Arabian Contracting Services Company Prospectus

Offering Period: Three (3) days

starting on Tuesday 20/ 03/1443H (corresponding to 26/10/2021G) and

ending on Thursday 22/03/1443H (corresponding to 28/10/2021G).

A Saudi joint stock company pursuant to Commercial Register No. 1010048419 dated

18/05/1403H (corresponding to 3 March 1983G), and Ministerial Resolution No. 1132 dated

02/05/1427H (corresponding to 30 May 2006G).

Offering of fifteen million (15,000,000) ordinary shares, representing 30% of the Arabian

Contracting Services Company’s capital at an offer price of [•] SAR per share.

The Arabian Contracting Services Company (hereinafter “the Company”, “ Al Arabia”, “ Al Arabia

Company” or the “Issuer”) was incorporated as a Saudi limited liability company in Riyadh under

Commercial Register No. 1010048419 dated 18/05/1403H (corresponding to 3 March 1983G), with

a share capital of one million Saudi riyals (SAR 1,000,000) for the objective of engaging in outdoor

advertising, particularly installing, and operating outdoor advertising billboards. The Company

was converted into a (closed) joint stock company under HE Minister of Commerce Resolution No.

1132 issued on 02/05/1427H (corresponding to 30 May 2006G). At the same time, the Company’s

capital was increased from one million Saudi riyals (SAR 1,000,000) to sixty million Saudi riyals (SAR

60,000,000) by transferring twenty-three million, nine hundred nine thousand, one hundred three

Saudi riyals (SAR 23,909,103) from the shareholder’s accounts receivable and capitalising a sum of

thirty-five million, ninety thousand, eight hundred ninety-seven Saudi riyals (SAR 35,090,897) out

of the retained earnings. On 02/12/1429H (corresponding to 30 November 2008G), the Company

increased its capital from sixty million Saudi riyals (SAR 60,000,000) to one hundred fifty million

Saudi riyals (SAR 150,000,000) divided into fifteen million (15,000,000) ordinary shares with a fully

paid-up nominal value of ten Saudi riyals (SAR 10) per share through a cash contribution from the

current shareholders of thirteen million, four hundred thousand Saudi riyals (SAR 13,400,000), the

capitalisation of sixty-nine million, eight hundred eighty-five thousand, five hundred eighty-two

Saudi riyals (SAR 69,885,582) out of the retained earnings, and the transfer of six million, seven

hundred fourteen thousand, four hundred eighteen Saudi riyals (SAR 6,714,418) from the balance

of the statutory reserve. On 22/06/1433H (13 May 2012G), the Company increased its capital from

one hundred fifty million Saudi riyals (SAR 150,000,000) to two hundred ten million Saudi riyals

(SAR 210,000,000) divided into twenty-one million (21,000,000) ordinary shares with a fully paid

nominal value of ten Saudi riyals (SAR 10) per share through capitalisation of forty-four million,

four hundred sixty-four thousand, nine hundred sixty-six Saudi riyals (SAR 44,464,966) from the

retained earnings and fifteen million, five hundred thirty-five thousand, thirty-four Saudi riyals

(SAR 15,535,034) from the balance of the statutory reserve. On 21/06/1435H (corresponding to

21 April 2014G), the Company increased its capital from two hundred ten million Saudi riyals (SAR

210,000,000) to five hundred fifty million Saudi riyals (SAR 550,000,000) divided into fifty-five million

(55,000,000) ordinary shares with a fully paid nominal value of ten Saudi riyals (SAR 10) per share,

through capitalisation of three hundred one million, forty-six thousand, six hundred forty-five Saudi

riyals (SAR 301,046,645) from the retained earnings and thirty-eight million, nine hundred fifty-three

thousand, three hundred fifty-five Saudi riyals (SAR 38,953,355) from balance of the statutory reserve.

On 27/03/1440H (corresponding to 5 December 2018G), it was decreased (for further details, see

Section 4 (“The Company”) because it was in excess of the Company’s needs from five hundred fifty

million Saudi riyals (SAR 550,000,000) to two hundred fifty million Saudi riyals (SAR 250,000,000)

divided into twenty-five million (25,000,000) ordinary shares with a fully paid-up nominal value of

ten Saudi riyals (SAR 10) per share. On 01/04/1441H (corresponding to 28 November 2019G), the

Company increased its capital to meet its future expansion needs from two hundred fifty million

Saudi riyals (SAR 250,000,000) to five hundred million Saudi riyals (SAR 500,000,000) divided into fifty

million (50,000,000) ordinary shares with a fully paid nominal value of ten Saudi riyals (SAR 10) per

share, through the capitalisation of one hundred seventy-five million Saudi riyals (SAR 175,000,000)

from the retained earnings and seventy-five million Saudi riyals (75,000,000) from the balance of the

statutory reserve. (For more information, see Section 4.2 (“Development of Company’s Capital and

Ownership Structure”)).

The initial public offering (hereinafter the “Offering”) consists of the sale of fifteen million (15,000,000)

ordinary shares (collectively, the “Offer Shares” and individually an “Offer Share”), with a fully paid

nominal value of ten Saudi riyals (SAR 10) per ordinary share. The offer price shall be [•] Saudi riyals

per share (hereinafter the “Offer Price”). The Offer Shares represent 30% of the Company’s capital.

The Offer Shares are restricted to the following two categories of investors (hereinafter the “Investors”):

Tranche A - Participating Parties: This category consists of the parties entitled to participate in

the book-building process as specified under the Capital Market Authority (hereinafter the “CMA”)

Instructions on Book-Building and Allocation of Shares in Initial Public Offerings (hereinafter

the “Book-Building Instructions”) (collectively, the “Participating Parties” and individually a

“Participating Party”) (For more information, see Section 1 (“Definitions and Abbreviations”)).

The number of Offer Shares to be allocated to the Participating Parties actually involved in the

book building process is 15,000,000 (fifteen million) ordinary shares, representing 100% of the total

Offer Shares. In the event that there is sufficient demand from individual investors (as defined in

Tranche B below), the Bookrunner is entitled to reduce the number of Offer Shares allocated to the

Participating Parties to a minimum of thirteen million, five hundred thousand (13,500,000) ordinary

shares, representing 90% of the total Offer Shares. The number and percentage of Offer Shares to be

allocated to the Participating Parties will be determined by the Financial Advisor in consultation with

the Company and the Selling Shareholders using the optional allocation mechanism mentioned in

Section 18.4.1.

Tranche B - Individual Investors: This category consists of Saudi natural persons, including any

divorced or widowed Saudi woman with minor children from a marriage to a non-Saudi who is

entitled to subscribe to the Offer Shares in their names on her own behalf, on the condition that she

provides proof that she is divorced or widowed and the mother of her minor children. It also includes

GCC investors who are natural persons and resident foreign investors holding valid residency permits

and having bank accounts (collectively, the “Individual Investors” and individually an “Individual

Investor”). Subscription of a person in the name of his divorcee shall be deemed invalid, and if a

transaction of this nature is demonstrated to have occurred, then the law shall be enforced against

the applicant. If a duplicate subscription is made, the second subscription will be considered void

and only the first subscription will be accepted. Individual Investors will be allocated a maximum of one

million, five hundred thousand (1,500,000) ordinary shares, representing 10% of the Offer Shares. If there

is not sufficient demand by Individual Investors for all the Offer Shares allocated to them, the Bookrunner

is entitled to reduce the number of Offer Shares allocated to Individual Investors in proportion to the

number of Offer Shares that they subscribed for.

The Company’s Current Shareholders (collectively, the “Current Shareholders”) hold all of the Company’s

shares prior to the Offering. All Offer Shares will be sold by the shareholders Abdelellah Abdulrahman

Alkhereiji and Engineer Holding Group Company (hereinafter the “Selling Shareholders”) as per Table

12.1 (“The Company’s Ownership Structure Pre- and Post-Offering”). Prior to the Offering, Abdelellah

Abdulrahman Alkhereiji and Engineer Holding Group Company directly own 25% and 70% of the

Company’s shares respectively. Upon completion of the Offering, Abdelellah Abdulrahman Alkhereiji will

not directly own any shares.

Upon completion of the Offering, the Current Shareholders will own 70% of the Company’s shares and

will consequently retain a controlling interest in the Company. The Company’s Current Shareholders are

Abdelellah Abdulrahman Alkhereiji, Engineer Holding Group Company, and MBC Group Holdings Ltd.

The Substantial Shareholders, (with the exception of Abdelellah Abdulrahman Alkhereiji as he will not

directly own any Company shares after completion of the Offering), will be subject to a lock-up period

during which they will be prohibited from selling or disposing of their shares for a period of six (6) months

(hereinafter the “Lock-up Period”) as at the date trading starts on Saudi Tadawul Group (hereinafter

“Tadawul”, “ Exchange”, or “Stock Exchange”). After the lock-up period, Substantial Shareholders shall be

entitled to dispose of their shares. The Substantial Shareholders are: Abdelellah Abdulrahman Alkhereiji,

Engineer Holding Group Company, and MBC Group Holdings Ltd. Details of their respective ownership

ratios are shown in Table 1.2 (“Substantial Shareholders and Their Shareholding Percentages in the

Company Pre- and Post-Offering”) of the Offering Summary on page (l). After deducting the Offering

expenses, the proceeds from the Offering (hereinafter “Net Offering Proceeds”) will be distributed to

the Selling Shareholders. The Company will not receive any part of the Net Offering Proceeds (For more

information, see Section 8 (“Use of Offering Proceeds”)). The Offering will be fully underwritten by the

Underwriter (For more information, see Section 13 (“Underwriting”)).

The offering period starts on Tuesday 20/03/1443H (corresponding to 26/10/2021G) and remains open

for a period of (3) three days including and up to the Offering closing date at the end of Thursday

22/03/1443H (corresponding to 28/10/2021G) (hereinafter the “Offering Period”). Subscription to

the Offer Shares can be made through any of the branches of the receiving agents (hereinafter the

“Receiving Agents”) listed on Page I during the Offering Period (For more information, please see Page

R (“Key Dates and Subscription Procedures”)). The Participating Parties may subscribe for the Offer

Shares through the Bookrunner (as defined in Section 1 (“Definitions and Abbreviations”)) during

the book-building process, which will take place prior to offering of the shares to Individual Investors.

Individual Investors who subscribe for the Offer Shares shall submit a Subscription Application Form for a

minimum of ten (10) ordinary shares, noting that the maximum subscription is three hundred thousand

(300,000) ordinary shares. The remaining Offer Shares (if any) will be allocated on a pro rata basis based

on the portion of the Offer Shares applied for by each Individual Investor out of the total number of

shares applied for. If the number of Individual Investors exceeds one hundred fifty thousand (150,000)

investors, the Company will not guarantee the minimum allocation of Offer Shares and the Offer Shares

will be allocated at the discretion of the Issuer and the Financial Advisor. Excess subscription monies, if

any, will be refunded to the Individual Investors without any charge or withholding by the Receiving

Agents. Announcement of the final allotment and refund of excess subscription monies, if any, will be

made no later than 29/03/1443H (corresponding to 04/11/2021G) (For more information, see Page R

(“Key Dates and Subscription Procedures”) and Section 18 (“Subscription Terms and Conditions”)).

The Company has one class of ordinary shares. Each share entitles its holder to one vote. Each

shareholder (hereinafter “Shareholder”) has the right to attend and vote at the Shareholders’ General

Assembly meetings (hereinafter the “General Assembly”). The shares do not confer preferential voting

rights upon their Shareholder. The Offer Shares will be entitled to receive dividends declared and paid

by the Company as at the date of this Prospectus (“Prospectus”) and in subsequent fiscal years (for more

information, see Section 7 (“Dividend Distribution Policy”)).

Prior to the Offering, there has been no public trading or listing of the shares in any market in the

Kingdom of Saudi Arabia (hereinafter “Kingdom of Saudi Arabia” or “Saudi Arabia”) or elsewhere. The

Company has submitted an application to: (1) the CMA for the registration and offering of the shares,

and (2) the Exchange for acceptance to list its shares. All supporting documents required by the CMA

have been submitted. All requirements have been met, including requirements for listing the Company

on the Exchange, and all approvals pertaining to the Offering, including this Prospectus (hereinafter the

“Prospectus”), have been granted. Trading of the shares on the Exchange is expected to commence once

Offer Share allocation is concluded and all necessary legal requirements and relevant procedures are

fulfilled (For more information, see Page R (“Key Dates and Subscription Procedures”)). Saudi nationals,

GCC nationals, Saudi and GCC companies, banks, and investment funds, and residents holding valid

residency permits in the Kingdom of Saudi Arabia will be permitted to trade in the Offer Shares once

they begin to be traded in Tadawul. Moreover, qualified foreign investors will be permitted to trade in

the shares in accordance with the Rules for Qualified Foreign Financial Institutions Investment in Listed

Shares. Non-Saudi nationals living outside the Kingdom of Saudi Arabia and institutions registered

outside the Kingdom of Saudi Arabia (hereinafter “Foreign Investors”) are also entitled to acquire

economic benefits in the shares by entering into Swap Agreements through a Capital Market Institution

authorised by the CMA to acquire and trade in shares on Tadawul on behalf of a Foreign Investor

(hereinafter “Capital Market Institutions”). Under Swap agreements, Capital Market Institutions will be

registered as legal owners of the shares.

Investment in Offer Shares involves certain risks and uncertainties. For a discussion of certain factors

that should be carefully considered prior to making a decision to subscribe to the Offer Shares, see Page

A (“Important Notice”) and Section 2 (“Risk Factors”) of this Prospectus. These two sections should be

considered carefully before any decision to invest in the Offer Shares is made.

This Prospectus includes information provided as part of the application for the registration and offer of securities in compliance with the Rules on the Offer of Securities and Continuing Obligations of the Capital Market Authority (the “CMA”) and the application

for listing securities in compliance with Tadawul Group’s Listing Rules. The Board Members, whose names appear on Page D, jointly and severally, accept full responsibility for the accuracy of the information contained in this Prospectus and confirm, having made

all reasonable inquiries that to the best of their knowledge and belief there are no other facts the omission of which would make any statement herein misleading. The CMA and the Exchange do not take any responsibility for the contents of this Prospectus, do not

make any representations as to its accuracy or completeness, and expressly disclaim any liability whatsoever for any loss arising from, or incurred in reliance upon, any part of this Prospectus.

This Prospectus is dated 18/11/1442H (corresponding to 28/06/2021G)

This Red Herring prospectus will be made available to Participating Parties participating in the Book-building process, and does not include the Offer Price. The final version of this Prospectus which will include the Offer Price shall be published after the completion of the Book-building process and the determination of the Offer Price.

This Prospectus is an unofficial English translation of the official Arabic Prospectus and is provided for information purpose only. The Arabic Prospectus published on the CMA's website (www.cma.org.sa) remains the only official, legally binding version and shall prevail in the event of any conflict between the two languages.

Financial Advisor, Lead Manager,

Bookrunner and Lead Underwriter

Co-Underwriter

al-arabia.com

A

Important Notice

This Prospectus contains detailed information relating to the Company and the Offer Shares. When submitting a

Subscription Application Form for the Offer Shares, Participating Parties and Individual Investors will be considered to be

applying based on the information contained in this Prospectus, copies of which can be obtained from the Company, the

Lead Manager, the Receiving Agents, or by visiting the CMA website (www.cma.org.sa), the Saudi Tadawul Group website

(www.saudiexchange.com), the Company website (www.al-arabia.com), or the Financial Advisor and Lead Manager

website (www.gibcapital.com).

The Company has appointed GIB Capital as Financial Advisor in connection with the Offering (hereinafter the “Financial

Advisor”), and as Lead Underwriter (hereinafter “Lead Underwriter”). The Company also appointed GIB Capital to act as

the Bookrunner and Lead Manager (hereinafter “Bookrunner” or “Lead Manager”). Albilad Investment Company has been

appointed as the co-underwriter (hereinafter “Co-Underwriter”).

This Prospectus includes information that has been presented in accordance with the Rules on the Offer of Securities and

Continuing Obligations issued by the CMA and Listing Rules of Saudi Tadawul Group. The Board Members, whose names

appear on Page D, jointly and severally accept full responsibility for the accuracy of the information contained in this

Prospectus and confirm, having made all reasonable enquiries, that to the best of their knowledge and belief there are no

other facts the omission of which would make any statement herein misleading.

Whilst the Company has made all reasonable enquiries as to the accuracy of the information contained in this Prospectus

as at the date hereof, substantial portions of the information herein regarding the market and industry are derived from

external sources. While neither the Company nor any of the Company’s advisors, whose names appear on Pages F and G of

this Prospectus (collectively referred to with the Financial Advisor as the “Advisors”) has any reason to believe that any of the

market and industry data is materially inaccurate, neither the Company nor any of the Advisors has independently verified

such information. Accordingly, no representation or assurance is made with respect to the accuracy or completeness of any

of this information.

The information contained in this Prospectus as at the date hereof is subject to change. In particular, the Company’s

financial position and the value of the Offer Shares may be adversely affected by future developments such as inflation,

interest rates, taxation or other economic and political factors and factors over which the Company has no control (for

further details, see Section 2 (“Risk Factors”)). Neither the delivery of this Prospectus nor any oral, written or printed

information in relation to the Offer Shares is intended to be nor should be construed as or relied upon in any way as a

promise, confirmation or representation as to future earnings, results or events.

The Prospectus is not to be regarded as a recommendation on the part of the Company, the Board Members, the Current

Shareholders, the Receiving Agents, or the Advisors to subscribe to the Offer Shares. Moreover, information provided in this

Prospectus is of a general nature and has been prepared without taking into account the individual investment objectives,

financial situation or particular investment needs of those intending to invest in the Offer Shares. Prior to making an

investment decision, each recipient of this Prospectus is responsible for obtaining professional advice from a CMA licensed

financial advisor in relation to the Offering to consider the appropriateness of both the investment and the information

herein with regard to the recipient’s individual objectives, financial situation and needs, including the merits and risks

involved in investing in the Offer Shares. An investment in the Offer Shares may be appropriate for some investors but not

others, and prospective investors should not rely on another party’s decision on whether or not to invest as a basis for their

own examination of the investment opportunity and their individual circumstances.

Subscribing for the Offer Shares shall be limited to two categories of investors as follows:

Tranche A - Participating Parties: consisting of the parties entitled to participate in the book-building process in accordance

with the Book-Building Instructions (for further details, see Section 1 (“Definitions and Abbreviations”)); and Tranche

B - Individual Investors, consisting of Saudi natural persons, including any divorced or widowed Saudi woman with minor

children from a marriage to a non-Saudi, who is entitled to subscribe to the Offer Shares in their names on her own behalf,

on the condition that she provides proof that she is divorced or widowed and the mother of her minor children. It also

includes GCC investors who are natural persons and resident foreign investors holding valid residency permits and having

bank accounts. Subscription of a person in the name of his divorcee shall be deemed invalid, and if a transaction of this

nature is demonstrated to have occurred, then the law shall be enforced against the applicant. If a duplicate subscription is

made, the second subscription will be considered void and only the first subscription will be accepted.

B

Distribution of this Prospectus and the sale of the Offer Shares in any country other than Saudi Arabia are expressly

prohibited except for Qualified Foreign Financial Institutions and/or Foreign Investors by entering into swap agreements

with a Capital Market Institution in accordance with the terms and conditions for swap agreements, and subject to the

relevant applicable laws and instructions. Recipients of this Prospectus are required to inform themselves of any regulatory

restrictions relevant to the Offering or the sale of Offer Shares and to observe all such restrictions. Both qualified Individual

Investors and qualified investing institutions shall read this Prospectus in full and seek advice from their attorneys, financial

advisors and any professional advisors regarding statutory, tax, regulatory and economic considerations related to their

investment in the shares, and will personally assume the fees associated with such advice obtained from their attorneys,

accountants and other advisors regarding all matters related to investment in the Company’s shares. No guarantees with

regard to profits can be provided.

Market and Industry Data

The information contained in Section 3 (“Market and Industry Data”) is taken from the market study report prepared

for the Company on 12 April 2020G by the market consultant, Frost & Sullivan (“Market Consultant”), on the outdoor

advertising sector in the Kingdom of Saudi Arabia (“Market Study”).

The Board Members believe that the information and data from the Market Study provided in this Prospectus and obtained

from other sources, including those provided by the Market Consultant, are reliable. However, this information was not

independently verified by the Company, its Board Members, Advisors, or Selling Shareholders, and they assume no liability

for the accuracy or completeness of this information.

The Market Consultant was established in 1961G and has over 1,200 employees in over 40 offices worldwide working

exclusively for it as at March 2020G. The Market Consultant is headquartered in the United States of America. For more

information, please visit the Market Consultant’s website (ww2.frost.com).

The Market Consultant does not, nor do any of its subsidiaries, associates, partners, shareholders, board members,

managers or relatives thereof, own any shares or interest of any kind in the Company or its subsidiaries. As at the date of

this Prospectus, the Market Consultant has given and not withdrawn its written consent for the use of its name and logo

and the market information and data supplied thereby to the Company in the manner and form set out in this Prospectus.

Financial and Statistical Information

The financial statements mentioned below are presented in the annexes of this Prospectus:

The Company’s audited financial statements for the fiscal year ended 31 December 2018G and the Company’s audited

financial statements for the fiscal year ended 31 December 2019G and 31 December 2020G, along with notes thereto,

prepared in accordance with the International Financial Reporting Standards (IFRS) as approved in the Kingdom (IFRS-

Kingdom of Saudi Arabia) and other standards and pronouncements issued by the Saudi Organisation for Certified

Chartered Accountants (SOCPA), and audited by Baker Tilly, as detailed in its report attached to this Prospectus.

The statements for fiscal year 2019G are the Company’s first consolidated financial statements. Since 2018G, the financial

statements have been prepared in accordance with IFRS-Kingdom of Saudi Arabia.

The above financial statements are found in Section 20 (“Financial Statements and Auditor’s Report”). The Company

publishes its financial statements in Saudi riyals.

To assess the operational and financial performance of its business, the Company uses certain measures that are unaudited

supplemental measures and are not required by, or presented in accordance with, Saudi GAAP or IFRS-Kingdom of Saudi

Arabia. These non-Saudi GAAP financial measures include gross profit margin, operating margin, and net profit margin.

Management uses such measures to assess operating performance and as a basis for strategic planning and forecasting.

Management believes that these and similar measures are used widely by certain investors, securities analysts and other

stakeholders as supplemental performance metrics. These non-Saudi GAAP measures may not be comparable to other

similarly titled measures used by other companies and have limitations as analytical tools and should not be considered

in isolation of or as a substitute for the analysis of the Company’s operating results as reported under Saudi GAAP or IFRS-

Kingdom of Saudi Arabia. For further details on how the Company measures its gross profit margin, operating margin, and

net profit margin, see the margins listed in the “Summary of Financial Information” table below. The financial and statistical

data contained in this Prospectus has been rounded to the nearest integer. Therefore, there may be minor differences

C

between the figures shown for the same item in the different tables and figures shown as totals in some tables may

not equal the mathematical sum of the figures that preceded them. Where amounts cited in this Prospectus have been

converted from a foreign currency into Saudi riyals, the exchange rate of the Saudi riyal against the relevant currency as at

the date of this Prospectus was used.

In this Prospectus, Hijri dates are mentioned along with their Gregorian counterparts where appropriate. The Hijri

calendar is calculated based on the anticipated lunar cycles. However, the start of each month is determined by the actual

observation of the moon. Therefore, conversions from the Hijri calendar to the Gregorian calendar are often subject to one-

day discrepancies. In addition, any reference to a “year” or “years” shall refer to Gregorian years unless otherwise expressly

stated in this Prospectus.

Forecasts and Forward-Looking Statements

The forecasts set forth in this Prospectus have been prepared on the basis of projections made from the Company’s

information based on its market experience, as well as on publicly available market information. Future operating

conditions may differ from the projections used, and consequently no representation or guarantee is made with respect to

the accuracy or completeness of any of these forecasts. The Company confirms that, to the best of its reasonable knowledge,

all professional due diligence has been taken in preparing the statements contained in this Prospectus.

Certain statements in this Prospectus constitute “forward-looking statements”. Such statements can generally be identified

by their use of forward-looking terminology such as “plans”, “estimates”, “believes”, “expects”, “anticipates”, “may”, “would

be”, “should”, “expected”, or the negation of these terms or other comparable terminology or terms with corresponding

meanings.

These forward-looking statements reflect the Company’s current views with respect to future events and are not a guarantee

of future performance, as there are many factors that could affect the Company’s real performance, actual achievements

or results and cause them to be significantly different from what was expected, whether expressed or implied. Some of

the risks and factors that could have such effect are described in more detail in other sections of this Prospectus (for more

information, see Section 2 (“Risk Factors”)). Should one or more of these risks or uncertainties materialise or any underlying

assumptions prove to be inaccurate or incorrect, the Company’s actual results may materially vary from those mentioned,

described, expected, estimated or planned in this Prospectus.

Pursuant to the requirements of the Rules on the Offer of Securities and Continuing Obligations (OSCOs), the Company

must submit a supplementary prospectus to the CMA if, at any time after the date of the Prospectus and prior to completion

of the Offering, the Company becomes aware that:

a) There has been a significant change in material matters contained in the Prospectus or any document required by

OSCOs.

b) Any additional significant matters have become known which should have been included in the Prospectus.

Except in the aforementioned circumstances, the Company does not intend to update or otherwise revise any industry

or market information or forward-looking statements in this Prospectus, whether as a result of new information, future

events or otherwise. As a result of the aforementioned and other risks, uncertainties and assumptions, the forward-looking

events and circumstances discussed in this Prospectus might not occur in the way the Company expects, or at all. Therefore,

prospective investors should consider all forward-looking statements in light of these explanations and should not unduly

rely on forward-looking statements.

D

Corporate Directory

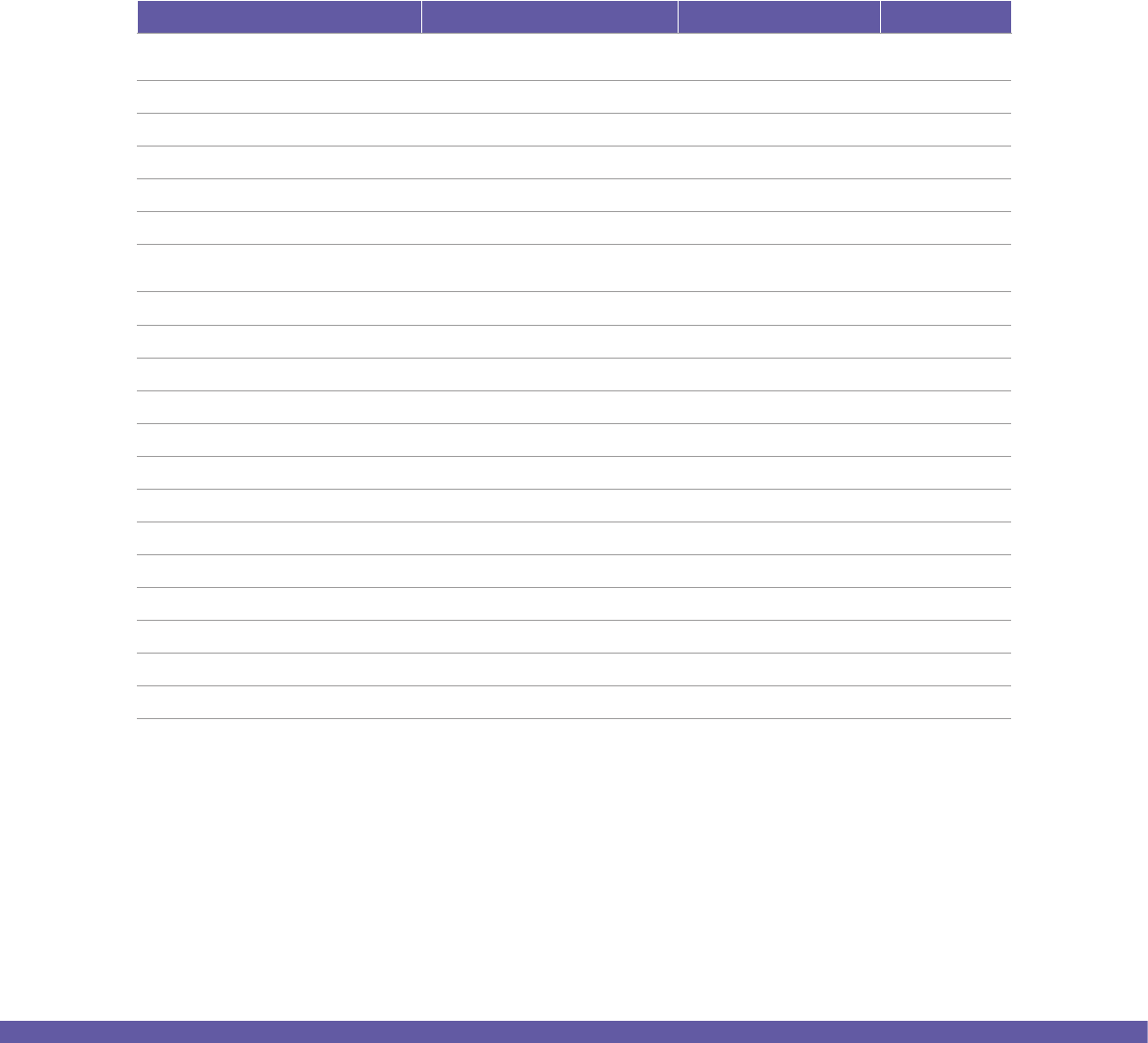

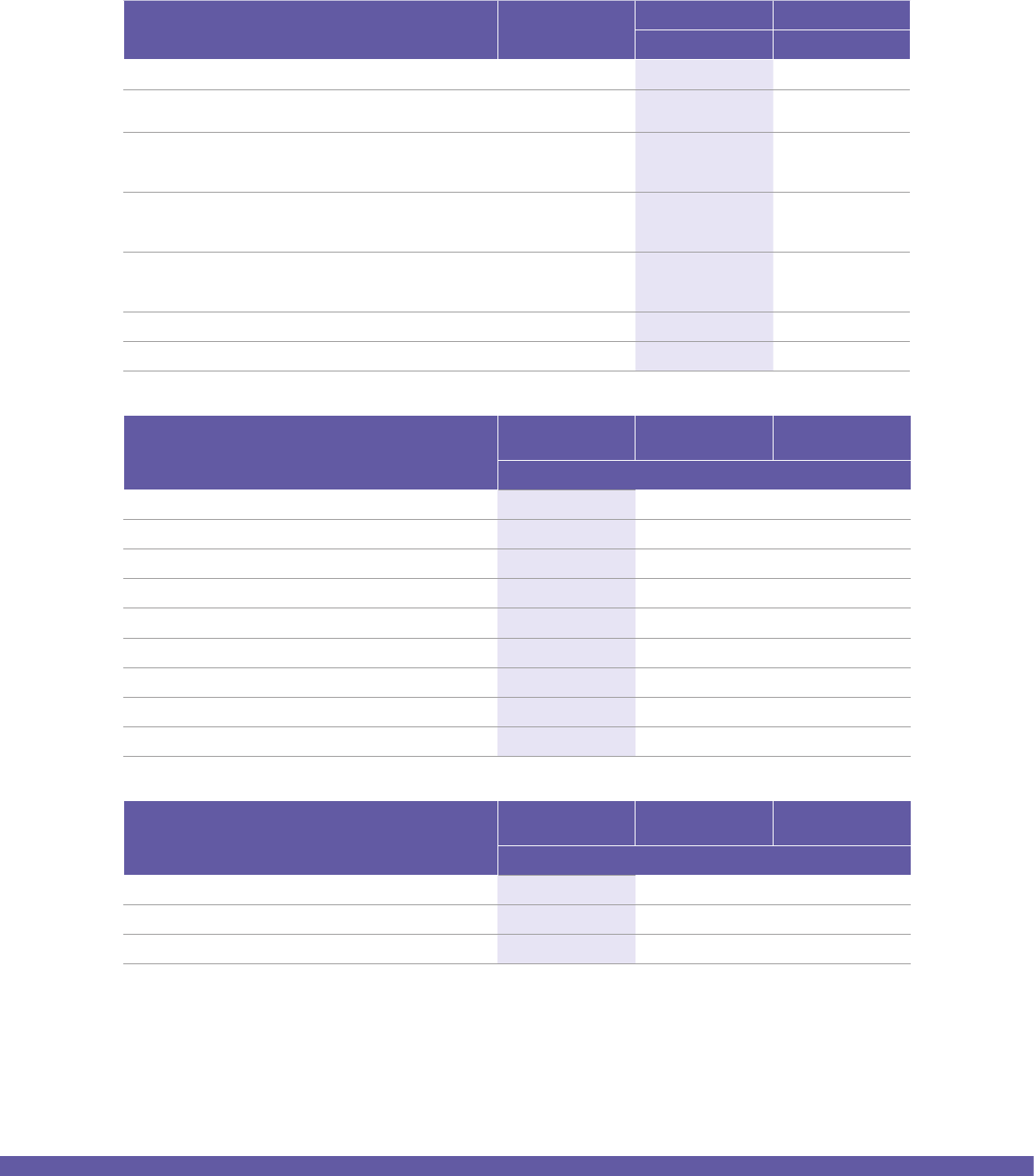

Company’s Board of Directors

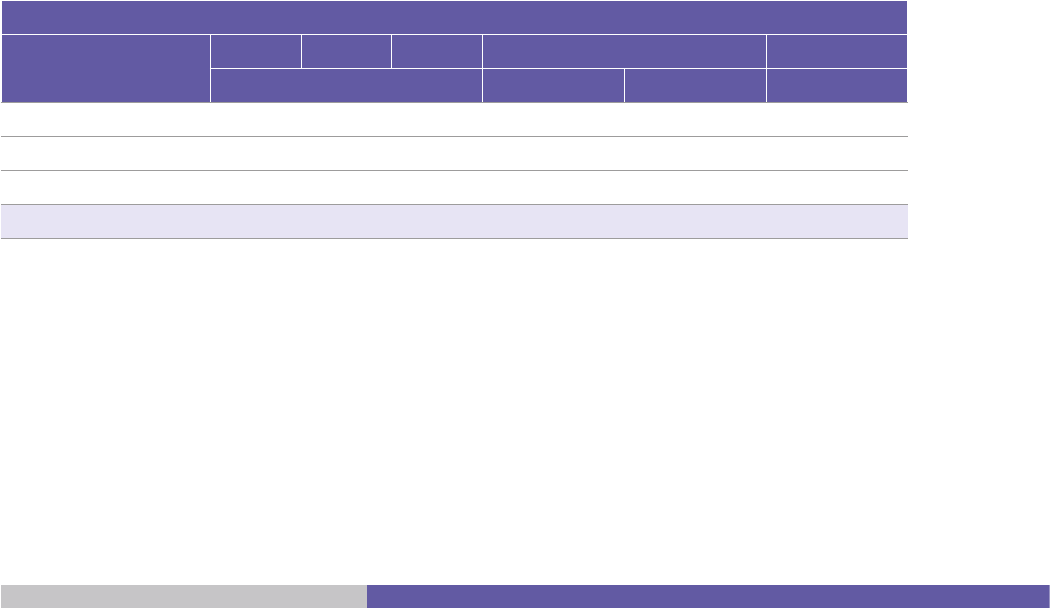

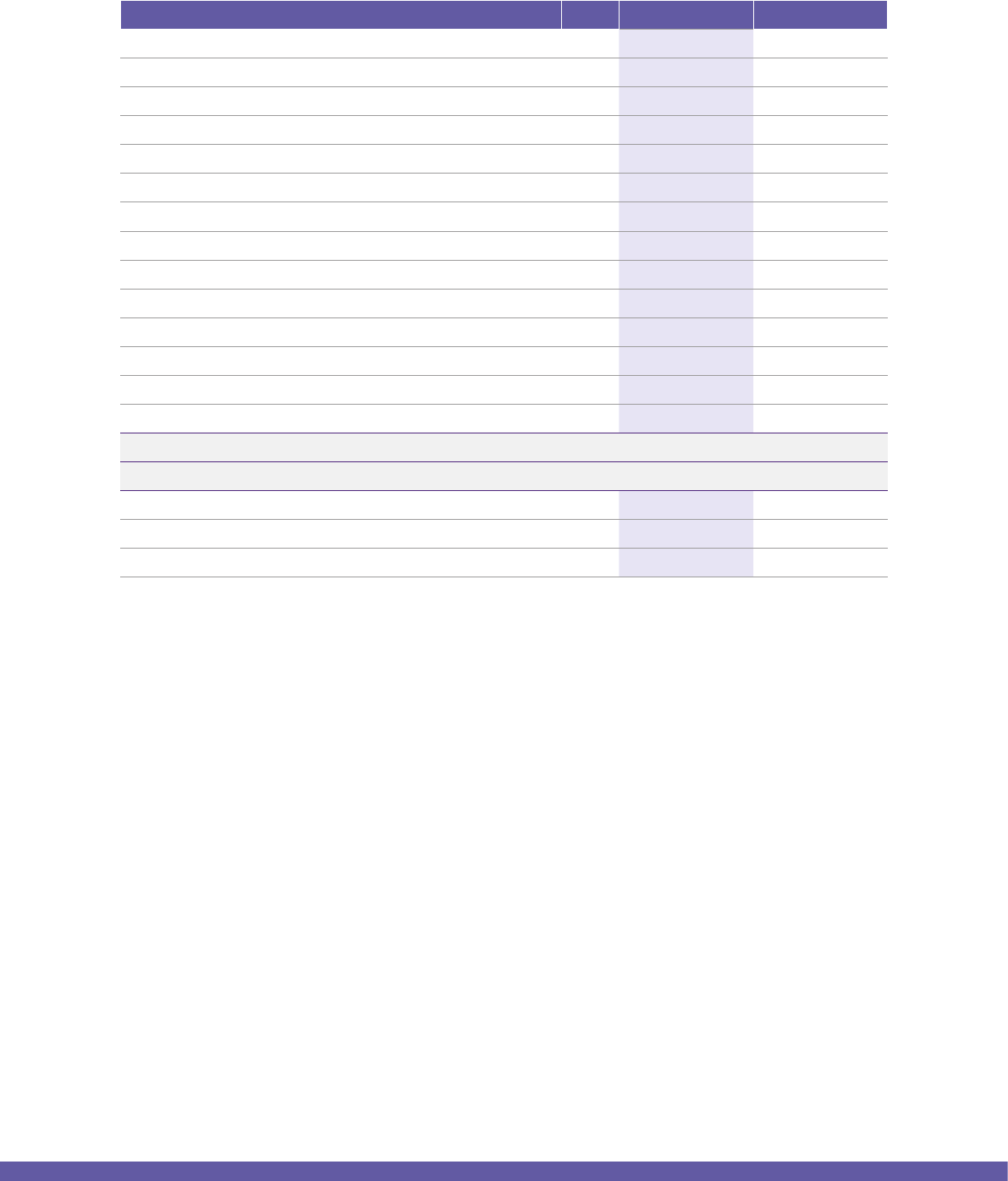

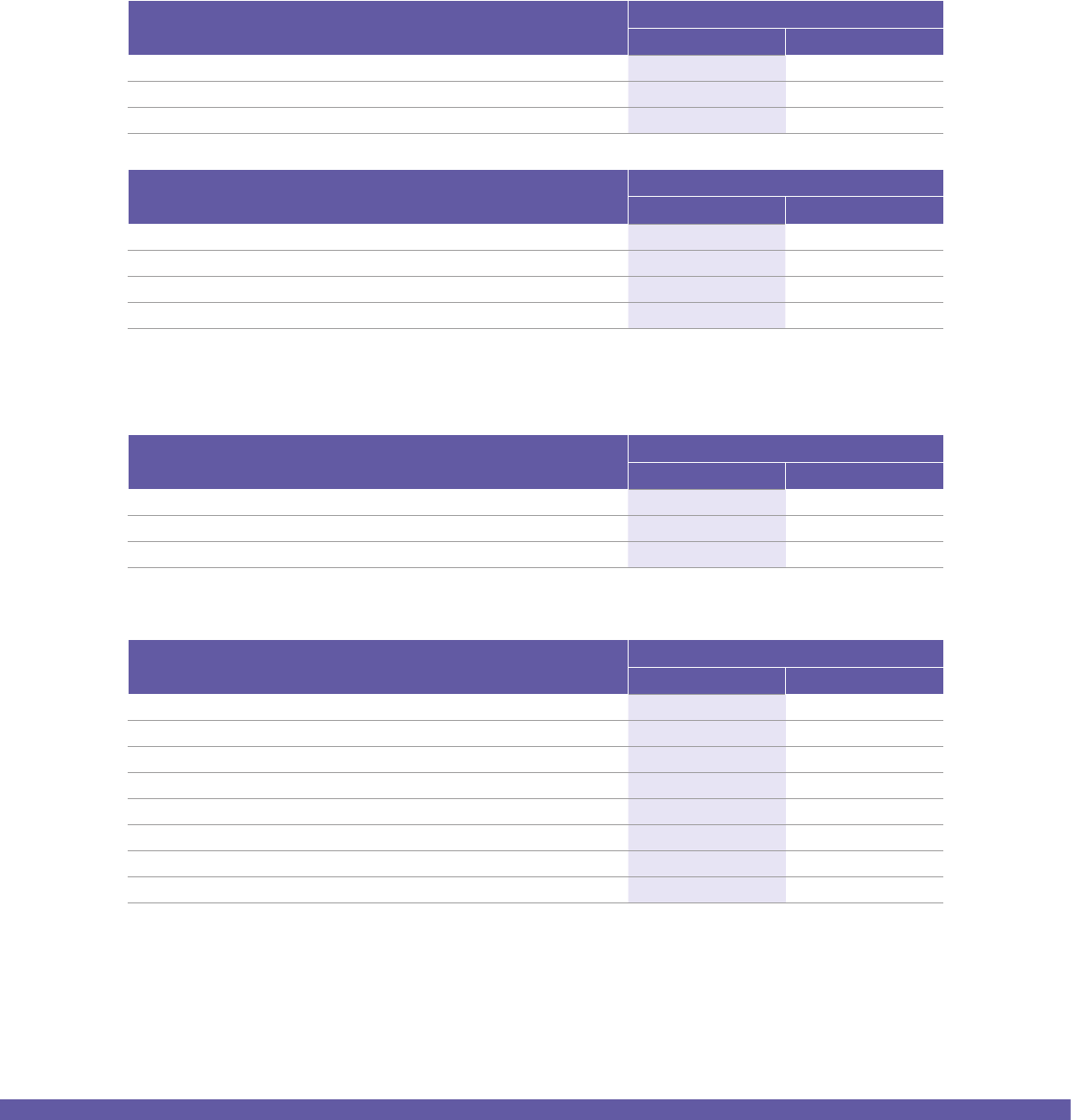

Table (1-1): Company’s Board Members

No. Name Position

Nation-

ality

Status

Inde-

pen-

dence

Date of

Ap-

point-

ment

Direct Ownership

(%)

Indirect Owner-

ship (%)

Pre-Of-

fering

Post-Of-

fering

Pre-Of-

fering

Post-Of-

fering

1-

Abdelellah

Abdulrahman

Alkhereiji

Chairman

of the

Board

Saudi

Non-ex-

ecutive

Non-in-

depen-

dent

2015G 25% - 35%

1

32.5%

2

2-

Abdel Mohsen

Abdulrahman

Alkhereiji

Vice

Chairman

Saudi

Non- ex-

ecutive

Non-in-

depen-

dent

2020G - - -

3-

Muhammad

Abdelellah

Alkhereiji

Managing

Director

Saudi

Execu-

tive

Non-in-

depen-

dent

2015G - 7.7%

3

7.1%

4

4-

Samuel James

Killion Barnett

Member British

Non- ex-

ecutive/

Repre-

senta-

tive of

MBC

Group

Holding

Ltd.

Non-in-

depen-

dent

2020G - - - -

5-

Munaji Fouad

Zamakhshari

Member Saudi

Non- ex-

ecutive

Indepen-

dent

2020G - - -

6-

Muhammad

Abdullah Al-

Nimr

Member Saudi

Non- ex-

ecutive

Indepen-

dent

2020G - - -

Source: The Company

The current Secretary of the Company’s Board of Directors is Mustafa Fawzi Al-Saeedi, who does not own any shares in the

Company.

1 Pre-Offering, Abdelellah Abdulrahman Alkhereiji indirectly owns 35% as a result of a 50% ownership percentage in Engineer Holding Group Company,

which directly holds 70% of the Company’s shares.

2 Post-Offering, Abdelellah Abdulrahman Alkhereiji will indirectly own 32.5% as a result of a 50% ownership percentage in Engineer Holding Group

Company, which will directly hold 65% of the Company’s shares after the Offering.

3 Pre-Offering, Mohammed Abdelellah Alkhereiji indirectly owns 7.7% as a result of a 11% ownership percentage in Engineer Holding Group Company,

which directly holds 70% of the Company’s shares.

4 Post-Offering, Mohammed Abdelellah Alkhereiji will indirectly own 7.1% as a result of a 11% ownership percentage in Engineer Holding Group Company,

which will directly hold 65% of the Company’s shares after the Offering.

E

Company’s Address, Representatives and Board Secretary

Arabian Contracting Services Company

P.O. Box 55905

Riyadh 11544,

Olaya Towers - Floor 33

Kingdom of Saudi Arabia

Unified Tel: +966 92 003 3343

Tel: +966 11 271 6900

Fax: +966 11 229 2550

Website: www.al-arabia.com

Email: [email protected]

Company’s Representatives

Abdelellah Abdulrahman Al-Khereiji

Arabian Contracting Services Company

P.O. Box 55905 Riyadh 11544

Olaya Towers – Floor 33

Kingdom of Saudi Arabia

Unified Tel: +966 92 003 3343

Direct Tel: +966 11 271 6901

Fax: +966 11 229 2550

Website: www.al-arabia.com

Email : [email protected]

Muhammad Abdelellah Al-Khereiji

Arabian Contracting Services Company

P.O. Box 55905 Riyadh 11544

Olaya Towers – Floor 33

Kingdom of Saudi Arabia

Unified Tel: +966 92 003 3343

Direct Tel: +966 11 271 6990

Fax: +966 11 229 2550

Website: www.al-arabia.com

Email : [email protected]

Secretary of the Board

Mustafa Fawzi Al-Saeedi

Arabian Contracting Services Company

P.O. Box 55905 Riyadh 11544

Olaya Towers – Floor 33

Kingdom of Saudi Arabia

Unified Tel: +966 92 003 3343

Direct Tel: +966 11 271 6904

Fax: +966 11 229 2550

Website: www.al-arabia.com

Email : [email protected]

F

The Exchange

Saudi Tadawul Group (Tadawul)

King Fahd Road – Al Olaya 6897

Unit No. 15

Riyadh 12211- 3388

Kingdom of Saudi Arabia

Tel: +966 92 000 1919

Fax: +966 11 218 9133

Website: www.saudiexchange.sa

Email: [email protected]

Financial Advisor, Lead Manager, Bookrunner and Lead Underwriter

GIB Capital

Low Rise Building 1 Granada Business & Residential Park

Eastern Ring Road

P.O. Box 89589

Riyadh 11692,

Kingdom of Saudi Arabia

Tel: +966 11 511 2200

Fax: +966 11 511 2201

Website: www.gibcapital.com

Email: customercare@gibcapital.com

Co-Underwriter

Albilad Investment Company

King Fahad Road

P.O. Box 140

Riyadh 11411,

Kingdom of Saudi Arabia

Tel: +966 92 000 3636

Fax: +966 11 290 6299

Website: www.albilad-capital.com

Email: clientservices@albilad-capital.com

G

The Issuer’s Legal Advisor

Legal Advisors, Abdulaziz Alajlan & Partners

Olayan Complex, Tower II, 3rd Floor

Al Ahsa Street, Malaz

P.O. Box 69103

Riyadh 11547,

Kingdom of Saudi Arabia

Tel: +966 11 265 8900

Fax: +966 11 265 8999

Website: www.legal-advisors.com

Email : [email protected]

Financial Due Diligence Advisor

Ernst & Young & Co (Chartered Accountants)

6th & 14th Floors – Al Faisaliah Tower, King Fahd Street

P.O. Box 2732 Riyadh 11461

Kingdom of Saudi Arabia

Tel: + 966 (11) 273 4740

Fax: + 966 (11) 273 4730

Website: www.ey.com

Email: [email protected].com

Market Consultant

Frost & Sullivan

Al-Akaria Plaza, 6th Floor

Gate D, Olaya Road

P.O. Box 86334

Riyadh 11622

Kingdom of Saudi Arabia

Tel: +966 11 486 8463

Fax: +966 11 486 8463

Website: ww2.frost.com

Email: [email protected]om

Independent Auditors

Baker Tilly MKM & CO (Certified Accountants)

Suite 1, Level 3

Uthman Ibn Affan Rd, At Taawun

P.O. Box 300467

Riyadh 11373

Kingdom of Saudi Arabia

Tel: +966 11 835 1600

Fax: +966 11 835 1601

Website: www.bakertillymkm.com

Email: [email protected]

Note:

Up to the date of this Prospectus, all the above-mentioned Advisors and Independent Auditors have given and have not

withdrawn their written consent for the publication of the names and logos attributed to each of them in the form and

content appearing herein. Moreover, they do not themselves, or any of their employees or relatives, have any shareholding

or interest of any kind in the Company as at the date of this Prospectus.

H

Receiving Agents

Saudi National Bank

King Abdul Aziz Road

P.O Box 3555

Jeddah 21481

Kingdom of Saudi Arabia

Tel: +966 12 649 3333

Fax: +966 12 643 7426

Website: www.alahli.com

E-Mail: [email protected]

Bank Albilad

King Abdullah Road, Al-Worood District

P.O. Box 140

Riyadh 11411

Kingdom of Saudi Arabia

Tel: +966 11 203 9815

Fax: +966 11 401 3030

Website: www.bankalbilad.com

Email: [email protected]

Saudi British Bank (SABB)

Prince Abdulaziz Ibn Musaid Ibn Jalawi St, Al Murabba

P.O. Box 9084

Riyadh 11413

Kingdom of Saudi Arabia

Tel: +966 11 440 8440

Fax: +966 11 276 3414

Website: www.sabb.com

Email: [email protected]

Riyad Bank

Eastern Ring Road

P.O. Box 22622

Riyadh 11614

Kingdom of Saudi Arabia

Tel: +966 11 401 3030

Fax: +966 11 403 0016

Website: www.riyadbank.com

Email: [email protected]

I

The Company’s Main Banks

Riyad Bank

Eastern Ring Road

P.O. Box 22622

Riyadh 11614

Kingdom of Saudi Arabia

Tel: +966 11 401 3030

Fax: +966 11 403 0016

Website: www.riyadbank.com

Email: [email protected]

Arab National Bank

King Faisal Street

P.O Box 9802

Riyadh 11423

Kingdom of Saudi Arabia

Tel: +966 11 402 9000

Fax: +966 11 404 7535

Website: www.anb.com.sa

Email: info@anb.com.sa

Saudi British Bank (SABB)

Prince Abdulaziz Ibn Musaid Ibn Jalawi St

P.O. Box 9084

Riyadh 11413

Kingdom of Saudi Arabia

Tel: +966 11 276 4779

Fax: +966 11 276 4356

Website: www.sabb.com

Email: [email protected]

The Saudi Investment Bank (SAIB)

Al Maathar District

P.O. Box 3144

Riyadh 12622

Kingdom of Saudi Arabia

Tel: +966 11 418 3100

Fax: +966 11 477 6781

Website: www.saib.com.sa

Email: [email protected]

Bank Albilad

King Abdullah Road, Al-Worood District

P.O. Box 140

Riyadh 11411

Kingdom of Saudi Arabia

Tel: +966 11 203 9815

Fax: +966 11 401 3030

Website: www.bankalbilad.com

Email: [email protected]

J

Summary of the IPO

This summary of the IPO aims to give a brief overview of the information contained in this Prospectus. As such, it does not contain all of the

information that may be important to prospective investors. Accordingly, this summary must be read as an introduction to this Prospectus,

and prospective investors should read this entire Prospectus in full. Any decision to invest in the Offer Shares by prospective investors

should be based on a consideration of this Prospectus as a whole. In particular, it is important to carefully consider Page A (Important

Notice) and Section 2 (Risk Factors) prior to making any decision to invest in the Offer Shares.

Company Name, Description and

Establishment Information

The Arabian Contracting Services Company was incorporated as a Saudi limited liability

company in Riyadh under Commercial Register No. 1010048419 dated 18/05/1403H (corre-

sponding to 3 March 1983G), with a share capital of one million Saudi riyals (SAR 1,000,000)

for the objective of engaging in outdoor advertising, particularly installing, and operating

outdoor advertising billboards. The Company was converted into a (closed) joint stock com-

pany under HE Minister of Commerce Resolution No. 1132 issued on 02/05/1427H (corre-

sponding to 30 May 2006G). At the same time, the Company’s capital was increased from

one million Saudi riyals (SAR 1,000,000) to sixty million Saudi riyals (SAR 60,000,000) by trans-

ferring twenty-three million, nine hundred nine thousand, one hundred three Saudi riyals

(SAR 23,909,103) from the shareholder’s accounts receivable and capitalising a sum of thir-

ty-five million, ninety thousand, eight hundred ninety-seven Saudi riyals (SAR 35,090,897)

out of the retained earnings. On 02/12/1429H (corresponding to 30 November 2008G),

the Company increased its capital from sixty million Saudi riyals (SAR 60,000,000) to one

hundred fifty million Saudi riyals (SAR 150,000,000) divided into fifteen million (15,000,000)

ordinary shares with a fully paid-up nominal value of ten Saudi riyals (SAR 10) per share

through a cash contribution from the current shareholders of thirteen million, four hundred

thousand Saudi riyals (SAR 13,400,000), the capitalisation of sixty-nine million, eight hun-

dred eighty-five thousand, five hundred eighty-two Saudi riyals (SAR 69,885,582) out of the

retained earnings, and the transfer of six million, seven hundred fourteen thousand, four

hundred eighteen Saudi riyals (SAR 6,714,418) from the balance of the statutory reserve. On

22/06/1433H (13 May 2012G), the Company increased its capital from one hundred fifty mil-

lion Saudi riyals (SAR 150,000,000) to two hundred ten million Saudi riyals (SAR 210,000,000)

divided into twenty-one million (21,000,000) ordinary shares with a fully paid nominal value

of ten Saudi riyals (SAR 10) per share through capitalisation of forty-four million, four hun-

dred sixty-four thousand, nine hundred sixty-six Saudi riyals (SAR 44,464,966) from the re-

tained earnings and fifteen million, five hundred thirty-five thousand, thirty-four Saudi riyals

(SAR 15,535,034) from the balance of the statutory reserve. On 21/06/1435H (corresponding

to 21 April 2014G), the Company increased its capital from two hundred ten million Saudi

riyals (SAR 210,000,000) to five hundred fifty million Saudi riyals (SAR 550,000,000) divided

into fifty-five million (55,000,000) ordinary shares with a fully paid nominal value of ten Saudi

riyals (SAR 10) per share, through capitalisation of three hundred one million, forty-six thou-

sand, six hundred forty-five Saudi riyals (SAR 301,046,645) from the retained earnings and

thirty-eight million, nine hundred fifty-three thousand, three hundred fifty-five Saudi riyals

(SAR 38,953,355) from balance of the statutory reserve.

On 27/03/1440H (corresponding to 5 December 2018G), it was decreased (for further details,

see Section 4 (“The Company”) because it was in excess of the Company’s needs from five

hundred fifty million Saudi riyals (SAR 550,000,000) to two hundred fifty million Saudi riyals

(SAR 250,000,000) divided into twenty-five million (25,000,000) ordinary shares with a fully

paid-up nominal value of ten Saudi riyals (SAR 10) per share.

On 01/04/1441H (corresponding to 28 November 2019G), the Company increased its cap-

ital to meet its future expansion needs from two hundred fifty million Saudi riyals (SAR

250,000,000) to five hundred million Saudi riyals (SAR 500,000,000) divided into fifty mil-

lion (50,000,000) ordinary shares with a fully paid nominal value of ten Saudi riyals (SAR 10)

per share, through the capitalisation of one hundred seventy-five million Saudi riyals (SAR

175,000,000) from the retained earnings and seventy-five million Saudi riyals (75,000,000).

K

Company’s Activities

The Company’s business includes setting up and operating outdoor advertising billboards,

including roadside advertising and indoor advertising. In roadside advertising, the Company

participates in the tenders organised by various secretariat, municipalities, and government

agencies in all provinces and cities of KSA to lease and invest in the many sites belonging to

these agencies and secretariat by installing billboards in them and selling these billboards’

advertising spaces to their clients. The Company has recently expanded its business by en-

tering the indoor advertising market. In this regard, the Company entered into a number of

exclusive contracts with the owners of commercial centres in different regions within the

Kingdom.

The main objectives of the Company in accordance with its Bylaws include:

y Promotion and advertising, printing advertisement materials, commercial printing, and

binding.

y Manufacture of steel, aluminium and plastic materials used in advertising.

y Implementation of contracting and construction works.

y Purchase of lands and properties to construct buildings for the Company’s benefit.

y Import, export, wholesale and retail of materials, advertising billboards, and printing

supplies and equipment of all kinds.

y Installation and equipment of displays.

y Road works and maintenance, electrical works and maintenance, mechanical works and

maintenance, construction works and maintenance.

y Manufacturing and assembly of advertisements and informational billboards, including

digital TV billboards.

Selling Shareholders

y The Company’s Shareholders, whose names and shareholding percentages are listed in

Table 12.1 (“The Company’s Ownership Structure Pre- and Post-Offering”) and who

will sell a portion of their shares in the Offering, include:

y Abdelellah Abdulrahman Alkhereiji.

y Engineer Holding Group Company.

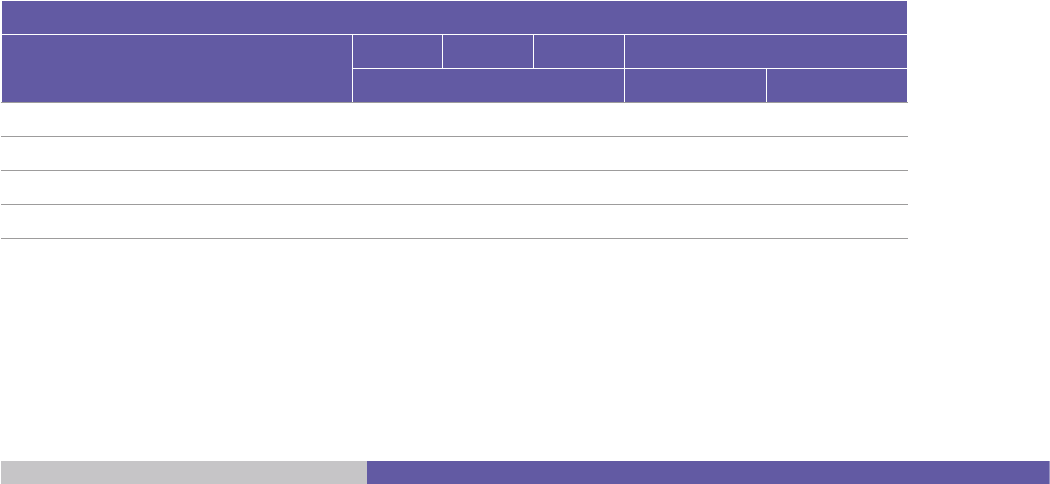

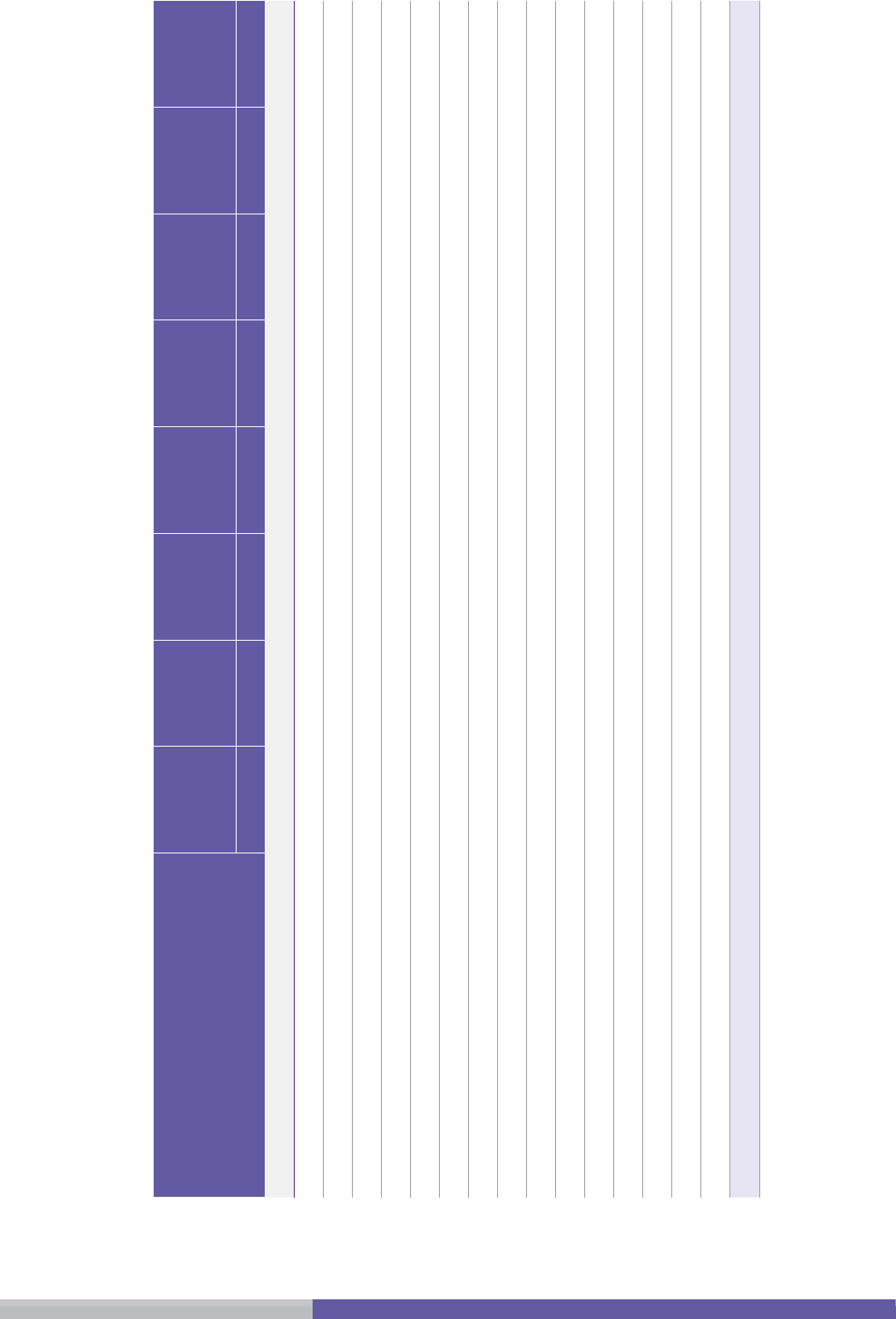

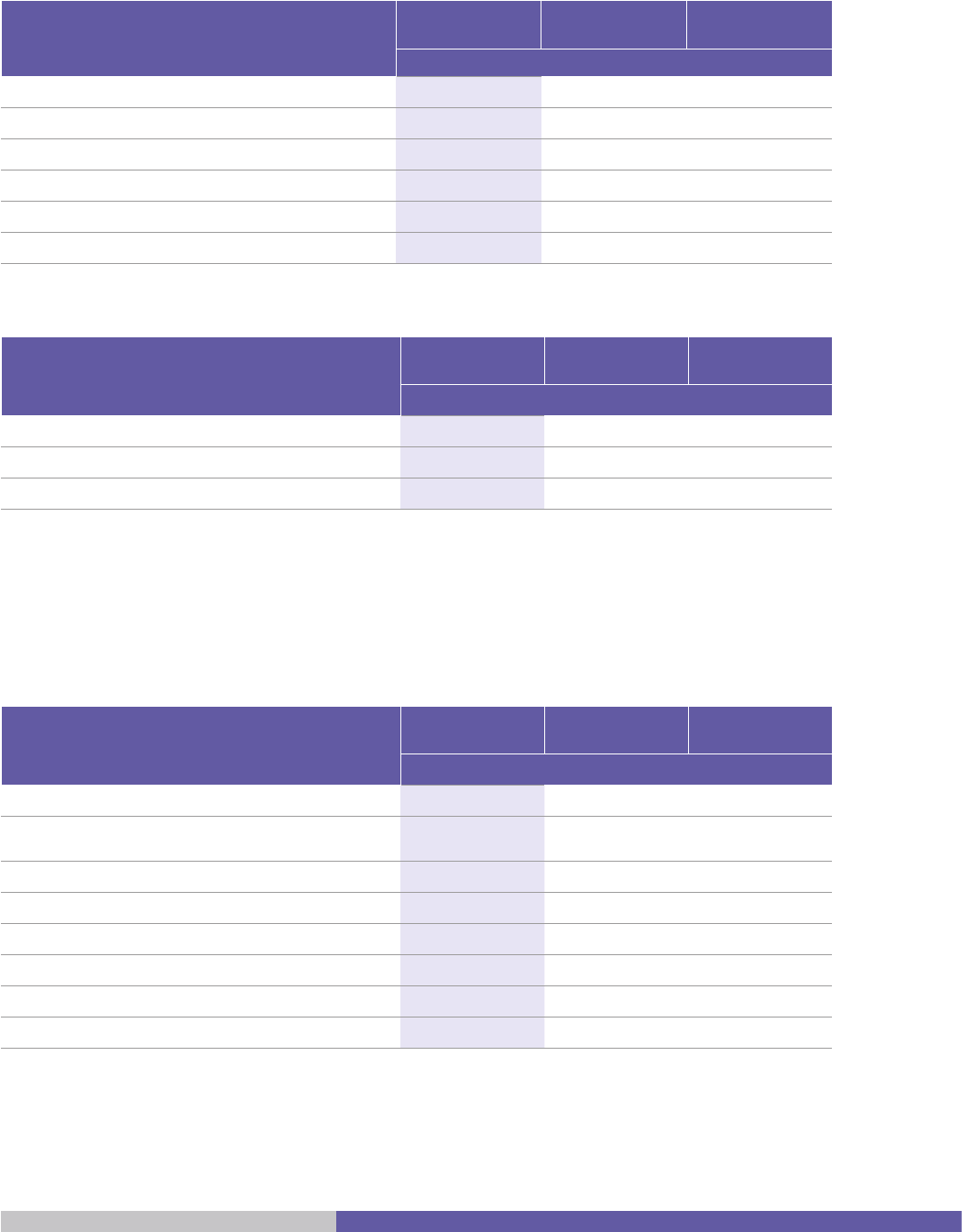

Substantial Shareholders, No. of

Shares and Shareholding Percentag-

es Pre- and Post-Oering

The following table sets out the names and shareholding percentages of the Company’s

Substantial Shareholders pre- and post-Offering.

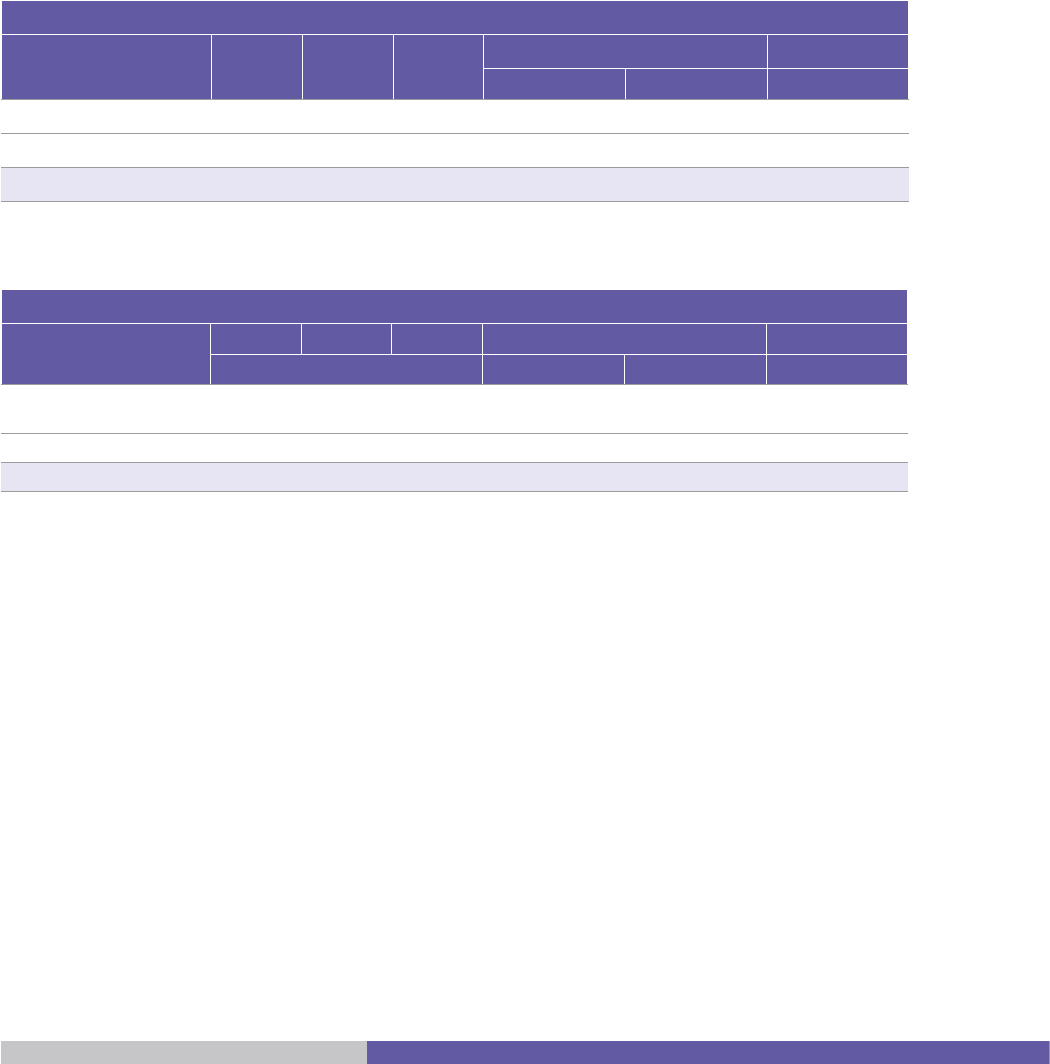

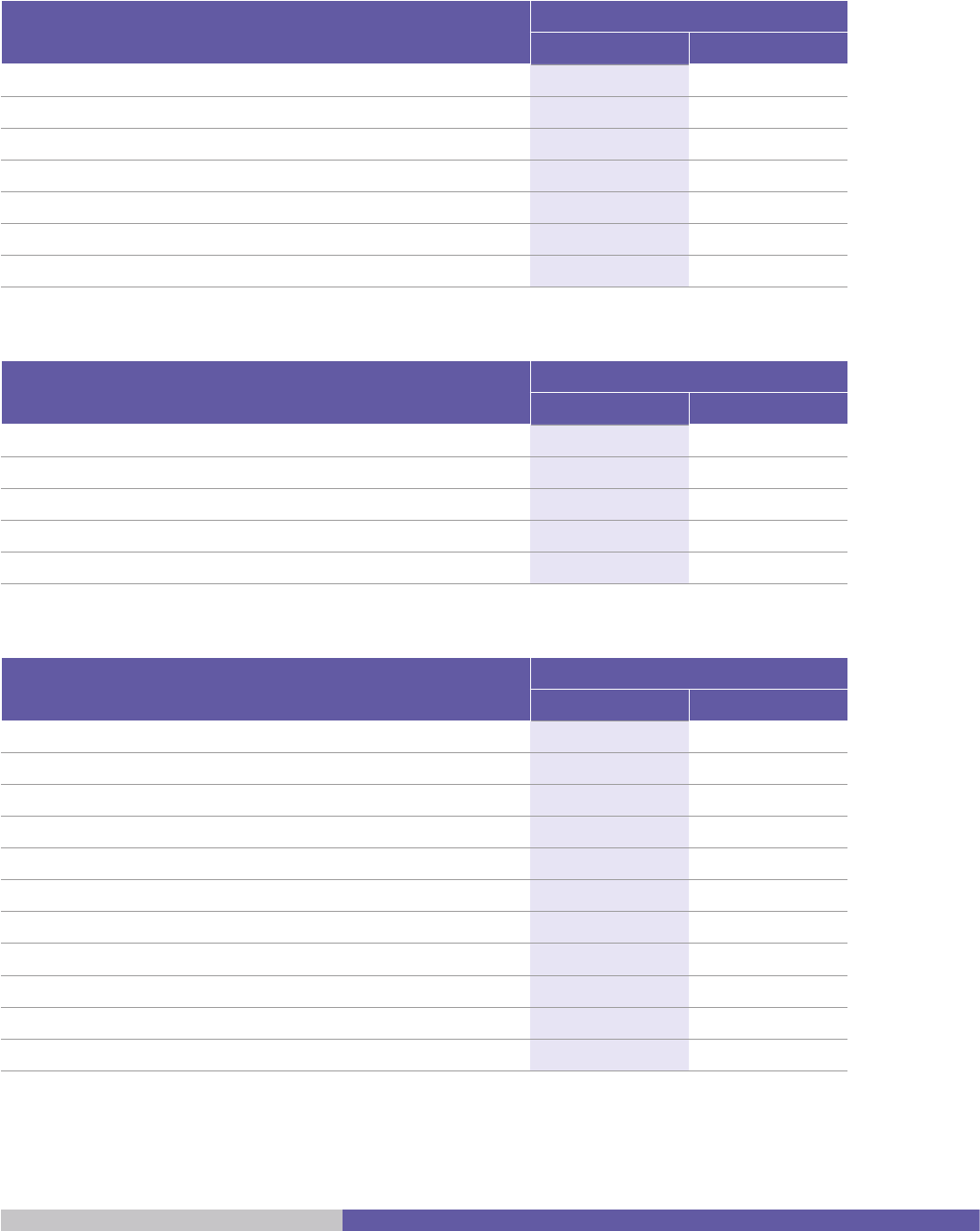

Table (1-2): Substantial Shareholders and Their Shareholding Percentages in the

Company Pre- and Post-Offering

Shareholders

Pre-Offering Post-Offering

No. of Shares

Direct Owner-

ship (%)

Nominal

Value (SAR)

No. of

Shares

Direct

Owner-

ship (%)

Nominal

Value (SAR)

Selling Shareholders

Abdelellah Abdulrahman Alkhereiji 12,500,000 25% 125,000,000 - - -

Engineer Holding Group Company 35,000,000 70% 350,000,000 32,500,000 65% 325,000,000

Other Current Shareholders

MBC Group Holdings Ltd. 2,500,000 5% 25,000,000 2,500,000 5% 25,000,000

The Public - - - 15,000,000 30% 150,000,000

Total 50,000,000 100% 500,000,000 50,000,000 100% 500,000,000

The Company’s Share Capital (As at

the Date of this Prospectus)

Five hundred million Saudi riyals (SAR 500,000,000).

Total No. of Issued Shares (As at the

Date of this Prospectus)

Fifty million (50,000,000) fully paid ordinary shares.

Oering

Fifteen million (15,000,000) ordinary shares with a fully paid nominal value of ten Saudi riyals

(SAR 10) per share, representing 30% of the Company’s share capital, are offered at a price of

SAR [•] Saudi riyals per share.

Total No. of Oer Shares

Fifteen million (15,000,000) fully paid ordinary shares.

Nominal Value Per Share

Ten Saudi riyals (SAR 10) per share.

Oer Shares as a Percentage of

Company Capital

The Offer Shares represent 30% of the Company’s share capital.

L

Oer Price

[•] Saudi riyals per share.

Total Oering Value

[•] Saudi riyals.

Use of Oering Proceeds

The net Offering proceeds of SAR [•] Saudi riyals, after deducting the full Offering expenses

amounting to thirty-five million Saudi riyals (SAR 35,000,000), will be distributed to the Sell-

ing Shareholders in proportion to their Offer Shares. The Company will not receive any share

of the Offering proceeds. For more information, see Section 8 (“Use of Offering Proceeds”).

Number of Underwritten Oer

Shares

Fifteen million (15,000,000) ordinary shares.

Amount to be Underwritten

[•] Saudi Riyals.

Categories of Target Investors

Subscription for Offer Shares is restricted to:

Tranche A - Participating Parties: This category consists of the parties entitled to partic-

ipate in the book-building process in accordance with the Book Building Instructions (for

further details, see Section 1 (“Definitions and Abbreviations”)).

Tranche B - Individual Investors: Saudi natural persons, including any divorced or wid-

owed Saudi woman with minor children from a marriage to a non-Saudi, who is entitled to

subscribe to the Offer Shares in their names on her own behalf, on the condition that she

provides proof that she is divorced or widowed and the mother of her minor children. It

also includes GCC investors who are natural persons and resident foreign investors holding

valid residency permits having bank accounts. Subscription of a person in the name of his

divorcee shall be deemed invalid, and if a transaction of this nature is demonstrated to have

occurred, then the law shall be enforced against the applicant. If a duplicate subscription is

made, the second subscription will be considered void and only the first subscription will be

accepted.

Total Offer Shares Available for Each Category of Target Investors

No. of Shares Oered to Participat-

ing Parties

Fifteen million (15,000,000) ordinary shares, representing 100% of the total Offer Shares.

Note that if there is sufficient demand by Individual Investors, the Bookrunner shall be en-

titled to reduce the number of shares allocated to Participating Parties to thirteen million,

five hundred thousand (13,500,000) ordinary shares, representing 90% of the Offer Shares.

The number and percentage of Offer Shares to be allocated to the Participating Parties will

be determined by the Financial Advisor in consultation with the Company and the Selling

Shareholders using the allocation mechanism mentioned in Section 18.4.1.

No. of Shares Oered to Individual

Investors

A maximum of one million, five hundred thousand (1,500,000) shares, representing 10% of

the total Offer Shares. If Individual Investors have not subscribed for all shares allocated to

them, the Lead Manager may reduce the number of shares allotted thereto in proportion to

the number of shares they subscribed for.

Subscription Method for Each Category of Target Investors

Subscription Method for Participat-

ing Parties

Participating Parties, as defined in Section 1 (“Definitions and Abbreviations”) may apply

for subscription. The Bookrunner will provide the Subscription Application Forms to Partic-

ipating Parties during the book building process. Following the provisional allocation, the

Bookrunner will provide Subscription Forms to Participating Parties, which shall fill out such

forms in accordance with the instructions set forth in Section 18 (“Subscription Terms and

Conditions”).

Subscription Methods for Individual

Investors

Subscription Application Forms will be made available to Individual Investors during the Of-

fering Period at all Receiving Agents’ branches. Subscription Application Forms for Individual

Investors must be filled out according to the instructions set forth in Section 18 (“Subscrip-

tion Terms and Conditions”). Individual Investors who have already subscribed in previous

IPOs in the Kingdom of Saudi Arabia may also subscribe through the Internet, telephone

banking or ATMs at any of the Receiving Agents’ branches that offer any of these services,

provided that: (a) the investor has a bank account with the Receiving Agent that offers such

services; and (b) there have been no changes to the Individual Investor’s personal or private

information since they last participated in an IPO.

Minimum No. of Offer Shares for Each Category of Target Investors

Minimum No. of Oer Shares to be

Applied for by Participating Parties

One hundred thousand (100,000) shares.

Minimum Subscription for Individu-

al Investors

Ten (10) shares.

Minimum Subscription Amount for Each Category of Target Investors

Minimum Subscription Amount for

Participating Parties

[•] Saudi riyals.

M

Minimum Subscription Amount for

Individual Investors

[•] Saudi riyals.

Maximum No. of Offer Shares for Each Category of Target Investors

Maximum Subscription for Partici-

pating Parties

Two million, four hundred ninety-nine thousand, nine hundred ninety-nine (2,499,999)

shares

Maximum No. Oer Shares for Indi-

vidual Investors

Three hundred thousand (300,000) shares.

Maximum Subscription Amount for Each Category of Target Investors

Maximum Subscription Amount for

Participating Parties

[•] Saudi riyals.

Maximum Subscription Amount for

Individual Investors

[•] Saudi riyals.

Allocation of Offer Shares and Refund of Excess Proceeds for Each Category of Target Investors

Allocation of Oer Shares to Partici-

pating Parties

Final allocation of the Offer Shares to Participating Parties shall be made through the Lead

Manager upon completion of the Individual Investors’ subscription process. Fifteen million

(15,000,000) Offer Shares, representing 100% of the total Offer Shares, will be initially allocat-

ed to Participating Parties. If there is sufficient demand from Individual Investors, the Lead

Manager is entitled to reduce the number of Offer Shares allocated to Participating Parties

to a minimum of thirteen million, five hundred thousand (13,500,000) ordinary shares, repre-

senting 90% of the total Offer Shares, upon completion of the Individual Investors’ subscrip-

tion process. The number and percentage of Offer Shares to be allocated to Participating

Parties will be determined by the Financial Advisor in consultation with the Company and

the Selling Shareholders using the allocation mechanism mentioned in Section 18.4.1.

Allocation of Oer Shares to Indi-

vidual Investors

Allocation of Offer Shares to Individual Investors is expected to be completed no later than

29/03/1443H (corresponding to 04/11/2021G). The minimum allocation per Individual In-

vestor is ten (10) shares and the maximum allocation per Individual Investor is three hun-

dred thousand (300,000) shares, with the remaining Offer Shares, if any, being allocated on

a pro-rata basis based on the portion of the Offer Shares applied for by each Individual In-

vestor out of the total number of shares applied for. If the number of Individual Investors

exceeds one hundred fifty thousand (150,000) investors, the Company will not guarantee

the minimum allocation. In this case, the allocation shall be made in accordance with the

allocation mechanism mentioned in Section 18.4.1.

Refund of Excess Subscription

Monies

Any surplus subscription proceeds will be refunded without charge or withholding by the

Lead Manager or Receiving Agents. Notification of the final allotment and refund of sub-

scription monies, if any, will be made by 29/03/1443H (corresponding to 04/11/2021G) at

the latest. (For further details, see Page O (“Key Dates and Subscription Procedures”) and

Section 18 (“Subscription Terms and Conditions”).)

Oering Period

The Offering Period will commence on Tuesday 20/03/1443H (corresponding to 26/10/2021G)

and will remain open for a period of three days, including and up to the Offering closing

date, which occurs on 22/03/1443H (corresponding to 28/10/2021G).

Dividend Distributions

The Offer Shares will be entitled to receive any dividends declared and paid by the Company

as at the date of this Prospectus and for subsequent fiscal years. (For further details, see Sec-

tion 7(“Dividend Distribution Policy”).)

Voting Rights

All Company shares are one class of ordinary shares, and none of the shares confer prefer-

ential voting rights. Each share entitles its holder to one vote and each Shareholder has the

right to attend and vote at General Assembly meetings. A Shareholder has the right to dele-

gate another non-Board Member Shareholder to attend General Assembly meetings on their

behalf (for further details, see Section 12.16 (“Description of the Shares”)).

Restrictions on the Shares (Lock-Up

Period)

The Substantial Shareholders will be subject to a lock-up period during which they will

be prohibited from disposing of any of their shares for a period of six (6) months from the

date trading begins on the Exchange. Substantial Shareholders may not dispose of any of

their shares during the Lock-up Period. (For more information, see Table 1.2 (“Substantial

Shareholders and Their Shareholding Percentages in the Company Pre- and Post-Of-

fering”) of the Offering Summary on Page K.)

N

Listing and Trading of Shares

Prior to the Offering, there has been no public trading or listing of the shares in any market

in the Kingdom of Saudi Arabia or elsewhere. The Company has submitted an application to

the CMA to register and offer the shares in accordance with OSCOs. The Company has also

submitted a listing application to the Exchange in accordance with the Listing Rules. All rel-

evant approvals pertaining to the Offering have been obtained. All supporting documents

required by the CMA have been submitted. All requirements have been met, including re-

quirements for listing the Company on the Exchange, and all approvals pertaining to the

Offering have been granted. Trading in the Offer Shares is expected to commence on the

Exchange soon after the final allocation of the Offer Shares.

Risk Factors

There are certain risks related to the investment in the Offer Shares. These risks can be gener-

ally categorised into: (i) risks relating to the Company’s business; (ii) risks relating to the mar-

ket, industry and regulatory environment; and (iii) risks relating to the Offer Shares. These

risks are described in Section 2 (“Risk Factors”) of this Prospectus and the Important Notice

in the introduction, which should be considered carefully prior to making a decision to invest

in the Offer Shares.

Oering Expenses

The Selling Shareholders will bear all Offering expenses and costs, estimated at around thir-

ty-five million Saudi riyals (SAR 35,000,000). These costs will be deducted from the Offering

Proceeds and include the fees of the Financial Advisor, the Underwriters, the Issuer’s Legal

Advisor, the Chartered Accountants, the Financial Due Diligence Advisor, the Auditors, the

Receiving Agents, and the Market Consultant in addition to marketing, printing, distribution

and other relevant expenses.

Financial Advisor, Lead Manager,

Bookrunner and Lead Underwriter

GIB Capital.

Co-Underwriter

Albilad Investment Company.

Note

Page A (“Important Notice”) and Section 2 (“Risk Factors”) should be read thoroughly prior to making any decision to

invest in the Offer Shares.

O

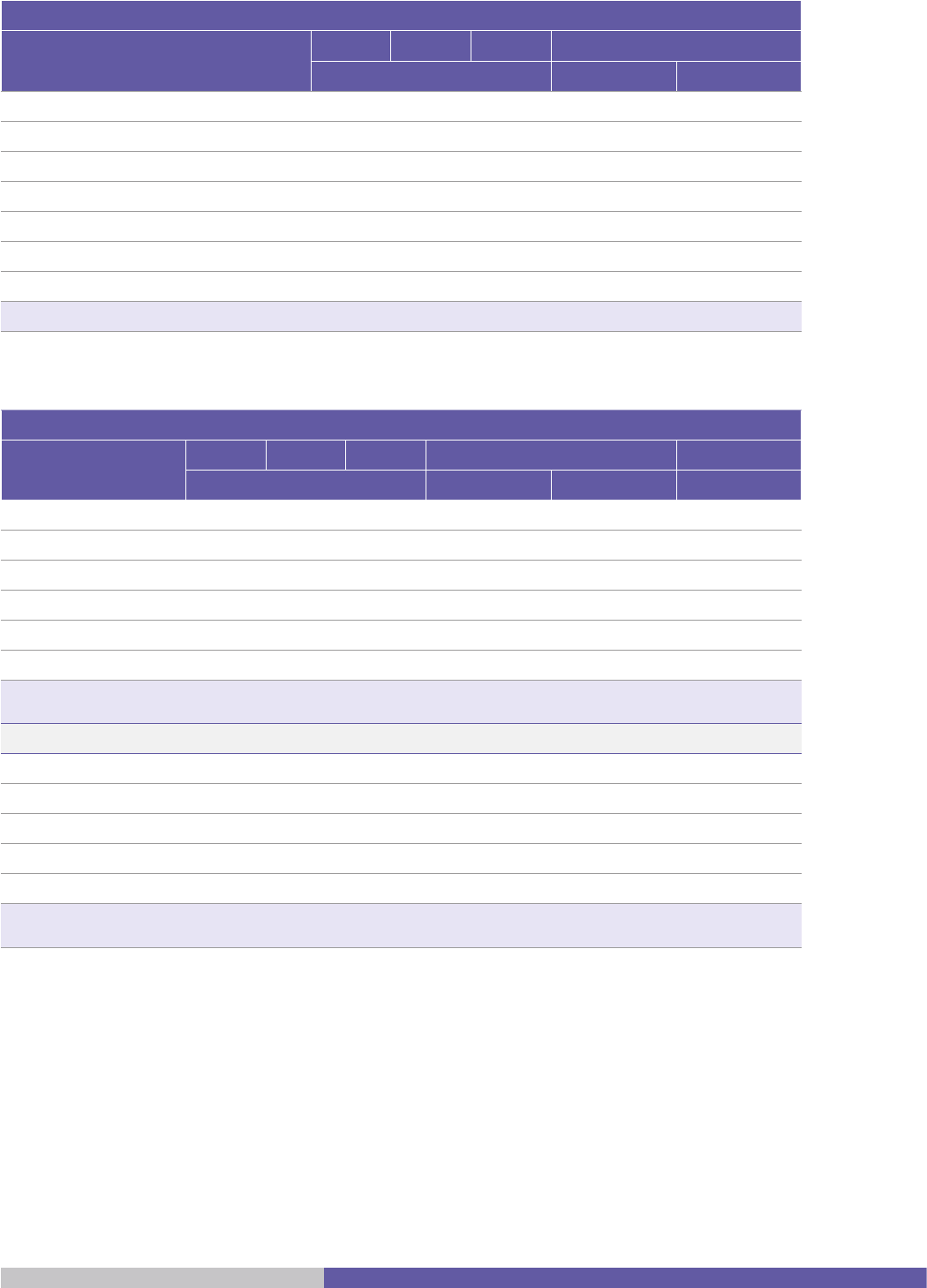

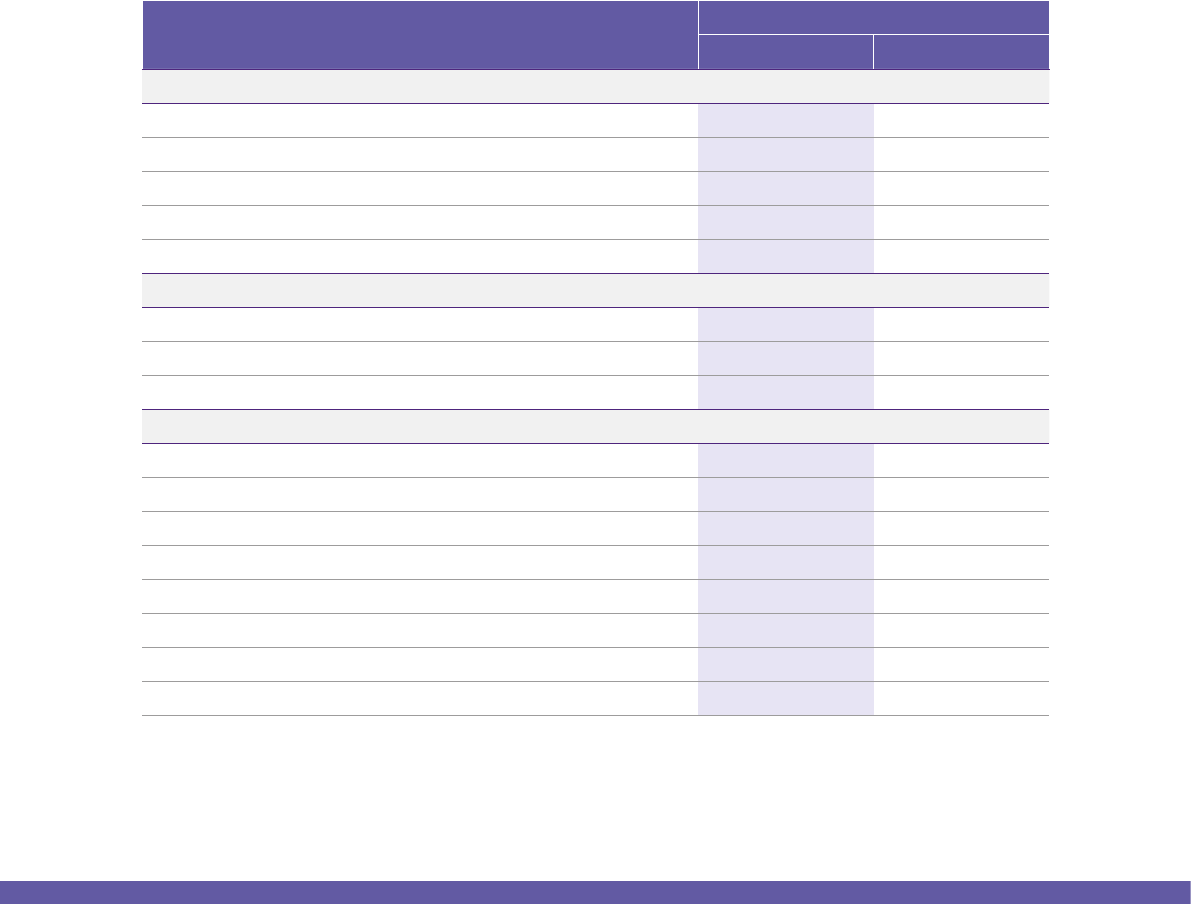

Key Dates and Subscription Procedures

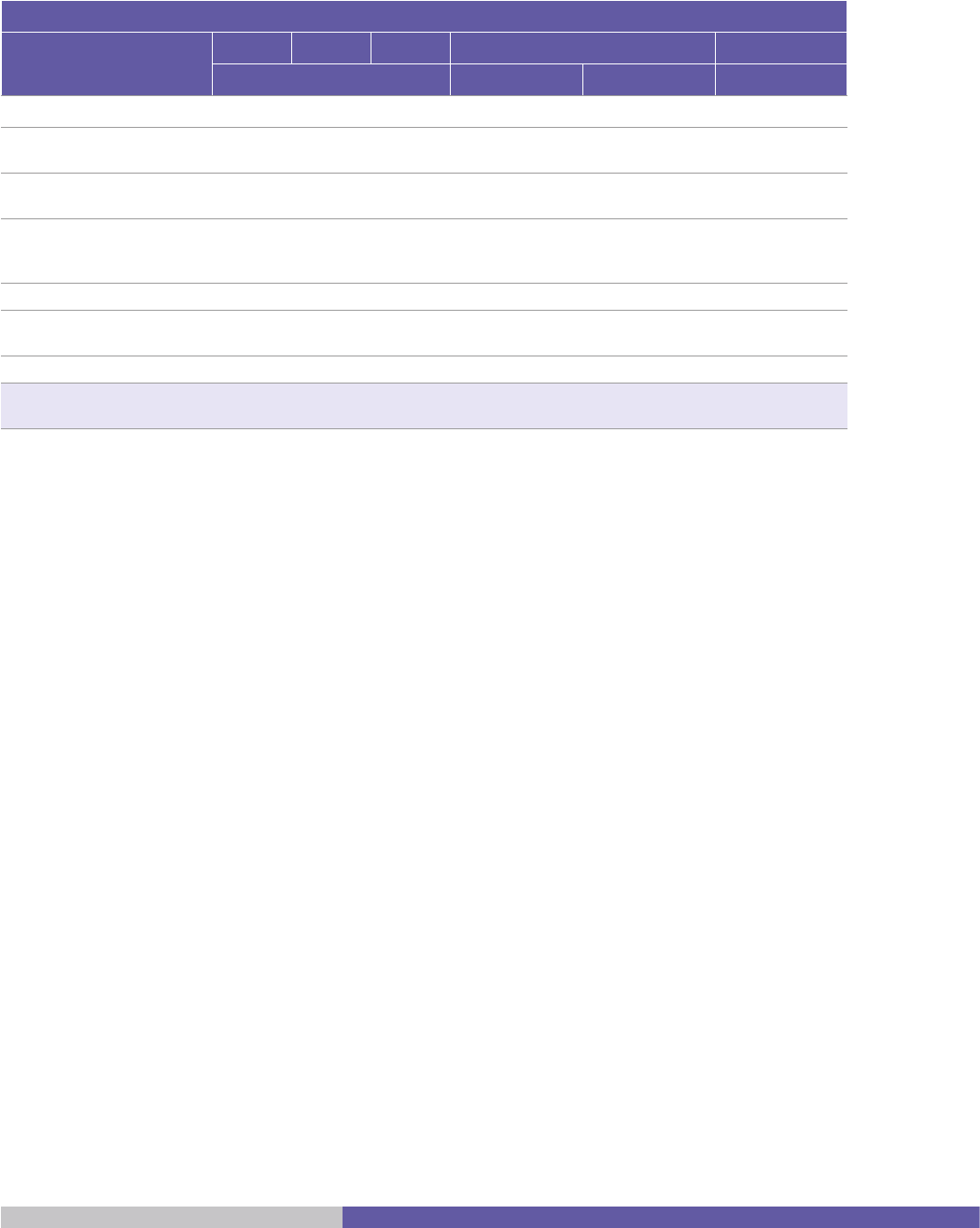

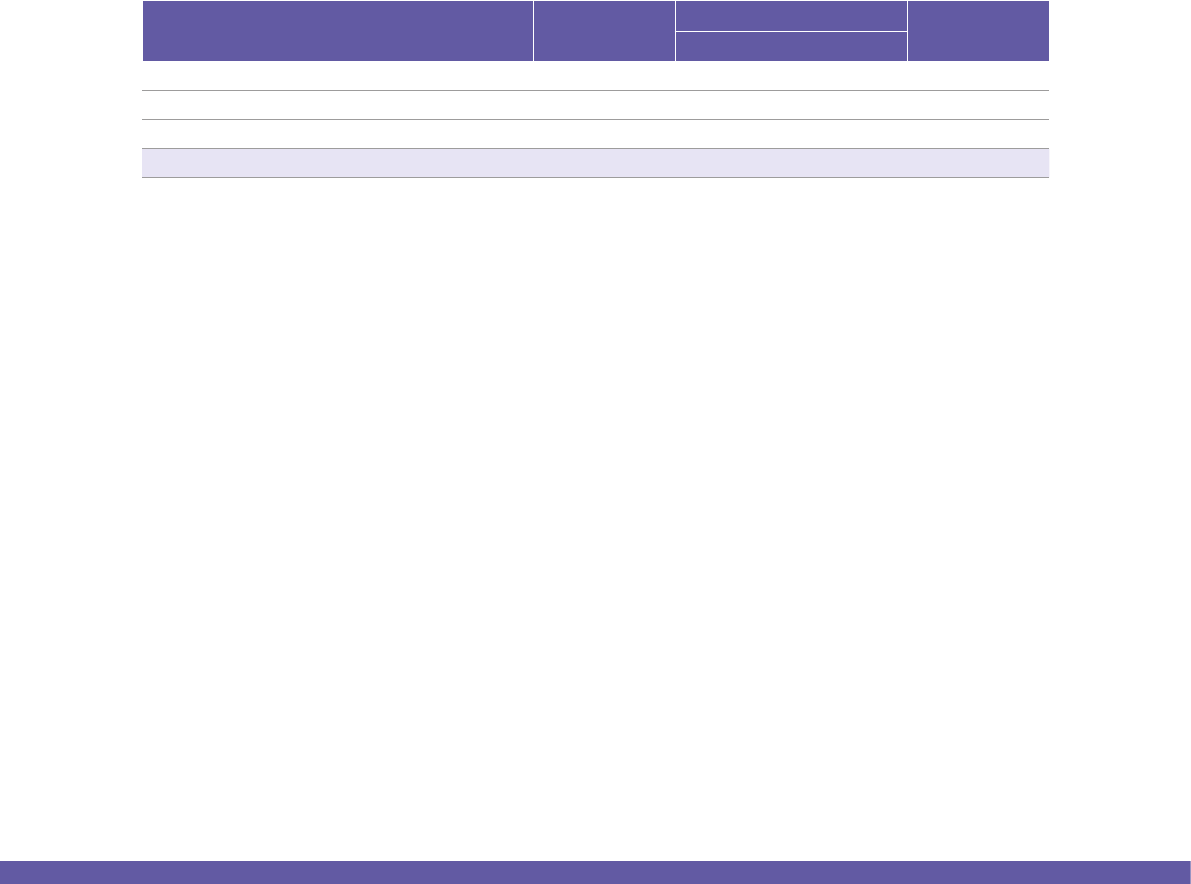

Table (1-3): Projected Offering Timetable

Projected Offering Timetable Date

Processing Participating Parties’ Applications and Book-Building

Starting on Sunday 04/03/1443H (corresponding to

10/10/2021G), until 12 pm Tuesday 13/03/1443H (correspond-

ing to 19/10/2021G)

Individual Investors’ Subscription Period

The Offering Period will last for three days, commencing

on Tuesday 20/03/1443H (corresponding to 26/10/2021G),

until the end of Thusday 22/03/1443H (corresponding to

28/10/2021G)

Deadline for Participating Parties to Submit Application Forms Based

on the Provisionally Allocated Offer Shares

Sunday 18/03/1443H (corresponding to 24/10/2021G) 4 pm

Deadline for Individual Investors to Submit Application Forms and

Pay Subscription Monies

Thursday 22/03/1443H (corresponding to 28/10/2021G)

Deadline for Participating Parties to Pay Subscription Monies Based

on the Provisionally Allocated Offer Shares

Wednesday 21/03/1443H (corresponding to 27/10/2021G)

Announcement of Final Offer Shares Allotment Thursday 29/03/1443H (corresponding to 04/11/2021G)

Refund of Excess Subscription Monies (if any) 29/03/1443H (corresponding to 04/11/2021G)

Expected Start Date of Trading on the Exchange

Trading in the Offer Shares is expected to commence after all

relevant legal requirements and procedures have been com-

pleted. An announcement of the commencement of trading

of the shares will be made on Tadawul’s website: www.saudi-

exchange.sa

Note: The above timetable and dates therein are approximate. Actual dates will be communicated through announcements

appearing on the Tadawul website, (www.saudiexchange.sa), the Financial Advisor’s website, www.gibcapital.com, and the

Company website, www.al-arabia.com

P

How to Apply for the Offering

Subscription for the Offer Shares is restricted to the following categories of Investors:

Tranche A - Participating Parties: This tranche includes all parties entitled to participate in the book-building process as

specified under the Book-Building Instructions (for further details, see Section 1 (“Definitions and Abbreviations”) and

Section 18 (“Subscription Terms and Conditions”)).

Tranche B - Individual Investors: This category consists of Saudi natural persons, including any divorced or widowed

Saudi woman with minor children from a marriage to a non-Saudi, who is entitled to subscribe to the Offer Shares in their

names on her own behalf on the condition that she provides proof that she is divorced or widowed and the mother of her

minor children. It also includes GCC investors who are natural persons holding bank accounts. Subscription of a person

in the name of his divorcee shall be deemed invalid, and if a transaction of this nature is demonstrated to have occurred,

then the law shall be enforced against that person. If a duplicate subscription is made, the second subscription will be

considered void and only the first subscription will be accepted.

Participating Parties:

Participating Parties can obtain Application Forms from the Bookrunner during the book-building process period and can

obtain Subscription Application Forms following the provisional allocation. The Bookrunner shall, with the approval of the

CMA, offer the Offer Shares to Participating Parties only during the book-building period. Subscriptions by Participating

Parties shall commence during the Offering Period, which also includes Individual Investors, in accordance with the

terms and conditions detailed in the Subscription Application Forms. A signed Subscription Application Form must be

submitted to the Bookrunner. This form represents a legally binding agreement between the Selling Shareholders and the

Participating Party submitting the form.

Individual Investors:

Subscription Application Forms will be made available to Individual Investors during the Offering Period at Receiving Agent

branches. Individual Investors may also subscribe through the Internet, telephone banking or ATMs of Receiving Agents

that offer any of these services to Individual Investors who have recently participated in previous Offerings, provided that

the following requirements are satisfied:

a) the Individual Investor has a bank account with a Receiving Agent which offers such services; and

b) there have been no changes to the Individual Investor’s personal or private information (removal or addition of a family

member) since they last participated in an IPO.

Subscription Application Forms must be completed in accordance with the instructions set out in Section 18 (“Subscription

Terms and Conditions”) of this Prospectus. An applicant must complete all relevant sections of the Subscription

Application Form. The Company reserves the right to reject any Subscription Application Form, in whole or in part, if any of

the subscription terms and conditions are not met. The Subscription Application Form may not be amended or withdrawn

once submitted. Furthermore, the Subscription Application Form shall, upon submission, be a binding agreement

between the relevant Investor and the Selling Shareholders (for further details, see Section 18 (“Subscription Terms and

Conditions”)).

Excess subscription monies, if any, will be refunded to the Investor’s main account at the Receiving Agent from which the

subscription value was debited, without any commissions or withholding by the Lead Manager or Receiving Agents. Excess

subscription monies shall not be refunded in cash or to third-party accounts.

For more information on the subscription of Individual Investors and the Participating Parties, see Section 18 (“Subscription

Terms and Conditions”) of this Prospectus.

Q

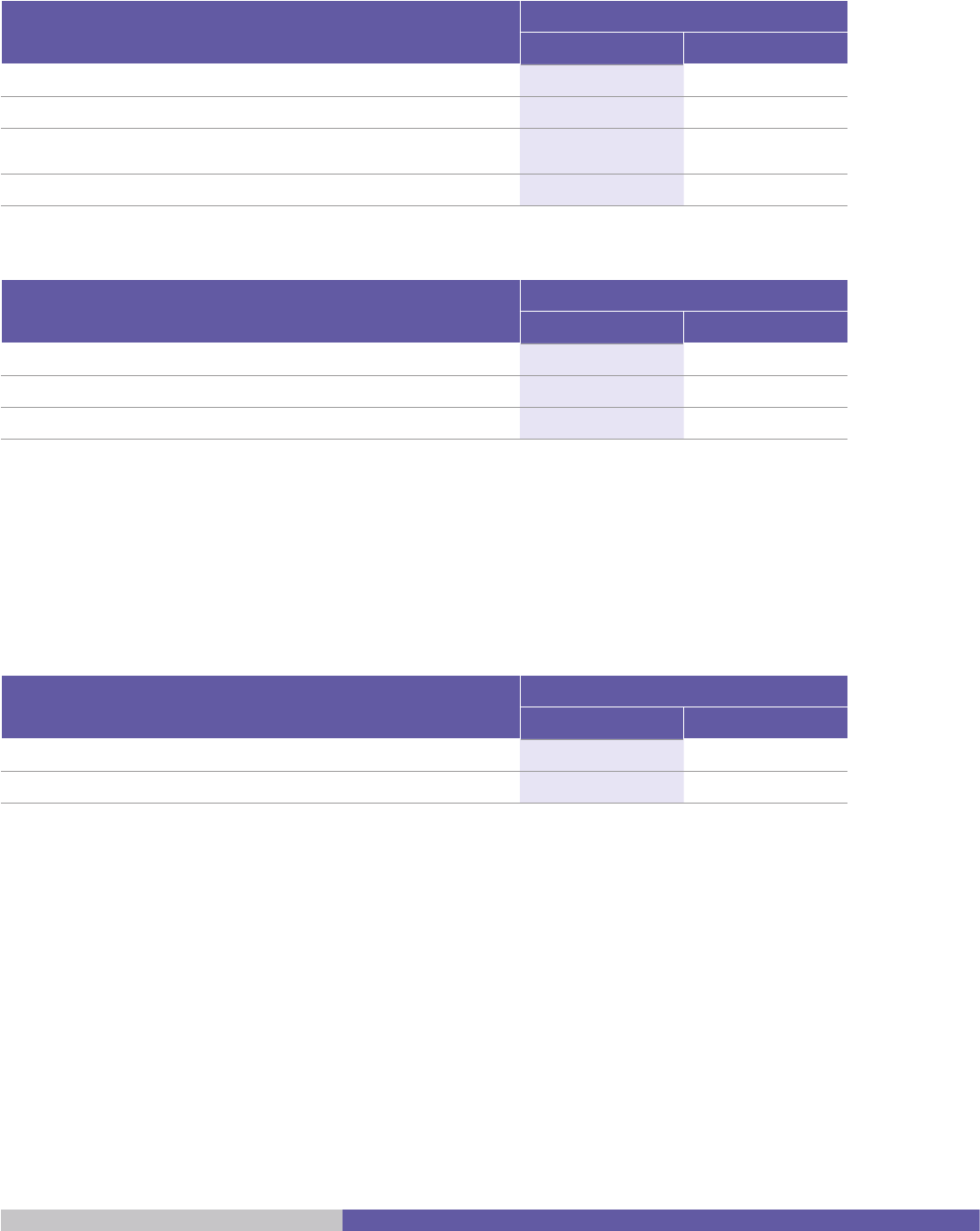

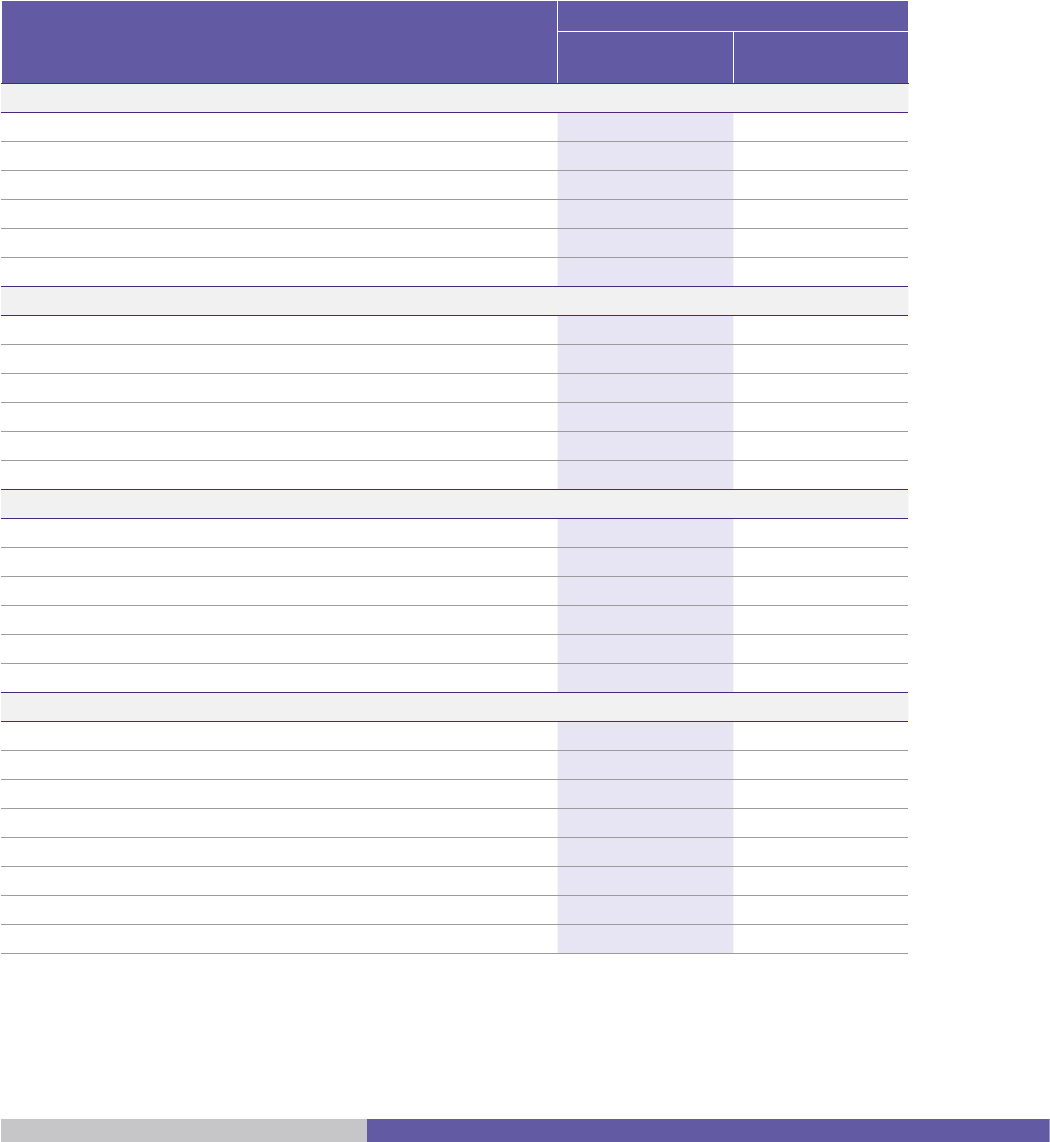

Summary of Key Information

This summary of key information is intended to provide an overview of the information contained in this Prospectus. This

Prospectus does not contain all information that may be important to prospective investors. Accordingly, this summary

must be treated as an introduction to this Prospectus, and recipients of this Prospectus are advised to read the entire

Prospectus in full. Any decision by a prospective investor to invest in the Offer Shares should be based on the consideration

of this Prospectus as a whole. In particular, it is important to carefully consider Page A (“Important Notice”) and Section 2

(“Risk Factors”) prior to making a decision to invest in the Offer Shares.

Overview of the Company

The Arabian Contracting Services Company was incorporated as a Saudi Arabian limited liability company in Riyadh under

Commercial Register No. 1010048419 on 18/05/1403H (corresponding to 03 March 1983G) with a capital of one million

Saudi riyals (SAR 1,000,000) for the objective of engaging in the business of outdoor advertising, particularly installing

and operating outdoor advertising billboards. The Company was converted into a (closed) joint stock company under

HE Minister of Commerce Resolution No. 1132 issued on 02/05/1427H (corresponding to 30 May 2006G). At the same

time, the Company’s capital was increased from one million Saudi riyals (SAR 1,000,000) to sixty million Saudi riyals

(SAR 60,000,000) by transferring twenty-three million, nine hundred nine thousand, one hundred three Saudi riyals

(SAR 23,909,103) from the shareholder’s accounts receivable and capitalising a sum of thirty-five million, ninety thousand,

eight hundred ninety-seven Saudi riyals (SAR 35,090,897) out of the retained earnings. On 02/12/1429H (corresponding to

30 November 2008G), the Company increased its capital from sixty million Saudi riyals (SAR 60,000,000) to one hundred

fifty million Saudi riyals (SAR 150,000,000) divided into fifteen million (15,000,000) ordinary shares with a fully paid-

up nominal value of ten Saudi riyals (SAR 10) per share through a cash contribution from the shareholders of thirteen

million, four hundred thousand Saudi riyals (SAR 13,400,000), capitalisation of sixty-nine million, eight hundred eighty-five

thousand, five hundred eighty-two Saudi riyals (SAR 69,885,582) out of the retained earnings, and the transfer of six million,

seven hundred fourteen thousand, four hundred eighteen Saudi riyals (SAR 6,714,418) from the balance of the statutory

reserve. On 22/06/1433H (13 May 2012G), the Company increased its capital from one hundred fifty million Saudi riyals

(SAR 150,000,000) to two hundred ten million Saudi riyals (SAR 210,000,000) divided into twenty-one million (21,000,000)

ordinary shares with a fully paid nominal value of ten Saudi riyals (SAR 10) per share through capitalisation of forty-four

million, four hundred sixty-four thousand, nine hundred sixty-six Saudi riyals (SAR 44,464,966) from the retained earnings

and fifteen million, five hundred thirty-five thousand, thirty-four Saudi riyals (SAR 15,535,034) from the balance of the

statutory reserve. On 21/06/1435H (corresponding to 21 April 2014G), the Company increased its capital from two hundred

ten million Saudi riyals (SAR 210,000,000) to five hundred fifty million Saudi riyals (SAR 550,000,000) divided into fifty-

five million (55,000,000) ordinary shares with a fully paid nominal value of ten Saudi riyals (SAR 10) per share, through

capitalisation of three hundred one million, forty-six thousand, six hundred forty-five Saudi riyals (SAR 301,046,645) from

the retained earnings and thirty-eight million, nine hundred fifty-three thousand, three hundred fifty-five Saudi riyals (SAR

38,953,355) from the balance of the statutory reserve. On 27/03/1440H (corresponding to 12 May 2018G), due to the capital

being in excess of the Company’s needs, it was decreased from five hundred fifty million Saudi riyals (SAR 550,000,000) to

two hundred fifty million Saudi riyals (SAR 250,000,000), divided into twenty-five million (25,000,000) ordinary shares with a

fully paid-up nominal value of ten Saudi riyals (SAR 10) per share. On 01/04/1441H (corresponding to 28 November 2019G),

the Company increased its capital to meet its future expansion needs from two hundred fifty million Saudi riyals (SAR

250,000,000) to five hundred million Saudi riyals (SAR 500,000,000) divided into fifty million (50,000,000) ordinary shares

with a fully paid nominal value of ten Saudi riyals (SAR 10) per share, through the capitalisation of one hundred seventy-five

million Saudi riyals (SAR 175,000,000) from the retained earnings and seventy-five million Saudi riyals (75,000,000) from the

balance of the statutory reserve.

The Company’s head office is located in Olaya Towers, Olaya District, Riyadh. The Company owns Al Arabia Out of Home

Advertising Company, a wholly owned subsidiary in the United Arab Emirates. There are also Company branches in Jeddah

and Riyadh, through which the Company conducts its various activities in the sectors mentioned below.

The Company’s main activity is in the Kingdom of Saudi Arabia outdoor advertising sector. It started operating in this sector

about thirty-five years ago. The Company is currently considered the frontrunner of companies operating in this sector in

the Kingdom of Saudi Arabia in terms of market share and revenue. The Company’s business includes setting up, operating

and maintaining outdoor advertising billboards, specifically roadside advertising and indoor advertising.

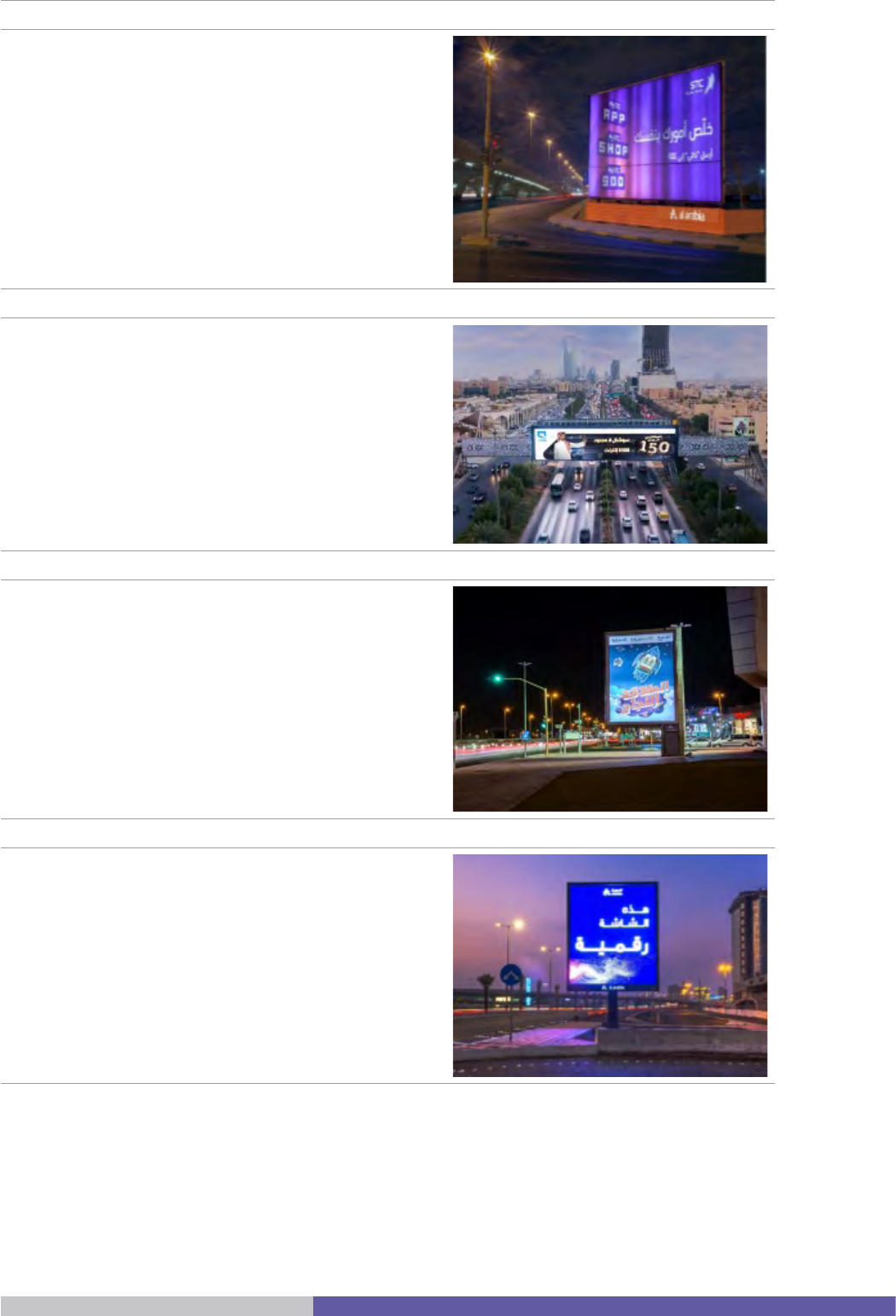

Al Arabia is a leading company in outdoor advertising in the Kingdom of Saudi Arabia. As at 31 December 2020G, the

Company had about 4,942 roadside billboards and 73 indoor billboards. The Company has a variety of billboards utilising

different technologies to meet various client needs, including static billboards, dynamic billboards and digital billboards.

R

The Company has recently introduced new types of billboards in line with global developments in the outdoor advertising

sector that maximise the direct impact of these billboards on the public and users. This was demonstrated by “The Guide”

screen that was installed and operated at the beginning of 2021G on Prince Mohammed Bin Abdulaziz Street – Tahlia

Street, in Riyadh. These billboards are located in about 28 cities across the Kingdom of Saudi Arabia, making Al Arabia

the company in this sector with the greatest geographical coverage in the country according to the market study report

prepared by the Market Consultant, Frost & Sullivan.

Outdoor advertising is a core advertising method that specifically targets people outside their homes, whether they are

pedestrians, drivers, passengers, shopping centre visitors, or airport travellers. Outdoor advertising is divided into three

categories, by location: (1) roadside advertising, (2) indoor advertising, and (3) transit advertising. The Company’s business

is currently limited to roadside advertising and indoor advertising. The Company carries out its activities through an

integrated business model that encompasses all operational processes that serve the outdoor advertising sector, involving

billboard installation (including site construction operations and electrical works), marketing and selling advertising

spaces to clients, printing advertisements and installing them on billboards, and maintenance operations. The Company

carries out silk-screen printing (a printing technique using a silk screen to print advertisements), offset printing (a printing

technique using metal printing plates in various printing operations) and digital printing (a printing technique in which

computer systems are used to print advertisements).

Recently, the Company introduced digital billboard technology to its billboards. These billboards are attractive and

capable of displaying a greater number of advertising panels, and the advertisements displayed thereon can be instantly

changed from the Company’s main control centre, thus facilitating the implementation of advertising campaigns for the

Company’s clients.

The Company’s business includes setting up and operating outdoor advertising billboards, including roadside advertising

and indoor advertising. With respect to roadside advertising, the Company participates in tenders organised by various

secretariats, municipalities, and government agencies throughout the Kingdom of Saudi Arabia to lease and invest in

numerous sites belonging to these agencies and secretariats by installing billboards and selling the advertising space on

such billboards to clients. The Company has recently expanded its business by entering the indoor advertising market.

In this regard, the Company has entered into a number of exclusive contracts with the owners of commercial centres in

different regions within the Kingdom of Saudi Arabia.

Vision

To cement our position as the leading Saudi company in out-of-home media and to become the catalyst of the national

economy, in the media sector, by expanding our leadership in the Middle East region.

Mission

To provide cities and clients with top-notch advertising products, data driven solutions and world-class services using

international standards and the latest technologies.

Strategy

Maintain a market leading position to help the Company stay at the forefront of companies operating in its field.

Maintain and increase market share to enhance revenues and profits.

Raise the operational efficiency of the Company’s integrated business model and increase revenues from support

services within said model.

Maintain and improve the quality of services by introducing the latest technologies in the field of outdoor advertising.

Increase sales through direct marketing to strategic clients.

Maintain the Company’s excellent financial position and establish factors of resistance to recession stages in economic