

General Auditing Standards

Independence:

In all matters relating to the audit work, the audit organization and

the individual auditor, whether government or public, must be independent.

1

The current version of GAS was published in December 2011 and is available on the GAO website at http://

http://www.gao.gov/assets/590/587281.pdf. This revision supersedes the 2007 revision.

Procedure 1.03

Page 2 of 3

Professional Judgment:

Auditors must use professional judgment in planning and

performing audits and in reporting the results.

Competence:

The staff assigned to perform the audit must collectively possess

adequate professional competence needed to address the audit objectives and

perform the work in accordance with GAGAS.

Quality Control and Assurance:

Each audit organization performing audits in

accordance with GAGAS must:

a. Establish and maintain a system of quality control that is designed to provide

the audit organization with reasonable assurance that the organization and its

personnel comply with professional standards and applicable legal and

regulatory requirements.

b. Have an external peer review performed by reviewers independent of the

audit organization being reviewed at least once every 3 years.

II.

Fieldwork Standards for Performance Audits

Planning:

Auditors must adequately plan and document the planning of the work

necessary to address the audit objectives.

Supervision:

Audit supervisors or those designated to supervise auditors must

properly supervise audit staff.

Evidence:

Auditors must obtain sufficient, appropriate evidence to provide a

reasonable basis for their findings and conclusions.

Audit Documentation:

Auditors must prepare audit documentation related to

planning, conducting, and reporting for each audit. Auditors should prepare audit

documentation in sufficient detail to enable an experienced auditor, having no

previous connection to the audit, to understand from the audit documentation the

nature, timing, extent, and results of audit procedures performed, the audit evidence

obtained and its source and the conclusions reached, including evidence that

supports the auditors' significant judgments and conclusions. An experienced

auditor means an individual (whether internal or external to the audit organization)

who possesses the competencies and skills that would have enabled him or her to

conduct the performance audit. These competencies and skills include an

understanding of (1) the performance audit processes, (2) GAGAS and applicable

legal and regulatory requirements, (3) the subject matter associated with achieving

the audit objectives, and (4) issues related to the audited entity's environment.

Ill.

Reporting Standards for Performance Audits

Form:

Auditors must issue audit reports communicating the results of each

completed performance audit.

Report Contents:

Auditors should prepare audit reports that contain (1) the

objectives, scope, and methodology of the audit; (2) the audit results, including

findings, conclusions, and recommendations, as appropriate; (3) a statement about

Procedure 1.03

Page 3 of 3

the auditors' compliance with GAGAS; (4) a summary of the views of responsible

officials; and (5) if applicable, the nature of any confidential or sensitive information

omitted.

Report Distribution:

Distribution of reports completed under GAS depends on the

relationship of the auditors to the audited organization and the nature of the

information contained in the report. Auditors should document any limitation on

report distribution. The following discussion outlines distribution for reports

completed in accordance with GAGAS:

a. Audit organizations in government entities should distribute audit reports to

those charged with governance, to the appropriate audited entity officials, and

to the appropriate oversight bodies or organizations requiring or arranging for

the audits. As appropriate, auditors should also distribute copies of the

reports to other officials who have legal oversight authority or who may be

responsible for acting on audit findings and recommendations, and to others

authorized to receive such reports.

b. Internal audit organizations in government entities may also follow the

Institute of Internal Auditors' (IIA) International Standards for the Professional

Practice of Internal Auditing. In accordance with GAGAS and IIA standards,

the head of the internal audit organization should communicate results to

parties who can ensure that the results are given due consideration. If not

otherwise mandated by statutory or regulatory requirements, prior to releasing

results to parties outside the organization, the head of the internal audit

organization should: (1) assess the potential risk to the organization, (2)

consult with senior management or legal counsel as appropriate, and (3)

control dissemination by indicating the intended users of the report.

Organizations.

c. Public accounting firms contracted to perform an audit in accordance with

GAGAS should clarify report distribution responsibilities with the engaging

organization. If the contracting firm is responsible for the distribution, it should

reach agreement with the party contracting for the audit about which officials

or organizations will receive the report and the steps being taken to make the

report available to the public.

Procedure 1.04

Page 1 of 5

Office of Independent Internal Audit

Audit Function

Procedures Manual

I

Chapter 1

Procedure 1.04 -

Audit Process Overview

Purpose:

Audits conducted by the Office of Independent Internal Audit (OIIA) comply with

Government Auditing Standards. The audit process ensures and support compliance

with Government Auditing Standards.

Authority:

Government Auditing Standards (GAS) also known as the "Yellow Book" promulgated

by the Comptroller General of the United States and published by the United States

Government Accountability Office.

ApplicabiIity:

The audit process and Team

Mate (Audit Management Software) procedures are to

be followed for each audit engagement unless an exception is approved and

documented. The office's compliance with Government Auditing Standards shall be

achieved and demonstrated through adherence to the audit process and TeamMate

procedures, as well as adequate documentation, supervision, and communication.

Audit Process

I.

Introduction

Before an audit is assigned, the Internal Audit Management team formulates

preliminary objectives

of engagements through a review of the annual internal

audit plan and prior engagement results, discussions with stakeholders, and

consideration of the mission, vision, and objectives of the area or process under

review. The

preliminary objectives

are further enhanced through risk assessment

Subject

Audit Fieldwork

Procedure

Number

1.04

References

GAS 3.92, GAS 6.06-6.34, GAS 6.36,

GAS 6.47-6.50

Issue

Date:

I

Effective:

Approved: John L. Greene, Chief Audit Executive

Amended:

Procedure 1.04

Page 2 of 5

exercises to cover the governance, risk management, and controls of the area or

process under review.

Although every audit project is unique, the audit process is similar for most

engagements and normally consists of four stages:

Planning

(sometimes called

Survey or Preliminary Review),

Fieldwork, Reporting, and Follow-up Review.

Client involvement is critical at each stage of the audit process.

II.

Planning

(Refer to 01/A Chapter 2 - Project Initiation and Planning Procedures)

Internal auditors typically gather information regarding the audit client's policies and

procedures and seek to understand any Information Technology systems used by

the area under review, along with sources, types, and reliability of information used

in the process and those that will be evaluated as evidence. Internal auditors also

obtain and review the results of work performed by other internal or external

assurance providers and/or prior audit results from the area or process under

review, if applicable.

While planning an engagement, internal auditors establish the engagement's

objectives and scope in conformance with GAS Standard Planning 6.06-6.09. Doing

so allows internal auditors to consider what should be tested in the process or area

under review. It also enables them to prioritize the areas within the engagement

scope based on the significance of the risks identified. Priority is generally

determined by the likelihood of a risk occurrence and the impact that risk would have

on the organization if it occurred. Risks with a higher likelihood of occurrence and

the greatest impact are generally given the highest priority for testing.

Preliminary Survey

In this phase the auditor gathers relevant information about the entity in order to

obtain a general overview of operations. Internal auditors typically talk with key

personnel who work in the area or process under review and review reports, files,

and other sources of information. This will enhance the auditor's understanding and

lead to more effective engagement planning.

Internal Control Review (Risk Assessment

&

Fraud Considerations)

The internal auditor will review the agency's internal control structure, a process

which is usually time-consuming. In doing this, the auditor will use a variety of tools

and techniques to gather and analyze information about the operation. The review

of internal controls helps the auditor determine the areas of highest risk and design

tests to be performed in the fieldwork section.

Procedure 1.04

Page 3 of 5

Narrative or flowchart

Prepare the process narrative or flowchart to document the process under audit

based on discussions held with individual familiar with the process.

Engagement Letter

The auditor drafts an engagement letter to the entity head of audited area

communicating an overview of the objectives, scope, and methodology and the

timing of the performance audit.

Conduct Entrance Conference

This meeting is used to communicate with entity management the reasons for the

audit, describe the audit process, address management's questions or concerns,

identify key contacts, and discusses logistics if necessary.

Audit Program

Preparation of the audit program concludes the preliminary review phase. This

program outlines the fieldwork necessary to achieve the audit objectives.

(The audit

program and other planning procedures must be approved in TeamMate prior

to performing fieldwork procedures.)

Ill.

Fieldwork

(Refer to OIIA Chapter 3 -Audit Fieldwork Procedures)

The fieldwork concentrates on transaction testing and informal communications. It is

during this phase that the auditor determines whether the controls identified during

the preliminary review are operating properly and in the manner described by the

client. The fieldwork stage concludes with a list of, if any, significant findings from

which the auditor will prepare a draft of the audit report.

One of the key objectives is to avoid disrupting ongoing activities.

Transaction Testing

After completing the preliminary review, the auditor performs the procedures in the

audit program. These procedures usually test the major internal controls and the

accuracy and propriety of the transactions. Various techniques including sampling

are used during the fieldwork phase.

Advice

&

Informal Communications

As the fieldwork progresses, the auditor discusses, if any, significant findings with

the client. Hopefully, the client can offer insights and work with the auditor to

Procedure 1.04

Page 4 of 5

determine the best method of resolving the finding. Usually these communications

are oral.

Discussion of Preliminary Results

Once the auditor has completed the fieldwork, the auditor and the OIIA management

team assess the evidence gathered, come to agreement about the major findings

and conclusions and determine whether additional data collection or analysis is

needed based on our overall assessment of evidence, significance, and audit risk.

Afterwards, the auditor will draft a PowerPoint to discuss the preliminary findings

with client. Our goal: No surprises.

(The fieldwork procedures must be approved in TeamMate prior to performing

reporting procedures.)

IV.

Reporting

(Refer to 01/A Chapter 4 - Communicating Results Procedures)

Our principal product is the final report in which we express our opinions, present the

audit findings, and discuss recommendations for improvements.

Draft Report

At the conclusion of fieldwork, the auditor drafts the report. Audit management

thoroughly reviews the audit working papers and the draft report before it is

presented to the client for comment. This discussion draft is prepared for the entity's

operating management and is submitted for the client's review before the exit

conference. This draft report is also submitted to Audit Oversight Committee for

comment.

Exit Conference

When audit management has approved the draft report, Internal Audit meets with

the entity's management team to discuss the findings, recommendations, and text of

the draft. At this meeting, the client comments on the draft and the group work to

reach an agreement on the audit findings.

Formal Draft Report

The auditor then prepares a formal draft, taking into account any revisions resulting

from the exit conference and other discussions. When the changes have been

reviewed by audit management, the Chief Audit Executive issues the final draft

report to the client for written response to the findings and recommendations within

60 days, as required by law. The client indicates whether they concur or do not

concur with the recommendations, plans for addressing recommendations and a

timetable to complete such activity.

Procedure 1.04

Page 5 of 5

Final Report

Internal Audit distributes the final report, with the client's comments, to the entity's

operating management, senior management of DeKalb County (CEO, COO, &

Deputy COO of the entity), Board of Commissioners, Ethics Officer, the County

Attorney, and Audit Oversight Committee. If no response is received, Internal Audit

notes that fact in the transmittal letter and the final report is released.

Handling Confidential Information

The office will protect confidential information from unauthorized disclosure and will

handle the withholding of confidential information from audit reports in accordance

with Government Auditing Standards, and applicable laws and regulations.

Guidance on handling confidential information is outline in the OIIA Procedure 1.05

Handling Confidential and Sensitive Information of information Exempt from Public

Disclosure. If all or part of an audit is deemed to be confidential, TeamMate

procedures for confidential audits should be followed.

Once the results of a confidential audit (or portion of an audit) are communicated to

authorized recipients, the office will post the name of the report on its OIIA's website

and note that it is confidential; however, the contents of the report will not be

published. The office is committed to transparency in government and will make

every effort to maximize the amount of information provided to the public.

Client Comments

Finally, as part of Internal Audit's self-evaluation program, we ask clients to comment

on Internal Audit's performance through a survey distributed from TeamMate. This

feedback has proven to be very beneficial to us, and may result in changes in our

procedures as a result of clients' comments and/or suggestions.

V.

Audit Follow-Up

(Refer to OJ/A Chapter 6 - Audit Follow-up Procedures)

Within approximately six months of the final report, Internal Audit will perform a

follow-up review to verify the resolution of the report findings.

Procedure

1.05

Page

1

of

6

Office of Independent Internal Audit

Audit Function

Procedures Manual

I

Chapter 1

Procedure 1.05 - Handling Confidential and Sensitive Information or

Information Exempt from Public Disclosure

Purpose:

To specify the policies and procedures that apply within the Office of Independent

Internal Audit (OIIA) regarding the use, maintenance, and disclosure of confidential and

non-public (exempt from open records request) information.

Authority:

Government Auditing Standards (GAS) also known as the "Yellow Book" promulgated

by the Comptroller General of the United States and published by the United States

Government Accountability Office. Also, Georgia Open Records Act§ 50-18-70 et seq.

provides for exemptions of confidential information that would put the organization at

risk. O.C.G.A. § 50-18-72(a) (1) through. (46).

ApplicabiIity:

Whenever an engagement includes the handling of confidential and sensitive

information or information exempt from public disclosure, steps should be taken to

prevent unauthorized access and disclosure. To the extent practicable, confidential and

sensitive information or information exempt from public disclosure should not be

mentioned in working papers and audit reports. However, when it is necessary, as part

Subject

Confidential and Non-Public Information

Procedure

Number

1.05

References

GAS 6.63-6.69, GAS 9.61-9.67 Reporting

Confidential and Sensitive Information

GAS 6.70 Distributing Reports

GAS 9.10-9.17, Report Contents

Georgia Open Records Act 50-18-70

Issue

Date:

06/24/2019

I

Effective:

07/01/2019

Approved: John L. Greene, Chief Audit Executive

Amended:

2/28/2020

Procedure

1.05

Page

2

of

6

of the labeling of the documents, the specific Act or law that provides the exemption

should be cited.

The following are the most common examples of confidential and exempt information

encountered within OIIA activities (this list is not comprehensive):

•

Individual Social Security Numbers which have been lawfully collected during

the course of an audit from program areas are confidential and exempt from

public inspection.

•

The identity of an individual disclosing information pursuant to the Whistle-

Blower Act.

•

Information received in an investigation designated as whistle-blower while

the investigation is active.

•

Risk analysis information, as a result of audits and evaluations relating to

security of data and information technology resources, and internal policies

and procedures which, if disclosed, could facilitate the unauthorized

modification, disclosure, destruction of data or information technology

resources, or expose the County to risks.

•

Information security and Information Technology documentation, data or

information that would expose the County to risks.

•

Personally identifiable information related to customers, County residents,

and employees.

Audit reports with confidential, sensitive, nonpublic information, or information that could

put the County at risk will not be published on the OIIA website. In addition, such reports

will be discussed in person and copies collected at the end of discussion. All nonpublic,

confidential, sensitive information should be redacted or omitted, whichever deemed

appropriate by the CAE. In the case where the subject of the entire report (as in the case

with security) is exempt from public disclosure by state law, the completion of the audit

will be reported on the OIIA website but the law exempting the report from public

disclosure will be referred to instead.

Work Papers and Audit Documentation

Whenever audit work papers and documentation will need to include confidential

information or information exempt from public disclosure, steps will be taken to prevent

unauthorized disclosure. The information should be secured with a password and/or

redacted.

The Audit Manager and/or Auditor in charge will possess the password for such files. The

name of all electronic files, containing confidential or information exempt from public

disclosure, will contain the word

"Confidential"

in the name.

Procedure

1.05

Page

3

of

6

All audit files containing working papers with information that is exempt from public

disclosure, whether electronic or hard copy, are required to contain the OIIA

Confidentiality Statement template which includes the following:

OIIA Confidentiality Statement

(This statement should be placed in the hard and/or electronic copy)

"These project working papers and any associated reports may contain

information which is confidential and exempt from inspection and copying.

Office of the Independent Internal Audit (O1/A) project working papers are

subject to laws related to their disclosure. Information should not be

released without complying with the process which ensures that any

appropriate information is redacted prior to project working papers and any

associated reports being released. O1/A project working papers are to be

disclosed only in compliance with O1/A Procedure

1.05

of the Policies and

Procedural Manual."

Whenever requesting information that is confidential and exempt from public disclosure,

precautions should be taken to obtain the information in a secure manner. The auditor

should advise management of the Office procedures for handling confidential and

sensitive information. A memorandum

(see templates for a copy of the

memorandum)

to management should be prepared outlining the items that are

considered confidential, the persons the audit believes will provide the information, the

secure method that will be used to provide the requested information or documentation,

and requesting that management contact audit management if any other requests are

made that are also confidential that were not included in the memorandum. Also, the

auditor should follow Office procedures for safeguarding confidential and sensitive

information.

Handling Confidential, Sensitive, and Nonpublic Information:

Emailing Confidential Information:

Documents, reports, or forms that contain confidential, sensitive, and exempt from public

information should be password protected before they are attached to an email. Also, the

following statements should be added to the body of any email with a confidential

attachment.

The

document attached to

this

email is

password protected. Please contact

at

XXX-XXXX

to obtain the password. This email and any attachments

may contain information that is exempt from disclosure under applicable law. Do not

release or disseminate without prior coordination with the O1/A.

Procedure

1.05

Page

4

of

6

Release of Work papers and Audit Documentation:

No workpapers will be released to anyone outside of the office without the Chief Audit

Executive's (GAE) prior knowledge. Incomplete workpapers are generally not

considered final and should not be released for fear of misinterpretation, etc. In the

event that the GAE cannot be reached, workpapers that are open to the public may be

copied at the expense of the requester, and the GAE should be immediately informed.

No documents/workpapers should be released without also consulting the Office's

General Counsel.

Workpapers and other audit documentation released internally that contain confidential,

sensitive, and nonpublic information will be distributed using the following procedures:

•

The documents should be marked confidential.

•

The documents should be distributed to management via secure methods.

•

The document should include the Office's confidential statement.

CONFIDENTIALITY NOTICE: The Office of Independent Internal Audit intends for these

documents to be used only by the person(s) or entity to which they are addressed. The

documents may contain confidential, sensitive, nonpublic information or information that

could put the County at risk. If the reader is not the intended recipient of this message

or an employee or agent responsible for delivering the message to the intended

recipient, you are hereby notified that you are prohibited from printing, copying, storing,

disseminating or distributing this communication. If you received this communication in

error, please delete it from your computer and notify the sender by reply e-mail.

Requests for the disclosure of information contained within, or referred to by, the

audit report of the OIIA concerning security for the protection of confidential and

exempt data, software support, authentication, logging and separation of duties.

Preserving the confidentiality of sensitive documents is eminently reasonable, but

nonetheless requires compliance with the Georgia Open Records Act (O.C.G.A. §50-

18-70 through -77). The legislative findings of the Open Records Act include these

statements of policy:

The General Assembly ...

finds and declares that there is a strong

presumption that public records should be made available for public

inspection without delay. This article [of the law] shall be broadly

construed to allow the inspection of governmental records. The exceptions

set forth in this article, together with any other exception located

elsewhere in the Code, shall be interpreted narrowly to exclude only those

portions of records addressed by such exception.